Transcription

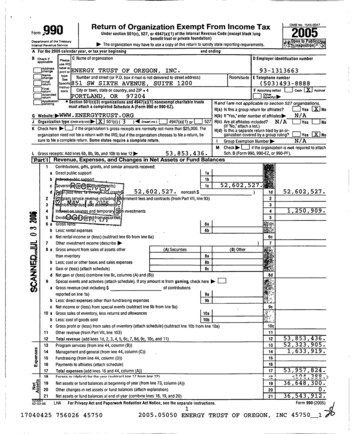

OMB No 1545-0047R e t urn o f O rgan i za ti on E xemp t F rom I ncome T axForm w990Under section 501(c), 527, or 4947( a)(1) of the Internal Reven ue Code ( except black lungbenefit trust or private foundation)Department of the TreasuryThe organizationmayhaveto use a copy of this return to satisfy state reporting requirements.RevenueServiceInternaland endingA For the 2005 calendar year, or tax year beginningBPlease C Name of organizationCheck Ifapplicablerint ENERGY TRUST OF OREGON,change returnIn lINC .rOrAmended(503)493-8888City or town, state or country, and ZIP 4tonsreturnORTLAND, Room/swte E Telephone numberspecrnc 8 51 SW SIXTH AVENUE, SUITE 1200Instruc- FinalIC93-1313663Number and street (or P.O. box if mail is not delivered to street address)S pen„ oss u.:. %lnpectionzaD Employer identification numberuse IRSlabelporOchargeschangeNameE Itia2005ORF Accounting method97204Cash [RTAccrualQ Pay) Section 501(c)(3 ) organizations and 4947 ( a)(1) nonexempt charitable trustsmust attach a completed Schedule A ( Form 990 or 990 EZ ).Hand I are not applicable to section 527 organizations.H(a) Is this a group return for affiliates? Yes NoH(b) If "Yes," enter number of affiliates'N/A. ENERGYTRUST. ORGG Website :) 14 (insert no) L j 4947(a)(1) or527 H(c) Are all affiliates included?J Organization type (checkonyone) 00- X 501(c)( 3N/AYesNo(If " No; attach a list)K Check here Po. L-j if the organization's gross receipts are normally not more than 25,000. TheH(d) Is this a separate return filed by an organization covered by a group ruling? Yes Noorganization need not file a return with the IRS; but if the organization chooses to file a return, besure to file a complete return . Some states require a complete return .IGroup Exemption Number N/AM Check L-j if the organization is not required to attachSch. B (Form 990, 990-EZ, or 990-PF).L Gross receipts: Add lines 6b, 8b, 9b, and fob to line 12 53,853,436. pendmguonRevenue, Expenses , and Changes in Net Assets or Fund BalancesxPart"I1Contributions , gifts, grants, and similar amounts received:a Direct public supportbcovernnRiCeepOEud yt araservice evenue Incnlu dInbrduejaod gse55ren2323investments4bc10 abc11121314151617DivideW a 4srtj fro n tGuriti esGross re6aLess: rental expenses6bNet rental income or (loss ) ( subtract line 6b from line 6a)Other investment income ( describe Gross amount from sales of assets other( B) Other( A) Securitiesthan InventoryLess: cost or other basis and sales expensesGain or ( loss) (attach schedule)Net gain or ( loss) (combine line 8c, columns ( A) and (B))Special events and activities ( attach schedule ). If any amount is from gaming , check here of contributionsGross revenue ( not including reported on line 1a)9aLess: direct expenses other than fundraising expenses9bNet income or ( loss) from special events (subtract line 9b from line 9a)Gross sales of inventory, less returns and allowances10aLess: cost of goods sold10bGross profit or ( loss) from sales of inventory ( attach schedule) (subtract line fob from line 1Oa)Other revenue (from Part VII , line 103)Total revenue (add lines 1d, 2 , 3, 4, 5, 6c, 7, 8d, 9c, 10c, and 11 )Program services (from line 44 , column ( B))Management and general ( from line 44 , column (C))Fundraising ( from line 44 , column (D))Payments to affiliates ( attach schedule)Total expenses ( add lines 16 and 44, column (A))1RFvrocc or frlefiritl for tho ,asr lciihtrart lino 17 from lino 191192021Net assets or fund balances at beginning of year ( from line 73, column (A))Other changes in net assets or fund balances ( attach explanation)Net assets or fund balances at end of year ( combine lines 18, 19, and 20 )9a-5tZ,1drnment fees and contracts (from Part VII , line 93)InQW52,602,527.52, 602 , 527. noncash 56 abc78 abcd02-03-06LHAs and temporah4-Jf/11cnts)IrrestothreB lalb1,250,909.56c7)8d9ch10c1112131453 , 853 , 436 .52 , 323 , 905 .1 , 633, 919 .15161753 , 957 , 824-1 n A3 0 0192036 , 648 , 3002136 , 543 , 912Form 990 (2005)For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions .117040425 756026 4575052, 602, 527.2005.05050 ENERGY TRUST OF OREGON,0INC 45750 1

