Transcription

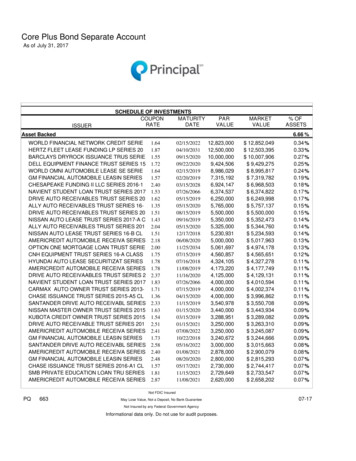

Core Plus Bond Separate AccountAs of July 31, 2017ISSUERSCHEDULE OF UE% OFASSETS6.66 %Asset BackedWORLD FINANCIAL NETWORK CREDIT SERIEHERTZ FLEET LEASE FUNDING LP SERIES 20BARCLAYS DRYROCK ISSUANCE TRUS SERIEDELL EQUIPMENT FINANCE TRUST SERIES 15WORLD OMNI AUTOMOBILE LEASE SE SERIEGM FINANCIAL AUTOMOBILE LEASIN SERIESCHESAPEAKE FUNDING II LLC SERIES 2016-1NAVIENT STUDENT LOAN TRUST SERIES 2017DRIVE AUTO RECEIVABLES TRUST SERIES 20ALLY AUTO RECEIVABLES TRUST SERIES 16DRIVE AUTO RECEIVABLES TRUST SERIES 20NISSAN AUTO LEASE TRUST SERIES 2017-A CALLY AUTO RECEIVABLES TRUST SERIES 201NISSAN AUTO LEASE TRUST SERIES 16-B CLAMERICREDIT AUTOMOBILE RECEIVA SERIESOPTION ONE MORTGAGE LOAN TRUST SERIECNH EQUIPMENT TRUST SERIES 16-A CLASSHYUNDAI AUTO LEASE SECURITIZAT SERIESAMERICREDIT AUTOMOBILE RECEIVA SERIESDRIVE AUTO RECEIVAABLES TRUST SERIES 2NAVIENT STUDENT LOAN TRUST SERIES 2017CARMAX AUTO OWNER TRUST SERIES 2013CHASE ISSUANCE TRUST SERIES 2015-A5 CLSANTANDER DRIVE AUTO RECEIVABL SERIESNISSAN MASTER OWNER TRUST SERIES 2015KUBOTA CREDIT OWNER TRUST SERIES 2015DRIVE AUTO RECEIVABLE TRUST SERIES 201AMERICREDIT AUTOMOBILE RECEIVA SERIESGM FINANCIAL AUTOMOBILE LEASIN SERIESSANTANDER DRIVE AUTO RECEIVABL SERIESAMERICREDIT AUTOMOBILE RECEIVA SEREISGM FINANCIAL AUTOMOBILE LEASIN SERIESCHASE ISSUANCE TRUST SERIES 2016-A1 CLSMB PRIVATE EDUCATION LOAN TRU SERIESAMERICREDIT AUTOMOBILE RECEIVA 9,6492,620,000 12,852,049 12,503,395 10,007,906 9,429,275 8,995,817 7,319,782 6,968,503 6,374,822 6,249,998 5,757,137 5,500,000 5,352,473 5,344,760 5,234,593 5,017,963 4,974,178 4,565,651 4,327,278 4,177,749 4,129,131 4,010,594 4,002,374 3,996,862 3,550,708 3,443,934 3,289,082 3,263,310 3,245,087 3,244,666 3,015,663 2,900,079 2,815,293 2,744,417 2,733,547 2,658,2020.34 %0.33 %0.27 %0.25 %0.24 %0.19 %0.18 %0.17 %0.17 %0.15 %0.15 %0.14 %0.14 %0.14 %0.13 %0.13 %0.12 %0.11 %0.11 %0.11 %0.11 %0.11 %0.11 %0.09 %0.09 %0.09 %0.09 %0.09 %0.09 %0.08 %0.08 %0.07 %0.07 %0.07 %0.07 %Not FDIC InsuredPQ663May Lose Value, Not a Deposit, No Bank GuaranteeNot Insured by any Federal Government AgencyInformational data only. Do not use for audit purposes.07-17

