Transcription

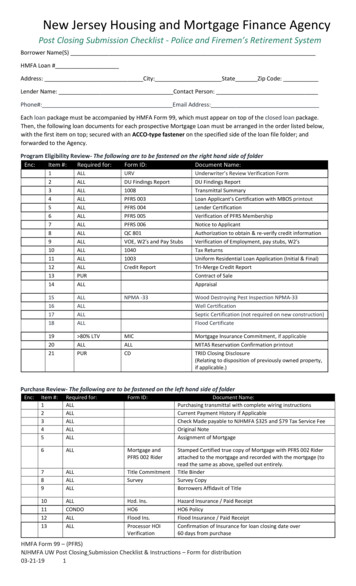

The Digital-First MortgageMAKING BORROWERS, LOAN OFFICERS, AND PARTNERS FEEL RIGHT AT HOME

ContentsIntroduction1Mortgage Providers Are Missing Expectations3Discover the Digital-First Mortgage4Borrower and Partner Satisfaction Are All about the Journey6Scale Your Business and Improve Compliance8Understand Your Borrowers and Partners Like Never Before10Grow with Enterprise Scale Referral Management12Build a Stronger Partner Community14Instill Innovation and Agility16Put It All under One Roof17

INTRODUCTIONToday’s consumers are accustomed to getting the productsand services they need, when and where they need them.Americans Owning a SmartphoneYesNo2011201677% of Americans23%35%owned a smartphonein 2016, up from35% in 2011.165%77%1

3As a result, consumers have learned to expectstatus updates on their smartphones andother connected devices. And Millennials, inparticular, spend an increasing amount of theirtime interacting with products from companiesAmericans spend an average of 74 hoursper month using mobile applications.2such as Apple, Google, Amazon, and Facebook,which have redefined the standards forcustomer experience.2

Mortgage Providers Are Missing ExpectationsThe landscape where the mortgage industrypay stubs and credit reports, and more than 500finds itself is one in which most lenders arepossible document types into which each of thelagging far behind. Instead of a seamless,documents and pages must then be sorted.3intelligent mortgage experience, consumers arecarrying the weight. They have to navigate anMoreover, mortgages involve numerousintricate web of paperwork and a disconnectedstakeholders who need to work together to keepgalaxy of stakeholders — loan officers, brokers,the process on track. And whereas consumers canmortgage underwriters, title companies, andeasily track the progress of everyday transactionssellers. Instead of a transparent environment,online and via mobile apps, it is still exceedinglyconsumers encounter an opaque and tension-difficult to monitor the status of a loan for thefilled process.largest purchase most people will make intheir lives.Indeed, what is unique about taking out aThe result:There is a growingengagement gapbetween mortgagelenders and theircustomers.mortgage today as opposed to a couple ofdecades ago is how little has changed. Themortgage process remains complex and weighteddown with a huge number of documents neededto satisfy regulatory and compliance requirements,adding frustration and stress for everyone involvedin the process. It’s not unusual for a mortgagerequest to have more than 500 pages in a file,with everything from W-2s and tax returns to3

Discover the Digital-First MortgageMortgage lenders have taken some halting steps toward meeting theneeds of new mortgage customers, such as setting up online mortgageapplications. But consumers recognize that a mortgage loan is a complexproduct. Indeed, an Accenture survey of nearly 33,000 consumers in 18countries found that 66% still want human interaction in financial services,especially when getting advice about complex products like mortgages,where 61% said they want personalized advice.4 That is why the greatestopportunity for mortgage providers is to use new technology to facilitateseamless and intelligent human engagement that is personalized to meetthe needs of individual borrowers.Customers don’t want amortgage. They want thekeys to their new home.4

