Transcription

THE SAFE ACTTHE SECURE AND FAIRENFORCEMENT FOR MORTGAGELICENSING ACT OF 2008REQUIRED REGISTRATION BY7‐29‐2011I know the feeling You can find this in the Banker Tools section of BankersOnline.com.1

SAFE Act The SAFE Act is intended to improvepthe accountabilityy and trackingg of residential mortgageg g loanoriginators (MLOs), provide protection for consumers, reduce fraud, and provide consumers with information regarding MLOs. Institutions are expected to implement appropriate policiesand procedures Board Approved and on the intranetYou can find this in the Banker Tools section of BankersOnline.com.SAFE Act Requires each institution to register with the NationwideMortgage Licensing System & Registry (NMLS) Requires individual mortgage loan originators (MLOs) toregister with the Nationwide Mortgage Licensing System& Registry (NMLS) Must register within 180 days of the date the FDICprovides public notice of the availability of the registry.(7/29/2011)You can find this in the Banker Tools section of BankersOnline.com.2

SAFE Act – System Administrator Institutions will need to request an account and establishAccount Administrators to handle the administrativeprocesses. The NMLS Federal Registry requires each federally chartered orinsured institution to identify at least two Account Administrators Administrator should not be an MLO HR/Complianceis recommendedYou can find this in the Banker Tools section of BankersOnline.com.SAFE Act – Identification of MLO An MLO means an individual who:1) takes a residential mortgage loan application; AND2) offers or negotiates terms of a residential mortgage loan forcompensation or gain. A residential mortgage loan means any loan primarily forpersonal, family, or household use that is secured by a mortgageon a dwelling or residential real estate upon which is constructedor intended to be constructed a dwelling, includingmanufacturedf t d housingh i andd condominiumsd i i Includes refinancings, reverse mortgages, home equity lines ofcredit, and other first and second lien loans that meet thedefinition of a residential mortgage loanYou can find this in the Banker Tools section of BankersOnline.com.3

SAFE Act For example, offering or negotiating terms of a loanincludes1. Presenting a loan offer either verbally or in writing,including but not limited to, providing a TIL disclosure,even if the offer is conditional, further verification isnecessary, or other individuals must complete theloan process2. Responding to a consumer’s request for a lower rateor points by presenting the consumer either verballyor in writing a revised loan offer that includes a lowerinterest rate or lower points than originally offeredYou can find this in the Banker Tools section of BankersOnline.com.SAFE Act - Registration An employee who acts as a MLO is required to registerwithi h theh Registry,R iobtainb i a uniqueiidentifier,id ifi anddmaintain his or her registration Employees must complete an initial registration withthe Registry within 180 days from the date the FDICprovides in a public notice that the Registry is acceptingregistrations and are allowed to continue to originateregistrations,residential mortgage loans during this periodYou can find this in the Banker Tools section of BankersOnline.com.4

SAFE Act - Registration An institution must require its employees to registerandd maintaini t i thithis registration,i t tiandd are nott permitteditt d ttoallow their employees to act as an MLO unlessregistered with the Registry After the 180 day period expires, existing and newlyhired employees are prohibited from originatingresidential mortgage loans without first registering A MLO’s failure to register does not affect the validityor enforceability of any mortgage loan contract madeby the institution that employs the originatorYou can find this in the Banker Tools section of BankersOnline.com.SAFE Act - RegistrationThe Registry must be furnished with information concerning theMLOs identity including, but not limited to: Name, address, contact information, prior financial services‐related employment, social security numbernumber, gender, date of birth, information concerning finalcriminal actions, financial services‐related civiljudicial actions andprofessional licenserevocations or suspensions, AND fingerprints for submission tothe FBI and any other relevantgovernmental agency for acriminal history backgroundcheckYou can find this in the Banker Tools section ofBankersOnline.com.5

SAFE Act – Registration Renewal A registered MLO must renew his orher registration with the Registryannually during November 1stthrough December 31st of each year Failure to renew prohibits theemployee from acting as a MLO andthe registration becomes inactiveuntil such time the registrationrequirements are met, which can beydone at anyy time duringg the year Annual registration renewalrequirements do not apply if a MLOjust completed registration less thansix months prior to December 31stYou can find this in the Banker Tools section of BankersOnline.com.SAFE Act – Registration Updates Registration must be updated within 30days of the occurrence of the followingtevents:1. a change in the employee’s name,2. the registrant ceases to be an employeeof the institution3. any of the employee’s responses to theinformation required for registrationbecome inaccurate. A previously registered employee isrequired to maintain his or her registrationunless the employee is no longer a MLO,even if, in any subsequent 12 monthperiod, the employee originates fewermortgage loans than the number specifiedin the de minimis exception provisionYou can find this in the Banker Tools section of BankersOnline.com.6

