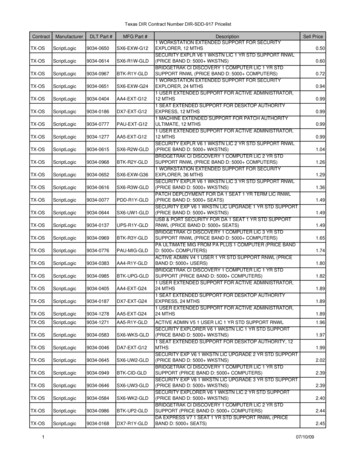

Transcription

j If k)(¶* jEf gG* z Credit Card Contract

j If k)(¶* jEf gG* z Credit Card Contract Ó f D D*§º* . § G* *{J µ z G* *{J 4 0.(" ¡gG* " C z f D G(* 4f MK 24&¶* 11190 – f 926190 zM Kz¡ 8 Çf G* *§¡ G* 2 -4f - 24zIfk 6 ¡ K&¶* M G*. j ¡·* . j ¡·* .ÇfnG* M G*ª f G* 6(¶* j 6f 6&¶* jEf gG* Hf0ª f G* CCCC 6(¶* j fkG* jEf gG* Hf0 Ó I24&¶* Ò G G* 5*§/ E4 . Ó I24&ÏG ª¡:§G* E4("jEf gG* Hf0" C z f D G(* 4f M . *§¡ G*This contract is made on this day .between:First Party: Standard Chartered Bank, Address: Shmeissani P.O.Box 926190 Amman 11190 Jordan (Hereinafter referred to as the “Bank”)Second Party: .Primary Cardholder (four sections):.Nationality: .Supplementary Cardholder (four sections):.Nationality: .National Number (for Jordanians) . Passport Number (for non-Jordanians) .Address: . (Hereinafter referred to as the Cardholder)Version: November/2018

z MK j If k)¶* jEf gG* h : s3§Å H &* qkM N* / f 0&¶*K K} G* {J Êk H zEf kGf ¡H 4* E(* jEf gG* 4*z 8(* hGf: G* gE H f E§kG* 9 G*K 4* E(¶* ¼(* jDf 9(¶f z G* f 0&*K K}7 jDfF §g K ¡gG* §J f g 0 h G* z º jEf ÒD§- 2 -4f - 24zIfk 6 ¡ j D*§H s4z¡ jEf gG* Hf0 h : N* f¡ ]jEf gG* Hf0 ª M f D f G(* 4f M fI2* 2z¿j GfkG* f 0&¶*K K} G* Ó M G* Ó j D*§º* l³ z DThese Terms and Conditions is considered to be part of the CreditCard application and read with it as one unit and singing on them bythe customer-Card applicant will consider as acceptance of contracting with the Bank and acceptance of all terms and conditions on thiscontract in addition to the declaration, offer.In consideration of Standard Chartered Bank agreeing to make aCard available to the applicant in accordance with the following at theCardholder’s request, both parties have agreed on the following termand conditions:mf M kG* 1 'HÀQLWLRQVa) ‘ATM’ means an automated teller machine or any card-operatedmachine or device whether belonging to the Bank or otherSDUWLFLSDWLQJ EDQNV RU ÀQDQFLDO LQVWLWXWLRQV QRPLQDWHG IURP WLPH to time by the Bank, which accepts the Card.b) ‘Bank’ means Standard Chartered Bank, its successors and itsassignees and the companies related to it.c) ‘Card’ means the applicable Standard Chartered Bank CreditCards, including Visa Card issued by the Bank to the Cardholderand includes Primary, Supplementary and Replacement Cards.d) Cardholder: the individual requested to issue the card in connection with the Credit Card application which will be issues byStandard Chartered Bank for the purpose of using it, and theCardholder includes the primary cardholder and any of thesupplementary Cardholders.e) ‘Card Account’ means the Standard Chartered Bank Visa