ENERGY TRUST OF OREGON , INC.93-1313663Form 990 2005All organizations must complete column (A). Columns ( B), (C), and ( D) are required for section 501(c)(3)Statement ofT9!i1niFunctional Expensesand (4 ) organizations and section 4947( a)(1) nonexempt chantable trusts but optional for others.Do not include amounts reported on line6b, 8b, 9b, 10b, or 16 of Part 1.22(B) Programservices( A) Total(C) Managementand generalPag e 2( D) FundraisingGrants and allocations (attach schedule)(cash 0 noncash If this amount includes foreign grants, check here010, LJ23 Specific assistance to individuals (attachschedule)24 Benefits paid to or for members (attachschedule)22232425 Compensation of officers , directors , etc.* *25362,691.2,854.359,837.26 Othersalanesandwages26271, 416, 281, 784, 925.127,141.342,0 57.29 Payroll taxes29178, 251.120, 377.30 Professional fundraising fees31 Accounting fees30313231,264.127, 764.88,396.39,368.3332,960.21,755.11,205.3420 , 158.35 Postage and shipping3520,598.15,707.16,88 7.4,451.3,711.36 Occupancy36320, 652.220, 872.99,780.37 Equipment rental and maintenance38 Printing and publications373852,420.10 7,676.39 Travel3952 ,617.31,450.101,903.36,064.20,970.5,773.16,553.40 Conferences , conventions , and meetings4087 ,723.34,887.52,836.41 .50,240,995.49,848,911.392,084.27 Pension plan contributions28 Other employee benefits32 Legal fees33 Supplies34 Telephone42 Depreciation , depletion , etc. (attach schedule )4243 Other expenses not covered above (itemize):a43a43bbc43cdef43d43e43fgSEE STATEMENT 1430.31,264.44 Total functional expenses . Add lines 22through 43 . (Organizations completingcolumns (B)-(D), carry these totals to lines13-15)2, 323, 905., 633, 919.53,957,824.4Joint Costs . Check U if you are following SOP 98-2.Are any joint costs from a combined educationa l campaign and fundraising solicitation reported in (B) Program services N/A; (ii) the amount allocated to Program services If 'Yes,' enter ( l) the aggregate amount of these joint costs N/A, and ( iv) the amount allocated to Fundraising ( iii) the amount allocated to Management and general .YesN/AN/ANoForm 990 (2005)**SEE STATEMENT 252301102-03-06210540510756026 457502005.05060 ENERGY TRUST OF OREGON,INC 457501

Form 990 (2005)ENERGY TRUST OF OREGON , INC.Partr,111 ] Statement of Program Service Accomplishments (See the instructions.)93-1313 663Page 3Form 990 is available for public inspection and, for some people , serves as the primary or sole source of information about a particular organization.How the public perceives an organization in such cases may be determined by the information presented on its return . Therefore , please make sure thereturn is complete and accurate and fully describes , in Part III , the organization 's programs and accomplishments.What is the organization's primary exempt purpose? SEE STATEMENT 3Program ServiceExpenses(Required for 501(c)(3)and (4) orgs., and4947(a)(1) trusts; butoptional for others.)All organizations must describe their exempt purpose achievements in a clear and concise manner. State the number ofclients served, publications issued, etc. Discuss achievements that are not measurable. (Section 501 (c)(3) and (4)organizations and 4947(a)(1) nonexempt charitable trusts must also enter the amount of grants and allocations to others.)a SEE ATTACHED STATEMENT# 7 FOR PART III,LINE A(Grants and allocations ) If this amount includes foreign grants, check here (Grants and allocations )If this amount includes foreign grants, check here (Grants and allocations ) If this amount includes foreign grants, check here (Grants and allocations )If this amount includes foreign grants, check here )If this amount includes foreign grants, check here 52,323,905.bCL-jde Other program services (attach schedule)(Grants and allocations f Total of Program Service Expenses (should equal line 44, column (B), Program services)El 52,323,905.Form 990 (2005)52302102-03-06317040425 756026 457502005.05050 ENERGY TRUST OF OREGON,INC 457501

