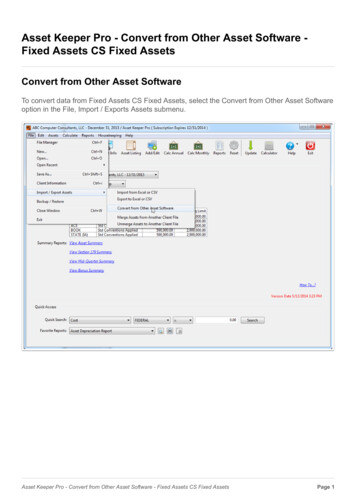

Transcription

Guide for taxpayers with depreciating assetsGuide todepreciating assets2021To help you complete your tax returnfor 1 July 2020 – 30 June 2021Covers deductions you can claim for depreciating assetsand other capital expenditureFor more informationgo to ato.gov.auNAT 1996-06.2021

OUR COMMITMENT TO YOUWe are committed to providing you with accurate,consistent and clear information to help you understandyour rights and entitlements and meet your obligations.If you follow our information in this publication and it iseither misleading or turns out to be incorrect, and youmake a mistake as a result, we must still apply the lawcorrectly. If that means you owe us money, you mustpay it but we will not charge you a penalty. Also, if youacted reasonably and in good faith we will not chargeyou interest. If correcting the mistake means we oweyou money, we will pay it and pay you any interest youare entitled to.If you feel that this publication does not fully cover yourcircumstances, or you are unsure how it applies to you,you can seek further help from us.We have a Taxpayers’ Charter which will help youunderstand what you can expect from us, your rights andobligations and what you can do if you are not satisfied withour decisions, services or actions. For more information,go to ato.gov.au and search for ‘Taxpayers’ Charter –helping you to get things right’.We regularly revise our publications to take account ofany changes to the law, so make sure that you have thelatest information. If you are unsure, you can check formore recent information on our website at ato.gov.auor contact us.This publication was current at June 2021. AUSTRALIAN TAXATION OFFICE FOR THECOMMONWEALTH OF AUSTRALIA, 2021You are free to copy, adapt, modify, transmit and distribute this material asyou wish (but not in any way that suggests the ATO or the Commonwealthendorses you or any of your services or products).PUBLISHED BYAustralian Taxation OfficeCanberraJune 2021DE-23358

CONTENTSAbout this guide2In-house software25Abbreviations used in this publication2Common-rate pools26Deductions for the cost of depreciating assets2Uniform capital allowances2Depreciating assets and taxation of financialarrangements (TOFA)27What is a depreciating asset?3Primary production depreciating assets28Capital expenditure deductible under UCA31Who can claim deductions for thedecline in value of a depreciating asset?4Small business entity concessions37Working out decline in value5Certain start-up expenses immediately deductible37Record keeping39Definitions40Guidelines for using the depreciating assets worksheet41Guidelines for using the low-value pool worksheet42Immediate deduction for certain non-businessdepreciating assets (costing 300 or less)11Effective life of depreciating assets13The cost of a depreciating asset15What happens if you no longerhold or use a depreciating asset?18Worksheet 1: Depreciating assets43Low-value pools23worksheet 2: Low-value pool44More informationGUIDE TO DEPRECIATING ASSETS 2021ato.gov.auinside back cover1

ABOUT THIS GUIDEAs a general rule, you can claim deductions for expensesyou incurred in gaining or producing your income (for example,in carrying on a business) but some expenditure, such as thecost of acquiring capital assets, is generally not deductible.However, you may be able to claim a deduction for thedecline in value of the cost of capital assets used in gainingassessable income.Guide to depreciating assets 2021 explains:n how to work out the decline in value of yourdepreciating assetsn what happens when you dispose of or stop usinga depreciating asset, andn the deductions you may be able to claim underuniform capital allowances (UCA) for capital expenditureother than on depreciating assets.Since 1 July 2001, UCA apply to most depreciating assets,including plant. Under UCA, deductions for the cost of adepreciating asset are based on the decline in value ofthe asset.Simplifying tax obligations for businessWho should use this guide?Use this guide if you bought capital assets to use in gaining orproducing your assessable income and you would like to claima deduction for the assets’ decline in value. Also use this guideif you incurred other capital expenditure and want to knowwhether you can claim a deduction for the expenditure.Small business entity concessionsSmall business entities may choose to use simplifieddepreciation rules. For more information see Small businessentity concessions on page 37.To find out how to get a publication referred to in this guideand for information about our other services, see the insideback cover.Unfamiliar termsUnfamiliar terms are shown in bold when first used in thisguide. For an explanation of these unfamiliar terms, seeDefinitions on page 40.ABBREVIATIONS USED IN THIS OFATRTVUCA2Australian Capital Territorycapital gains taxCommissioner of Taxationenvironmental protection activitiesforeign exchangegoods and services taxlow-cost assetlow-value assetopening