CreditCard account opened by the Bank for the purpose of entering allcredits and debits result from use of the Card by the PrimaryCardholder and Supplementary Cardholder, if any, under theseconditions of use and includes, without limitation, all debitsincurred by the Cardholder resulting from any Cash Advancesand or with drawals and/or purchazes and/or charges and/orliabilities arising out of or in connection with any Card transactions otherwise.f) ‘Card Transaction’ means any Cash Advance made by a bank orthe amount charged by the Bank or any Merchant for any goods,VHUYLFHV EHQHÀWV RU UHVHUYDWLRQ LQFOXGLQJ ZLWKRXW OLPLWDWLRQ DQ\ reservation made by the Cardholder for air, ship, rail, motor orother transportation or hotel or other lodging or accommodation,rental, or hire, whether or not utilised by the Cardholder)REWDLQHG E\ WKH XVH RI WKH &DUG V RU WKH 3,1 RU LQ DQ\ RWKHU manner including, without limitation, mail, telephone or facsimileorders or reservations authorised or made by the Cardholderregardless of whether a sale slip or Cash Advance or othervoucher or form is signed by the Cardholder.g) ‘Cash Advance’ means any amount obtained by the use of the&DUG WKH &DUG QXPEHU RU WKH 3,1 RU LQ DQ\ PDQQHU DXWKRULVHG E\ WKH &DUGKROGHU IURP WKH %DQN RU DQ\ RWKHU EDQN RU ÀQDQFLDO institutions or ATM displaying the MasterCard/Visa scheme anddisbursements.h) Charges’ mean all and any purchases charged and all amountspayable by the Cardholder arising from the issuance or use ofthe Card and/or all and any purchase charge by use of the CardQXPEHU RU WKH 3,1 DQG LQFOXGHV ZLWKRXW OLPLWDWLRQ DOO &DUG Transactions, fees, charges, interest, expenses, damages andlegal costs and disbursements.i) ‘Credit Limit’ means the maximum outstanding balance permittedby the Bank for the Card Account for the Primary Card andSupplePHQWDU\ &DUG DQG QRWLÀHG WR WKH 3ULPDU\ &DUGKROGHU IURP time to time.j) ‘Current Balance’ means the total balance outstanding on theCard Account payable to the Bank according to the Bank’srecords on the date the Statement of Account is issued includingall charges and liabilities.k) ‘Merchant’ means any retail outlet, person or corporate entitysupplying goods and/or services who accepts the Card of theCardholder as a means of payment or reservation by theCardholder.l) ‘Month’ means calendar month.P ¶3D\PHQW 'XH 'DWH· PHDQV WKH GDWH VSHFLÀHG LQ WKH 6WDWHPHQW RI Account by which date payment of the Current Balance or anypart thereof or the Minimum Payment Amount is to be made tothe Bank.Q ¶3,1· PHDQV WKH SHUVRQDO LGHQWLÀFDWLRQ QXPEHU LVVXHG WR WKH Cardholder to enable the Card to be used at an ATM and/orother