Transcription

SUMMARY OF BENEFITS:HOURLY EMPLOYEES

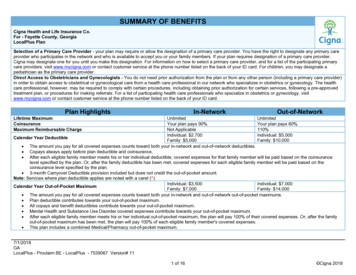

HEALTH AND WELFARE BENEFITSMedical PlansPPO Plan - CignaEmployee OnlyEmployee and ChildEmployee and SpouseEmployee and FamilyUnited HealthcareEmployee OnlyEmployee and ChildEmployee and SpouseEmployee and FamilyDental PlanMetLifeEmployee OnlyEmployee and SpouseEmployee and ChildEmployee and FamilyVision PlanEyeMed SelectEmployee OnlyEmployee and SpouseEmployee and ChildEmployee and FamilyVoluntary AD&D PlanSecurian LifeEmployee OnlyEmployee and FamilyShort-Term Disability PlanCignaEmployee OnlyLong-Term Disability PlanCignaEmployee OnlyEmployee Group Term Life InsuranceSecurian LifeEmployee group term life insurance is available for up to 7x an employee’s annual salary.Spouse/Domestic Partner Group Term Life InsuranceSecurian LifeDependent Group Term Life InsuranceSecurian LifeADDITIONAL BENEFITS401K-Sodexo Retirement ProgramAll employees age 21 are immediately eligible to participate at the time of hire. Eligible employees will be automaticallyenrolled 30 days after your hire date with a 1% deferral rate that will escalate by 1% per year to a max to 3% by year 3.Sodexo pays .50 for every 1 you save, up to 6%. For more information visit the website atwww.MySodexoSavingsPlan.com or by calling 1 866 7MY PLAN (1 866 769 7526).

Flexible Spending AccountsAnnual pre-tax dependent care or health care program. Employees enrolled in the flexible spending accounts authorize aweekly deduction from their paycheck before taxes to be set aside for eligible expenses. As employees pay their serviceprovider, they are reimbursed from their flexible spending account. No tax is ever owed on these funds. Funds left in theaccount at the end of the year are forfeited by the employee.COBRAOffered continued health coverage for a limited period of time if certain events called “qualifying events” such asseparation of an employee, hours of an employee are reduced to part-time temporary or pool status, an employeebecomes legally separated, or divorced is not preceded by a legal separation, an employee dies, an employee’sdependent child is no longer under the age of 26.Employee WebsiteLooking for more information on what Sodexo can offer you as an employee visit the employee website atwww.sodexolink.com. You can also register for Employee Self Service (ESS) to track and update your individual payrollinformation at your convenience. Once registered at ESS you can update your address, see and print each paycheckstatement, print W2’s and get other helpful financial information.Sodexo Employee Discount ProgramSodexo offers a free discount program designed to offer money-saving opportunities and timesaving tools. Employeescan find discounts from national vendors and brand name companies in travel, lodging, entertainment, and more. Thesediscounts can be found at www.sodexolink.com.Service AwardsSodexo jewelry, gifts, etc.Direct DepositPaycheck may be direct deposited to employee’s bank, savings and loan, or credit union.Credit UnionMultiple banking services are available through Marriott Employees’ Federal Credit Union (MEFCU) for all current andretired Sodexo employees. This can be accessed at www.mefcudirect.com or by calling (800) 821-7280.Bereavement LeaveA maximum of 3 days of paid bereavement leave is available to eligible employees following the death of a qualifyingfamily member.Jury DutyEligible employees who are called for jury service during their regularly scheduled work hours will receive their normal payminus any monies received from the court for a maximum of 4 weeks.Leave of AbsenceThree types of LOA are available to eligible employees: Personal, Medical and Family Medical Leave.A personal leave may be requested and approved in writing at the discretion of management. The length of the leavemay vary but is generally limited to 30 days.A medical leave may be requested and approved in writing at the discretion of management. The employee must be ill orinjured with satisfactory medical evidence. The length of the leave may vary but is generally limited to 90 days.A family medical leave may be requested for up to 12 weeks for the birth of a child, adoption, or foster care of a child; tocare for your spouse, parent or child with a serious health condition; or for your own serious health condition. Theemployee must provide satisfactory medical documentation for self, spouse, parent, or child. This must be approved in

