Transcription

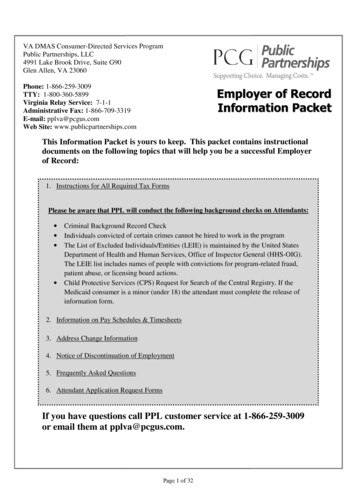

VA DMAS Consumer-Directed Services ProgramPublic Partnerships, LLC4991 Lake Brook Drive, Suite G90Glen Allen, VA 23060Phone: 1-866-259-3009TTY: 1-800-360-5899Virginia Relay Service: 7-1-1Administrative Fax: 1-866-709-3319E-mail: pplva@pcgus.comWeb Site: www.publicpartnerships.comEmployer of RecordInformation PacketThis Information Packet is yours to keep. This packet contains instructionaldocuments on the following topics that will help you be a successful Employerof Record:1. Instructions for All Required Tax FormsPlease be aware that PPL will conduct the following background checks on Attendants: Criminal Background Record CheckIndividuals convicted of certain crimes cannot be hired to work in the programThe List of Excluded Individuals/Entities (LEIE) is maintained by the United StatesDepartment of Health and Human Services, Office of Inspector General (HHS-OIG).The LEIE list includes names of people with convictions for program-related fraud,patient abuse, or licensing board actions.Child Protective Services (CPS) Request for Search of the Central Registry. If theMedicaid consumer is a minor (under 18) the attendant must complete the release ofinformation form.2. Information on Pay Schedules & Timesheets3. Address Change Information4. Notice of Discontinuation of Employment5. Frequently Asked Questions6. Attendant Application Request FormsIf you have questions call PPL customer service at 1-866-259-3009or email them at pplva@pcgus.com.Page 1 of 32

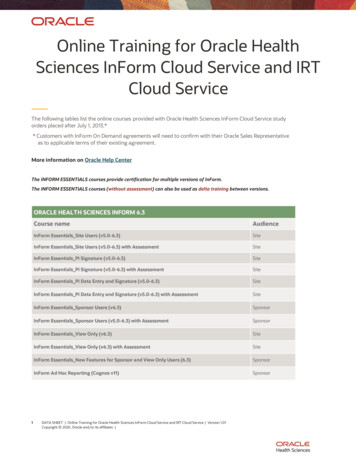

Table of ContentsPage #FormInstructions on the Employer of Record Confirmation of Information Form3Instructions on IRS Form SS-44Instructions on IRS Form 26785Instructions on IRS Form 88216Instructions on Virginia DMAS Signature Authority &Release of Information Form7Instructions on Address Changes8Address Change Forms9-10Instructions on Notice of Discontinuation of Employment Form11Notice of Discontinuation of Employment Form12Instructions on Acceptance of Responsibility for Employment Form13Acceptance of Responsibility for Employment Form14Frequently Asked Questions15-24Information on Timesheets25-28Payroll Schedule29Attendant Application Request Form30Instructions on Attendant Application31-32Page 2 of 32

Instructions for PPLConfirmation of EmployerInformation FormformWhat is the purpose of this form?The Services Facilitator provides Public Partnerships, LLC (PPL) with the Employer of Recordinformation. Please review to ensure the information is correct. If it is correct, the Employer of Record shouldsign the all forms in this packet. If it is incorrect, please call or email customerservice immediately so we can send you a newEmployer of Record packet.Page 3 of 32

SS-4 Application for EmployerIdentification NumberThis form tells the IRS you are going to be an employer.It is used to obtain an Employer Identification Number(EIN) from the IRS. The form will designate all taxdeposit and filing responsibility to PPL.Why isn’t my address listed on lines 4a and4b?Lines 4a and 4b ask for the mailing address to beattached to this employer account. By establishingPPL’s mailing address on your employer account, PPLwill receive the IRS paperwork.Who are the people listed in the ‘Third PartyDesignee’ section?These are PPL staff members who will obtain an EIN onyour behalf.What lines do I complete?You must review, sign and date the bottom of the form.If you have applied for an EIN in the past, complete lines 16a, 16b, and 16c.What if I have an existing EIN number?The DMAS program will only allow the use of an existing EIN through an exception process.PPL will need a letter from the IRS that must state the EIN number is free of “liens andliabilities”.Page 4 of 32

