Transcription

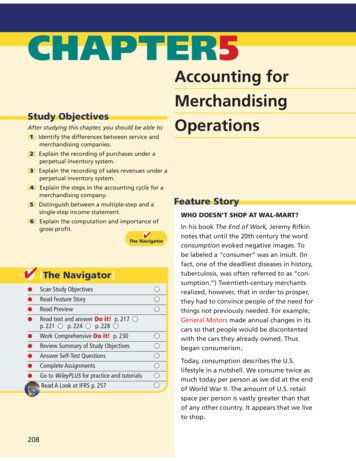

CHAPTER5Study ObjectivesAfter studying this chapter, you should be able to:Accounting forMerchandisingOperations[1] Identify the differences between service andmerchandising companies.[2] Explain the recording of purchases under aperpetual inventory system.[3] Explain the recording of sales revenues under aperpetual inventory system.[4] Explain the steps in the accounting cycle for amerchandising company.[5] Distinguish between a multiple-step and asingle-step income statement.Feature StoryWHO DOESN’T SHOP AT WAL-MART?[6] Explain the computation and importance ofgross profit.In his book The End of Work, Jeremy RifkinApagoEnhancer PDF notesthat until the 20th century the word[The Navigator] [The Navigator] Scan Study Objectives Read Feature Story Read Preview Read text and answer Do it! p. 217 p. 221 p. 224 p. 228 Work Comprehensive Do it! p. 230 Review Summary of Study Objectives Answer Self-Test Questions Complete Assignments Go to WileyPLUS for practice and tutorials Read A Look at IFRS p. 257 208consumption evoked negative images. Tobe labeled a “consumer” was an insult. (Infact, one of the deadliest diseases in history,tuberculosis, was often referred to as “consumption.”) Twentieth-century merchantsrealized, however, that in order to prosper,they had to convince people of the need forthings not previously needed. For example,General Motors made annual changes in itscars so that people would be discontentedwith the cars they already owned. Thusbegan consumerism.Today, consumption describes the U.S.lifestyle in a nutshell. We consume twice asmuch today per person as we did at the endof World War II. The amount of U.S. retailspace per person is vastly greater than thatof any other country. It appears that we liveto shop.

The first great retail giantwas Sears Roebuck. It startedas a catalog company enablingpeople in rural areas to buythings by mail. For decades,it was the uncontestedmerchandising leader.Today, Wal-Mart Stores, Inc. isthe undisputed championprovider of basic (and perhapsnot-so-basic) human needs. Wal-Mart opened its first store in 1962, and it now has more than8,000 stores, serving more than 100 million customers every week. A key cause of Wal-Mart’sincredible growth is its amazing system of inventory control and distribution. Wal-Mart has amanagement information system that employs six satellite channels, from which companycomputers receive 8.4 million updates every minute on what items customers buy and the relationship among items sold to each person.Measured by sales revenues, Wal-Mart isthe largest company in the world. In sixyears, it went from selling almost no groceries to being America’s largest groceryretailer.Wal-Mart net sales, years ending January 31st (billions) 050100150200250300 350400 4502010Apago PDF EnhancerIt would appear that things have neverlooked better at Wal-Mart. On the otherhand, a Wall Street Journal article entitled“How to Sell More to Those Who Think It’sCool to Be Frugal” suggests that consumerism as a way of life might be dying. Don’tbet your high-definition 3D TV on it .92003200220014.74.4Total number ofstores,‘0004.2Source: “How Big Can It Grow?” The Economist (April 17, 2004),pp. 67–69, and www.walmart.com (accessed November 23, 2010). [The Navigator]InsideCHAPTER5 Investor Insight: Morrow Snowboards Improves Its Stock Appeal (p. 213) Anatomy of a Fraud (p. 219) Accounting Across the Organization: Should Costco Change Its Return Policy? (p. 220) Ethics Insight: Disclosing More Details (p. 226)209

