Transcription

Climate changeThe investmentperspective

Climate-related risksare too far-reaching forfinancial institutions toavoid entirely. They willimpact all sectors, andrequire tangible actionsto address these issues.ContentsExecutive summary1The complex financial impact of climate risks2How did we get here — and what comes next?4Climate and the investment value chain8Challenges and responses:ConclusionAsset owners11Asset managers13Consultants, advisors and ratings agencies14Banks1516

Executive summaryThe risks posed by “stranded assets” — assets that unexpectedly losevalue as a result of climate change — are rapidly climbing theinvestment industry’s agenda.The 21st annual Conference of the Parties (COP 21),held in Paris during December 2015 and ratified in earlyOctober 2016 by 74 signatories, has propelled globalwarming toward the top of the financial services agenda.Even so, the sheer scale of the issue makes it achallenging one for many institutions.Despite these obstacles, financial institutions are takingtangible actions to address climate-related challenges.This not only allows them to begin identifying risks andopportunities. It also shows that external stakeholderssuch as regulators, individual investors and the media areplaying an active role in the energy transition.Stranding may have grabbed the headlines, but it isarguably the tip of an iceberg. If commitments to limitglobal warming to 2 C are to be fulfilled, then the comingdecades will see a worldwide “energy transition” with vastfinancial implications. Financial institutions face manyinterrelated and highly complex climate-related risks. Onthe upside, research suggests that investment opportunitiesarising from the energy transition will actually outweighclimate-related risks in the long term.The report will address a number of specific steps that assetowners, asset managers, banks and other players, such asconsultants and advisors should consider taking. These varybetween institutions, but consistent themes include:The scale of these issues calls for an urgent response acrossthe investment value chain. Individual firms also have afiduciary duty to address climate-related opportunities toenhance value of the investment. Indeed, climate-relatedrisks are too far-reaching for financial institutions as thepossible value creation or erosion can be significant. Theywill impact all sectors, including extraction industries(mining and energy), manufacturing, and carbon sinks*such as forestry. A dearth of consistent, reliable data andan absence of credible analytical models also mean thatinvestment professionals trying to address climate changeare largely working in the dark.* Developing investment beliefsStrengthening governance and risk managementWorking with clients to develop investment strategiesEngaging with other financial institutions andnonfinancial companiesAbove all, it is vital for financial institutions to understandthat addressing stranding risks and other financial risksand opportunities of climate change is not a one-offprocess. It needs to become a permanent part ofeveryday decision-making.Addressing climate change requires collective actionand collaboration across the investment value chain.But individual institutions bear ultimate responsibility formanaging climate-related risks and opportunities on behalfof their clients and their own shareholders. Those thatrespond proactively will create value for their clients, givethemselves a competitive advantage, reduce systemicfinancial risks and make an invaluable contribution tosociety as a whole. However, those who fail to take actionwill soon experience the implications across the wholeinvestment value chain, resulting in significant costsand damage to economies.A carbon sink is a forest, ocean, or other natural environment viewed in terms of its ability to absorb carbon dioxide from the atmosphere.1

