Transcription

2Report of Independent AuditorsThe DirectorsExpro Holdings UK2 LimitedSecond Floor Davidson HouseForbury SquareReadingBerkshireUnited KingdomRG1 3EUReport on the Financial StatementsWe have audited the accompanying consolidated financial statements of Expro Holdings UK2Limited and subsidiaries, which comprise the consolidated balance sheets as of December 31,2019 and 2018, and the related consolidated statements of comprehensive income, changes instockholders’ equity and cash flows for the years then ended, and the related notes to theconsolidated financial statements.We are independent of the Company in accordance with the ethical requirements that arerelevant to our audit of the financial statements in the United States of America together withthe International Ethics Standards Board for Accountants’ Code of Ethics for ProfessionalAccountants and we have fulfilled our other ethical responsibilities in accordance with theserequirements, respectively.Responsibilities of Management and Those Charged With Governance for theConsolidated Financial StatementsManagement is responsible for the preparation and fair presentation of these consolidatedfinancial statements in conformity with U.S. generally accepted accounting principles; thisincludes the design, implementation and maintenance of internal control relevant to thepreparation and fair presentation of consolidated financial statements that are free of materialmisstatement, whether due to fraud or error. This also includes assessing that the consolidatedfinancial statements are prepared using the appropriate basis of accounting.In preparing the consolidated financial statements, management is responsible for evaluatingwhether there are conditions and events, considered in the aggregate, that raise substantial doubtabout the entity’s ability to continue as a going concern within one year after the date that thefinancial statements are issued, or are available to be issued, and disclosing, as applicable,matters related to this evaluation unless the liquidation basis of accounting is being used by theentity. Those charged with governance are responsible for overseeing the Company’s financialreporting process.Auditor’s Responsibility

3Our responsibility is to express an opinion on these consolidated financial statements based onour audits. We conducted our audits in accordance with auditing standards generally accepted inthe United States. Those standards require that we plan and perform the audit to obtainreasonable assurance about whether the consolidated financial statements are free from materialmisstatement, whether due to fraud or error. Reasonable assurance is a high level of assurancebut is not a guarantee that an audit will always detect a material misstatement when it exists.Misstatements can arise from fraud or error and are considered material if, individually or in theaggregate, they could reasonably be expected to influence the economic decisions of users takenon the basis of these consolidated financial statements.An audit involves performing procedures to obtain audit evidence about the amounts anddisclosures in the consolidated financial statements. The procedures selected depend on theauditor’s judgment, including the assessment of the risks of material misstatement of theconsolidated financial statements, whether due to fraud or error. We design audit proceduresresponsive to those risks and obtain audit evidence that is sufficient and appropriate to provide abasis for our opinion. The risk of not detecting a material misstatement resulting from fraud ishigher than for one resulting from error because fraud may involve collusion, forgery,intentional omissions, misrepresentations, or the override of internal control.In making those risk assessments, the auditor considers internal control relevant to the entity’spreparation and fair presentation of the consolidated financial statements in order to designaudit procedures that are appropriate in the circumstances but not for the purpose of expressingan opinion on the effectiveness of the Company’s internal control. Accordingly, we express nosuch opinion. An audit also includes evaluating the appropriateness of accounting policies usedand the reasonableness of significant accounting estimates made by management, as well asevaluating the overall presentation, structure, and content of the consolidated financialstatements, including disclosures, and whether the consolidated financial statements representthe underlying transactions and events in a manner that achieves fair presentation.As part of an audit, we exercise professional judgment and maintain professional scepticismthroughout the audit. We also: Conclude on the appropriateness of management’s use of the going concern basis ofaccounting and based on the audit evidence obtained, whether substantial doubt existsrelated to the Company’s ability to continue as a going concern. If we conclude thatsubstantial doubt exists, we are required to draw attention in our auditor’s report to therelated disclosures in the consolidated financial statements or, if such disclosures areinadequate, to modify our opinion. Our conclusions are based on the audit evidenceobtained up to the date of our auditor’s report. However, future events or conditions maycause the Company to cease to continue as a going concern. Obtain sufficient appropriate audit evidence regarding the financial information of theentities or business activities within the Company to express an opinion on theconsolidated financial statements. We are responsible for the direction, supervision, andperformance of the group audit. We remain solely responsible for our audit opinion.

