Transcription

Public Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure AuthorizedPublic Disclosure Authorized38018FIAS:The investment climateadvisory serviceFY2006ANNUAL REPORT

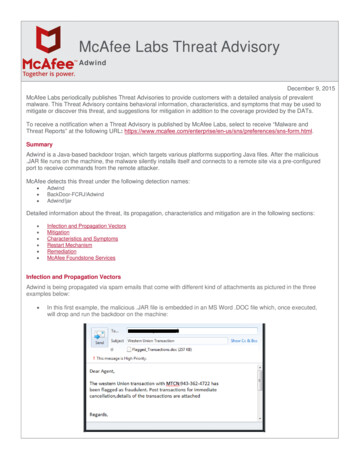

2006 Annual ReportFIAS advises governments of developing and transition countries on how to improve their investment climate fordomestic and foreign investors. FIAS, a multi-donor service of the International Finance Corporation (IFC) and theWorld Bank, focuses on four main areas: investment climate diagnostics, investment laws and promotion, administrative barriers solutions, and industry competitiveness. Since its establishment in 1985, it has assisted over 130countries in increasing the level and impact of private investments through more than 680 projects.A distinguishing trait of FIAS’ modus operandi is the ability to respond quickly to the requests of our clients— an impossibility without the prompt mobilization of co-financing by our donors. Current core donors to FIASinclude Canada, Ireland, Luxembourg, the Netherlands, Norway, Sweden, Switzerland, and the UnitedKingdom, while regional funding is provided by Australia, Canada, New Zealand, Ireland, Switzerland, andSweden. Finally, Australia, Canada, Denmark, the Netherlands, Sweden, the United Kingdom, and theUnited States of America also provided direct financial assistance to our clients on selected projects.For more information on current and past FIAS projects, our areas of expertise, our client and donor base, and adownloadable version of this annual report, please visit our website at www.fias.net.A multidonorserviceservice ofA multi-donorof thethe World Bank and theInternational Finance CorporationInternational Finance Corporationand the World BankPhoto background & credit: A worker at a foreign-owned metal fabrication plant in Argentina.Courtesy Jim Pickerell, IFC Photo LibraryAbout this report: All dollar amounts are in current US dollars unless otherwise specified.Translations of this annual report in Arabic, Chinese, French, Russian or Spanish are available upon request.Acronyms: A full list of acronyms used in this annual report can be found on Page 54.

2006 Annual ReportMeeting with officials from Liberia’sMinistry of Agriculture to discuss amini-diagnostic projectPhotograph courtesy of FIASstaff member Zenaida HernandezTable of ContentsSection 1: About FIASFY06 Operational ResultsTransition & ProgressFrom the General ManagerHistory & AchievementsFY06 Project SnapshotsCreating More Opportunities for Growth: South-South FDI24581214Section 2: Core ServicesInvestment Climate DiagnosticsInvestment Laws and PromotionAdministrative Barriers SolutionsIndustry Competitiveness18202224Section 3: Regional FocusSub-Saharan AfricaSouth AsiaEast Asia & PacificMiddle East & North AfricaLatin America & the CaribbeanEurope & Central Asia282930313233Section 4: Ensuring SuccessMonitoring & EvaluationFIAS Team & Expertise3640Section 5: FinancingSources of FundsUses of FundsFunding Analysis424343Section 6: AppendixAdvisory Projects Completed in FY06461

2006 Annual ReportABOUT FIASFY06 Operational ResultsProject performanceIn FY06, FIAS completed an all-time high of 84 projects, surpassing last year’s 74 projects and 60 projects in FY04. More than half of theseprojects were in frontier markets. Equally important, our project base remains strong with 140 assignments under development, illustratingthe continuing increase in demand for FIAS services.CLIENT SATISFACTIONOverall, 89 percent of FIAS’ clients (all of whom are governments) rated FIAS’ performance either“satisfactory/very satisfactory” or “extremely satisfactory” in a recent IFC Client Survey.COLLABORATIONCollaboration with the World Bank Group (WBG) increased significantly in FY06 to a total of 53 joint projects with the World Bank, 30 joint projects with IFC’s Facilities, and 6 joint projects with the World Bank’sMultilateral Investment Guarantee Agency (MIGA).PROGRAMMATIC APPROACH FIAS continued to implement the programmatic approach that began in FY05 with multi-year projects inBangladesh, Sierra Leone, and Fiji.POST-DIAGNOSTICS74 percent of FIAS advisory projects in FY06 focus on design and implementation of reform 00220032004RATESFY 2001-200520CLIENT SATISFACTION RATEFY 200620% 12000Funding & expenditures 80000%2001200220032004852107017200540% IMPLEMENTATION 1600034“SATISFACTORY”OR ABOVE80%6820022003200420050200651COMPLETED PROJECTSFY 2002-20063417 80000200520022003200420052006140PROJECTS IN PIPELINEFY 2002-2006 16000 1200020027020032004200502006Total expenditures amounted to 13.7 million in FY06, representing an increaseof 8 percent over the previous year, while at the same time 4000 4000the total number of projects increased by 14 percent over the same period. All amounts shown below are in thousands of US dollars. 0 16000 02002200320042005200620022003 16000200520042006WORLD BANK GROUP CONTRIBUTIONSOTHER INCOME (CLIENT/DONOR COPAY) 12000OPERATING COSTS 8000 12000 8000OPERATIONAL TRAVEL COSTS 4000 0PERSONNEL COSTS 4000 020022003200420052006SOURCES OF FUNDS FY 2002-20062002200320042006USES OF FUNDS FY 2002-20061The FIAS fiscal year is July 1 through June 30.2Rate of implementation of FIAS recommendations one year after project completion. Dates represent when project was completed.220052006 ANNUAL REPORT2002200

