Transcription

The 85% Winning Strategy85% Average Win Rate over the last 9 yearsChris WhiteFounder and CEO, EdgeRater LLChttp://www.edgerater.com

ContentsDisclaimer. 2Introduction . 3The Reference Book . 3A Brief History . 3The Strategy Rules . 4The Initial Results . 5January 1st 2009 to December 31st 2013 . 5The Interview with Steve Alexander . 6The Last 7 Years . 62014 Full Year Results . 72015 Full Year Results . 82016 Full Year Results . 92017 Full Year Results . 102018 Full Year Results . 112019 Full Year Results . 122020 Full Year Results . 13What The Data Shows . 14Download ETF Trading Bandit Today . 14https://www.EdgeRater.com

DisclaimerBacktested results presented in this report use simulated trades. Every effort has been made to ensurethe accuracy of the results but it is possible that the results contain incorrect data. The reader isencouraged to independently verify the results using their own software and data.EdgeRater LLC. ("Company") is not an investment advisory service, nor a registered investment advisoror broker-dealer and does not purport to tell or suggest which securities or currencies customers shouldbuy or sell for themselves. The analysts and employees or affiliates of Company may hold positions inthe ETFs, stocks, currencies or industries discussed here. You understand and acknowledge that there isa very high degree of risk involved in trading securities and/or currencies. The Company, the authors,the publisher, and all affiliates of Company assume no responsibility or liability for your trading andinvestment results. Factual statements on the Company's website, or in its publications, are made as ofthe date stated and are subject to change without notice. It should not be assumed that the methods,techniques, or indicators presented in these products will be profitable or that they will not result inlosses. Past results of any individual trader or trading system published by Company are not indicative offuture returns by that trader or system, and are not indicative of future returns which can be realized byyou. In addition, the indicators, strategies, columns, articles and all other features of Company'sproducts (collectively, the "Information") are provided for informational and educational purposes onlyand should not be construed as investment advice. Examples presented on Company's website are foreducational purposes only. Such set-ups are not solicitations of any order to buy or sell. Accordingly, youshould not rely solely on the Information in making any investment. Rather, you should use theInformation only as a starting point for doing additional independent research in order to allow you toform your own opinion regarding investments. You should always check with your licensed financialadvisor and tax advisor to determine the suitability of any investment.HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN INHERENT LIMITATIONS. UNLIKEAN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING ANDMAY NOT BE IMPACTED BY BROKERAGE AND OTHER SLIPPAGE FEES. ALSO, SINCE THE TRADES HAVENOT ACTUALLY BEEN EXECUTED, THE RESULTS MAY HAVE UNDER- OR OVER-COMPENSATED FOR THEIMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADINGPROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFITOF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TOACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN.https://www.EdgeRater.com

IntroductionHi, I’m Chris White, founder and CEO of EdgeRater LLC, a trading toolssoftware development company based in Seattle.Several years ago I wrote a software program called the ETF TradingBandit with the sole aim to provide its users with actionable highprobability trading signals every day. The signals were derived fromformulas contained in the book ‘High Probability ETF Trading’ byLarry Connors and Cesar Alvarez.In this report I will explain the background behind the software, the strategies and where they camefrom and show which strategy has had an over 85% win rate in each of the last 7 years.The Reference BookAll of the strategies discussed in this document have formulas that were published in the book ‘HighProbability ETF Trading’ by Larry Connors and Cesar Alvarez. The book is available on Amazon, there’seven a Kindle edition available for only 10. The reference book is a recommended read for anyone whodecides to trade the strategies. Not only do the authors give the formulas for the strategies but they alsodiscuss how best to trade them and what to do in various situations, for example what to do if morethan one ticker is signaling a buy.A Brief HistoryAt the time the book was published I had already written a backtesting program called EdgeRater PROand was looking for strategies to test. The strategies in this book were a good fit because:1.2.3.4.The rules are clearly explainedThe strategies use only technical analysis (no fundamentals)The strategies had already been backtested by the authors over a 16-year periodThe strategies have quantifiable/verifiable resultshttps://www.EdgeRater.com

