Transcription

EmployeeBenefits GuideGraceKennedy Foods (USA) LLCApril 1, 2017 – March 31, 2018The information in this Benefits Guide is presented for illustrative purposes only. The text contained in this Guide wastaken from various plan documents and/or benefit information. While every effort was taken to accurately report yourbenefits, discrepancies or errors are always possible. In case of discrepancy between the Benefits Guide and the actualplan documents the actual plan documents will prevail. All information is confidential, pursuant to the Health InsurancePortability and Accountability Act of 1996. If you have any questions about this guide, contact Human Resources.February 21, 2017

TABLE OF CONTENTSOpen Enrollment3Making Changes To Your Benefits3Who Is Eligible?3Medical(Available to all, except New York)4Medical (New York residents)5Dental8Vision10Life Insurance12Disability14TransAmerica Voluntary Products15Employee Assistance Program (EAP) 17Grace Kennedy Foods (USA) LLC is pleased to offer you thefollowing benefit options. This guide provides an overview ofthe benefit plans and programs available to you as well asinformational tools to optimize your coverage. As youconsider your benefit options, take an active role inunderstanding any changes to your needs and seize thisopportunity to make any necessary updates. If you have anyquestions or require additional information please referencethe contacts page in this guide.If you (and/or your dependent) have Medicare orwill become eligible for Medicare in the next 12months, a Federal law gives you more choicesabout your prescription drug coverage. Please seeAddendum B on page 23 for more details.OPENOPENENROLLMNTENROLLMENTWILL STARTWILL STARTON FEBRUARYONFEBRUARY27 & CLOSE27 & CLOSEON MARCHON MARCH10, 2017.6, 2017.IF YOU DOEVERYONENOT MAKEMUSTANYCOMPLETECHANGES, YOURCURRENTAND SUBMITELECTIONSAN ENROLLMENTWILL ROLLOVER!FORM.What’s New! The calendar year maximum on the High Dental planhas increased from 1,500 to 2,000Travel Assistance18 The Guarantee Issue amount on voluntary life hasincreased from 130,000 to 180,000Individual Mandate19 Marketplace Notice20Annual Notices21True annual open enrollment for the voluntary life andvoluntary disability (short and long term). For thoseindividuals that have not been previously denied forcoverage, this is your chance to elect coverage withoutproviding an evidence of insurability (EOI)Women’s Health & Cancer Rights Act of 1998Newborns’ ActRight to Receive a Notice of Privacy PracticesAddendum A – Medicaid and CHIPAddendum B – Medicare Part DGlossary24Contacts25ENROLLMENT CHECKLIST Review your benefit options Verify your provider(s) are contracted in the network Complete the enrollment form including informationfor dependents and beneficiaries (Per Health CareReform (HCR), a social security number (SSN) isrequired for all dependents enrolled in healthcoverage) Complete Evidence of Insurability (EOI), if applicable Submit completed enrollment formThe information in this benefit guide is presented for illustrative purposes only. Please refer to the plan document for complete details.Page 2

OPEN ENROLLMENTEach year, during the open enrollment period, you will have the opportunity to enroll in or make changes toyour benefit elections and dependents without a qualifying event. Once you have made your elections youwill not be able to change them until the next open enrollment period, unless you experience a qualifyingevent.MAKING CHANGES TO YOUR BENEFITS DURING THE PLANYEAR (QUALIFYING EVENT)Per IRS code Section 125, once your benefits are effective you may not make changes toyour benefits until the next open enrollment period unless you experience a qualifyingevent. Qualifying events that permit mid-year changes include:- Marriage- Divorce- Death of spouse, child or other qualified dependent- Legal Separation- Birth or adoption of child- Change of dependent status- Loss of other group coverage- Change in employment status (employee, spouse, domestic partner or dependent)- Change in residence due to an employment transferIf you do not make changes within 30 days of the ‘qualifying event,’ you must waituntil the following open enrollment period. It is your responsibility to notifyHuman Resources within 30 days of the qualifying event.WHO IS ELIGIBLE?Full-time employees (working 30 hours per week)New hires are eligible for benefits on the 1st of the month following 30 days of employment.Family members eligible for dependent coverage include:- Legal spouse- Domestic partner (Same and Opposite sex)- Natural, adopted, foster or step child(ren)- Child(ren) for whom court appointed or legal guardianship has been awardedEligible dependent children may be covered until:- Medical: end of the calendar year they turn age 26- Dental: end of the month they turn age 26- Vision: end of the month they turn age 26- Voluntary Life: they turn age 26 (coverage ends on birthday)A handicapped dependent child may continue coverage beyond the age limit if determined to meet plan requirements.The information in this benefit guide is presented for illustrative purposes only. Please refer to the plan document for complete details.Page 3

