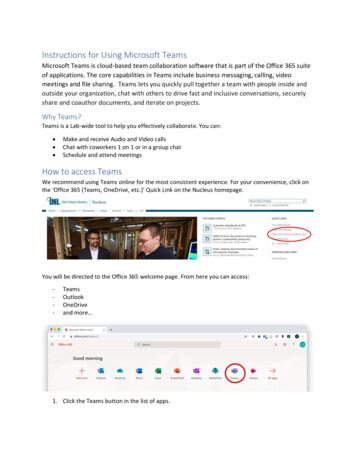

Transcription

2021Notice of Annual Meetingand Proxy Statement

Letter from theLead DirectorGE’s Purpose,Strategy and ProgressVoting RoadmapNotice ofAnnual MeetingGovernanceCompensationAuditReverse StockSplitShareholderProposalsVoting andMeeting InformationAppendix AGuide to GE’s Proxy Statement1Letter from the Lead Director2 GE’s Purpose, Strategy and Progress4Voting Roadmap5Notice of Annual Meeting6GovernanceElection of Directors77781215161821222425Board NomineesQualifications and AttributesKey Corporate Governance PracticesNominee BiographiesBoard CompositionBoard Leadership StructureBoard OperationsKey Areas of Board OversightBoard Governance PracticesHow We Get Feedback from InvestorsOther Governance Policies & PracticesStock Ownership Information27Compensation27 Letter from the Management Development& Compensation CommitteeM A N AG E M E N T P R O P O S A L N O . 1Advisory Approval of Our Named Executives’ Pay29Overview of Our Executive Compensation Program30 Overview of Our Incentive Compensation Plans35Compensation Actions for 202039Summary Compensation41Long-Term Incentive Compensation44Deferred Compensation46Pension Benefits48Potential Termination Payments53Other Executive Compensation Practices & Policies54 Explanation of Non-GAAP Financial Measuresand Performance Metrics55CEO Pay Ratio55Director Compensation57Audit575759M A N AG E M E N T P R O P O S A L N O . 2Ratification of Deloitte as Independent Auditor for 2021Independent Auditor RotationIndependent Auditor InformationAudit Committee ReportSignificant Informationin this Section8Nominee Biographies15Board Leadership Structure18Risk Oversight22Investor Outreach24Board Meeting Attendance14Director Independence12Director Qualifications12Director Term Limits24Overboarding Policy24Political Spending Oversight25Related Person Transactions25 Stock Ownership forExecutives & Directors53 Peer Group andBenchmarking35 CEO PerformanceEvaluation48 Employment and SeparationAgreements50Severance Benefits51Death Benefits53Succession Planning30Pay for Performance53 Our Policies on CompensationConsultants54 Share OwnershipRequirements54Hedging Policy54Pledging Policy54Dividend Equivalents Policy5857Auditor FeesAuditor Tenure60 Reverse Stock SplitM A N AG E M E N T P R O P O S A L N O . 3Approval of a Reverse Stock Split and Reduction in our AuthorizedStock and Par Value60 Reverse Stock Split and Reduction in Authorized Stock and Par Value64Shareholder Proposals6468SHAREHOLDER PROPOSAL NO. 1Multiple Candidate ElectionsSHAREHOLDER PROPOSAL NO. 2Independent Board ChairmanSHAREHOLDER PROPOSAL NO. 3Report on Net Zero IndicatorSubmitting 2022 Proposals69Voting and Meeting Information696971Proxy Solicitation & Document Request InformationVoting InformationMeeting Information656672 Appendix A7273Reverse Stock Split Form of Charter AmendmentHelpful ResourcesGeneral ElectricCompanyExecutive Offices5 Necco StreetBoston, MA 02210WHY ARE WE SE NDINGYOU THESE MATE RIAL SOn behalf of our Board ofDirectors, we are makingthese materials available toyou (beginning on or aboutMarch 23, 2021) in connectionwith GE’s solicitation ofproxies for our 2021 annualmeeting of shareholders.WHAT DO WENE E D FROM YOU?Please read these materialsand submit your vote andproxy by mobile device or theInternet, or, if you receivedyour materials by mail, youcan also submit your voteand proxy by telephoneor complete and returnyour proxy card or votinginstruction form.WHE RE C ANYOU FIND MOREINFORMATION?6868Deadlines for 2022Proxy Access2020 Annual report2020 Diversity Annual Reporthttps://www.ge.com/about-us/diversity2021 Proxy Statementhttps://www.ge.com/proxyAlso see “Acronyms Used” onpage 73 for a guide to the acronymsused throughout this proxystatement.2021 Sustainability ReportTo be published later this yearhttps://www.ge.com/sustainability