2006 Annual ReportRegional distributionFor FY06, frontier countries1 continued to comprise the majority of FIAS advisory projects (52 percent). Of particular note in the past yearwas our growth in Sub-Saharan Africa, where we achieved a record 27 projects, an increase of 80 percent over FY05.303030302020202010101010002002 2003 2004 2005 200602002 2003 2004 2005 2006EAST ASIA &PACIFICEUROPE &CENTRAL ASIA302002 2003 2004 2005 2006LATIN AMERICA &THE CARIBBEAN02002 2003 2004 2005 2006MIDDLE EAST &NORTH AFRICA302020101000EAST ASIA & PACIFICKNOWLEDGEMANAGEMENTEUROPE &CENTRAL ASIASUB-SAHARANAFRICALATIN AMERICA& CARIBBEANSOUTH ASIA2002 2003 2004 2005 2006MIDDLE EAST& NORTH AFRICA2002 2003 2004 2005 2006SUB-SAHARAN AFRICASOUTH ASIAREGIONAL DISTRIBUTIONFY 2006Product rangeOver the last four years, the mix of FIAS products as defined by the four broad categories has been more or less stable. What has changedsignificantly has been the shift from pure diagnostics work to a much stronger focus on solution design and DESIGN ONLY20SOLUTIONADMINISTRATIVEDESIGN &BARRIERSIMPLEMENTATION8%INVESTMENT LAWS& PROMOTIONDIAGNOSTIC &SOLUTIONINDUSTRYDESIGN 56%INVESTMENT CLIMATEDIAGNOSTICSDIAGNOSTIC0200216%PROJECT TYPE20032004200539% 2006INVESTMENT LAWS& PROMOTIONADMINISTRATIVEBARRIERS SOLUTIONSINVESTMENT CLIMATEDIAGNOSTICSMULTIPLE TYPESFIAS PROJECTS BY STAGES FY 20061& SOLUTIONDESIGNINDUSTRYCOMPETITIVENESSPRODUCT DISTRIBUTION FY 2006Frontier countries are those countries considered by the World Bank Group to be high risk and/or low-income countries with an Institutional Investor Country Credit Rating of 30 or less, and a gross national income per capita of 765 or less.SECTION 1: ABOUT FIAS3

