Transcription

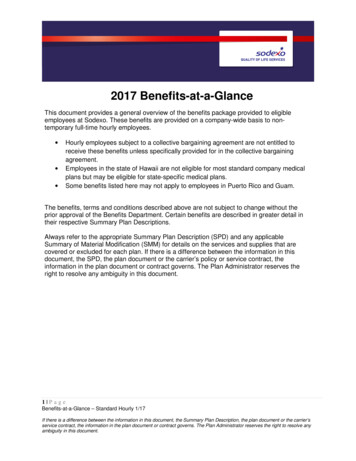

2017 Benefits-at-a-GlanceThis document provides a general overview of the benefits package provided to eligibleemployees at Sodexo. These benefits are provided on a company-wide basis to nontemporary full-time hourly employees. Hourly employees subject to a collective bargaining agreement are not entitled toreceive these benefits unless specifically provided for in the collective bargainingagreement.Employees in the state of Hawaii are not eligible for most standard company medicalplans but may be eligible for state-specific medical plans.Some benefits listed here may not apply to employees in Puerto Rico and Guam.The benefits, terms and conditions described above are not subject to change without theprior approval of the Benefits Department. Certain benefits are described in greater detail intheir respective Summary Plan Descriptions.Always refer to the appropriate Summary Plan Description (SPD) and any applicableSummary of Material Modification (SMM) for details on the services and supplies that arecovered or excluded for each plan. If there is a difference between the information in thisdocument, the SPD, the plan document or the carrier’s policy or service contract, theinformation in the plan document or contract governs. The Plan Administrator reserves theright to resolve any ambiguity in this document.1 P ageBenefits-at-a-Glance – Standard Hourly 1/17If there is a difference between the information in this document, the Summary Plan Description, the plan document or the carrier’sservice contract, the information in the plan document or contract governs. The Plan Administrator reserves the right to resolve anyambiguity in this document.

Your Choices.Your Health. MedicalDentalVisionDisabilityFlexible SpendingAccountso Healthcare SavingsAccounto Family Care SavingsAccountYour Choices.Your Future. Life Insurance401(k) Retirement SavingsPlanCredit UnionsTuition ReimbursementPayroll Optionso Direct Deposito Money NetworkServicesYour Choices.Your Life. Total RewardsSodexo team members make significantcontributions that improve the quality of daily lifefor our clients, customers and in the communitieswe serve. In return, Sodexo is committed to caringfor our employees in the same way that we careabout our customers.One way we care about our employees isproviding a Total Rewards package that meets orexceeds standards for our industry and attracts,retains and rewards the people responsible for ourgrowth and success—you.Total Rewards represents a broad spectrum ofplans and programs designed to reward andmotivate you throughout your career.It includes benefits programs to support you indifferent stages of your life. Whether you aresingle or supporting several dependents, savingfor your future, or going back to school, Sodexoprovides a range of benefits options.This At-a-Glance document provides an overviewof the Total Rewards package Sodexo offers toyou—to help you meet your needs now and in thefuture.VacationSick LeaveOther Time OffLifeWorksEmployee Discounts2 P ageBenefits-at-a-Glance – Standard Hourly 1/17If there is a difference between the information in this document, the Summary Plan Description, the plan document or the carrier’sservice contract, the information in the plan document or contract governs. The Plan Administrator reserves the right to resolve anyambiguity in this document.

Benefits Eligibility You are eligible for benefits if you are a non-temporary, full-time hourly employee working an averageof at least 30 hours per week over the 52-week measurement period. Hours will be measured eachyear to determine whether you have maintained an average of at least 30 hours per week and remaineligible for benefits the following year.To determine eligibility for non-temporary full-time hourly employees, the Company looks back at thehours you have worked over a 12-month (or 52-week) period, known as the Measurement Period*. Thisincludes vacation, sick and holiday time off, as well as Temporary Unit Closing leaves and protectedleaves like FMLA, Military Leave.*Measurement Periods do not apply to employees in Guam, Puerto Rico and Hawaii and do not applyto the eligibility for the 401(k) Retirement and Savings Plan. Once you enroll, coverage will be effective for a minimum of 12 months or through the end of the PlanYear following 12 months, otherwise known as the Stability Period. During the Stability Period, you willremain eligible to continue participating, if applicable, in the Medical, Dental, Vision and/or Health CareSpending Account. Eligibility will generally continue even if you have a change in your work schedule(unless your employment is terminated). You will, however, need to re-enroll during Annual Enrollmentto maintain your coverage during the Stability Period, and in accordance with the terms of the Plan, youhave the right to alter your coverage should a qualifying event occur.After You EnrollAfter you enroll, your Confirmation of Enrollment, will be sent to you through the preferred method ofdelivery. If you chose postal, you will receive it by mail. If you chose electronic, you will receive it throughyour secure mailbox located at the Sodexo Benefits Center. It lists the specific date your benefits will begin.Check your paycheck after this effective date of coverage to review your benefit deductions to be sure theyare correct.3 P ageBenefits-at-a-Glance – Standard Hourly 1/17If there is a difference between the information in this document, the Summary Plan Description, the plan document or the carrier’sservice contract, the information in the plan document or contract governs. The Plan Administrator reserves the right to resolve anyambiguity in this document.