Trust and service are central to a positive mortgage experience. Therefore,transparency, and efficiency. The solution should enable banks and mortgagethe key for both banks and nonbank mortgage lenders is to implement alenders to predict future behavior and needs, rather than simply analyzingdigital-first mortgage solution that connects borrowers, real estate agents,past behaviors.brokers, and loan officers in a single seamless environment that builds trust,With a digital-first process, mortgage lenders can:Engage borrowers and partners with one-to-Expand their footprint while ensuringOptimize the mortgage process with key insightsone journeys that span the entire mortgage lifecompliance by tracking loan officer andabout borrower and partner profilescycle and leverage preferred channelsborrower activity in a single placeGrow the business with enterprise-gradeEnhance collaboration and visibility amongInstill innovation among loan officers andreferral managementloan officers, borrowers, brokers, and realpartners, which in turn increases speed-estate agents with omni-channel portalsto-value5

Borrower and Partner SatisfactionAre All about the JourneyTo stand out from the competition, mortgage lenders must connectcustomers, real estate agents, brokers, and loan officers and coordinatetheir actions to deliver a single effortless mortgage journey.This journey begins by identifying a prospect’s needs and engaging him orher with the right message. The digital-first mortgage should support thenurturing of prospects with this message across multiple channels — bothonline channels, such as social media and email, as well as offline channels,including direct mail and print advertising — driving prospects to real estateagents and then continuing to cultivate and connect them with loan officers.For example, a prospective borrower might see a lender’s advertisement onFacebook and proceed to engage via Facebook Messenger. This lead could beimmediately routed to the appropriate real estate agent, who would receivea notification on any device — smartphone, tablet, desktop, or laptop — thata new lead is ready for follow-up. The agent could then automatically followup with a co-branded email sharing information about an open house, whichis both a logical next step in the mortgage journey and a reinforcementof the partnership between the lender and the agent. The prospect couldsimultaneously be added to a list that will receive the next co-brandeddirect-mail campaign.6

Lenders and real estate agents must have the tools to deliver timely andpersonalized communications across any device and channel.A digital-first approach can ensure that prospects have a consistentfor refinancing. A best-of-breed marketing automation system couldexperience regardless of where they interact with lenders or lenders’proactively identify those borrowers and recommend a communicationpartners. In addition, the right digital strategy can ensure compliance withinforming them about their refinancing options.regulations and corporate standards by enforcing the use of standardizedmarketing templates for email and direct mail.Furthermore, an intelligence-driven marketing automation system canpredict which borrowers are most likely to perform certain actions inThe key to success is a robust marketing automation system that can helpresponse to a communication, such as opening or unsubscribing fromlenders and real estate agents identify the right audiences and engagean email. This can empower marketers to leverage the best channelsthem with the right message via the right channels at the right time.for engaging with borrowers. For example, borrowers who are likely toMarketing automation enables mortgage providers to keep their prospectsunsubscribe from an email could instead receive a call or a direct-mailand borrowers engaged with relevant information and key status updatesdrop with information about refinancing.across email, mobile, phone, direct mail, and other channels, even afterthe mortgage origination process is complete.For example, best-of-breed marketing automation could serve adsautomatically to consumers whose online behavior suggests they’re in themarket for a new home loan or refinancing. These prospects would beidentified using machine learning that recognizes the patterns of sitevisits that tend to predict a home buyer or refinancer, and the rightad could then be delivered at the right time on the right device.Consider another scenario where interest rates decline, and a lenderwants to communicate with a set of borrowers about the opportunity7

Scale Your Business andImprove ComplianceA digital-first mortgage also provides clarity, enabling the loanofficer, borrower, and all the other partners in the process toview the exact status of the loan, including what has beendone and what remains to be done.In fact, a digital-first mortgageshould offer the same transparencyone gets when you order foodthrough a mobile app.8