adjustable valueTaxation of financial arrangementsTaxation Rulingtermination valueuniform capital allowancesUnder income tax law, you are allowed to claim certaindeductions for expenditure incurred in gaining or producingassessable income, for example, in carrying on a business.Some expenditure, such as the cost of acquiring capitalassets, is generally not deductible. Generally, the value of acapital asset that provides a benefit over a number of yearsdeclines over its effective life. Because of this, the cost ofcapital assets used in gaining assessable income can bewritten off over a period of time as tax deductions.Before 1 July 2001, the cost of plant (for example, cars andmachinery) and software was written off as depreciationdeductions.In this guide, the words ‘ignoring any GST impact’ mean thatif you are not entitled to claim an input tax credit for GSTfor a depreciating asset that you hold, then the cost of thedepreciating asset includes any GST.Publications and servicesDEDUCTIONS FOR THE COSTOF DEPRECIATING ASSETSThe practice statement Law Administration Practice StatementPS LA 2003/8 – Practical approaches to low-cost businessexpenses, provides guidance on two straightforward methodsthat you can use if you are carrying on a business to helpdetermine whether you treat expenditure incurred in acquiringcertain low-cost tangible assets as revenue expenditure orcapital expenditure.Subject to certain qualifications, the two methods coverexpenditure below a threshold and the use of statisticalsampling to estimate total revenue expenditure on low-costtangible assets. The threshold rule allows an immediatededuction for qualifying low-cost tangible assets costing 100 or less, including any GST. If you have a low-value pool(see Low-value pools on page 23), the sampling rule allowsyou to use statistical sampling to determine the proportion ofthe total purchases on qualifying low-cost tangible assets thatis revenue expenditure.We will accept a deduction for expenditure incurred onqualifying low-cost tangible assets calculated in accordancewith this practice statement.UNIFORM CAPITAL ALLOWANCESUCA provide a set of general rules that apply across a varietyof depreciating assets and certain other capital expenditure.UCA do this by consolidating a range of former capitalallowance regimes. UCA replace provisions relating to:n plantn softwaren mining and quarryingn intellectual propertyn forestry roads and timber mill buildings, andn spectrum licences.UCA maintain the pre-1 July 2001 treatment of somedepreciating assets and capital expenditure suchas certain primary production depreciating assets andcapital expenditure.UCA introduced deductions for some types of capitalexpenditure such as certain business and project-relatedcosts; see Capital expenditure deductible under UCA onpage 31.ato.gov.auGUIDE TO DEPRECIATING ASSETS 2021

You use these rules to work out deductions for the cost ofyour depreciating assets, including those acquired before1 July 2001. You can generally deduct an amount for thedecline in value of a depreciating asset you held to the extentthat you used it for a taxable purpose.However, an eligible small business entity may choose towork out deductions for their depreciating assets using thesimplified depreciation rules; see Small business entityconcessions on page 37.Under UCA, there are a number of steps to work out yourdeduction for the decline in value of a depreciating asset.n Is your asset a depreciating asset covered by UCA?See What is a depreciating asset? below.n Do you hold the depreciating asset?See Who can claim deductions for the decline in valueof a depreciating asset? on the next page.n Has the depreciating asset started to decline in value?See When does a depreciating asset start to declinein value? on page 6.n What method will you use to work out decline in value?See Methods of working out decline in value on page 8.n What is the effective life of the depreciating asset?See Effective life of depreciating assets on page 13.n What is the cost of your depreciating asset?See The cost of a depreciating asset on page 15.n Must you reduce your deduction for any use for anon‑taxable purpose?See Decline in value of a depreciating asset usedfor a non-taxable purpose on page 10.See Working out decline in value on page 5.WHAT IS A DEPRECIATING ASSET?A depreciating asset is an asset that has a limited effectivelife and can reasonably be expected to decline in value overthe time it is used. Depreciating assets include such itemsas computers, electric tools, furniture and motor vehicles.Land and items of trading stock are specifically excludedfrom the definition of depreciating asset.Most intangible assets are also excluded from the definitionof depreciating asset. Only the following intangible assets,if they are not trading stock, are specifically included asdepreciating assets:n in-house software; see In-house software on page 25n certain items of intellectual property (patents, registereddesigns, copyrights