Transcription

Capital Market Day 2021Automotive TechnologyEssen, December 2nd, 2021Foto: Porsche AGFoto: Ford

Leadership team with vast automotive and operational experienceDr.-Ing. Karsten KroosCEO & CFO Since 2019 301 Leading mgmt. roles in engineering,business development, sales, businesstransformation and restructuring onplant-, BU- and corporate-levelFrank AltagCOO Since 2019 301 Strong experience in in- and externalboard positions More than 30 years in automotive andindustry businesses, thereof more than26 years with direct P&L responsibility19992 Various leading roles in automotivecontext of thyssenkrupp Leadership experience with largeGerman OEM1. Years of industry experience 2. With tk since2CHRO Since 2019 301 Simultaneously Chief Operations Officerof business segment AutomotiveTechnology Development of several global marketleaders with above average growth rates19902 Multiple years in CEO role of BUDynamic ComponentsKerstin Ney Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive Technology Multiple years of experience in leadingHR positions across thyssenkrupp(Automotive and further industrialexperience) Broad experience in transformation andreorganization projects19912 Broad international project experience inChina, USA, Europe Excellent network among DAX/MDAXHR-leaders and within co-determination

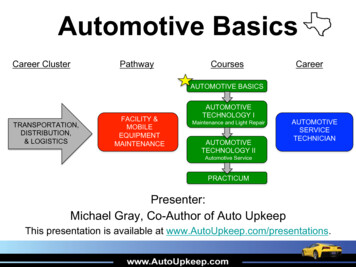

AT with international set-up and diverse product portfolio to serve across customer segmentsHigh-tech components and systems as well asautomation solutions for vehicle manufacturingSteeringDamperCold forgingPassive,(Semi-) activeAir springs &modulesSteering columnRack-EPS1Column-EPS1AT is one of the leading suppliers andengineering partners to the international auto industryDynamicComponentsAutom. dulesVariable systemsRotor shaftsChassis andbody in whiteStandard productsAxle assemblyDamper46%19%11%5%Camshafts(now Dynamic Components)Automotive Body SolutionsAutomotive ishiStellantisToyotaVolkswagenVolvoBMWJaguar Land RoverTool manufacturingMercedes-BenzPorscheNEWElectric vehicle OEMsNEW andChinese OEMsNioBAICPolestarFAWTeslaGeelyGWMSAICAT has positioned itself internationally close to its customers ingrowing markets to partake in even the largest global platformsSales by region2 FY 20/21Sales by BU FY 20/21Steeringand volume OEMsModule assemblyDiverse product portfolio with international relevance20%Established premium 2%20%Germany31%Western EuropeCentral/Eastern Europe23%14%10%North AmericaChinaRest of World 4.5 bn1. Electric Power Steering (EPS) 2. FY 20/21. Sales according to home state principle, addition of regional sales (not consolidated)3 Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive TechnologyRegional development

AT portfolio with 80% of sales independent of Internal Combustion Engine (ICE) developmentComponents, systems and servicesSteeringcolumnSteeringgearChassis andbody in whiteFull system steering supplierNew set-up as chassis and body supplierBU SteeringBU Automotive Body Solutions(Semi-) activedampersBU DamperFor OE and aftermarket businessCamshaftsModuleassemblyRotor shaftsBU Automotive SystemsBU Dynamic ComponentsAssembly and logistics servicesFor conventional and alternative engines4 Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive TechnologyICE dependentICE independent

