Transcription

RediShred Capital Corp.Consolidated Interim Financial StatementsSeptember 30, 2020 and 2019(Unaudited – Prepared by Management)(expressed in Canadian dollars)

November 26, 2020In accordance with National Instrument 51-102, released by the Canadian Securities Administrators,the Corporation discloses that its auditors have not reviewed the unaudited consolidated interimfinancial statements for the period ended September 30, 2020.

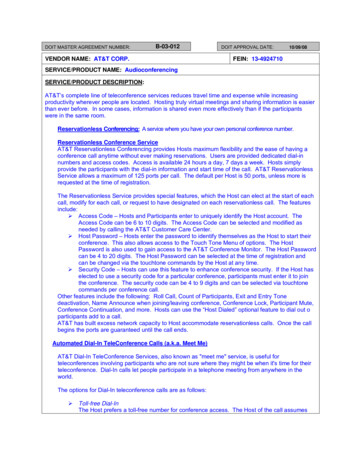

RediShred Capital Corp.Consolidated Statements of Financial PositionAs at September 30, 2020 and December 31, 2019(expressed in Canadian dollars)2020 2019 Current assetsCash and cash equivalentsCash attributable to the Growth Fund (note 3)Trade receivables (note 4)Prepaid expensesNotes receivable from franchisees (note 5)Total current ,097Non-current assetsNotes receivable from franchisees (note 5)Tangible assets (note 6)Intangible assets (note 7)Goodwill (note 8)Deferred tax asset (note 18)Total non-current assetsTotal AssetsLiabilitiesCurrent liabilitiesAccounts payable and accrued liabilitiesDeferred revenueIncome taxes payableCurrent portion of long-term debt (note 11)Notes payable (note 9)Lease liability (note 12)Contingent consideration (note 10)Total current liabilitiesNon-current liabilitiesLong-term debt (note 11)Deferred revenueNotes payable (note 9)Lease liability (note 12)Contingent consideration (note 10)Total non-current liabilitiesTotal liabilitiesShareholders’ equityCapital stock (note 13)Contributed surplusAccumulated foreign currency translation lossDeficitTotal liabilities and shareholders’ equityThe accompanying notes are an integral part of these consolidated interim financial statements.Approved on behalf of the Board of Directors

RediShred Capital Corp.Consolidated Statements of Comprehensive IncomeFor the three and nine months ended September 30, 2020 and 2019(expressed in Canadian dollars)For the 3 months endedSeptember 30Revenue (note 14)Corporate operating locationsexpenses (note 15)Selling, general and administrativeexpenses (note 16)Income before depreciationDepreciation – tangible assetsOperating incomeInterest expenseInterest incomeFor the 9 months endedSeptember 302020 2019 2020 2019 1,397)61,9431,866,2264,439,752(1,917,122)Income before the following620,548320,4291,384,9042,143,176Other income (note 2,5621,346,096Foreign exchange gain (loss)23,072155,2391,995,645(584,819)Income tax expense (note 18)(83,395)(9,666)Net income for the 0060.0020.0020.0440.0440.0090.009Weighted average number of commonshares outstanding – ted average number of commonshares outstanding – rtization – intangible assets(Loss) gain on sale of assetsTransaction recoveryIncome before foreign exchange andincome taxesForeign currency translation gain (loss)Comprehensive incomefor the period(596,905)–(2,256)(77,069)(143,654)Net income per shareBasicDilutedThe accompanying notes are an integral part of these consolidated interim financial statements.

RediShred Capital Corp.Consolidated Statements of Changes in EquityFor the nine months ended September 30, 2020 and 2019(expressed in Canadian dollars)Contributedsurplus Accumulatedforeigncurrencytranslationloss Deficit 24,961,090890,757(649,893)(5,254,419)19,947,535Net income for the period–––617,623617,623Foreign currency translation loss––(56,022)–(56,022)Balance – January 1, 2019Capitalstockandwarrants (note 13)Comprehensive income for theperiodTotal shareholders’equity ��–131,655Balance – September 30, 2019 alance – January 1, 297Net income for the period–––3,511,1383,511,138Foreign currency translation loss––(52,980)–(52,980)Issue of shares (note 13)Stock-based compensation(note 13)Comprehensive income for ––99,492Balance – September 30, 2020 ssue of shares (note 13)45,0Stock-based compensation(note 13)The accompanying notes are an integral part of these consolidated interim financial statements.

