Transcription

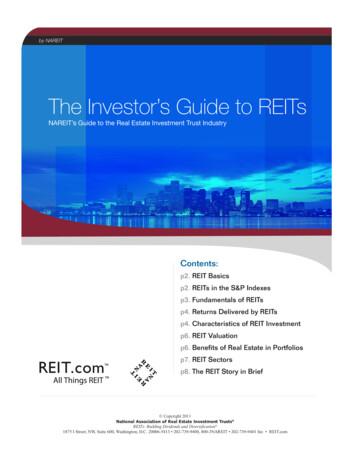

by NAREITThe Investor’s Guide to REITsNAREIT’s Guide to the Real Estate Investment Trust IndustryContents:p2. REIT Basicsp2. REITs in the S&P Indexesp3. Fundamentals of REITsp4. Returns Delivered by REITsp4. Characteristics of REIT Investmentp6. REIT Valuationp6. Benefits of Real Estate in Portfoliosp7. REIT Sectorsp8. The REIT Story in Brief Copyright 2011National Association of Real Estate Investment Trusts REITs: Building Dividends and Diversification 1875 I Street, NW, Suite 600, Washington, D.C. 20006-5413 202-739-9400, 800-3NAREIT 202-739-9401 fax REIT.com

The Investor’s Guide to REITsNAREIT NewsBriefNAREIT’s Guide to the Real Estate Investment Trust IndustryREIT BasicsReal estate investment trusts (REITs) arecompanies that own and most often activelymanage income-producing commercial realestate. Some REITs make or invest in loans andother obligations that are secured by real estatecollateral. The shares of most large REITs arepublicly traded.NAREIT’s Monthly NewsletterInvestors can choose to benefit from theopportunities in the REIT market by purchasing thestocks of individual REITs or investing in REITmutual funds or ETFs. Actively managed mutualfunds are run by portfolio managers with a highdegree of expertise in the real estate industry.REITs in the S&P IndexesThe U.S. Congress created the legislativeframework for REITs in 1960 to enable theinvesting public to benefit from investments inlarge-scale, commercial real estate enterprises.Commercial real estate equity investment throughREITs has much to offer institutional and retailinvestors. REIT stocks provide superior dividendincome along with the potential for long-termcapital gains through share price appreciation,and can also serve as a powerful tool for portfoliodiversification.Research by Ibbotson Associates, an investmentresearch unit of Morningstar, Inc., demonstratesthe multi-faceted benefits of investing in REITs: The ownership of REIT shares over time hashistorically increased investors’ total returnand/or lowered the overall risk in both equityand fixed-income portfolios over time.The inclusion of REITs in 2001 in the Standard &Poor’s Indexes, the most widely followedinvestment performance benchmarks for the U.S.equity markets, underscored the importance ofREITs in public capital markets andacknowledged the integral role they play in theeconomy and in diversified investment portfolios.The ongoing success of the REIT model is areflection of many things, from its incomegenerating and growth potential, to the provenportfolio diversification benefits of owning REITshares; and from the benefits of active andprofessional management of real estateproperties, to the transparency and managementaccountability that are essential components ofREIT corporate governance. Dividend growth rates for REIT shares haveoutpaced inflation over the last decade.Page TwoThe Investor’s Guide to REITs

The Investor’s Guide to REITsNAREIT NewsBriefNAREIT’s Guide to the Real Estate Investment Trust IndustryFundamentals of REITsPublicly traded REITs are vital companies thatoffer investors the benefits of commercial realestate investment along with the advantages ofinvesting in a publicly traded stock.LiquidityInvestors can purchase or sell shares in REITs aseasily as they purchase or sell shares in any otherpublicly traded company. REIT shares are tradedon all of the major stock exchanges in the U.S.,including the New York Stock Exchange (NYSE),Nasdaq, American Stock Exchange (AMEX), aswell as various after-hours markets.Shareholder ValueJust like investors in other public companies,REIT shareholders can receive value in the form ofboth dividend income and share valueappreciation.Active Management/Corporate GovernancePublicly traded REITs generally are actively andprofessionally managed corporations. Theyadhere to the same corporate governanceprinciples that apply to all major publiccompanies.They have a senior management team that isheaded by a chief executive officer (CEO) whoactively manages the overall strategic vision andequity of the enterprise. The board of directorsappoints the CEO, which in turn is elected by andaccountable to the shareholders of the REIT.The Investor’s Guide to REITsNAREIT’s Monthly NewsletterDisclosure ObligationPublicly traded REITs, like other public companiesin the U.S., are required to make regular financialdisclosures to the investment community,including quarterly and yearly audited financialresults with concomitant filings with the Securitiesand Exchange Commission.No Shareholder LiabilityAs is the case with equity investments in otherpublicly traded companies, shareholders have nopersonal liability for the debts of the REITs inwhich they invest.Low LeverageLike most other publicly traded companies, REITstend to use moderate levels of debt in their capitalstructures. In fact, the average REIT debt ratio hasbeen below 55 percent for much of the lastdecade.Investors can purchaseshares in REITs as easilyas they purchase sharesin any other publiclytraded company. REITshares are traded on allmajor stock exchanges.Page Three

