Transcription

Equity Risk Models Built for Manager OversightActive skill is not simply a function of performance relative to a benchmark – anyone can invest ina benchmark with leverage, outperforming it most years and over the long term. Active skill isinstead outperformance in excess of what could have been generated with a passive portfolio ofindex funds, ETFs, or futures matching the fund’s historical risk. To show evidence of skill a fundmust perform better than its passive replicating portfolio.Beta differences from a benchmark are a byproduct, usually unintentional, of any securityselection process. Since consistent beta differences, properly identified, can be freely obtained oroffset, they are not part of active contribution.By isolating beta differences, asset owners can reduce fees and risk while retaining the sameactive exposure; and because beta-exposures tend to be random or mean-reverting, isolatingsecurity-selection return from their impact removes much of the noise that obscures skill.This paper introduces a powerful technique for Isolating active from passively-availablecontributions which reveals security-selection skill that persists, true active risk, and unintentionalbets that may endanger performance.Market Noise Overwhelms SkillThe problem with assessing skill using nominal performance is that the effects of luck or marketfluctuations, potentially random or mean-reverting, overwhelm any effects of manager skill.For example, a typical mutual fund’s volatility attributable to security-selection accounts forapproximately 5% of the total. Market noise accounts for approximately 95%With this high level of market noise, traditional techniques relying on nominal returns requiredecades of data to detect statistically significant evidence of skill.Over individual market cycles, the relative ranking of a fund’s returns in one sample of historyis negatively correlated with its relative ranking in the other. When “skill” is evaluated naively, “thebest” funds in one period tend to become “the worst” in another, and vice versa.Peer Analytics1

Existing Approaches to Isolating Active Risk and ReturnIn order to select managers likely to outperform, and to know if managers should be replaced, thechallenge is to look beneath the surface to determine whether the true source of return isinvestment skill (stock picking, market timing, etc.) or some combination of luck, high beta, andout-sized risk. Two attribution approaches attempt to separate active and passive contributions:holdings-based and returns-based analyses.Holdings-Based Approaches: Brinson Attributions and Active ShareHoldings-based approaches to performance attribution typically rely on the principles firstdiscussed in Brinson and Fachler, Journal of Portfolio Management, 1985. The approach attributesrelative returns to sector allocation relative to the benchmark and to stock selection, defined asoutperformance of a stock’s sector.Providers, including Morningstar, FactSet, Novus, and others, offer attribution analysis using theBrinson approach.The Brinson method – as well as the Active Share approach to active risk - assumes that all stockshave the same market risk and all stocks within a sector have the same sector risk (e. g., a dollar inApple and a dollar in Facebook have the same market, sector, and other systematic exposures).Unfortunately, sector and market risks vary widely across securities, as do sector betas -- evenamong the largest sector indexes and funds:Sector and Market Betas: Largest Tech Stocks2.5as of 12/31/172.01.5sector1.0market0.50.0Peer Analytics2

Sector Betas: Tech ETFs and FundsCurrent, Average, and Historical Range1.81.61.41.21.00.80.60.40.20.0Fortunately, any performance attribution system that claims to identify active return is easilytested.Since security-selection return is a residual, free from systematic risk, it is by definitionuncorrelated with passive benchmarks. To the extent security-selection return and passive returncalculated by a given system are correlated, the system has failed (see: three additional tests).Returns-Based Style AnalysisReturns-basedstyleperform regressions toanalysiscomputeandreturns-based performanceportfolio betas tors)and alphas (residual returns unexplained by systematic risk factors).The simplicity of the returns-based approach has made it popular. It is often the only practicalmethod for evaluating multi-asset-class portfolios that span commodities, public securities,derivatives, and private investments. However, this simplicity comes at a heavy cost.The limiting assumption of returns-based analyses is the constancy of factor exposures. Thisassumption breaks down for active managers. In Flaws of Returns-based Style Analysis we show: When an active manager varies bets, a returns-based analysis typically yields flawedestimates of portfolio risk and may not even accurately estimate average portfolio risk. Errors will be most pronounced for the most active funds: Estimates of a manager’s historical and current systematic risks will be flawed. Skilled funds may be deemed unskilled and unskilled funds may be deemed skilled.Peer Analytics3

