Transcription

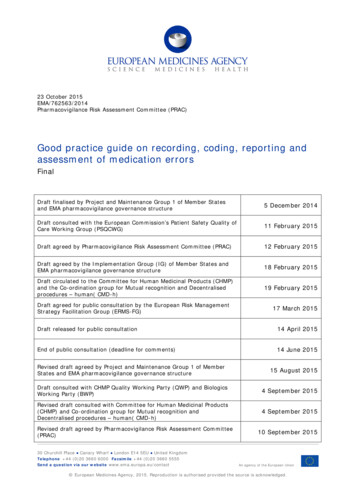

Recording & Supporting Grant ExpendituresApril 16 & 17, 2019Sarah ShimSpecial Review Audit Resolution Team LeadEsther LiuSpecial Review Audit Resolution Team AuditorDivision of Financial Integrity, Financial Advisory BranchHealth Resources and Services Administration (HRSA)

AgendaAllowable Costs must be: Reasonable Allocable Adequately DocumentedHow to Adequately Document: Separate Tracking of Federal Expenditure Chart of Account General Ledger Type of Documentation Record Retention Period2

Statutory, Regulatory, and National Public PolicyRequirementsAvailable Resources for Proper FinancialManagement of your Grant: 45 CFR Part 75 HHS Grants Policy Statement (HHS GPS) Policy Information Notice (PIN) 2013-01 Health Center Budgeting and AccountingRequirements3

Allowable Costs - 45 CFR 75.403Allowable - To be allowable under Federal awards, costs must meetthe following general criteria: Be necessary and reasonable for proper and efficientperformance and administration of Federal awards and; Be consistent with policies, regulations, and procedures thatapply uniformly to both Federal awards and other activities ofthe governmental unit and; Be allocable to the grant.4

Allowable Costs – 45 CFR 75.403 (cont’d) Not be included as costs or used to meet cost sharing or matchingrequirements of any other federally-financed program eithercurrent or a prior period. Be accorded consistent treatment. Be determined in accordance with generally accepted accountingprinciples (GAAP), except, for state and local governments andIndian tribes only, as otherwise provided for in this part. Be adequately documented.5

Example – Summer CampSUMMER ingDuration5 days14 days30 daysContribution 300 500 1,000Skills6

Example – Summer Camp (cont’d)GRANT RECIPIENTTITLE OF PROJECT/PROGRAMParticipantsGRANT SCOPESkillsPROJECT PERIOD DurationBUDGET AMOUNT ContributionSUMMER CAMPSusanSwimming5 days 300CindyCooking14 days 500DavidDancing30 days 1,000Grant No. S1 Grant No. C1 Grant No. D17

Reasonable CostsReasonableA cost is reasonable if, in its nature and amount, it does notexceed that which would be incurred by a prudent personunder the circumstances prevailing at the time the decisionwas made to incur the cost.8

Reasonable Costs (cont’d)Reasonable Costs Must: Be generally recognized as ordinary and necessary foroperations and performance Restraints or requirements (e.g. internal control) are inplace Must be comparable to market prices for goods or services Indicate that individuals acted with prudence for thecircumstances Must not significantly deviate from established practicesand policies9

Example – Summer Camp (cont’d)ParticipantsSUMMER ation5 days14 days30 daysContribution 300 500 1,000REASONABLE COSTS bathing suits, feefor pool, & busfaremusic, shoes, feegrocery items,Cookware, fee for for gym, & bus fareKitchen, mileageclaim10

Allocable CostsAllocableA cost is allocable to a particular Federal award or other costobjective if the goods or services involved are chargeable orassignable to that Federal award or cost objective inaccordance with relative benefits received.11

Allocable Costs (cont’d)Allocable Costs Must: Be incurred specifically for the Federal award Benefit both the Federal award and other work of thenon-Federal entity and be distributed in proportionsthat may be approximated using reasonable methods Be necessary to the overall operation of the nonFederal entity and is assignable in part to the Federalaward12

Cost Allocation Federal vs. Non-federal Be accorded consistent treatment Direct vs. Indirect Costs A cost cannot be both an direct and indirect cost Documented Allocation Plan Negotiated Indirect Cost Rate (if applicable)13

Example – Summer Camp (cont’d)SUMMER ingDuration5 days14 days30 daysContribution 300 500 1,000REASONABLECOSTSbathing suits, feefor pool, & bus faregrocery items,Cookware, fee forKitchen, mileageclaimmusic, shoes, feefor gym, & bus fareSkills14

How to Document Federal Expenditures The grantee’s records must identify the source and application offunds for federally funded activities and be supported by sourcedocumentation (45 CFR §§ 75.302(b)(3). The grantee must comply with Federal statutes, regulations, and theterms and conditions of the Federal awards (45 CFR § 75.303(b) and 2CFR part 230, Appendix A, § A.3.b). Policies and Procedures15