Core Plus Bond Separate AccountAs of July 31, 2017ISSUERSCHEDULE OF INVESTMENTSCOUPONMATURITYRATEDATENAVIENT STUDENT LOAN TRUST SERIES 2015DRIVE AUTO RECEIVAABLES TRUST SERIES 2ENTERPRISE FLEET FINANCING LLC SERIESWORLD OMNI AUTO RECEIVABLES TR SERIEGM FINANCIAL AUTOMOBILE LEASIN SERIESAMERICREDIT AUTOMOBILE RECEIVA SERIESCARMAX AUTO OWNER TRUST SERIES 2017-3SOCIAL PROFESSIONAL LOAN PROGR SERIEAMERICREDIT AUTOMOBILE RECEIV SERIESSANTANDER DRIVE AUTO RECEIVABL SERIESNAVIENT STUDENT LOAN TRUST SERIES 2017SANTANDER DRIVE AUTO RECEIVABL SERIESGREAT AMERICA LEASING RECEIVA SERIES 2SBA TOWER TRUST SERIES 2014-1A CLASS CFORD CREDIT AUTO LEASE TRUST SERIES 16AMERICREDIT AUTOMOBILE RECEIVA SERIESCAPITAL AUTO RECIEVABLES ASS SERIES 16BARCLAYS DRYROCK ISSUANCE TRUS SERIECNH EQUIPMENT TRUST SERIES 2014-C CLASNOMURA HOME EQUITY LOAN INC SERIES 20GM FINANCIAL AUTOMOBILE LEASIN SERIESWORLD FINANCIAL NETWORK CREDIT SERIESOCIAL PROFESSIONAL LOAN PROG SERIESCAPITAL AUTO RECEIVABLES ASSET SERIESCAPITAL AUTO RECEIVABLES ASSET SERIESNAVIENT STUDENT LOAN TRUST 201 SERIESCAPITAL ONE MULTI-ASSET TRUST SERIES 2SOCIAL PROFESSIONAL LOAN PROGR SERIECARMAX AUTO OWNER TRUST SERIES 2014-4AMERICREDIT AUTOMOBILE RECEIVA SERIESGM FINANCIAL AUTOMOBILE LEASIN SERIESMMCA AUTOMOBILE TRUST SERIES 2014-A CONEMAIN DIRECT AUTO RECEIVABLE SERIESAMERICREDIT AUTOMOBILE RECEIVA SERIESHERTZ FLEET LEASE FUNDING LP SERIES 20COUNTRYWIDE ASSET-BACKED CERT SERIESLM STUDENT LOAN TRUST SERIES 2013-B RKETVALUE 2,501,303 2,381,730 2,329,501 2,223,022 2,198,089 2,163,540 2,099,160 2,047,317 2,013,309 2,012,385 1,999,995 1,982,704 1,904,136 1,865,549 1,826,837 1,766,556 1,757,243 1,750,273 1,650,449 1,416,690 1,391,635 1,375,298 1,236,066 1,113,767 1,049,941 1,045,834 1,013,859 1,008,108 1,005,298 1,003,170 995,720 985,430 943,355 922,900 900,249 872,070 865,206% OFASSETS0.07 %0.06 %0.06 %0.06 %0.06 %0.06 %0.06 %0.05 %0.05 %0.05 %0.05 %0.05 %0.05 %0.05 %0.05 %0.05 %0.05 %0.05 %0.04 %0.04 %0.04 %0.04 %0.03 %0.03 %0.03 %0.03 %0.03 %0.03 %0.03 %0.03 %0.03 %0.03 %0.03 %0.02 %0.02 %0.02 %0.02 %Not FDIC InsuredPQ663May Lose Value, Not a Deposit, No Bank GuaranteeNot Insured by any Federal Government AgencyInformational data only. Do not use for audit purposes.07-17