Leading market positions established – Future technology trends offering further growth potentialSteeringDamperLong bility,Autonom.DrivingCurrentmarketpositioning Holistic steeringsystem providerwith strong software& E/E3 competence Focus on active andsemi activedamping systemslevering a strongbrand No. 1 steeringcolumn No. 4 total steeringmarket No. 1 semi activedampersCompetitivepositionDynamic ComponentsEfficientdrives/engines Leverage strong ICEposition fortransformation andparallel diversification No. 1 assembledcamshafts andsliding cam systemsAutom. Body SolutionsLightweightsolutions Integrated providerand engineeringpartner with serialbusinesscapabilitiesAutomotive Systems1Services Portfolio roundingoff for selected keyOEMs No. 4 plantengineering21. Comparable basis IFRS15 2. Related to BU SY assessment and competitive data. New BU AB assessment ongoing 3. Electric/Electronic5 Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive TechnologyIn line with market growthAbove market growthStrongly above market growth

Early and consequent portfolio development along future technologiesNew plants1Global footprintDynamicComponentsSteering3New productsState of the art technologyMore intelligenceand more content per carDual PinionX 5Column-EPS2Rack-EPS2Variable systemsX 15Rotor shaftsModulesAssembled camshaftDamperFull active damperModulesX 5DampTronic X dampertoday201220162021First SOP1. Exemplary 2. Electric Power Steering (EPS) 3. Full portfolio player6EPS2Steering column Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive TechnologyPassive damperSemi-active damperApproximate price multiplier

Strong recovery in FY 20/21 – Current outlook of FY 21/22 with market related uncertainty[ mn]FinancialparametersFinancialsFY 19/201OutlookFY 20/21Sales4,0904,522EBIT adj.-166264EBIT adj.margin [%]-45.8BCF-595591. FY 19/20 figures adjusted for portfolio changes and new special items guideline7 Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive TechnologyEstimation FY 21/22CommentContinuedsemiconductorshortage and notreliably predictablecustomer call-offsIncreased material,transport andenergy costsBCF on stable levelMid-term targetCommentAbove marketgrowth, 5,500 salesReachingbenchmarkperformance,7-8% EBIT adj.marginCCR min. 0.5

Automotive Technology – Value creation based on passion for innovation and financial performanceInvestment highlightsMission critical components & systemsLeverage strong ICE position for transformation of dynamic components businessSound order book & strong customer baseGlobal footprint with customer proximityRestructuring & improved resilienceDigitized products, processes & business models8 Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive Technology

1Mission critical components with huge growth potentialSteeringcolumnSteeringgear Steerby WireVMC1Electro mech.BrakeBatteryHousingChassis and body in whiteECUBU SteeringBU Automotive Body SolutionsFull system steering supplier AT supplies missioncritical componentsgloballyNew set-up as chassis and body supplier(Semi-) active Semi activedampersentry damper Majority ofAT business isindependent of ICE BU DamperFor OE and aftermarket businessCamshaftsRotorshaftsModuleassembly CompressorBU Dynamic ComponentsBU Automotive SystemsFor conventional and alternative enginesAssembly and logistics servicesICE dependentICE independentNew ICE independent 15 bn potential market volume2 via new products1. Vehicle Motion Control (VMC) 2. VMC, Steer-by-wire, compressor, battery housing, electro mechanical brake9 New productssupport growth andfoster diversification Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive Technology AT as chassissystem providerto major OEMs

1BU Steering Electric/Electronic competence center built up as major internal software hubE/E1 competence center as internal software hubBU Steering competence center BudapestScope of Budapest E/E1 development ST established as system partner E/E1 design including hardware/software design,implementation, testing and integration Competence in highest security level ASIL2 DHeadcount development 95080200120201. Electric/Electronic 2. Automotive Safety Integrity Level10 Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive Technology 45% of totalR&D workforce BU ST Software & E/E1 competence with 950 Softwaredevelopers in Hungary ST as AT internal technology hub, further AT BUs getsupported with SW & E/E1 competence

Leverage existing high performance ICE business to further drive transformation anddiversification of powertrain business2Status quoWay forwardBU Dynamic ComponentsBy far market leader forassembled camshaftsTakeover of competitor businessand in-house productionOngoing discussions with majorOEMs regarding end of life supply11ICE businessSales & EBIT of DC businessVery strong order intake of 4 bnlifetime sales in last 3 yearsContinuous growth ofexisting rotor shaft businessRotor shafts with increasingvalue and new functionality(e.g. increased complexitydue to cooling necessity)Electro mobilityand new productsFurther expansion throughdiversification in e-mobility(e.g. AC compressor)Today Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive TechnologyMid-term29/30