Example – Summer Camp (cont’d)SUMMER LECOSTSALLOCABLE COSTSSUPPORTED COSTSSusanSwimming5 days 300bathing suits, feefor pool, & busfareCindyDavidCookingDancing14 days30 days 500 1,000grocery items,music, shoes, feeCookware, fee for for gym, & bus fareKitchen, mileageclaimSusan's accountCindy's accountDavid's accountreceipts and payment records16

KNOWLEDGE CHECK QUESTION 1An organization claimed the mileage reimbursement at 3 per mile for the site visit under the Federal award.This visit is part of the organization’s routine practice tomonitor the Federal program. Would this claim bereasonable?17

KNOWLEDGE CHECK QUESTION 2To be allowable under Federal awards, costsmust be1.2.3.RAD.18

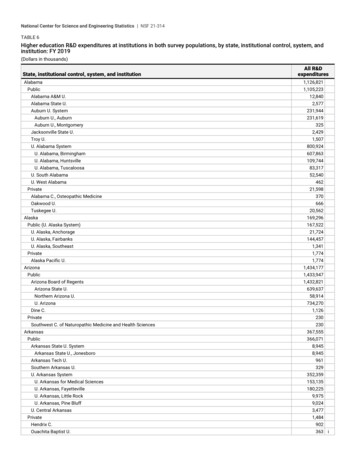

Separate Tracking of a Federal Grant 45 CFR § 75.302 (b)(1) The financial management system must identify, inits accounts, all Federal awards received andexpended and the Federal programs under whichthey were received.19

Separate Tracking of a Federal GrantChart of Account A Chart of Accounts (COA) is the complete list of all accounts that arerelated to an organization. It is used to organize the finances of theentity and to segregate expenditures, revenue, assets and liabilities inorder to give interested parties a better understanding of the financialhealth of the entity. Accounts are typically defined by an identifier (account number) and arecoded by account type. Sub-account for a separate tracking of a Federal grant; subsidiary ledgercontains information that is specific to a certain general ledger account.20

Separate Tracking of a Federal GrantCOA - Typical 5 CategoriesCode10002000300040005000Code DescriptionAssetsLiabilitiesNet AssetsRevenuesExpenses21

Separate Tracking of a Federal GrantCOA Example Sub-Account (Asset & Liability)CodeCode Description1000Assets1001Cash – Operating Account1002Cash – Payroll Account1101Account Receivable – Medicare1102A/R – HRSA Grant 3301301Prepaid Insurance2000Liabilities2001Account Payable – Vendor2002Account Payable – Salaries2003Long-term: Mortgage Payable3000Net Assets3001Unrestricted Net Assets3002Restricted Net Assets22

Separate Tracking of a Federal GrantCOA Example Sub-Account (Revenue)Code40004001400240034004Code DescriptionRevenuesHRSA 330 GrantHRSA Capital Development GrantRevenue - Private InsuranceRevenue - Medicaid23

Separate Tracking of a Federal GrantCOA Example Sub-Account 0030Code DescriptionExpensesSalaries & WagesHRSA 330 GrantLocal GrantTravel - Program supportHRSA 330 GrantLocal GrantSupplies - Program supportHRSA 330 GrantHRSA CIP Grant24

Separate Tracking of a Federal GrantChart of Account- ExampleSummer Camp ngDancingContribution 300 500 1,000REASONABLE COSTSbathing suits, fees forpool, & bus faregrocery items, Cookware,fee for Kitchen, mileageclaimmusic, shoes, fee for gym,& bus fareALLOCABLESusan's accountCindy's accountDavid's accountChart of AccountSC (01)-SW(0010)SC (01)-CO(0020)SC 003Facility -50701-0030-5070

Separate Tracking of a Federal GrantChart of Account- ExampleCode DescriptionSite CodeSite CodeProgram CodeProgram CodeProgram CodeProgram CodeProgram CodeRevenue CodeRevenue CodeRevenue CodeRevenue CodeRevenue 05Code DescriptionSummer Camp (SC)Winter Camp (WC)Swimming (SW)Cooking (CO)Dancing (DA)Snowboard/ SkiingLocal Grant for SCSC - Contribution for SWSC - Contribution for COSC - Contribution for DAWC - ContributionLocal Grant for SC26

Separate Tracking of a Federal GrantGeneral Ledger A general ledger (GL) is complete record of all the financialtransactions over the life of your organization. The generalledger holds all of the information needed to prepare financialstatements and includes assets, liabilities, equity (net asset),revenue and expenses. Expenditure report for a Federal grant27