PreviewofCHAPTER5Merchandising is one of the largest and most influential industries in the United States. It is likely thata number of you will work for a merchandiser. Therefore, understanding the financial statements ofmerchandising companies is important. In this chapter, you will learn the basics about reporting merchandising transactions. In addition, you will learn how to prepare and analyze a commonly used formof the income statement—the multiple-step income statement. The content and organization of thechapter are as follows.Accounting for Merchandising OperationsMerchandisingOperations Operating cycles Flow of costs—perpetual andperiodic inventorysystemsRecording Purchasesof MerchandiseRecording Sales ofMerchandise Freight costs Purchase returns andallowances Purchase discounts Summary ofpurchasingtransactions Sales returns andallowances Sales discountsCompleting theAccounting Cycle Adjusting entries Closing entries Summary ofmerchandisingentriesForms of FinancialStatements Multiple-step incomestatement Single-step incomestatement Classified balancesheet [The Navigator]Merchandising OperationsStudy Objective [1]Identify the differencesbetween service andmerchandisingcompanies.Illustration 5-1Income measurementprocess for a merchandisingcompanyApago PDF EnhancerWal-Mart, Kmart, and Target are called merchandising companies because they buyand sell merchandise rather than perform services as their primary source of revenue.Merchandising companies that purchase and sell directly to consumers are calledretailers. Merchandising companies that sell to retailers are known as wholesalers.For example, retailer Walgreens might buy goods from wholesaler McKesson; retailerOffice Depot might buy office supplies from wholesaler United Stationers. The primary source of revenues for merchandising companies is the sale of merchandise,often referred to simply as sales revenue or sales. A merchandising company has twocategories of expenses: cost of goods sold and operating expenses.Cost of goods sold is the total cost of merchandise sold during the period.This expense is directly related to the revenue recognized from the sale of goods.Illustration 5-1 shows the income measurement process for a merchandisingSalesRevenueLessCost ofGoods sNetIncome(Loss)

Merchandising Operations211company. The items in the two blue boxes are unique to a merchandising company;they are not used by a service company.Operating CyclesThe operating cycle of a merchandising company ordinarily is longer than that of aservice company. The purchase of merchandise inventory and its eventual salelengthen the cycle. Illustration 5-2 contrasts the operating cycles of service andmerchandising companies. Note that the added asset account for a merchandisingcompany is the Inventory account. Companies report inventory as a current asseton the balance sheet.Illustration 5-2Operating cycles for a servicecompany and a merchandisingcompanyService CompanyReceive CashPerform ServicesCashAccountsReceivableMerchandising CompanyApago PDF EnhancerReceive CashBuy InventoryCashSell InventoryBrien's itunes playlistSgt. Pepper's L. H.C.B.When My Ship Comes InWhat Gonna Do Wia Cowboy?All I Want is A LifeAccountsReceivableInventoryMENUTVFlow of CostsThe flow of costs for a merchandising company is as follows: Beginning inventoryplus the cost of goods purchased is the cost of goods available for sale. As goods aresold, they are assigned to cost of goods sold. Those goods that are not sold by theend of the accounting period represent ending inventory. Illustration 5-3 (page 212)describes these relationships. Companies use one of two systems to account for inventory: a perpetual inventory system or a periodic inventory system.Helpful HintPERPETUAL SYSTEMIn a perpetual inventory system, companies keep detailed records of the cost ofeach inventory purchase and sale. These records continuously—perpetually—showthe inventory that should be on hand for every item. For example, a Ford dealership has separate inventory records for each automobile, truck, and van on its lotand showroom floor. Similarly, a Kroger grocery store uses bar codes and opticalFor control purposes,companies take a physicalinventory count underthe perpetual system,even though it is notneeded to determine costof goods sold.

2125 Accounting for Merchandising OperationsIllustration 5-3Flow of costsBeginningInventoryCost of GoodsPurchasedCost of GoodsAvailable for SaleCost ofGoods SoldEndingInventoryscanners to keep a daily running record of every box of cereal and every jar of jellythat it buys and sells. Under a perpetual inventory system, a company determinesthe cost of goods sold each time a sale occurs.PERIODIC SYSTEMIn a periodic inventory system, companies do not keep detailed inventory recordsof the goods on hand throughout the period. Instead, they determine the cost ofgoods sold only at the end of the accounting period—that is, periodically. At thatpoint, the company takes a physical inventory count to determine the cost of goodson hand.To determine the cost of goods sold under a periodic inventory system, the following steps are necessary:Apago PDF Enhancer1. Determine the cost of goods on hand at the beginning of the accounting period.2. Add to it the cost of goods purchased.3. Subtract the cost of goods on hand at the end of the accounting period.Illustration 5-4 graphically compares the sequence of activities and the timingof the cost of goods sold computation under the two inventory systems.Illustration 5-4Comparing perpetual andperiodic inventory systemsInventory PurchasedPerpetualSystemItem SoldEnd of PeriodLDSONo entryRecord purchaseof inventoryRecord revenueandcompute and recordcost of goods soldInventory PurchasedItem SoldLDSOPeriodicSystemRecord purchaseof inventoryRecord revenueonlyEnd of PeriodCompute andrecord costof goods sold