RediShred Capital Corp.Consolidated Statements of Cash FlowsFor the three and nine months ended September 30, 2020 and 2019(expressed in Canadian dollars)For the 3 months endedSeptember 30Cash provided by (used in)2020 For the 9 months endedSeptember 302019 2020 2019 6,613)132,000(10,567,208)Operating activitiesNet income for the periodItems not affecting cashAmortization of tangible and intangible assetsStock-based compensationUnrealized foreign currency loss (gain)Transaction recoveryIncome tax (expense) recoveryNet change in non-cash working capitalbalances(Increase) decrease in trade receivables(Increase) decrease in prepaid expensesIncrease (decrease) in accounts payable andaccrued liabilities(Decrease) increase in income taxes payable(Decrease) in deferred revenueNet cash provided by operations455,540Financing activitiesBorrowings from long-term debtRepayment of long-term debtIssuance of capital stock (net of fees)Payment of contingent considerationsIssuance of notes receivableRepayment of notes receivableRepayment of notes payableRepayment of lease liabilitiesInvesting activitiesAcquisitionsCash held by Growth FundPurchase of tangible and intangible assetsProceeds from sale of assetsEffect of foreign exchange rate changes oncash129,44724,645(35,242)(229,817)Net change in cash for the 6,451,180Cash – Beginning of periodCash – End of period8,957,345The accompanying notes are an integral part of these consolidated interim financial statements.

RediShred Capital Corp.Notes to Condensed Consolidated Financial StatementsSeptember 30, 2020(expressed in Canadian dollars)1Corporate information and nature of operationsRedishred Capital Corp. (“Redishred” or the “Company”) was incorporated under the Canada BusinessCorporations Act on October 18, 2006 and is domiciled in Canada. Redishred’s common shares are listed fortrading on the TSX Venture Exchange under the symbol “KUT”. The registered address of the Company is 6505Mississauga Road, Suite A, Mississauga, Ontario, L5N 1A6.Redishred manages and operates the Proshred brand and business platform (“system”) in the United States andinternationally. Redishred operates the Proshred system under two business models in the United States, (1) viafranchising, and (2) via direct operation of eleven corporate shredding locations, as of September 30, 2020.2Significant accounting policiesBasis of PresentationThese unaudited consolidated interim financial statements have been prepared in accordance with InternationalFinancial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”)applicable to the preparation of interim financial statements, including IAS 34, Interim Financial Reporting. Theconsolidated interim financial statements should be read in conjunction with the most recently issued AnnualReport of Redishred for the year ended December 31, 2019, which includes information necessary or useful tounderstanding the Company’s business and financial statement presentation. These consolidated interim financialstatements comprise the financial statements of Redishred and its subsidiaries as of September 30, 2020.Together, Redishred and its subsidiaries are referred to as “the Company.”The Company’s significant accounting policies were presented as Note 3 to the Audited Consolidated FinancialStatements for the year ended December 31, 2019 and have been consistently applied in the preparation of theseconsolidated interim financial statements.The results reported in these consolidated interim financial statements should not be regarded as necessarilyindicative of results that may be expected for the entire year. Certain prior period amounts have been reclassifiedto conform to the current period’s presentation. These consolidated interim financial statements were prepared ona going concern basis, under the historical cost convention. The consolidated interim financial statements arepresented in Canadian dollars, which is the Company’s presentation currency.During 2020, the global spread of the COVID-19 virus has led to significant disruptions to businesses worldwide,resulting in an economic downturn. In many countries, including Canada and the United States, measures suchas travel bans, quarantines, social distancing and closures of non-essential services have been taken to containthe spread of the virus. Governments have responded with monetary and fiscal interventions in an attempt tostabilize economic conditions. The Company has considered the potential negative impacts and cash flowdifficulties of the virus on its franchisees, customers, suppliers and lenders. The impacts and length of time of theCOVID-19 pandemic and its impacts are currently unknown. The Company has used the best information availableas of September 30, 2020, in determining its estimates and the assumptions that affect the carrying amounts ofassets and liabilities, and earnings for the period. Actual results could differ from those estimates.The consolidated interim financial statements of the Company for the three and nine months ended September30, 2020 were authorized for issue in accordance with a resolution of the Directors on November 26, 2020.

