Transcription

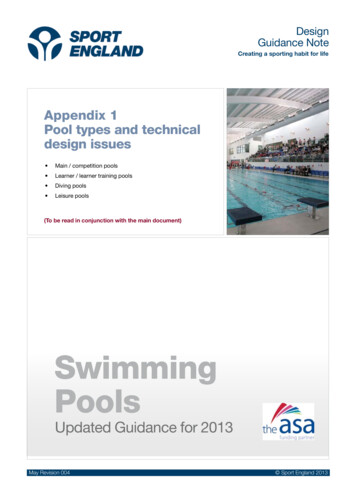

www.pwc.com/r&cIssues and solutions forthe retail and consumergoods industriesA Comparison ofInternationalFinancial ReportingStandards andUS GAAPMay 2012

ForewordWe first published ‘Issues and Solutions forthe Retail and Consumer Goods Industries’in 2008 to provide perspectives on a range offinancial reporting issues specific to the retailand consumer goods (R&C) sector.Recent economic conditions have been challenging to many R&C companies around the globeand have shown the interconnected nature ofthe world’s capital markets. Conditions havealso demonstrated the importance of achievinggreater transparency and a common accountinglanguage that will enable investors to make moreinformed capital allocation decisions.Global transition to International FinancialReporting Standards (IFRS) has continued togather pace as countries around the worldstart to allow or incorporate IFRS into theirlocal standards for both public and privatecompanies, and ongoing convergence effortsbetween the International AccountingStandards Board (IASB) and the FinancialAccounting Standards Board (FASB) willbring further change in the coming years.We have taken the opportunity to updatethis publication taking specific accountingchallenges that PwC’s global network ofR&C engagement partners and their clientshave been dealing with in responding tothese challenges.We have combined this knowledge with that ofour accounting consulting services network toprepare an extensive set of accounting solutionsto help you understand and debate the issuesand explain some of the approaches oftenseen in practice. We hope this will encourageconsistent treatment of similar issues acrossthe sector.Our framework focuses on generic issuesrather than specific facts and circumstances,and it does not necessarily address the exactsituations that might arise in practice. Eachsituation should be considered on the basisof the specific facts and in most cases theaccounting treatment adopted should reflectthe commercial substance of the arrangements.We encourage you to discuss the facts andcircumstances of your specific situations withyour local PwC R&C contact.We hope that you find the publication usefulin addressing your own reporting challenges.John MaxwellGlobal Retail & Consumer LeaderDavid MasonChairman, Retail & ConsumerIndustry Accounting Group1

2PwC Issues and solutions for the retail and consumer goods industries

IntroductionThis publication summarises some of the complex accounting areas that are specific to the R&Csector based upon applicable standards as of December 31, 2011. This publication does not addressthe impact of the ongoing standard-setting activities of either the IASB or the FASB.Some aspects of technical accounting under both IFRS and US GAAP are complex but common toall sectors—such as financial instruments, share-based compensation, business combinationsand pensions. These are not addressed in this publication. For discussions regarding the impactof exposure drafts, such as ‘Revenue from Contracts with Customers’ and ‘Leases’, please refer towww.pwc.com/r&c.The R&C sectorUS GAAP considerationsThe R&C sector comprises three main participants:the supplier (referred to as ‘CPG company’), theretailer and the final customer.Where the possible treatment for a particularaccounting issue might differ between US GAAPand IFRS, we have highlighted areas for furtherconsideration.The CPG company is usually a producer of massproducts. It earns its revenue from the retailer butmust also convince the customer to buy its products.The retailer is the link between the CPG companyand the consumer. The retailer’s activity typicallycomprises the purchase of products from the CPGcompanies for resale to customers.The customer is the consumer who purchasesproducts from the retailer.This publication explains the accounting issues thatarise throughout the R&C value chain, from theinnovation function of the CPG companiesto the sales and marketing function of the retailers.The issues we have addressed are summarised byreference to their point in the value chain and theaspects of the business model affected.KeyUS GAAP and IFRS are similarThe overall approach to USGAAP is similar to IFRS, butdetailed application needs to becarefully assessed as significantdifferences may arise fromspecific issuesSpecific differences betweenUS GAAP and IFRS may exist3