2006 Annual ReportFISCAL 2006: A PRÉCISTransition & progressHalfway through the implementation of FIAS’ three-yearstrategy, FIAS tops last year’s performanceFY06 HIGHLIGHTS The implementation rate by clients of FIAS recommendations increasedto 68 percent (from 47 percent in FY02), as measured a year after projectcompletion. FIAS completed 84 advisory and analytical projects, or four more thanplanned, and developed a strong demand-driven pipeline of projects forFY07 and beyond. 52 percent of FIAS projects are in frontier countries and an additional 17percent in frontier regions. FIAS contributed to 41 of the investment climate reforms reported in theDoing Business 2007 report, including 58 percent of reforms of businesslicensing, 35 percent of business entry, 31 percent of tax administration,and 24 percent of property registration in developing and transition countries. Sub-Saharan Africa saw the strongest growth in demand and supportprovided to the region. Integration with World Bank Group partners was at its highest, with virtually every project done in connection with an IFC Facility, the World Bankand/or MIGA. FIAS launched new joint ventures with new Business Enabling Environment (BEE) teams of Private Enterprise Partnership-China and PrivateEnterprise Partnership-Africa, and FIAS Africa manager relocated to Johannesburg. Implementation of new Technical Assistance Advisory Service (TAAS)guidelines and processes increased transaction costs but contributed to astronger focus on Monitoring & Evaluation. Client satisfaction was 89 percent (vs. 86 percent average for IFC TAAS)according to a recent IFC Client Survey, and donor satisfaction was 90percent. FIAS spent 13.7 million, or 1 million more than in FY05, as a result ofincreased demand and donor/client funding secured Average project size remained small, less than a third of the average size ofIFC BEE projects, but is growing slowly A new general manager joined FIAS in January 2006, six months afterthe previous GM’s departure.4Fiscal year 2006 (FY06) marked the second year ofimplementation of FIAS’ three-year strategy, whichplaces greater emphasis on solution design and theimplementation of private sector reform programs. Thisstrategy has received strong support from clients anddonors. During FY06, FIAS pursued a multi-year andmulti-product programmatic approach in working withcommitted client countries. Initial diagnostic studieswere followed by solution design and the implementation of priority recommendations. This new approachhas reshaped FIAS’ project portfolio and supported thecompletion of 84 projects in FY06, up from 75 in FY05.FIAS is developing new approaches. For example, inBangladesh it is creating with the South Asia EnterpriseDevelopment Facility (SEDF), the UK’s Department forInternational Development (DFID), the EC and otherdonors, the Bangladesh Investment Climate Fund(BICF), a comprehensive long-term program that willsupport the government of Bangladesh and the privatesector in the implementation of major investmentclimate reforms.The focus on the implementation of investment climatereforms has enabled FIAS to pay special attention tobroader stakeholder involvement, sequencing of specific recommendations for implementation, the choice ofinstitutions, and the skills and incentives that determinethe behavior of authorities involved. This focus hasbeen successfully adopted in countries such as Bangladesh, Kenya, Sierra Leone, Turkey, and Fiji. Accordingto a recent IFC Client Survey, a full 89 percent of clientswere “satisfied/very satisfied/extremely satisfied” withFIAS’ advisory services.Moving forward, the successful implementation ofFIAS’ strategy rests on the following three pillars:Strengthening Partnerships for Better Outcomes:Fostering partnerships with other parts of the WorldBank Group, as well as with bilateral and multilateraldonors, continues to be FIAS’ primary way of leveraging its specialized expertise and delivering tailoredand integrated investment climate solutions to clientcountries. In FY06, FIAS implemented around 30 jointprojects with IFC’s regional facilities, 6 with the WorldBank’s Multilateral Investment Guarantee Agency(MIGA), and at least one integrated project with a2006 ANNUAL REPORT

2006 Annual ReportPhoto credit: Deborah W. CamposA message from Pierre“These are indeed exciting times for all of us whowork on improving the investment climate in developing countries. Never before have the opportunities tobenefit from a better business environment been sogreat for our client countries. The hard-won successesof the last two decades (low inflation, more democracyand political stability, less state control of the economy,more open trade), together with sustained technological progress, have opened the way to countlessopportunities for productive and profitable privateinvestments within and across borders. Indeed, grossdomestic product (GDP) per capita growth rates, tradeand FDI flows have all reached record levels in developing countries.And yet, this is no time for complacency. Growth ratesin GDP per capita remain grossly inadequate in many ofthe poorest countries to make a significant dent in poverty. Many microeconomic barriers are left, dampening the investment climate. The Doing Business indicators have barely started to improve in the countries thatneed it the most. Improving the investment climate atthe microeconomic level is one of the last big hurdlesstanding in the way of eliminating poverty – and mayalso be one of the most challenging. This challengerequires governments to develop new organizationaland technical skills. The list of potential reforms is longand they are not all equal in terms of pay-offs andcosts — governments need to be strategic as to wherethey should expand their limited financial, political, andhuman capital.FIAS, together with its many clients and partners fromwithin and outside the World Bank Group, is workinghard to develop new tools and new approaches to helpidentify and surmount the most important microeconomic barriers. For example, we are developing moreprecise diagnostic tools (e.g., Industry Value ChainAnalysis and new Doing Business indicators); we arehelping governments design comprehensive privatesector development strategies; and we are adaptingthe “guillotine” approach to review, eliminate andsimplify the 1,347 business license regulations on thebooks in Kenya. Our goal is to help mobilize nationaland regional coalitions for change and support ourclients in their efforts to win this crucial and neverending battle, and thus become more competitive ina fast-changing and increasingly integrated globalmarketplace and better able to give their people hopeand opportunity.”Pierre GuislainGeneral Manager, FIASSECTION 1: ABOUT FIASABOUT PIERRE GUISLAINPierre Guislain, a Belgiannational, became the GeneralManager of FIAS in January2006. In his capacity of Investment Climate Director, Pierreis also overseeing IFC’s overallBusiness Enabling Environmenttechnical assistance businessline, as well as the World Bank’swork on competition policy.Pierre joined the World Bank in1983 and worked successively inthe West Africa Projects Department, the Legal Department,the Asia Technical Department,and the Private Sector AdvisoryServices Department, beforemoving to Brussels in 1997to manage a joint programbetween the World Bank andthe European Commission onPrivate Sector Participation inInfrastructure in the SouthernMediterranean region. Pierrereturned to Washington in 2001to lead the Bank’s Informationand Communication Technologies division.Pierre is the author or editorof several publications on information and communicationtechnology (ICT), foreign directinvestment (FDI), infrastructuresector reform and privatization.Pierre holds an MPA in Economics and Public Policy from Princeton University and a graduatelaw degree from the Universityof Louvain.5