Instructions for Form 2678:Employer/Payer Appointmentof AgentWith this form, you give the employer tax responsibility to PPL.What is PPL’s role as my agent?The IRS Form 2678 only allows PPL to withhold taxes from your employee’s paychecks anddeposit those taxes to the IRS. The form does not allow PPL to perform any other taxresponsibilities.PPL is responsible by law for correctlyrepresenting you. PPL will incur anypenalties of misfiling or incorrectlydepositing your employer taxes.Does the IRS Form 2678authorize you to file my personalincome taxes?No. PPL cannot handle any of yourpersonal income tax matters.What sections do I complete?This form is completed for you.You must review, sign and date thebottom of the form.Page 5 of 32

Instructions for Form 8821:Tax Information AuthorizationThis form allows PPL to discuss your employerwithholding account with the IRS.Will PPL be able to discuss my personal taxaccount with the IRS?No. PPL is only able to discuss the employer tax formslisted in Section 3b. PPL will never be able to obtain anyof your personal income tax information.What lines do I complete?You must review, sign and date the bottom of the form inSection 7.Page 6 of 32

Instructions for SignatureAuthority/Release ofInformation FormThis form allows another person to help you whenmanaging your services. The form will allow you topick someone to sign timesheets for you or PPL to speakwith another person about your services.What does Signature Authority mean?Signatory Authority will allow the person listed on theform to sign timesheets for you.What does Release of Information mean?Release of Information will allow PPL to speak with theperson listed on the form about your services.Do I have to sign the Form?Yes.If you do not have a Signature Authority or you only want PPL to talk with you, complete the topof the form and sign at the bottom. Mark the “I do not give anyone permission on my account”.If you wish to allow another person to sign timesheets, list the person on the form underSignature Authority. If you wish to allow PPL to speak with another person, list the person onthe form under Release of Information. You can allow the same person to be the SignatureAuthority and on the Release of Information. List the person helping you manage services, markthe “I give the above person(s) permissions on my account” and sign the form.Who can PPL talk to about my services?Only the person you list on the form. The person must verify your address and Social SecurityNumber.Can the Signature Authority sign the Employer tax packet or AttendantForms?No, only the Employer of Record can sign the tax forms and attendant forms.Page 7 of 32

Instructions for an AddressChangeConsumer Address ChangePPL cannot change the Consumer’s address. If the consumer has a change of address, thechange must be reported to the local Department of Social Services. DMAS will reportconsumer address changes to PPL on a weekly basis.Consumer Phone Number or E-mail ChangePPL can change your phone number and/or email address usingthe Consumer Change Form.Employer of Record Address ChangeThe Employer of Record, who is not the consumer, has twooptions to notify PPL of address changes. You can changeyour information using the Employer of Record Change ofAddress Form.How can I change my information?To change your information you can Send the change form to PPL using the form on PPL’s website athttps://www.publicpartnerships.com//. Scroll to the middle of the screen. Answer UserName vaclient. The password is pcgva67. The form can also be found on page 9 and 10 of this packet. Calling customer service to have a form sent to you.Page 8 of 32

Consumer Change FormIf you have an address change, you must change your address with the Department of Social Services.Check All Boxes That Apply: Change in E-Mail Change in Phone NumberConsumer ID:Initial:Consumer First Name & Middle InitialConsumer Last Name:Consumer Date of Birth:Consumer Phone Number :(Email Address:)DateConsumer or Employer of Record SignatureIf you have any questions, please call PPL at 1-866-259-3009Mail:Public Partnerships, LLCAttn: DMAS Consumer Directed Services Program4991 Lake Brook Drive, Suite G90Glen Allen, VA 23060Fax:1-866-709-3319Page 9 of 32

Employer of Record Change ofAddress FormPlease complete this form when there is a change in your personal information. If you are also theconsumer, you must change your address with the Department of Social Services.Check All Boxes That Apply: Change in NameChange in Address Change in Phone NumberConsumer ID:EOR First Name & Middle Initial:EOR Last Name:EOR Date of Birth:EOR Phone Number:(Email Address:)EOR Old Mailing Address:New Physical Address:City/State/Zip Code:County:New Mailing Address:City/State/Zip Code:County:DateEmployer of Record SignatureIf you have any questions, please call PPL at 11-866-259-3009Mail:Public Partnerships, LLCAttn: DMAS Consumer Directed Services Program4991 Lake Brook Drive, Suite G90Glen Allen, VA 23060Fax:1-866-709-3319Page 10 of 32