4PwC Issues and solutions for the retail and consumer goods industries

Table of contentsInnovation, brand, R&Dand licensingProperty and leases24.Rent-free periods1.Development costs25.Treatment of lease advance payments2.Brands and CGUs26.Key money3.Useful life of brands27.Contingent rental payments4.Up-front fees28.Impairment of stores to be closed5.Sales to a franchisee29.Determining CGUs for multi-site retailers6.Franchise arrangements30.Flagship stores31.Cash flows relating to Internet-based sales32.Allocation of rebates to CGUs33.Pre-opening costs34.Make-good provisions35.Properties with mixed use—sub-lettingof retail space36.Favourable and unfavourable leasecontracts in a business combinationMarketing and advertising7.Advertising costs8.Point-of-sale advertising9.Coupons10.Marketing expenses at interim periodsSelling to retailers11.Trade loading12.Buy one get one free13.Close-out fees14.Pallet allowances15.Integrated value partner agreement16.Co-advertising services17.Retail markdown compensation18.Scan deals19.Provision for returns from wholesalers/resellers20.Slotting and listing fees21.Excise taxStorage22.Shrinkage23.Warehouse costsSales and marketing37.Distributor acting as an agent38.Right of return in exchange for cash39.Discount coupons40.Revenue from sale of gift vouchers41.Customer loyalty programmes42.Exceptions to point-of-sale advertising43.Extended warranties44.Credit card feesInventory45.Retail inventory method46.Accounting for inventories in abusiness combination5

Innovation, brand,R&D and licensing6

1. Development costsBackgroundA detergent manufacturer incurs significant costsdeveloping a new technology that allows consumersto wash clothes significantly quicker.Issue(d) How the intangible asset will generate probablefuture economic benefits. Among other things,the entity can demonstrate the existence of amarket for the output of the intangible asset orthe intangible asset itself or, if it is to be usedinternally, the usefulness of the intangible asset.Are the development costs incurred by the CPGcompany capitalised as an intangible asset?(e) The availability of adequate technical, financial andother resources to complete the development and touse or sell the intangible asset.Relevant guidance(f) Its ability to measure reliably the expenditureattributable to the intangible asset during itsdevelopment.’Development activities are defined in IAS 38 as‘the application of research findings or other knowledgeto a plan or design for the production of new orsubstantially improved materials, devices, products,processes, systems or services before the start ofcommercial production or use.’IAS 38.57 states that ‘An intangible asset arising fromdevelopment (or from the development phase of aninternal project) shall be recognised if, and only if, anentity can demonstrate all of the following:(a) The technical feasibility of completing the intangibleasset so that it will be available for use or sale.(b) Its intention to complete the intangible asset and useor sell it.SolutionDevelopment costs should be capitalised if all thecriteria in IAS 38.57 are fulfilled. It is sometimesdifficult to determine the point at which the criteriaare met. The Company would need to map itsdevelopment ‘stage-gate’ process to the above criteriato determine if and when the criteria to capitalise costsare met.US GAAP commentDevelopment costs are expensed as incurred inaccordance with ASC 730, ‘Research and Development.’(c) Its ability to use or sell the intangible asset.Innovation, brand, R&D and licensing7

2. Brands and CGUsBackgroundRelevant guidanceCompany A acquires Company B. Both operate in thesame consumer goods sector.A CGU is defined as the ‘smallest identifiable groupof assets that generates cash inflows that are largelyindependent of the cash inflows from other assets orother groups of assets’ [IAS 36.6].After acquisition, Company A intends to integratethe manufacturing of Company B’s products into itsown facilities and close Company B’s manufacturingfacilities.Brand recognition is important in this sector. CompanyA will continue to sell products under CompanyB’s brand after integration of the manufacturingfacilities. The brand will not be licensed out and hasan indefinite life.IssueManagement believes that most of the value of theacquired business is derived from the brand. As theacquired manufacturing facilities are not requiredto support the brand, management considers thebrand to be a separate cash generating unit (CGU).Is this supportable?8SolutionA brand usually increases the revenue from sales of aproduct. The revenues from sales of a branded productcannot be split between that generated by the brandand that generated by the production facilities. Brandsare typically not a separate CGU under IFRS and arenot tested for impairment individually. The brand istested for impairment together with the associatedmanufacturing facilities.US GAAP commentIn accordance with ASC 350, ‘Intangibles—Goodwilland Other’, as the brand has an indefinite life, theintangible asset is not grouped with other assets whentesting for impairment. Rather the indefinite-livedintangible asset is tested on a stand-alone basis.PwC Issues and solutions for the retail and consumer goods industries

