Transcription

SECURITY AND GROWTH POTENTIALQUANTUM PLUS26 DEPOSITStandard BankIsle of Man Limitedand Standard BankJersey LimitedStructured Product

RECENT INTERNATIONALAWARDSRECEIVED BY COMPANIES WITHIN THE STANDARD BANK OFFSHORE GROUPInternational Fund andProduct Awards – 2018Highly Commended –Best InternationalPrivate Banking ServiceSRP Europe Awards– 2020Best Distributor MEASRP Europe Awards– 2020Best House MEASRP Europe Awards– 2020Best Performance,South AfricaWHAT DOES QUANTUM PLUS 26DEPOSIT OFFER?A fixed rate ofinterest on 40%of your depositfor one year (theQuantum portion)Capitalprotection*Stock market linkedgrowth potential on theother 60% of your depositover a five and a half yearterm (the PLUS portion)Choice between marketsdepending on yourcurrency choice*Capital protection refers to the Product’s design to repay your original Sterling, US dollar or Australian dollar deposit in full providing you retain your deposit until therelevant Maturity Date. Monies deposited in Quantum PLUS 26 Deposit will be held by Standard Bank Jersey Limited or Standard Bank Isle of Man Limited subject to theterms, conditions and risks set out in this brochure. See “Risks and other considerations” from page 9 for further details and an explanation of the limitations of the capitalprotection offered.1

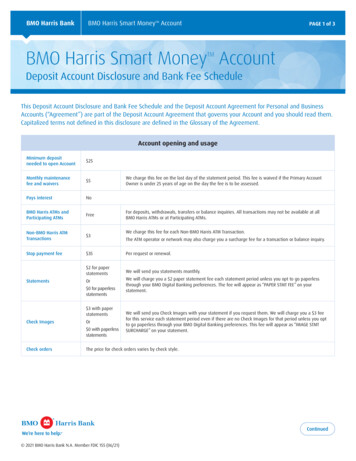

HOW DOES QUANTUM PLUS 26DEPOSIT WORK?QUANTUM PORTION:FIXED RATE OF INTEREST FOR ONE YEAR40% of your deposit (the Quantum portion) is held for one year in a deposit accountearning 1.25% AER for Sterling deposits or 2.50% AER for US dollar deposits or 1.75%AER for Australian dollar deposits. Provided that the deposit is held to maturity, youwill be entitled to interest at the relevant fixed rate for your Market Choice. Intereston the Quantum portion will only accrue and be paid at the end of the one year period.ANNUAL EQUIVALENTRATE (AER)NOMINAL RATESterling1.25%1.2500%US dollar2.50%2.4658%Australian dollar1.75%1.7260%CURRENCYThe nominal rate for the Quantum portion is the rate as it will appear on InternationalOnline Banking. Market convention for US dollar and Australian dollar deposits is toexpress annual interest rates over a 360 day period.When this nominal rate is adjusted for the number of days over which interest is paid,the rate paid to you is the annual equivalent rate (AER) as shown above.2

HOW DOES QUANTUM PLUS 26DEPOSIT WORK?PLUSPORTIONReturn linked to a proportion of stock market growthThe return on the other 60% of your deposit (the PLUS portion) islinked to the Market Performance over the five and a half year term.At maturity, five business days after the End Date, you will receive backthis portion of your deposit plus 60% of the Market Performance if yourMarket Choice is the USA or Australia, and 50% of the Market Performanceif your Market Choice is the UK. There is no cap on the Market Performanceused to calculate your potential return. Your return is based on the growth inyour Market Choice:UK – Sterling deposits, linked to the performance of the S&P UnitedKingdom IndexUSA – US dollar deposits, linked to the performance of the S&P 500Low Volatility IndexAustralia – Australian dollar deposits, linked to the performance ofthe S&P / ASX 200 IndexPlease see page 7 for Product Features and Definitions.3

4

HOW DOES QUANTUM PLUS 26DEPOSIT WORK?S&P UNITED KINGDOM INDEXSterling deposits are linked to the performanceof the S&P United Kingdom Index. This indexis a subset of the S&P Europe 350 Index andrepresents the performance of all UK-domiciledstocks from the parent index. The S&P Europe350 Index represents the performance of 350leading blue-chip companies drawn from 16developed European markets.The S&P United Kingdom Index is a pricereturn index, it therefore measures the capitalperformance of the constituent companies butexcludes dividend income.6 year S&P United Kingdom Index performance(monthly close) (31 December 2013 to 31 December 2019)1 7001 6001 5001 4001 3001 n18Source: Bloomberg, priced in Sterling.Past performance is not an indicator of future performance.5Dec18Jun19Dec19

