Transcription

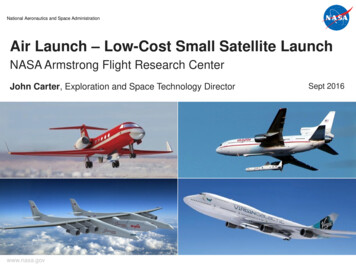

SOLUTIONS OVERVIEWL AUNCHThe People, Processes, and Technologyto Effectively Launch a Digital Bank

Digital isthe DefaultWe believe when you set off on the path to innovation, you shouldfeel excitement and confidence, not fear and dread. Our team andour technology are bringing delight back into the process. Ourgoal: to ensure you move quickly with quality customer experience,support, and safety leading the way.

LAUNCHWe believe when you set off on the path to innovation, you should feel excitement andconfidence, not fear and dread. Our team and our technology are bringing delight back intothe process.Since the mid-2010’s, technology continues to be a key driver of the financial sector’sinnovation. The digital revolution is here to stay, but it’s entering a powerful new phasethat will create a new generation of customer loyalty.With digital now the default, Nymbus is transforming the way financial institutionsacquire, nurture, and expand relationships. We want our partners to be thrilled about thepossibilities we are creating together.The journey to growth begins with doing something differentand Nymbus is the catalyst that can help launch you there.Nymbus Anticipates,Innovates, & CollaboratesIn 2020, a terrible global pandemic made crystalclear why financial technology is so importantto consumers and companies alike. Travel wasrestricted. Offices were closed. No one could visittheir local bank in person but individuals andcompany owners still had bills to pay.“Our philosophy is to anticipate what ourclients might need in the future, and planaccordingly. While we could never predictthe gravity of a widespread outbreak ofCOVID-19, we have always operated on thebasis of being prepared to help our clientssatisfy their customers’ changing needs.”Anne MielaExecutive, Nymbus3

LAUNCHSavvy financial executives responded to this unthinkable crisis swiftly, with a lot of helpfrom Banking-As-A-Service pioneers. Nymbus was ready with expertise and configurabletechnology solutions.In mid-March 2020, Nymbus announced the launch of its Emergency Preparedness Planto provide its clients with a 24/7/365 call center, business process management support,and all other standard operating functions from remote locations via the industry’s mostadvanced remote workforce solution. Shortly after the U.S. Congress approved the CARESAct in late March 2020, Nymbus leveraged its digital tools and full remote processingservices already in place to help organizations like NCR Corporation process loans for smallbusinesses desperately in need of funds.“At Nymbus, our top priority is the healthand safety of employees, customers,partners, and the communities we all servetogether. We are proud of our ability touphold these values while also maintainingcontinuity of service to all stakeholders.”Dr. Joerg RichterCOO - PlatformThe Future is NowNot every financial institution yet grasps the reality of digital as the default, to theirdetriment. According to Ron Shevlin, Managing Director of Fintech Research at CornerstoneAdvisors, smart financial institutions “recognize that the digital cores are good ways to createand deploy new products and services that would take years if they tried to do it with theirexisting core system.” Companies like Nymbus offer platforms that can be assembled in asshort a period as ninety days at a lower cost than building a solution from scratch.The coming decades belong to those banks and credit unions that successfully satisfy theircustomers with digital-powered products that deliver speed, security, and flexibility.4

LAUNCHBuild Versus BuyDeveloping a proprietary digital technologyPartnering with an end-to-end solutionsplatform from scratch is out of reach forcompany is a sensible option for a financialmany banks and credit unions. They lackinstitution with limited resources andthe budget and technology expertise.pressing customer demand, especially ifTime is another consideration since it willthe vendor can configure its offering for abe difficult to compete with organizationsparticular bank or credit union. Selectingthat long ago committed to offering theirthe right vendor is an important first step incustomers digital banking services.helping your customers meet their goals.5

