Transcription

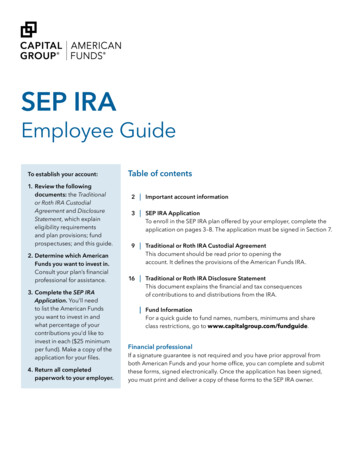

SIMPLE IRAEmployee GuideTo establish your account:1. Review the followingdocuments: the SummaryDescription, which explainseligibility requirements and planprovisions; the Notification toEligible Employees, whichspecifies your employer’scontribution amount; fundprospectuses; and this guide.2. Determine how much of yoursalary you want to save in yourSIMPLE IRA and which AmericanFunds you want to invest in.Consult your plan’s financialprofessional for assistance.3. Complete the SIMPLE IRAApplication and any otherapplicable forms. You’ll need tolist the American Funds you wantto invest in and what percentageof your contributions you’d liketo invest in each ( 25 minimumper fund). Make a copy of theapplication for your files.4. On the Salary Deferral Electionprovided by your employer,indicate how much of yoursalary you want to save in yourSIMPLE IRA.5. Return all completed paperworkto your employer.Table of contents1 SIMPLE IRA ApplicationTo open your SIMPLE IRA, complete the application and signin Section 7.6 SIMPLE IRA Custodial AgreementThis document should be read prior to opening the account.It defines the provisions of the American Funds IRA.12 SIMPLE IRA Disclosure StatementThis document explains the financial and tax consequencesof contributions to and distributions from the IRA.Fund informationFor a quick guide to fund names, numbers, minimums, and share classrestrictions, go to www.capitalgroup.com/fundguide.Financial professionalIf a signature guarantee is not required and you have prior approval fromboth American Funds and your home office, you can complete and submitthese forms, signed electronically. Once the application has been signed,you must print and deliver a copy of these forms to the IRA owner.

Important account informationEligibilityYour investment optionsIn general, if you expect to earn at least 5,000 in the currentcalendar year AND you’ve earned at least 5,000 during anytwo prior calendar years, you’re eligible to participate in yourcompany’s SIMPLE IRA plan. Your employer may have lessrestrictive requirements, which would be outlined in yourplan’s Summary Description.You’re in control: You select the American Funds you believeare most appropriate for your financial needs and goals. Whenchoosing your investments, it’s a good idea to consult yourfinancial professional.Your contributionsYou decide how much of your pay, up to IRS limits,* you wantto contribute. Your contributions will be deducted directlyfrom your paycheck. You can make: Before-tax contributions. Because you’re contributingmoney from your paycheck before income taxes arededucted, you reduce your annual taxable income in theyear the contributions are made. Before-tax contributionsallow your savings to accumulate tax-deferred. In otherwords, you don’t pay taxes on what you save or onyour assets as they grow until you take the money outat retirement. Additional catch-up contributions. If you’re 50 or older,you can contribute an additional amount* before taxes.*See the Disclosure Statement in the back of this guide for currentcontribution limits.Your employer’s contributionsAs described in your plan’s Summary Description, youremployer will make one of two types of contributions: Matching. Your employer may match any contributions youmake, dollar for dollar, up to 3% of eligible compensation. Nonelective. Your employer may contribute up to 2% ofyour eligible compensation to your SIMPLE IRA account —regardless of whether you make any contributions. Reviewthe Notification to Eligible Employees for the maximumcompensation amount used to calculate contributions.Vesting01/21The money that you and your employer contribute to the planis vested immediately — in other words, it’s yours to keep.Monitoring your accountYou can monitor your investment results with: Your quarterly statement The American Funds 24-hour automated phone serviceat (800) 325-3590 www.capitalgroup.comMaking changes to your accountYou’ll receive a welcome package including your newaccount number. Once you receive it, we encourage you tovisit www.capitalgroup.com/getstarted to set up onlineaccount access.This will enable you to: Sell and exchange shares online View current and past account balances as well as dividendand capital gain information Manage your account information Sign up for electronic delivery of tax forms, annual andsemiannual reports, quarterly statements and prospectusesWithdrawalsAny money you take out of your SIMPLE IRA is subject toordinary income tax, and if you withdraw the money before youreach 59½, a 10% federal tax penalty may apply. If withdrawalsare made during the first two years of participation in the planand you’re under 59½, a 25% tax penalty may apply.Have questions?To learn more about your SIMPLE IRA plan, please contactyour employer or your plan’s financial professional.