3. Useful life of brandsBackgroundSolutionA luxury goods company has acquired two fragrancesfor its product range:The timeless classic brand is likely to have anindefinite life. The brand has already proven itslongevity by having been successful in the marketfor many decades. A perfume that is a timeless classic and has been aflagship product for many decades; and A new perfume named after a newly-famous popstar who has been actively involved in promotingand marketing the fragrance.IssueManagement is unable to estimate the useful life ofeither fragrance and therefore proposes to treat bothbrands as having an indefinite life. Is this appropriate?Relevant guidanceIntangible assets have an indefinite useful life whenthere is no foreseeable limit to the period over which,based on an analysis of all relevant factors, the assetis expected to generate net cash inflows for theentity [IAS 38.88].In this situation, factors that might be considered include: The entity’s commitment to support the brand; The extent to which the brand has long-termpotential that is not underpinned by short-termfashion or market trends but has been proven by itssuccess over an extended period; andThe perfume named after the newly-famous pop staris most likely linked to the popularity of the star;therefore it is difficult to assess whether the brandwould survive beyond the life or even the media life ofthe star. It is also a new product, and its longevity hasnot been proven. It is unlikely that this brand has anindefinite life.US GAAP commentThere is specific guidance in ASC 350, ‘Intangibles—Goodwill and Other’ that should be considered whenestimating the useful life of an intangible asset. Thisis similar to the IFRS guidance, although in specificcircumstances may be more stringent/lenient.The useful life of an intangible asset is consideredindefinite if no legal, regulatory, contractual,competitive, economic or other factors limit itsuseful life to the entity.However, based on the above considerations, theperfume named after the famous star would likelyhave a finite life. The extent to which the products carrying thebrand are resistant to changes in operatingenvironments. The products should, for example,be resistant to changes in the legal, technologicaland competitive environment.Innovation, brand, R&D and licensing9

4. Up-front feesBackgroundUnder the 10-year license agreement, Manufacturer Bpays Luxury brand C a CU 100 non-refundable up-frontfee and an annual royalty calculated as a percentage ofnet sales, with a minimum of CU 10 a year.Example 20 of IAS 18 states: ‘Fees and royalties paidfor the use of an entity’s assets (such as trademarks,patents, software, music copyright, record mastersand motion picture films) are normally recognised inaccordance with the substance of the agreement. As apractical matter, this may be on a straight-line basis overthe life of the agreement; for example, when a licenseehas the right to use certain technology for a specifiedperiod of time.’The agreement is cancellable after five years shouldManufacturer B not meet minimum revenue levels.SolutionLuxury brand C grants Manufacturer B the exclusiverights to produce and sell glasses under brand C. Designof the products are to be agreed by C.IssueHow should this up-front fee be accounted for?Relevant guidanceThe up-front fee should be spread over the expectedsales volume to be made in the future or over theduration of the license agreement.Note: The timing of the recognition of up-front fees thatinvolve licensing arrangements could be impacted by thenew converged standard on revenue when issued.Royalties paid for the use of the licensor’s asset(the consumer brand) are normally recognised onan accrual basis in accordance with the substanceof the agreement [IAS 18.30].10PwC Issues and solutions for the retail and consumer goods industries

5. Sales to a franchiseeBackgroundIn exchange for an up-front payment of CU 100,000 afranchisor grants a five-year franchise to an overseascompany to accelerate its global expansion. No otherservices will be provided by the franchisor.The franchisor specialises in Product A, which has ausual selling price of CU 100, and agrees to sell thisproduct to the franchisee for CU 70 throughout thefranchise period.Issue(a) How does the franchisor account for theup-front payment?(b) How is the sale of Product A accounted forby the franchisor?(c) How is the up-front payment accountedfor by the franchisee?Relevant guidanceFees charged for the use of continuing rights grantedby a franchise agreement or for other continuingservices provided during the agreement’s term arerecognised as revenue as the services are provided orthe rights are used [IAS 18 App 18].When the relevant criteria are met, service revenue isrecognised by reference to the stage of completion ofthe transaction [IAS 18.20].An asset meets the identification requirement in thedefinition of an intangible asset when it:b) arises from contractual or other legal rights,regardless of whether those rights are transferableor separable from the entity or from other rightsand obligations [IAS 38.12].Solution(a) The franchisor recognises as revenue the upfront fee as units of Product A are delivered to thefranchisee over the five-year period of the contract,or pro rata over the duration of the franchisearrangement.(b) Sales to the franchisee are treated in the same wayas the sale of goods to other customers.(c) The franchisee should recognise an intangibleasset (distribution rights) and amortise it over thefive-year period.US GAAP commentIn accordance with ASC 952, ‘Franchisors’, the upfront revenue received should be allocated to theunits sold to provide a reasonable profit when theprice of goods does not provide the franchisor witha reasonable profit. In practice it is not uncommonfor the franchisor to recognise the fee relating to theaccess to the franchise on a straight line basis whenthe franchisor is unable to estimate the amountof units expected to be sold over the term of thefranchise arrangement.Note: The accounting for franchise arrangements couldbe impacted by the new converged standard on revenuewhen issued.a) is separable—i.e., is capable of being separatedor divided from the entity and sold, transferred,licensed, rented or exchanged, either individually ortogether with a related contract, asset or liability; orInnovation, brand, R&D and licensing11