LAUNCHThe Nymbus StorySince its inception, Nymbus, Inc. has supported financial institutionswith its end-to-end suite of advanced, digital-first products andservices that transform all aspects of banking. In the hands of itsseasoned Chairman and CEO, Jeffery Kendall, and his team ofsoftware engineers and industry experts, this innovative Fintechcompany is busy building solutions to help keep community bankscompetitive with national brands that spend billions of dollars a yearon technology.In an era when banks and credit unions must adapt to theircustomers’ need for digital convenience, Kendall is convincedthere’s no going back to the past.“Throughout my 25-year career, I have seenfirst hand that although sophisticatedtechnology and a clean slate can be anadvantage, projects are made successfulby the people, processes, and theentrepreneurial spirit driving them.”Jeffery KendallChairman and CEO, Nymbus6

LAUNCHSetting New Industry BenchmarksMake more money for lessNymbus lowers the cost for financialEmpower employees tosell moreinstitutions to produce a new dollar ofNymbus helps your employees managerevenue.significantly more assets.Average Efficiency RatioAverage ,00067Market Average Financial InstitutionsMarket Average Financial InstitutionsNymbusNymbusGain new accountsseamlesslyLower your expenses whilegrowing assetsNymbus provides onboarding and newNymbus leverages technology to decreaseaccount openings online so you can growexpenses while increasing assets.your deposits easily without any physicalbranch interactions.Average NoninterestExpense/Average AssetsAverage Deposit 22.00%21.80%0.00%Market Average Financial InstitutionsMarket Average Financial InstitutionsNymbusNymbus7

LAUNCH“We exist for our customers. We understandthe vital link between a local financialinstitution and its neighbors. We were thrilledto earn the title of Best Solution for CustomerExperience in the 2020 Best of FinXTech Awards.”Scott KillohExecutive Chairman, FounderFrom its inception in 2015, Nymbus owesits continued growth to satisfied clientsBest ofFinXTechAwardswho understand the importance ofhaving a pragmatic team of customercentric professionals in their corner.20208

LAUNCHThe Nymbus DigitalBanking SolutionUnlike many companies that offer a one-size-fits-all product, Nymbus offers anarray of operational, marketing, and compliance solutions that can be set up asa total system or integrated on a plug and play basis with a financial institution’sexisting core applications. Nymbus clients only pay for what they want, and onlywhen the configured infrastructure is ready to go al BankingContentMarketing ServicesBSA/AML dMngtItems/ ConfigWork onCustomerEngagementCore BankingWW Code DevelopmentNymbus EcosystemPrivate Cloud, Multi-Cloud Support, Tier 4 Data Centers, Disaster Recovery9CRM

LAUNCHThe Nymbus suite of products, collectively known as the NymbusEcosystem, reflects an unparalleled technology platform, builton ultra-modern and future-proof technologies that enabletransformative change in the approach to banking softwaresolutions. It’s the result of over a decade of development and nearly 400 million in invested capital dedicated to expanding its alreadyimpressive menu of digital banking solutions. As investors continueto see the platform’s transformative effect on financial institutionsacross the country, Nymbus continues to restyle the staid world ofbanking with relevant, cost-effective, time-saving digital solutions.As Peter Sobiloff, Managing Director with Insight Partners, adds:“The shift to profitable digital banking isstill in its early stages for many traditionalinstitutions, and Nymbus fills a tremendoushole in the market for enabling thesebanks and credit unions to finally movebeyond playing catchup and set up theirbusinesses for meaningful growth. Welook forward to continue working withNymbus as they build out a best-in-classfinancial services model that is wellpositioned to be a leader in the industry.”Peter SobiloffManaging Director, Insight Partners10

LAUNCHNYMBUS Ecosystem3rd PartySystemiOSAppAndroidAppWeb Appslow-codeHTML5 UINGINXLaunchCustomerEngagementDigitalCoreRobots &WebhooksRobots &WebhooksRobots &WebhooksMicro ServicesMicro ServicesMicro ServicesDBDBDBMessage BrokerThe breadth, depth, and variety of theAs the figure above shows, the suite ofNymbus Ecosystem offers banks and creditNymbus Ecosystem partnerships reflectsunions a significant bonus. Instead ofstate-of-the-art solutions, including, butnegotiating contracts with multiple vendorsnot limited to: bill pay, debit cards, Bankand dealing with different IT departments,Secrecy Act and Anti Money LaunderingNymbus clients enjoy the convenienceadherence, instant account authentication,of working with a dedicated relationshipencryption key management, EFT testing,management team that handles logistics,check image creation, statements andquality testing, and implementation, fromnotices, and Interactive Voice Response.start to finish.11

