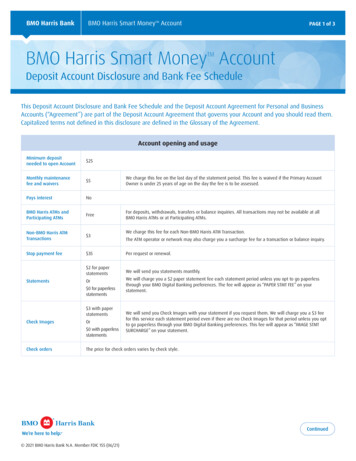

Transcription

Online Check DepositUser Manual

THIS IS A CONFIDENTIAL DOCUMENT THAT YOU SHOULD MAINTAIN IN A SECURELOCATIONThe information contained in this manual is the property of SunTrust Banks, Inc.Reproduction, manipulation, adjustment or transfer transmission, either in part orin whole, is prohibited without prior written permission from SunTrust Banks, Inc.SunTrust Bank, Member FDIC. 2019 SunTrust Banks, Inc. SUNTRUST and theSunTrust logo are trademarks of SunTrust Banks, Inc.

Online Check Deposit: User ManualTable of ContentsGetting Started . 1Maintaining Security . 1Your Responsibility for Maintaining Security. 1System Access . 1IDs and Passwords. 2Inactivity Time Out . 2Scanner Time-Out Feature . 2Important Notes . 2Understanding Online Check Deposit Service . 3Secure Storage for Deposited Checks . 4Using Online Check Deposit . 5Eligible Items Accepted . 5Ineligible Items Not Accepted . 5Misread Information . 6Serious Scanner Errors . 6Check Routing Symbols . 6Preparing Your Deposit . 7To Prepare Your Deposit . 7The Welcome Page . 8Scanner Setup . 10To Download the Scanner Drive . 11To Install the Scanner Drive . 11Scanner Guidelines . 11Deposits . 12Deposit Types . 12To Create a New Deposit . 12Scanning Deposit Items . 13Preparing Items for Scanning . 13To Create a New Deposit . 13Responding to Scanner Errors . 14To Recover From a Scanner Error: . 14Correcting a Deposit . 14Identifying Required Corrections. 14Editing Item Details . 17Balancing a Deposit . 18Changing the Declared Deposit Amount . 19To Change the Declared Deposit Amount . 19Editing Deposit Details . 19To Edit the Deposit Details . 19To Add Additional Items to a Deposit. 20Rearranging Deposit Items . 20To Delete an Item From a Deposit . 21To Delete a Transaction From a Deposit . 21To Delete a Deposit . 21Correcting Deposit Items . 21Manipulating Image Views . 21i

Online Check Deposit: User ManualTo Enter Field Data . 22Completing Custom Field Data . 23To Enter Custom Field Data . 23Handling Unknown Items/Reclassifying Items . 23To Specify the Correct Item Type for an Item . 23Handling Duplicate Items . 23To Respond to a Duplicate Item Error . 25Handling Failed Image Quality Items . 25To Respond to a Failed Image Quality Error . 25Completing a Deposit . 26To Complete a Deposit . 26Supervisor Tasks . 27About Deposit States . 27To Review the Deposit Information for a Selected Deposit. 28To Access the Error Filter. 29Reviewing Deposit Items . 29To Review a Specific Deposit Item: . 29Reviewing a Deposit Item's History . 29To Review a Specific Deposit Item’s Processing History: . 30Assigning a Deposit . 30To Assign a Specific Deposit to Another User . 31To Disapprove a Deposit . 31Transmitting a Deposit. 32To Transmit a Deposit . 32Adjusting a Deposit Amount. 33To Adjust a Deposit Amount. 33Generating Reports . 33To Create a Report. 34Viewing Report Creation Settings . 34To View the Settings Used to Generate a Report . 35Creating Online Reports . 35To Create a Deposit Summary Report . 35To Create a Deposit Details Report . 35Researching an Item . 36To Research an Item . 36To Store Research Results . 37Creating an Item Research Report . 38To Create a Report Based on Your Item Research Results . 38Troubleshooting . 38Responding to Scanner Time-outs . 38Responding to Serious Scanner Errors . 38If You Need Assistance . 39Online . 39Technical Support . 39Client Services Support . 39Appendix A: Reports . 40Deposit Summary – Sample Report . 40Deposit Details by Deposit Number – Sample Report . 41ii

Online Check Deposit: User ManualSummary of Remittances by Account – Sample Report . 42Exception Item Export – Sample Report . 43Detailed Item Export – Sample Report . 44iii

