Transcription

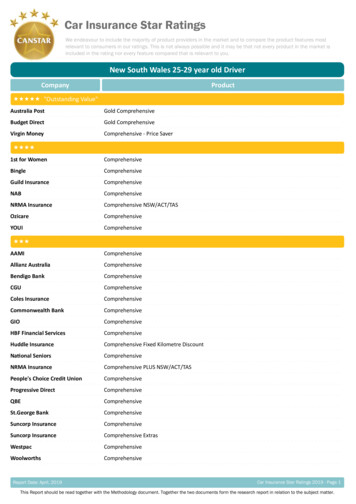

This report is no longer current. Please refer to the CANSTAR CANNEX website for the most recent star ratings report on this topic.CAR INSURANCE STAR RATINGSReport No. 2April 2008IN THIS REPORT WE EXPLORE Road test – how good is the claims service? A significant result – survey overview Oldies rule – APIA triumphs Youth vs experience – common myths busted Battle of the sexes – who is the bigger risk? State of play – NSW most expensiveED The lion’s share – AAMI fixes 1 in 5 claimsED Five star awards - some surprises second time aroundROAD TESTING THE CLAIMS SERVICEPERCWe buy insurance so that should the worst happen and our car is damaged in an accident orstolen, we’re covered. The CANNEX car insurance star ratings is designed to assist consumersby comparing the value for money offered by each insurer on a balance of cost they charge fortheir premiums and the features they offer in their policy. In order to do this, CANNEX hascollated the details of each policy and generated over 15,000 phone and internet quotes to judgewhich insurers boast the strongest value for money.SUThis methodology of course cannot measure or compare the actual service delivered by aninsurer when handling a claim that has been made. To enhance the value of the car insurancestar ratings to consumers, CANNEX has undertaken a separate consumer study to ascertain thelevel of claims service provided by the insurers.We asked a survey sample of 3,000 drivers whether they had made a motor insurance claim inthe last three years and if so, who the insurer was. We also asked how likely were they, on ascale of 0 – 10, to recommend the insurer to family and friends based on this claims serviceexperience.From the results, one in three Australian drivers have made a claim in the last three years.That’s a lot of people road testing the service provided by our insurers.How did the car insurers fare overall? Well it seems as if Australia really is the lucky country ifyou need to make a car insurance claim. The results of the CANNEX survey tell us that themajority of motorists are happy with the service they are receiving. The average mark given tothe insurers was 7.6 out of 10.The graph below shows just how positive the results were as it plots the frequency of each scorerecorded, illustrating a very strong favouring toward the higher scores, and the most frequentresponse was the full 10 out of 10.YOUR GUIDE TO PRODUCT EXCELLENCEHow we get paid: www.canstar.com.au/images/legals/fsg.pdf

EDA SIGNIFICANT RESULTRCEDWe realise the insurance market in Australia is varied, with new players yet to prove themselvesand the older, established brand names dominating the scene. Naturally, the results of ourconsumer research will not favour many insurance companies operating in Australia who havean insufficient market share, as yet, to make their results significant. This means that the resultsfrom many of the brands available in Australia are not reliable enough to be used as a validindicator because the number of participants who insured with them and had made a claim wastoo small.SUPEThe following plot shows the results from insurers for which, based on a 95% confidence intervalof 1.96 standard deviations either side of the mean, the standard error of their result was withinthe bounds of 1. Additionally, this graph also represents no company for which there werefewer than 20 respondents.Insurers' Average Scores10APIA9876543210 8.17.0 - 8.1APIAAAMI, Allianz, Budget Direct, CGU, GIO, NRMA Insurance, RAC, RACQ, RACV,Suncorp & Western QBEYOUR GUIDE TO PRODUCT EXCELLENCE2How we get paid: www.canstar.com.au/images/legals/fsg.pdf