Instructions for a Notice ofDiscontinued EmploymentThis form tells PPL when an attendant is no longer working for you.Why is this form important?PPL needs to know when an attendant is no longer working for thefollowing reasons: To prevent incorrect paymentsFor correct information on who is working for you or who hasworked for youFor unemployment hearings. PPL can communicate to theVirginia Employment Commission the last date of employmentand reason.Does the attendant need to sign the form?No, just complete and sign the form yourself. The attendant doesnot need to sign this form.What must I include on the form?Complete all sections of the form including the Last Date Attendant Worked and the Reason forSeparation.Does the Services Facilitator need to sign?No, The Services Facilitator can sign the form but it is not required.Need more forms? Download the form on PPL’s website at https://www.publicpartnerships.com//. Scroll tothe middle of the screen. Answer User Name vaclient. The password is pcgva67. The form can also be found on page 12 of this packet. Calling customer service to have a form sent to you.Where do I send the form?Mail or fax the form to PPL.Mail: Public Partnerships, LLCFax:Attn: DMAS Consumer Directed Services Program4991 Lake Brook Drive, Suite G90Glen Allen, VA 23060Page 11 of 321-866-709-3319

Notice of DiscontinuedEmployment FormThis form tells PPL when an attendant is no longer working for you. The information on this form will be usedby PPL to prevent incorrect payments, maintain up-to-date information on who is working for you, andcommunicate to the Virginia Employment Commission the last date of employment and reason.This form can be completed by the Employer of Record, or by both parties (the Employer and the Attendant).Consumer Name Consumer IDEMPLOYER of RECORD (EOR)Name:Phone:ATTENDANT/EMPLOYEEName: Attendant ID:Phone:LAST DATE EMPLOYEE WORKED:REASON FOR SEPARATION: Quit Fired Deceased OTHER(Circle One)Include the last timesheet for hours worked.Timesheet Attached: (Circle One) YESNOThe form provides an opportunity for either or both parties to document the reason(s) for ending employment.Briefly state the reason(s) for ending the employment agreement between the two parties.Employer Signature: Date:Attendant Signature: Date*Power of Attorney, Executor of Estate, or Service FacilitatorSignatureDateIf the Attendant cannot or will not sign, the Employer of Record should sign, date, and return this form withoutthe Attendant’s signature. *A Power of Attorney (POA), Executor of the Estate (must provide a copy of thePOA to ensure that they have authority to terminate the employee) or Service Facilitators may sign the formwhen the Employer of Record is unable to do so. This form must be signed. Mail or fax the form to PPL.Mail:Public Partnerships, LLCVA DMAS Consumer-Directed Services Program4991 Lake Brook Drive, Suite G90Glen Allen, VA 23060Fax:1-866-709-3319REVISED: January 2013Page 12 of 32

Instructions for Acceptance ofResponsibility for EmploymentFormThe employer can accept responsibility on behalf of theattendant AFTER being notified by PPL of theircriminal history results.Can I hire an employee who has beenconvicted of a crime?You may be able to hire an attendant convicted of acrime. The felony conviction cannot be listed on theBarrier Crimes List.The Barrier Crimes list is found on page 22 of thispacket in accordance with the Code of Virginia §37.2314, §37.2-416, or §32.1-162.9:1 and Virginiaregulations 12 VAC 30-120-770In the event that your attendant has been convicted of acrime that is not a barrier crime, you will be given theopportunity to employ the attendant. You will be required to complete the Acceptance ofResponsibility for Employment form and send it back to PPL. You can fax or mail the form toPPL.What if I do not want to hire an attendant convicted of a crime?Complete the Notice of Discontinued Employment Form and send it to PPL. The form can befound on page 12 of this packet.What if I learn the attendant was convicted of a barrier crime?Contact your Service Facilitator. Complete the Notice of Discontinued Employment Form andsend it to PPL. The form can be found on page 12 of this packet.Can the attendant be paid for hours worked if convicted of a Barrier Crime?DMAS and PPL are not allowed to pay someone who has been convicted of a Barrier Crime.The attendant can be paid for work up until the results were received or no more than 30 daysafter the start date.Page 13 of 32

Acceptance of Responsibilityfor Employment FormConsumer Name:Consumer ID:Employer of Record (EOR) Name:This form must be signed and sent to PPL if you decide to hire an attendant that has beenconvicted of a non-barrier crime.As an employer, I have the right to choose to hire and employ an attendant who I know has beenconvicted of a crime. If the employee has been convicted of barrier crimes, I cannot hire him/herper Section 32.1-162.9:1, §63.2-1719, and §37.2-314 of the Code of Virginia and Virginiaregulations 12 VAC 30-120-770. Barrier crimes can change at any time. A list of the barriercrimes can be found in Frequently Asked Questions in this Packet.By choosing to hire an attendant who has been convicted of a non-barrier crime:I understand this decision and the consequences are my sole responsibility. In making anyand all hiring decisions as an employer, I agree to hold harmless from any claims andresponsibility the Department of Medical Assistance Services, the Service Facilitator that Ihave chosen, and Public Partnerships, LLC.Attendant/Employee:Print NameDate:Employer Signature:Send the completed form to PPL.Mail:Public Partnerships, LLCFax:VA DMAS Consumer-Directed Services Program4991 Lake Brook Drive, Suite G90Glen Allen, VA 230601-866-709-3319REVISED: January 2013Page 14 of 32