MEDICAL INSURANCEAetna – www.aetna.comParticipating provider information can be found on the carrier’s website.AVAILABLE TO ALL, EXCEPT NEW YORK EMPLOYEESIN-NETWORK BENEFITSNetwork NamePlan CoinsuranceCalendar Year DeductibleIndividual / FamilyOut of Pocket MaxIndividual / FamilyDeductible Applies To Out of PocketMedical Copays Apply To Out of PocketRX Copays Apply To Out of PocketOffice ChargesOffice Visit / Specialist VisitReferral RequiredPreventiveFacility ChargesConvenience Care (i.e. CVS Minute Clinic)Emergency Room (In or out of network)Inpatient Hospital / Outpatient HospitalUrgent CarePhysician FeesIndependent Facility ChargesLabsX-raysComplex Diagnostic ImagingMental HealthInpatient FacilityPhysician VisitPrescription DrugsDeductibleTier 1Tier 2Tier 3Specialty (GH, Self Injectable, etc)Mail Order - 90 day supplyOUT-OF-NETWORK BENEFITSPlan CoinsuranceCalendar Year DeductibleIndividual / FamilyOut of Pocket MaxIndividualFamilyOffice / Facility ChargesBalance BillingEmployeeEmployee SpouseEmployee Child(ren)Employee FamilyPOS HNOption 1500Aetna Open Access PlanHealth Network Option100%Embedded 1,500 / 3,000HMO HNOnly 1500Aetna Open Access PlanHealth Network Only100%Embedded 1,500 / 3,000OAMC 9Aetna Open Access PlanManaged Choice POS80%Embedded 5,000 / 10,000 3,000 / 6,000YesYesYes 3,000 / 6,000YesYesYes 6,350 / 12,700YesYesYes 15 / 50No 0 15 / 50No 0 30 / 60No 0 15 100DeductibleNJ: 100 / FL, MA, MD: 50Deductible 15 100DeductibleNJ: 100 / FL, MA, MD: 50Deductible 30 20020% after deductible 5020% after deductible 0 (Quest) 50NJ: 50 / FL, MA, MD: 200 0 (Quest) 50NJ: 50 / FL, MA, MD: 200 0 (Quest) 0 300 after deductibleDeductible 50Deductible20% after deductible 50 60Mandatory Generic Value Plus Open Formulary 0 0 0 10 10 20 30 30 40 45 45 70Applicable Cost ShareApplicable Cost Share30% not to exceed 2502 x retail copay2 x retail copay2 x retail copay70%50% 5,000 / 10,000 15,000 / 30,000No benefits exceptfor emergency care 10,000 balance billing 20,000 balance billing30% after deductibleYesBI-WEEKLY PAYROLL DEDUCTIONS 71.31 59.18 393.11 367.13 302.78 280.69 618.93 583.25 30,000 balance billing 60,000 balance billing50% after deductibleYes 0 (Employer Paid) 240.50 172.06 409.27The information in this benefit guide is presented for illustrative purposes only. Please refer to the plan document for complete details.*Benefits may vary slightly based upon your state of residence.Page 4