The Investor’s Guide to REITsNAREIT NewsBriefNAREIT’s Guide to the Real Estate Investment Trust IndustryNAREIT’s Monthly NewsletterCharacteristics of REIT InvestmentReturns Delivered by REITsREITs Deliver Income & Long-term GrowthThe special investment characteristics ofincome-producing real estate provide REITinvestors with competitive long-term rates ofreturn that complement the returns from otherstocks and from bonds.In addition to the investment performance andportfolio diversification benefits available frominvesting in REITs, REITs offer several advantagesnot found in companies across other industries.These benefits are part of the reason that REITshave become increasingly popular with investorsover the past two decades:High Dividend YieldREITs are required to distribute at least 90 percentof their taxable income to shareholders annually inthe form of dividends. Significantly higher onaverage than other equities, the industry'sdividend yields historically have produced asteady stream of income through a variety ofmarket conditions.Share Price AppreciationApproximately one-third of the total return fromREIT stocks since 1972 came from moderate,long-term growth in share prices.Predictable Revenue StreamREITs’ reliable income is derived from rents paid tothe owners of commercial properties whosetenants often sign leases for long periods of time,or from interest payments from the financing ofthose properties.Earnings TransparencyMost REITs operate along a straightforward andeasily understandable business model: Byincreasing property occupancy rates and rentsover time, higher levels of income may beproduced. When reporting financial results, REITs,like other public companies, must report earningsper share based on net income as defined bygenerally accepted accounting principles (GAAP).Dividend Yields:FTSE NAREIT Equity Return ComponentsFTSE NAREIT All REIT Index vs. S&P 500Returns (%)(Year-end dividend yields, 1990-2010)(Percent change, as of December 31, 2010)PriceIncomeAverage Annual Total Returns: 13.75%Average Annual Income Returns: 8.30%12FTSE NAREIT All REIT Index10S&P 5008642Source: NAREIT and Standard and Poor’s.Page 082006200420022000199819961994199219900Source: NAREIT The Investor’s Guide to REITs

The Investor’s Guide to REITsNAREIT NewsBriefNAREIT’s Guide to the Real Estate Investment Trust IndustryNAREIT’s Monthly NewsletterREITs OutperformLeading U.S. Benchmarks6420S&PIn short, REITs over time have demonstrated ahistorical track record providing a high level ofcurrent income combined with long-term shareprice appreciation, inflation protection, andprudent diversification for investors across theage and investment style spectrums.850Ru0ssAgelgr Bl2eg ar00at cla0e ysBo Cnd apIn itade lxTotal ReturnThe combination of income returns fromdividends and capital gains from share priceappreciation can result in healthy overall returnsfor REIT investors. Analysis by IbbotsonAssociates demonstrates that the combination ofdividends and share price appreciation has madeREIT returns competitive with other majorinvestments, including a broad range of large-capstocks, small-cap stocks and fixed-incomesecurities.10Al FTl E SEqu Nity ARRE EIIT TsGiven the broad range of real estate propertysectors and business lines, there also are anumber of additional earnings metrics, which areused by REITs in order to provide investors with agreater level of insight into their performance.10.048.921210.7130-Year Compound Annual Total ReturnsData as of December 31, 201011.87Another way year-to-year financial progress canbe gauged is by comparing levels of Funds FromOperations (FFO). FFO, the industry’ssupplemental performance measure, differsmainly from net income by excluding depreciationand amortization of real estate assets and gainsand losses from most property sales.The Investor’s Guide to REITsPage Five