and licences of these)n mining, quarrying or prospecting rights and informationn certain indefeasible rights to use a telecommunicationscable systemn certain telecommunications site access rightsn spectrum licences, andn datacasting transmitter licences.GUIDE TO DEPRECIATING ASSETS 2021In most cases, it will be clear whether or not something isa depreciating asset. If you are not sure, contact us or yourrecognised tax adviser.Second-hand depreciating assets in residentialrental propertiesSteps to work out your deductionSome of these steps do not apply:n if you choose to allocate an asset to a pooln if you can claim an immediate deduction for the assetn to certain primary production assetsn to some assets used in rural businesses.Improvements to land or fixtures on land (for example,windmills and fences) may be depreciating assets and aretreated as separate from the land, regardless of whetherthey can be removed or not.From 1 July 2017, you cannot claim a deduction for thedecline in value of certain second-hand depreciating assetsin your residential rental property unless you are using theproperty in carrying on a business, including the businessof letting rental properties, or you are an excluded entity.These changes generally apply to depreciating assets:n for which you entered into a contract to acquire, or whichyou otherwise acquired, at or after 7.30 pm on 9 May 2017,orn which you used, or had installed ready for use, for anyprivate purpose in 2016–17 or earlier, and for which youwere not entitled to a deduction for a decline in valuein 2016–17.Residential rental property is residential premises you useto provide residential accommodation for the purpose ofproducing assessable income.For more information about the limit on the deductions fordecline in value of second-hand depreciating assets in yourresidential rental property, including on how the new rulesapply to the assets allocated to low-value pools, see Rentalproperties 2021 (NAT 1729).Depreciating assets excluded from UCADeductions for the decline in value of some depreciatingassets are not worked out under UCA. These depreciatingassets are:n depreciating assets that are capital works, for example,buildings and structural improvements for which deductions– are available under the separate provisions forcapital works– would be available if the expenditure had beenincurred, or the capital works had been started,before a particular date– would be available if the capital works were usedin a deductible way in the income yearn cars, where you use the cents per kilometre method forcalculating car expenses; this method takes the decline invalue into account in its calculationsn indefeasible rights to use an internationaltelecommunications submarine cable system, if theexpenditure was incurred or the system was used fortelecommunications purposes at or before 11.45am AESTon 21 September 1999n indefeasible rights to use a domestic telecommunicationscable system or telecommunications site access rights if theexpenditure was incurred before 12 May 2004; special rulesapply to deem certain of those rights to be acquired beforethat date, and to exclude certain expenditure incurred on orafter that date that actually relates to an earlier rightato.gov.au3

nnwork-related items (such as laptop computers, personaldigital assistants, computer software, protective clothing,briefcases and tools of trade), ordinarily eligible for adepreciation deduction under UCA, will not be eligible if:– the item was provided to you by your employer, or someor all of the cost of the item was paid for or reimbursed byyour employer, and– the provision, payment or reimbursement was exemptfrom fringe benefits taxdepreciating assets for which deductions were availableunder the specific film provisions.WHO CAN CLAIM DEDUCTIONS FOR THEDECLINE IN VALUE OF A DEPRECIATING ASSET?Only the holder of a depreciating asset can claim a deductionfor its decline in value.In most cases, the legal owner of a depreciating asset will beits holder.There may be more than one holder of a depreciating asset,for example, joint legal owners of a depreciating asset are allholders of that asset. Each person’s interest in the asset istreated as a depreciating asset. Each person works out theirdeduction for decline in value based on their interest in theasset (for example, based on the cost of the interest to them,not the cost of the asset itself) and according to their use ofthe asset.In certain circumstances, the holder is not the legal owner.Some of these cases are discussed below.If you are not sure whether you are the holder of a depreciatingasset, contact us or your recognised tax adviser.Leased luxury carsA leased car, either new or second-hand, is generally a luxurycar if its cost exceeds the car limit that applies for the financialyear in which the lease is granted. The car limit for 2020–21 is 59,136; see Car limit on page 17.For income tax purposes, a luxury car lease (other than agenuine short-term hire arrangement) is