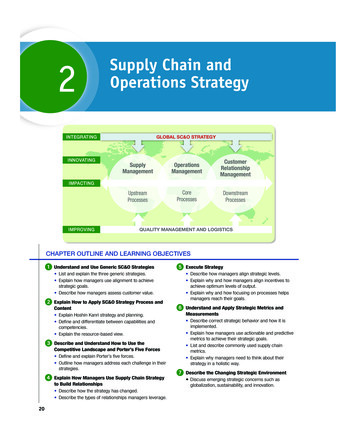

The Strategy RulesThe 7 strategies in the book are named as follows:1.2.3.4.5.6.7.The 3-Day High/Low MethodRSI25 & RSI75R3 StrategyThe %b StrategyMultiple Days Up (MDU) and Multiple Days Down (MDD) StrategyRSI 10/6 & RSI 90/94 StrategyTime-Price-Scale-inEach strategy has a long and a short version. The theme for the long strategies it is to buy long termstrength on a pullback and for the short strategies it is to sell long term weakness on a rally.The long term strength or weakness criteria are the same for all strategies. An ETF is assumed to havelong term strength if it has a daily close above its 200 Day Simple Moving Average and it is assumed tohave long term weakness if it has a daily close below its 200 Day Simple Moving Average.Each strategy determines the short term pullback or rally as described in the following tableStrategyShort term pullback criteriaShort term rally criteria3-Day High/LowConsecutive Lower highs andlower lows*4 period Wilder’s RSI below 25Consecutive higher highs andhigher lows*4 period Wilder’s RSI above 75Consecutive 2 period Wilder’s RSIlowerConsecutive Bollinger’s %B under.2Lower close for 4 out of past 5days*1st unit: 2 period Wilder’s RSIunder 10Consecutive 2 period Wilder’s RSIhigherConsecutive Bollinger’s %B over .81st unit: 2 period Wilder’s RSIunder 251st unit: 2 period Wilder’s RSI over75RSI25 & RSI75R3%bMDU &MDDRSI 10/6 & RSI 90/94**Time-Price-Scale in**Higher close for 4 out of 5 days*1st unit: 2 period Wilder’s RSI over90Notes:* These criteria have an additional 5 period Simple Moving Average condition.** These strategies involve scaling in or averaging down – the short term pullback criteria are only listedfor the first unit.https://www.EdgeRater.com

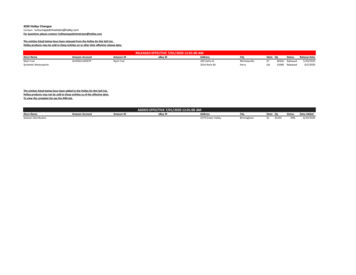

The Initial ResultsWhen I initially tested these strategies with EdgeRater I was able to verify that my results usingEdgeRater matched the results published in the book. This gave me confidence that I was testing using agood methodology and data set.I then used the same methodology on data that was released after the book was published in order tosee how the strategies continued to perform. The results were impressive:January 1st 2009 to December 31st 2013StrategyEntry/Exit On CloseEntry/Exit Next OpenBasic VersionTradesP/L%Hold%WinTradesP/L%Hold%Win3 Day Hi/Lo Long3 Day Hi/Lo ShortRSI 25 LongRSI 75 ShortR3 LongR3 Short%B Long%B ShortMDD LongMDU ssive %67.00%76.37%65.16%82.28%73.47%3 Day Hi/Lo Long5020.61% 5.380.68%3 Day Hi/Lo Short3170.93% 5.272.87%RSI 25 Long5941.30% 6.984.68%RSI 75 Short2721.24% 9.073.16%R3 Long5051.14% 5.884.55%R3 Short2781.30% 7.275.54%%B Long7280.79% 5.182.28%%B Short3821.15% 5.973.56%MDD Long7490.67% 4.780.91%MDU Short3981.12% 5.174.12%RSI 10/6 Long7660.77% 4.881.98%RSI 90/94 Short3771.07% 5.372.15%TPS Long8071.30% 5.789.59%TPS Short4271.57% 6.580.80%BACKTESTED RESULTS FOR THE PERIOD 1/1/2009-12/31/2013https://www.EdgeRater.com