Letter from theLead DirectorLetter from the Lead DirectorFellow Shareholders,When I wrote to you last year, none ofus could have imagined the scale of thechallenges that 2020 would bring. I amproud of how the GE team rose to meetthese challenges, while continuing todeliver for customers and propelling ourtransformation forward. As we begin 2021,I want to take this opportunity to shareinsights into how our Board worked on yourbehalf this past year.Energy businesses, where operationalimprovements are underway to expandmargins and improve cash realization. As aBoard, we oversaw actions to:CEO and other key employees, as describedin greater detail in the letter from theManagement Development & CompensationCommittee.Strengthen our businesses: reducedcosts by more than 2 billion, executed on 3 billion of cash preservation actions anddelivered positive free cash flow at GasPower one year ahead of target.PROTEC TING OUR E MPLOYE ES ANDCOMMUNITIESDuring 2020, the GE team was focused firstand foremost on protecting the health andsafety of our employees and communities.At the onset of the COVID-19 pandemic, GEquickly instituted strong safety precautionsfor its global workforce and pledged financialsupport to employees and their familiesthrough GE’s new Employee Relief Fund.The Board was engaged throughout theyear with leadership in taking steps to keepour workplaces around the world safe, toaccelerate the manufacture of life-savingrespirators and to assure GE’s operationswere functioning well in a digital and remotework environment.Fortify the balance sheet: took action toreduce GE’s debt by 16 billion in 2020 andby 30 billion since the beginning of 2019,and reduced near-term liquidity needs by 10.5 billion.As a Board, we switched from in-personto virtual meetings, just as many ofour employees did the same. Directorscontinued their ongoing discussions withleadership throughout the year, albeitusually by video. Larry has encourageddirectors to feel free to speak to anymember of leadership at any time, to divedeeper into topic areas where we havespecific expertise or concern and to heardirectly from GE’s people. Larry regularlyupdates the full Board informally, and manyof us talk with him individually on a widerange of topics as issues arise. We held morethan 35 formal meetings across the fullBoard and committees in 2020, in addition tonumerous other engagements with the teamthroughout the year, including participationin GE employee leadership meetings. Theatmosphere among Board members andwith Larry and the GE team is exceptionallyopen, engaged and constructive.As part of his drive to use lean principles toimprove GE’s performance, our Chairmanand CEO, Larry Culp, has prioritizedoperational safety and product quality. Weare also focused on this at the Board. Weuse reporting from management in both ofthese areas as a barometer of organizationalhealth, as well as of the safety of our peopleand the products that GE produces.ACCE LE R ATING GE ’STR ANSFORMATIONGE entered 2020 with momentum and aclear plan to drive profitable growth, marginexpansion and cash generation. However,we embraced new realities due to thepandemic, and GE’s leadership team tookdecisive action to preserve and build GE’sstrength. The Board focused on how theteam was mitigating the financial impact ofthe pandemic on the company overall and,in particular, on the Aviation and Healthcarebusinesses that were most directly affectedby the global downturn. Meanwhile,we engaged with leadership on theturnarounds in the Power and RenewableFocus the portfolio: completed the sales ofthe BioPharma and Lighting businesses andlaunched a program to fully monetize GE’sremaining stake in Baker Hughes Company.The Board also worked with Larry over thepast year on key leadership hires and diddeep dives into succession planning. WhatGE does is critically important to the world,and a key part of our responsibility on theBoard is making sure that GE has the rightpeople in the right jobs today and a pipelineof talent for tomorrow. We have reviewedelements of GE’s long-term strategy at everymeeting, and those discussions invariablyrevolved around ensuring financial resilienceand properly investing in people, businessprocesses and technology for the future.BOARD OVE RSIGHT ANDE NGAGE ME NTDuring the early months of the pandemic,our oversight at the Board was focused onhealth and safety, business continuity, riskmanagement and governance for weatheringan exceptionally challenging and uncertainenvironment. We