Transcription

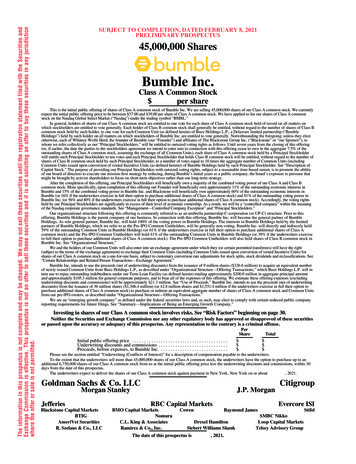

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities andExchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdictionwhere the offer or sale is not permitted.SUBJECT TO COMPLETION, DATED FEBRUARY 8, 2021PRELIMINARY PROSPECTUS45,000,000 SharesBumble Inc.Class A Common Stock per shareThis is the initial public offering of shares of Class A common stock of Bumble Inc. We are selling 45,000,000 shares of our Class A common stock. We currentlyexpect the initial public offering price to be between 37.00 and 39.00 per share of Class A common stock. We have applied to list our shares of Class A commonstock on the Nasdaq Global Select Market (“Nasdaq”) under the trading symbol “BMBL.”In general, holders of shares of our Class A common stock are entitled to one vote for each share of Class A common stock held of record on all matters onwhich stockholders are entitled to vote generally. Each holder of Class B common stock shall generally be entitled, without regard to the number of shares of Class Bcommon stock held by such holder, to one vote for each Common Unit (as defined herein) of Buzz Holdings L.P., a Delaware limited partnership (“BumbleHoldings”) held by such holder on all matters on which stockholders of Bumble Inc. are entitled to vote generally. Notwithstanding the foregoing, unless they electotherwise, each of Whitney Wolfe Herd, the founder of Bumble (our “Founder”) and affiliates of The Blackstone Group Inc. (“Blackstone” or “our Sponsor”), towhom we refer collectively as our “Principal Stockholders,” will be entitled to outsized voting rights as follows. Until seven years from the closing of this offering(or, if earlier, the date the parties to the stockholders agreement we intend to enter into in connection with this offering cease to own in the aggregate 7.5% of theoutstanding shares of Class A common stock, assuming the exchange of all Common Units), each share of Class A common stock held by a Principal Stockholderwill entitle such Principal Stockholder to ten votes and each Principal Stockholder that holds Class B common stock will be entitled, without regard to the number ofshares of Class B common stock held by such Principal Stockholder, to a number of votes equal to 10 times the aggregate number of Common Units (includingCommon Units issued upon conversion of vested Incentive Units (as defined herein)) of Bumble Holdings held by such Principal Stockholder. See “Description ofCapital Stock.” The purpose of providing our Principal Stockholders with outsized voting rights, subject to a reasonable time-based sunset, is to promote the abilityof our board of directors to execute our mission-first strategy by reducing, during Bumble’s initial years as a public company, the board’s exposure to pressure thatmight be brought by activist shareholders to focus on short-term objectives rather than our long-term strategy.After the completion of this offering, our Principal Stockholders will beneficially own a majority of the combined voting power of our Class A and Class Bcommon stock. More specifically, upon completion of this offering our Founder will beneficially own approximately 11% of the outstanding economic interests inBumble and 15% of the combined voting power in Bumble Inc. and Blackstone will beneficially own approximately 60% of the outstanding economic interests inBumble (or 16% if the underwriters exercise in full their option to purchase additional shares of Class A common stock) and 81% of the outstanding voting power inBumble Inc. (or 56% and 80% if the underwriters exercise in full their option to purchase additional shares of Class A common stock). Accordingly, the voting rightsheld by our Principal Stockholders are significantly in excess of their level of economic ownership. As a result, we will be a “controlled company” within the meaningof the Nasdaq corporate governance standards. See “Management—Controlled Company Exception” and “Principal Stockholders.”Our organizational structure following this offering is commonly referred to as an umbrella partnership-C-corporation (or UP-C) structure. Prior to thisoffering, Bumble Holdings is the parent company of our business. In connection with this offering, Bumble Inc. will become the general partner of BumbleHoldings. As sole general partner, Bumble Inc. will hold 100% of the voting power in Bumble Holdings. The interests in Bumble Holdings held by the limitedpartners of Bumble Holdings, which we refer to as the Pre-IPO Common Unitholders, will be generally non-voting. Bumble Inc. will directly and indirectly hold59% of the outstanding Common Units in Bumble Holdings (or 61% if the underwriters exercise in full their option to purchase additional shares of Class Acommon stock) and the Pre-IPO Common Unitholders will hold 41% of the outstanding Common Units in Bumble Holdings (or 39% if the underwriters exercisein full their option to purchase additional shares of Class A common stock). The Pre-IPO Common Unitholders will also hold shares of Class B common stock inBumble Inc. See “Organizational Structure.”We and the holders of our Common Units will also enter into an exchange agreement under which they (or certain permitted transferees) will have the right(subject to the terms of the exchange agreement) to exchange their Common Units (including Common Units issued upon conversion of vested Incentive Units) forshares of our Class A common stock on a one-for-one basis, subject to customary conversion rate adjustments for stock splits, stock dividends and reclassifications. See“Certain Relationships and Related Person Transactions—Exchange Agreement.”Bumble Inc. intends to use the proceeds (net of underwriting discounts) from the issuance of 9 million shares ( 326.6 million) to acquire an equivalent numberof newly-issued Common Units from Buzz Holdings L.P., as described under “Organizational Structure—Offering Transactions,” which Buzz Holdings L.P. will inturn use to repay outstanding indebtedness under our Term Loan Facility (as defined herein) totaling approximately 200.0 million in aggregate principal amountand approximately 105.3 million for general corporate purposes, and to bear all of the expenses of this offering. We estimate these offering expenses (excludingunderwriting discounts and commissions) will be approximately 21.3 million. See “Use of Proceeds.” Bumble Inc. intends to use the proceeds (net of underwritingdiscounts) from the issuance of 36 million shares ( 1,306.4 million) (or 42.8 million shares and 1,551.4 million if the underwriters exercise in full their option topurchase additional shares of Class A common stock) to purchase or redeem an equivalent aggregate number of shares of Class A common stock and Common Unitsfrom our pre-IPO owners, as described under “Organizational Structure—Offering Transactions.”We are an “emerging growth company” as defined under the federal securities laws and, as such, may elect to comply with certain reduced public companyreporting requirements for future filings. See “Summary—Implications of Being an Emerging Growth Company.”Investing in shares of our Class A common stock involves risks. See “Risk Factors” beginning on page 30.Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securitiesor passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.PerShareInitial public offering price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Underwriting discounts and commissions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Proceeds, before expenses, to Bumble Inc. . . . . . . . . . . . . . . . . . . . . . . . . . . . .Total Please see the section entitled “Underwriting (Conflicts of Interest)” for a description of compensation payable to the underwriters.To the extent that the underwriters sell more than 45,000,000 shares of our Class A common stock, the underwriters have the option to purchase up to anadditional 6,750,000 shares of our Class A common stock from us at the initial public offering price less the underwriting discounts and commissions, within 30days from the date of this prospectus.The underwriters expect to deliver the shares of our Class A common stock against payment in New York, New York on or about, 2021.Goldman Sachs & Co. LLCMorgan StanleyJefferiesBlackstone Capital MarketsBTIGAmeriVet SecuritiesR. Seelaus & Co., LLCJ.P. MorganRBC Capital MarketsBMO Capital MarketsNomuraC.L. King & AssociatesRamirez & Co., Inc.CowenEvercore ISIRaymond JamesDrexel HamiltonSiebert Williams ShankThe date of this prospectus isCitigroup, 2021.SMBC NikkoLoop Capital MarketsTelsey Advisory GroupStifel