Frequently Asked QuestionsGeneral Program QuestionsWhat does the Employer of Record (EOR) mean?The EOR is the person who will employ the Attendants working to provide authorized services.Can the Consumer be the EOR?Yes, either you or someone you designate can be the EOR.What do I need to do as the Employer?As the Employer you will, Review the Employer/Employee agreement with each AttendantSign all Employer of Record tax paperworkSign all Attendant paperworkMonitor the Attendant’s workned timesheets to PPL for each AttendantsignedApprove timesheets and submit sigKeep track of authorized services usedEstablish schedules and tasks for each Attendant in line with the plan of careHire, supervise, and discontinue employment of the Attendants.PPL will, Perform a criminal background check on all Attendants Perform child abuse and neglect background checks on prospective Attendants providingcare to individuals under the age of 18 Perform required state and federal background and employment eligibility checks onAttendants Issue wages using direct deposit to your Attendant’s checking or savings account, debitcard of the Attendant’s choice, or the PPL Debit Card Withhold state and federal taxes and other withholdings for each Attendant File monthly, quarterly, and annual tax deposits and forms with state and federal agencies Issue a W-2 Wage Statement to each Attendant in January every year Provide the Quarterly Service Report (QSR) four times a year to review your serviceauthorizations Answer questions about enrollment, timesheets, and payments Help you and your Attendant with the enrollment process through Customer Service.Page 15 of 32

Frequently Asked QuestionsWhat do I need to do first?Review and sign all required forms. Once completed, fax or mail the EOR Tax Forms back toPPL.What is a Web Portal?PPL has an online system for employers to track timesheets, approve or reject timesheets andreview your service authorization use and patient pay requirements. PPL Web Portal accessinformation is in your Information Packet on page 25.Where can I find out more information on the PPL Web PortalYou can visit the Public Partnership’s website. Type https://www.publicpartnerships.com// intothe internet browser. Scroll to the middle of the screen. Answer User Name vaclient. Thepassword is pcgva67.Learning tutorials are located at the bottom of the screen at “How To Guides” on the PPLwebsite.How does the consumer change an address with PPL?All consumer address changes must be reported to the local Department of Social Services.Please contact your eligibility worker to report address changes. PPL will receive the newaddress automatically.Can the consumer change the phone number and email address with PPL?Yes, PPL can accept the consumer’s phone number and email address changes. Use the form onpage 9 of this packet.Can the Employer of Record change their records with PPL?Yes, The Employer of Record (if different than the consumer) can notify PPL of an addresschange. To change your information you can Send the change form to PPL using the form on PPL’s website athttps://www.publicpartnerships.com//. Scroll to the middle of the screen. Answer Userhttps://www.publicpartnerships.com//Name vaclient. The password is pcgva67. The form can also be found on page 10 of this packet. Calling customer service to have a form sent to you.Page 16 of 32

Frequently Asked QuestionsWhat if the consumer loses Medicaid/Waiver Eligibility?ces (DSS) eligibility worker or yourServicesYou should contact your local Department of Social ServiService Facilitator.The consumer is in a Nursing Facility, can the Attendant be paid?No, the Attendant cannot be paid to provide care while the consumer is receiving services in anin-patient setting.Will I be required to pay for services out of my own pocket?All payroll related expenses are funded using Medicaid funds. These expenses include Attendantwages, employer payroll taxes, and unemployment insurance.DMAS will not pay for services not meeting requirements, such as but not limited to: Medicaid or Waiver ineligibilityhistoryy check due to a barrier crimean Attendant has failed a criminal historan Attendant has failed a child abuse and neglect records checkan Attendant is named in the federal List of excluded Individuals/ Entities databasethe Attendant worked over authorized service hours.timesheets were not submitted to PPL before 1 year of the date worked.The consumer will be responsible for paying the patient pay as determined by the Department ofSocial Services.What is the Employer/Employee AgreementYou must review the Employer/Employee Agreement with each Attendant. The agreement isfound in the Attendant Forms packet. This document needs to be signed and dated by theAttendant and you before PPL can issue a paycheck. The agreement will establish a hire date,wage rate, and conditions of employment.What if I do not understand how to complete the PPL paperwork?Call PPL Customer Service (866) 259-3009 (toll free) – Customer Service staff will assist incompletion of paperwork. PPL also providers interpreter service by calling our CustomerService line.Page 17 of 32

Frequently Asked QuestionsWhy do I need to sign the USCIS Form I-9 for my Attendant?The United States Citizens

Information on Pay Schedules & Timesheets 3. Address Change Information 4. Notice of Discontinuation of Employment 5. Frequently Asked Questions 6. Attendant Application Request . LLC (PPL) with the to ensure the information is