Clear and reset formSIMPLE IRAApplicationTo be completed by employer(Name of companyEmployer contact)Ext.Daytime phoneCompany addressCityStateZIPCheck A or B.A. New plan (must be accompanied by a copy of the employer’s completed and signed SIMPLE IRA Adoption Agreement)B. Existing plan (provide Plan ID for reference)To be completed by employee1Information about youImportant: This section must be completed, and the application must be signed in Section 7 before an account can be established.Please type or print clearly.–––SSN of SIMPLE IRA owner–Date of birth (mm/dd/yyyy)First nameMICountry of citizenship of SIMPLE IRA ownerLastResidence address (physical address required — no P.O. boxes)CityStateZIPMailing address (if different from residence address)CityStateZIP(Email address*)Daytime phone* Your privacy is important to us. For information on our privacy policies, visit www.capitalgroup.com.Please mail orfax this form tothe appropriateservice center.Indiana Service CenterVirginia Service CenterAmerican Funds Service CompanyP.O. Box 6164Indianapolis, IN 46206-6164American Funds Service CompanyP.O. Box 2560Norfolk, VA 23501-2560(If you live outsidethe U.S., mail theform to the IndianaService Center.)Overnight mail address12711 N. Meridian St.Carmel, IN 46032-9181Overnight mail address5300 Robin Hood Rd.Norfolk, VA 23513-2430Fax (888) 421-4371Fax (888) 421-437101/21If you have questions or require more information, contact your financial professional or call American Funds Service Company at (800) 421-4225.1 of 13

SIMPLE IRAApplication2Financial professionalThis section must be filled out completely by the financial professional(s).We authorize American Funds Service Company (AFS) to act as our agent for this account and agree to notify AFS of purchases made undera Statement of Intention or Rights of Accumulation. If applicable, we have provided a copy of our SEC Form CRS to the investor named onthis application.(Name(s) of financial professional(s)Professional/team ID #Branch numberBranch address)Ext.Daytime phoneCityStateZIPXName of broker-dealer firm (as it appears on the Selling Group Agreement)3Signature of person authorized to sign for the broker-dealer — requiredInvestment instructionsI elect to invest my contributions in Class A shares of the American Funds Target Date Retirement Series fund with the yearclosest to my 65th birthday unless I complete the SIMPLE IRA Transfer Election form or elect otherwise below.If you wish to systematically transfer your contributions to another custodian, investments must be in the money market fund.You'll need to complete the SIMPLE IRA Transfer Election form, available from your financial professional.A. Invest 100% of my contributions in Class A shares of the American Funds Target Date Retirement Series fund with the year closestto my 65th birthday. New funds for future retirement dates may be added to the series as needed.Target Date Fund 2065 (designed for those born 1998 or later)Target Date Fund 2035 (designed for those born 1968–1972)Target Date Fund 2060 (designed for those born 1993–1997)Target Date Fund 2030 (designed for those born 1963–1967)Target Date Fund 2055 (designed for those born 1988–1992)Target Date Fund 2025 (designed for those born 1958–1962)Target Date Fund 2050 (designed for those born 1983–1987)Target Date Fund 2020 (designed for those born 1953–1957)Target Date Fund 2045 (designed for those born 1978–1982)Target Date Fund 2015 (designed for those born 1948–1952)Target Date Fund 2040 (designed for those born 1973–1977)Target Date Fund 2010 (designed for those born 1947 or earlier)ORB. Invest my contribution as instructed below. For a quick guide to fund names, numbers, minimums and share class restrictions, go towww.capitalgroup.com/fundguide. If you do not select a share class, this investment will be placed in Class A shares. (The percentageyou elect must equal the minimum of 25 per fund. You may customize your investment strategy by selecting a combination of funds.)Select a share class: Class AFund name or numberOR Class CPercentageFund name or numberPercentage(whole % only)(whole % only)%%%%%%Total01/21Notes: To make changes to your fund selections and/or percentage allocations in the future, notify your employer. To rebalance funds or set up an automatic exchange plan, visit www.capitalgroup.com. To add bank information for future redemption requests, include a completed Add/Update Bank Information form. The 10 setup fee will be deducted from your account.2 of 13%

