Transcription

International Journal of Engineering Research & Technology (IJERT)ISSN: 2278-0181Vol. 3 Issue 8, August - 2014Designing Conceptual Model for BankingCustomer Relationship Management SystemsBased on Cloud ComputingFatemeh Hajmaleki, MscDepartment of computer (Software)Engineering Science and Research branch,Islamic Azad UniversityTehran, Iran.Seyyed Mohsen Hashemi, PhdDepartment of computer (Software)Engineering Science and Research branch,Islamic Azad UniversityTehran, IranKeywords—Customer RelationshipComputing; Banking CRM; e-Banking.I.In this study, we intend to express and model therequirements of a banking CRM1 system by using cloudcomputing. Cloud computing is discussed as a model forinteraction between IT service providers and their customers.Since providing services in short time with the lowest price isthe main mission of Banks and cloud computing meets theseobjectives, implementing CRM based on cloud computingwill cause numerous benefits for banks.II.CUSTOMER RELATIONSHIP MANAGEMENTAND CLOUD COMPUTINGIJERTAbstract— nowadays customer requirements and customerbehavior have changed considerably. To support these needs,and to gain competitive advantages, customer-centric strategiesmust be used. Customer relationship management is one of thesestrategies. In This Study by considering the importance ofcustomer relationship management and its positive effects inbanks, a banking CRM model has been designed based on cloudcomputing to improve the quality of services in banks and toincrease the customer trust.The presented banking CRM model which is based on cloudcomputing is a good starting point for the banks which arelooking for designing and implementing CRM systems.Implementing this model in banks will enhance organizationalcompetitiveness, In addition to increasing revenues andreducing operational costs.Management;CloudINTRODUCTIONBy advancement of science and technology and withregard to deployment of communication world, allorganizations look for delivering better services to theircustomers to gain competitive advantages. Nowadays,customers are considered as an organization's asset;Organizations by preserving old customers and by attractingnew customers can gain competitive advantages. Banks alsoface the same challenges. In banks, every work is done toabsorb and satisfy the customers. Therefore in competitiveenvironment, those banks are successful which acquire morecustomers' loyalty. On the other hand, due to extremesensitivity of customers about Services provided by Banks,customers demand better and desirable services constantly[1]. Therefore, effective and efficient relationshipmanagement with customers is the major issue fororganizations and especially for banks.Customer relationship management (CRM) is a strategywhich causes stronger relationship between organizations andtheir customers by analyzing customers' requirements. In fact,Customer relationship management is the philosophy,strategy and technology for identifying, attracting andexpanding customer and it is certainly a matter fordevelopment of banking.A. What is CRM?CRM is Abbreviation of Customer relationshipmanagement. "Customer relationship management" is acomprehensive and systematic solution that plays asignificant role in organizations by integrating the principlesof customer relationship to acquire, develop and maintaincustomer satisfaction, increase profitability and create valueadded economic.In other words, customer relationship management (CRM)is a term that describes how your business can interact withcustomers. Most people think CRM is a system that storesand maintains the information of customers; while this is onlypart of the work is done by CRM; CRM also help to meetcustomers' needs and identify new customers by using thesecollected information.CRM is composed of three main parts: Customer,Relationship and management. “Customer” can be defined asthe ultimate consumer who plays supporting role. “Relation”can be defined as an activity which Attract customer’s loyaltyand profitability by learner communications. “Management”can be defined as an activity which Conduct a Customerbased business process and putting the customer at the centerof organization's processes and practices [3].1IJERTV3IS080731Customer relationship Managementwww.ijert.org(This work is licensed under a Creative Commons Attribution 4.0 International License.)934