also moved swiftly to takea series of treasury actions to shore up thebalance sheet and preserve liquidity, aswell as operational cost and cash actionsacross GE’s businesses to manage risk andmitigate adverse financial impacts fromthe volatile supply and demand dynamicsin our industries. During the summer, afterimplementing those earliest stabilizingactions, the Board’s attention also shiftedto the leadership team and providingappropriate incentive arrangements for theWe have made meaningful progress over thepast year, despite the additional unexpectedchallenges of a global pandemic. We alsoknow that we have more work to do to drivethe desired performance improvementsand organizational change. On behalf of theentire Board, I thank you for your continuedinvestment and support of GE as we worktogether to continue our transformation.We are committed to ensuring that GE isvery well positioned to deliver value over thelong term.THOMAS W. HORTONLead DirectorG E 2 0 2 1 P R O X Y S TAT E M E N T1

GE’s Purpose, Strategy and ProgressGE’s Purpose,Strategy and ProgressOUR PURPOSEWe rise tothe challengeof building aworld thatworks.OUR S TR ATEGY1Continuing toStrengthenour businessesInvesting in strategic sectors forsociety’s future. Leading withtechnology, solving sustainabledevelopment challenges,and partnering to resolvelocal needs.Energy TransitionTransforming millions oflives with access to reliable,affordable, and cleanerelectricity.Precision HealthBuilding an intelligence-basedhealthcare system and ahealthier world with moreintegrated, efficient, andpersonalized care.Future Of FlightLeadershipStrengthening our businesses begins with building thebest team. Over the last two years we have continuedto build our world-class team, with new leaders joiningour strong bench of GE talent. These leaders areplaying a critical role in GE’s transformation, and weare committed to the leadership behaviors of humility,transparency, and focus.POWERRENEWABLE ENERGYMISSION Powering livesand making electricity moreaffordable, reliable, accessible,and more sustainableMISSION Making renewablepower sources more affordable,reliable, and accessible for thebenefit of people everywhereUNITS Gas Power, PowerPortfolioINSTALLED BASE 7,000 gasturbinesUNITS Onshore Wind, OffshoreWind, Grid Solutions Equipmentand Services, Hydro Solutions,Hybrids SolutionsCEO Gas Power: Scott Strazik;Power Portfolio: Dan JankiINSTALLED BASE 400 GW ofrenewable energy equipmentEMPLOYEES 34,000CEO Jérôme PécressePROGRESSEMPLOYEES 40,000Gas Power built a lower riskequipment backlog, and deliveredpositive free cash flow one yearahead of its commitment dueto efforts to reduce costs andimprove working capital.PROGRESS Partnering to facilitate recoveryof the commercial aviationindustry and help airlinesachieve their sustainability goals. How We GovernOur CompanyOnshore Wind delivered recordglobal volumes in 2020, holdingthe No. 1 U.S. market positionfor the last two years.Offshore Wind receivedfull certification for boththe 12- and 13-megawattHaliade -X, the world’s mostpowerful offshore wind turbinein operation today, whichnow has 5.7 gigawatts incustomer commitments.Renewable Energy’s growingbacklog stands at an all-timehigh of 30 billion.Holding ourselves and ourpartners accountable to thehighest standards of integrityand competitiveness.How We Invest InOur CommunitiesOur approach to social impactis embedded in our businessstrategy. Fostering innovation,building infrastructure, andshaping the diverse workforceof tomorrow.2G E 2 0 2 1 P R O X Y S TAT E M E N T2Solidifyingour FinancialPositionWe reduced debt by about 16 billion in 2020 and by 30 billion since the beginning of 2019. We entered2021 with 37 billion of liquidity, giving us that capacityto weather continued volatility, further de-lever, andfocus on organic growth.3Drivinglong‑termprofitablegrowthLeanOur lean operating philosophy supports our long-termgrowth strategies by emphasizing customer focus,elimination of waste, and ruthless prioritization ofwork to improve safety, quality, delivery, and cost. Leanprinciples help us examine processes and continuallyimprove them by solving problems at their root cause.