Core Plus Bond Separate AccountAs of July 31, 2017ISSUERSCHEDULE OF INVESTMENTSCOUPONMATURITYRATEDATEWAMU ASSET-BACKED SERIES 2006-HE1 CLAMASTR ASSET BACKED SEC SERIES 2003-WMNISSAN AUTO RECEIVABLES OWNER SERIESCARMAX AUTO OWNER TRUST SERIES 2014-4FIRST NLC TRUST SERIES 2005-1 CLASS M1AMERIQUEST MORTGAGE SECURITIES SERIEDRIVE AUTO RECEIVABLES TRUST SERIES 16SAXON ASSET SECURITIES TRUST SERIES 20CAPITAL ONE MULTI-ASSET TRUST SERIES 2SATANDER DRIVE AUTO RECEIVABLE SERIESSPECIALTY UNDERWRITING & RESID SERIESOPTION ONE MORTGAGE LOAN TRUST SERIEAMERICREDIT AUTOMOBILE RECEIVA SERIESHYUNDAI AUTO RECEIVABLES TRUST SERIESNEW CENTURY HOME EQUITY LOAN T SERIESANTANDER DRIVE AUTO RECEIVABL SERIESSANTANDER DRIVE AUTO RECEIVABL SERIESSANTANDER DRIVE AUTO RECEIVABL SERIESLONG BEACH MORTGAGE LOAN TRUST SERICDC MORTGAGE CAPITAL TRUST SERIES 200FNMA SERIES 2003-T2 CLASS A1ENTERPRISE FLEET FINANCING LLC SERIESMASTR ASSET BACKED SEC SERIES 2003-WMCHASE FUNDING MORTGAGE LOAN AS SERIEVOLKSWAGEN AUTO LOAN ENHANCED SERIESLM STUDENT LOAN TRUST SERIES 2014-A CTOTALAsset ,96125,02422,306 796,167 756,465 652,503 651,876 614,431 602,484 600,147 522,469 504,005 408,318 405,008 396,212 302,444 274,957 259,873 236,445 184,881 166,116 163,243 159,624 148,951 93,729 72,738 43,026 25,015 22,309 000 43,341,709 41,908,236 40,147,570 32,492,403 28,447,091 18,806,246 15,880,858 14,535,8780.02 %0.02 %0.02 %0.02 %0.02 %0.02 %0.02 %0.01 %0.01 %0.01 %0.01 %0.01 %0.01 %0.01 %0.01 %0.01 %0.00 %0.00 %0.00 %0.00 %0.00 %0.00 %0.00 %0.00 %0.00 %0.00 %60.91 %Bonds & NotesUS TREASURY N/BUS TREASURY N/BUS TREASURY N/BUS TREASURY N/BUS TREASURY N/BUS TREASURY N/BUS TREASURY N/BXLIT LTD% OFASSETS1.16 %1.13 %1.07 %0.87 %0.76 %0.50 %0.43 %0.39 %Not FDIC InsuredPQ663May Lose Value, Not a Deposit, No Bank GuaranteeNot Insured by any Federal Government AgencyInformational data only. Do not use for audit purposes.07-17

Core Plus Bond Separate AccountAs of July 31, 2017ISSUERSCHEDULE OF INVESTMENTSCOUPONMATURITYRATEDATEGOLDMAN SACHS GROUP INC SERIES MBANK OF NEW YORK MELLON SERIES EINTESA SANPAOLO SPA SERIES 144AVERIZON COMMUNICATIONS INC SERIES WISKANDINAVISKA ENSKILDA SERIES EMTNUS TREASURY N/BUS TREASURY N/BANHEUSER-BUSCH INBEV FINUS TREASURY N/BTELEFONICA EMISIONES SAUDIAMOND 1 FIN DIAMOND 2 SERIES 144AUS TREASURY N/BCOMCAST CORPUS TREASURY N/BUS TREASURY N/BUBS GROUP AGJPMORGAN CHASE & COBRIGHTHOUSE FINANCIAL INC SERIES 144AUBS GROUP FUNDING SERIES 144ACREDIT SUISSE GROUP AGRECKITT BENCKISER TSY SERIES 144ADISCOVER BANK SERIES BKTNBANK OF NEW YORK MELLON SERIES FMORGAN STANLEY SERIES MTNCITIGROUP INCSOUTHERN CO SERIES BBANK