Online Check Deposit: User ManualGetting StartedMaintaining SecurityYour company must designate at least one company security administrator(CSA) to control account access and transactional capabilities of any userswithin your company. Your CSA will set up users, locations, entitlements,and permissions. You will receive your User ID and temporary passworddirectly from your company’s designated CSA.Your Responsibility for Maintaining SecurityYour company must maintain appropriate internal controls over access toand use of Online Check Deposit. Each CSA has access to the Audit Reportfor system usage and activity information. This includes exceptionactivity, successful attempts to use the system, and completed activities.If you discover or suspect any fraudulent activity with respect to yourcompany’s Online Check Deposit service or accounts, disable any affecteduser ID immediately, and please contact your company’s TreasuryManagement Client Services Specialist at 866.448.6394, option 2.Representatives are available from 8:00 a.m. – 8:00 p.m. ET, Mondaythrough Friday on bank business days.System AccessOnline Check Deposit can be accessed on the Internet sit1!SunTrust recommendsthat you create a userID with CSA entitlementfor daily use. Keep allIDs and passwords in asecure location, and donot share passwordswith other users.

Online Check Deposit: User ManualIDs and PasswordsNon-SSO OnlyDoes not apply when SunTrust SunView is enabled.To access Online Check Deposit, you will need your User ID and Password.You are responsible for maintaining the confidentiality of your userauthorization credentials. Do not share your User ID and Password withanyone. System parameters for password usage have been defined to helpmaintain the security of your company’s information. Guidelines basedupon these parameters include: New users must have a user ID and password to access the system forthe first time. There is a minimum User ID length of seven characters with amaximum length of 20. User Ids must contain at least one alphacharacter, one numeric character, and cannot contain specialcharacters. User IDs are not case-sensitive and cannot be changedonce created. The password must be seven characters in length. Passwords are casesensitive, should contain at least one alpha character, at least onenumeric character, and cannot contain special characters. You mustchange your password after your initial login. Sign-on information is case-sensitive. Disabled User ID: The system will disable your user ID after fiveunsuccessful attempts to sign on. Contact your CSA to reset your userID and password.Inactivity Time OutIf your session is idle for more than 20 minutes, the system will time outdue to inactivity and your access will be suspended. When a session timesout, the message Your session has timed out due to inactivity will appearand you will be returned to the login screen. If a timeout occurs, you willhave to sign back onto the system. Scanned data that has not beentransmitted prior to time-out will be saved, but will need to betransmitted when ready.Scanner Time-Out FeatureWhen an Online Check Deposit operator stops scanning for approximatelyone minute, the scanner will time out. The operator must click Add Itemsto resume scanning checks. If a scanner times out, the deposit state willremain in an Open-Processing state. You will simply need to continuescanning and submit when ready.Important NotesWhen using Online Check Deposit, please do not use your browser’snavigation button (back, forward) to navigate. Instead, use the tabs andlinks provided in the system.2!If your company hassingle sign onpermissions, you willbe automaticallylogged into OnlineCheck Deposit.!Click Logoff at the topright of any page toend your Online CheckDeposit session andclose the connectioncompletely.

Online Check Deposit: User ManualUnderstanding Online Check Deposit ServiceOnline Check Deposit is a depository service that allows you to createcheck image files that can be electronically transmitted to SunTrust fordeposit. The service allows you to make multiple deposits per account perday. Payments received in the afternoon, which normally would have tobe delivered for deposit the next day, can be transmitted to SunTrust forsame-day credit. The service allows you to capture images of remittancecoupons for reconciliation of your deposits. The service may not be usedto deposit ineligible items. A list of items that are eligible and ineligiblefor transmission through the service is provided in this manual.Imaged check transactions received by SunTrust before 10:30 p.m. ET aredeposited to your account the same business day. Deposits received afterthe deadline will be considered deposited on the next business day.Deposits submitted on a Saturday, Sunday, or holiday will be considereddeposited on the next business day following the weekend or holiday.The service may not be used outside of the United States, U.S.territories, U.S. military bases, or U.S. embassies.We are not liable for any delays or errors in transmission of the images orassociated information. If the service is not available, you must make yourdeposits by another method, such as an in-person deposit at one of ourbranches or a deposit by mail. If you must make a deposit by other meansdue to service being unavailable, you should deposit only checks andshould retain in your possession the other documents you would normallyscan with an Online Check Deposit deposit.We will make funds for each substitute check or electronic item that weprocess for deposit to your account available to you under the sameschedule that would have applied if you had deposited the original papercheck to your account.3!You can make multipledeposits per accountper day.