2006 Annual ReportFISCAL YEAR 2006Transition & progressWorld Bank loan operation. Virtually all FIAS projectsare aligned with country-specific programs of theWorld Bank.Driving for Impact: FIAS’ overall strategy relies onthe systematic measurement of the performance ofprojects to assess their effectiveness in improving theinvestment climate of client countries. In FY06, FIASlaunched two pilot benchmarking projects in SierraLeone and Bangladesh to monitor the progress of private sector development reforms. Both pilots fosteredthe creation of public-private committees to build localcapacity in monitoring and evaluation. During FY06,FIAS also implemented a number of monitoring andevaluation tools, including a Project Implementation Monitoring System (PIMS), new Doing Businessindicators, the IFC client survey, end-of-project-cycleindependent evaluation, selected impact assessments,and participation in IFC’s technical assistance andadvisory services.Generating Leading-edge Practical Knowledge:Understanding the political economy of investmentclimate reforms remained FIAS’ key priority in FY06.During the year, 10 knowledge management productswere completed; and 30 good-practice case studieswere developed. In addition, several new productsand/or themes were piloted in such areas as SouthSouth foreign direct investment, regulatory governance, tax administration, competition policy, securedlending, special economic zones, informality surveys,private sector development strategy and organization,stakeholder management in reform processes, and landmarkets.FIAS AND DOING BUSINESS REFORMSFIAS has contributed to 41 reforms of the businessenvironment described in the Doing Business 2007report. FIAS advisory work focuses mainly on four ofthe ten Doing Business indicators: starting a business,dealing with licenses, registering property, and payingtaxes. In fact, FIAS has been involved in 58 percent ofall business licensing-, 35 percent of all business entry-,31 percent of all tax administration-, and 24 percentof all property registration reforms in developing andtransition countries identified by the Doing Business2007 report.Kenya, Latvia, Romania, and Mali are some of thecountries that FIAS has helped reform business licensing, as well as some of its most damaging regulations.For example, FIAS’ Administrative Barriers Diagnostics6of 2000 in Romania helped generate momentum onbusiness licensing reform and support the reformprocess ever since. The countries of Croatia, Egypt,Georgia, Macedonia, Peru, and Mexico have allimproved their business entry regulations. Some haveeven achieved the Doing Business’ report’s top-tenreformers list. Croatia, for instance, now takes only 10procedures and 45 days to register a business (downfrom 12 and 49 in 2005). All of these countries havebeen working with FIAS on multi-year reform efforts ofbusiness entry. For example, in Peru FIAS conducted aninitial diagnostic in six districts of Lima in 2003, implemented a business entry simplification project jointlywith the IFC Latin American and Caribbean (LAC) Facility in 2005, and scaled up the entry simplification workto five other Peruvian regions in 2006 in partnershipwith the IFC LAC Facility.In many cases, FIAS’ advisory work and impact goes farbeyond helping clients improve specific Doing Businessindicators. For example, in Bosnia and Herzegovina,Croatia, Macedonia, Serbia, and Kenya FIAS is currentlybuilding the capacity of the government to establisha comprehensive system of regulatory governance toimprove the quality of business regulations. In Kenya,FIAS initially helped review the 1,347 licenses by applying the “guillotine approach” as a way to engagethe government in a broad regulatory reform program.This approach sets the new criteria and a deadline forscreening all existing licenses with a view to eliminatingthose that do not pass muster. For example, in June2006 the Kenyan government committed itself to eliminate 800 business licenses. In the last five years FIAShas also assisted Georgia in undertaking the overallregulatory reform agenda. This sustained engagementhas helped the country to make substantial progressin business entry, dealing with licenses, customs administration, and contract enforcement, and in the endto reach the top of the list of reformers of the DoingBusiness 2007 report.Finally, as part of the ongoing collaboration with theDoing Business team, FIAS conducted two major studies of the business environment at the sub-nationallevel in Brazil and Mexico and developed the “tradingacross borders” indicator (comparing global tradelogistics indicators for over 155 countries) of the DoingBusiness 2006 report.2006 ANNUAL REPORT

2006 Annual ReportFIAS KNOWLEDGE MANAGEMENT IN FY06Consistent with our strategic shift towards advising onsolution design and implementation, we continued tomake good progress in doc

domestic and foreign investors. FIAS, a multi-donor service of the International Finance Corporation (IFC) and the World Bank, focuses on four main areas: investment climate diagnostics, investment laws and promotion, admin-istrative barriers solutions, and industry competitiveness.