OF AMERICA CORP SERIES GMTNANHEUSER-BUSCH INBEV FINROYAL BANK OF SCOTLND GRP PLCCVS CAREMARK CORP SERIES WIPETROBRAS GLOBAL FINANCESHIRE ACQ INV IRELAND DAROCK-TENN COKRAFT HEINZ FOODS COPRUDENTIAL FINANCIAL INCBNP PARIBAS SERIES 144AROYAL BANK OF SCOTLND GRP 0006,115,0005,590,0005,610,0005,700,000MARKETVALUE 13,809,675 12,483,785 11,522,696 11,511,662 10,900,050 10,423,738 10,023,543 9,533,494 9,104,003 8,414,061 8,319,468 8,067,936 8,035,885 7,942,590 7,841,613 7,783,375 7,765,326 7,664,047 7,586,379 7,555,914 7,515,887 7,457,290 7,120,583 6,917,658 6,883,000 6,879,209 6,852,525 6,676,645 6,598,526 6,541,584 6,424,638 6,350,100 6,325,195 6,236,046 6,121,050 6,100,875 6,020,625% OFASSETS0.37 %0.33 %0.31 %0.31 %0.29 %0.28 %0.27 %0.26 %0.24 %0.23 %0.22 %0.21 %0.22 %0.21 %0.21 %0.22 %0.21 %0.20 %0.20 %0.20 %0.20 %0.20 %0.19 %0.18 %0.18 %0.19 %0.18 %0.18 %0.18 %0.17 %0.17 %0.17 %0.17 %0.17 %0.16 %0.17 %0.16 %Not FDIC InsuredPQ663May Lose Value, Not a Deposit, No Bank GuaranteeNot Insured by any Federal Government AgencyInformational data only. Do not use for audit purposes.07-17

Core Plus Bond Separate AccountAs of July 31, 2017ISSUERSCHEDULE OF INVESTMENTSCOUPONMATURITYRATEDATEINDONESIA REPUBLIC OF SERIES 144AABBOTT LABORATORIESVERIZON COMMUNICATIONS INC SERIES WIUS TREASURY N/BTALISMAN ENERGY INCING US INCALLY FINANCIALONCOR ELECTRIC DELIVERYBARRICK GOLD CORPPPL WEM HOLDINGS PLC SERIES 144AMORGAN STANLEYUBS GROUP FUNDING SWITZE SERIES 144AUS TREASURY N/BBANK OF AMERICA CORP SERIES AACCO HLDGS LLC/CAP CORP SERIES 144AUBS GROUP FUNDING SWITZE SERIES 144AHSBC HOLDINGS PLCCC HOLDING GS V LLCPACKAGING CORP OF AMERICACONTINENTAL RESOURCES SERIES WIAT&T INCMICROSOFT CORPCOLUMBIA PIPELINE GROUP SERIES WIBANK OF AMERICA CORP SERIES MTNREYNOLDS AMERICAN INC SERIES WIHUMANA INCMACDONALD DETTWILER TERM LOANUS TREASURY N/BMORGAN STANLEYBANK OF AMERICA CORP SERIES MTNJP MORGAN CHASE & COXLIT LTDTURKEY REPUBLIC OFCENCOSUD SA SERIES 144AUNITEDHEALTH GROUP INCACTAVIS FUNDING SCSCONCHO RESOURCES LUE 5,995,119 5,992,629 5,964,271 5,858,215 5,848,778 5,823,675 5,794,050 5,775,080 5,761,628 5,684,312 5,648,440 5,619,922 5,601,531 5,589,675 5,502,000 5,496,228 5,474,997 5,472,954 5,456,987 5,374,250 5,234,519 5,220,407 5,213,091 5,178,011 5,047,401 5,006,105 4,983,953 4,943,750 4,942,979 4,931,701 4,915,878 4,868,591 4,856,989 4,855,500 