Transcription

eyT.Smith678- 905- 4450www.wiserinvestor.com

40.09- 231.660.80%1.00%0.68%- ‐S&P5002.79%15.75- ‐- inthelastthreeyears.Asasidenote,overthelongterm10 chlumberger5.UnionPacificCaseyT.Smith678- 905- 4450www.wiserinvestor.com

turyACIIX0.77%EquityIncome- ‐InvEquityIncome- IX0.80%Value- ‐InvValue- ex- ‐SelectIndex- 1.15%InternationalInternationalGrowth- ‐InvGrowth- uallyanestimated 356,000inadministrationfees( 88perplanparticipant),whichisincludedin ExpressJet401kplanisvaluedat 400 illbecollecting 238,918inadministrationfees( 59perparticipant),whichisincludedin ncludingExpressJet’s401k. CaseyT.Smith678- 905- 4450www.wiserinvestor.com

tmentexample.I.StockLet’ssayweinvest hatisyourCokestockworth? edCaseyT.Smith678- 905- 4450www.wiserinvestor.com

01kplanhasoneIndexfund- - isleadsustoalessknownoption.CaseyT.Smith678- 905- 4450www.wiserinvestor.com

outawayfromtheactivefundstohaveastand- avehad,inmanycases,alarge- ,forparticipants,itprovidesbroadlydiversified,low- thacombined onalanyonecouldsayno.CaseyT.Smith678- 905- 4450www.wiserinvestor.com

Building blocks of awell-balanced portfolioSummer 2010Recent developments in themarketplace are making the casefor expanding the number of indexinvestment options within 401(k) andother defined contribution (DC) plans.Perhaps the most important trend isincreased attention to plan fees. Plansponsors are increasingly consciousof the need to reconsider plan costs,especially given the growing scrutinyby Congress, the Department of Labor,and the courts. A second developmentis the ongoing concern about increasingthe diversification, transparency, andeffectiveness of a plan’s lineup—aconcern that reemerged in the recent2008–2009 market decline.In response to these developments,Vanguard believes that plan sponsorswould be well served to considerincluding a separate index tier as theheart of their plan investment menus.Connect with Vanguard institutional.vanguard.comOften called the passive or index core,an index tier is a comprehensive set ofdiversified index funds communicatedas a distinct part of the plan lineup.An index tier can offer advantagesfor both sponsors and participants.For sponsors, it means a simplerinvestment selection and monitoringprocess, lower plan costs, enhancedmanager predictability, and the potentialfor above-average returns. It canalso reduce the potential for secondguessing of plan sponsors by regulatorsand the courts over investment returnsand plan fees. Participants’ benefitsinclude the possibility of tailoringa complex portfolio using low-costfunds and reduced active managerrisk (i.e. the risk that active managerswill underperform their respectivebenchmarks)—leading to potentiallymore favorable retirement outcomesover time.Building blocks of a well-balanced portfolio 1

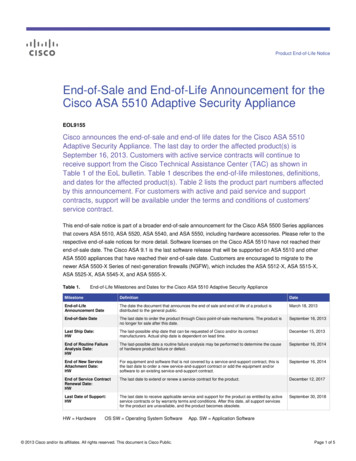

WhyindexingworksIndexing remains a compelling investmentstrategy for both plan sponsors and participants.Given the significant time horizons mostparticipants face as they save for retirement,the benefits of indexing compound. For example,when looking at a longer time horizon suchas the last 15 years, a majority of activelymanaged funds have failed to beat theirrespective benchmarks in most of the commoninvestment categories (see Figure 1). Thebenefits of indexing are well-known in highlyefficient markets, such as the market for U.S.large-capitalization stocks. Yet the performanceadvantage of indexing extends even tosmall-cap and international mandates—afteraccounting for survivorship bias (the removal ofclosed funds from performance databases) andstyle drift (the tendency of managers’ holdingsto “drift” from one asset class or investmentstyle to another).Why have actively managed funds generallyfailed to measure up? Investing is a zero-sumgame. For every buyer, there must be a seller,and for every dollar that wins, there must bea dollar that loses. In aggregate, before costs,the sum of all these positions constitutes aninvestment market.1Vanguard calculations.2However, security transactions incur costs, andmanagers charge fees for service. The result:after accounting for these costs, a majority ofinvestment dollars underperform the costlessmarket. And because actively managedportfolios generally incur significant costs,it is not surprising that, on average, high-costactively managed funds underperforma costless index over time.An indexed strategy seeks to track a costlessbenchmark at minimal expense, therebybenefiting from the zero-sum game whileoffering investors the highest degree oftransparency and the broadest level ofdiversification. These advantages representa significant hurdle for an active manager toovercome just to break even with a low-costindex strategy over time, in any market. Thatis why index funds can make sense as thecore of a long-term portfolio.