OLDIES RULEThe hat-wearing, Volvo-driving oldie of urban myth looks like having the last laugh – APIA ratedhighest in the area of claims satisfaction. This is significant, as the insurer has zeroed in on oneprofile only – the over 50s who are no longer working full time – and still come up trumps. Thesuspicion that baby-boomers make up the majority of APIA’s customers is even moreimpressive, as this segment of the market has a reputation for being particular. Although APIA,according to our survey, gives superior service in the event of making a claim, it does not rate inthe CANNEX five star list. This is simply due to its profile exclusivity and its pricing. However,according to motorists surveyed on the level of claims service provided, APIA’s average scorewas over 9 out of 10. Congratulations to APIA for being awarded the inaugural CANNEX 5 starrating for superior claims service.YOUTH vs EXPERIENCECEDEDIt is commonly accepted that young drivers, in particular those under the age of 25, will have topay a higher insurance premium when compared with their more experienced drivingcounterparts. The increased likelihood of these drivers being involved in an accident has beenasserted many times in research and all insurers reflect this in their pricing. However, islikelihood of being involved in a crash the same as the probability that a young driver will make aclaim? If you accept the premise that young drivers are more likely to crash, then it would appearnot. The results of the CANNEX survey show that 36.7% of drivers aged under 25 had made aclaim in the last three years. Although this is higher than the total population proportion of33.1%, drivers aged 35 – 39 were more likely to have made a claim than the under 25s, with38.2% of them having made a claim in the last three years.SUPERIt could be argued that although the younger drivers are more likely to be involved in anaccident, they are less likely to claim on their insurance when they do, compared with the olderdrivers. When you consider the already increased cost of purchasing insurance as a youngdriver, combined with the cost of the standard and additional excesses for which they are liableand the resultant increased premium as a result of making a claim, it takes a rather seriousaccident before the cost of making the claim is actually worth it. This is particularly true of youngdrivers who are less likely to be flush with cash in the first place.There is also the possibility that the reporting of claims by older drivers includes those claims inwhich the car belonged to them, but the driver was their young son or daughter. The accidentmay have occurred as a result of the younger driver, however the claims process was handledby the 35 parent.Proportion of Driverswho have made aclaim in the last 3YearsUnder25s25-2930-3435-3940-4950-65Over 6536.7%33.7%34.7%38.2%33.2%30.4%27.3%It would appear that the older drivers are safer drivers; only 27.3% of drivers over the age of 65had made a car insurance claim in the last three years, well below the average of the totalpopulation of respondents. This could be due to either the older generation’s hesitancy inmaking a claim, or the older drivers being on the roads less, particularly in peak hour so they areless likely to find themselves involved in a crash. Of course, this scenario won’t ring true formany older motorists who have used retirement to take to the roads with greater freedom thanever before. Add a caravan or trailer and you will agree, the older drivers are definitely out therein substantial numbers on the roads. That leaves the somewhat controversial theory that olderdrivers really are safer drivers, backed up by the figures that they have made less car insuranceclaims in the past three years than their younger counterparts.YOUR GUIDE TO PRODUCT EXCELLENCE3How we get paid: www.canstar.com.au/images/legals/fsg.pdf

BATTLE OF THE SEXESMales or females - who are the better drivers? Remembering that this survey is a measure onlyof the likelihood of making a claim, not having a crash in the first place, it will probably come assomewhat of an anti-climax to find that there is no significant difference between the claiminghabits of men and women. 33.5% of women and 32.1% of men admitted to having made a claimin the last three years, showing that both genders are fairly evenly matched on the roads. But wehave uncovered some interesting additional facts. Although both equally likely to have made theclaim, for drivers under 40, the claim was more likely to have been made by a man whereasdrivers making claims who are aged 40 and above are more likely to women.STATE OF PLAYEDPremiums for drivers in Sydney are, on average, the highest in the country due to the populationdensity and the relatively higher chances of two cars colliding, as well as higher incidences oftheft and other damage. Bearing this is mind, it may come as a surprise to find that the averagenumber of claims made in Sydney is not greatly in excess to the national average. 36.7% ofSydney drivers have made claims compared with the national 33.1% average.EDHowever, this probably doesn’t mean the insurers are charging Sydneysiders extra on a whim.With premiums already higher than the rest of the country, drivers in Sydney are quite possiblyhesitant to make a claim unless the damage is going to be very expensive to repair. Making aninsurance claim to fix a minor ding could see a driver’s premium head skyward so it is moreeconomic to maintain the claim-free record and fix the panel damage yourself.CTHE LION’S SHAREPERWhich insurer is paying up the bulk of the claims in Australia? The data points to AAMI, withmore than one in five claims made being fixed by the national insurer. Although only available inNew South Wales, Queensland and Tasmania, more than one in every eight claims is takencare of by NRMA Insurance.SUThere are 1.5 million car insurance claims made every year, so for the insurers of Australia toachieve an average rating of 7.6 out of 10 on their claims service, according to customers, is avery positive reflection on the industry. Although some insurers do appear to perform better thanothers, it does seem that Australians can be confident that their insurer will take care of themwhen they need it.Every time you renew your car insurance you should shop around on value for money. This ishighlighted in our star ratings report, but also ask your friends and family for their experiences.The best deal for them may not be the best deal for you, but by gathering all the informationavailable, you will be better equipped to select an insurer who will give you the cover you needat a cost that won’t break your budget.SOME SURPRISES SECOND TIME AROUNDThere have been a few moves and shakes in this, our second round of car insurance star ratingsresults, but there are also some familiar faces amongst those brands performing strongly.CANNEX has included extra brands in this run of the results, such as ANZ Bank, APIA, ibuyeco,RAA (South Australia only) and Real Insurance to ensure that the survey of the current marketplace is as comprehensive as possible.Insurers are constantly monitoring the risk of insuring each driver of each car in each suburb todevelop risk profiles for each potential driver. Depending upon these profiles, the insurers willform a view on the type of driver they wish to cover and how much they will charge to do so.YOUR GUIDE TO PRODUCT EXCELLENCE4How we get paid: www.canstar.com.au/images/legals/fsg.pdf