4,797,548 4,796,359 4,795,313% OFASSETS0.16 %0.16 %0.16 %0.16 %0.16 %0.16 %0.16 %0.15 %0.15 %0.15 %0.15 %0.15 %0.15 %0.15 %0.15 %0.15 %0.15 %0.15 %0.15 %0.14 %0.14 %0.14 %0.14 %0.14 %0.14 %0.13 %0.13 %0.13 %0.13 %0.13 %0.13 %0.13 %0.13 %0.13 %0.13 %0.13 %0.13 %Not FDIC InsuredPQ663May Lose Value, Not a Deposit, No Bank GuaranteeNot Insured by any Federal Government AgencyInformational data only. Do not use for audit purposes.07-17

Core Plus Bond Separate AccountAs of July 31, 2017ISSUERSCHEDULE OF INVESTMENTSCOUPONMATURITYRATEDATEUS TREASURY N/BHCA INCAT&T INCAPPLE INCAMER AIRLINES SERIES 2015-1 CLASS AWELLS FARGO & COENLINK MIDSTREAM PARTNERJP MORGAN CHASE & COPHILIP MORRIS INTERNATIONALVIMPELCOM HOLDINGS SERIES 144AMICROSOFT CORPRUSSIAN FEDERATION SERIES REGSNABORS INDUSTRIES INC SERIES WIBECTON DICKINSON & COSABINE PASS LIQUEFATION SERIES WISHIRE ACQ INV IRELAND DAWELLS FARGO & COMPANY SERIES MTNGOLDMAN SACHS GROUP INCCITIGROUP INCVERIZON COMMUNICATIONS INCUNICREDIT SPA SERIES 144AUS TREASURY N/BCREDIT SUISSE GROUP AG SERIES 144ARECKITT BENCKISER TSY SERIES 144ABANCO SANTANDER SAZIMMER BIOMET HOLDINGS INCDTE ENERGY COUS TREASURY N/BPETROLEOS MEXICANOS SERIES 144APRUDENTIAL FINANCIAL INCQUALCOMM INCWM WRIGLEY JR CO SERIES 144AFIRST REPUBLIC BANKCOMCAST CORPDIAMOND 1 FIN DIAMOND 2 SERIES 144AANHEUSER-BUSCH INBEV FINUS TREASURY 00MARKETVALUE 4,755,434 4,750,413 4,740,284 4,739,195 4,708,342 4,708,227 4,692,526 4,643,504 4,633,019 4,617,250 4,616,899 4,609,000 4,573,902 4,518,901 4,513,081 4,506,557 4,442,489 4,430,346 4,420,192 4,416,747 4,403,053 4,396,950 4,386,234 4,335,229 4,311,384 4,271,982 4,220,079 4,214,932 4,189,305 4,145,612 4,140,264 4,133,784 4,109,377 4,094,446 4,067,277 4,039,020 3,992,500% OFASSETS0.13 %0.13 %0.13 %0.13 %0.13 %0.12 %0.13 %0.12 %0.12 %0.12 %0.12 %0.12 %0.12 %0.12 %0.12 %0.12 %0.12 %0.12 %0.12 %0.12 %0.12 %0.12 %0.12 %0.12 %0.12 %0.11 %0.11 %0.11 %0.11 %0.11 %0.11 %0.11 %0.11 %0.11 %0.11 %0.11 %0.11 %Not FDIC InsuredPQ663May Lose Value, Not a Deposit, No Bank GuaranteeNot Insured by any Federal Government AgencyInformational data only. Do not use for audit purposes.07-17