The complex financial impact ofclimate risksThe Paris Agreement of December 2015, ratified in earlyOctober 2016, provides a milestone achievement in a seriesof events, speeches and reports that have propelled theissue of climate change to prominence over the pasttwo years.The potential financial consequences of climate risk areoften debated in terms of “stranded assets.” The value ofglobal financial assets at risk from climate change has beenestimated at US 2.5t by the London School of Economics,1and US 4.2t by the Economist.2 For comparison, the annualGross Domestic Product (GDP) of Japan, the world’s thirdlargest economy, is worth about US 4.8t.The staggering scale of these potential losses has done a lotto raise awareness of climate risks in investment circles. But“stranding” is only part of a complex range of climate risks —each of which creates its own opportunities. Climate riskscan be summarized as: Physical: damage to land, buildings, stock orinfrastructure owing to physical effects of climate-relatedfactors, such as heat waves, drought, sea levels, oceanacidification, storms or flooding Secondary: knock-on effects of physical risks, such asfalling crop yields, resource shortages, supply chaindisruption, as well as migration, political instabilityor conflict Policy: financial impairment arising from local, nationalor international policy responses to climate change,such as carbon pricing or levies, emission caps orsubsidy withdrawal Liability: financial liabilities, including insurance claimsand legal damages, arising under the law of contract,tort or negligence because of other climate-related risks Transition: financial losses arising from disorderly orvolatile adjustments to the value of listed and unlistedsecurities, assets and liabilities in response to otherclimate-related risks Reputational: risks affecting businesses engaging in,or connected with, activities that some stakeholdersconsider to be inconsistent with addressingclimate change21.2.3.4.This simplified list is only a starting point for assessingclimate-related risks. Scientists expect many physicaleffects of climate change — such as polar melting — to beself-reinforcing. Different types of these risks can interactwith each other in complex ways, for example when physicaleffects lead to migration, causing economic instability orunderinvestment, all contributing to the stranding of thecore asset. Other external factors also have huge potentialto complicate or enhance climate-related risks. Thesefactors include oil, gas, coal and energy prices, the potentialfor emerging renewable technologies to render existinginfrastructure uneconomical, and the views of consumers,lobbyists and nongovernmental organizations.As complex as climate risks may be, they only representhalf the story. Global GDP is expected to triple by 2060,driven largely by developing markets.3 Yet, today, 1.3 billionpeople in those markets still have no reliable access toelectricity.4 Delivering the power that global developmentwill require represents a vast investment opportunity.Research suggests that the economic benefits ofinvestment will outweigh the costs of inaction. Studiesby both the London School of Economics and Economist(referenced earlier) expect total global output to be higherunder a lower emissions scenario; Citigroup expectsinvestment in climate change mitigation to generateattractive and growing yields;5 and Mercer believes a 2 Cscenario will not harm diversified returns to 2050, andwould be accretive thereafter.6Of course, the precise balance of investment risks andopportunities will depend on future climate scenarios, andwhat investment decisions will be made — whether throughconventional means, e.g., coal-fired power stations, whichadd to global warming and climate change, or throughlow carbon means to help mitigate the problem. But, inaggregate, the post-Paris “energy transition” shouldnot present fears for well-prepared investors.1.3 billion peoplein the developing markets stillhave no reliable access toelectricity.Dietz, Bowen, Dixon & Gradwell, Climate value at risk of global financial assets, Nature Climate Change, April 2016“The cost of inaction”, Economist Intelligence Unit, July 2015, 2015 The Economist Intelligence Unit Limited“GDP long-term forecast (indicator). doi: 10.1787/d927bc18-en”, OECD, (Accessed on 19 July 2016)“World Energy Investment Outlook”, International Energy Agency, June 2014, 2014 OECD/IEA

Climate change scenariosClimate change scenarios are used by public and private sector bodies as a basis for policy decisions and economicplanning. Financial institutions can develop their own scenarios, but many will find it easier to adapt those used byexpert bodies, such as the Intergovernmental Panel on Climate Change (IPCC). Climate change scenarios are oftendescribed in terms of post-industrial temperature rises (e.g. “a 2 C scenario” or “a 4 C scenario”), but are properlydefined by both probabilities and temperatures. For example, the IPCC’s Representative Concentration Pathway 2.6(RCP 2.6) offers a 50% chance of limiting global warming to 2 C.The IPCC’s latest scenarios are: RCP 2.6 — a “severe mitigation” scenario where significant efforts are made to transition from fossil fuels toalternative energy sources and to try to limit post-industrial global warming to 2 C. RCP 4.5 — an intermediate scenario with material efforts to reduce emissions. RCP 6 — a higher greenhouse gas emission version of the intermediate scenario. RCP 8.5 — a high greenhouse gas emissions (or “inaction”) scenario with no additional effort to limit emissions.Each scenario makes assumptions about the levels of greenhouse gas emissions and the capture mechanismsrequired to achieve it. Understanding and questioning those assumptions is crucial to gaining valuable insights fromscenario planning.Source: Pachuari, Meyer, “Climate Change 2014: Synthesis Report – Summary for Policymakers”, IntergovernmentalPanel on Climate Change, 2014, 2014 IPCC5. Channell, Curmi, Nguyen, Prior, Syme, Jansen, Rahbari, Morse, Kleinman, Kruger, “Energy Darwinism II”, Citi, August 2015, 2015Citigroup5“World Energy Investment Outlook”, International Energy Agency, June 2014, 2014 OECD/IEA6. “Investing in a time of climate change”, Mercer, April 2015 2015 Mercer LLC/International Finance Corporation/UK Department forInternational Development3