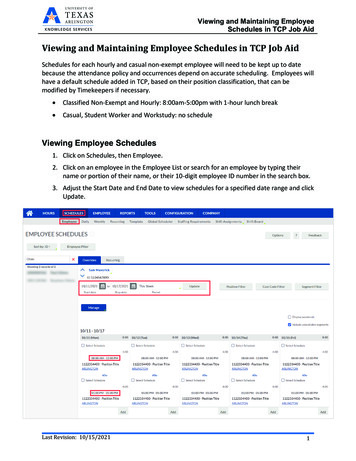

MEDICAL INSURANCEAetna – www.aetna.comParticipating provider information can be found on the carrier’s website.AVAILABLE ONLY TO NEW YORK RESIDENTSIN-NETWORK BENEFITSNetwork NamePlan CoinsuranceCalendar Year DeductibleIndividual / FamilyOut of Pocket MaxIndividual / FamilyDeductible Applies To Out of PocketMedical Copays Apply To Out of PocketRX Copays Apply To Out of PocketOffice ChargesOffice Visit / Specialist VisitReferral RequiredPreventiveFacility ChargesConvenience Care (i.e. CVS Minute Clinic)Emergency Room (In or out of network)Inpatient Hospital / Outpatient HospitalUrgent CareIndependent Facility ChargesLabsX-raysComplex Diagnostic ImagingMental HealthInpatient FacilityPhysician VisitPrescription DrugsDeductibleTier 1Tier 2Tier 3Mail Order - 90 day supplyOUT-OF-NETWORK BENEFITSPlan CoinsuranceCalendar Year DeductibleIndividual / FamilyOut of Pocket MaxIndividualFamilyOffice / Facility ChargesBalance BillingEmployeeEmployee SpouseEmployee Child(ren)Employee FamilyOAMC 16 Buy Up PlanAetna Open Access PlanOAMC 9Aetna Open Access Plan100%Embedded 0OAMC 15 Base PlanAetna Open Access PlanManaged Choice POS100%Embedded 0 3,000 / 6,000YesYesYes 3,000 / 6,000YesYesYes 6,350 / 12,700YesYesYes 15 / 50No 0 15 / 50No 0 30 / 60No 0 15 100Covered at 100% 35 15 100Covered at 100% 35 30 20020% after deductible 50 0 (Quest) 50 50 0 (Quest) 50 50 0 (Quest) 0 300 after deductible 0 1520% after deductible 60 0 10 30 452 x retail copay 0 15Mandatory Generic 0 10 30 452 x retail copay70%50%50% 500 / 1,000 500 / 1,000 15,000 / 30,000 10,000 balance billing 30,000 balance billing 20,000 balance billing 60,000 balance billing30% after deductible50% after deductibleYesYesBI-WEEKLY PAYROLL DEDUCTIONS 71.31 59.18 393.11 367.13 302.78 280.69 618.93 583.2580%Embedded 5,000 / 10,000 0 20 40 702 x retail copay 30,000 balance billing 60,000 balance billing50% after deductibleYes 0 (Employer Paid) 240.50 172.06 409.27The information in this benefit guide is presented for illustrative purposes only. Please refer to the plan document for complete details.Page 5