R elations hips Are the Backb one of Ou r Lives Wh ere We Are To day 4 2M 417M Q3 ’20 MA Us Y TD S ep ’20 Revenue 1 15% YO Y 2.4M (117 )M YTD Sep ’20 Paying Users YTD S ep ’20 Net (Los s) Earn ing s 2 (28 )% M argin 3 650 108M Q 3 ’ 20 F ull Time EmployeesY TD S ep ’2 0 A djusted EBITDA 4 26% M ar gin 5 1 In cludes 40.0 million for the predeces sor period fr om January 1,4 In cludes 9.4 million for th e predeces sor perio d fro m January 1, 2020 to J anuary 2 8, 2020 and 3 76.6 million for the s ucces sor20 20 to January 28, 2020 and 98.9 million for the succes sor period from J anu ary 29, 2 020 to September 30, 20 20.p eriod from January 2 9, 2020 to S ep tember 3 0, 2020. 2 Includes (32.6) million for th e predeces sor perio d fro m January 1, 5 Adjus ted EB ITD A M argin was 23.4% an d 26.3% for th e 2020 to J an uar y 28, 2020 and (84 .1) million fo r the s ucces sorpredecessor period from J an uar y 1, 2 020 to January 28, 2020 and period from January 29, 2020 to September 30, 2020 .for the su ccess or p eriod from January 2 9, 2020 to S ep tember 3 0, 2020, res pectively. 3 N et (Lo ss) Earnin gs Margin was (81.4)% and (22.3)% for th e predeces sor perio d fro m January 1, 2020 to J anuary 2 8, 2020 and fo r the s ucces sor perio d from January 29, 202 0 to September 30, 2020 , res pectively .