When Your Benefits BeginEmployees Who Live in the U.S. (except Hawaii)New Hires Full-time hourly employees are eligible forcoverage on the 90th day after their hire date.You must enroll for benefits coverage withinyour first 89 days of employment. If you do notenroll within your enrollment period, you willhave to wait until the next Annual Enrollmentperiod to enroll.When you become eligible, you willautomatically be enrolled in the Free Basic LifeInsurance Plan at no cost to you. This planpays a monetary benefit to your designatedbeneficiary in the event of your death.If your unit offers standard paid time off policies,vacation and sick leave will begin to accrueimmediately when you are eligible.You are automatically enrolled in the companysponsored LifeWorks Plan on your first day ofemployment. LifeWorks is a free, confidentialprogram that can help with almost anything —from handling stress, relationships, challengesat work, parenting or caring for an older relativeto health issues like losing weight or quittingsmoking.Newly Eligible Employees who become eligible due to a classchange (for example, your position changesfrom part-time to full-time hourly) are eligible forcoverage on the 90th day after the classchanges in the payroll system. You must enrollfor benefits coverage within 89 days from thisdate. If you miss this enrollment window, youwill have to wait until the next AnnualEnrollment period to enroll.If you change from full-time to part-time, andyou are participating in medical, dental, vision,and healthcare spending account coverage,your coverage will continue through the StabilityPeriod. Life insurance and disability plans endon the date you become part-time.Eligibility for vacation, sick, and other paidleave, Tuition Reimbursement and LifeWorks isbased on your status of part-time or full-time. Ifyour status changes from part-time to full-time,you will immediately become eligible for thesebenefits except Tuition Reimbursement. Youmust have one year of service to be eligible forthe Tuition Reimbursement Program. If youchange to part-time, you will no longer beeligible for Tuition Reimbursement andLifeWorks, as of the date your status changes.Check with your manager to determine whetheryou qualify for any paid leave as a part-timeemployee at your location.4 P ageBenefits-at-a-Glance – Standard Hourly 1/17If there is a difference between the information in this document, the Summary Plan Description, the plan document or the carrier’sservice contract, the information in the plan document or contract governs. The Plan Administrator reserves the right to resolve anyambiguity in this document.

When Your Benefits BeginEmployees Who Live in HawaiiNew Hires All full-time hourly employees are eligible for benefits on the 24th day after their hire date.New hires must enroll for benefits coveragewithin the first 23 days of employment. If you donot enroll within this enrollment window, you willhave to wait until the next Annual Enrollmentperiod.If your unit offers standard paid time off policies,vacation and sick leave will begin to accrueimmediately upon becoming eligible.There is no waiting period to use LifeWorks, theemployee resource program.Newly Eligible Employees who become eligible due to a classchange (for example, your position changesfrom part-time to full-time) must enroll forcoverage within 31 days from the date theirclass changed, which is their eligibility date. Ifyou do not enroll within the 31 day timeframe,you will have to wait until the next AnnualEnrollment period to enroll for coverage.Eligibility for vacation, sick, and other paidleave, Tuition Reimbursement and LifeWorks isbased on your status. If your status changesfrom part-time to full-time, you will immediatelybecome eligible. You must have one year ofservice before you become eligible for theTuition Reimbursement Program. If the statusis changed to part-time, you will no longer beeligible for Tuition Reimbursement andLifeWorks, as of the date of the status change.Check with your manager to determine whetheryou qualify for any paid leave as a part-timeemployee at your location.NOTE: If you live and work in Hawaii and you donot enroll, you must submit a Hawaii StateWaiver Form to the Sodexo Benefits Center oryou will automatically be enrolled in the KaiserPermanente HMO Plan.5 P ageBenefits-at-a-Glance – Standard Hourly 1/17If there is a difference between the information in this document, the Summary Plan Description, the plan document or the carrier’sservice contract, the information in the plan document or contract governs. The Plan Administrator reserves the right to resolve anyambiguity in this document.