AETNA DISCOUNT PROGRAMAetna – www.aetna.comGlobalFit – www.globalfit.com/fitnessSave on gym memberships, eye exams and eyeglasses, weight-lossprograms, massage therapy and more.Fitness discountsWeight management discountsGet the guaranteed lowest rates at your choice of over 10,000gyms (and growing) in the GlobalFit network. This offer is fornew gym members only. If you belong to a gym now, orbelonged recently, call GlobalFit at 1-800-298-7800 to see if adiscount applies.Save with CalorieKing!Learn to control your weight long term. Join an annual or monthly CalorieKing Program, then get a7-day free trial period. You’ll get a discount when you continue your annual programmembership. With either an annual or monthly program membership, you alsosave on products in the CalorieKing online Store. You also getCalorieKing’s Food and Exercise Diary, extensive food database,personalized goals and more.You also get: FREE guest pass at most gyms Flexible membership options Easy billing through your bank account or major credit card Membership transfer to another participating gym or person Freeze and travel privilegesSave on home exercise equipmentDo you prefer to exercise in the privacy of your home? Getdiscounts on elliptical trainers, treadmills and strengthequipment, and start building your home gym today.More healthy perksGetting fit is just the start to a healthier you. You can also try outan at-home weight-loss program. Or get one-on-one healthcoaching to help you quit smoking, lower stress, lose weightand more.Natural Products and Services DiscountsSave on good health, naturally. Get a discount off the normalfee for these services offered through the ChooseHealthyprogram. Massage Therapy Acupuncture Chiropractic Nutrition ServicesDiscounts on health and wellness productsYou can also get a discount off the retail price on a variety ofproducts like over-the-counter vitamins, yoga equipment andmore on the ChooseHealthy website.Save with Jenny Craig !You can choose from these offers: FREE 30-Day Program Percent off the Jenny All Access Program enrollment fee, JennyAnywhere!Jenny gives you two options to choose from: Get weekly, face-to-face support and motivation atone of approximately 400 locations. Enjoy the convenience and privacy of getting your support andmotivation over the phone each week.You also get one-on-one support from your personalconsultant, planned and personalized menus, and more.Save with Nutrisystem!Lose weight and learn how to keep it off. Save on any 28-Day Nutrisystem Success weight-loss mealplan. Get other offers when you purchase a plan. Enjoy a larger discount when you sign up forAuto-Delivery.Start saving todayYou can save on so much more. It’s easy. To getstarted:1. Log in to your secure member website atwww.aetna.com once you’re an Aetna member.2. Choose “Health Programs,” then “See the discounts.”3. Follow the steps for each discount you want to use.The information in this benefit guide is presented for illustrative purposes only. Please refer to the plan document for complete details.Page 6

SAVINGS TIPSBelow are a few ideas on how to spend your dollars or save on prescriptions and medications.Pharmacy discount programs. Before youpay for your next prescription, check to see ifthey are available for free or at a low cost.Pharmacies such as Walmart and Costcooffer prescription discount programs thatallow you to purchase medications for as lowas 4 for a 30-day supply. Publix pharmaciesoffer select free antibiotics and diabetesmedications.www.NeedyMeds.org is a national non-profitorganization that maintains a website of freeinformation on programs that help people who needassistance with the cost of medications andhealthcare costs.Some resources available through NeedyMeds are: Patient Assistance Programs Free / Low Cost Clinics Diagnosis – Based Assistance State Programs Free Drug Discount CardUrgent Care vs Emergency Room (ER). The Emergency Room is meant for true emergencies such as lifethreatening illnesses and injuries. The ER costs an average of three times more than a visit to the urgentcare. In a non-life threatening situation, you can most likely be treated at an urgent care. Urgent Care centersare available for non-life threatening immediate care.Emergency Room Examples:Urgent Care Examples: Chest PainBroken BonesAllergic ReactionsContinuous BleedingHead InjurySevere Shortness of BreathDeep WoundsCoughs and Sore ThroatMinor Injuries and BurnsEar / Sinus InfectionsFlu and ColdSprains and StrainsFeverVaccinationsConvenience Care Clinic. Don’t pay more if you don’t have to. Convenience care clinics are walk-in clinicslocated in a supermarket, pharmacy or retail store, where available, such as CVS Caremark, Walgreens andWalmart. Services may be provided at a lower out-of-pocket cost compared to urgent or emergency care asthey are subject to primary care office visit co-pays, and/or coinsurance. Convenience care clinics areavailable for non-life threatening immediate care.Convenience Care Clinic Examples: Common Infections (e.g.: ear,bladder, pink eye, strep throat)Flu ShotsMinor Skin ConditionsPregnancy TestsAllergiesImmunizationsSchool PhysicalsThe information in this benefit guide is presented for illustrative purposes only. Please refer to the plan document for complete details.Page 7

