Transcription

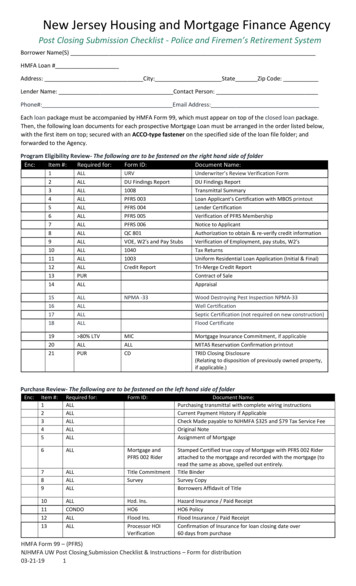

New Jersey Housing and Mortgage Finance AgencyPost Closing Submission Checklist - Police and Firemen’s Retirement SystemBorrower Name(S)HMFA Loan #Address: City: State Zip Code:Lender Name: Contact Person:Phone#: Email Address:Each loan package must be accompanied by HMFA Form 99, which must appear on top of the closed loan package.Then, the following loan documents for each prospective Mortgage Loan must be arranged in the order listed below,with the first item on top; secured with an ACCO-type fastener on the specified side of the loan file folder; andforwarded to the Agency.Program Eligibility Review- The following are to be fastened on the right hand side of folderEnc:Item #:Required for:Form ID:Document LALLALLALLPURALLURVDU Findings Report1008PFRS 003PFRS 004PFRS 005PFRS 006QC 801VOE, W2’s and Pay Stubs10401003Credit ReportUnderwriter’s Review Verification FormDU Findings ReportTransmittal SummaryLoan Applicant’s Certification with MBOS printoutLender CertificationVerification of PFRS MembershipNotice to ApplicantAuthorization to obtain & re-verify credit informationVerification of Employment, pay stubs, W2’sTax ReturnsUniform Residential Loan Application (Initial & Final)Tri-Merge Credit ReportContract of SaleAppraisal15161718ALLALLALLALLNPMA -33Wood Destroying Pest Inspection NPMA-33Well CertificationSeptic Certification (not required on new construction)Flood Certificate192021 80% LTVALLPURMICALLCDMortgage Insurance Commitment, if applicableMITAS Reservation Confirmation printoutTRID Closing Disclosure(Relating to disposition of previously owned property,if applicable.)Purchase Review- The following are to be fastened on the left hand side of folderEnc:Item #:12345Required for:ALLALLALLALLALLForm ID:Document Name:Purchasing transmittal with complete wiring instructionsCurrent Payment History if ApplicableCheck Made payable to NJHMFA 325 and 79 Tax Service FeeOriginal NoteAssignment of Mortgage6ALLMortgage andPFRS 002 Rider789ALLALLALLTitle CommitmentSurveyStamped Certified true copy of Mortgage with PFRS 002 Riderattached to the mortgage and recorded with the mortgage (toread the same as above, spelled out entirely.Title BinderSurvey CopyBorrowers Affidavit of Title10111213ALLCONDOALLALLHzd. Ins.HO6Flood Ins.Processor HOIVerificationHazard Insurance / Paid ReceiptHO6 PolicyFlood Insurance / Paid ReceiptConfirmation of Insurance for loan closing date over60 days from purchaseHMFA Form 99 – (PFRS)NJHMFA UW Post Closing Submission Checklist & Instructions – Form for distribution03-21-191

1415161718192021ALLALLALLALLREFIALLALLALLLEPFRS007 (LE)CDPFRS-008 (CD)TRID Loan Estimate- LEStatutory Requirement Disclosure- LETRID Closing Disclosure- CDStatutory Requirements Disclosure - CDRight of Rescission (only on refinance)Tax Authorization NoticeFirst Payment LetterPMI Disclosure2223242526ALLALLALLALLALLDeedDeedInitial Escrow DisclosureServicing Disclosure StatementNon-assignability StatementTransfer of ower of Attorney (If Applicable)Errors and Omissions/Compliance AgreementQuality Control Release and Authorization to RE-VerifySub Servicer/Overnight LabelMISCELLANEOUS/REMINDERS:Electronic signatures are permitted on non-recordable instruments/documents only if “DocuSign” or "Dotloop" is used.NJHMFA will not accept loans closed in MERS.Income: There are several forms wherein the borrower’s income is reflected. Income on all these forms must beidentical. If the borrower’s income changes after application, underwriting must be notified and the file will then haveto be re-underwritten. The loan will not be purchased if the income differs on any of these forms, without underwritingapproval. Borrowers must initial any corrections.Collateral Documents: In the instance where the Trailing Documents have been outstanding for more than 120 daysfrom the Purchase Date, NJHMFA has the right to charge/collect from the Participating Lender a fee of 25 per TrailingDocuments or the actual recovery cost and recorded costs, whichever is greater.Please forward the completed checklist together with the requested closed loan documentation as follows:NEW JERSEY HOUSING AND MORTGAGE FINANCE AGENCYATTENTION: Single Family Division637 SO. CLINTON AVENUE TRENTONNJ 08611(For use with overnight delivery services)HMFA Form 99 – (PFRS)NJHMFA UW Post Closing Submission Checklist & Instructions – Form for distribution03-21-192