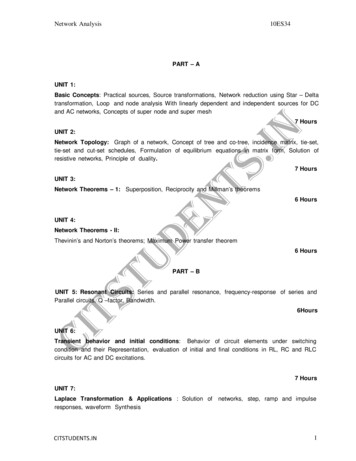

Recording Purchases of Merchandise213ADDITIONAL CONSIDERATIONSCompanies that sell merchandise with high unit values, such as automobiles, furniture, and major home appliances, have traditionally used perpetual systems. Thegrowing use of computers and electronic scanners has enabled many more companies to install perpetual inventory systems. The perpetual inventory system is sonamed because the accounting records continuously—perpetually—show thequantity and cost of the inventory that should be on hand at any time.A perpetual inventory system provides better control over inventories than aperiodic system. Since the inventory records show the quantities that should beon hand, the company can count the goods at any time to see whether the amountof goods actually on hand agrees with the inventory records. If shortages are uncovered, the company can investigate immediately. Although a perpetual inventory system requires additional clerical work and additional cost to maintain thesubsidiary records, a computerized system can minimize this cost. As noted in theFeature Story, much of Wal-Mart’s success is attributed to its sophisticated inventory system.Some businesses find it either unnecessary or uneconomical to invest in a computerized perpetual inventory system. Many small merchandising businesses, inparticular, find that a perpetual inventory system costs more than it is worth. Managers of these businesses can control their merchandise and manage day-to-dayoperations using a periodic inventory system.Because the perpetual inventory system is growing in popularity and use, weillustrate it in this chapter. Appendix 5A describes the journal entries for the periodicsystem.INVESTORS O INSIGHTSGApago PDF EnhancerMorrow Snowboards Improves Its Stock AppealInvestors are often eager to invest in a company that has a hot new product. However, when snowboard maker Morrow Snowboards, Inc., issued shares of stock to thepublic for the first time, some investors expressed reluctance to invest in Morrow because ofa number of accounting control problems. To reduce investor concerns, Morrow implementeda perpetual inventory system to improve its control over inventory. In addition, it stated thatit would perform a physical inventory count every quarter until it felt that the perpetualinventory system was reliable.?If a perpetual system keeps track of inventory on a daily basis, why do companies everneed to do a physical count? (See page 257.)Recording Purchases of MerchandiseCompanies purchase inventory using cash or credit (on account). They normallyrecord purchases when they receive the goods from the seller. Business documentsprovide written evidence of the transaction. A canceled check or a cash registerreceipt, for example, indicates the items purchased and amounts paid for eachcash purchase. Companies record cash purchases by an increase in Inventory and adecrease in Cash.A purchase invoice should support each credit purchase. This invoice indicatesthe total purchase price and other relevant information. However, the purchaserdoes not prepare a separate purchase invoice. Instead, the purchaser uses as aStudy Objective [2]Explain the recordingof purchases under aperpetual inventorysystem.

2145 Accounting for Merchandising Operationspurchase invoice a copy of the sales invoice sent by the seller. In Illustration 5-5, forexample, Sauk Stereo (the buyer) uses as a purchase invoice the sales invoice prepared by PW Audio Supply, Inc. (the seller).Illustration 5-5Sales invoice used aspurchase invoice by SaukStereoINVOICE NO. 731PW Audio Supply, Inc.27 Circle DriveHarding, Michigan 48281Helpful HintTo better understand thecontents of this invoice,identify these items:1. Seller2. Invoice date3. Purchaser4. Salesperson5. Credit terms6. Freight terms7. Goods sold: catalognumber, description,quantity, price per unit8. Total invoice amountSOLDFirm NameSauk StereoAttention ofJames Hoover, Purchasing AgentTOAddress125 Main StreetChelseaIllinois60915StateZipCityDate 5/4/12Catalog No.X572Y9820Salesperson MaloneTerms 2/10, n/30DescriptionFOB Shipping PointQuantityPriceAmount12,300 2,30053001,500TOTAL 3,800Printed CircuitBoard-prototypeApago PDF EnhancerA2547Z45Production ModelCircuitsIMPORTANT: ALL RETURNS MUST BE MADE WITHIN 10 DAYSA 513,800L13,800Cash Flowsno effect1Sauk Stereo makes the following journal entry to record its purchase fromPW Audio Supply. The entry increases (debits) Inventory and increases (credi

A perpetual inventory system provides better control over inventories than a periodic system. Since the inventory records show the quantities that should be on hand, the company can count the goods at any time to see whether the amount of goods actually on hand agrees with the inventory records. If shortages are un-covered, the company can investigate immediately. Although a perpetual inven .