DENTAL INSURANCEUnum – www.unumdental.comParticipating provider information can be found on the carrier’s website.Dental Network: Advantage Plus 2.0High Plan PPO F-Plan3WIn-NetworkOut-Of-NetworkIN-NETWORK ajor50%50%Orthodontia50%50%Benefits Based onContracted Rates90th PercentileBalance BillingNoYesCalendar Year Deductible (Individual /Family) 50 / 150Deductible Waived for Preventive ServicesYesCalendar Year Maximum 2,000Maximum RolloverPreventive Incentive & Smile for HealthLifetime Orthodontic Maximum 1,000SCHEDULE OF BENEFITSRoutine Exams (2 every 12 months)PreventiveCleaning (2 every 12 months)PreventiveX-RaysBitewingPreventiveFull MouthPreventiveSealants (under age 16)PreventiveFillingsAmalgamBasicComposite ResinBasicOral Surgery*BasicRepairsBasicRoot CanalBasicPeriodontal Maintenance*BasicPeriodontal Surgery*BasicEndosteal ImplantsNot coveredCrownsMajorFixed BridgesMajorFull And Partial DenturesMajorOrthodontiaTo age 19*Co-insurance based on complexity of procedurePOLICY PROVISIONSLate Entrant PenaltiesNoneBI-WEEKLY PAYROLL DEDUCTIONSEmployee 17.06Employee Spouse 33.75Employee Child(ren) 35.55Employee Family 56.10Low Plan PPO cted RatesNo80%80%50%50%90th PercentileYes 50 / 150Yes 1,000Preventive Incentive & Smile for Health ntiveBasicBasicBasicBasicBasicBasicBasicNot coveredMajorMajorMajorTo age 19None 13.55 26.72 28.65 44.93The information in this benefit guide is presented for illustrative purposes only. Please refer to the plan document for complete details.Page 8

PREVENTIVE INCENTIVE & SMILE FOR HEALTHDental coverage available through Unum is designed to help you cut costs over the long term by encouragingemployees to get preventive care. And now Unum offers plan upgrades to help employees get the care theyneed:IMPROVED ORAL HEALTH FOR YOUR EMPLOYEES CAN MEAN REAL HEALTH CARE SAVINGS.Preventive Incentive - promotes routine preventive services like cleanings, exams and X-rays as thoseservices do not count toward the plan’s annual maximum, leaving more benefit dollars for other covered dentalprocedures. Preventive Incentive encourages employees to have regular dental checkups which can detecttooth decay, as well as dental problems that can lead to serious diseases.Examples of Savings with Preventive IncentiveAnnual maximum Incentive2 Cleanings 0 126 874 1,0002 Exams 0 66 808 1,0001 set of X-rays 0 40 768 1,000Total 0 232ReducesAnnualMaximumNo Reductionon AnnualMaximumWith Preventive Incentive, the employee would have 232more to use on other covered dental procedures.Smile for Health - provides more comprehensivecoverage for employees with covered chronic illnessesby increasing the amount the dental plan currently paystoward nonsurgical periodontal services. It also includescoverage for additional services employees may need,such as diagnostic tests and preventive procedures. Inaddition, it increases the percentage the plan will pay forenhanced periodontal disease management.The information in this benefit guide is presented for illustrative purposes only, please refer to the plan document for complete details.Page 9