The end result is that any change in the relative risk of any particular demographic will lead to achange in the pricing for those drivers. This can be a good thing if your insurance gets cheaper,but if you happen to be a member of the segment that is now deemed a higher risk, you couldfind yourself paying a bit extra for your cover for the next twelve months.Best Value CarInsurer - NationalAAMIBudget DirectCommInsureThis time, our national awards go to Budget Direct, AAMI and Comminsure.Budget Direct represents a group of brands – Budget Direct, Ozicare,Cashback and ibuyeco - all of which offer similar value for money.Budget Direct, AAMI and Comminsure stood out for their broad and deepvalue offered to consumers around the country. CANNEX’s population-basedweightings across eight driver profiles made sure our winners were reachingthe most consumers possible.STATE BREAKDOWNEDAfter we added up strong performances by particular car insurance brands for each profile(weighted by state’s respective population size) within each state, it became clear whichcompanies dominated this sector. Budget Direct appeared at the top of the list in all states,sharing the limelight with NRMA Insurance, AAMI, GIO, ING and AON.EDIn the previous star ratings report, only one insurer per state was highlighted as offering superiorvalue for money. However, since the release of the last report, new companies have been addedto the comparison. The CANNEX star ratings have reflected this increase in consumer optionsby awarding two insurers per state for the value for money they provide.Budget Direct & NRMA InsuranceQLDAAMI & Budget DirectVICAAMI & Budget DirectBudget Direct & INGTASAON & Budget DirectPEBudget Direct & GIOSASUWARNSWCBest Value Car Insurer - StatesPROFILE AWARDSThe top insurers per profile were calculated using a variation of the state methodology. Thedifferent states were all given equal weighting because CANNEX deemed that for an insurer tobe said to offer good value for a particular driver profile across the nation, it was just asimportant for them to offer good value in the smaller states like Tasmania as it was in theheavyweight states like New South Wales.Best Value Car Insurer - ProfilesDrivers 30 - 59Budget DirectExecutive Car DriverBudget DirectFamiliesBudget DirectMature DriversCommInsureFemale Drivers 25-29Budget DirectMale Drivers 25-29Budget DirectYoung Female Drivers 25INGYoung Male Drivers 25INGYOUR GUIDE TO PRODUCT EXCELLENCE5How we get paid: www.canstar.com.au/images/legals/fsg.pdf

MAKE A SHOPPING LISTOur research into the best value car insurance, taking into account price and desirable features,revealed the companies who delivered the best value for money for each driver profile in eachstate. If you did your homework and shopped around last year for the best price, you quitepossibly feel you don’t need to bother this time around. Not so fast there. As already mentioned,the insurance pricing landscape is constantly evolving and each insurer is re-evaluating theprices they offer every year. Thus one year is not the same as the next in car insurance terms.The best deal available for you may be with the same insurer but you should know this forcertain.EDEach year when you receive your renewal take the opportunity to shop around and gather pricesfrom the whole market. Include your own insurer in this survey to make sure you are getting theirbest deal. CANNEX car insurance star ratings is a helpful way to make a short list of suitableproducts you may like to follow up on.The following companies received 5 star awards for each driver profile in each state.QLDSAYoung FemaleDrivers 25AAMI & INGCGU & INGCGU & INGYoung MaleDrivers 25AAMI & INGCGU & INGFemale Drivers25-29Budget Direct &OzicareBudget Direct &OzicareMale Drivers 25-29Budget Direct &OzicareBudget Direct &OzicareDrivers 30 - 59Ozicare & RealInsuranceExecutive CarDriversFamiliesMature DriversVICWACommInsureCGU & INGCGU & INGINGCGU & INGCGU & INGAllianz &Budget DirectBudget DirectBudget Direct& OzicareAllianz & GIOBudget Direct& OzicareBudget DirectBudget Direct& OzicareBudget Direct& OzicareBudget Direct &OzicareBudget Direct& OzicareBudget Direct& OzicareBudget Direct& OzicareBudget Direct& OzicareBudget Direct &Real InsuranceBudget DirectBudget DirectBudget DirectBudget DirectBudget DirectJust CarInsurance &OzicareAAMI & JustCar InsuranceBudget Direct& RAABudget DirectAAMI &Budget DirectBudget Direct& OzicareCommInsure &Real InsuranceBudget Direct &OzicareBudget Direct& OzicareBudget Direct& OzicareBudget Direct& OzicareGIO & SuncorpCCGU & INGRPESUTASEDNSWThe CANNEX star ratings award 5 stars to the products achieving scores in the top 5% of eachcategory. There are now 26 insurers compared in the star ratings. In many state and profilecombinations, there are now more than 20 products. In these state and profile combinations, thetop 5% now includes two products.The methodology used to determine the star ratings results is included below.YOUR GUIDE TO PRODUCT EXCELLENCE6How we get paid: www.canstar.com.au/images/legals/fsg.pdf