50Figure 1: Percentage of actively managed funds outperforming benchmark:15 years ended December 31, 2009U.S. Large ValueU.S. Large BlendU.S. Large GrowthU.S. Mid ValueU.S. Mid BlendU.S. Mid GrowthU.S. Small ValueU.S. Small BlendU.S. Small GrowthInternational DevelopedInternational EmergingShort GovernmentIntermediate GovernmentShort CorporateIntermediate Corporate0%20%40%60%80%100%Sources: Vanguard calculations using data from Morningstar, Standard & Poor’s, MSCI, and Barclays Capital. U.S.-style benchmark represented by the following indexes: Large Blend: S&P 500:1/1995–11/2002, MSCI Prime Market 750: 12/2002–Current; Large Value: S&P 500 Value: 1/1995–11/2002, MSCI Prime Market 750 Value: 12/2002–Current; Large Growth: S&P 500 Growth 1/1995–11/2002,MSCI Prime Market 750 Growth 12/2002–Current; Mid Blend: S&P Midcap 400: 1/1995–11/2002, MSCI Mid Cap 450: 12/2002–Current; Mid Value: S&P Midcap 400 Value: 1/1995–11/2002, MSCI Mid Cap450 Value: 12/2002–Current; Mid Growth: S&P Midcap 400 Growth: 1/1995–11/2002, MSCI Mid Cap 450 Growth: 12/2002–Current; Small Blend: S&P Small Cap 600: 1/1995–11/2002, MSCI Mid Cap 1750:12/2002–Current; Small Value: S&P Small Cap 600 Value: 1/1995–11/2002, MSCI Small Cap 1750 Value: 12/2002–Current; Small Growth: S&P Small Cap 600 Growth: 1/1995–11/2002, MSCI Small Cap 1750Growth: 12/2002–Current. International benchmarks represented by the following MSCI indexes: All Country World Index; EAFE Index. Fixed income benchmarks represented by the following BarclaysCapital Indexes: U.S. 1–5 Year Government Bond Index, U.S. 1–5 Year Credit Bond Index, U.S. Intermediate Government Bond Index, and U.S. Intermediate Credit Bond Index.Building blocks of a well-balanced portfolio 3

What isan indextier?Historically most plan sponsors have respondedto the case for indexing by including at leastone low-cost large-capitalization U.S. stockindex fund in their investment lineup. Yet giventhe ongoing scrutiny of plan costs, as well asthe benefits of indexing in other asset classes,Vanguard believes that every 401(k) plan shouldconsider offering a comprehensive set of indexoptions that spans most liquid and accessibleglobal capital markets. This is the idea ofthe index tier—a comprehensive set of indexoptions presented and communicated distinctlyto participants.What investment options should plan fiduciariesinclude within the index tier? A minimalistapproach might be to include four very broadlydiversified options:Figure 2: The basic index tierCashU.S.bondsU.S.equities U.S. equity market. Non-U.S. equity market. U.S. taxable bond market. Cash reserves1.An index tier that includes just these fouroptions can offer a highly efficient and simpleset of investment choices (see Figure 2).Actively managed.14InternationalequitiesSource: Vanguard.

Figure 3: The expanded index tierCashCashU.S. bondsU.S.bondsU.S. edmarketsEmergingmarketsSmallcapSource: Vanguard.However, many sponsors have expanded thenumber of options within the index tier forparticipants who want to tailor their portfoliosto meet their individual beliefs about risk. As aresult, one strategy might be to offer separateU.S. equity options by capitalization—includinglarge-, mid-, and small-cap funds. On thenon-U.S. side, a similar approach would be tooffer separate developed and emerging marketoptions (see Figure 3).In deciding what component options toinclude in the index tier, sponsors will want tobalance both expanded choice and complexity.Additional options allow more experiencedparticipants to tailor their portfolio strategiesin distinct ways. But at some point, too manypassive options might add to complexity andconfusion among participants striving to createtheir own portfolios using the index tier.Building blocks of a well-balanced portfolio 5

Introducing anindex tier intoyour planIntroducing an index tier into an existing planlineup poses a number of considerations. First,if index options are simply listed with otheractive plan options, the ability to communicatethe merits of indexing is hindered. The idea ofan index tier is that it should be a highlightedelement of the investment menu.Second, research over the past decadeconfirms that a long list of investment options,including both active and index funds, is toocomplex for many participants to understandand effectively use. They need all-in-oneportfolio solutions as part of the investmentmenu.The solution to these challenges is touse a tiering strategy for organizing andcommunicating the investment menu. Thefirst level of that tiered menu should be anasset allocation tier for one-stop decisionmaking by participants. A second tier shouldbe devoted to index options for participantswho want to design their own portfolios.Tiered investment menus. If participantsare presented with a long list of investmentoptions, one possible risk is choice overload—an inability for most participants to makecomparative choices among the 20, 30, o

ASAJPMorgan#401k#Plan! Research! Casey#T.#Smith# 678 905 4450# # www.wiserinvestor.com#!! The!data!above!shows!th