S&P 500 LOW VOLATILITY INDEXUS dollar deposits are linked to the performanceof the S&P 500 Low Volatility Index. This index isdesigned to measure the performance of the 100least volatile stocks of the S&P 500 Index. The S&P500 Index represents the performance of the 500largest companies by market capitalisation traded ona variety of stock exchanges in the USA.The S&P 500 Low Volatility Index is a price returnindex, it therefore measures the capital performanceof the constituent companies but excludes dividendincome.6 year S&P 500 Low Volatility Index performance(monthly close) (31 December 2013 to 31 December e: Bloomberg, priced in US dollars.Past performance is not an indicator of future performance.S&P / ASX 200 INDEXAustralian dollar deposits are linked to the performanceof the S&P / ASX 200 Index. This index represents theperformance of the 200 largest index-eligible stockswithin Australia, traded on the Australian SecuritiesExchange.The S&P / ASX 200 Index is a price return index, ittherefore measures the capital performance of theconstituent companies but excludes dividend income.6 year S&P / ASX 200 Index performance(monthly close) (31 December 2013 to 31 December ec15Jun16Dec16Jun17Dec17Jun18Source: Bloomberg, priced in Australian dollars.Past performance is not an indicator of future performance.6Dec18Jun19Dec19

PRODUCT FEATURES & DEFINITIONS1.25% AER (1.2500% nominal) for Sterling2.50% AER (2.4658% nominal) for US dollar1.75% AER (1.7260% nominal) for Australian dollarQUANTUMTermOne yearStart Date13 May 2020MaturityDate13 May 2021, which is the date your original capital deposited in the Quantum portion and your return,will be paid to you40%QUANTUM PLUS 26 DEPOSIT DIVIDES YOUR ORIGINAL CAPITALDEPOSITED BETWEEN TWO DEPOSITS60%PLUSDepositChoiceTermDeposit CurrencyIndexMarket Linked ReturnUKSterlingS&P United Kingdom Index50% of the Market PerformanceUSAUS dollarS&P 500 Low Volatility Index60% of the Market PerformanceAustraliaAustralian dollarS&P / ASX 200 Index60% of the Market PerformanceFive and a half years from Start Date to End DateStart Date13 May 2020, which is the start of the period for measuring the Market PerformanceEnd Date13 November 2025, which is the end of the period for measuring the Market PerformanceMaturity Date20 November 2025, which is the date your original capital deposited in the PLUS portion and your return,if applicable, will be paid to youStart LevelClosing level of the Index for your Market Choice on the Start DateEnd LevelAverage of the closing levels of the Index for your Market Choice over the final 18 months of the Term,including the closing level on the End Date (that is, the average of 19 closing levels)MarketPerformance7Market ChoiceGreater of zero or (End Level – Start Level) / Start Level(Capital protection applies even if Market Performance is negative)

HOW YOUR RETURN IS CALCULATED FOR THE PLUS PORTIONThe Start Level is recorded as theclosing level of the Index for your MarketChoice on the Start Date.01Your return onthe Maturity Dateis calculated asthe amount ofthe PLUS portionmultiplied by theMarket LinkedReturn.0504The Market Linked Returnis calculated as the MarketPerformance multiplied by 60%for Australian dollar or US dollardeposits, or multiplied by 50%for Sterling deposits.80203The End Level iscalculated using the19 closing levels of theIndex for your MarketChoice over the final18 months of the Termfor PLUS on the 13thday of each month.The last closing levelis on the End Date.Where the 13th dayof the month is nota business day, theclosing level of theIndex for your MarketChoice from thefollowing businessday will be used. Theaverage of these 19closing levels is theEnd Level.The percentage changefrom the Start Level to theEnd Level is the MarketPerformance.

FEES &CHARGESWITHDRAWING YOUR DEPOSITIf, at our discretion, we agree to you withdrawing your deposit prior to the Maturity Date, an administration feemay be charged (maximum amount of 250) per deposit (refer to page 13 of this brochure for further details).FEESThe relevant Standard Bank Offshore Entity may pay a referral fee of 1.25% to your financial advisor wherea referral is made, or up to 2.50% advice fee where your financial advisor provides advice to you, and fees ofup to 0.35% to other relevant intermediary platforms and service providers. However, these costs are alreadytaken into account in the overall returns stated in this brochure.THIRD PARTYFinancial advisors have their own terms and conditions. It is the obligation of any third party to advise you of anyadditional fees and charges which are applicable.RISK &OTHER CONSIDERATIONSCURRENCIES AND MINIMUM DEPOSITSQuantum PLUS 26 Deposit is available in three currencies. The minimum deposit amount depends on yourDeposit Currency: 10,0009US 15,000AU 15,000