Note that the book only tested entering and exiting at the close of the day butthat I have tested entering the next open and closing the next open after theentry/exit signals are generated. Both sets of results are shown in the repor ttables.All of the strategies showed good statistics but one in particular, TPS outperformed all the others withan 89% win rate on the long side and an 80% win rate on the short side.ETF Trading Bandit users were able to see the signals for all the strategies each and every day and thenplace trades in their brokerage accounts. At the time, the majority of users were using ThinkOrSwim astheir brokerage but also many were using TradeStation. Because ETF Trading Bandit only gives signals, itdoesn’t matter what brokerage is being used, the thing to focus on is reducing commission costs.The Interview with Steve AlexanderA few months after I released the ETF Trading Bandit, I interviewed one useronline where he shared his real money results from trading the strategies in a 10,000 account. In just one short month he was able to cover the cost of thesoftware. This is a big deal because the software is permanently licensed to auser, meaning there is a one-time payment and the user can keep and use theprogram forever. Also, all the data comes from free online sources so once theinitial payment has been made, the ongoing costs are zero .forever!See my online interview with Steve Alexander here:Watch The InterviewThe Last 7 YearsThe above tables show the 2009-2013 combined results. In this section you will find a performancereport for each of the last 7 full years from 2014 to 2020.https://www.EdgeRater.com

2014 Full Year ResultsEntry/Exit on CloseEntry/Exit next openBasic StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long1000.42%4.970.00%1000.24%4.967.00%3 Day Hi/Lo Short32-1.53%6.943.75%32-1.17%6.953.13%RSI 25 Long1160.32%7.772.41%1160.29%7.771.55%RSI 75 Short27-1.24%12.944.44%26-1.49%13.138.46%R3 Long900.37%6.565.56%900.31%6.565.56%R3 Short29-2.00%9.844.83%29-1.51%9.848.28%%B Long1480.17%5.771.62%1480.19%5.764.19%%B Short37-1.29%8.851.35%36-1.31%8.950.00%MDD Long1570.34%4.370.70%1560.21%4.362.82%MDU Short44-1.21%6.550.00%42-1.25%6.835.71%Aggressive StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long1000.60%4.975.00%1000.31%4.973.00%3 Day Hi/Lo Short32-1.19%6.946.88%32-0.85%6.959.38%RSI 25 Long1160.62%7.777.59%1160.51%7.775.00%RSI 75 Short27-1.01%12.951.85%26-1.30%13.142.31%R3 Long900.60%6.572.22%900.53%6.570.00%R3 Short29-1.49%9.855.17%29-1.24%9.851.72%%B Long1480.33%5.772.97%1480.36%5.770.95%%B Short37-1.23%8.854.05%36-1.17%8.950.00%MDD Long1570.55%4.375.16%1560.37%4.368.59%MDU Short44-0.91%6.559.09%42-0.92%6.845.24%RSI 10/6 Long1560.55%4.971.15%1560.28%4.964.74%RSI 90/94 Short41-1.16%7.453.66%40-1.03%7.552.50%TPS 55.56%45-0.63% 10.164.44%TPS ShortBACKTESTED RESULTS FOR THE PERIOD 1/1/2014-12/31/2014https://www.EdgeRater.com