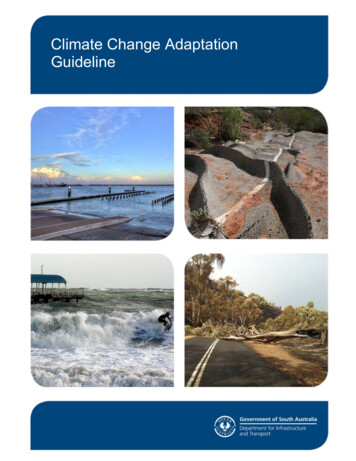

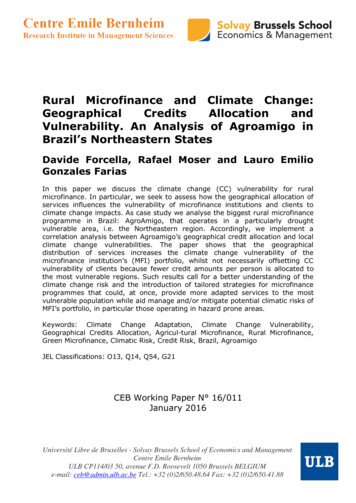

How did we get here, and whatcomes next?Sustainability campaigners have tried for years to usethe financial industry as a lever for environmental action.However, direct activism has often been counter-productiveand deterred financial institutions from engaging withclimate-related issues.In contrast, research-led campaigns — such as CarbonTracker’s influential Unburnable Carbon reports — havedone much more to raise awareness of stranding risks andspark debate over other climate-related factors. Figure 1from the Carbon Tracker Initiative reflects the surplus ofoil and coal that exists that would not be useable in a 2 Cscenario. This awareness has led to the developmentof more than 400 national and international corporatedisclosure schemes, such as the International IntegratedReporting Council (IIRC) and the World Bank’s CarbonPricing Leadership Coalition (CPLC). Approximately 90%of FTSE 100 and 80% of Fortune Global 500 companiesparticipate in at least one of these schemes.1At the same time, institutional investors such as pensionfunds and insurers have made commitments to improve thedisclosure of the carbon footprints of their investments. Forexample, 2014 saw the Montreal Carbon Pledge signed by92 institutions managing US 6t in assets, and the GlobalInvestor Statement on Climate Change signed by 347institutions managing US 24t. The Carbon DisclosureProject (CDP) has also been a key contributor in thisarea, not just for carbon.Figure 1: Carbon dioxide emissions potential of listed fossil fuel reservesThe below graph shows the relative 2 degree carbon budget against listed fossil fuel reserves. It demonstrates the largedisconnect between what is being invested and what the Paris Agreement will allow.800GtCO² (cumulative carbon budget)Gas37.34600565Oil319.13400200149Coal389.192 CRemainingglobal carbonbudget2ºCListedcarbonbudget0Source: Unburnable Carbon Report, Carbon Tracker Initiative41. Mark Carney, “Breaking the Tragedy of the Horizon – climate change and financial stability” speech given at Lloyd’s of London,29 September 2015

Timeline on climate action1987–20161987The World Commission on Environment andDevelopment issues the report Our CommonFuture with the most commonly accepted definitionof sustainability as: “Sustainable development isdevelopment that meets the needs of the presentwithout compromising the ability of futuregenerations to meet their own needs.”1991The United Nations Framework Convention onClimate Change (UNFCCC) opens for signature atRio Earth Summit in June, bringing the worldtogether to curb greenhouse gas emissions andadapt to climate change.2001The seventh Conference of the Parties (COP7),held in Marrakesh in November 2001, formalizedthe agreement on operational rules forInternational Emissions Trading Association (IETA),the Clean Development Mechanism (CDM) andJoint Implementation (JI) along with a complianceregime and accounting procedures.2005The UN-backed Principles for ResponsibleInvestment (PRI) are launched, a catalyst forfinancial markets to adopt responsible investmentapproaches.2006The Stern Review concludes that climate changedamages global GDP by up to 20% if left unchecked,and climate change emerges on the global businessagenda.1990UN General Assembly negotiations on aFramework Convention begin in December. TheIntergovernmental Negotiating Committee (INC)held five sessions, where more than 150 statesdiscussed binding commitments, targets andtimetables for emissions reductions, financialmechanisms, technology transfer, and “commonbut differentiated” responsibilities of developedand developing countries.1997Kyoto Protocol is adopted in December 1992,establishing for the first time

19.07.2016 · warming toward the top of the financial services agenda. Even so, the sheer scale of the issue makes it a challenging one for many institutions. Stranding may have grabbed the headlines, but it is arguably the tip of an iceberg. If commitments to limit global warming to 2 C are to be fulfilled, then the coming decades will see a worldwide “energy transition” with vast financial .