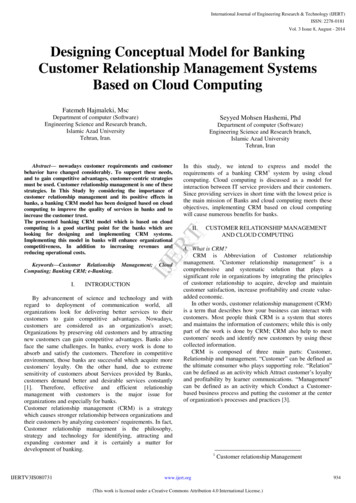

International Journal of Engineering Research & Technology (IJERT)ISSN: 2278-0181Vol. 3 Issue 8, August - 2014B. Banking CRMIn recent years, in the areas such as Banking Industry thatthere is strong competition, gain Customer satisfaction is veryimportant. Banks should use customer relationshipmanagement to increase customer satisfaction [2]. Some ofthe advantages that banks will obtain by using CRM are asfollows:- Determining the main bank’s customers and helpingto make effective relationship with them- Reconfiguring the bank's sales and marketingcampaigns- Providing competitive advantage- Increasing productivity- Increasing the customer loyalty- Increasing the speed of bank’s operations- Reducing the waiting time for customers to get theservice[2,3]The main goal of CRM is to help banking business obtainCustomer-Oriented approach about human resources andtechnology [4, 5]. If this system works well, the business can[4]:- Provide better services for customers,- Make efficiently call centers,- Attract more customers and- Increase bank earningsReduced repetitive operations and Increased focuson key operations [8,11]- Cash flow and Better financial transparency [11]E. Cloud-based CRMCloud-based CRM provide valuable flexibility forbusiness, in addition to perform all the functions of traditionalCRM systems.All hardware and software required to support cloudbased CRM, are out place and are monitored by third-partyservice providers. Service providers are responsible for tasksrelated to the establishment and management such asinstallation, integration, testing and maintenance; they alsostore and mange all application data [13].In general, the benefits of cloud-based CRM can be stated asfollow [13]:- Access to the latest versions of CRM, services andinnovations- Easily remote access- Easily deployment- Frequently updates- AffordabilityF. Cloud-based Banking CRMThe bank which use cloud-based banking CRM systems,don’t need to buy a CRM program and install it on everycomputer in bank and also they don’t need to update them;instead of all these, bank only must Connect to the cloud anduse user interface easily.In fact, by using cloud-based banking CRM, banks canmanage their data more efficiently and thus they will be ableto offer friendlier customer services to their customers. Thisproperty leads to easier and faster customer relationshipmanagement [14, 15].IJERTC. Cloud computingCloud computing technology is an IT service deliverymodel that presents computing services to Customers basedon their requests through network. Resources can be shareddynamically in any scale by using cloud computing. Ingeneral, some general Features of this technology aredynamic resource scalability, independence of location ordevice, automatically recourse delivery and pay per usemodel [6].Cloud computing helps organizations manage their databetter and enable them to provide better services for theircustomers [7].D. Cloud computing in banksSome advantages of using cloud computing in banks are:- A significant reduction in the costs of informationtechnology [8,9,10]- Speed and flexibility in providing hardwareresources [8,10,11,12]- Better performance of IT experts [8,9,11]- Increased efficiency and reduced hardware resourceswaste- The rapid development of software requirements atlower costs [9,10,11,12]-IJERTV3IS080731III.PROPOSED CONCEPTUAL MODELDue to the numerous benefits of CRM and cloudcomputing model in banks, we intended to present aconceptual model of cloud-based banking CRM. Thisconceptual model demonstrates services which provide bysystem and states the components of system and theirinterconnected. By this conceptual model, physical entitiescan be tested and simulated before implementation, thereforeimplementing of cloud-based banking CRM system will beeasier.This conceptual model presents system which isunderstandable to the bank managers and includes all thebenefits listed above. Proposed conceptual model isillustrated in figure1.www.ijert.org(This work is licensed under a Creative Commons Attribution 4.0 International License.)935

