Transcription

Money Stock Control and ItsImplications for Monetary Policyby ALBERT E. BURGER, LIONEL KALISH III, and CHRISTOPHER T. BABBIn the last two years there has been an increased concern within the Federal Reserve Systern about the role of monetary aggregates in policy, and about the operating procedures irnpiicit in the policy directive of the Federal Open Mark-ct Committee. A collection of studies onthese subjects, Onyx MARKET PoLIcmEs AND OpEISATJNC PROCEDURES STArE STUDIEs, was pubUs/med by the Board of Governors in 1971. Other economists have presented methods for analyzing the effects of different growth rates of money on policy objectives. An equally importantsubject is the controllability of different aggregates and the effect tlits controllability wouldhave on the ability of policyrnakers to achieve policy objectives.-This article presents a procedure that could he used by the Federal Reserve System to control the growth of the money stock and a method for evaluating the effect of this control procedure on the ability of policymakers to achieve their policy objectives.Agrowing volume of research has demonstratedthat changes in the money stock are a reliable summary measure of the effect of monetary policy actionson economic activity. One result of this research hasbeen the suggestion that the monetary authoritiescould best achieve ultimate policy objectives, such asfull emnployment and stable prices, by controlling thegrowth rate of the money stock. Such a suggestion re(luires (1) an operational procedure for controllingmoney, and (2) a means of assessing the implications of such a procedure for the ability of policymakers to achieve their policy objectives.A possible procedure for monetary policy includes:(1) The Federal Open Market Committee (FOMC)decides upon the ultimate objectives of monetarypolicy, such as desired growth rates for real outputand prices, and a desired level of employment.(2) These ultimate objectives are related to a growthrate of money, and the FOMC issues a “direc The authors wish to express their thanks to the many peoplewho read earlier drafts of this article. A special obligationis due the following economists who, in working sessions orotherwise, offered specific comments: Professors MiltonFriedman, Arnold Zellner, Robert Gordon, Richard Zecher,Stanley Fisher, Allan Mcltzer, Michele Fratianni, WilliamYohe, David Fand, and Messrs. Paul Meek and WolfgangGebauer. As always, we benefited from comments and criticism of the research staff at the Federal Reserve Bank ofSt. Louis. The procedures and conclusions are the responsibility of the authors and do not necessarily reflect the viewsof any of the commentators on the article or the FederalReserve System.Page 6tive” to the Trading Desk to obtain this growthrate for money)(3) The Trading Desk uses open market operationsto achieve the growth rate of money which isconsistent with the policvmaker’s objectives.This article is concerned with the actual implementation of policy decisions. It is riot concerned withhow the policymakers decide upon their ultimate ob-jectives, or with the specific way in which these objectives are related to a growth rate for mnoney. Thepolicy objectives are taken as given. Converting policyobjectives into a desired growth rate of money requires information on the linkage between changes inthe growth rate of the money stock and the ultimateobjectives. Such informnation can be derived from competing models of incomne or spending determination.This article presents a procedure the Federal Reserve could use to control mnoney and a method forevaluating the effect of this control on the policymaker’s ability to achieve GNP objectives. The moneystock control procedure requires o’nly that the FederalReserve has information about the previous threemThe FOMC issues a policy directive to the New York Federal Reserve Bank. The Trading Desk at the New York Bankcarries out day-to-day open market transactions (purchaseand sale of Government securities) for the System, The textof each policy directive issued by the FOMC is made publicabout 90 days after each FOMC meeting and published inthe Federal Reserve Bulletin.