LAUNCHThe Nymbus platform is built for flexibility,Nymbus installations include a range ofwith innovative, reliable, and provenoutcomes, including core conversions,architecture. Features include table-drivencore migrations, online and mobileconfiguration options for all out-of-the-boxbanking upgrades, marketing andfunctionality, reusable micro-services foronboarding upgrades, 100% custom Fintechboth the core technology and APIs, and aapplications, rapid low-code composition oflow-code platform with a data access layer,new applications, and rapid-deploy “bank inIntegrated Development Environment,a box” turnkey digital banks.User Interface composer, and automationengine. Every Banking-As-A-Service set-upis persona-driven for easy recognition by aDEBITfinancial institution’s customers.The entire ecosystem, including every critical banking function Application ProgrammingInterface (API), can be run “headless,” as a back-end operation. Alternatively, a financialinstitution can quickly turbo-charge its customer count by installing the comprehensiveNymbus marketing solution. Brand creation, creative asset production, digital campaignstrategy and execution, and customer journey engagement are all included.Configurability and customer coordination are cornerstones of the Nymbus approach toassisting enlightened banks and credit unions ready for the digital transformation theircustomers demand.12

LAUNCHAccelerating Your Financial InstitutionTowards Digital Banking ExcellenceNymbus begins the partnership with a new client by listening to them and thenresponding with a needs analysis that identifies the problems a bank or credit union seeksto solve. Discussions about Nymbus products are specific to each client. An assignedproject manager discusses potential solutions, along with logistics about the schedulefor completing each stage of the digital transformation. A typical set-up, depending oncomplexity and existing client infrastructure, takes ninety days to finish. The client paysnothing until Nymbus completes the contractual integration.The Nymbus onboarding team wants client involvement throughout the set-up process.The goal is to improve each person’s productivity in service of their customers, not toreplace them with new technology.FTP ankingBill PayBrandingCoreACHFeature OnboardDisclosures DevelopmentEnvironment ConfigurationDigital Management ServicesCommunicationPlanningKick OffOptimization& Post LaunchDevelopmentBusiness ProcessingEnvironment BuildingMonth 1Month 213Month 3LAUNCH

LAUNCHSelecting The Right DigitalSolutions CompanyWe’ve built our company on intentional innovation and with clients who share in apassion for developing more meaningful financial solutions. We know selecting a newtechnology partner is daunting, so we’re providing a list of 10 criteria to help you make thedecisioning process easier.Configurability1You want a digital banking experience that can be modified to match your financialinstitution’s and customers’ specific needs without busting your budget. Somecompanies offer a single product that locks you into spending for features you won’t use.Look for a vendor with a suite of products that lets you configure the right solution foryour customers.Security2Cyber breaches cost financial institutions and their customers millions of dollars every year.It’s critical to know how your digital banking vendor protects against fraud and unwantedintrusions. Ask for specifics about dark web monitoring, watchlist scanning, transactionmonitoring, BSA/AML detection, and ongoing due diligence. Query about the frequency ofupdates to ensure robust functionality.34EfficiencyYou want a digital solution that delivers comprehensive value at a reasonable cost. Askvendors to quantify efficiencies so you can meaningfully compare fees with potentialsavings by transforming the way you interact with your customers.ReliabilityDowntime is more than a nuisance. Failure to launch or maintain crucial customerexperiences makes it more difficult for banks and credit unions to grow. Require the vendorto disclose its procedures for minimizing operational problems and, should problems occur,its action plan for restoring service.14