International Journal of Engineering Research & Technology (IJERT)ISSN: 2278-0181Vol. 3 Issue 8, August - 2014 extend Banking CRM EmployeeCommunication ChannelsManagementCustomers VerificationBanking Customer Include Task ManagementService Order Include Customers AccountManagement Include Include Include CRM AnalystLogin to CloudCreating Log Include extend include Knowledge ManagementIJERTSLA ManagementReportingCustomers RequirementAnalysisBanking CRM TransactionsManagementCloud ProviderBanking CRM ServicesManagementManage Bank Service NeedVia Cloud Service Provide.CRM Human ResourceManagementCRM PerformanceEvaluationBanking CRM AdminOwner of Banking CRMFigure 1: Conceptual Model of Banking CRM Systems based on Cloud ComputingIn this model, the essential components and theircommunications for implementing cloud-based bankingCRM are illustrated. We will describe each use case and actorof this conceptual model in next sections.A. ActorsIn this conceptual model, banking customer, CRManalyst, banking CRM employee, Owner of banking CRM,banking CRM admin and cloud provider are actors of systemwho impact on the system or affected by system.In general, duty of each actor in this proposed system is asfollow:- Banking customer: is a person who uses bankingservices.IJERTV3IS080731--CRM analyst: is a team that analyzes the datacollected through the system, then identifies andcategorizes requirement based on analysis results.Banking CRM employee: is a bank employee whoworks with banking CRM system.Owner of banking CRM: is a team that isresponsible for developing banking CRM system.Banking CRM admin: is a person who is responsiblefor managing and leading banking CRM system.Cloud provider: is a company that delivers cloudservices to the bank.www.ijert.org(This work is licensed under a Creative Commons Attribution 4.0 International License.)936

International Journal of Engineering Research & Technology (IJERT)ISSN: 2278-0181Vol. 3 Issue 8, August - 2014“Reporting” use case: the purpose of this use case isproviding different and required reports for CRMusers. These reports are used for different aims.- “Banking CRM transactions management” use case:the purpose of this use case is managing andcategorizing transactions. A distinctive feature of thebanking CRM system (in comparison with otherCRM systems) is that the number of bankingtransactions is much more than other businesses.Hence, these transactions should be managed andcategorized to help CRM admin making betterbusiness decisions. Transactions can categorizedbased on transaction’s run time (short lifetransaction- long life transaction), not finalizedTransactions due to disruption of system, financialtransactions performed by each customer and etc.- "Service order" use case: the purpose of this use caseis delivering banking services to customers. This usecase include following modules: Transfer money Observe last flow of accounts Pay bills and apply an account balance Become a member in customer club Chang password and user name.For better perception, these modules are considered as oneuse case called service order; so actor by choosing this usecase can implement each of these modules.- “Banking CRM service management” use case: thepurpose of this use case is helping banking CRMstaff to deliver banking services by integratingfacility.- “Task management” use case: the purpose of thisuse case is helping users of banking CRM systemsto manage their daily works.- “Customer verification” use case: The purpose ofthis use case is customer authentication andcustomer authorization. In other words, in this usecase the customer credentials is evaluated to allowcustomer to access to the system.- “Creating log” use case: the purpose of this use caseis creating log from all the tasks performed by users.In this way history of user’s action stored in systemand can be referred if necessary.- “SLA management” use case: the purpose of this usecase is managing service level agreements to realizesystem needs.- “Customer Requirements Analysis” use case: thepurpose of this use case is identifying customers’requirements by data mining in customerinformation.- “CRM Human Resource Management” use case: thepurpose of this use case is managing persons whouse this system to increase their efficiency.- “Bank’s Service Need management via cloudService Provider’s Service” use case: As the nameimplies, the purpose of this use case is managingBank’s Service Need management via cloud ServiceProvider’s Service.-IJERTB. Use casesUse cases indicate services which must be provided foractors to realize their needs. In this section we will describeeach of use cases and their goals:- “Customer accounts’ Management” use case: thepurpose of this use case is managing bankingcustomer accounts. This use case include followingmodules: Register customer, Remove customer, Edit customer information, Search customer, Create group, Delete group, Add customer to the group, Remove customer from group, Edit customer information in group, Search group.For better perception, these modules are considered as oneuse case called Customer accounts’ Management; so actorby choosing this use case can implement each of thesemodules.- “Communication channels management” use case:the purpose of this use case is interacting withcustomers in different ways and obtaining theirsatisfaction. This use case include followingmodules: Fax Telephone/mobile SMS E-mail Chat Call center IVR.For better perce

responsible for developing banking CRM system. - Banking CRM admin: is a person who is responsible for managing and leading banking CRM system. - Cloud provider: is a company that delivers cloud services to the bank. Task Management Customers Verification Communication Channels Management Banking Customer Service Order Creating Log Customers .