FEDERAL RESERVE BANK OF ST. LOUISmonth’s values of the money multiplier and the effectof reserve requiremnent changes on mnember bank reserv-es. Using a simulation technique, some emnpiricalevidence is presented on the control the Federal Reserve could expect to exercise, using this procedure,over the growth of the money stock, and the effect ofsuch control on the Federal Reserve’s ability to attainits policy objectives. The technical details of themoney stock control procedure, the simulatiomi procedure, and the development of the statistic for assessing the influence of money stock control on achievingpolicy objectives, are discussed in the Appendix tothe article and in a working paper of technical appendices available upon request from this Bank)OCTOBER 1971at the Federal Reserve, Treasury cash holdings, andother deposits and other Federal Reserve accountswill decrease the net source base. A complete listingof the sources and tmses of base money mind the relationships between the net source base, source base,amid monetary base arc’ given in Table I.The net source base is taken as the control variablefor the process.’ From the sources side, the majorcomnpomment of the net source base ( about 75 per cent)is Federal Reserve holdings of Government securities.The Federal Reserve is assumed to be able to aceuratc’ly mneasure and cietermimie the mnagnitude of thebase withimi a monthly period. Evidence on the accuracy with which the Federal Reserve has been able toforecast and measure the net source base is presentedMoney Stock Control ProcedureThere are two major ways in which the FederalReserve might operate to control the growth of money.One way is to estimnate the mnoney mnarket conditionsthat would be consistent with the growth rate ofmoney stated in the directive, and then operate toachieve these conditions in the money market. Thisapproach mnight involve choosing bounds for the Federal funds rate and free reserves and then operatingon a day—to-clay basis to maintain money mnarket conditions within these bounds. A second method ofmoney stock control, the omic discussed in this article,involves estimating the changes in thesource base (orsonic other reserve aggregate) required to achievethe policy determined grosvth path for money. TheFederal Reserve would then operate on a day-to-daybasis to cleternsine the growth of the source base)The money stock control procedure used in thisarticle is developed from a multiplier-base framnework,within which the mnoney stock ( M ) is expressed as:M mB.imi the workimig paper of technical appendices.5The money mnultiplier ( m ) summarizes all otherfactors involved in the mnonev supply process. Themommy mnultiplier responds to portfolio decisions bythe eosnmnercial banks, the Treasury, and the public.Also included in this formulation of the mtmltiplier arethe influences of reserve requiremnent changes, thediscount rate, and Regulation Q)In our mnoney stock control procedure the FederalReserve dlceidles upon the desired growth rate of‘l’he data requirements for controlling the net source base areas smiiall or smaller than any of the other major aggregatescommonly suggested as operating targets for the FederalReserve. Richard Davis has shown that out of a wide rangeof possible aggregate targets the nonborrowed base andnommborrowed reserves woold he the easiest targets for theDesk to hit. These two targets are entirely exogeneous withrespect to open market operations. Contrary to other proposed targets, success in hitting these two targets does notdepend upon the Desk offsetting itemns whose movements arefimnetioaally related to open market operations. See RichardC. Davis, “Short-Run Targets For Open Market Operations,Open Market Policies and Operating Procedures-Staff Studies,Board of Governors of the Federal Reserve System, July1971, pp. 37-70.5Burger, Kalish, Babh, Working Paper No. 14. ThemoneyIn this expression B denotes the net source base andm represents the money multiplier. An increase inFederal Reserve holdings of securities, float, the goldstock, and Treasury currency outstanding will increasethe net source base. An increase in Treasury deposits Albert E. Burger, Lionel Kalish III, and Christopher T.Babb, “Money Stock Control mmd Its Implications for Monetary Policy: Technical Appendices,” Working Paper No. 14,Federal Reserve Bank of St. Louis, October 1971.3These two methods of money stock control are not independent of each other. Open market actions taken to determine money mnarket conditions will influence the growth ofthe base, and actions taken to influence the base “ill affectshort-term money market conditions. See, Albert E, Burger,“The Implementation Problem of Monetary Policy, thisReview (March 1971).multiplier associated with the net source base is:1 km(sb) (1 t d) kwhere k and d, respectively, are the ratios of currency heldby the public and L’S. Government deposits at eommoercialbanks to the demand deposit component of the moneystock.r, b, and t, respectively, arc the ratios of hank reserves.member hank borrowings, and time deposits to enmnmercialhank deposit liabilities (excluding interhank deposits).The reserve ratio (through the dependence of banks’ desired excess reserves), the borrowing ratio and the timedeposit ratio are all dependent upon credit market interestrates.This formulation of the muoney umultiplier is taken from theBrunner-Meltxer nonlinear muoney ssspply hypothesis. KarlBmunner and Allan II. Meltzer, ‘Liquidity Traps for Money,Bank Credit and Interest Rates,” Journal of Political Eeossomy (january/February 1968), pp. 1-37.Page 7