SIMPLE IRAApplication4Beneficiary designationWe encourage you to consult a professional regarding the tax-law and estate planning implications of your beneficiary designation. All statedpercentages must be whole percentages (e.g., 33%, not 33.3%). If the percentages do not add up to 100%, each beneficiary’s share will be basedproportionately on the stated percentages. When percentages are not indicated, the beneficiaries’ shares will be divided equally.Notes: Your spouse may need to sign in Section 6. If you wish to name more than one trust or entity, customize your designation or needmore space, attach a separate page. Include the name, address, relationship, date of birth or trust, SSN/TIN and percentage foreach beneficiary. If you name a trust as beneficiary, provide the full legal name of the trust. Example: “The Davis Family Trust.”A. Primary Beneficiary(ies): If any designated Primary Beneficiary(ies) dies before I do, that beneficiary’s share will be divided proportionatelyamong the surviving Primary Beneficiaries unless otherwise indicated. If no Primary Beneficiaries survive me, assets will be paid to thenamed Contingent Beneficiaries, if any.1.First name (print)MISuffixLast nameORName of trust or other entity (print)AddressCity Other entitySpouse* Child of owner Other person TrustStateDate of birth or trust (mm/dd/yyyy)%SSN/TINWhole % only2.First name (print)MI Spouse* Child of owner Other personSuffixLast nameAddressCityStateMISSNWhole % onlySuffixLast nameAddress Spouse* Child of owner Other personCityStateMISSNWhole % onlySuffixLast nameAddress Spouse* Child of owner Other personZIP%Date of birth (mm/dd/yyyy)4.First name (print)ZIP%Date of birth (mm/dd/yyyy)3.First name (print)ZIPCityStateZIP%Date of birth (mm/dd/yyyy)SSNWhole % only* By naming my spouse as a beneficiary, I elect to treat such spouse as a beneficiary while we are married. Effective immediately upon the divorce, annulmentor other lawful dissolution of my marriage, the designation shall be null and void, unless after the dissolution of my marriage I affirmatively elect to name myformer spouse as my non-spouse beneficiary.01/21Continued on next page3 of 13

SIMPLE IRAApplication4Beneficiary designation(continued)Important: Section 4-A must be completed prior to completing Section 4-B.B. Contingent Beneficiary(ies): If no Primary Beneficiary survives me, pay my benefits to the following Contingent Beneficiary(ies).If any designated Contingent Beneficiary(ies) dies before I do, that beneficiary’s share will be divided proportionately among the survivingContingent Beneficiaries unless otherwise indicated. If no Contingent Beneficiaries survive me, assets will be paid according to theCustodial Agreement default designation.1.First name (print)MISuffixLast nameORName of trust or other entity (print)AddressCity Other entitySpouse* Child of owner Other person TrustStateDate of birth or trust (mm/dd/yyyy)%SSN/TINWhole % only2.First name (print)MI Spouse* Child of owner Other personSuffixLast nameAddressCityStateMISSNWhole % onlySuffixLast nameAddress Spouse* Child of owner Other personCityStateMISSNWhole % onlySuffixLast nameAddress Spouse* Child of owner Other personCityStateMISSNWhole % onlySuffixLast nameAddress Spouse* Child of owner Other personZIP%Date of birth (mm/dd/yyyy)5.First name (print)ZIP%Date of birth (mm/dd/yyyy)4.First name (print)ZIP%Date of birth (mm/dd/yyyy)3.First name (print)ZIPCityStateZIP%Date of birth (mm/dd/yyyy)SSNWhole % only01/21* By naming my spouse as a beneficiary, I elect to treat such spouse as a beneficiary while we are married. Effective immediately upon the divorce, annulmentor other lawful dissolution of my marriage, the designation shall be null and void, unless after the dissolution of my marriage I affirmatively elect to name myformer spouse as my non-spouse beneficiary.4 of 13