All activity should be recorded in one central hub.By consolidating and tracking activity, a digital-firstmortgage process ensures that all parties are on thesame page and have a single, unambiguous record thatcan ensure compliance with regulations and guidelines.The key for making this vision a reality is a strongcustomer relationship management (CRM) systemthat captures data automatically and surfaces theinformation in a centralized console that is accessibleacross any device — smartphone, desktop, laptop, ortablet. This system should log calls, SMS messages,social posts, and emails from loan officers, and it shouldtrack how prospects engage with communications anddocuments that are shared throughout the process. Thiswill provide management with visibility into internalactivities, and it enables front-line staff to respond tocustomer actions more quickly and intelligently.Moreover, a digital-first mortgage should enable loan officers and real estateagents to enforce brand and legal standards effortlessly with dynamic contentand delivery rules. A marketing automation system that can access the datain a lender’s CRM system should be able to send content in the appropriatemarketing templates to borrowers based on their geography or whether theyhave opted in to certain communications.9

Understand Your Borrowers and Partners Like Never BeforeA digital-first mortgage also offers lenders enhanced visibility intorelationships with partners and borrowers, allowing lenders toapproach the process in a more strategic way.The vast amount of financial informationrequired by the loan process providesbanks and mortgage lenders with uniqueinsights into household finances andportfolios, which can lead to opportunitiesfor identifying other customer needs.10

If your CRM system has a robust data modeland could be in the market for a home.leads. This enables a mortgage lender to letthat supports the mapping of sprawlingImproved visibility also allows mortgageagents participate in a co-branded email orfinancial portfolios with complex householdlenders to view leads more holistically. Loandirect-mail campaign. With an agent-facingrelationships, you can begin to visualizeofficers can situate leads by their geography,community that syncs to the CRM system, itopportunities to deepen relationships with youroverlay the zip code with both leads andis also simple to administer co-billing forborrowers. For example, loan officers couldrecent loans, and then create a cordonthese promotions and ensure RESPAeasily see if another member of a borrower’saround the area that includes all the realSection 8 compliance.household recently moved to a new locationestate agents within a specific radius of theIn addition, a digital-first mortgage process enables banks and lenders to track and consolidate information about real estate agents, providing insightinto how many loans an agent has sourced and allowing the bank to build metrics around productivity. Finally, the platform allows banks to implementcompliance measures and manage risk effectively, alerting management to geographies where they may be overweight in loans.11

Grow with Enterprise ScaleReferral ManagementFor both banks and nonbank lenders, a digital-first mortgage can also offermuch-needed support for managing new business that comes via referrals.The right foundational system should provide banks with simple andintelligent cross-line-of-business referral management. This should empowerbanks to connect and collaborate across their mortgage, retail, credit, andeven private wealth arms to identify opportunities to address emerging orunmet needs for customers.Digital-first referral management addressesa critical gap in many banks’ operations,given that recent research showed that 49%of customers say that banks don’t reach outto understand their needs.512

Banks should be able to identify potentialMoreover, relationship managers should havereferrals among their borrowers and routevisibility into which referrals are the most likelythem to the relationship managers best suitedto want certain products or services so referralsto follow up based on their history of handlingcan be prioritized accordingly.clients with similar needs. Because referrals aretracked in one place, the relationship managersNonbank lenders can benefit from strongerreceiving these leads should also have contextreferral management as well. A digital-firstabout client needs and the ability to collaborateapproach can help lenders track referralsquickly and transparently with the referrer iffrom real estate agent or insurance partnersmore information is needed.in a single hub available across any device,ensuring a clean handoff and fewer missedopportunities. In addition, lenders can buildreports that show which of their partners areproviding the highest-quality referrals andalign resources around supporting thehighest-value referrers.13

Build a Stronger Partner CommunityA recurring pain point for borrowers hasgreater collaboration among all the participantshouse schedule, ensure they are in compliancebeen the fact that they are forced to act as anin the mortgage process.with RESPA Section 8 guidelines, assessthe budget impact of co-branded content,integration point for the complex mortgageprocess. But a digital-first solution enhancesBorrowers should be able to apply online,manage communication with clients and loancoordination among all the mortgagemonitor the progress on their loans, and accessofficers, and view clients’ loan applications.stakeholders, removing the burden from thekey resources such as low-income borrowerLoan officers can access the same portals andcustomer. By giving stakeholders access to theinformation or rate calculators. Real estatecan communicate directly with agents andsame data and tools across any device, a digital-agents can log into an online community toborrowers by commenting directly on datafirst mortgage builds community and allows forsee their closing calendar, monitor their open-that is mutually available.14

