Transcription

TD Ameritrade toacquire ScottradeCombination enhances scale,accelerates growthTim Hockey, President and CEOSteve Boyle, EVP and CFOOctober 24, 2016TD Ameritrade Holding Corporation (Nasdaq: AMTD). Brokerage services provided by TDAmeritrade, Inc., member FINRA/SIPC, and TD Ameritrade Clearing, Inc., member FINRA/SIPC,subsidiaries of TD Ameritrade Holding Corp. TD Ameritrade is a trademark jointly owned by TDAmeritrade IP Company, Inc. and The Toronto-Dominion Bank. 2016 TD Ameritrade IP Company,Inc. All rights reserved. Used with permission.1

Forward-looking StatementsImportant InformationThis document contains forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation ReformAct of 1995, including statements giving expectations or predictions of future financial or business performance or conditions. We intend these forwardlooking statements to be covered by the safe harbor provisions of the federal securities laws. Forward-looking statements are typically identified bywords such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “prospects” or “potential,” by future conditional verbssuch as “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions.In particular, any projections or expectations regarding the proposed business combination transaction between TD Ameritrade Holding Corporation(“TD Ameritrade”) and Scottrade Financial Services, Inc. (“Scottrade”) described herein, our future revenues, expenses, earnings, capital expenditures,effective tax rates, client trading activity, accounts or stock price, as well as the assumptions on which such expectations are based, are forward-lookingstatements. These statements reflect only our current expectations and are not guarantees of future performance or results. These statements involverisks, uncertainties and assumptions that change over time and could cause actual results or performance to differ materially from those contained inthe forward- looking statements and historical performance. In addition to the risks, uncertainties and assumptions previously disclosed in TDAmeritrade’s reports and documents filed with the Securities and Exchange Commission (“SEC”) and those identified elsewhere in this communication,these risks, uncertainties and assumptions include, but are not limited to: the ability to obtain regulatory approvals and meet other closing conditions tothe proposed transaction, including the completion of the merger between Scottrade Bank and TD Bank, N.A., on the expected terms and schedule;delay in closing the transaction; difficulties and delays in integrating the TD Ameritrade and Scottrade businesses or fully realizing cost savings andother benefits; business disruption following the proposed transaction; changes in asset quality and credit risk; the inability to sustain revenue andearnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; customerdisintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; TD Ameritrade’s and Scottrade’sbusinesses experiencing disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships withemployees, customers, other business partners or governmental entities; the inability to realize synergies or to implement integration plans and otherconsequences associated with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes,capital management activities, and other actions of regulatory bodies and legislative and regulatory actions and reforms, general economic and politicalconditions and other securities industry risks, fluctuations in interest rates, stock market fluctuations and changes in client trading activity, credit risk withclients and counterparties, increased competition, systems failures, delays and capacity constraints, network security risks, liquidity risks, new laws andregulations affecting our businesses, regulatory and legal matters and uncertainties and other risk factors described in our latest Annual Report on Form10-K, filed with the SEC on Nov. 20, 2015 and our subsequent Quarterly Reports on Form 10-Q filed thereafter and other reports and documents we filewith the SEC. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflectactual results.These forward-looking statements are subject to numerous assumptions, risks and uncertainties which change over time and speak only as of the dateon which the statements were made. We undertake no obligation to update or revise publicly any forward- looking statements, whether as a result ofnew information, future events or otherwise, except to the extent required by the federal securities laws.2

TD Ameritrade & ScottradeTransaction Details3

Our StrategyCore ObjectiveDeliver a Superior Client ExperienceExecution DriversScaleSpeedSimplicityInnovationStrategic GoalsLead in TradingGrow ClientAssetsBuild out AdviceSolutions4

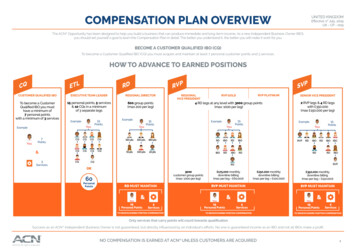

Combination Extends Our Leadership Position in the Retail Brokerage IndustryCombined 950b(5) in client assets and 600k DARTs (1) Leader in trading 463k DARTs(1) Leading retail brokerage franchise One of the pioneers of investing services Premier asset gatherer 774b in client assets(5) Award-winning client service Growth in fee-based investment balances 170b in fee-based investment balances(7) Well positioned for rising interest rates 119b in interest rate sensitive assets(8) Good stewards of shareholder capital Target 60-80% net income return to shareholders(9) Unique relationship with TD Bank Capital light model Large client base of traders and investors 2m clients with 3m funded accounts(2) Largest physical network among online brokers 500 branches(5) Consistently delivering strong organic growth 170b in client assets(5) Strong trader franchise 137k DARTs(1)Combination will enhance our scale, growth, cash flow and capital returns5