treated as a notionalsale and loan transaction.The first element of cost of the car to the lessee and theamount lent by the lessor to the lessee to buy the car is takento be the car’s market value at the start time of the lease. Forfurther information on the first element of cost see The costof a depreciating asset on page 15.The actual lease payments made by the lessee are divided intonotional principal and finance charge components. That partof the finance charge component applicable to the particularperiod may be deductible to the lessee.The lessee is generally treated as the holder of the luxury carand is entitled to claim a deduction for the decline in value ofthe car. For the purpose of calculating the deduction, the firstelement of cost of the car is limited to the car limit for the yearin which the lease is granted. For more information, go toato.gov.au and search for 'Yearly car limit'.Any deduction must be reduced to reflect any use of thecar other than for a taxable purpose, such as private use.See Decline in value of a depreciating asset used for anon-taxable purpose on page 10.4If the lessee does not actually acquire the car from the lessorwhen the lease terminates or ends, the lessee is treated as ifthey sold the car to the lessor. The lessee will need to workout any assessable or deductible balancing adjustmentamount; see What happens if you no longer hold oruse a depreciating asset? on page 18.Depreciating assets subjectto hire purchase agreementsFor income tax purposes, certain hire purchase and instalmentsale agreements entered into after 27 February 1998 aretreated as a notional sale of goods by the financier (or hirepurchase company) to the hirer, financed by a notionalloan from the financier to the hirer. The hirer is in thesecircumstances treated as the notional buyer and owner underthe arrangement. The financier is treated as the notional seller.Generally, the cost or value of the goods stated in the hirepurchase agreement or the arm’s length value is taken to bethe cost of the goods to the hirer and the amount lent by thefinancier to the hirer to buy the goods.The hire purchase payments made by the hirer are separatedinto notional loan principal and notional interest under a formulaset out in Division 240 of the Income Tax Assessment Act 1997.The notional interest may be deductible to the hirer to the extentthat the asset is used to produce assessable income.Under UCA, if the goods are depreciating assets, the hirer isregarded as the holder provided it is reasonably likely that theywill actually acquire the asset.If these conditions are met, the hirer is able to claim adeduction for decline in value to the extent that the assetsare used for a taxable purpose, such as for producingassessable income.If the hirer actually acquires the goods under the agreement,the hirer continues to be treated as the holder. Actual transferof legal title to the goods from the financier to the hirer is nottreated as a disposal or acquisition.On the other hand, if the hirer does not actually acquire thegoods under the arrangement, the goods are treated as beingsold back to the financier at their market value at that time.The hirer will need to work out any assessable or deductiblebalancing adjustment amount; see What happens if you nolonger hold or use a depreciating asset? on page 18.The notional loan amount under a hire purchase agreementis treated as a limited recourse debt; see Limited recoursedebt arrangements on page 23.Leased depreciating assets fixed to landIf you are the lessee of a depreciating asset and it is ffixed toyour land, under property law you become the legal owner ofthe asset. As the legal owner you are taken to hold the asset.However, an asset may have more than one holder. Despitethe fact that the leased asset is fixed to your land, if the lessorof the asset (often a bank or finance company) has a right torecover it, then they too are taken to hold the asset as long asthey have that right to recover it. You and the lessor, each beinga holder of the depreciating asset, would calculate the declinein value of the asset based on the cost that each of you incur.ato.gov.auGUIDE TO DEPRECIATING ASSETS 2021

Partnership assetsEXAMPLE: Holder of leased asset fixed to landThe partnership (not the partners or any particular partner) istaken to be the holder of a partnership asset, regardless of itsownership. A partnership asset is one held and applied by thepartners exclusively for the purposes of the partnership and inaccordance with the partnership agreement.Jo owns a parcel of land. A finance company leases somemachinery to Jo who pays the cost of fixing it to her land.Under the lease agreement, the finance company has aright to recover the machinery if Jo defaults on her leasepayments.WORKING OUT DECLINE IN VALUEThe finance company holds the machinery as it has aright to remove the machinery from the land. The financecompany is entitled to deductions for the decline in valueof the machinery, based on