VISION INSURANCEVision Service Provider – www.vsp.comParticipating provider information can be found on the carrier’s website.This plan is designed to provide high quality vision care while controlling costs. To do this, we encourage youto seek care from doctors and vision facilities that belong to the VSP Choice network. You will receivediscounts and preferred member pricing for a variety of benefits.IN-NETWORK BENEFITSVision ExaminationSingle LensesBifocal LensesTrifocal LensesProgressive LensesFramesContact Lens Exam & FittingElective Contact Lenses - In lieu of framesLaser Vision CorrectionOUT-OF-NETWORK BENEFITSVision ExaminationSingle LensesBifocal LensesTrifocal LensesFramesElective Contact Lenses - In lieu of framesFREQUENCYExamsLenses/ContactsFrames 10 copay 10 copay 10 copay 10 copayStandard 55 copay / All others: 95 - 175 130 retail allowance 20% off over allowance15% off U&C. Not to exceed 60 copayNot deducted from contact lens allowance 130 allowance15% off retail or 5% off promotional pricing at VSP approved centersReimbursement up to 45 30 50 65 70 10512 months12 months24 monthsBI-WEEKLY PAYROLL DEDUCTIONSEmployeeEmployee SpouseEmployee Child(ren)Employee Family 3.91 6.26 6.40 10.31The information in this benefit guide is presented for illustrative purposes only. Please refer to the plan document for complete details.Page 10

VISION SAVINGSEnjoy exclusive member extras from VSP totaling more than 2,500 in savings.Visit www.vsp.com/specialoffers for more great offers.VSP Primary EyeCare PlanSupplemental coverage for non-surgical medical eye care services and conditions such as: Treatment for eye pain, or conditions like pink eye; Tests to diagnose sudden vision changes; Exams to monitor cataracts; Pictures of your eyes to detect and track eye conditions, such as glaucoma and diabetic eyedisease Retinal screenings (for eligible members with diabetes)You pay only 20 copay per visit at VSP approved providers.Special Deal on GlassesGet an extra 20 to spend on featured frame brands. Maximize your benefitswith an extra 20 to spend, on top of your allowance, on any frame from a wideselection of featured frame brands. Simply select a featured frame brand in yourVSP doctor’s office and the 20 will automatically be applied to your purchase.Visit www.vsp.com/specialoffers for a list of qualified featured brands. Framebrands subject to change.TruHearingEnjoy savings of up to 2,400 on a pair of digital hearing aids and savings on batteries for you andyour extended family members through TruHearing. Hearing aid batteries for less! Get 120 batteries for only 39 through TruHearing Each purchase includes 45-day money-back guarantee, 48 batteries per aid, 3-yearmanufacture warranty for repair, one-time loss & damage*For more products, pricing and savings visit www.vsp.truhearing.com.The information in this benefit guide is presented for illustrative purposes only. Please refer to the plan document for complete details.Page 11

LIFE INSURANCEUnum – www.unum.comBASIC LIFE/AD&D INSURANCE (EMPLOYER PAID)Grace Kennedy Foods (USA) LLC provides 20,000 worth of Basic Life and Accidental Death & Dismemberment(AD&D) Insurance through Unum to all full time employees at no cost. Please be sure to review your beneficiaryinformation and contact your Human Resources department should you have any changes throughout the year.Benefit Reduction Schedule: 35% at age 65, 50% at age 70VOLUNTARY LIFE INSURANCEEmployees who would like to supplement their basic life insurance benefits may purchase additional coverage. Ifyou purchase coverage for yourself, you may also purchase coverage for your spouse and/or your dependentchildren. To be eligible for coverage you must be actively at work, you and your dependents must be able toperform normal activities and not be confined (at home, in a hospital, or in any other care facility). When you enrollyourself and/or your dependents in this benefit, you pay the full cost through payroll deductions. Be sure to reviewyour beneficiary information and contact your Human Resources department should you have any changes. If youhave previously declined voluntary life insurance and now wish to enroll you will not need to provide anEvidence of Insurability form if you elect up to the guarantee issue amount for this open enrollment periodunless you have been previously denied coverage. The voluntary life Insurance coverage minimums,maximums and guarantee issue (G.I.) amounts are as follows:Voluntary Life Insurance Benefit DescriptionEmployee Maximum Benefit: Up to 5 x annual salary not to exceed 500,000( 10,000 increments) Minimum Benefit: 10,000 Guarantee Issue: 180,000Benefit Reduction Schedule: Reduces by 35% at age 65, to 50% at age 70Spouse /Domestic Partner Maximum Benefit: Up to 500,000, not to exceed employee’s election( 5,000 increments) Minimum Benefit: 5,000 Guarantee Issue: 30,000Benefit Reduction Schedule: Reduces by 35% at age 65, to 50% at age 70 Child(ren) Minimum Benefit: 2,000( 2,000 increments)Maximum Benefit: 10,000Guarantee Issue: 10,000(Birth to 6 months: 1,000, 6 months to age 26: full benefit amounts)It is the EMPLOYEE’s responsibility to complete and submit an Evidence of Insurability (EOI) form.Note: Benefit coverage & payroll deductions for newly elected amount will not take effect until EOI is approved by the carrier.The information in this benefit guide is presented for illustrative purposes only. Please refer to the plan document for complete details.Page 12