Compelling Combination of Leading Firms Immediately enhances our scale and accelerates our growthEnhanced Scale Extends our leadership position in trading ( 600k in pro forma DARTs(1)) Significantly grows our client base by adding over 2m clients with 3m funded accounts (2) Expected to generate double digit accretion post-conversion 12% to 15% accretive in years 2 and 3 (GAAP basis)(3)Financially Attractive 15% to 20% accretive in years 2 and 3 adjusted basis (excluding intangible amortization)(4) Expected to achieve double digit ROIC/IRR post-conversion Ability to monetize 36b(5) in incremental client cash balancesExpanded Footprint andClient Reach Significantly expands our geographic footprint through an established branch network Enhances our asset gathering capabilities Enhances our presence in markets where Scottrade is strong Operating leverage in existing model will enable us to generate significant synergies Cost savings related to technology, operations/back office, and advertisingSignificant Synergies Approximately 450m anticipated in annual cost saves; realized in full by Year 2(6) Potential for meaningful additional opportunity, primarily through growing share of wallet(e.g., mobile, derivatives, fixed income, and investment advice) 300m long-term opportunityStrong Cash Flow andOperating LeverageProven Consolidator Robust pro forma cash flow profile; enhanced by meaningful tax benefits Modest combined leverage at closing (at or below pre-acquisition levels after synergies) Track record of successful acquisitions History of integrating acquisitions, realizing synergies, and driving shareholder returns6

Combination Benefits Both Scottrade and TD Ameritrade ClientsA transaction which drives benefits for both client basesClient BenefitsClient BenefitsComprehensive investor education tools Sophisticated trading platforms and advanced mobile trading technology Enhanced product capabilities (i.e., complex options, futures, foreignexchange, mutual funds/ ETFs, and portfolio margin) Access to more investment guidance and advice solutions (i.e., goalplanning, “robo” advice, and Amerivest managed portfolios) Further strengthen client relationships via expanded branch footprint Enhanced offering resulting from award winning client-centric culture Leverage the benefit of enhanced scale to drive innovation7

Transaction StructureTD Bank, N.A. acquires Scottrade Bank from Scottrade Financial Services, Inc.(SFSI), followed byTD Ameritrade acquiring SFSIStep One: TD Bank, N.A. Acquires Scottrade BankStep Two: TD Ameritrade Acquires SFSI(11)TD Bank, N.A.TD AmeritradeAcquisition of100% ofScottrade BankCashxxpayment(10)Acquisition of 100%Scottrade FinancialServices, Inc. 3.0b in cash(12) 1.0b in equityXXIncluding cash frombank trade FinancialServices, Inc.Scottrade FinancialServices, age8

Transaction SummaryStructureStrategic Rationale TD Ameritrade will acquire Scottrade Financial Services, Inc. for 4b(12) 2.7b(12) net price after accounting for TD Bank's 1.3b(10) acquisition of Scottrade Bank In combination with the cash proceeds from the sale of Scottrade Bank, Scottradeshareholders will receive 3.0b(12) of cash and 1.0b of TD Ameritrade equityFinancingFinancial Rationale 2.7b(12) net price being funded with 1.3b of cash and 1.4b of TD Ameritrade equity 1.3b cash sourced from TD Ameritrade cash ( 900m) and new debt offering ( 400m) 1.4b equity issued: Scottrade shareholders ( 1.0b) and TD Bank ( 400m)(13)Boardof DirectorsCompellingValue CreationSignificant SynergiesPro-FormaOwnership(14) Rodger Riney to join the TD Ameritrade board at closing Approximately 565m basic shares outstanding at close Public Float 42% / TD Bank 41% / Ricketts 11% / Scottrade Shareholders 4.9%Strong Cash Flow andTimingOperating Leverage Expected to close during FY17(15)Proven IndustryRegulatory Approvals(28)Consolidator and Innovator Regulatory approvals: FINRA, HSR, and customary closing conditions Anticipate clearing conversion to TD Ameritrade systems in FY18 TD Bank regulatory approvals from OCC and OSFI9