the cost of the machinery tothe finance company.You workout deductions for the decline in value of mostdepreciating assets, including those acquired before1 July 2001, under UCA.UCA contain general rules for working out the decline invalue of a depreciating asset, and those rules are covered inthis part of the guide. Transitional rules apply to depreciatingassets held before 1 July 2001 so you can work out theirdecline in value using these rules; see Depreciating assetsheld before 1 July 2001 on page 10.However, Jo also holds the machinery as it is attachedto her land. She is entitled to a deduction for thedecline in value of it based on the cost to her of holdingthe machinery. This cost would not include her leasepayments but would include the cost of installing themachinery. For more information about what amountsform part of the cost of a depreciating asset, see Thecost of a depreciating asset on page 15.Depreciating assets which improveor are fixed to leased landIf a depreciating asset is fixed to leased land and the lesseehas a right to remove it, the lessee is the holder for the timethat the right to remove the asset exists.EXAMPLE: Holder of depreciating assetfixed to leased landJo leases land from Bill, who owns the land. Jo purchasessome machinery and fixes it to the land. Under propertylaw, the machinery is treated as part of the land so Bill isits legal owner.However, under the terms of her lease, Jo can removethe machinery from the land at any time. Because shehas acquired and fixed the machinery to the land and hasa right to remove it, Jo is the holder of the machinery forthe time that the right to remove it exists.If a lessee or owner of certain other rights over land (for example,an easement) improves the land with a depreciating asset, thatperson is the holder of the asset if the asset is for their ownuse, even though they have no right to remove it from the land.They remain the holder for the time that the lease or right exist.EXAMPLE: Holder of depreciating assetthat improves leased landJo leases land from Bill to use for farming. Jo installs anirrigation system on the land which is an improvement tothe land. While Bill is the legal owner under property lawas the irrigation system is part of his land, Jo is the holderof the irrigation system. Even though she has no right toremove the irrigation system under her contract with Bill, Jomay deduct amounts for its decline in value for the term ofthe lease because:n she improved the land, andn the improvement is for her use.GUIDE TO DEPRECIATING ASSETS 2021The general rules do not apply to some depreciating assets.UCA provide specific rules for working out deductions for theassets listed below:n certain depreciating assets that cost 300 or less andthat are used mainly to produce non-business assessableincome; see Immediate deduction for certainnon‑business depreciating assets (costing 300or less) on page 11n assets that cost less than the Instant asset write-off onpage 7n assets that may be eligible for the Backing BusinessInvestment measure; see Backing business investmenton page 7n certain depreciating assets that may be eligible forTemporary full expensing of depreciating assets onpage 6n certain depreciating assets that cost or are written downto less than 1,000; see Low-value pools on page 23n in-house software for which expenditure has beenallocated to a software development pool; see Softwaredevelopment pools on page 26n depreciating assets used in exploration or prospecting; seeMining and quarrying, and minerals transport on page 33n water facilities, fencing assets, fodder storage assets andhorticultural plants (including grapevines); see Primaryproduction depreciating assets on page 28n certain depreciating assets of primary producers, otherlandholders and rural land irrigation water providers used inlandcare operations; see Landcare operations on page 31n certain depreciating assets of primary producers and otherlandholders used for electricity connections or phone lines;see Electricity connections and phone lines on page 32n trees in a carbon sink forest; see Carbon sink forests onpage 36.There are also specific rules for working out notationaldeductions for depreciating assets used in carrying on researchand development activities; see Research and developmenttax incentive schedule instructions 2021 (NAT 6709).ato.gov.au5