Drivers of TrustReasons cited for having complete trust in primary financial services provider6InstitutionalstabilityTheir security procedurescreates a virtuous cycle amongThe size of the companymore likely to share additionalCustomerexperiencereferrals that can be managedprovider. Indeed, the key drivers of trust,according to a recent report from EY/EFMA,are the way customers are treated and how44%How they communicate with meRates and41%38%feesOther19%The fees I pay26%Interest rates I earn on my accounts24%Interest rates I earn on my loanswhich in turn instills confidence in a mortgage50%The way I am treatedMy relationship with certain employeeswill be more likely to stayThis teamwork is also critical to building trust,42%Problem resolution/complaint handlingsystem, and borrowers, whoopportunities arise.51%Quality of advice providedin the same user-friendlywith a lender if refinancing54%Ability to withdraw moneyThis collaborative environmentreal estate agents, who will be60%Financial stabilityStories from friends or relatives20%14%Their decision to open or close branches9%Recent articles or news stories8%providers communicate with customers.615

Instill Innovation and AgilityAgility and innovation are critical requirements for competing in amortgage and documentation. This allows lenders to create enterprise-securechanging mortgage landscape. A digital-first mortgage platform allowsand engaging apps that streamline processes and raise the bar for customerlenders to become more agile and profitable, increasing the speedexperience across multiple channels.to value and decreasing the cost per loan across marketing, sales,underwriting, and service.For example, a mortgage provider can extend its digital-first mortgageprocess with recruiting and expense management applications built atop theA digital-first mortgage platform should enable lenders to rapidly builddata it has gathered from partners and customers. This will enable lenders toapplications that provide effortless service and offer high scalability,track partners and manage follow-ups more effectively, while continuing tointegration with a variety of data sources, and transparency into theenforce budget and regulatory standards.The solution should lead to fasterdesign, configuration, and deploymentof innovations that reduce IT costs,enhance collaboration amongstakeholders, and offer lenders thespeed and agility they need to meeta shifting regulatory landscape.16

Put It All under One RoofTo unlock the full potential of the digital-first mortgage, lenders mustpartner and borrower communities, and custom apps for recruiting oridentify a platform where tools are integrated and built atop a commonexpense management atop an existing foundation of data and engagementfoundation, rather than a system where separate solutions must becapabilities.integrated and made to work in sync. The platform approach allowsfor a closed-loop of data and insights to be delivered to customers,Buying a home is one of the most important and emotional purchases apartners, and employees, providing greater transparency into thecustomer will make in his or her life, which means that it is paramount tomortgage process. Furthermore, a platform approach enablesavoid adding stress through an opaque and uncoordinated lending process.mortgage lenders to continue innovating and building out theirIf lenders instead embrace a digital-first approach, they can transformdigital-first approach over time. Even if certain applications cannotthe mortgage process from a minefield of potential complications intobe implemented right away, lenders can innovate more quickly whenan opportunity to connect with their borrowers in new ways, establishingthey are empowered to add tools such as marketing automation,relationships that last a lifetime.SEE SALESFORCE FOR BANKING IN ACTIONWatch Demo17

Sources:1“Mobile Fact Sheet,” Pew Research Center, January 12, 2017.2“The 2016 U.S. Mobile App Report,” comScore, 2016.3“Advanced OCR in the Mortgage Industry,” Paradatec, 2014.4“Beyond Digital: How Can Banks Meet Customer Demands?” Accenture, 2017.5“2017 Connected Banking Customer Report,” Salesforce, 2017.6“Looking at the bank from the customer’s point of view,” EY/EFMA, October 2014.18

experience regardless of where they interact with lenders or lenders’ partners. In addition, the right digital strategy can ensure compliance with regulations and corporate standards by enforcing the use of standardized marketing templates for email and direct mail. The key to succ