2015 Full Year ResultsEntry/Exit on CloseEntry/Exit next openBasic StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long850.55%4.570.59%850.28%4.563.53%3 Day Hi/Lo Short1040.75%4.375.00%1040.43%4.364.42%RSI 25 Long880.84%7.076.14%880.73%7.075.00%RSI 75 Short750.21%9.160.00%730.03%9.356.16%R3 Long640.63%5.075.00%640.64%5.073.44%R3 Short790.47%6.063.29%770.26%6.053.25%%B Long1010.66%5.178.22%1010.61%5.168.32%%B Short1150.59%5.463.48%1130.29%5.354.87%MDD Long1260.68%4.181.75%1260.47%4.172.22%MDU Short1130.48%5.666.37%1120.17%5.658.93%Aggressive StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long850.74%4.580.00%850.37%4.568.24%3 Day Hi/Lo Short1041.01%4.381.73%1040.62%4.368.27%RSI 25 Long881.05%7.085.23%880.90%7.082.95%RSI 75 Short750.48%9.166.67%730.22%9.365.75%R3 Long640.88%5.085.94%640.85%5.082.81%R3 Short790.75%6.068.35%770.41%6.059.74%%B Long1010.87%5.184.16%1010.70%5.174.26%%B Short1150.76%5.466.96%1130.38%5.357.52%MDD Long1260.84%4.185.71%1260.53%4.176.98%MDU Short1130.69%5.670.80%1120.31%5.660.71%RSI 10/6 Long1240.63%4.480.65%1240.58%4.475.00%RSI 90/94 Short1060.64%5.270.75%1060.38%5.260.38%TPS 3.33%TPS ShortBACKTESTED RESULTS FOR THE PERIOD geRater.com

2016 Full Year ResultsEntry/Exit on CloseEntry/Exit next openBasic StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long1110.41%4.872.07%1110.60%4.868.47%3 Day Hi/Lo Short58-0.60%5.860.34%58-0.20%5.860.34%RSI 25 Long1111.03%7.281.98%1111.15%7.277.48%RSI 75 Short50-1.41%12.748.00%50-1.65%12.744.00%R3 Long860.79%6.977.91%850.99%6.871.76%R3 Short46-0.27%7.663.04%46-0.31%7.654.35%%B Long1480.77%5.179.73%1470.95%5.175.51%%B Short62-0.85%7.556.45%62-0.45%7.550.00%MDD Long1390.54%5.071.94%1390.55%5.067.63%MDU Short61-0.86%6.047.54%61-0.44%6.049.18%Aggressive StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long1110.61%4.880.18%1110.64%4.873.87%3 Day Hi/Lo Short580.03%5.868.97%580.13%5.865.52%RSI 25 Long1111.24%7.284.68%1111.29%7.281.08%RSI 75 Short50-0.99%12.748.00%50-1.33%12.744.00%R3 Long860.97%6.983.72%851.02%6.881.18%R3 Short460.18%7.669.57%460.00%7.665.22%%B Long1480.90%5.181.76%1470.97%5.181.63%%B Short62-0.44%7.558.06%62-0.20%7.559.68%MDD Long1390.72%5.078.42%1390.63%5.070.50%MDU Short61-0.28%6.059.02%61-0.08%6.054.10%RSI 10/6 Long1390.73%5.174.82%1390.68%5.173.38%RSI 90/94 Short68-0.03%6.364.71%68-0.02%6.360.29%TPS .97%740.56%7.771.62%TPS ShortBACKTESTED RESULTS FOR THE PERIOD 1/1/2016-12/31/2016https://www.EdgeRater.com