LIFE INSURANCEUnum – www.unum.comBelow is the cost for the Voluntary Life Insurance coverage. The rates/premium are age banded based on theemployee’s age as of the first day of the plan year for both the employee and spouse.If the benefit amount you would like to select is over 100,000, select the benefit amount from the first column(Coverage Amount) that when multiplied by another number results in the benefit amount you want. Forexample: If you would like to elect 150,000 in coverage, use the 50,000 row rate which applies to your ageband and multiply by 3.EMPLOYEE BI-WEEKLY PAYROLL 5-4950-5455-5960-6465-6970-7475 10,000 0.28 0.30 0.41 0.60 0.92 1.43 2.11 3.02 3.89 5.53 10.46 32.34 20,000 0.55 0.60 0.81 1.21 1.84 2.86 4.23 6.05 7.78 11.06 20.93 64.69 30,000 0.83 0.90 1.22 1.81 2.76 4.29 6.34 9.07 11.67 16.59 31.39 97.03 40,000 1.11 1.20 1.62 2.42 3.67 5.72 8.46 12.09 15.56 22.12 41.85 129.38 50,000 1.38 1.50 2.03 3.02 4.59 7.15 10.57 15.12 19.45 27.65 52.32 161.72 60,000 1.66 1.80 2.44 3.63 5.51 8.58 12.68 18.14 23.34 33.18 62.78 194.07 70,000 1.94 2.10 2.84 4.23 6.43 10.02 14.80 21.16 27.24 38.70 73.24 226.41 80,000 2.22 2.40 3.25 4.84 7.35 11.45 16.91 24.18 31.13 44.23 83.70 258.76 90,000 2.49 2.70 3.66 5.44 8.27 12.88 19.02 27.21 35.02 49.76 94.17 291.10 100,000 2.77 3.00 4.06 6.05 9.18 14.31 21.14 30.23 38.91 55.29 104.63 323.45SPOUSE BI-WEEKLY PAYROLL 5-4950-5455-5960-6465-6970-7475 5,000 0.14 0.15 0.20 0.30 0.46 0.72 1.06 1.51 1.95 2.76 5.23 16.34 10,000 0.28 0.30 0.41 0.60 0.92 1.43 2.11 3.02 3.89 5.53 10.46 32.68Note: Your actual payroll deduction may vary slightly due to rounding.CHILD(REN) BI-WEEKLY PAYROLL DEDUCTION 2,000 0.22 4,000 0.44 6,000 0.66 8,000 0.89 10,000 1.11*Regardless of how many children you have.The information in this benefit guide is presented for illustrative purposes only. Please refer to the plan document for complete details.Page 13