Separate Tracking of a Federal GrantGL Example – Expenditure ReportExpenditure Report (1-0020-5070) for the month of July 2018SiteCodeTitleSite Code GL TitleGLSubAccount AcctCodeCodeTitleSubEffectiveAccount DateCodeTransactionDebitCreditTotalSummer 01CampSupplies5070Cooking00207/4/2018ABC Mart89.2189.21Summer 01CampSupplies5070Cooking00207/8/2018XYZ Kitchen 60.6760.67Summer 01CampSupplies5070Cooking00207/15/2018ABC Mart40.4640.46190.44190.44Sub-Total for 1-0020-507028

KNOWLEDGE CHECK QUESTION 3is the complete set of all accountsrelated to an organization.It typically has five categories: 1) Assets; 2)Liabilities;; and 5)3) Net Asset; 4)29

KNOWLEDGE CHECK QUESTION 4is the complete records of all financialtransactions over the life of an organization. It isthe backbone of any accounting system.30

Adequately DocumentedTypes of DocumentationPersonnel Costs Salaries and Wages - Timecard/ PAR (Personnel Activity Report) allocatingactual hours to a specific fund; payroll records Fringe Benefit CostsNon-Personnel Costs Invoices including vendor (within the grant scope), date (within the projectperiod), amount (if entire amount is not claimed, the basis of the cost shouldbe documented.), and authorization record for cost approval and allocation. Payment records (canceled checks)31

Adequately DocumentedMost common deficiency – Lack of Supporting Documentation Invoices showing vendor, dateand amount paid. Receipt of purchase. Dates on invoices and receiptsshould fall within the grantperiod. Copies of cancelled checksshowing the amounts wereactually paid. Connection to the grant (costcenter, fund type code) – ingeneral ledger. Subrecipient agreements orcontracts. Costs should support onlyitems listed in the grantbudget. Travel logs. Personal Activity Reports.32

What to Document for Salaries and Wages For salaries and wages to be allowable for Federal reimbursement,grantees must maintain monthly after-the-fact certifications of theactual activity for each employee working on Federal awards (2 CFRpart 230, Appendix B, §§ 8.b and 8.m). Charges to Federal awards for salaries and wages must be based onrecords that accurately reflect the work performed. The records mustsupport the distribution of the employee’s salary or wages amongspecific activities or costs. The grantee’s system of internal controlsshould include processes to review after-the-fact interim chargesmade to a Federal award based on budget estimates. (45 CFR §75.430(i)(1)).33

Time and Effort ReportingSalaries and Wage (45 CFR § 75.430(i)(1)) Budget vs. Actual Time ACTUAL TIME ONLY! Adjustments from budgeted time to actual time Employees Funded by Multi-sources Requirement – Personnel Activity Reports 100% Funded Employees Semi-Annual Compliance Certification34

Federal Record RetentionRecord Retention (45 CFR 75.361) Must retain all records for three years after submitting the finalexpenditure report (FFR for non-construction awards; OutlayReport and Request for Reimbursement for construction awards) Exception for the 3-year rule - If any litigation, claim, or audit isstarted before the expiration of the 3-year period, the recordsmust be retained until all litigation, claims, or audit findingsinvolving the records have been resolved and final action taken.35

Avoiding Unallowable CostsExamples of Unallowable Cost Alcoholic beverages(45 CFR 75.423) Fines and penalties(45 CFR 75.441) Bad debt (45 CFR 75.426) Lobbying (45 CFR 75.450) Contingency provisions(45 CFR 75.433) Entertainment Costs (e.g.amusement, social activities,meals)(45 CFR 75.438)36

KNOWLEDGE CHECK QUESTION 5An organization charged meals to the Federalaward. The meals were prepared for the staffevent, “Bring kids to the workplace”. Would thisbe allowable cost under the Federal awards?37

KNOWLEDGE CHECK QUESTION 6How long should the Federal records beretained?38

Key Points Documented! Documented!! DOCUMENTED!!!

Key Points (cont’d) Think Allowable, Allocable & Reasonable Grantees should have adequate policiesand procedures for fiscal oversight Be compliant, and follow the rules of theNOFO and NOA

Key Points (cont’d) Use the approved budget as your guide When in doubt, consult your HRSAGrants Management Specialist orProject Officer REMEMBER: IF IT IS NOTDOCUMENTED IT DOES NOT EXIST!

Questions?42

Contact InformationSarah ShimSpecial Reviews Audit Resolution Team Lead, Division of Financial IntegrityHealth Resources and Services Administration (HRSA)Email: sshim@hrsa.govPhone: 212.264.2749Esther LiuAuditor, Division of Financial IntegrityHealth Resources and Services Administration (HRSA)Email: eliu@hrsa.govPhone: 301.945.3347Web: www.hrsa.gov/about/organization/bureaus43

Connect with HRSATo learn more about our agency, visitwww.HRSA.govSign up for the HRSA eNewsFOLLOW US:44

Separate Tracking of a Federal Grant. Chart of Account A Chart of Accounts (COA) is the complete list of all accounts that are related to an organization. It is used to organize the finances of the entity and to segregate expenditures, revenue, assets and liabilities in order to give i