writing and scheduled 30 days in advance, if possible. Family medical leave protects the employee’s job, seniority, andbenefits while on leave.Time OffVacationVacation time is given to all full time employees at the following rates:-0 – 3 years of service earns 96 hours of vacation4 – 6 years of service earns 120 hours of vacation7 – 9 years of service earns 144 hours of vacation10 – 14 years of service earns 168 hours of vacation15 years of service and beyond earns 200 hoursIn addition to vacation time detailed above, employees with more than 26 years of service will receive an additionalpremium payment of 16 hoursSick LeavePaid absence due to illness accrues at 10 days per year.HolidaysEight paid holidays per year.

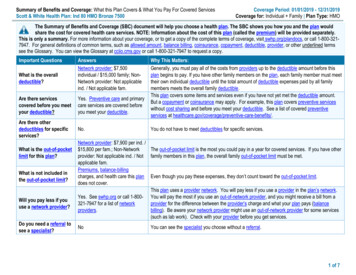

MEDICAL BENEFITSPlan – Cigna Preferred Provider Non-temporary, full-time frontline employees (class code 6) & eligible dependentsWaiting PeriodYour benefits begin the first of the month following 90 days after you are hired.Precertification required for all hospital servicesDescriptionAnnual DeductibleIn-network: 1,000/individual, 2,000/familyOut-of-network: 2,000/individual, 4,000/familyAnnual Out-of-PocketMaximumIn network: 5,000/individual, 12,700/familyOut-of-network: 10,000/individual, 30,000/familyCoinsuranceIn-network: you pay 30%, plan pays 70%Out-of-network: you pay 50%, plan pays 50%Doctor Office VisitIn-network: 30 per visitOut-of-network: 50% coinsuranceSpecialist VisitIn-network: 50 per visitOut-of-network: 50% coinsurancePreventive Care/screening/ImmunizationIn-network: 100%Out-of-network: 100%HospitalInpatientFacility Fee Physician/surgeon fee -Outpatient SurgeryIn-network: 250 copay, 70% covered after deductibleOut-of-network: 250 copay, 50% covered after deductibleIn-network: 70% covered after deductibleOut-of-network: 50% covered after deductibleIn-network: 70% after deductibleOut-of-network: 50% after deductibleMaternity (pre- and postnatal In-network: 30 initial visit PCPOffice visits)Out-of-network: 50% after deductibleDelivery and inpatientIn-network: 250 copay, then 70% covered after deductibleOut-of-network: 50% covered after deductibleEmergency CareIn Area (when not followedby admission)Out of Area (when notfollowed by admission) 150 per ER visit, then 70% covered after deductible 150 per ER visit, then 70% covered after deductible

Mental Health:InpatientOutpatientSubstance Abuse:InpatientOutpatientIn-network: 250 copay, 70% covered after deductible. PrecertificationRequiredOut-of-network: 50% after deductibleFacilityIn-network: 50 specialist copay, 70% covered after deductible.Out-of-network: 50% covered after deductible.In-network: 250 specialist copay, 70% covered after deductible.Out-of-network: 50% covered after deductible.In-network: 50 specialist copay, 70% covered after deductible.Out-of-network: 50% covered after deductible.Prescription Drug BenefitProvided through Express ScriptRetail (for 30-day supply)GenericBrand NameNon-Formulary Brand NameCopay or Coinsurance 1090% covered70% coveredMinimumN/A 35 50Mail Order (for 90-day supply)GenericBrand NameNon-Formulary Brand NameCopay or Coinsurance 2090% covered70% coveredMinimumN/A 87.50 125MaximumN/A 100 150MaximumN/A 200 300Plan – United Healthcare HRA(Consumer Driven porary, full-time frontline employees (class code 6) & eligible dependentsWaiting PeriodYour benefits begin the first of the month following 90 days after you are hired.DescriptionHealth ReimbursementAccount (HRA)Annual Fundingby SodexoPlan Year Deductible 750 employee only, 1,175 employee 1, 1,500 family.Rollover available.Annual Out-of-PocketMaximumIn-network: 6,350 employee only, 12,700/employee 1, 12,700/employee children, 12,700/familyOut-of-network: 12,750 employee only, 25,500/employee 1, 37,175/employee children, 37,500/familyDoctor Office Visit (primaryIn-network: 80% covered after deductible.In-network: 1,750 employee only, 3,500/employee 1, 4,175/employee children, 4,500/familyOut-of-network: 2,750 employee only, 5,500/employee 1, 7,175/employee children, 7,500/family