When does a depreciating assetstart to decline in value?The decline in value of a depreciating asset starts when youfirst use it, or install it ready for use, for any purpose, includinga private purpose. This is known as a depreciating asset’sstart time.Although an asset is treated as declining in value from itsstart time, a deduction for its decline in value is only allowableto the extent it is used for a taxable purpose; see Definitionson page 40.If you initially use a depreciating asset for a non-taxablepurpose, such as for a private purpose, and in later yearsuse it for a taxable purpose, you need to work out the asset’sdecline in value from its start time, including the years youused it for a private purpose. You can then work out yourdeductions for the decline in value of the asset for the yearsyou used it for a taxable purpose; see Decline in valueof a depreciating asset used for a non-taxable purposeon page 10.New accelerated depreciation measuresMeasures introduced in March 2020 provide an incentive forbusinesses with aggregated turnover of less than 500 millionto deduct the cost of depreciating assets at an acceleratedrate in 2019-20 and 2020–21. See Backing businessinvestment on page 7.Measures introduced in October 2020 provide further incentivefor businesses with an aggregated turnover of less than 5 billion (or corporate tax entities satisfying the alternativetest) to deduct the full cost of eligible depreciating assets ifthey are first held and first used, or installed ready for use, bythem for a taxable purpose from 7:30pm (AEDT) on 6 October2020 to 30 June 2022. Businesses are also able to deductthe full cost of improvements to these new or existing eligibledepreciating assets made during this period. See Temporaryfull expensing of depreciating assets below.Temporary full expensing of depreciating assetsBusinesses with an aggregated turnover of less than 5 billion(or corporate tax entities satisfying the alternative test), canimmediately deduct the business portion of the cost of eligiblenew depreciating assets of any value. The eligible new assetsmust be first held, and first used or installed ready for use for ataxable purpose, between 7.30pm AEDT on 6 October 2020and 30 June 2022.Businesses can also immediately deduct the business portionof the cost of improvements to eligible depreciating assets(and to assets acquired before 7.30pm AEDT on 6 October2020 that would otherwise be eligible assets) if those costsare incurred between 7.30pm AEDT on 6 October 2020 and30 June 2022.Generally, to be eligible for the temporary full expensingincentive, a depreciating asset must be:n first held, and first used or installed ready for use, for ataxable purpose, between 7:30pm (AEDT) on 6 October2020 and 30 June 2022;n located in Australia and principally used in Australia for theprincipal purpose of carrying on a business; andn not have a balancing adjustment event happen in the sameincome year.6Additionally, the depreciating asset:n must not be excluded from the uniform capital allowancerules in Division 40 of the ITAA 1997 (such as a building orother capital works); orn must not be subject to the capital allowance rules of theITAA 1997– in Subdivision 40-E (about low value and softwaredevelopment pools), or– in Subdivision 40-F (about primary productiondepreciating assets).If your business has an aggregated turnover of 50 million ormore, you are excluded from immediately deducting the costof an eligible asset that is:n an asset you entered into a commitment to hold, constructor use before 7.30pm AEDT on 6 October 2020; orn a second-hand asset.The car limit applies to limit the temporary full expensingdeduction where a car is designed to mainly carry passengers.If you start to hold an eligible asset and you first use the asset,or have it installed ready for use, for a taxable purpose in thesame income year, you deduct in the income year the sum of:n the asset’s cost, andn the costs of improvements incurred in the income year.If you only start to use the asset, or have it installed ready foruse, for a taxable purpose in an income year that is later thanthe year when you started to hold the asset, you deduct inthat later income year the sum of:n the asset’s opening adjustable value for that later incomeyear, andn the costs of improvements incurred in that later income year.Small business entities that choose to use the simplifieddepreciation rules in an income year ending between6 October 2020 and 30 June 2022, must apply temporary fullexpensing. However, if you do not want to apply temporaryfull expensing, you will need to opt out of the simplifieddepreciation rules during this period. However, you must stilldeduct the balance of your small business pool in the year youchoose to opt out of the simplified depreciation rules.For other entities that do not use the simplified depreciationrules, if an asset qualifies for an immediate deduction undertemporary full expensing in an income year, you can makea choice to opt-out of temporary full expensing on anasset-by-asset basis for a particular income year. However,you must notify us in an approved form (such as using thenew items on the tax return form) that you have chosen not toapply temporary full expensing to the asset for an applicableincome year. The choice is irrevocable, and you must notify usby the day you lodge your income tax return for the incomeyear to which the choice relates. Once you have lodgedyour return, you will not be able to opt-out of temporaryfull expensing.F

For more information go to ato.gov.au NAT 1996-06.2021 Guide to depreciating assets 2021 To help you complete your