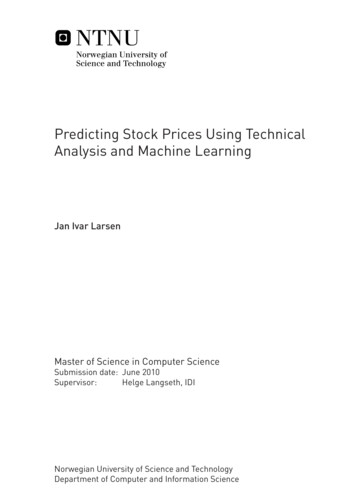

FFEDERAL RESERVE BANK OF ST LOUISOCTOBERTable ISources and Uses of the Net Source Base,the Source Bose,and the Monetary Base, January 1971millions of dollars IusesSom.’cecFederal Ress.-rve holdings a’Government secssmeesMember bank deposes at 62.’ 41Faderal Rese’ve float3,636Gold stock plus speciald.aw:ng rights11,132Treasery cursency o tstanding7,157Other Feaas at Rcs,’rve Assets1,216LessTsc’anui y cash holdings445Treosury deposits at Federal Reses ye Banks1.028Po’e’gn deposits at Federat Reservs Banks155Other deposits at P.R.pl.,s P.R. liabimities andcoplal2,894Ecuals.Net source base580.760PlumFederal Rrsurve discountsand advanceu370Eqs,ais.Source bose581130PlunFederal Raserve Banks lessdisroe.its and cdvancescurancy held ny banksCur’ency held by It,e publkRessve adjustmentEqua IsMonetary baseReserve adjustmentEqs. otsMonetary 4,956 24,5687.092‘9,100the expected squared deviation of themonthly value of money from its desired growth path. The net source baseis assumed to be controllable on a dailyaverage monthly basis; therefore, within our control procedure monthly average multipliers are forecast, Havimigpredicted the value for the month’smoney multiplier, and given the desiredlevel for the money stock in that mouth,the average monthly value for the netsource base necessary to achieve thedesired growth of money is determined.bor000sttn.L! the MonewMultiplierEquo’n:Net saurce basePlus:Federal Reserve diecounts and advancesEquals’Saurce basePlus:‘ut,i ‘—Is,!.money, converts this growth rate into desired moneystock levels for the control periods, and forecasts themoney mnultiplier (m) for the control periods. Thenduring the control periods, the Federal Reserve usesopen market operations to attain the net source base(B) such that the product (mB) equals the desiredmoney stock levels. Implementing mnonetary policyunder such a money stock control procedure requiresthree considerations: (1) the length of the controlperiod; (2) a procedure for forecasting the moneymultiplier; and (3) the response to previous errors inmoney stock control. 80,160Definitional method — Themultiplier-base framework istreated as an accounting iden3.826tity. Some of the ratios of the 84,956multiplier are forecast using information about the variouscomponents (for example, Treasury deposits) acquired by theDesk in its daily operations. Other elements ofthe ratios are treated as being equal to theirprevious values with some adjustment for trend7or seasonal variation.581,1 3C(1)(2) Regression method—The money multiplier isexpressed as a function of variables that areknown or are under the policy control of theFederal Reserve at the thne each forecast ismade. This relationship is estimated each periodby multiple regression analysis.(3) Behavioral method— Each of the ratios of themultiplier is expressed as being dependent uponother variables such as interest rates, policyinstruments, and other factors influencing thedeposit behavior of the banks and the public.This procedure requires predicting these othervariables.The niaximum acceptable time period for forecastsof the multiplier depends upon the relationship between changes in money and changes in economicactivity. Empirical evidence indicates that quarter-toquarter changes in the growth rate of money influence economnic activity. Therefore, the maximum timeperiod over which the Federal Reserve would aim tocontrol the money stock \vould be a quarterly period.Such an assumption, however, leaves open the possibility of sharp fluctuations in the growth of momieyover the quarter. Therefore, it is further assumed thatas an operating strategy, it is preferable to minimizeNext period’s multiplier might beforecast by any one of the followingmethods:370Control PeriodPage 81971In this article, the second method is used. Eachmonth’s multiplier is forecast using the three-monthmoving average of past values of the multiplier, reserve adjustment magnitude in the forecast month,7See Leonall C. Andersen, “A Study of Factors Affecting theMoney Stock: Phase I,” Federal Reserve Bulletin (October1965),p. 1379; and WilliamG. DeWaid, “Monetary Controland the Distribution of Money,” unpublished Ph.D. thesis,University of Minnesota, 1963.