COPYRIGHT Cannex (Aust) Pty Limited Pty Ltd ABN 21 053 646 165, 2007. The recipient must not reproduce or transmit to third parties thewhole or any part of this work, whether attributed to Cannex or not, unless with prior written permission from Cannex, which ifprovided, may be provided on conditions.SUPERCEDEDDISCLAIMERTo the extent that any CANNEX data, ratings or commentary constitutes general advice, this advice has been prepared by CANNEX(Aust) Pty Ltd ABN 21 053 646 165 AFSL 312804 and does not take into account your individual investment objectives, financialcircumstances or needs. Information provided does not constitute financial, taxation or other professional advice and should not berelied upon as such. CANNEX recommends that, before you make any financial decision, you seek professional advice from asuitably qualified adviser. A Product Disclosure Statement relating to the product should also be obtained and considered beforemaking any decision about whether to acquire the product. CANNEX acknowledges that past performance is not a reliable indicatorof future performance. Please refer to CANNEX’s FSG for more information at www.cannex.com.au.YOUR GUIDE TO PRODUCT EXCELLENCE7How we get paid: www.canstar.com.au/images/legals/fsg.pdf

car insurance star ratingsNew South WalesYoung Male Driver ore BreakdownCar Replaced ifWritten-OffCostFeatureAvailableAge ofCarMonthly RoadsideAgreed orAssistMarket Value Pmts no Extracost AAMIComprehensive Car 1103.0094.5285.009.52 12 mEither ING InsuranceComprehensive 1165.7993.2680.4212.83 3yEither ANZ BankComprehensive 1393.1379.3967.3012.10 3yEither AONComprehensive 1350.3183.1769.4313.74 3yEither CGUComprehensive 1238.8989.3575.6813.67 3yEither Commonwealth BankComprehensive Cover 1384.8382.7067.7015.00 2yEither Just Car InsuranceComprehensive Car 1108.9488.6384.544.09 N/AAgreed NRMA InsuranceComprehensive 1274.2385.0073.5811.42 24 mEither St George BankComprehensive 1201.73Allianz AustraliaSureCover Plus 1741.63Bendigo BankComprehensiveBudget 212.58 3yEither RCEDED 64.1453.8310.31 2yEither 1547.9274.2460.5713.67 3yEither 1501.0873.6662.4611.21 12 mEither 1560.5471.5360.0811.45 12 mEither Comprehensive Car 2239.0855.4541.8713.58 2yAgreed ibuyecoComprehensive Car 1612.0569.2558.1611.09 12 mEither nabComprehensive 2690.7447.6534.8412.80 2yEither OzicareComprehensive 1530.1272.4861.2711.21 12 mEither Real InsuranceMotor Vehicle Insurance 2446.8646.8138.328.49 1yEither SUNCORPComprehensive Cover 2686.9848.7334.8913.83 2yEither Western QBEComprehensive 3060.3942.2430.6311.60 24 mEither WestpacMotor Plus Insurance 2362.2853.4839.6913.80 24 mEither SUPE your guide to product excellenceReport Date: April, 2008How we get paid: www.canstar.com.au/images/legals/fsg.pdf

car insurance star ratingsNew South WalesYoung Female Driver ore BreakdownCar Replaced ifWritten-OffCostFeatureAvailableAge ofCarMonthly RoadsideAgreed orAssistMarket Value Pmts no Extracost AAMIComprehensive Car 1043.0094.5285.009.52 12 mEither ING InsuranceComprehensive 1165.7988.8876.0512.83 3yEither ANZ BankComprehensive 1393.1375.7363.6412.10 3yEither AONComprehensive 1350.3179.3965.6613.74 3yEither CGUComprehensive 1238.8985.2371.5613.67 3yEither Commonwealth BankComprehensive Cover 1246.6886.1171.1115.00 2yEither Just Car InsuranceComprehensive Car 1077.1786.3982.304.09 N/AAgreed NRMA InsuranceComprehensive 1200.3785.2873.8611.42 24 mEither St George BankComprehensive 1201.73Allianz AustraliaSureCover Plus 1608.37Bendigo Ba

There have been a few moves and shakes in this, our second round of car insurance star ratings results, but there are also some familiar faces amongst those brands performing strongly. CANNEX has included extra brands in this run of the results, such as ANZ Bank, APIA, ibuyeco,