The following instructions are to assist with the lender’s review of the Program Eligibility requirements:InSub#RequiredForm ID:Doc Name:CopySpecial Instructions:1ALLURVCopy2ALLDUUnderwriter’s ReviewVerification FormDU Findings3ALL1008Transmittal SummaryCopy4ALLPFRS 003Loan ApplicantCertificationOriginal5ALLPFRS 004Lender CertificationOriginalLender Underwriter to complete fully evidencing allNJHMFA Guidelines have been met.All conditions on DU Findings Report must be met.Approve/Eligible Rating is required.All sections to be fully completed. Must list DUApproval Info and be consistent with DU Findings.Signed original. Must include the Member Benefitsonline System Statement (MBOS) evidencingeligibility.Signed original6ALLPFRS 005Original7ALLPFRS 006Verification of PFRSMembership (MBOS)Notice to ApplicantOriginalMust include the Member Benefits Online SystemStatement.Signed original8ALLQC 801OriginalSigned original9ALLCopy10ALLVOE, PayStubs &W2’s1040Authorization toobtain & re-verifycredit informationVerification ofEmployment, W2’s &Pay StubsSigned FederalIf a borrower has been in his present job 2 yrs., aVOE from previous job is also required. 30 daysconsistent pay stubs and 2yrs W2’s are required.Minimum of one (1) year, most recent Federal taxreturn, signed and dated with all pages and schedulesincluded for income qualifying purposes, unless AUSfindings require additional tax returns be submitted.11ALL1003Uniform ResidentialLoan Application(Initial & Final)CopyAll sections must be completed in its entirety. Lot &Block must be indicated in “legal Description”.Applicants and lender must sign and date. Initial andFinal.12ALLTri-Merge CreditReportCopy13PURContract of SaleCopyAll borrowers must have a minimum tri-merge“middle” score of 620 or above. The lender isrequired to obtain a tri-merge credit report for eachborrower on the loan application. Cannot be olderthan 4 months old at time of closing.Must be completely filled out, signed and dated.Seller’s concession must follow appropriate FannieMae Guidelines. Any changes must be fullyinitialed/signed by all parties on the contract orprovided in an addendum preceding Contract of Sale.14ALLAppraisalCopy15ALLTermite Cert.Copy16PURWell CertificationCopy17PURSeptic CertificationCopyNPMA-33CopyCopyMust contain a written certification signed by twopersons from the same appraisal company whichshall include the opinion of the signatories as to thevalue of the land and the improvements thereon.Failure of an appraisal to meet this requirement willmake the loan ineligible for purchase.Copy unless damage noted or damage was observedthen original signatures is required. Certification canbe no older than 4 months prior to the loan closing.A certification stating all damages & treatments havebeen repaired & completed is required. InspectionReport to be a HUD form NPMA-33. Any infestationis to be cured. Any damage noted, either from wooddestroying insects or other causes, is to be certified,or noted that damage is minor, cosmetic and doesnot affect the structural integrity of premises.Certification is to be from inspection company ortrade expert and must be signed by borrowers.Evidence of paid invoices must be included. Wooddestroying insect certifications are not required onnew homes completed less than a year prior to theclosing date or condominium units constructed ofconcrete and steel.Refer to the Agency Policy and ProceduresGuidelines for Lenders for specific requirements.Not required for new construction. Refer to theAgency Policy and Procedures Guidelines for Lendersfor specific requirements.HMFA Form 99 – (PFRS)NJHMFA UW Post Closing Submission Checklist & Instructions – Form for distribution03-21-193