In Love In Life In Work

Dat e Hone stly

Table of ContentsPageA Letter from Whitney Wolfe Herd, Founderand CEO . . . . . . . . . . . . . . . . . . . . . . . . . . . .Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Risk Factors . . . . . . . . . . . . . . . . . . . . . . . . . . .Forward-Looking Statements . . . . . . . . . . . . . .Market and Industry Data . . . . . . . . . . . . . . . . .Trademarks, Service Marks and Copyrights . .Organizational Structure . . . . . . . . . . . . . . . . . .Use of Proceeds . . . . . . . . . . . . . . . . . . . . . . . .Dividend Policy . . . . . . . . . . . . . . . . . . . . . . . .Capitalization . . . . . . . . . . . . . . . . . . . . . . . . . .Dilution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Unaudited Pro Forma Condensed ConsolidatedFinancial Information . . . . . . . . . . . . . . . . . .Selected Historical Consolidated FinancialData . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Management’s Discussion and Analysis ofFinancial Condition and Results ofOperations . . . . . . . . . . . . . . . . . . . . . . . . . . .PageBusiness . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Management . . . . . . . . . . . . . . . . . . . . . . . . . . .Certain Relationships and Related PersonTransactions . . . . . . . . . . . . . . . . . . . . . . . . .Principal Stockholders . . . . . . . . . . . . . . . . . . .Description of Certain Indebtedness . . . . . . . . .Description of Capital Stock . . . . . . . . . . . . . . .Material U.S. Federal Income and Estate TaxConsequences to Non-U.S. Holders . . . . . . .Shares Eligible for Future Sale . . . . . . . . . . . . .Underwriting (Conflicts of Interest) . . . . . . . .Legal Matters . . . . . . . . . . . . . . . . . . . . . . . . . .Change in Auditor . . . . . . . . . . . . . . . . . . . . . . .Experts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Where You Can Find More Information . . . . .Index to Financial Statements . . . . . . . . . . . . . 237245245246247F-1105Neither we nor the underwriters have authorized anyone to provide you with information different from thatcontained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectusprepared by us or on our behalf. Neither we nor the underwriters take any responsibility for, or can provide anyassurance as to the reliability of, any information other than the information in this prospectus, any amendment orsupplement to this prospectus or any free writing prospectus prepared by us or on our behalf. We and theunderwriters are offering to sell, and seeking offers to buy, shares of our Class A common stock only injurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the dateof this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our Class A commonstock. Our business, financial condition, results of operations and prospects may have changed since that date.Through and including, 2021 (the 25th day after the date of this prospectus), all dealers effectingtransactions in these securities, whether or not participating in this offering, may be required to deliver aprospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter andwith respect to an unsold allotment or subscription.About This ProspectusFinancial Statement PresentationFollowing this offering, Bumble Holdings will be the predecessor of Bumble Inc. for financial reportingpurposes. Immediately following this offering, Bumble Inc. will be a holding company, and its sole material assetwill be a controlling equity interest in Bumble Holdings. As the general partner of Bumble Holdings, Bumble Inc.will operate and control all of the business and affairs of Bumble Holdings, have the obligation to absorb losses andreceive benefits from Bumble Holdings and, through Bumble Holdings and its subsidiaries, conduct our business.The Reorganization Transactions (as defined below) will be accounted for as a reorganization of entities undercommon control. As a result, the consolidated financial statements of Bumble Inc. will recognize the assets andliabilities received in the Reorganization Transactions at their historical carrying amounts, as reflected in thehistorical financial statements of Bumble Holdings. Bumble Inc. will consolidate Bumble Holdings on itsconsolidated financial statements and record a non-controlling interest related to the Common Units (as definedbelow) and the Incentive Units (as defined below) held by our pre-IPO owners on its consolidated balance sheet andstatement of operations. See “Organizational Structure.”i