Your Choices. Your Health.Good health is essential to a good life. Sodexo’s health plans are designed to keep you and your familyfeeling good while helping you manage the costs of medical care. One of the best ways to stay healthy andsave money is to take advantage of preventive healthcare which is free to you. Getting recommendedscreenings, annual check-ups and immunizations is important for staying healthy.Medical BenefitsMedical - PPO Plan (CIGNA)www.cigna.com/sodexo800 909 2227Available to employees in the continental United States, Alaska and Guam.Not available to employees in Puerto Rico or Hawaii.CoverageIn-NetworkOut-of-NetworkAnnual Deductible 1,000 individual; 2,000 familyAnnual Out-Of-Pocket Maximum 5,000/individual, 12,700/familyPreventive Care (routine physicalexams, well-baby care, gyn exams,immunizations)You pay 0% and plan pays 100% 2,000 individual; 4,000family 10,000/individual, 30,000/familyYou pay 0% and planpays100%Tobacco cessation program andHealth Coaching services availableat no cost to youDoctor Office Visit (primary and 30 primary/ 50 specialist copay per visitYou pay 50% and plan paysspecialist)50% after deductibleTelemedicine – MDLIVE 25 per visitNot coveredMDLIVE is a convenient way to visit a doctor without going to the doctor’s office for non-life threatening conditionswhich may include urinary tract infections, colds/flu, fever, pink eye, migraines, bronchitis.Log in to myCigna.com and click on MDLIVE or mdlive.com/Sodexoor call 888 726 3171Note Limitations by State: AR – Not available, IA, LA, TX – Phone Consultations Only, ID – Video consultations only, CA – 72hour supply of prescriptions by phone (no restrictions for video consultation)6 P ageBenefits-at-a-Glance – Standard Hourly 1/17If there is a difference between the information in this document, the Summary Plan Description, the plan document or the carrier’sservice contract, the information in the plan document or contract governs. The Plan Administrator reserves the right to resolve anyambiguity in this document.

Medical BenefitsMedical - PPO Plan (CIGNA)CoverageUrgent CareHospital -Inpatient (includes maternityadmissions)Prior authorization required for allinpatient and outpatient hospitalservicesHospital- Outpatient SurgeryPrior authorization required for allinpatient and outpatient hospitalservicesMaternity(pre- and postnatal office visits)Emergency Care(when not followed by admission)Mental Health – InpatientPrior authorization requiredMental Health – OutpatientSubstance Abuse – InpatientPrior authorization requiredSubstance Abuse – OutpatientIn-Network 30 copay per visit 250 copay then you pay 30% andplan pays 70% after deductibleOut-of-Network 30 copay per visit 250 copay then you pay 50% andplan pays 50% after deductibleYou pay, 30% and plan pays 70%after deductibleYou pay 50% and plan pays 50%after deductible 30 Primary Care Physician or 50Specialist copay for initial visit, then100% 150 copay per Emergency Roomvisit waived if admitted, then you pay30% and plan pays 70% afterdeductible 250 copay then you pay 30% andplan pays 70% after deductible.FacilityYou pay 30% and plan pays 70%after deductibleYou pay 50% and plan pays 50%after deductibleOffice Visit 50 per visitOffice VisitYou pay 50% and plan pays 50%after deductible 250 copay then you pay 50% andplan pays 50% after deductible.Prior authorization requiredFacilityYou pay 50% and plan pays 50%after deductible. 250 copay then you pay 30% andplan pays 70% after deductible. Priorauthorization requiredFacilityYou pay 30% and plan pays 70%after deductibleOffice Visit 50 per visit 150 copay per Emergency Roomvisit waived if admitted, then youpay 30% and plan pays 70% afterdeductible 250 copay then you pay 50% andplan pays 50% after deductible.FacilityYou pay 50% and plan pays 50%after deductible.Office VisitYou pay 50% and plan pays 50%covered after deductible7 P ageBenefits-at-a-Glance – Standard Hourly 1/17If there is a difference between the information in this document, the Summary Plan Description, the plan document or the carrier’sservice contract, the information in the plan document or contract governs. The Plan Administrator reserves the right to resolve anyambiguity in this document.

Medical BenefitsMedical - PPO Prescription Drug Benefit – (ExpressScripts)www.expressscripts.com800 903 7968Mandatory Generic Drugs - If you purchase brand-name drugs when a generic isavailable, you pay more.CoverageTypeRetail (30-daysupply)Generic 10 copayBrand Name10% coinsurance- 35 minimum/ 100 maximumNon-Formulary Brand Name30% coinsurance - 50 minimum/ 150 maximumGeneric 20 copayBrand Name10% coinsurance- 87.50 minimum/ 200 maximumNon-Formulary Brand Name30% coinsurance - 125 minimum/ 300 maximumIf you don’t use mail order for your non-specialty long-term medications, you will pay100% of the cost of the medication after you fill your initial prescription and two refills ofthe drug at a retail pharmacy.Mail Order (90-daysupply)Retail RefillAllowanceCopay/CoinsuranceSome long-term specialty drugs, including but not limited to, Copaxone, Enbrel, Humiraand Sovaldi are required to be filled through Accredo, Express Script’s mail orderpharmacy, on the first fill.WELLNESS INCENTIVEEarn 100 Toward Your Medical ExpensesTo participate, each plan year you take an online Health Assessment. If youcomplete a Health Assessment, you will earn a 100 credit. If you are a PPOPlan member, you will have the credit held in an account for you at Cigna touse toward paying medical expenses for yourself and your dependents.To take your Health Assessment and for more details on this incentiveprogram, visit www.mycigna.com8 P ageBenefits-at-a-Glance – Standard Hourly 1/17If there is a difference between the information in this document, the Summary Plan Description, the plan document or the carrier’sservice contract, the information in the plan document or contract governs. The Plan Administrator reserves the right to resolve anyambiguity in this document.