Core Plus Bond Separate AccountAs of July 31, 2017ISSUERSCHEDULE OF INVESTMENTSCOUPONMATURITYRATEDATEMPLX LP SERIES WIAT&T INCUS TREASURY N/BAPPLE INCLLOYDS BANK PLCMARATHON OIL CORPJPMORGAN CHASE & CO SERIES VFORTIS INC SERIES 144AARGENTINA REPUBLIC OF SERIES WIEL PASO PIPELINE PART OPCIT GROUP INCMARKEL CORPHCA INCTIAA ASSET MGMT FIN LLC SERIES 144ACOOPERATIEVE CENTRALE RAIFFEISGOLDMAN SACHS GROUP INCPIONEER NATURAL RESOURCES COANADARKO PETROLEUM CORPAT&T INCDIAMOND 1 FIN DIAMOND 2 SERIES 144AHOSPITALITY PROPERTIES TMORGAN STANLEYCHUBB CORPANHEUSER-BUSCH INBEV FINPANAMA REPUBLIC OFUS TREASURY N/BNXP BV/NXP FUNDING LLC SERIES 144ANATIONWIDE BLDG SOCIETY SERIES 144A21ST CENTURY FOX AMERICASOUTHERN CAL EDISON SERIES CBECTON DICKINSON & COUS TREASURY N/BSHERWIN-WILLIAMS CODOMINION ENERGY GAS HOLDINGSTIME WARNER INCANADARKO PETROLEUM CORPFORD MOTOR CREDIT CO 00MARKETVALUE 3,969,751 3,957,885 3,913,801 3,910,462 3,901,765 3,878,963 3,865,345 3,855,176 3,848,875 3,833,848 3,823,706 3,812,079 3,808,350 3,785,212 3,780,211 3,734,609 3,719,780 3,708,884 3,696,115 3,664,815 3,642,509 3,636,367 3,598,719 3,593,064 3,588,000 3,574,230 3,536,000 3,508,379 3,502,012 3,486,750 3,458,234 3,458,064 3,430,316 3,369,114 3,334,617 3,334,256 3,309,372% OFASSETS0.11 %0.11 %0.11 %0.11 %0.11 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.10 %0.09 %0.09 %0.09 %0.09 %0.09 %0.09 %0.09 %0.09 %0.09 %0.09 %Not FDIC InsuredPQ663May Lose Value, Not a Deposit, No Bank GuaranteeNot Insured by any Federal Government AgencyInformational data only. Do not use for audit purposes.07-17

Core Plus Bond Separate AccountAs of July 31, 2017ISSUERSCHEDULE OF INVESTMENTSCOUPONMATURITYRATEDATEGOLDMAN SACHS GROUP INCPUGET ENERGY INCUS TREASURY N/BROYAL BANK OF SCOTLND GRP PLCAMERICAN INTERNATIONAL GROUP ISIEMENS FINANCIERINGSMAT SERIES 144AMEDTRONIC INC SERIES WINATL RURAL UTILITY CFCJP MORGAN CHASE & COANHEUSER-BUSCH INBEV FINAT&T INCUNITED TECHNOLOGIES CORPFIRST DATA CORPORATION SERIES 144AMEDTRONIC GLOBAL HLDINGSALIBABA GROUP HOLDING LTD SERIES WIPHILLIPS 66AT&T INCBNP PARIBAS SERIES 144AENCANA CORPREYNOLDS AMERICAN INCHCA INCSVENSKA HANDELSBANKEN ABARCELORMITTAL SAABBVIE INCKINDER MORGAN INC SERIES 144AIMPERIAL TOBACCO FINANCE SERIES 144AWYNDHAM WORLDWIDE CORP21ST CENTURY FOX AMERICAACTAVIS FUNDING SCS SERIES WIWILLIAMS PARTNERS L.PINTL LEASE FINANCE CORPNAVIOS MARITIME ACQ COR

americredit automobile receiva series 1.52 06/10/2019 302,443 302,444 0.01% HYUNDAI AUTO RECEIVABLES TRUST SERIES 1.48 02/18/2020 275,000 274,957 0.01 % NEW CENTURY HOME EQUITY LOAN