18ALL19 80% LTV20ALL21PURMICCDFlood CertificateCopyMortgage InsuranceCopyRequired on all loans where LTV is greater than 80%.Any conditions listed on the commitment must besatisfied and/or resolved before it is submitted toHMFA for UW. All information must be consistentwith lender approval. Private Mortgage Insurancecompanies must be Fannie Mae approved. NJHMFArequired coverage amounts to be adhered to.MITAS ReservationConfirmationDocumentTRID ClosingDisclosureCopyAll information on this printout to be consistent withloan approval. Reservation to be active through dateof purchase.To evidence disposition of previously owned property,if applicable.CopyThe following instructions are to assist with the lender’s review of the Purchase requirements:In Sub#Required1ALL234ALLALLALL5Form ID:Doc Name:CopySpecial Instructions:PurchaseTransmittalPayment HistoryCheckOriginal NoteCopyProvide complete wiring instructionsCopyOriginalOriginalALLAssignment ofMortgageCopy6ALLMortgage andPFRS 002 RiderCopy7ALLTitle BinderCopyCurrent payment history if applicableMade payable to NJHMFA 325 and 79 Tax Service FeeOriginal Note endorsed to: Police and Firemen’sRetirement System Board of Trustees by itsAdministrative Agent New Jersey Housing and MortgageFinance Agency. Signed by borrowersStamped Certified true copy of Assignment of Mortgage –Endorsed to: Police and Firemen’s Retirement SystemBoard of Trustees by its Administrative Agent New JerseyHousing and Mortgage Finance Agency.Stamped Certified true copy of Mortgage with PFRS 002Rider attached to the mortgage and recorded with themortgage endorsed to: Police and Firemen’s RetirementSystem Board of Trustees by its Administrative Agent NewJersey Housing and Mortgage Finance Agency.Signed by appropriate title officer, must not be over sixmonths old, showing borrowers’ complete legal names andmarital status, the correct mortgage amount, and nameNJHMFA, or your institution, with “and/or assigns” added.The legal description in the binder must agree with thesurvey, and be either a metes and bounds or a filed mapdescription. The binder must contain a surveyendorsement, or the survey exception must be removed inthe binder. Alta 8.1 & 9 etc. endorsements to be attachedwhere applicable. The binder should be fully marked up asto open mortgages “satisfied,” tax and assessments “paidthrough current quarter, subsequent billings not yet dueand payable,” and exceptions removed or insured over.Searches must be included (Charles Jones, Patriot Act, etc.).We require the standard FNMA/FHLMC affirmativeinsurance language for easements, restrictions, andcovenants, agreements, etc. and insurance against loss ordamage for minor encroachments. A closing agent/lendercertification attached to the binder will be acceptable in lieuof markup8ALLSurvey CopyCopy9ALLBorrowersAffidavit of TitleCopyIf a refinance, we will accept a survey that is up to 10 yearsold with an affidavit of no change from the title company,which itself shall not be over six months old, certified toborrowers, lender and Title Company with surveyorsignature, license number and seal, acceptable to the TitleCompanyForm to be supplied by lender or closing agent.Allstate/Blumberg/Attorney form is acceptable. Must havemarital information section completely filled in, referHMFA Form 99 – (PFRS)NJHMFA UW Post Closing Submission Checklist & Instructions – Form for distribution03-21-194