CAPITAL PROTECTIONThe use of the word “protection” in relation to Quantum PLUS 26 Deposit refers to the obligation of the relevant StandardBank Offshore Entity, as applicable, to repay your original Sterling, US dollar or Australian dollar deposit, and the fixedinterest in respect of the Quantum portion of your original deposit in full, providing you retain your deposit for the Termuntil the relevant Maturity Date. In the unlikely event that the Standard Bank Offshore Entity which holds your depositbecomes insolvent, repayment is not guaranteed by any other party, including any other member of the StandardBank Group Limited. This could result in the loss of any return, including your original deposit.POTENTIAL RETURNSUnlike direct investments, Quantum PLUS 26 Deposit does not pay dividends and therefore there is anopportunity cost to depositors in this Product when compared to investing in the index constituents directly.If your Market Choice remains flat or rises between the Start Date and the End Date then your return maybe less than it would have been had you invested directly in the stock market, as depending on yourMarket Choice you may only receive a proportion of the Market Performance and the End Level usedto calculate the Market Performance is subject to averaging over the final 18 months of the depositTerm. However, unlike a direct investment in a stock market, Quantum PLUS 26 Deposit protectsyour deposit against potential stock market losses.10

AVERAGINGAveraging of the 19 closing levels to calculate the End Level as described as per above has the effect of smoothing outvolatility. If your Market Choice declines over the final 18 months of the Term of PLUS, averaging may produce a higherreturn than a return if no averaging applied. If your Market Choice rises over the final 18 months of the Term of PLUS,averaging may produce a lower return than a return if no averaging applied.INDEX LEVELFalling market over thefinal 18 monthsRising market over thefinal 18 monthsStart Level100100Observation date 1120120Observation date 2119121Observation date 3118122Observation date 4117123Observation date 5116124Observation date 6115125Observation date 7114126Observation date 8113127Observation date 9112128Observation date 10111129Observation date 11110130Observation date 12109131Observation date 13108132Observation date 14107133Observation date 15106134Observation date 16105135Observation date 17104136Observation date 18103137Observation date 19102138End Level with averaging applied111129Market Performance with averaging applied11%29%End Level if averaging had not been applied102138Market Performance if averaging had not been applied2%38%Figures are illustrative only for the purposes of demonstrating how averaging works. They are not intended to suggest how the Product willactually perform.11

CURRENCY CONVERSION RISKIf your Deposit Currency for this Product is different to the currency by which you measure your wealth (your basecurrency), you should be aware of the effect of currency fluctuations. When you convert your Deposit Currency back toyour base currency after the relevant Maturity Date, the impact of currency fluctuations may be either unfavourableor favourable to the overall value of your wealth.For example, if your Deposit Currency weakens relative to your base currency, your wealth measured in your basecurrency will decline and after the relevant Maturity Date you may receive back less when your proceeds areconverted back into your base currency, than you originally deposited. Conversely, if your Deposit Currencystrengthens relative to your base currency, your wealth measured in your base currency will be enhanced.INFLATION RISKIf the rate of inflation for your Deposit Currency exceeds the gain provided by Quantum PLUS 26Deposit, the real value measured in your Deposit Currency will reduce.SUITABILITYQuantum PLUS 26 Deposit presents a low risk of loss of some or all of a depositor’s capital in thecurrency of the deposit when held to the Maturity Date. Quantum PLUS 26 Deposit has an overallrisk rating of low to medium when considering both the risk of loss of capital and the risk of thereturns being below the rate of inflation, both measured in your Deposit Currency.RISKLowModerateHighWhen measured in South African rand terms or in terms of any currency otherthan the Deposit Currency, this Product is deemed to be of a moderate riskdue to the risk of fluctuations in the value of the South African rand or anycurrency other than the Deposit Currency against the Deposit Currency ofthe Product.12

This brochure does not represent advice or recommendationson the suitability of Quantum PLUS 26 Deposit to you.The Product may be suitable for clients who believe that therelevant Index will rise, but who seek capital protection on theterms available for this Product if this proves not to be the case.You or your financial advisor, as appropriate, should conduct yourown investigations into your Market Choice, and form your ownviews on the merits of a product linked to the performance of yourMarket Choice. You should not rely on any information given in thisbrochure when conducting your investigation into your Market Choice.Please contact your financial advisor if you are unsure of the suitability ofQuantum PLUS 26 Deposit for your needs.DEPOSIT TERMWith Quantum PLUS 26 Deposit you should be prepared to commit the Quantumportion of your deposit for one year, and the PLUS portion for five and a halfyears and one week. Therefore, you should ensure that you have sufficient fundsavailable to cover your cash and other financial needs until the relevant MaturityDates. Unless otherwise required by contract or law, early encashment of any part orall of your deposit will not generally be permitted and is only allowed under exceptionalcircumstances at the discretion of the relevant Standard Bank Offshore Entity and theProduct therefore should not be used for trading or speculative purposes. See “Productterms and conditions” on page 21 and “Other important information” on page 24 for furtherdetails. If early encashment is permitted by the relevant Standard Bank Offshore Entity, suchdeposit may only be withdrawn in its entirety for both the Quantum and PLUS portions and issubject to the terms described below.If the relevant Standard Bank Offshore Entity permits an early encashment, you may notreceive back as much as you originally deposited, or receive any gain even if the Market Choiceto which the PLUS portion of your deposit is linked to, has risen. The amount you receive backin respect of your deposit will depend on the market value of assets held by the relevant StandardBank Offshore Entity in respect of Quantum PLUS 26 Deposit. The market value of these assets will varydepending on prevailing market conditions and the time remaining to the End Date. In addition to this,the Standard Bank Offshore Entity which holds your deposit may charge an administration fee (maximumamount of 250) per deposit. Full details are available on request.13