RediShred Capital Corp.Notes to Condensed Consolidated Financial StatementsSeptember 30, 2020(expressed in Canadian dollars)3Growth fundThe Company manages an Growth Fund (formerly referred to as the “Ad Fund”) established to collect andadminister funds contributed for use in regional and national advertising programs, and amongst other things,initiatives designed to increase sales and enhance general public recognition, acceptance and use of the ProshredSystem. The fund contributions are segregated, designated for a specific purpose and the Company acts, insubstance, as an agent with regard to these contributions. Growth Fund contributions are required to be madefrom both franchised and Company owned and operated locations and are based on the annual level of revenuefrom each location. The Growth Fund contributions and expenses from the Company owned locations have beeneliminated on consolidation.In response to COVID-19, the Company has reduced certain program costs.The Growth Fund related contributions and expenses as well as cash balance as of September 30, 2020 andDecember 31, 2019 are as follows:For the 3 months endedSeptember 3020202019Growth Fund contributionsGrowth Fund expensesGrowth Fund deficitAs at,Cash attributable to the Growth Fund4 er 30, 2020 144,611For the 9 months endedSeptember 3020202019 ember 31, 2019 155,162Trade and other receivablesTrade receivables include receivables from franchisees and shredding and recycling customers. Otherreceivables include amounts related to Harmonized Sales Tax (“HST”) refunds. To support franchisees duringCOVID-19, the Company deferred royalty fee payments related to royalties earned in March and April of 2020 forits franchisees. 74% of franchisees have begun to repay the deferred royalties over a 12-month period. The nettrade and other receivables as of September 30, 2020 and December 31, 2019 are as follows:Trade receivables – corporate locationsTrade receivables – franchising & licensingTotal trade receivablesOther receivablesLess: Allowance for doubtful accountsTrade receivables – netSeptember 30, 2020 cember 31, 2019 1,649,135154,7951,803,93055,520(2,292)1,857,1582

RediShred Capital Corp.Notes to Condensed Consolidated Financial StatementsSeptember 30, 2020(expressed in Canadian dollars)5Notes receivable from franchiseesNotes receivable arise from the financing of the initial franchise fee and from the sale of customer assets whenthe customer assets are located in the franchisee territories. All notes receivable are guaranteed by the respectiveowners of the franchises. The notes receivable bear interest rates ranging from 5.25% to 6.00% per annum withmonthly blended payments of principal and interest ranging from USD 1,007 to USD 3,735. The payments onthe notes mature between dates ranging from September, 2021 to September, 2025.The notes receivable as of September 30, 2020 and December 31, 2019 are as follows:September 30, 2020 December 31, 2019 Opening balanceAdd: issuance of notesLess: 4)Closing balanceLess: current portionLong-term 753

RediShred Capital Corp.Notes to Condensed Consolidated Financial StatementsSeptember 30, 2020(expressed in Canadian dollars)6Tangible assetsThe foreign exchange adjustment is a result of the translation of foreign operation intangible assets in US dollarsto Canadian dollars at September 30, 2020 and December 31, 2019.4

RediShred Capital Corp.Notes to Condensed Consolidated Financial StatementsSeptember 30, 2020(expressed in Canadian dollars)7Intangible assetsThe foreign exchange adjustment is a result of the translation of foreign operation intangible assets in US dollarsto Canadian dollars at September 30, 2020 and December 31, 2019. Amortization of intangible assets for theperiod is included in the statement of comprehensive income. The Company’s re-acquired franchise rights, andcustomer relationships are attributed to the Company’s franchises and corporately owned locations in the US.8GoodwillThe goodwill as of September 30, 2020 and December 31, 2019 is as follows:Opening balanceAcquisitionsForeign currency translationClosing balanceSeptember 30, 2020December 31, 2019 14,102,8152,037,201710,48216,850,498 4,812,4489,663,762(373,395)14,102,8155