3Solid market positions with established OEMs and new playersExemplary 85% of plan sales1 backed with booked businessEstablished premium AudiBMWJaguar Land RoverMercedes-BenzPorscheand volume llantisToyotaVolkswagenVolvoWell established partnerof leading automotive OEMs1. FY 21/22 to mid-term AT total12 Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive TechnologyNEWElectric vehicle OEMsNEW andChinese OEMsNioBAICPolestarFAWTeslaGeelyGWMSAICSupplier forkey EV playersServe topChinese OEMs

4Global set-up with focus on customer proximity and best cost locationsBottom line improvementsFTE [k] by region1 withclear trend to best cost regionsNew plants: Customer proximity and above average financial performance17.5Mühlacker (AB)EBIT adj.Jászfényszaru (ST)14.355%45%30.09.1630.09.21Western Europeincl. GermanyUSACentral/Eastern EuropeMexico & BrazilPuebla (ST)Changzhou (ST), Changzhou (DA)China1. Internal FTE comparable excl. Automotive Body Solutions, w/o Rest of World (10FTE 30.09.21)13Additional manufacturing plants of DC Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive Technology19/20 20/21Midterm

5Structural cost improvements: Restructuring, better resilience & best cost set-upRestructuring measuresImproved labor cost2Better resilienceBest cost country share (Personnel) 1,500 FTEin ongoing &plannedrestructuringactivities50%30%FY 15/16Planmid-termG&A expenses16.0%FY 18/191. 18/19 without SY, from FY 20/21 on incl. AB 2. Internal FTE comparable excl. Automotive Body Solutions, w/o Rest of World (10FTE 30.09.21)14 Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive TechnologyHigh cost countries [FTE k]Best cost countries [FTE id-term

6Digitalization as fundamental driver of future enessECU EPS1 systems Vehicle Motion ControlEnrichment ofcurrent products,higher sales andcontent per vehicleDigital processesValue iencyQuality MES/MOM2 – globallylinked production Traceability of productsand production data 70 automation projectsReduction of COGSand online visibilityfor immediateresponse &improvementDigitalbusiness modelsDigitalbusiness models ST E/E3 competenceNew services carValoo1. Electric power steering 2. Manufacturing Execution System, Manufacturing Operations Management 3. Electric/Electronic15 Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive TechnologyAccess to newcustomers andmarkets

Automotive industry with highest aspirations regarding sustainabilityFront runnerClear targetsAwarding relevanceAutomotive industry withstrong political guidancetowards sustainable solutionsAll OEMs and big tier 1suppliers with sustainabilityroadmaps defined and communicatedSustainability alreadyestablished as criterionfor awarding future businessClimateneutral20242035Scope1 1 & 2Scope1 31. Scope 1 and 2: Own emissions; Scope 3 Emissions incl. supply chain16 Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive TechnologyShort termmeasurestkAT roadmaptk Automotive roadmap and exemplary measures: Energy efficiency programs Renewable energy production Procurement of green energy

Automotive Technology – Committed to realize sustainable shareholder valueConclusion80% of business already based on non ICE related future oriented technologySemiconductor shortage actively managedGrowth with existing and new productsStructural topics approached to reach benchmark performance levelsMid-term target margin level of 7-8% and CCR min. 0.517 Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive Technology