authorised terminals for a Cash Advance.o) Primary Cardholder: means the individual requested to issuecard other than “Supplementary Cardholder” for whom the cardDFFRXQW LV ÀUVW RSHQHG E\ WKH %DQN j 6*§ M 5f / K&* jG%* «&* K&* ½%¶* } G* 5f / ª¡ M ]½%¶* *} G* 5f / &* j GfH mf 6'§H K&* §¡ K&* ¡gGf Nf 8f1 fF *§ 6 jEf gG* g MK jEf gG* 1%¶ Ó0 H f k k ¡gG* § M jF4f H L 1&* j fkG* mfF} G*K G 5f¡kº*K 1K 2 -4f - 24zIfk 6 ¡ ª¡ M ] ¡gG* i f G ¡gG* H ,42f G* * D 2 -4f - 24zIfk 6 ¡ f k)(* jEf ª¡ - ]jEf gG* s j fkG* mfEf gG* j 6f 6&¶* mfEf gG* k-K jEf gG* Hf0 ¼(* j MzgG* mfEf gG*K jEf gG* h : s3§Å h/§ jEf gG* 4*z 8(* hGf: w G* jEf gG* Hf0 2 mfMf G 2 -4f - 24zIfk 6 ¡ gE H fJ4*z 8(* kM ªkG*K j If k)(¶* H «&*K j 6f 6&¶* jEf gG* Hf0 M jEf gG* Hf0K f Gf k 6* j fkG* jEf gG* ª Hf0 * D 2 -4f - 24zIfk 6 ¡ f k)(* jEf if 0 ª¡ M ]jEf gG* if 0 CJ jq kI j¡)*zG*K j¡Mzº* 2§ G* jDfF f12(* mfMf G ¡gG* gE H tkD «{G* j fkG* jEf gG* Hf0K ª 6f 6&¶* jEf gG* Hf0 gE H jEf gG* *zwk 6(* / } 0 K2 - ªkG*K {J f k 6(¶* K}7 h/§ z/K (* K&* K jMz I mf §t 6 «&* j f¡G*K jEf gG* Hf0 fJzg - ªkG* §MzG* j kº* K&* &f ¡- ªkG* mfH* kG(* K&* K mf I K&* K mfMÌ H K&* K mf §t 6 m¶§ G* K&* K z)*§ G* K&* K § 6 G* K&* K jEf gGf j 8f¹* mf Gf z M «{G* gº* K&* ¡gG* H z H «z I ht 6 «&* ª¡ - ]jEf gG* mÏHf H K «&* } 0 K2 M q0 K&* fM* H mfHz1 )f jM&* f H /f- K&* ¡gG* 4f Gf K&* tgGf K&* §·f I j 6K jM&¶ jEf gG* Hf0 gE H kM q0 L 1&¶* jHfE(¶* K&* G* FfH&* K&* 2f¡ G* K&* L 1&¶* ¡G* )f 6K K&* jgF H K&* Hf0 gE H k - » &* l k 6* *§ 6 4fqM(¶* K&* 4fqck 6(¶* K&* E4 K&* mfEf gG* K&* jEf gG* *zwk 6f f § * kM ªkG*K ]jEf gG* K&* mfg G* } 0 Kz K NÏHf 7 L 1&* j M : jM&f K&* ª w G* M kG* k- ªkG* m*5§q * K&* Ff G* K&* -f G* K&* zMÊG* M : k- ªkG* m*5§q * E§kG* *3(* f ¡G* } ]jEf gG* Hf0 gE H f v} M K&* jEf gG* Hf0 gE H 1%* f M(* «&* K&* «z I ht 6 K&* mf gH j E ¡ «&* H K&* ¡gG* H § * gH «&* ª¡ - ]jMz ¡G* mf §t G* 5 Dz G * D f I ,4f 7(* tM ½%* *}8 5f / K&* j GfH j 6'§H K&* 1%* L 1&* j M : «&* µ K&* ª w G* M kG* E4 K&* jEf gG* f k 6(* j 6*§ jEf gG* Hf0 gE H f v} H Gfgº* jDfFK f k E z E kM ªkG* mfMÌ º* H «&*K jDfF ª¡ - ]mf ¡G* v f k 6* K&* 4*z 8(* jc 7f¡G* ]jEf gG* Hf0 gE H DzG* j tk H f k 6* j 6*§ f k E kM *}7 jG§ «&*K jDfF K&* K jEf g G / } 0 K2 G3 kMK ]ª w G* M kG* E4 K&* jEf gG* E4 4} G*K G* M4f º* z)*§ G* mf ¡G*K § 6 G* ]jEf gG* mÏHf H mf ¡G*K j I§If G* if -&¶* ¡gG* gE H v§ º* Mzº* z 8 G E&¶* z * ª¡ M ] f k)(¶* z0 4f 1(* «{G*K j fkG* jEf gG*K j 6f 6&¶* jEf g G G3K jEf gG* if 1%¶ lEK H ª 6f 6&¶* jEf gG* Hf0 tk º* jEf gG* if 0 Mzº* z 8 G* ½f /(* ª¡ M ]½f * z 8 G* « if * F 4*z 8(* xM4f- µ ] ¡gG* mÏq G Nf g: ] ¡g G DzG* mfH* kG(¶*K z)*§ G*K m¶§ G* / NÏHf 7 zM4§k § - jM4fgk (* jc J K&* w 7 «&* K&* j) qkGf «&* ª¡ M ] /fkG* j 6§F jEf gG* Hf0 H jEf gG* g M «{G*K mfHz¹* K&* K )f gG* jEf gG* Hf0 gE H q * K&* Dz G «2Ï º* G* ª¡ M ] G* G§ t «{G*K if * 2ztº* xM4fkG* ª¡ M ]j DzG* f tk 6(* xM4f- ¡gG* ¼(* ] Dz G I2&¶* z * K&* ¡H / «&* K&* ½fC * z 8 G* 2*z 6 Ó kM Hf 42f G* ª w G* M kG* E4 ª¡ M ]ª w G* M kG* E4 1%* 5f / «&* K&* K ½%¶* *} G* , /&* µ jEf gG* f k 6(* Ó kG jEf gG* «z I ht 6 § t G v} H Hf0" Ò jEf 4*z 8(* hGf: w G* ª¡ M j 6f 6&¶* jEf gG* Hf0 6 jM*z {¡H ¡gG* gE H G "jEf gG* if 0" ukD «{G*K "j fkG* jEf gG* Hf kG*-2-

Gf 64(* kM «{G* «4KzG* K&* « G* ¡gG* F ª¡ M ]if * F z 8 G* 8f - D Nft 9§H j 6f 6&¶* jEf gG* Hf0 ¼(* ¡gG* j 6*§ jEf gG* Hf0 gE H jEf gG* *zwk 6* jq kI zg - «{G*K ½f * ] ¡g G DzG* tk º* z/K (* ]j fkG* jEf gG* Hf0 K ]j 6f 6&¶* ]j f- jEf G ¡gG* 4z 8&* «{G* w G* ª¡ M ]j fkG* jEf gG* Hf0 ]j 6f 6&¶* jEf gG* Hf0 h : N f¡ p) ‘Statement of Account’ means the Bank’s monthly or other periodicCardholder showing particulars of the Current Balance incurredfrom using the Card by the Primary Cardholder and the Supplementary Cardholder, if any, payable to the Bank.q) ‘Supplementary Cardholder’ means the person who has beenissued with a Supplementary Card by the Bank, at the request ofthe Primary Cardholder. 8QOHVV WKH FRQWH[W UHTXLUHV RWKHUZLVH- Words denoting one gender shall include all other genders.- Words denoting the singular shall include the plural and vice versa;- Words importing person shall include a sole proprietor, individualSDUWQHUVKLS ÀUP FRPSDQ\ FRUSRUDWLRQ RU RWKHU QDWXUDO RU OHJDO person whatsoever.- The word ‘terminal’ means any terminal or device through whichCard Transactions or payment by the use of the Card can beperformed. ,VVXDQFH RI WKH &DUG2.1 As a pre-condition for approving any application to issue a Card,the Bank may, in its absolute discretion, require the customer topledge and/or assign a cash deposit in favour of the Bank for anyamount determined by the Bank. The Bank shall maintain thissecurity so long as the Card is valid and there is any outstandingbalance on the Card Account. If the outstanding balance is fullysettled the Bank shall continue to maintain this security for aSHULRG QRW OHVV WKDQ IRUW\ ÀYH GD\V IURP WKH GDWH RI FDQFHO ling the Card.2.2 If the Bank holds any security as collateral for the issuance of theCard, the Bank reserves the right to retain such security for aPLQLPXP SHULRG RI IRUW\ ÀYH GD\V IROORZLQJ WKH &DUG FDQFHO lation and its return to the Bank, whether such cancellation isdetermined by the Bank or at the request of the Cardholder,provided that the outstanding balance is fully settled. 