DISABILITY INSURANCEUnum – www.unum.comVOLUNTARY SHORT TERM DISABILITYIn the event you become disabled from a non work-related injury or sickness, disability income benefits areprovided as a source of income. Employees may purchase Short Term Disability (STD) through payrolldeductions. Coverage is offered through Unum. If you have previously declined Short Term Disabilitycoverage and now wish to enroll, you will not need to complete an Evidence of Insurability (EOI) formfor this open enrollment period unless you have been previously denied coverage.STD SCHEDULE OF BENEFITSBenefits Begin8th day Accident / SicknessBenefit Duration / Payable12 weeksPercentage of Income Replaced60%Maximum Weekly Benefit 1,000Pre-Existing Condition LimitationNonePremium Factor 0.0001810BI-WEEKLY PAYROLL DEDUCTION CALCULATIONAnnual Salary x Premium Factor payroll deduction( 86,666.67 Maximum Annual Salary)*If your salary is more than 86,666.67, use 86,666.67 to calculate your premium.Note: Your actual payroll deduction may vary slightly due to rounding.VOLUNTARY LONG TERM DISABILITYIn the event you become disabled from a non work-related injury or sickness, disability income benefits areprovided as a source of income. Employees may purchase Long Term Disability (LTD) through payrolldeductions. Coverage is offered through Unum. If you have previously declined Long Term Disabilitycoverage and now wish to enroll, you will not need to complete an Evidence of Insurability (EOI) formfor this open enrollment period unless you have been previously denied coverage.LTD SCHEDULE OF BENEFITSBenefits Begin91st day Accident / Sickness2 years (Own Occupation)Benefit Duration / Payable Social Security Normal Retirement Age (SSNRA)(Any Occupation)Percentage of Income60%ReplacedMaximum Monthly Benefit 6,000Disabilities that occur during the first 12 months ofPre-Existing Conditioncoverage due to a pre-existing condition that occurredLimitationduring the 3 months prior to coverage are excluded.BI-WEEKLY PAYROLL DEDUCTION CALCULATIONAnnual Salary x Premium Factor payroll deduction( 120,000 Maximum Annual Salary)Age / PremiumFactor TableAge 2425 – 2930 – 3435 – 3940 – 4445 – 4950 – 5455 – 5960 – 6465 – 6970 PremiumFactor 0.0000511 0.0000768 0.0001315 0.0002118 0.0003473 0.0004603 0.0005884 0.0006722 0.0006357 0.0005115 0.0005042*If your salary is more than 120,000, use 120,000 to calculate your premium.Note: Your actual payroll deduction may vary slightly due to rounding.The information in this benefit guide is presented for illustrative purposes only. Please refer to the plan document for complete details.Page 14

VOLUNTARY PRODUCTSTransamerica – www.transamerica.comTransconnect Gap Plan pays a benefit amount for out of pocket medical expenses including deductibles, coinsurance and co-payments. BENEFIT WILL BE AVAILABLE ONLY IF PARTICIPATION IS MET.HELP PROTECT YOUR TOMORROWTRANSCONNECT GAP PLAN BENEFITSHelps pay the out-of-pocket expense for an inpatient hospital stay,inpatient surgery, physician’s in-hospital charges.In-Patient Hospital Benefit Pays actual charges for applicable services up to 4,000 per coveredmemberHelps pay the out-of-pocket expense for surgery in a hospital outpatientfacility or free-standing outpatient surgery center.Out-Patient Hospital Benefit Pays actual charges for applicable services up to 2,000 per coveredmemberAmbulance BenefitHelps pay the out-of-pocket expenses incurred for ambulancetransportation (ground or air) to a hospital or emergency center for injuriessustained in an accident. Pays up to 1,000 per covered memberBI-WEEKLY PAYROLL DEDUCTIONUnder age 54Age 55 Employee 18.12 28.99Employee Spouse 38.96 62.33Employee Child(ren) 32.98 46.38Employee Family 57.98 84.07The information in this benefit guide is presented for illustrative purposes only. Please refer to the plan document for complete details.Page 15

VOLUNTARY PRODUCTS1Transamerica – www.transamerica.c

MEDICAL INSURANCE Aetna –www.aetna.com Participating provider information can be found on the carrier’swebsite. AVAILABLE ONLY TO NEW YORK RESIDENTS OAMC 16 Buy Up Plan OAMC 15 Base Plan OAMC 9 IN-NETWORK BENEFITS Aetna Open Access Plan Aetna Open Access Plan Aetna