Inclusion and diversityAfter a thorough and competitive review, ourBoard selected Deloitte as GE’s independentauditor for 2021.We named Mike Barber Chief Diversity Officer,and appointed Chief Diversity Officers in eachof our businesses. In February of 2021, wepublished GE’s first Diversity Annual Report inmany years.AVIATIONHEALTHCARECAPITALMISSION Providing customerswith engines, components,avionics and systems forcommercial, military and business& general aviation aircraft and aglobal service network to supportthese offeringsMISSION Operating at thecenter of an ecosystem workingtoward precision health –digitizing healthcare, helpingdrive productivity and improvingoutcomes across the healthsystemMISSION Designing anddelivering innovative financialsolutions for GE Industrialcustomers in markets around theworldUNITS Commercial, Military,Systems & OtherUNITS Healthcare Systems,Pharmaceutical Diagnostics,BioPharma (this business was soldon March 31, 2020)INSTALLED BASE 37,700commercial aircraft engines1 and 26,500 military aircraft enginesCEO John SlatteryINSTALLED BASE 4M healthcare installationsEMPLOYEES 40,000CEO Kieran MurphyPROGRESSEMPLOYEES 47,000 PROGRESS As commercial airlines lost ahalf-trillion dollars in revenueand saw demand drop bymore than 65 percent2,Aviation supported our globalcustomers throughout, helpingthem manage their fleets andmaintenance plans as theysought to conserve cash.Aviation improved marginsthrough the year and deliverednearly breakeven free cash flow.Our LEAP backlog stands atapproximately 9,600 engines.1Including GE and its jointventure partners2IATA data, November 24, 2020 We delivered positive free cash flow despite the still-difficultmacro environment.In addition to improving our manufacturing processes anddelivering higher quality service to our customers, we’realso running the company with a lean operating model,standardizing our quarterly operating approach to focus onkey company priorities such as talent, strategy, and budgeting.We are working hard to scale lean company-wide to help GEimprove performance and drive lasting cultural change.CEO Jennifer VanBelleEMPLOYEES 2,000PROGRESS Healthcare grew revenueorganically and delivered strongmargin and cash performance.In 2020, the team increasedoutput for critical medicalequipment helping doctorsdiagnose and treat patients withCOVID-19, including quadruplingventilator production.We invested for the future,launching more than 40new products.Margins and profit also contracted organically, but theyimproved through the year as we executed better andstreamlined our costs.UNITS GE Capital AviationServices (GECAS), Energy FinancialServices (EFS), Working CapitalSolutions (WCS), Insurance GE Capital continued tosupport our industrialbusinesses and reduce overallrisk while navigating significantindustry disruption.With lower debt and a broadercommercial market recovery,we expect GE Capital earningsto improve.Some of the information in this section isforward-looking. For more information aboutour forward-looking statements, see “CautionConcerning Forward-Looking Statements” onpage 54.GE’s Purpose,Strategy and ProgressNew independent auditorHOW GE SUPPORTE DTHE FIGHT AGAINS TCOVID -19 IN 2020Healthcare quadrupledventilator production;increased productioncapacity and output forcritical medical equipmentin the diagnosis andtreatment of COVID-19—including monitoringsolutions, x-ray, anesthesia,and point-of-careultrasound products; andlaunched digital solutionsto help providers delivercare to patients virtually.Aviation produced andserviced engines andcomponents for militaryand cargo aircraft flyingdaily around the world toassist in response efforts.Power and RenewableEnergy supportedelectricity generation forcritical hospitals, healthcare facilities, and homesand businesses.Digital offered free licensesto customers to allow plantoperators and managementteams real-time monitoringand control access to plantoperations.GE’s Employee ReliefFund supported 3,900GE employees and theirfamilies around the worldfacing unprecedentedchallenges due to thepandemic.The GE Foundationcontributed to global andcommunity health anddisaster relief efforts,helped deliver personalprotective equipment toU.S. healthcare workers inurgent need, and workedto shore up healthcaresystems in Southeast Asiaand Africa with trainings,infrastructure, andequipment.G E 2 0 2 1 P R O X Y S TAT E M E N T3

Voting Roadmap12CompensationElection ofdirectorsAdvisory approvalof our namedexecutives’ payVoting RoadmapDirectorElections3Audit4ReverseStock SplitRatificationof Deloitte asindependentauditor for 2021Approve a reversestock split andreduction in ourauthorized stockand par valueSee page 27 for a Letterfrom the ManagementDevelopment &Compensation Committeethat discusses theCommittee’s actions overthe past year.Your Board recommendsa vote FOR eachdirector nomineeYour Board recommends avote FOR this proposalYour Board recommends avote FOR this proposalYour Board recommends a voteFOR this proposalSee page 6See page 27See page 57See page 602021ShareholderProposalsSHAREHOLDERPROPOSAL NO. 1SHAREHOLDERPROPOSAL NO. 2SHAREHOLDERPROPOSAL NO. 3Multiple CandidateElectionsIndependentBoard ChairmanReport on NetZero IndicatorYour vote is neededon three proposals:See page 644G E 2 0 2 1 P R O X Y S TAT E M E N TYour Board recommends a vote AGAINSTShareholder Proposals 1 and 2Your Board recommends a voteFOR Shareholder Proposal 3