Medical BenefitsMedical - UnitedHealthcare Health ReimbursementAccount (HRA)https://www.myuhc.com800 784 2023Available to employees in the continental United States and Alaska.Not available to employees in Guam, Puerto Rico and Hawaii.CoverageYou OnlyHRA 750You Spouse/DomesticPartner 1,175You Child(ren)You Family 1,175 1,500CoverageIn-NetworkOut-of-NetworkAnnual Deductible 1,750 per member; 3,500 member spouse/DP orchild; 4,175 member Children; 4,500 family 2,750 per member; 5,500 member spouse/DPor child; 7,175 member Children; 7,500 family 6,350 per member; 12,700 member spouse/DP orchild; 12,700 member children; 12,700 familyYou pay 20% and plan pays 80%after deductibleYou pay 0% and plan pays 100% 12,750 per member; 25,500 member spouse/DPor child; 37,175 member child; 37,500 familyYou pay 40% and plan pays60% after deductibleYou pay 0% and planpays100%(HRA Annual Funding MemberResponsibility)Annual Out of Pocket MaximumMember Responsibility and Medical andPharmacy Copays and Coinsuranceapplied to out of pocket maximumDoctor Office Visit (primary andspecialist)Preventive Care (routine physicalexams, well-baby care, gyn exams,immunizations)Tobacco cessation program and HealthCoaching services available at no costto youVirtual VisitsApproximate cost is 40 - 50Not CoveredVirtual Visits – See your doctor anytime, anywhere through video, phone or e-mail. Common conditions thatwould be treated during a virtual doctor visit would include urinary tract infections, colds/flu, fever, pink eye,migraines, bronchitis.Go tomyuhc.com, click on Physician & Facilities tab at the top of the pageor call Advocate4Me 800 784 20239 P ageBenefits-at-a-Glance – Standard Hourly 1/17If there is a difference between the information in this document, the Summary Plan Description, the plan document or the carrier’sservice contract, the information in the plan document or contract governs. The Plan Administrator reserves the right to resolve anyambiguity in this document.

Medical BenefitsMedical - UnitedHealthcare Health Reimbursement Account (HRA)CoverageIn-NetworkOut-of-NetworkUrgent CareYou pay 20% and plan pays 80% afterdeductibleYou pay 20% and plan pays 80%after deductibleHospital –Inpatient (includesmaternity admissions)You pay 20% and plan pays 80% afterdeductibleYou pay 40% and plan pays 60%after deductibleHospital- Outpatient SurgeryYou pay 20% and plan pays 80% afterdeductibleYou pay 40% and plan pays 60%after deductibleMaternity(pre- and postnatal office visits)You pay 20% and plan pays 80% afterdeductibleYou pay 40% and plan pays 60%after deductibleEmergency Care(when not followed byadmission)Mental Health – Inpatient andOutpatientYou pay 20% and plan pays 80% afterdeductibleYou pay 20% and plan pays 80%after deductibleYou pay 20% and plan pays 80% afterdeductibleYou pay 40% and plan pays 60%after deductibleSubstance Abuse – Inpatientand OutpatientYou pay 20% and plan pays 80% afterdeductibleYou pay 40% and plan pays 60%after deductible10 P a g eBenefits-at-a-Glance – Standard Hourly 1/17If there is a difference between the information in this document, the Summary Plan Description, the plan document or the carrier’sservice contract, the information in the plan document or contract governs. The Plan Administrator reserves the right to resolve anyambiguity in this document.

Medical BenefitsMedical - UnitedHealthcare HRA Prescription Drug BenefitCoverageTypeCopay/CoinsuranceRetail (30-day supply)GenericBrand NameNon-Formulary Brand NameGenericBrand NameNon-Formulary Brand NameSame as brand, as applicable 10 co

service contract, the information in the plan document or contract governs. The Plan Administrator reserves the right to resolve any ambiguity in this document. 2017 Benefits-at-a-Glance This document provides a general overview of the benefits package p