FEDERAL RESERVE BANK OF ST. LOUISOCTOBER1971dummy variables to account for seasonal factors, andan adjustment for autoeorrelation. The values of theseindependent variables are kno\vn to the Federal8Reserve.Re;spon.se to Prevrou.s Errors inMon.r.y Stoek Cou.trolIf there are errors in the forecasts of the moneymultiplier, the desired growth of money and the controlled growth of money will not he the same in everyperiod. Under these conditions, further information isrequired to determine the optimal setting for the netsource base. Suppose in period tm the money managers over-predict the money multiplier. Consequently,the achieved growth of money is less than the desiredgrowth rate. What is the optimal setting for the netsource base in period t ? Should the money managers1ignore the shortfall of money in t ? Should they try1and make up the shortfall of money in t by settingthe net source base in t so that the grostth of money2is above the desired growth path? If they try andmake up the shortfall, should they operate to makeup all of the gap in t , or only part of the gap in t22and the remainder in succeeding periods?There are many possible error-response mechanisms. Our procedure assumes that the money managers assign proportionally more weight to large errorsin money stock control than small errors. Therefore,the error-response mechanism is designed to nminimizethe expected value of the squared deviations of con9trolled mnoney from its policy chosen growth path.At the end of each control period, the money managers compute their error in mnoney stock control.During the next control pei-iod the net source base is1set approximately to make up last period’s error. The money stock control procedure is illustrated inthe following exhibit.8The Federal Reserve sets member hank reserve requiremneats. Since, under the current lagged reserve requirementprocedure the effect on member bank required reserves ofa change in reserve requirements effective this week dependsupon member bank deposits subject to reserve requirementstwo weeks earlier, the Federal Reserve can accurately determine the effect of a change in reserve requirements 0mmthe reserve adjustment magnitude.9This error-response mechanism assumes a quadratic lossfunction for the money managers. The control periods’ basevalues are detemsined by minimizing the expected value ofthe loss function with respect to B. For a discussion of thisprocedure see the Appendix at the end of this article,iojf only the growth rate of money mattered, then the moneymanagers would not attempt to make up last periodserror in the level of money. Each period the money mangers would try to move along the dessred growth path fromwhere they were last period,Simulationof Money Stock Control and GNPHow would the mnoney stock control achieved bythis procedure affect the ability of the Federal Reserve to achieve policy objectives? To gain some information on this question, the money stock controlprocedure was simulated over two sample periods,Page 9

FEDERAL RESERVE BANK OF ST. LOUISand the effects of these simulation restilts on GNP were analyzed. First, themethod and results of simulating theInoney stock comitrol procedure are presemitecl. Then, tIme method of relatingchamiges in money to GNP is discussed,and the results of simulating GNPwhen money is eomitrollec xvithout error are compared to the case wheremoney is controlled by our procedure.OCTOBERable IIElControlraiserryF hoaryM isApr Istock comitrol:(1) It vas assissued thaI the polic’vmnakers choosea cosmstasit 4 per ces mt seasossally adjusted asinualmoneoverthecontrolK 2)The Federal Reserve adjusts the netbase in the ctsrremi t loom sth to minimizepected value of the squared deviationachieved monthly stock level fmous the4 per cemit growth line. m2(3)Two control periods ‘vere chosemi, 1962 through1965 amid 1966 through 1969. The base periodswere chosen as fomsrt!i quarter 1961 ammd fourthquarter 1965.K 4)Each month, the mnomiev stock- achieved b ’thecontrol process (controlled mnonev) is eosi pmstedby taking the level of time net soum’ce base dIe—termnined by our operating strategy and multi—plvimig it by the value of the multi her thatactsmallv prevailed in that mrmosslh.To the cx—tent that the forecast mnultiplier is diflerent fromsourcethe exof theoriginal‘The desired growth rate of money was converted intodesired monthly levels in the following manner: (1) theaverages of money in 1VJ6 1 and TV/OS were taken as thebase period; (2) these base values were placed on December of 1961 and December 1965; (3) to compute the conversion factor for a 4 per cent growth rate we divided .04by 12 to yield .00333; and (4) each month’s desiredmoney stock level was equal to (base month) (basemonth) X (number of months out from base month) X(.00333). For examnple, December 1966 desired level equals(167.0999) (167.0999) (12) (.00333) - 173.78 billioa, where 167.0999 equals the average of the last threemonths of 1965.This procedure yields a simple 4 per cent gm’owth rateof money that appears as a straight line cia an arithmeticscale. When computing quartem’—to—quarter growth rates ofmoney, however, the desired rate will be below 4 per centnear the end of the period. The results of oar procedurewould not have been altered if we had used a compoundedannual rate for money.i2This implies the Desk aims slightly below the desiredgrowth path. See the Appendix at the end of this article.Page 10 200201202203204Forecast ChangMultiplierBa2.502 0252.50.40400872inActualBase LevelActualMu tsplserontoll ciMoney 80002502 502.502502.50 2000201 0202.0202.2204 080 4080.80808891 60tbe one that actually prevailed in that mnomith,the achieved level of mnonev is different fromtIme desired. fhe following method was used to simtmlate moneyforample of Money Stock ControlLie s dMon ySinrutotzon of the Money StockCrmti-ol Proceduregrowth rateperiod. mm1971The example in Table II, which may be use

Review (March 1971). at the Federal Reserve, Treasury cash holdings, and other deposits and other Federal Reserve accounts will decrease the net source base. A complete listing of the sources and tmses of base money mind the rela-tionships between the net source bas