7KH &DUG VKDOO EH YDOLG IRU WKH SHULRG VSHFLÀHG RQ WKH &DUG DQG the Card can be used only within the said period.2.4 The Bank reserves the right to change the designs of the Card atany time without notice.2.5 The Cardholder agrees that the Bank in its absolute discretionprocures insurance whether on the life of the Cardholder, on thedebt incurred to the Bank or on any other risks as the Bankdeems appropriate. The Cardholder also agrees to bear all fees,costs and expenses incurred as a result. The Bank shall, at anytime, be entitled to alter the terms and conditions of anyinsurance and shall be entitled to terminate the insurance at itsown discretion and without prior notice to the Cardholder. 7KH &DUG 3.1 The Card is and will be, at all times, the property of the Bank andmust be surrendered to the Bank immediately upon request bythe Bank or its duty authorised agent. The Bank reserves theright to withdraw the Card at its absolute discretion and/or toterminate the use of the Card, with prior notice, and in whateverFLUFXPVWDQFHV LW GHHPV ÀW 7KH %DQN VKDOO EH HQWLWOHG WR EORFN and/or suspend the Card without prior notice in cases where theBank suspects a high risk of fraud or possibility of misconduct inrelation to the Card.3.2 The Card may be collected by the Cardholder or sent by post orFRXULHU WR WKH DGGUHVV QRWLÀHG WR WKH %DQN E\ WKH &DUGKROGHU DW the risk of the Cardholder.3.3 Upon receipt of the Card, the receipient shall sign the Cardimmediately and such signature and/or use of the Card willFRQVWLWXWH ELQGLQJ DQG FRQFOXVLYH HYLGHQFH RI WKH FRQÀUPDWLRQ RI the Cardholder to be bound by the Term and Condition of thisFRQWUDFW QRWZLWKVWDQGLQJ WKDW WKH %DQN LV QRW QRWLÀHG RI WKH Cardholder’s receipt of the Card.3.4 In the event that the Cardholder does not wish to be bound bythese Terms and Conditions of Use, the Cardholder shall cut the&DUG LQ KDOI DQG UHWXUQ ERWK KDOYHV WR WKH %DQN DQG &ODXVH hereof shall henceforth be operative.3.5 The Card is not transferable and shall not be used excessively bythe Cardholder. The Card may not be pledged by the Cardholderas security for any purpose whatsoever. 8VH RI WKH &DUG4.1 The Card is ready for use in connection with the facilities madeavailable by the Bank from time to time at its absolute discretionCardholder showing particulars of the Current Balance incurredby including, but not limited to the following:a)The payment for any purchase of goods and/or services, whichpayment may be charged to the Card Account.b) Any ATM transaction effected through the use of the Card.F &DVK GYDQFHV VHW RXW XQGHU &ODXVH KHUHRI DQG RU d) Other facilities subject to pre-arrangement with the Bank, ifapplicable. (fD G3 Ï1 ¡G* f 6 ª k M » fH 1 1 Ó ¡·* k- oI'§º*K F{º* o 0 H ¡·* ¼(* Ò - ªkG* mf G* Gf K ·* Nf M&* ª¡ - 2 G Ò - ªkG* mf G* K&* jM2 G* j 6'§º* K&* z 0§G* Gfº* - ] w G* ¼(* Ò - ªkG* mf G* fF NfM&* «4fgk (* K&* ª g: w 7 «&* K&* j 6'§º* K&* jF} G* DzG* K&* jEf gG* mÏHf H 5fÃ(* M : È 5f / «&* ª¡ - ]5f / j F jEf gG* M : jEf gG* 4*z 8(* 2 Nf DK ¡g G 5§qM jEf 4*z 8(¶ h : «&* j D*§ G g H } F 1 2 5f¡kG* K&* K J4 jEf gG* Hf0 z kº* H h M &* º* Mz kG *{ ¡gG* ktM ¡gG* 2ztM gH «&f ¡gG* uGf G jMz I j M2K if 0 µ MzH z 84 Gf¡J *2 fHK jEf gG* § H fM}6 j : f G* *{ fCC k0(¶* ¡gG* Ó kM Hf Gf Mzº* z 8 G* 2*z 6 *3(* jEf gG* jEf gG* fC G(* xM4f- H NfH§M Ó 4&*K j 1 45 - ¶ ,zº f G* * ¡g G § M jEf gG* 4*z 8(¶ µf 9(* f 9 «&f ktM ¡gG* fF *3(* 2 2 f G(* zC NfCH§M Ó 4&*K j 1 45 fC E&* ,zCº fCC G* G{ f k0(¶f f¡ K&* ¡gG* 4* CC zE f G(¶* *{J fCF *§ 6 ¡g G f -2f (*K jEf gG* Hf Gf Mzº* z 8 G* zMz - j M}7 jEf gG* Hf0 h : ÈK jEf gG* ,2ztº* ,zº* Ï1 § º* jM4f 6 jEf gG* § - 3 2 ,4§F{º* ,zº* Ï1 D jEf gG* *zwk 6(* g H 4f 7(* K2 lEK «&* µ jEf gG* - Ò - t ¡gG* ktM 4 2 § f º* Mz - h 0 ¡gG* f E jEf gG* Hf0 D*§M 5 2 «&* K&* ¡g G h-̺* M2 K&* jEf gG* Hf0 ,f 0 *§ 6 ÓH&f jEf gG* Hf0 D*§M f F Nfg 6f¡H ¡gG* * M f g 0 L 1&* :fÀ lEK «&* µ ¡g G 5§CqM G3 jg-̺* M4f º*K mf ¡G*K § 6 G* jDfF ÓH&fkG* f G(* ¡g G 5§qM f F ÓH&f- «&f j 8f¹* f 0&¶*K K} G* Mz jEf gG* Hf g H 4f 7(* K2 4f k1(* t jEf gG* 3 fCC - hqMK ¡g G Nf H mfEK&¶* / µ g-K jEf gG* Êk - 1 3 C ktM §CC 8&¶* h 0 9§C º* FK K&* ¡gG* h : z¡ N*4§CCD CC¡g G *zCCwk 6* f I(* K&* K º* Mz kG Nf DK jEf gG* ht 6 µ f C¡gG* CE§M K&* K CC C M &* C¡g G tM g H 4fCCC C 7(* h/§C jCCEf gG* CC¡gG* f D gk M ªkG* m¶fCC * µ Cg H 4fCC C 7(* hC/§ jCCEfC gG* kM f D } - §CC 6 j Gf k0(* K&* ÒgF fCC k0* C 1 2§CC/K jCCEf gGf zMÊG* K&* zMÊGf f Gf 64(* K&* jEf gG* Hf0 gE H jEf gG* Ïk 6* 5§qM 2 3 G3K jEf gG* Hf0 gE H ¡g G 4f 1(* «{G* *§¡ G* ¼(* M} G* jEf gG* Hf0 j GK'§ H Êk M N*4§D f E§kG* jEf gG* k H hqM jEf gG* Ïk 6* z¡ 3 3 H :fE G2K * kG(* j fn jEf g G H*zwk 6* K&* K jEf gG* Hf0 E§ jEf gG* z µ ,24*§G* f 0&¶*K K} G* k D*§HK G§g gE jEf g G HÏk 6f ¡gG* Ï (f Hf E z ¡G* j If k)(¶* Ó kM {J f k 6¶* K} * kG¶* µ jEf gG* Hf0 jg 4 z jGf0 µ 4 3 «} -K ¡gG* ¼(* Ó ¡G* ÏF ,2f (*K Ó I ¼(* f M ³ jEf gG* Hf0 z G* *{J H 9 z¡gG* f 0&* N*z f D lE§G* G3 Hf Gf k 6* z jEf gG* Hf0 Ó kMK M§tk G j fE Ò jEf gG* Êk - 5 3 «&¶ f F jEf gG* Hf0 gE H jEf gG* J4 5§qM ¶K H fF f H 9 jEf gG* f k 6* 4 CC¡gG* fJ CCD§M ªkG* mÏC C kG* f H f k 6(ÏG j f 8 jEf gG* § - 1 4 CC 0 K2 CC G CG3 CC C

k) ‘Merchant’ means any retail outlet, person or corporate entity supplying goods and/or services who accepts the Card of the Cardholder as a means of payment or reservation by the Cardholder. l) ‘Month’ means calendar month. P ¶3D\P