14

AN EXAMPLEOF WHAT YOU COULD GET BACKIf you deposit 50,000 in Quantum PLUS 26 Deposit 20,000 will be placed in the Quantum portionand the remaining 30,000 will be placed in the PLUS portionQUANTUM PORTIONAfter one year, for Sterling deposits, you would receive back 20,250, which is your original 20,000 plus 250interest, reflecting an interest rate of 1.25% AER (1.2500% nominal).For US dollar deposits you would receive back US 20,500, which is your original US 20,000 plus US 500 interest,reflecting an interest rate of 2.50% AER (2.4658% nominal).For Australian dollar deposits you would receive back AU 20,350, which is your original AU 20,000 plus AU 350interest, reflecting an interest rate of 1.75% AER (1.7260% nominal).PLUS PORTIONOn the Maturity Date, you will receive back your original amount deposited in the PLUS portion. You may receivemore than this depending on how the relevant Index has performed. Your return on the Maturity Date over and aboveyour original deposit is the Market Linked Return. The table opposite shows potential returns based on differentperformance scenarios.15

AUSTRALIAN DOLLAR AND US DOLLAR DEPOSITSUS dollar examples work in the same way as this Australian dollar example. Note that the potential returns shown in thetable below are based on 60% of the Market Performance.Market PerformanceInitial DepositReturnMaturity ProceedsAER 30%30,0005,40035,4003.04% 0,000030,0000.00%-30%30,000030,0000.00%STERLING DEPOSITSNote that the potential returns shown in the table below are based on 50% of the Market Performance.16Market PerformanceInitial DepositReturnMaturity ProceedsAER 30%30,0004,50034,5002.56% 0,000030,0000.00%-30%30,000030,0000.00%

HOW TO APPLY FORTHE QUANTUM PLUS 26 DEPOSITTo benefit from Quantum PLUS 26 Deposit, please contact your Relationship Manager or financialadvisor or the relevant office listed in the “Contact us” section on page 19 of this brochure.OFFER CLOSES BY 29 APRIL 2020Quantum PLUS 26 Deposit is a limited offer product and will close on Wednesday, 29 April 2020 orearlier if fully subscribed. Your account must be opened and your application and cleared funds receivedby the relevant Standard Bank Offshore Entity by this date.ANY QUESTIONS?If you have any questions about Quantum PLUS 26 Deposit, or would like help with completing the applicationform, please do not hesitate to contact us at one of the offices listed in the “Contact us” section on page 19 of thisbrochure. Alternatively, you can visit https://international.standardbank.com.17

WHAT HAPPENS NEXT?Monies received will be held on deposit by the relevant Standard Bank Offshore Entity which accepts your deposituntil the Start Date, after which time both the original amount deposited and any accrued interest will then be placedinto Quantum and PLUS.PRIOR TO THE START DATE, MONIES DEPOSITED WILL EARN:0.30% AER (0.30% nominal)for Sterling deposits0.70% AER (0.6904% nominal)for US dollar deposits0.50% AER (0.4931% nominal)for Australian dollar depositsShortly after the Start Date you will be sent a deposit advice which will specify the Start Level of your Market Choice andyour Quantum and PLUS deposit amounts for the relevant currency of your deposit.ON THE MATURITY DATES:Repayment of the Quantum portion and its accrued interest will be made on 13 May 2021.Repayment of the PLUS portion and any returns will be made on 20 November 2025. No further income will accruefor the period between the End Date and the Maturity Date for the PLUS portion, and the AERs stated in this brochurealready take account of this period.On the respective Maturity Dates, funds will be paid into your originating account, which may be a low or non-interestbearing account

Financial advisors have their own terms and conditions. It is the obligation of any third party to advise you of any additional fees and charges which are applicable. FEES & CHARGES CURRENCIES AND MINIMUM DEPOSITS Quantum PLUS 26 Deposit is available in three currencies. The minimum de