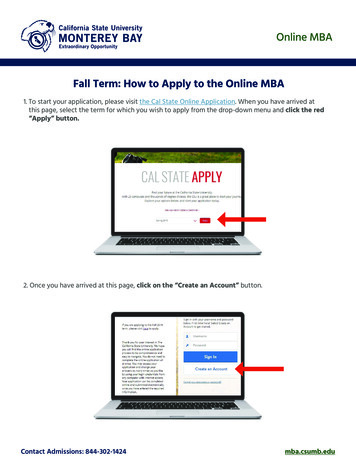

Final FeesEntityInitialSet-up FeeAnnualProcessing FeeMLO Changeof Check withPaperFiFingerprintsi tCriminalBackgroundCheck withELECTRONICFiFingerprintsi tInstitution(Form MU1RFiling) 100 100n/a 55/usern/an/aIndividual(Form MU4RFiling) for 2011 60 0 30n/a 49 39Individual(F(FormMU4RMU RFiling) for 2012and subsequentyears 30 if registrationi JJanuaryoccurs into June. 30 30n/a 49 (for newregistrationii only)l ) 39 (for newregistrationii only)l ) 60 if registrationoccurs in July toDecember.( 0 if registrationoccurred in July toDecember of sameyear.)You can find this in the Banker Toolssection of BankersOnline.com.How do I register? For Account Administrators: Go to the NMLS site. www.mortgage.nationwidelicensingsystem.org/Click “Getting Started” for your company or institutionChoose “Federal Registration”Follow the steps detailed for you on the “Getting Started” page For MLOs: Wait for instructions from your Account Administrator(s)You can find this in the Banker Tools section of BankersOnline.com.7

SAFE Act – Examination Requirements Confirm the institution maintains a list of the registrationnumbers of its MLOs, and provides the registration number toany loan applicant that requests it. In satisfying this requirement, a institution may choose to: directconsumers to a listing of registered MLOs and theirregistration numbers on its website; post this information in a prominently publicly accessible area,areasuch as a lobby or lending area notice; and/or establish a process that bank personnel provide theregistration number to consumers upon request.You can find this in the Banker Tools section of BankersOnline.com.SAFE Act – Examination Requirements Confirm that a registered MLO provides his or herunique identifier to a consumer upon request; before acting as a MLO; and through the originator’s initial writtencommunication with a consumer, if any, whetheron paper or electronically.You can find this in the Banker Tools section of BankersOnline.com.8

Safe Act – Practical Notes Freddie Mac requirement – registration numberof the MLO is required as a condition of sale toFreddie Mac Bulletin 2009‐27,2009 27 Freddie Mac providedadditional information regarding new loan‐level origination data requirements forMortgages with application dates on or afterJuly 1, 2010 If a Seller is a federally regulated institutionand the Seller's appropriate federalregulator has not yet required registrationof the Loan Originators and/or LoanOrigination Companies, the Seller will notbe required to enter the Loan Originatorand/or Loan Origination Company identifieron Form 65 or to deliver this information onthe Form 11 or Form 13SF. Once LoanOriginator and/or Loan OriginationCompany identifiers are required, Sellersmust deliver this data for Mortgages withapplication dates on or after the date therequirement becomes effective.You can find this in the Banker Tools section of BankersOnline.com.All in the details What do I do with my number?You can find this in the Banker Tools section of BankersOnline.com.9

What will customers see?This is a screen shot of the current state registry. We assume it will be similar.You can find this in the Banker Tools section of BankersOnline.com.Links Final Rules published by the Agencies on July 28, 2010 Choosing your Account Administrators Frequently Asked Questions about Two‐Factorauthentication VeriSign Website ‐https://idprotect.verisign.com/mainmenu.v eg/Phttp://mortgage nationwidelicensingsystem org/fedreg/Pages/GettingStartedFedCo.aspx ‐ Getting Started Steps Manage MLO Registration Navigation GuideYou can find this in the Banker Tools section of BankersOnline.com.10

2 SAFE Act The SAFE Act is intended to improve the accountability and tracking of residential mortgggage loan originators (MLOs), provide protection for consumers, reduce fraud, and provide cons