4We communicate with those charged with governance regarding, among other matters, theplanned scope and timing of the audit and significant audit findings, including any significantdeficiencies or material weaknesses in internal control that we identify during our audit.We believe that the audit evidence we have obtained is sufficient and appropriate to provide abasis for our audit opinion.OpinionIn our opinion, the financial statements referred to above present fairly, in all material respects,the consolidated financial position of Expro Holdings UK2 Limited and subsidiaries atDecember 31, 2019 and 2018, and the consolidated results of their operations and their cashflows for the years then ended in conformity with U.S. generally accepted accountingprinciples.Emphasis of MatterWe draw attention to Note 5 of the consolidated financial statements, which indicates that theCompany has changed its accounting policy for leases as of January 1, 2019, due to theadoption of ASC 842, Leases, and has applied that change using a modified retrospectivetransition approach. Our opinion is not modified in respect of this matter.As discussed in Note 30 to the consolidated financial statements, the 2018 financial statementshave been restated to correct a misstatement. Our opinion is not modified in respect to thismatter.Ernst & Young LLPReading31 March 2020

Expro Holdings UK 2 LimitedConsolidated Statements of Operations( in thousands)SuccessorTotal revenueOperating costs and expenses:Cost of salesSelling, general and administrativeGoodwill and Intangible asset impairmentOther income, netRestructuringTotal operating costs and expensesOperating lossReorganization items, netFinance (expense) income, net(Loss) Income before taxes and equity income of joint venturesEquity share of income from joint venturesIncome tax credit (expense)Net (loss) incomeThe accompanying notes are an integral part of these consolidated financial statements.December 31,2019Period February01, 2018 throughDecember 31, 2018PredecessorPeriod January01, 2018 throughJanuary 31, 542,937

Expro Holdings UK 2 LimitedConsolidated Statement of Comprehensive Income (Loss)( in thousands)SuccessorNet (loss) income for the periodOther comprehensive (loss) income:Actuarial (loss) gain on defined benefit pensionIncome taxes on pensionOther comprehensive (loss) incomeComprehensive (loss) income2December 31,2019(62,396)Period February01, 2018 throughDecember 31, 2018(31,078)PredecessorPeriod January01, 2018 throughJanuary 31, ,383)244244543,181

Expro Holdings UK 2 LimitedConsolidated Balance Sheet( in thousands)December 31,2019December 31,2018(Restated)AssetsCurrent assetsCash and cash equivalentsRestricted cashAccounts receivable, net and unbilledInventories, netTax receivablesOther current assetsTotal current assetsNon-current assetsProperty, plant and equipment, netInvestments in joint venturesIntangible assets, netGoodwillRight of use assets – Operating leasesAccounts receivable, net and unbilledOther non-current assetsTotal non-current assetsTotal 78Liabilities and stockholders’ equityCurrent liabilitiesAccounts payable and accrued liabilitiesTax liabilitiesFinance lease liabilitiesOperating lease liabilitiesOther current liabilitiesTotal current 7,53119,1281,35751,846219,862Non-current liabilitiesFinance lease liabilitiesOperating lease liabilitiesTax liabilitiesDeferred tax liabilitiesPost-retirement benefitsOther non-current liabilitiesTotal non-current liabilitiesTotal 6,695(31,078)984,6421,388,078Stockholders’ equity:Common stockAdditional paid-in capitalAccumulated other comprehensive incomeAccumulated deficitTotal stockholders’ equityTotal liabilities and stockholders’ equityThe accompanying notes are an integral part of these consolidated financial statements3