Transaction Summary: Purchase PricePaying 4b in cash and equity 4.0b Gross Purchase Price(12)(Less) 1.3b Scottrade BankSale Proceeds(10)Equals 2.7b TD Ameritrade'sNet Purchase Price(12)Funded With 1.3b Cash 1.4b Equity(13) 900m of cash from TD Ameritrade 28m shares to Scottrade shareholders 400m new debt offering 11m shares to TD Bank; cashproceeds used for consideration toScottrade shareholdersNote: Retirement of 385m Scottrade debt will beprimarily funded with cash acquired from Scottrade(ex. Bank cash) and cash from TD Ameritrade10

Financial Summary 4b (or 2.7b net of proceeds from bank sale)(12)Strategic RationalePurchasePriceAccretion/DilutionFinancial RationaleRevenueCompellingValue CreationExpenseSynergies Net purchase multiple: 3.8x revenue(16) Net purchase multiple: 3.0x revenue includes net present value of tax benefit(17) -7% to -12% dilutive in year 1 (excluding restructuring charges) 12% to 15% accretive in years 2 and 3 (GAAP basis)(3) 15% to 20% accretive in years 2 and 3 adjusted basis (excluding intangible amortization)(4) 713m in revenue (pro forma Scottrade revenue FY16) Includes 154m in pro forma IDA(18) revenue ( 28b in cash generating 55 bps blended yield)(19) Total addressable cost base of 750m (FY16)(6) Expect 450m in total expense synergies ( 60% of addressable costs) (6) 100m synergies pre-conversion 350m additional run-rate synergies post-conversionSignificant SynergiesAmortizationExpense Expect 60m to 70m of incremental client amortization expense (GAAP basis) (20) Primarily driven by client intangibleStrong Cash Flow andTax Benefit(21)Operating Leverage Estimate 338(h)(10) tax benefit of 50m per year for 15 years Estimated net present value of the 338(h)(10) election is 545mRestructuring Charges 550m in restructuring related charges Primary drivers are severance, vendor termination fees, transaction fees, debt retirementAdditional Opportunity 50m to 100m additional opportunity in years 2 and 3 ( 300m longer term)(22) Grow share of wallet by offering expanded products/platforms to Scottrade clients11

Enhancing Our Scale and Accelerating Our GrowthMeaningful lift across key operating metrics will drive scale, efficiencies and growth(23) Funded Accounts(2)7.0m3.1m10.1mClient Assets(5) 774b 170b 944b463k137k600k 11.76 10.10 11.38Derivatives(25)44%11%36%Client Cash(5) 113.3b 35.7b 149.0bMargin Balances(5) 11.8b 2.5b 14.3b 100 500 450DARTs(1)Revenue / Trade(24)Branches(5)12

Combination Will Significantly Grow Branch PresenceAnticipate that our physical footprint will expand to 450 branches; acceleratesTD Ameritrade’s asset gathering strategyCombined Footprint Scottrade TD Ameritrade 13

Track Record of Successful AcquisitionsProven experience acquiring and integrating to create client and shareholder valueSuccessful Acquisition Track Record 1,000 9441,000 900900 800800 653 600 667700DARTs600k 556 472 500 400 355 303 300 262 278600500 379400 302300 200200 100 26 3420012002 55 69 83200320042005100 RTs (000)(27)Client Assets ( b)(26) 774 700

SummaryOpportunistic acquisition extends TD Ameritrade’s leadership position1. Financially-attractive with compelling shareholder benefits, including doubledigit EPS accretion post-conversion.2. Provides clients with a broader, more robust offering, including more education,more advanced tools, more products and more long-term investing solutions.3. Accelerates our growth, adding significant scale to our retail business, extendingour leadership in trading, and more than quadrupling the size of our branchnetwork.10 Million Client Accounts 1 Trillion in Assets 600K Trades Per Day15

Q4 FY 2016Financial Results Summary16

September Quarter 2016Summary of Notable Items in the Quarter Notable operating expense items of approximately 46M, impacting earningsper share by 0.05 unfavorably Terminated various projects and contracts Better positioned to implement strategic plansNotable tax items of approximately 17M, impacting earnings per share by 0.03 favorably Incentives on software development Impacts go-forward tax rate assumptions17

IDA(12) Net RevenueBalance growth is keyIDA Net Revenue ( M)Outlook Range ( M)(6) 1,000 900 926 828 804 820 955 839 870 800 700Fiscal 2016 Record average balances Stable net yields Record client net buyingactivity 8 bps decline from Jun Q toSep Q including 4 bps dueto higher balances and 3bps due to increased FDICinsurance 600 500FY12FY13FY14FY15Avg. IDA Balance ( B)Outlook Range 90 841.37% 68 73 591.17% 60 941.40% 90 761.20%1.09% 70FY17Outlook Range ( B)Net Yield 80FY161.09%1.00%1.11%1.00% 500.80%FY12FY13FY14FY15FY16Fiscal 2017 0.95% 40 Balance growth expected tocompress yieldsFY1718