Online Check Deposit: User ManualSecure Storage for Deposited ChecksOriginal checks that have been imaged and deposited through OnlineCheck Deposit must be stored in a secure place until destroyed. Pleasefollow your company’s procedures for storage of deposited checks.Below are some recommendations for secure storage and destruction ofdeposited checks: Locate or purchase the following equipment for the Online CheckDeposit service in addition to your PC, printer, and scanner:–a secure storage facility, such as a safe or lockable cabinet forstoring processed checks–a paper shredder or other reliable means of destroying processedchecks Develop internal procedures your employees must follow beforebeginning the scanning process and after deposit processing iscompleted. Please note that SunTrust requires you to retain the originals ofscanned checks in a secure storage facility for a period as designatedby your company policies. However, we recommend that you storethe items no less than 30 calendar days. If you choose to store beyond30 days, we recommend that you mark the front of the item asPreviously Deposited. Consider developing an internal form that can be attached to batchesprocessed on the same date to record the processed date and thedestruction date for these batches.We strongly encourage implementing control procedures for the handlingof processed checks from their initial stage of placement in securestorage through the final stage of the destruction process as one of theways to reduce risk and opportunity for fraud.4

Online Check Deposit: User ManualUsing Online Check DepositUse of Online Check Deposit service involves important preliminary stepsin preparing your deposits, as well as steps to ensure the security oforiginal checks, images, and associated information once a deposit hasbeen completed.The terms and conditions in the agreement that governs your company’suse of the service require that you develop internal procedures to be usedin conjunction with the procedures described in this manual.Before you begin using the service, please obtain and review yourcompany’s internal procedures to ensure that you understand therequirements and your responsibilities for use of the service.Eligible Items AcceptedThe following items are acceptable for deposit through Online CheckDeposit: Checks denominated in U.S. currency that are drawn on financialinstitutions located in the U.S. Money orders Traveler’s checks Cashier’s checksIneligible Items Not AcceptedItems not eligible for deposit through Online Check Deposit must bedelivered to the bank for deposit. The following are examples of items noteligible for deposit through Online Check Deposit: Savings bonds Coupons (e.g. bond coupon, non-financial remittance coupon) Foreign items Items with illegible or missing account numbers or bank routingnumbers in the Magnetic Ink Character Recognition (MICR) line at thebottom of the check Items in document carriers Remotely-created checks5!Certain items are noteligible for OnlineCheck Deposit and willrequire you to deliverto the bank fordeposit.

Online Check Deposit: User ManualMisread InformationThe MICR line at the bottom of a check contains the account number,bank routing number, and check number information, all of which arerequired by banks for check processing.Online Check Deposit analyzes checks for the common features, includingthe information provided by the check’s maker, which includes: 1. Check number 2. Payee 3. Courtesy amount 4. Legal amount 5. Maker’s /drawer’s signature 6. Routing/transit number 7. Account numberWhen information is present, but not readable, Online Check Depositbrings this condition to your attention by displaying the warning iconnear the error field. Please see Handling Failed Image Quality for how tohandle these errors.Serious Scanner ErrorsIf your system has been configured to disable a check scanner when aserious error occurs, you will see a new error message. You will not beable to continue using the scanner until you contact the TechnicalServices Group for assistance and provide the listed scanner information.Check Routing SymbolsThe check routing symbolsandsurrounding the routing/transitnumber are used to distinguish this number from the account number. Ifboth symbols are missing, Online Check Deposit will prompt you to removethe check from your deposit. A check with this deficiency should be takento the branch for processing or returned to the check’s maker.6

Online Check Deposit: User ManualPreparing Your DepositBefore you log in to Online Check Deposit, follow these steps forpreparing your deposit: To Prepare Your Deposit1. Before you log in to Online Check Deposit, confirm that all checksbeing batched for imaging are acceptable for deposit throughOnline Check Deposit.2. Group your checks in batches.3. For each batch, follow these guidelines: Remove any attachment, including paperclips and staplesfrom the checks. Face checks in the same direction. Run a list tape to establish the expected total amount of thedeposit. Place the list with the batch until you are ready to scan thechecks. You will enter this total in a field on the Declared Amountscreen in Online Check Deposit.7

Online Check Deposit: User ManualThe Welcome PageAfter you log in/launch Online Check Deposit successfully, the Welcomepage will display. From the Welcome page, you can access commondeposit operations and see any messages that have been sent to you or allapplications users.1. Home – allows you to access the Home page2. Deposits - allows you to view a list of current deposits, edit andcomplete open deposits, and create new deposits3. Reports – allows you to generate and view reports4. Research – allows you to query information about completeddeposits or specific deposit items based on user role.5. User Information – displays your user information and

Online Check Deposit: User Manual 3 Understanding Online Check Deposit Service Online Check Deposit is a depository service that allows you to create check image files that can be electronically transmitted to S