Expro Holdings UK 2 LimitedConsolidated Statements of Cash Flows( in thousands)SuccessorCash flows from operating activities:Net (loss) incomeAdjustments to reconcile net (loss) income to net cash used in operating activities:Impairment of goodwill and intangible assetImpairment of property, plant and equipmentAmortization of intangible assetsDepreciation of property, plant and equipmentAmortization of capitalized interestLoss (Gain) on disposal of intangibles and property, plant and equipmentEquity share of income from joint venturesElimination of unrealized profit on sales to joint venturesAmortization of loan issuance costsInterest accreted to mezzanine loan balanceTerm loan and RCF interestReorganization items, netDeferred income tax creditUnrealized foreign exchangeChanges in assets and liabilities:Accounts receivable, net and unbilledInventories, netOther assetsAccounts payable and accrued liabilitiesOther liabilitiesIncome taxes - netOtherDividend received from joint venturesNet cash provided by (used in) operating activitiesCash flows from investing activities:Capital expendituresProceeds from disposal of property, plant and equipmentPayment of deferred considerationPayment for acquisition of business, net of cash acquiredNet cash used in investing activitiesCash flows from financing activities:Repayment of borrowings under debtors in possession facilityProceeds from borrowings under debtors in possession facilityProceeds from issue of share capitalProceeds from release (payment) of collateral depositsPayment of loan issuance and other transaction costsRepayment of finance leasesNet cash provided by (used in) financing activitiesEffect of exchange rate changes on cash and cash equivalentsNet (decrease) increase to cash and cash equivalents and restricted cashCash and cash equivalents and restricted cash at beginning of periodCash and cash equivalents and restricted cash at end of periodSupplemental disclosure of cash flow informationCash (paid) receipt during the period for income taxesCash paid, net, during the period for interestNet change in accounts payable and accrued expenses related to property and equipmentadditionsReorganization of loansThe accompanying notes are an integral part of these consolidated financial statements4December 31,2019(62,396)Period February01, 2018 throughDecember 31, 2018(31,078)PredecessorPeriod January01, 2018 throughJanuary 31, )(839)-(19,703)-1,3251,418,138

Expro Holdings UK 2 LimitedConsolidated Statements of Stockholders’ Equity( in thousands)Balance at January 1, 2018 (Predecessor)Comprehensive income:Net incomeOther comprehensive income:Actuarial (loss) gain on defined benefit pension,net of taxCancellation of Predecessor equityBalance at January 31, 2018 (Predecessor)Balance at February 1, 2018 (Successor)Shares issuedCapital contribution by parent companyComprehensive loss:Net lossOther comprehensive income:Actuarial (loss) gain on defined benefit pension,net of taxBalance at December 31, 2018 (Successor)Balance at January 1, 2019 (Successor)Comprehensive loss:Net lossOther comprehensive income (loss):Actuarial (loss) gain on defined benefit pension,net of taxBalance at December 31, 2019 55