Fiscal 2017 Outlook Range(6)HighFinancialMacro AssumptionsKey Metrics 1.80 EPS10% Market GrowthNNA(1) 85B / 11%(2)Increasing Fed FundsIncreasing Yield CurveTPD 505KOperating expense growthof 3%NIM(16) 1.38% / IDA(12) 1.00%0% Market GrowthNNA 55B / 7%No change in Fed Funds,flattening Yield CurveTPD 475KOperating expense growthof (1%)NIM 1.27% / IDA 0.95%42% Pre-TaxMargin 1.50 EPSLow38% Pre-TaxMargin19

ConclusionClosing out a good fiscal year, core strategy does not change Plans for fiscal 2017 – scale and speed are key Execution: focused on increased nimbleness, agility and throughput Investments: technology, sales people Priority: organic growth in trades, client assets Key initiative: building out solutions for investment guidance/advice Key opportunity: DOL Fiduciary Rule implications for the industry FY17 outlook range(6) of 1.50- 1.8020

Q&A21

Appendix: Scottrade Footnotes1.Total revenue-generating client trades divided by the number of trading days in the period as of FY16 (October 2015 to September 2016)2.Funded accounts as of September 30, 20163.Accretion/(dilution) includes moving Scottrade sweep deposits into the IDA, client attrition, expense synergies, additional opportunities, incremental client intangible amortization expense,and incremental corporate debt expense4.Accretion/(dilution) on an adjusted basis excludes current deal client intangible amortization expense5.Data as of September 30, 20166. 450m in annual cost saves is based on addressable operating expense base of 750m (excluding depreciation & amortization and corporate debt interest expense) for 12 month periodending September 30, 20167.Market fee-based investment balances plus money market mutual funds as of September 30, 20168.Interest rate sensitive assets consist of spread-based assets and money market mutual funds as of September 30, 20169.FY16 target of 60-80%, actual return was 80%10. Purchase price for Scottrade Bank is based on Scottrade Bank tangible book value at closing; Scottrade Bank tangible book value was 1.3b as of September 30, 201611. Excludes debt retirement and transaction fees and expenses12. Purchase price for Scottrade Financial Services, Inc. is subject to closing adjustments13. Equity issuance is calculated based on closing share price of 36.12 as of October 7, 201614. Pro forma ownership breakdown assumes current ownership plus new shares issued under the Scottrade transaction15. Subject to regulatory approvals and satisfaction of other closing conditions16. Net purchase multiple is calculated based on 2.7b net purchase price over pro forma Scottrade revenue for FY1617. Net purchase multiple is calculated based on 2.2b net purchase price (includes net present value of 338(h)(10) tax benefit of 545m) over pro forma Scottrade revenue for FY1618. Client cash is held in FDIC-insured deposit accounts (IDA)19. 28b excludes 5b in deposits at the broker/dealer20. Incremental client intangible amortization expense is an estimate and subject to final assessment21. Tax benefit is on a cash basis (non-GAAP); net present value of 338(h)(10) is estimated based on final purchase price and the projected book value at close22. 50m and 100m in additional opportunity are assumptions for year 1 and year 2 after clearing conversion23. May be some overlap due to common clients24. Revenue per trade includes commissions and order routing revenue25. % of derivatives trades (options, futures, and foreign exchange) over total revenue trades26. Client assets represent ending assets in reported period27. Total revenue-generating client trades divided by the number of trading days in the entire fiscal year28. Additional regulatory approvals may be required (e.g., Federal Reserve)22

Appendix: Earnings Footnotes1.Net new assets (NNA) consist of total client asset inflows, less total client asset outflows, excluding activity from business combinations. Client asset inflowsinclude interest and dividend payments and exclude changes in client assets due to market fluctuations. Net new assets are measured based on the marketvalue of the assets as of the date of the inflows and outflows.2.NNA growth rate is annualized net new assets as a

TD Ameritrade will acquire Scottrade Financial Services, Inc. for 4b(12) 2.7b(12) net price after accounting for TD Bank's 1.3b(10) acquisition of Scottrade Bank Financial Rationale In combination with the cash proceeds from the sale of