to any same/similar name judgments, and cover any othernames borrower is/has been known by. If any judgmentsshow against name of purchasers, affidavit must state eitherthey are not against them, or if they are against them, theymust be satisfied prior to closing and we must be furnishedproof of same (warrant to satisfy judgment. Attach divorcedecree if applicable. Acknowledge bankruptcies. Must showproperty address and/or title binder commitment number.10ALLHazardInsuranceHO6 ssorHOI VerificationCopy14ALLTRID LoanEstimate osure (LE)TRID rementsDisclosure (CD)Right ofRescissionHO6PFRS-007 (LE)PFRS-008 (CD)CopyCopyCopyMust have 1 year paid premium, if paid outside of closing, apaid receipt must be included in loan file.Minimum acceptable coverage of 50,000. Listed separatelyfrom personal property.Must have 1 year paid premium, if paid outside of closing, apaid receipt must be included in loan file.Processor certification to confirm active hazard/floodinsurance for loan closing dates that are over 60 days fromoriginal note date.Stamped Final. Compliance: Lender is liable and responsiblefor compliance with all applicable consumer lending lawsand regulations in effect at the time of closing of themortgage loan. This submission must include:A) The initial Loan Estimate as applicable, and SettlementServices Provider list.B) All subsequent Loan Estimates in reverse chronologicalorder, including dates of issuance, full documentation ofchange in circumstances (COC) and the date of such change.Screenshot of COCs accepted.C) The final document to be stamped or marked “FINAL” onthe disclosure.D) In all versions, the tax service fee should be disclosed asfollows:1) Loan Estimate: disclose the charge and the fee inSection B of “Closing Cost Details”2) GFE: disclose the charge and the fee in the sectiontitled “your charges for all other settlement services” #3,Required Services That We Select.Must be signed by all borrowers. To be executedsimultaneous with the TRID Loan Estimate and with anyreissuance thereof.A) The Closing Disclosure, is to reflect all charges to theborrower in connection with the loan, whether paid outsideclosing, or at closing.B) Any items paid outside closing should be marked“POC.”C) Must show proof of Escrows for Hazard Insurance,Mortgage Insurance, Taxes and Association fee, if applicable.When hazard insurance is included in the Condo fee, showproof of H06 policy with paid receipt with coverage no lessthan 50,000 and that the premium is part of the mortgagepayment. The Agency requires a 2 month cushion forescrows.D) The Closing Disclosure must include executed signaturesfor all mortgagors at “Confirm Receipt” on page 5.E) The tax service fee is to be disclosed as follows:1) Closing Disclosure: The tax service fee and its chargeshould appear at Section B of “Closing Cost Details” on bothforms of disclosure.F) Credits to borrowers post closing:1) In all instances, the Agency must be provided a copy ofthe letter from the Settlement Agent to the borrower(s) thatexplains the need to amend the form.2) Amended Closing Disclosure: the credit forreimbursement must appear as such in the “Adjustments”section in which the original amount was disclosed and asmay otherwise be required by the TRID regulations.Must be signed by all borrowers. To be executedsimultaneous with the TRID Closing Disclosure and with anyreissuance thereof.Only on refinanceHMFA Form 99 – (PFRS)NJHMFA UW Post Closing Submission Checklist & Instructions – Form for distribution03-21-195

19ALLTaxAuthorizationNoticeFirst PaymentLetterCopyMust be completed in its entirety.20ALLCopyMust be signed by all mortgagors21ALLPMI ial sign.Statement26ALL27PURTransfer ofServicingPOA28ALL29ALL30ALLMust match vesting on prelim title commitment exactly.Will require an amended policy.CopyTo be completed in its entiretyOriginalTo non-PFRS members who sign the mortgageCopyTrailing document/after purchase of the loanOriginalNJHMFA will allow a Power of Attorney for theBorrower/seller only at closing. Participating Lenders mustobtain NJHMFA’s written approval of a POA prior to closing.A POA for the Property seller is not acceptable atapplication, but is acceptable at closing and should berecorded simultaneously with the deed. In either case, theproper documentation must be obtained and provided toNJHMFA in the purchase package.Error andCopyOmissions/ComplianceAgreementQuality Control CopyRelease andAuthorization toRe-VerifyTo be completed in its entiretyTo be fully completed and signed by all borrowers.Provide FedEX Label addressed to:Susan PysarchykCenlar FSB New Loans Department425 Phillips Blvd.Ewing NJ 08618UNDERWRITING STAFF- Program Eligibility Review (right side)Justin TierneyAdministrator of Single ousaf ASING STAFF - Purchase Review (left side)Valerie J DromboskiManager of Mtg. ine PerchalskiDocument Reviewer II609-278-7374Jperchalski@njhmfa.govEva ChetnikDocument Reviewer II609-278-7387Echetnik@njhmfa.govHMFA Form 99 – (PFRS)NJHMFA UW Post Closing Submission Checklist & Instructions – Form for distribution03-21-196

Mortgage and PFRS 002 Rider Copy Stamped Certified true copy of Mortgage with PFRS 002 Rider attached to the mortgage and recorded with the mortgage endorsed to: Police and Firemen’s Retirement . System Board of Trustees by its Administrative Agent New Jersey