6. Franchise arrangementsBackgroundA retailer grants a five-year franchise to an overseascompany to accelerate its global expansion. Thefranchisee makes an up-front payment of CU 100,000for access to the franchise.The retailer specialises in Product A, which it purchasesfor an average cost of CU 60. The retailer agrees toarrange for the ordering and delivery of this productto the franchisee for a charge of CU 60, resulting innil profit. The contract allows the franchisee to setthe local sales price, but it has no right to return anyinventory to the retailer.IssueHow does the retailer account for the arrangementwith the franchisee and, in particular, the sale ofProduct A to the franchisee?Relevant guidance‘Revenue shall be measured at the fair value of theconsideration received or receivable’ [IAS 18.9].‘.in an agency relationship, the gross inflows of economicbenefits include amounts collected on behalf of theprincipal and which do not result in increases in equity12for the entity. The amounts collected on behalf of theprincipal are not revenue. Instead, revenue is the amountof commission’ [IAS 18.8].‘Transactions may take place between the franchisorand the franchisee which, in substance, involve thefranchisor acting as agent for the franchisee. For example,the franchisor may order supplies and arrange for theirdelivery to the franchisee at no profit. Such transactions donot give rise to revenue’ [IAS 18 App 18d].SolutionThe retailer/franchisor is acting as the purchasingagent on behalf of the franchisee. It does not bear theinventory risk and is not setting the final customersales price. The retailer/franchisor recognises itsmargin as revenue, which in this case is nil. This iscompensated for by the up-front fee, which shouldbe recognised as revenue by the retailer/franchisor,spread in an appropriate manner over the life of thefranchise agreement.Note: The accounting for franchise arrangements couldbe impacted by the new converged standard on revenuewhen issued.PwC Issues and solutions for the retail and consumer goods industries

Marketing and advertising13

7. Advertising costsBackgroundSolutionA company arranges for an external advertising agencyto develop and design a new advertising campaign. Thecampaign will cover television and press advertisingand is split into three phases: design, production andplacement. An initial contractual payment of CU 3million is made three months prior to the year end.The CU 2 million paid for the design and productionof the campaign does not qualify as an asset becausethe entity has access to the output from those services.These costs are expensed as incurred before the yearend. The CU 1 million placement costs are treated as aprepayment at year end and expensed in the followingperiod when those services are delivered.The design and production phases are complete at theyear end. The estimated cost of the placement phase isCU 1 million.IssueHow is the payment to the advertising agency treatedat the year end?Relevant guidanceUnder the guidance in IAS 38.68-70 advertising andpromotional expenditure is recognised as an expensewhen incurred. IFRS does not preclude recognising aprepayment when payment for the goods or serviceshas been made in advance of the delivery of goods orrendering of services.US GAAP commentIn most instances, the CU 2 million related to thedevelopment and conception of a new advertisingcampaign is usually considered as ‘Other than directresponse advertising’ under ASC 720-35, ‘AdvertisingCosts.’ It can therefore be either (1) expensed asincurred or (2) deferred and then expensed the firsttime the advertising takes place. The method selectedis an accounting policy choice for the company andmust be applied consistently to similar transactions.Consistent with IFRS, the remaining CU 1 millionrelated to placement is recognised as a prepayment atyear end.IA

Inventory 45. Retail inventory method 46. Accounting for inventories in a business combination. 6 Innovation, brand, R&D and licensing. Innovation, brand, R&D and licensing 7 Background A detergent manufacturer incurs significant costs developing a new technology that allows consumers