The Investor’s Guide to REITsNAREIT NewsBriefNAREIT’s Guide to the Real Estate Investment Trust IndustryNAREIT’s Monthly NewsletterREIT ValuationBenefits of Real Estate in PortfoliosMany factors affect the value of a REIT’s share priceGiven the investment strengths and historicalbeginning with the earnings tied to generallypredictable and growing streams of rental revenueperformance of REITs, it is no surprise that REITshares are commonly viewed as a good investmentand a price-earnings multiple assigned by themarketplace.for all long-term, diversified investors.Clearly, the inclusion of REIT shares in any investmentThe level and growth of rents are largely determinedby economic fundamentals of supply and demand inportfolio is a prudent investment decision:real estate markets. These fundamentals includedemographic factors such as population size,population growth, employment growth,Market Variability BalanceFirst, the variability of market returns over time andacross all economic sectors makes it clear thatdiversification is the key to long-term investmentconstruction and the level of overall economicactivity. While differing from region to region, all ofthese factors typically have a direct impact on rentsand occupancy rates, which affect projectedearnings and property values.success. Integral to diversification is the inclusion ofequities representing all sectors of the economy,including real estate.Attractive Risk/Reward BalanceOther factors include:Net Asset Value CalculationMany REIT analysts look at net asset value (NAV) asa reference point for the valuation of a company.NAV equals the estimated market value of a REIT’stotal assets (mostly real property) minus the value ofall liabilities. When divided by the number ofcommon shares outstanding, the net asset value pershare is viewed by some as a useful guideline fordetermining the appropriate level of share price.Property Portfolio EnhancementsThe value of a REIT’s property portfolio can bemaintained or enhanced through consistent capitalexpenditures. This is significant because strategicproperty portfolio enhancements help to maintain orincrease NAVs and can provide the basis for priceappreciation of a REIT’s shares.Page SixSecond, REIT shares have proven to offer anattractive risk/reward balance in investmentportfolios. Asset allocation analysis from IbbotsonAssociates has found that adding REIT shares to adiversified portfolio historically has increased totalportfolio returns or lowered overall portfolio risk.In fact, Ibbotson’s research shows that, when REITshares are added to an already diversified portfolio,the efficient frontier of the portfolio is raised. Whenportfolio investments are efficient, risk-averse investorscan expect to realize higher portfolio returns with thelow level of portfolio risk they prefer, whilerisk-tolerant investors can expect to realize lowerrisk along with the high level of returns they seek.Ultimately, a more efficient portfolio is somethingthat all investors – from those looking for value orincome, to those who are more growth-oriented –will find attractive.The Investor’s Guide to REITs

The Investor’s Guide to REITsNAREIT NewsBriefNAREIT’s Guide to the Real Estate Investment Trust IndustryNAREIT’s Monthly NewsletterREIT SectorsWith a very diverse profile, the REIT industry offersREITs regularly explore new opportunitiesinvestors many alternatives across a broad range ofspecific real estate property sectors, including:for income growth, from new acquisitions Apartment communities Office propertiesor development to providing income-producingleasing or tenant services. Regardless of specificbusiness lines, REITs acquire and develop theirproperties primarily to actively manage and operate Shopping centersthem as income-producing, ongoing businesses. Regional malls Storage centers Industrial parks and warehouses Lodging facilities, includinghotels and resorts Health care facilities Natural resources.REITs Invest In All Property Types(as of March 31, 2010)Mixed2.1%Industrial4.6%Self Storage5.3%Lodging/Resorts5.9%Freestanding Retail1.7%ManufacturedHomes0.6%Regional Health Care11.4%Shopping Centers7.8%Mortgage8.4%The Investor’s Guide to REITsOffice Buildings11.2%Page Seven

The Investor’s Guide to REITsNAREIT NewsBriefNAREIT’s Guide to the Real Estate Investment Trust IndustryThe REIT Story in BriefNAREIT’s Monthly NewsletterNAREIT OfficersBryce Blair, ChairREIT shares clearly can benefit most investors,whether value-driven or growth-oriented, individualor institutional.They offer the benefits of ongoing current income,with the potential for long-term capital appreciationthat historically has met or exceeded inflation.AvalonBay Communities, Inc.Donald C. Wood, First Vice ChairFederal Realty Investment TrustW. Edward Walter, Second Vide ChairHost Hotels & Resorts, Inc.They are equities that derive a large part of theirvalue from tangible, hard assets and the effectivemanagement of those assets.And they have been proven to bring the benefits ofbalance, diversification and greater risk/rewardefficiency to a broad range of investment portfolios.Ronald L. Havner, Jr., TreasurerPublic StorageNAREIT Executive StaffSteven A. Wechsler, President & CEOTony M. Edwards, Exec. VP & General CounselWe invite you to further explore what the REITsector can offer you.Sheldon M. Groner, Exec. VP, Finance & OperationsMichael R. Grupe, Exec. VP, Research & Investment AffairsThe Investor’s Guide to REITsNAREIT’s Guide to the Real Estate Investment Trust IndustryNAREIT does not intend this publication to be a solicitation related to any particular company, nor does itintend to provide investment, legal or tax advice. Investors should consult with their own investment, legalor tax advisers regarding the appropriateness of investing in any of the securities or investment strategiesdiscussed in this publication. Nothing herein should be construed to be an endorsement by NAREIT of anyspecific company or products or as an offer to sell or a solicitation to buy any security or other financialinstrument or to participate in any trading strategy. NAREIT expressly disclaims any liability for theaccuracy, timeliness or completeness of data in this publication. Unless otherwise indicated, all data arederived from, and apply only to, publicly traded securities. All values are unaudited and subject to revision.Any investment returns or performance data (past, hypothetical, or otherwise) are not necessarily indicativeof future returns or performance. Copyright 2011 National Association of Real Estate Investment Trusts NAREIT is the exclusive registered trademark of the National Association of Real Estate Investment Trusts.Page EightThe Investor’s Guide to REITs

NAREIT’s Guide to the Real Estate Investment Trust Industry 11.87 10.04 REITs Outperform Leading U.S. Benchmarks 30-Year Compound Annual Total Returns Data as of December 31, 2010 FTSE NAREIT s S&P 500Russell 2000 Aggregate Bond Index Barc