Notice of Annual MeetingVoting Q&ACordially,MIKE HOL S TON , SECRE TARYAgendanominees named in theproxy for the coming yearexecutives’ compensation inadvisory votePage 273 Ratify the selection ofDeloitte as independentauditor for 2021FORPage 574 Approve a reverse stocksplit and reduction in ourauthorized stock and parvalueFORPage 605 Vote on the shareholderproposals included in theproxy, if properly presentedat the meetingAGAINST proposals 1and 2FOR proposal 3How many shares are entitled to vote?8.8 billion common shares (preferred sharesare not entitled to vote).Is my vote confidential? Yes, only First CoastResults and certain GE employees/agents haveaccess to individual shareholder voting records.How many votes do I get? One vote on eachproposal for each share you held as of therecord date (see first question above).How many votes are needed to approvea proposal? Majority of votes cast, withabstentions and broker non-votes generallynot being counted and having no effect, exceptthat Management Proposal No. 3 – Approvalof a Reverse Stock Split requires a majorityof shares outstanding, with abstentions andbroker non‑votes having the same effect as avote against.Do you have an independent inspector ofelections? Yes, you can reach them at FirstCoast Results, Inc., 200 Business Park Circle,Suite 112, Saint Augustine, FL 32095.Can I change my vote? Yes, by votingduring the meeting, delivering a new proxyor notifying First Coast Results in writing.Via the internet atwww.proxyvote.comPage 62 Approve our namedFORHowever, if you hold shares through a broker,you will need to contact them directly.Where can I find out more information? See“Voting and Meeting Information” on page 69.HOW YOU C AN VOTE1 Elect the 11 directorFOR eachdirector nomineeWho can vote? Shareholders as of our recorddate, March 8, 2021.Page 64Shareholders also will transact anyother business that properly comesbefore the meetingBy TelephoneCall the telephonenumber on your proxycard, voting instructionform or noticeBy MailSign, date andreturn your proxycard or votinginstruction formLogisticsDATE AND TIMEMay 4, 2021 at 10:00 a.m. Eastern TimeLOC ATIONLive Webcast at:www.virtualshareholdermeeting.com/GE2021FORMAT OF THE ANNUAL ME E TINGThe Governor of the State of New York hasissued several temporary executive orderspermitting New York corporations to holdvirtual only shareholder meetings in light of theCOVID-19 pandemic. In addition, the New YorkState Legislature has approved amendments toNew York law, which, if signed by the Governor,would permit New York corporations to holdvirtual-only shareholder meetings this year. Ifpermitted by New York law or executive orderas of the date of the Annual Meeting, we intendto hold the Annual Meeting solely by meansof remote communications with no in-personlocation. In the event a solely virtual meeting isnot permitted as of such date, we may providea venue for an in-person annual meeting, inaddition to virtual participation. In that case, wewould notify our shareholders in advance on ourwebsite and by issuing a press release and filing itas additional proxy materials with the Securitiesand Exchange Commission. Attendance at an inperson meeting would include additional safetyprecautions in light of the COVID‑19 pandemic.ACCESS TO THE AUDIO WE BC A S T OFTHE ANNUAL ME E TINGThe live audio webcast of the 2021 AnnualMeeting will begin at 10:00 a.m. Eastern Time. Aswith our past in-person annual meetings, we aremaking the virtual meeting available to the publicto listen live. Anyone wishing to do so may go towww.virtualshareholdermeeting.com/GE2021and enter as a guest.AT TE NDANCE INS TRUC TIONSYou are entitled to participate in the AnnualMeeting if you were a shareholder as of the closeof business on March 8, 2021, the record date, orhold a valid proxy for the meeting. To participatein the virtual meeting, including to vote or to askquestions, you must access the meeting websiteat www.virtualshareholdermeeting.com/GE2021,and follow the instructions on your proxycard, voting instruction form or Notice ofInternet Availability. Online check-in will beginapproximately 15 minutes before the meetingand we encourage you to allow ample time forcheck-in procedures.Where can I find out more information? See“Voting and Meeting Information” on page 69.G E 2 0 2 1 P R O X Y S TAT E M E N T5Notice ofAnnual MeetingYou are invited to participatein GE’s 2021 Annual Meeting.If you were a GE shareholderat the close of business onMarch 8, 2021, you are entitledto vote at the Annual Meeting.Even if you plan to attend thelive webcast, we encourage youto submit your vote as soonas possible through one of themethods below.