2017 Full Year ResultsEntry/Exit on CloseEntry/Exit next openBasic StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long1250.64%3.882.40%1250.36%3.871.20%3 Day Hi/Lo Short9-1.33%7.144.44%9-1.22%7.133.33%RSI 25 Long1290.93%6.685.27%1290.65%6.675.97%RSI 75 Short11-1.36%12.545.45%11-1.32%12.545.45%R3 Long900.56%5.673.33%900.45%5.668.89%R3 Short11-2.13%12.045.45%11-1.76%12.036.36%%B Long1530.50%4.978.43%1530.33%4.967.97%%B Short15-0.85%8.546.67%15-0.79%8.553.33%MDD Long1850.47%3.977.84%1850.30%3.968.11%MDU Short15-1.20%6.940.00%15-1.18%6.953.33%Aggressive StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long1250.74%3.885.60%1250.43%3.873.60%3 Day Hi/Lo Short9-1.21%7.144.44%9-1.12%7.133.33%RSI 25 Long1291.11%6.689.15%1290.77%6.679.84%RSI 75 Short11-1.25%12.545.45%11-1.14%12.545.45%R3 Long900.72%5.681.11%900.58%5.677.78%R3 Short11-1.83%12.054.55%11-1.49%12.045.45%%B Long1530.59%4.982.35%1530.38%4.971.24%%B Short15-0.64%8.553.33%15-0.58%8.553.33%MDD Long1850.61%3.983.78%1850.37%3.970.27%MDU Short15-0.96%6.946.67%15-0.91%6.953.33%RSI 10/6 Long1730.77%4.385.55%1730.47%4.372.25%RSI 90/94 Short15-1.17%7.253.33%15-0.91%7.253.33%TPS 41.18%17-1.31% 11.047.06%TPS ShortBACKTESTED RESULTS FOR THE PERIOD 1/1/2017-12/31/2017https://www.EdgeRater.com

2018 Full Year ResultsEntry/Exit on CloseEntry/Exit next openBasic StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long105-0.41%5.159.05%105-0.40%5.155.24%3 Day Hi/Lo Short530.26%5.264.15%530.34%5.258.49%RSI 25 Long96-0.30%8.756.25%96-0.06%8.757.29%RSI 75 Short520.47%8.565.38%520.77%8.575.00%R3 Long900.23%6.770.00%900.32%6.767.78%R3 Short470.27%7.063.83%470.43%7.076.60%%B Long108-0.48%6.359.26%108-0.29%6.362.96%%B Short760.26%6.364.47%760.49%6.365.79%MDD Long136-0.53%5.159.56%136-0.58%5.157.35%MDU Short950.31%4.866.32%950.27%4.860.00%Aggressive StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long105-0.09%5.167.62%105-0.14%5.160.95%3 Day Hi/Lo Short530.53%5.273.58%530.56%5.256.60%RSI 25 Long960.26%8.767.71%960.40%8.766.67%RSI 75 Short520.75%8.573.08%520.89%8.578.85%R3 Long900.48%6.772.22%900.50%6.771.11%R3 Short470.54%7.068.09%470.59%7.076.60%%B Long108-0.30%6.363.89%108-0.18%6.362.96%%B Short760.43%6.368.42%760.56%6.365.79%MDD Long136-0.20%5.165.44%136-0.26%5.162.50%MDU Short950.56%4.874.74%950.46%4.864.21%RSI 10/6 Long122-0.30%5.858.20%122-0.28%5.859.02%RSI 90/94 Short740.61%5.470.27%740.65%5.466.22%TPS .16%871.11%6.085.06%TPS ShortBACKTESTED RESULTS FOR THE PERIOD 1/1/2018-12/31/2018https://www.EdgeRater.com