RediShred Capital Corp.Notes to Condensed Consolidated Financial StatementsSeptember 30, 2020(expressed in Canadian dollars)9Notes payableAs of September 30, 2020, the Company has the following related to notes payable:Range oforiginationRange ofinitial amountRange ofpayment (1)Range ofinterestper annumOctober 1, 2018 toUSD 75,000 toUSD 4,534 to1.25% toCAD 404,162CAD 26,752January 31, 2021 toJanuary 31, 2019USD 550,000USD 19,7535.00%USD 297,178USD 19,671October 5, 2021(1)CurrentportionLong-termportionRange ofmaturityBlended monthly payments of principal and interest.10 Contingent considerationThe Company has recorded contingent consideration liabilities as part of the businesses acquired. The contingentconsideration liabilities are paid to the vendors if certain financial results are achieved. During the nine monthsended September 30, 2020, the Company recorded a transaction recovery of 192,177 related to the Kansasacquisition. In this instance, the contingent consideration was not fully earned due to targeted revenue levels notbeing met in the first twelve months post-closing.As of September 30, 2020, the Company has the following related to contingent consideration:Range oforiginationRange of initialamountCurrentportionLong-termportionRange ofmaturityMarch 31, 2017 toUSD 98,000 toCAD 1,362,774CAD 94,669March 31, 2021 toMarch 1, 2020USD 1,223,362USD 1,002,040USD 69,610December 31, 202111 Long-term debtAs of September 30, 2020 and December 31, 2019 long-term debt is comprised of:September 30, 2020December 31, 2019 Bank facilities (i)Less: transaction costsNet bank 249,957)12,873,611Truck loans (ii)Total long-term debt3,746,38717,830,3173,071,01815,944,629Less: current portion(3,086,919)(2,875,391)Total long-term debt14,743,39613,069,2386

RediShred Capital Corp.Notes to Condensed Consolidated Financial StatementsSeptember 30, 2020(expressed in Canadian dollars)11 Long-term debt (continued)(i) Bank facilities (continued)As of September 30, 2020, the Company has the following secured senior credit facilities:1.2.3.An operating line of credit of CAD 1 million;A non-revolving term loan in the amount of CAD 3 million; andA non-revolving term loan in the amount of USD 12.5 million (advances can be taken in either USD orCAD equivalent, at the Company’s discretion).As of September 30, 2020, the Company has borrowed the following amounts on the non-revolving term loans:Month of AdvanceInitial amountInterest perannumAugust, 2017 (note 1) 2,006,7434.95%May, 20196,003,210November, 2019March, 2020Total bank facilitiesAmortizationperiodSeptember 30,2020 BalanceDecember 31,2019 Balance60 months – 1,036,8173.50%84 months5,298,0855,492,6386,664,2423.50%84 months6,295,4256,594,1132,688,0002.99%84 months2,688,000–14,281,51013,123,568Note 1: During the three months ended September 30, 2020, the Company repaid the outstanding balance of 936,480 on one of its term loans.In response to the impacts of COVID-19, the Company negotiated with its financial institution the deferral of itsprincipal payments for a six-month period from April 2020 to September 2020. Interest only payments were madeduring the six-month period.As of September 30, 2020, the Company has CAD 2.0 million available on its senior credit facilities.The Company has not drawn on its operating line of credit as of September 30, 2020.The credit facilities are secured by general security agreements over all present and future assets of the Companyand shares of each subsidiary held by the Company.7

RediShred Capital Corp.Notes to Condensed Consolidated Financial StatementsSeptember 30, 2020(expressed in Canadian dollars)11 Long-term debt (continued)(i) Bank facilities (continued)The bank credit facilities as of September 30, 2020, contain financial covenants that require the Company tomaintain certain financial ratios and meet certain financial thresholds. In response to COVID-19, the Company’sfinancial institution waived the financial covenants required for the third and fourth quarters of 2020. The facilitycontains covenants that require the Company to maintain the following:1.A minimum fixed charge coverage ratio

trading on the TSX Venture Exchange under the symbol “KUT”. The registered address of the Company is 6505 Mississauga Road, Suite A, Mississauga, Ontario, L5N 1A6. Redishred manages and operates the Proshred brand and business platform