Expro Holdings UK 2 LimitedNotes to the Consolidated Financial StatementsYear Ended December 31, 20191.Business DescriptionExpro Holdings UK 2 Limited (the “Company”) and our consolidated subsidiaries (collectively referred to as “We” or the “Group”),provide services and products that measure, improve, control and process flow from oil and gas wells, from exploration and appraisalthrough field production optimization and enhancement and field abandonment.Expro Holdings UK 2 Limited is a limited company incorporated in Great Britain with its registered office situated in the Englandand Wales.2.Business CombinationsOn July 1, 2019, Quality Intervention AS, a limited liability company registered in Norway, and its subsidiaries (“QualityIntervention”), was acquired (the “Acquisition”) by our wholly owned subsidiary Expro Holdings Norway AS, a limited liabilitycompany registered in Norway (“ENAS”). Quality Intervention is now a wholly owned subsidiary of ENAS. Quality Intervention’sshareholders received an aggregate cash consideration of 49.3 million, net of the customary closing adjustments. Transaction costsrelated to the Acquisition incurred during the twelve months ended December 31, 2019, were 1.0 million and are recorded in theConsolidated Statement of Operations within the other income, net. We recorded revenue of 2.0 million and a net loss of 0.8million related to the Acquisition during the period ended December 31, 2019.Quality Intervention has developed a number of innovative technologies and solutions to common problems when working in thewell intervention space.The Acquisition is accounted for as a business combination in accordance with Accounting Standards Codification (“ASC”) 805,Business Combinations, which requires the assets acquired and liabilities assumed to be recorded at their acquisition date fair values.The estimated fair values are based upon preliminary calculations and valuations, and those estimates and assumptions are subjectto changes as we obtain additional information for those estimates during the measurement period.The following table summarizes the purchase price and the preliminary allocation of the fair values of assets acquired and liabilitiesassumed and separately identifiable intangible assets at the acquisition date ( in thousands):Purchase PriceConsideration givenTotal Cash consideration49,258Allocation of Purchase PriceFair value of assets acquired:Current assetsProperty, plant and equipmentIntangible assets – TechnologyGoodwillTotal assets acquired2,58168117,92831,53052,720Fair value of liabilities assumed:Current liabilitiesNon-current liabilitiesDeferred tax liabilitiesTotal liabilities assumed1,1411012,2203,462Fair value of total assets and liabilities acquired49,258The intangible asset will be amortized on a straight-line basis over an estimated 10-year life. We expect annual amortization to beapproximately 1.8 million. The goodwill consists largely of the synergies and economies of scale expected from the technologyproviding more efficient services, the first mover advantage obtained through the acquisition and expected future developmentsresulting from the assembled workforce. The goodwill is not subject to amortization but will be evaluated at least annually forimpairment or more frequently if impairment indicators are present. An associated deferred tax liability has been recorded in regardsto the technology.6

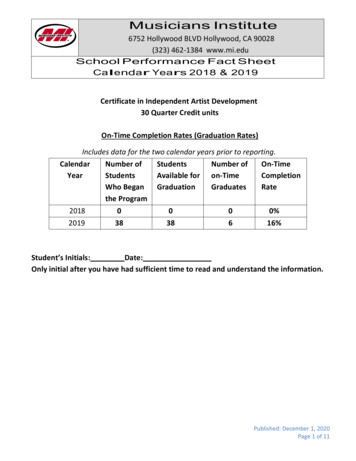

Expro Holdings UK 2 LimitedNotes to the Consolidated Financial StatementsYear Ended December 31, 2019The following unaudited pro forma combined financial information is provided as though the Acquisition had been completed as ofJanuary 1, 2018. These pro forma combined results of operations have been prepared by adjusting our historical results to includethe historical results of Quality Intervention and reflect pro forma adjustments based on available information and certainassumptions that we believe are reasonable. The unaudited pro forma combined financial information is provided for illustrativepurposes only and is not necessarily indicative of the actual results that would have been achieved by the combined company forthe periods presented or that may be achieved by the combined company in the future. Future results may vary significantly fromthe results reflected in this pro forma financial information. ( in thousands):Pro forma (Unaudited)SuccessorRevenueNet (Loss) Income3.PredecessorDecember 31,2019Period February01, 2018 throughDecember 31, 2018Period January01, 2018 throughJanuary 31, rgence from Voluntary Reorganization under Chapter 11 Proceedings and Plan of Reorganization:The Predecessor Group’s (comprising Expro Holdings UK 2 Limited and its subsidiaries) ultimate parent company and ultimatecontrolling party before 5 February 2018 was Expro International Group Holdings Limited (“EIGHL”). On 18 December 2017, thePredecessor Group filed a consensual pre-packaged plan of re-organisation under Chapter 11 of the United States Bankruptcy Code(the “Plan”), which was approved by the Court on 25 January 2018. Under the Plan, the Predecessor Group’s Term Loan andRevolving Credit Facility holders exchanged all of their outstanding principal and accrued interest for equity shares in thereorganized Group and the Mezzanine

Net change in accounts payable and accrued expenses related to property and equipment additions (839) (19,703) 1,325 Reorganization of loans - - 1,418,138 The accompanying notes are an