2019 Full Year ResultsEntry/Exit on CloseEntry/Exit next openBasic StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long880.53%4.180.68%880.54%4.178.41%3 Day Hi/Lo Short69-0.61%6.044.93%69-0.65%6.042.03%RSI 25 Long950.16%7.568.42%950.22%7.564.21%RSI 75 Short46-1.91%14.043.48%46-2.01%14.041.30%R3 Long820.38%6.271.95%820.38%6.269.51%R3 Short54-1.13%9.646.30%54-1.44%9.637.04%%B Long1330.32%5.378.95%1330.39%5.372.18%%B Short81-0.67%7.645.68%81-0.63%7.651.85%MDD Long1270.18%4.668.50%1260.28%4.669.84%MDU Short98-0.42%5.553.06%98-0.65%5.540.82%Aggressive StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long880.71%4.186.36%880.64%4.182.95%3 Day Hi/Lo Short69-0.37%6.050.72%69-0.49%6.043.48%RSI 25 Long950.46%7.577.89%950.50%7.575.79%RSI 75 Short46-1.55%14.050.00%46-1.64%14.045.65%R3 Long820.62%6.278.05%820.56%6.276.83%R3 Short54-0.86%9.653.70%54-1.18%9.638.89%%B Long1330.58%5.384.21%1330.59%5.380.45%%B Short81-0.39%7.656.79%81-0.55%7.650.62%MDD Long1270.37%4.677.17%1260.45%4.675.40%MDU Short98-0.21%5.555.10%98-0.46%5.541.84%RSI 10/6 Long1280.23%4.872.66%1280.25%4.872.66%RSI 90/94 Short83-0.07%5.763.86%83-0.39%5.746.99%TPS 2.27%88-0.20% 8.863.64%TPS ShortBACKTESTED RESULTS FOR THE PERIOD 1/1/2019-12/31/2019https://www.EdgeRater.com

2020 Full Year ResultsEntry/Exit on CloseEntry/Exit next openBasic StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long860.47%4.979.07%860.63%4.976.74%3 Day Hi/Lo Short960.90%5.067.71%961.03%5.065.63%RSI 25 Long84-1.07%7.670.24%84-0.90%7.670.24%RSI 75 Short670.83%8.370.15%670.46%8.365.67%R3 Long830.13%6.973.49%830.21%6.974.70%R3 Short771.82%6.475.32%772.12%6.476.62%%B Long1210.77%4.880.99%1210.74%4.874.38%%B Short1071.06%6.173.83%1071.10%6.171.03%MDD Long990.16%4.667.68%990.49%4.670.71%MDU Short1140.60%4.769.30%1141.46%4.769.30%Aggressive StrategyTradesP/LHold%WinTradesP/LHold%Win3 Day Hi/Lo Long860.75%4.981.40%860.84%4.980.23%3 Day Hi/Lo Short961.31%5.073.96%961.44%5.066.67%RSI 25 Long84-0.60%7.678.57%84-0.44%7.676.19%RSI 75 Short671.55%8.382.09%671.05%8.368.66%R3 Long830.47%6.983.13%830.51%6.979.52%R3 Short772.35%6.479.22%772.45%6.477.92%%B Long1210.91%4.882.64%1210.95%4.876.86%%B Short1071.53%6.179.44%1071.38%6.171.03%MDD Long990.51%4.674.75%990.81%4.675.76%MDU Short1141.19%4.779.82%1141.67%4.767.54%RSI 10/6 Long1080.38%5.174.07%1080.48%5.173.15%RSI 90/94 Short990.87%5.675.76%991.43%5.668.69%TPS .80%992.22%6.786.87%TPS ShortBACKTESTED RESULTS FOR THE PERIOD 1/1/2020-12/31/2020https://www.EdgeRater.com

What The Data ShowsIt’s impressive that even 11 years after the High Probability ETF Trading book was written the strategiesstill perform very well. There have been some challenging years for the short side strategies but oftenboth the long and short versions of the same strategy have been profitable in the same year, particularlywith the TPS strategy.2020 was another stellar year for TPS with an 85% Plus win rate in both the long and short versions.Download ETF Trading Bandit TodayDownload ETF Trading Bandit today and get free signals forever for the RSI25/75 strategy. At any timeyou can unlock the remaining strategies for lifetime use for an amazingly low price.Download ETF Trading BanditHappy Trading!Chris WhiteFounder and CEO, EdgeRater om

https://www.EdgeRater.com

formulas contained in the book High Probability ETF Trading [ by Larry Connors and Cesar Alvarez. In this report I will explain the background behind the software, the strategies and where they came from