& specialist)Out-of-network: 60% covered after deductible.Preventive CareIn/Out-of-network: 100% coverage.HospitalInpatient (includes maternityadmissions)In-network: 80% covered after deductible.Out-of-network: 60% covered after deductible.Outpatient SurgeryIn-network: 80% covered after deductible.Out-of-network: 60% covered after deductible.Maternity (pre- and postnataloffice visits)In-network: 80% covered after deductible.Out-of-network: 60% covered after deductible.Emergency Care(when not followed byadmission)In/Out: 80% covered after deductible.Mental HealthInpatientIn-network: 80% covered after deductible.Out-of-network: 60% covered after deductible.Substance AbuseInpatientIn-network: 80% covered after deductible.Out-of-network: 60% covered after deductible.Prescription Drug BenefitRetail (for 30-day supply)GenericBrand NameNon-Formulary Brand NameCopay or Coinsurance 1090% covered70% coveredMinimumN/A 35 50Mail Order (for 90-day supply)GenericBrand NameNon-Formulary Brand NameCopay or Coinsurance 2090% covered70% coveredMinimumN/A 87.50 125MaximumN/A 100 150MaximumN/A 200 300

Group Dental Insurance PlanPlan – gibilityNon-temporary, full-time frontline employees (class code 6) & eligible dependentsWaiting PeriodYour benefits begin the first of the month following 90 days after you are hired.DescriptionDeductible 50/Individual, 150/FamilyCoinsurance100% for Preventive Care80% for Basic Services80% for Periodontics50% for Major Services50% for Orthodontics (lifetime maximum of 2,000)Maximum Benefit/Period 2,000/calendar year – Dental 2,000/lifetime – OrthodonticsPreventive Care – Plan Pays 100%Oral examinations (non-emergency)Dental cleaningPeriodontic cleaningBasic Services – Plans Pays 80%After DeductibleComposite, tooth colored fillingsExtractionsRoot CanalsPeriodontics – Plan Pays 80%After DeductibleTreatment of gums and bones of mouthMajor Services – Plan Pays 50%After DeductibleInlaysGold restorationsCrownsImplantsOrthodontics – Plan pays 50%Available for participants younger than 19 when treatment begins

Vision Care PlanPlan – EyeMed ptionEye ExamContact Lenses Exam:Fit & Follow-up Visits - StandardFit & Follow-up Visits - PremiumFramesLenses:(Standard uncoated plastic),Single Vision, Bifocal, Trifocal,LenticularProgressive (standard)Contact Lenses:ConventionalDisposableMedically NecessaryRetinal ImagingIn-network: 0 CopayOut-of-network: up to 32In-network: 10 Copay, includes 2 follow-up visitsOut-of-network: up to 40In-network: 10 Copay, 10% off retail, 40 allowanceOut-of-network: up to 40In-network: 130 allowance, then 20% off balance over 130Out-of-network: up to 58In-network: 15 copayOut-of-network: Up to 28 – Single Vision, up to 44 – Bifocal, up to 72 – Trifocal, up to 72 – LenticularIn-network: 80 copayOut-of-network: up to 44In-network: 130 allowance, then 15% off balance over 130Out-of-network: up to 104In-network: 130 allowanceOut-of-network: up to 104In-network: covered in fullOut-of-network: up to 200In-network: Member cannot be charged more than 39 for this serviceOut-of-network: not covered

401K-Sodexo Retirement Program All employees age 21 are immediately eligible to participate at the time of hire. Eligible employees will be automatically enrolled 30 days after your hire date with a 1% deferral rate that will escalate by 1% per year to a max to 3% by year 3. S