Disclaimer thyssenkrupp AGThis presentation has been prepared by thyssenkrupp AG (“thyssenkrupp”) and comprises the written materials/slides for a presentation concerning thyssenkrupp. By attending thispresentation and/or reviewing the slides you agree to be bound by the following conditions. The distribution of this document in certain jurisdictions may be restricted by law and persons intowhose possession this document comes should inform themselves about, and observe, any such restrictions.This presentation is for information purposes only and the information contained herein (unless otherwise indicated) has been provided by thyssenkrupp. It does not constitute an offer to sell orthe solicitation, inducement or an offer to buy shares in thyssenkrupp or any other securities. Further, it does not constitute a recommendation by thyssenkrupp or any other party to sell or buyshares in thyssenkrupp or any other securities and should not be treated as giving investment, legal, accounting, regulatory, taxation or other advice. This presentation has been preparedwithout reference to any particular investment objectives, financial situation, taxation position and particular needs. In case of any doubt in relation to these matters, you should consult yourstockbroker, bank manager, legal adviser, accountant, taxation adviser or other independent financial adviser.The information contained in this presentation has not been independently verified, and no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness orcorrectness of the information contained herein and no reliance should be placed on it. To the extent permitted by applicable law, none of thyssenkrupp or any of its affiliates, advisers,connected persons or any other person accept any liability for any loss howsoever arising (in negligence or otherwise), directly or indirectly, from this presentation or its contents or otherwisearising in connection with this presentation. No representation or warranty, either express or implied, is provided in relation to the accuracy, completeness or reliability of the information containherein.This presentation contains forward-looking statements that are subject to risks and uncertainties. Statements contained herein that are not statements of historical fact may be deemed to beforward-looking information. When we use words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” “may” or similar expressions, we are making forward-lookingstatements. You should not rely on forward-looking statements because they are subject to a number of assumptions concerning future events, and are subject to a number of uncertaintiesand other factors, many of which are outside of our control, that could cause actual results to differ materially from those indicated. These factors include, but are not limited to, the following: (i)market risks: principally economic price and volume developments; (ii) dependence on performance of major customers and industries, (iii) our level of debt, management of interest rate riskand hedging against commodity price risks; (iv) costs associated with, and regulation relating to, our pension liabilities and healthcare measures; (v) environmental protection and remediationof real estate and associated with rising standards for real estate environmental protection; (vi) volatility of steel prices and dependence on the automotive industry; (vii) availability of rawmaterials; (viii) inflation, interest rate levels and fluctuations in exchange rates; (ix) general economic, political and business conditions and existing and future governmental regulation; and (x)the effects of competition.Any assumptions, views or opinions (including statements, projections, forecasts or other forward-looking statements) contained in this presentation represent the assumptions, views oropinions of thyssenkrupp as of the date indicated and are subject to change without notice. thyssenkrupp neither intends, nor assumes any obligation, unless required by law, to update orrevise these assumptions, views or opinions in light of developments which differ from those anticipated. All information not separately sourced is from internal company data and estimates.Any data relating to past performance contained herein is no indication as to future performance. The information in this presentation is not intended to predict actual results, and noassurances are given with respect thereto.Throughout this presentation a range of financial and non-financial measures are used to assess our performance, including a number of the financial measures that are not defined underIFRS, which are termed ‘Alternative Performance Measures’ (APMs). Management uses these measures to monitor the group’s financial performance alongside IFRS measures because theyhelp illustrate the underlying financial performance and position of the group. These APMs should be considered in addition to, and not as a substitute for, or as superior to, measures offinancial performance, financial position or cash flows reported in accordance with IFRS. APMs are not uniformly defined by all companies, including those in the group’s industry. Accordingly, itmay not be comparable with similarly titled measures and disclosures by other companies.18 Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive Technology

7 Essen, December 2nd, 2021 Capital Market Day 2021 thyssenkrupp Automotive Technology Strong recovery in FY 20/21 –Current outlook of FY 21/22 with market related uncertainty [ mn] FY 19/201 FY 20/21 Estimation FY 21/22 Comment Mid-term target Comment Sales EBIT adj. EBIT

![Welcome [dashdiet.me]](/img/17/30-day-weight-loss-journal.jpg)