LAUNCHCustomer Support5Support entails not only service to you as the client, but also ensuring your customershave the best possible experience. Discuss how the vendor supports its financialinstitution client during the onboarding process and thereafter. Investigate responsetime and types of support provided to both personal and business customers ormembers. Ask about the stages of support from implementation to onboarding tomaintaining quality customer relationships.CRM Power6The development of a digital platform with a top-notch partner offers banks and creditunions a special opportunity to let their customers know their voices are heard. Somefinancial institutions announce improvements as part of an ongoing outreach. Otherscreate a dedicated marketing campaign to explain why and how the digital service willbenefit their customers. Ask the vendor how their system augments or supplants anexisting Customer Relationship Management (CRM) infrastructure.78910Implementation TimetableTime is money. Once you’ve made the decision to go with a technology vendor, you needconcrete details about what will happen when, and who will make it happen. You shouldexpect absolute clarity and over-communication.Innovation and AwardsTechnology is changing at breakneck speed. Your digital banking vendor should bean industry thought leader by clearly demonstrating its commitment to customerutility, creativity, and compliance. Inquire about best practice awards, research anddevelopment initiatives, and the experience on the vendor’s team.Track RecordBuyer reviews, case studies, and compliance scorecards are a few of the many recordsto assess a digital banking vendor’s track record. You want to put your best foot forwardwith your customers. Evaluate a vendor’s commitment to integrity, transparency, andgood governance.Pricing OptionsGoing digital with the help of an experienced third party offers significant advantages tobank and credit union customers in the long run. Not every contract is equal. Ask vendorswhat they charge and how often. Remember to net those costs against expected savings.15

LAUNCHNymbus Labs Takes YourProducts To New HeightsNymbus Labs is an award-winning marketing support team insideour company, with the mission to remove barriers to digital bankinginnovation inside our clients’ organizations. Going beyond even themost advanced Customer Relation Management tool, we removethe burden of brand building and customer acquisition strategy, soyou can focus on building a great customer experience and servingyour new customers in new ways.90 Days To New Growth30 days60 days90 daysStrongFoundationsConfident &ReadyPowerLaunchBusiness planInfrastructure &operationsBrand Strategy& addressablemarketLaunchPlanningCreative& contentdevelopmentContinuousInnovationTest, learn &optimize launchmarketingAdvancedfeatures & easure, learn,adjustLaunchcampaignplanning90 daysOur 90-day growth marketing approach helps you jumpstart your new financial productoffering and go to market with focus and intention. We firmly believe technology alonecannot drive growth; you need a product and brand that aligns with community of affinity.Whether it is an underserved niche or a local audience in need of financial innovation, wehelp identify market opportunities and bring them to life.16

LAUNCHPost-Launch Marketing SupportOur support continues past launch as our teamand technology help you strengthen customerengagement. Through our rules engine and roboticprocess automation, we use data to make theright connection with the right person at the righttime. These connections can be in the form of textmessages, ads, emails, social media posts or otherways that make the most sense at the time.As an example, during onboarding, messagesare sent to customers that may have startedthe onboarding process, but have stalled. If theycompleted the process, the system would let themknow if they have been auto-approved or if theirapplication is under review. Updates can also be sentabout new features or services to leads you thoughthad gone cold. Once onboarding is complete, it’scritical your financial institution gets the mostout of your account holders. You need to ensurecustomers activate their debit card. You need toshow customers how to set up direct deposit (ifthey haven’t) or teach them about other bankingservices like bill pay, card management and more.This makes engagement with your banking servicesmuch stickier.Your bank will become a trusted source of information for their financial wellness. You cangive them tips on savings or other financial advice, and make targeted offers – all basedon THEIR data. Once a new account holder is secured, your institution needs to grow thatrelationship by selling more products and services to those individuals. Effective crossselling / up-selling is a complex mix of data, engagement techniques and technology.The data creates the insights to generate personalized offers. The consumer engagementwith those offers needs to be both relevant and multi-channel - including online banking,mobile banking, and email. Finally, the onboarding technology creates an elegant andstreamlined experience for your consumers to quickly add these new products and services.Nymbus also has one of the world’s most advanced integration tool sets for Salesforceshould you decide to stick with your Salesforce CRM system.17

LAUNCHNymbus-Powered Niches In ActionCASE STUDY“What attracted us to NYMBUS was theability for Launch to rapidly supportour new standalone BankMD brandTransPecos Bank chose NYMBUS to buildand provide a modern customera fully-serviced neo bank & digital brandexperience to this targeted digitaldirected towards medical professionals.audience of medical professionals.Complete range of Onboarding,NYMBUS does this with no disruptionLending and Deposit servicesor cost to our existing bankBusiness Process Outsourcing withinfrastructure and they are willing24/7/365 Supportand able to integrate with our cloudbased loan origi

of banking. In the hands of its seasoned Chairman and CEO, Jeffery Kendall, and his team of software engineers and industry experts, this innovative Fintech company is busy building solutions to help keep community banks competitive with national br