Form 990 (2005)ENERGY TRUST OF OREGON,Part, 1V Balance Sheets (See the instructions)INC.Note: Where required, attached schedules and amounts within the description columnshould be for end-of-year amounts only.454647a47bPledges receivableLess : allowance for doubtful accountsGrants rece ivableReceivables from officers , directors , trustees,and key employees 51 a Other notes and loans receivableb Less : allowance for doubtful accounts52Inventories for sale or usePrepaid expenses and deferred charges5354Investments - securities55 a Investments - land, buildings, andequipment : basis48a48bb5657 ab55b48 ab4950aLess : accumulated depreciationInvestments - otherLand , buildings , and equipment : basis SEELess : accumulated depreciation STMT 937,308,189.71, 823. 47c143,421.51c52535426,784. Q Cost-0 FMV41,047.55a57a57b55c56937,820.537,639.SEE STATEMENT 4)Other assets ( describe 59Total assets must e q ual line 74 ) . Add lines 45 throu g h 586061626364 abAccounts payable and accrued expensesGrants payableDeferred revenueLoans from officers , directors, trustees , and key employeesTax-exempt bond liabilitiesMortgages and other notes payable65Other liabilities ( describe SEEcomplete lines 70 through 74.Capital stock , trust principal, or current fundsPaid - in or capital surplus , or land , building , and equipment fundRetained earnings , endowment , accumulated income , or other fundsTotal net assets or fund balances (add lines 67 through 69 or lines 70 through 72;column (A) must equal line 19; column ( B) must equal line 21)Total liabilities and net assets/fund balances . Add lines 66 and 73606,492. 57c1,07 3,406. 58400,181.752,985.39 , 043,286. 5938,646,123.2,212 ,833.601,788,968.61626364a64bSTATEMENT 5Organizations that do not follow SFAS 117, check here 1110. 0 and74300 .4650aZ4551a51b5870717273300.37,264, 481.48c49Mm'LU, Q(B)End of year143,421.66Total liabilities . Add lines 60 throu g h 65)Organizations that follow SFAS 117, check here LXJ and complete lines67 through 69 and lines 73 and 74.67UnrestrictedSEE STATEMENT 8Temporarily restricted6869Permanently restricted- -CD(A)Beginning of yearCash - non-interest - beanngSavings and temporary cash investments47 a Accounts receivableb Less: allowance for doubtful accountsPage 493-1313663)182, 153.65313,243.2,394,986.662 ,102,211.Is,6736,317,226.,686. 68226,686.36,4 21,614.-22669707172:.36 , 648 , 300 .7339 , 043 , 286 .7436,543,912.38 ,646,123.Form 990 (2005)52303102-03-0617040425 756026 4575042005.05050 ENERGY TRUST OF OREGON,INC 457501

Form 990 (2005)ENERGY TRUST OF OREGON, INC.93-1313663art,, R econci l iation of R evenue per A u d ited F inancia l Statements W it h Revenue per R eturn (See theinstructions.)ab1234cd12Total revenue, gains, and other support per audited financial statementsAmounts included on line a but not on Part I, line 12:Net unrealized gains on investmentsDonated services and use of facilitiesRecoveries of prior year grantsOther (specify):Add lines b1 through b4Subtract line b from line aAmounts included on Part I, line 12, but not on line a:Investment expenses not included on Part I, line 6bOther (specify):Add lines dl and d2aaab1234a w,e 0 .c53853436.d0.e5385 3436 .Reconciliation of Expenses per Aud ited Financial Statements With Expenses per ReturnTotal expenses and losses per audited financial statementsAmounts included on line a but not on Part I, line 17:Donated services and use of facilitiesPrior year adjustments reported on Part I, line 20Losses reported on Part I, line 20Other (specify):a53957824.b1b2b3b4-Subtract line b from line aAmounts included on Part I, line 17, but not on line a:1 Investment expenses not included on Part I, line 6b2 Other (specify):Add lines dl and d2-b0.c53957824.d1d2Total expenses (Part I, line 1 7) . Add lines c and dPart Y A'bd1d2Add lines bl through b4cd53853436.b1b2b3b4Total revenue Part I, line 12) . Add lines c and dePage 5 d0.e5 3 9 5 7 8 2 4.Current Officers , Directors, Trustees, and Key Employees (List each person who was an officer, director, trustee,or kev emolovee at any time dunna the year even if they were not compensated.) (See the instructions.)Contributions to(E) Expense(B) Title and average hours (C) Compensationbenefit(A) Name and addressaccount andper week devoted to(If not paid , enter employeedlaposition-0-.)pins other ------------------------SEE STATEMENT ----------------------------------- --- --------------------------------------Form 990 (2005)523041 02-03-0617040425 756026 4575052005.05050 ENERGY TRUST OF OREGON,INC 457501