Bumble Holdings was formed primarily as a vehicle to finance the Sponsor Acquisition (as defined below).As Bumble Holdings did not have any previous operations, Worldwide Vision Limited, a Bermuda exemptedlimited company, is viewed as the predecessor to Bumble Holdings and its consolidated subsidiaries.Accordingly, this prospectus includes certain historical consolidated financial and other data for WorldwideVision Limited for periods prior to the completion of the Sponsor Acquisition. On January 29, 2020, WorldwideVision Limited was merged via a solvent transfer of trade and assets into Buzz Merger Sub Limited, a subsidiaryof Buzz Holdings L.P., which carries forward and continues to operate the Worldwide Vision Limited trade as ofthat date. As a result, on January 29, 2020, Worldwide Vision Limited ceased to exist and Buzz Merger SubLimited was subsequently renamed Worldwide Vision Limited. Accordingly, the unaudited consolidated interimfinancial statements of Bumble Holdings will include a black line as of January 28, 2020, and presentconsolidated financial statements of the predecessor for periods prior to January 28, 2020 and consolidatedinformation of the successor for periods following January 28, 2020. On September 9, 2020, Worldwide VisionLimited merged with and into Buzz Finco L.L.C., a Delaware limited liability company and an indirectsubsidiary of Buzz Holdings L.P., with Buzz Finco L.L.C. surviving such merger.Certain DefinitionsAs used in this prospectus, unless otherwise noted or the context requires otherwise: “Badoo App and Other Average Revenue per Paying User” or “Badoo App and Other ARPPU” is ametric calculated based on Badoo App and Other Revenue in any measurement period, excluding anyrevenue generated from advertising and partnerships or affiliates, divided by Badoo App and OtherPaying Users in such period divided by the number of months in the period. a “Badoo App and Other Paying User” is a user that has purchased or renewed a subscription plan and/or made an in-app purchase on the Badoo app in a given month (or made a purchase on one of ourother apps that we owned and operated in a given month, or purchase on other third-party apps thatused our technology in the relevant period). We calculate Badoo App and Other Paying Users as amonthly average, by counting the number of Badoo App and Other Paying Users in each month andthen dividing by the number of months in the relevant measurement period. “Badoo App and Other Revenue” is revenue derived from purchases or renewals of a Badoosubscription plan and/or in-app purchases on the Badoo app in the relevant period, purchases on one ofour other apps that we owned and operated in the relevant period, purchases on other third party appsthat used our technology in the relevant period and advertising, partnerships or affiliates revenue in therelevant period. “Blocker Companies” refer to certain entities that are taxable as corporations for U.S. federal incometax purposes in which the Pre-IPO Shareholders hold interests, as described under “OrganizationalStructure—Blocker Restructuring.” “Bumble,” the “Company,” “we,” “us” and “our” refer (1) prior to the consummation of the SponsorAcquisition, to Worldwide Vision Limited, a Bermuda exempted limited company, and its consolidatedsubsidiaries, (2) after the Sponsor Acquisition but prior to the consummation of the OfferingTransactions described under “Organizational Structure—Offering Transactions,” to Buzz HoldingsL.P., a Delaware limited partnership and its consolidated subsidiaries and (3) after the OfferingTransactions described under “Organizational Structure—Offering Transactions,” to Bumble Inc. andits consolidated subsidiaries. “Bumble App Average Revenue per Paying User” or “Bumble App ARPPU” is a metric calculatedbased on Bumble App Revenue in any measurement period, divided by Bumble App Paying Users insuch period divided by the number of months in the period. a “Bumble App Paying User” is a user that has purchased or renewed a Bumble subscription plan and/or made an in-app purchase on the Bumble app in a given month. We calculate Bumble App PayingUsers as a monthly average, by counting the number of Bumble App Paying Users in each month andthen dividing by the number of months in the relevant measurement period.ii

“Bumble App Revenue” is revenue derived from purchases or renewals of a Bumble subscription planand/or in-app purchases on the Bumble app in the relevant period. “Bumble BFF” or “Bumble for Friends” is a mode within the Bumble app that enables users to formplatonic connections. “Bumble Bizz” is a mode within the Bumble app that enables users to form professional connections. “Bumble Date” is a mode within the Bumble app that enables users to form romantic connections. “Blackstone” or “our Sponsor” refer to investment funds associated with The Blackstone

Feb 09, 2021 · reporting requirements for future filings. See “Summary—Implications of Being an Emerging Growth Company.” Investing in shares of our Class A common stock involves risks. See “Risk Factors” beginning on page 30. Neither the Securities and Exchange Commission nor any other regula