SIMPLE IRAApplication5Decline telephone and website exchange and/or redemption privileges (optional)Telephone and website exchange and redemption privileges will automatically be enabled on your account unless you decline below.To decline these privileges, read the individual statements and check the applicable box(es).Note: If either option is declined, no one associated with this account, including your financial professional, will be able to request exchangesor redemptions by telephone or via the website. Requests would need to be submitted in writing.Exchanges: I DO NOT want the option of using the telephone and website exchange privilege. Redemptions: I DO NOT want the option of using the telephone and website redemption privilege.6 Spousal consent to beneficiary designation — if requiredIf you are married to the IRA owner and he or she designated a Primary Beneficiary(ies) other than you, please consult your financial professionalabout the state-law and tax-law implications of this beneficiary designation, including the need for your consent.I am the spouse of the IRA owner named in Section 1, and I expressly consent to the beneficiary(ies) in Section 4 or attached.XName of spouse of IRA owner (print)/Signature of spouse of IRA ownerDate/(mm/dd/yyyy)This document may not be signed using Adobe Acrobat Reader’s "fill and sign" feature.7Your signatureI hereby establish an American Funds SIMPLE IRA, appoint Capital Bank and Trust CompanySM (CB&T) as Custodian and acknowledgethat I have received, read and agree to the SIMPLE IRA Custodial Agreement. I understand that I and all shareholders at my address willreceive one copy of fund documents (such as annual reports and proxy statements) unless I opt out by calling (800) 421-4225.I have read and agree to the terms of the current prospectus(es) of the funds selected in the investment instructions section and consentto the 10 setup fee and the annual custodial fee (currently 10). I understand that any dividends and capital gains will be reinvested forall my fund selections. I understand that amounts invested may not be redeemed for 7 business days.I agree to the conditions of the telephone and website exchange/redemption authorization unless I checked the box(es) in Section 5 andagree to indemnify and hold harmless CB&T; any of its affiliates or mutual funds managed by such affiliates; and each of their respectivedirectors; officers; employees; and agents for any loss, expense or cost arising from such instructions once the telephone and websiteexchange and redemption privileges have been established.I certify, under penalty of perjury, that my Social Security number in this application is correct. I authorize the financial professional assignedto my account to have access to my account and to act on my behalf with respect to my account. If applicable, I acknowledge that I havereceived and read a copy of my financial professional's SEC Form CRS. I designate the beneficiary(ies) specified in this application and certifythat, if I am married and have not named my spouse as Primary Beneficiary, I have consulted my financial professional about the need forspousal consent. If no beneficiary is named, the Custodial Agreement default will apply.I understand that to comply with federal regulations, information provided on this application will be used to verify my identity. For example,my identity may be verified through the use of a database maintained by a third party. If CB&T is unable to verify my identity, I understandit may need to take action, possibly including closing my account and redeeming the shares at the current market price, and that such actionmay have tax consequences, including a tax penalty.If this document is signed electronically, I consent to be legally bound by this document and subsequent terms governing it. The electronic copyof this document should be considered equivalent to a printed form in that it is the true, complete, valid, authentic and enforceable record of thedocument, admissible in judicial or administrative proceedings. I agree not to contest the admissibility or enforceability of the electronically storedcopy of this document.X/Signature of SIMPLE IRA ownerDateThis document may not be signed using Adobe Acrobat Reader’s "fill and sign" feature.01/21For fax and mailing instructions, see the maps on page 1.5 of 13/(mm/dd/yyyy)

SIMPLE IRACustodial AgreementPlease retain for your records.Internal Revenue Service Letter Serial No. K101971bSection 1 — DefinitionsAs used in this Custodial Agreement (“Agreement”)and the related Application, the following terms shallhave the meaning set forth below unless a differentmeaning is plainly required by the context:(a) “Account” means the SIMPLE IRA establishedunder this Agreement. “SIMPLE IRA” means theAccount established in accordance with Code§408(p), which is designated as a SIMPLE IRAupon establishment and which shall at all timesbe nonforfeitable.(b) “Application” means the accompanyinginstrument executed by or on behalf of theParticipant (or in the case of a minor, by theparent or legal guardian of the Participant)under which the Participant establishes theAccount as a SIMPLE IRA.(c) “Beneficiary” or “Beneficiaries,” unlesspreceded by the words “Primary,” “Contingent,”“Designated,” “Original” or “Subsequent,” meansthe person or entity (including a trust or estate)designated on the form described in Section 8(a),or otherwise entitled to receive the Account afterthe death of the Participant. “Primary Beneficiary”means the beneficiary designated by theParticipant to receive the Account after the deathof the Participant. “Contingent Beneficiary” meansthe beneficiary designated by the Participant toreceive the Account after the death of theParticipant provided that no Primary Beneficiarysurvives the Participant. “Designated Beneficiary”means the person whose life expectancy is usedfor the measuring period for required minimumdistributions under Section 8 of this Agreement.“Original Beneficiary” and “SubsequentBeneficiary” are defined in Section 8(m)of this Agreement.(d) “Child” or “Children” means the descendantsin any degree of the designated person andinclude legally adopted children who are adoptedduring their minority only and descendants ofsuch legally adopted children.(e) “Code” means the Internal Revenue Code of1986, as amended.(f) “Compensation” shall have the meaning asdefined under the provision of the SIMPLE IRAPlan as established by the employer.(g) “Custodian” means Capital Bank and TrustCompany or any successor thereto.(h) “Disabled” means disabled as defined inCode §72(m)(7).(i) “Fund” means shares of one or more of theinvestment com

SIMPLE IRA Application To be completed by employer ( ) Ext. Name of company Employer contact Daytime phone Company address City State ZIP Check A or B. A. New plan (must be accompanied by a copy of the employer’s completed and signed SIMPLE IRA Adoption Agreement) B. Existing plan (p