GovernanceElection of DirectorsWhat are you voting on? At the 2021 annual meeting, elevendirector nominees are to be elected to hold office until the2022 annual meeting and until their successors have beenelected and qualified.Your Board recommends a vote for each nomineeAll nominees are current GE Board members who wereelected by shareholders at the 2020 annual meeting.James Tisch, 68President & CEO, LoewsDirector Since: 2010Other Public CompanyBoards: Loews andits subsidiariesFrancisco D’Souza, 52Former CEO, CognizantTechnology SolutionsAshton Carter, 66Director, Belfer Center,Harvard Kennedy School &Former U.S. Secretaryof DefenseDirector Since: 2020Other Public CompanyBoards: Delta Air LinesFormer CFO, HPDirector Since: 2019Other Public CompanyBoards: PROS Holdings,SunPowerDirector Since: 2013Other Public CompanyBoards: MongoDBGovernanceCatherine Lesjak, 62Sébastien Bazin, 59 Chair & CEO, AccorHotels6arsYePaula RosputReynolds, 64CEO, PreferWestDirector Since: 2018Other Public CompanyBoards: BP, National Grid UKYearsDirector Since: 2016Other Public CompanyBoards: AccorHotels,Huazhu Group1-34- 6YearsRisa Lavizzo‑Mourey, 66H. LawrenceCulp, Jr., 58Professor Emeritus,University of Pennsylvania& Former President & CEO,Robert Wood JohnsonFoundationDirector Since: 2017Other Public CompanyBoards: Intel, MerckChair & CEO,General ElectricDirector Since: 2018Other Public CompanyBoards: NoneEdward Garden, 59Thomas Horton, 59Chief Investment Officer& Founding Partner, TrianFund ManagementPartner, Global InfrastructurePartners & Former Chairman& CEO, American AirlinesDirector Since: 2017Other Public CompanyBoards: InvescoLeslie Seidman, 58Former Chair, FinancialAccounting Standards BoardDirector Since: 2018Other Public CompanyBoards: Moody’sDirector Since: 2018Other Public CompanyBoards: EnLinkMidstream, WalmartBOARDBoard Rhythm6/year1/year1/year2020 MEETINGSRegular meetingsStrategy sessionBoard self‑evaluationOver 35 meetings of thefull Board and committees,including 3 meetings of theindependent directorsChairLead Director2 /year2 /yearCallsLarry CulpTom HortonBusiness visits foreach directorGovernance & investorfeedback reviewsBetween meetings6G E 2 0 2 1 P R O X Y S TAT E M E N T

Board NomineesTE NUREKeyCorporateGovernancePracticesAGEOur Board age limit is 75 years4.1 years average tenureOur Board term limit is 15 years3 Medium‑tenured(4‑6 years)6 Newer( 3 years)6 newer3 medium2 Longer‑tenured( 6 years)2 longerDIVE RSIT Y OF GE NDE R AND BACKGROUND2 of 4 Board leadership positions are held by womenOur policy is to build a cognitively diverse boardrepresenting a range of backgrounds4 Female(36%)2 Ethnically diverse(18%)6 60 years5 60‑70 years0 70 years 60 years60-70 years 70 yearsINDE PE NDE NCE91% Board independenceAll director nominees except our CEO are independentand meet heightened independence standards for ouraudit, compensation and governance committees3 Born outside U.S.(27%)10 Independent1 Not IndependentDIVERSITYGLOBALGOVERNMENT& REGULATORYRISKMANAGEMENTTECHNOLOGYINVESTORFINANCE &ACCOUNTINGINDUSTRY &OPERATIONS Board-level oversightof ESG Strong lead director withclearly delineated duties Regular executivesessions of independentdirectorsGE COMMITTEESACGSébastien BazinAshton CarterH. Lawrence Culp, Jr. Board and committeesmay hire outsideadvisors independentlyof management Proactive year‑roundshareholderengagement programFrancisco D’SouzaEdward Garden Clawback policy thatapplies to all cash andequity incentive awardsThomas HortonRisa Lavizzo‑MoureyCatherine Lesjak Anti-hedging andanti‑pledging provisionsPaula Rosput ReynoldsLeslie Seidman Strong stock ownershipguidelines and retentionprovisionsJames TischQUALIFICATIONS AND ATTRIBUTESCOMMITTEESIndustry &OperationsFinance &AccountingRiskManagementGovernment versityRecent Focus Areas Health and safety of employees and communities Oversight of risk management and governance forCOVID‑19-related uncertainty Capital structure and liquidity, particularly reducingleverage and de-risking the balance sheet Business performance and long-term strategy reviews Strategy for the energy transitionA AuditCommitteeC CompensationCommitteeG GovernanceCommitteeMember “Overboarding” limitsChair No poison pill ordual‑class sharesFinancialExpert Encourage all directorsto make at least twobusiness visits peryear without seniormanagement present Cybersecurity Shareholder right to call Leadership transitions, particularly forspecial meetings (at 10%)the CFO and Aviation CEO Boeing 737MAX safe return to flight Proxy access by‑law Enterprise risk managementprovisions on Oversight of Healthcare productmarket termsdevelopment and market dynamics GE Capital and Insurance7G E 2 0 2 1 P R O X Y S TAT E M E N TGovernancePRIMARY QUALIFICATIONS AND ATTRIBUTESAll director nominees attendedat least 75% of the meetingsof the Board and committeeson which they served in 2020,and on average we had a 98%attendance rate in 2020. No supermajorityprovisions in governingdocuments Annual Boardand committeeself‑evaluationsThe committee memberships indicate the composition of the committees of the Board as of the date ofthis proxy. Our director nominees’ primary qualifications and attributes are highlighted in the followingmatrix. The matrix is intended as a high‑level summary and not an exhaustive list of each director’s skills orcontributions to the Board.ATTENDANCE Annual election of alldirectors by majorityvoting Annual review of Boardleadership structureQualifications and AttributesNAME 10 out of 11 directornominees areindependent

Nominee BiographiesBoard LeadershipCHAIRMANLE AD DIREC TOR CHAIR: Management Development& Compensation Commit teeH. LawrenceCulp, Jr.ThomasHortonDirector Since: 2018Age: 58Birthplace:United StatesDirector Since: 2018Age: 59Birthplace:United StatesIndependentQualificationsGovernanceChairman and CEO, General Electric, Boston, MA(since September 2018)Prior Business Experience Senior Advisor, Bain Capital Private Equity, a globalprivate equity firm (2017–2018) Senior Lecturer, Harvard Business School(2015–2018) Former CEO and President, Danaher (2001–2014), aglobal science and technology company operatingin the healthcare, environmental and applied‑endmarkets; joined Danaher subsidiary Veeder‑Root in1990, serving in a number of leadership positionswithin Danaher, including COO and, following hisretirement, Senior Advisor (2014–2016)Prior Business Experience Senior Advisor, Warburg Pincus LLC, a private equityfirm focused on growth investing (2015–2019) Chairman, American Airlines Group, one of thelargest global airlines (formed following the mergerof AMR Corp and US Airways) (2013–2014) Chairman and CEO, American Airlines (2011–2014) Chairman and CEO, AMR (parent company ofAmerican Airlines) (2010–2013) EVP and CFO, AMR (2006–2010) Vice Chairman and CFO, AT&T (2002–2006) SVP and CFO, AMR (2000– 2002); joined AMR in 1985,serving in various finance and management rolesCurrent Public Company Boards General ElectricCurrent Public Company Boards General Electric EnLink Midstream Walmart (lead director)Past Public Company Boards GlaxoSmithKline Danaher T. Rowe Price GroupPast Publi

30 Overview of Our Incentive Compensation Plans 35 Compensation Actions for 2020 39 Summary Compensation . health and safety, business continuity, risk . a series of treasury actions to shore up the balance sheet and preserve liquidity, as well as operational cost and cash actions across GE's businesses to manage risk and mitigate adverse .