Form 990 (2005)ENERGY TRUST OF OREGON.93-1313663INC.Current Officers, Directors , Trustees, and Key Employees (continued)Part V APaoe6Yes No75 a Enter the total number of officers , directors , and trustees permitted to vote on organization business at board12 meetingsb Are any officers , directors , trustees, or key employees listed in Form 990, Part V-A, or highest compensated employeeslisted in Schedule A, Part I, or highest compensated professional and other independent contractors listed in Schedule A,Part II-A or II-B, related to each other through family or business relationships? If 'Yes,' attach a statement that Identifiesthe individuals and explains the relationship(s)X75bc Do any officers , directors , trustees , or key employees listed in Form 990, Part V-A, or highest compensated employeeslisted in Schedule A, Part I , or highest compensated professional and other independent contractors listed in Schedule A,Part II-A or II -B, receive compensation from any other organizations , whether tax exempt or taxable , that are related to thisorganization through common supervision or common control?14',nMX75cNote. Related organizations include section 509(a)(3) supporting organizations.If 'Yes,' attach a statement that identifies the individuals, explains the relationship between this organization and the other organization(s), anddescribes the compensation arrangements , including amounts paid to each individual by each related organization.d Does the organization have a written conflict of interest policy?X75draruw is rormer urncers , ufrectors , i rustees , ana rtey tmployees I nai rieceivea %,ompensaiion or vtnerBenefits (If any former officer, director, trustee, or key employee received compensation or other benefits (described below) duringthe year, list that person below and enter the amount of compensation or other benefits in the appropriate column. See the Instructions.)Contributions to(E) Expensebenefit(C) Compensation employee(A) Name and address(B) Loans and Advancesaccount anddeferredplansNONEcompensation plans other allowances- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -Pa rt VlYes NoOther Information (See the instructions.)Did the organization engage in any activity not previously reported to the IRS? If "Yes," attach a detaileddescription of each activityWere any changes made in the organizing or governing documents but not reported to the IRS?767778 ab7980 ahb7677XXIf "Yes," attach a conformed copy of the changes- Did the organization have unrelated business gross income of 1,000 or more during the year covered by this return?N/AIf "Yes,' has it filed a tax return on Form 990-T for this year?Was there a liquidation, dissolution, termination, or substantial contraction during the year? If "Yes,' attach a statementIs the organization related (other than by association with a statewide or nationwide organization) through commonmembership, governing bodies, trustees, officers, etc., to any other exempt or nonexempt organization?78a78b79XB0aX81bXIf "Vac " antnr the nomc of thn nrnnn-t ,nnEnter direct or indirect political expenditures (See line 81 instructions.)nonexempt81aDid the org anization file Form 1120 -POL for this y ear?523 1 6 1 /02-03-0617040425 756026 45750XN/A.and check whether it is L-J exempt or81 a62005.05050 ENERGY TRUST OF OREGON,0.LForm VUU (2005)INC 457501

Form 990 (2005)Part ,1fIENERGY TRUST OF OREGON ,INC.93-1313663Other Information (continued)82 a Did the organization receive donated services or the use of materials , equipment , or facilities at no charge or at substantiallyless than fair rental value?b If "Yes," you may indicate the value of these items here. Do not include thisamount as revenue in Part I or as an expense in Part II.82bN/A(See instructions in Part III .)83 a Did the organization comply with the public inspection requirements for returns and exemption applications?N/Ab Did the organization comply with the disclosure requirements relating to quid pro quo contributions?84 a Did the organization solicit any contributions or gifts that were not tax deductible ?N/Ab If "Yes ," did the organization include with every solicitation an express statement that such contributions or gifts were notN/Atax deductible ?85-.N/A501 (c)(4), (5), or (6) organizations . a Were substantially all dues nondeductible by members ?N/Ab Did the organization make only in-house lobbying expenditures of 2,000 or less'If 'Yes' was answered to either 85a or 85b , do not complete 85c through 85h below unless the organization received awaiver for proxy tax owed for the prior year.N/Ac Dues, assessments , and similar amounts from members85cN/A85dd Section 162 (e) lobbying and political expendituresN/Ae Aggregate nondeductible amount of section 6033(e)(1)(A) dues notices85eN/A85ff Taxable amount of lobbying and political expenditures (line 85d less 85e)N/Ag Does the organization elect to pay the section 6033(e) tax on the amount on line 85f?h If section 6033(e)(1)(A) dues notices were sent , does the organization agree to add the amount on line 85fto its reasonable estimate of dues allocable to nondeductible lobbying and political expenditures for thefollowing tax year?-- - .N/APage 7Yes NoX82a 1X83a83b84a84b85a85b85g85h501 (c)(7) organizations . Enter a Initiation fees and capital contributions included onN/Aline 1286aN/A86bb Gross receipts , included on line 12 , for public use of club facilitiesN/A87a87501 (c)(12) organizations. Enter: a Gross income from members or shareholdersb Gross income from other sources. (Do not net amounts due or paid to other sourcesN/Aagainst amounts due or received from them .)87b88At any time during the year , did the organization own a

OrAmendedr ORTLAND, OR 97204 QPay) . 10 a Gross sales of inventory, less returns andallowances 10a h b Less: cost of goodssold 10b c Gross profit or (loss) from sales of inventory (attach schedule) (subtract line fob from li