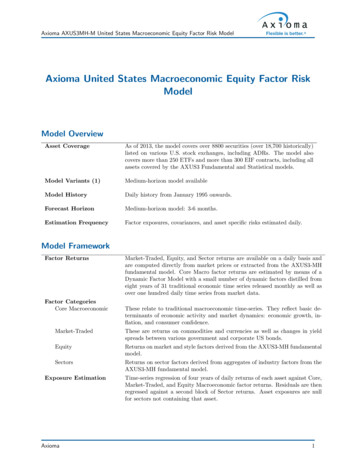

Equity Risk ModelsMulti‐factor equity risk models measure portfolio risk by calculating individual security factorexposures and can distinguish between systematic risk (due to endogenous factors that affectmultiple securities) and idiosyncratic risk (specific to an individual security).Equity risk models are classified as fundamental models, macroeconomic models, and statisticalmodels.As these models are designed to estimate risk as precisely as possible for even the most narrowportfolios, popular models today often use well over 100 risk factors, most of which are notdirectly investable.Bloomberg's Port function uses a fundamental risk model similar to but more rudimentary thanBarra's and Blackrock's. Our tests found that Bloomberg's portfolio risk model typically capturedless than half of the relative systematic (factor) risk explained by the more robust models.Bloomberg and other fundamental models have two key limitations when used for oversight:1) Fundamental models use 100 individual risk factors, most of which are not directly investable.Attributing performance to exposure differences in momentum, leverage or dozens of other noninvestable factors, while useful for portfolio construction and optimization, is not meaningful formanager and portfolio oversight.2) Fundamental models assume that exposures to country, currency, and sector factors are equalto one for all securities. There is no distinction in sector risk between the least risky stock in asector and the most risky one. Since individual securities’ sector risks vary widely (Apple, forexample, recently had Technology sector beta of 2.2 while IBM's sector beta is 0.2). Bloombergand other providers provide a very misleading picture of sector, country, currency, and at timeseven market risk.The fact that these models do not provide meaningful attributions for manager and portfoliooversight is due to an explicit design decision to target portfolio optimization and risk forecasting,rather than performance attribution.Peer Analytics4

A Statistical Risk Model Built for OversightStatistical factor models use various maximum likelihood and principal-components analysisprocedures on either cross-sectional or time-series security return samples to identify thesignificant underlying drivers of returns, or factors. Statistical factor models rely on fewerassumptions and use robust statistical processes to estimate factor betas.A statistical equity risk model built specifically for oversight, using a limited number of factors thatmap to common passive portfolios such as index funds and ETFs, explains risk as well as the mostrobust fundamental models in most cases, but can also distinguish skill from random marketfluctuations.For most portfolios, differences from the benchmark in exposures to Market, Sector, Regional, andStyle factors, all available via passive investments, explain over 96% of absolute return and over65% of relative return.These passive beta-differences from the benchmark, whether or not intentional, are not part of amanager’s active return and do not deserve compensation, since such exposures are availablethrough cheap index funds or ETFs -- easily obtained if intentional or offset if unintentional.FindingsSecurity selection skill persistsBy isolating returns due to security selection and market timing from those due to passivedifferences in factor (systematic) risk from the benchmark, the ABW Peer Analytics risk modelsmitigate the impact of noise and reveal skill.Top-decile stock-pickers are twice as likely to generate positive stock-picking returns as negativein the subsequent few years.Bottom decile managers are more than twice as likely to generate negative stock-picking returnsas positive ones in subsequent years (see: performance persistence within style boxes andperformance persistence within international style boxes).Peer Analytics5

In a recent study spanning 12 years, high αReturn funds outperformed the market by 75%; lowαReturn funds underperformed by 70%Returns of mutual funds with highest and lowest trailing 36-month αReturns – equal riskCloset indexing is prevalentMutual fund closet indexing is the practice of charging active fees for passive management. Overa third of active mutual funds and half of active mutual fund capital appear to be investingpassively: Funds tend to become less active as they accumulate assets. Skilled managers whowere active in the past may be closet indexing today. These active managers take too little activerisk to compensate for an average fee, even assuming top-decile skill.Risk varies significantly across equity portfoliosAggregate equity portfolio market exposures vary substantially across institutions and throughtime. Equity risk is a necessary consideration in the asset allocation decision and a criticalcomponent of portfolio oversight. Risk models measure point-in-time market risk, and all otherexposures based on current portfolio holdings, any changes in portfolio risk are knownimmediately.Quantitative insights inform qualitative assessmentsEquity risk models quantify all drivers of future return as well as all current “bets" relative to eithera benchmark market index or a peer company composite. Users can ensure managers’ relativerisk exposures are consistent with expressed strategy, and manager discussions can focus onthose decisions that most impact portfolio risk and return.Peer Analytics6

Manager structure can be optimizedAsset owners can avoid unintentionally reinforcing or offsetting active bets among individualmanagers, control unintended risks, avoid closet indexing by the overall portfolio, and betterassess how individual managers contribute to aggregate portfolio exposures.Model ValidationThough mathematically complex and hard to compare, equity risk models are easily tested.To evaluate the accuracy of an equity risk model, we compare returns predicted by past factorexposures to subsequent portfolio performance: We measure factor exposures using end-ofmonth holdings and predict the following month’s return as a function of index returns.The correlation between predicted and actual return measures a model’s accuracy. The higherthe correlation, the more effective a model is at hedging, stress testing, and scenario analysis, aswell as evaluating investment risk and skill.Our risk models are highly predictive and deliver over 0.96 median correlation between predictedex-ante and reported ex-post portfolio returns for both U.S. and Global Equity mutual funds (see:testing predictions of equity risk models and testing global equity risk models).Min.0.6661st Qu. Median Mean0.9420.96230.9503rd Qu. Max.0.9770.999Prospective clients need not rely on our out-of-sample tests, we're happy to provide passive ETFreplicating portfolios for any of your managers and you can evaluate the models' accuracyindependently. A few weeks of observations can provide dozens of observations and establish ahigh statistical confidence in the models’ predictive accuracy.Peer Analytics7

AppendixPeer Analytics

Equity Analytics Comparitive SummaryProvidersTypeAttribution: Active v. PassiveRobustValidationMeasure Current RiskMeasure Active ld/Active Share/etc./Bloomberg/etc.Brinson AttributionRisk ModelsRisk ModelsAttemptedNoYesNoYes(Bloomberg less so)ABW Peer AnalyticsYesEasily disprovenCan be provenEasily provenNoYesYesAttemptedNoYesYesMeasure Active SkillAttemptedNo(properly isolated stock-selectionskill persists)Quantify All Drivers of FuturePerformanceNoYesYes(less meaningful)(more meaningful)IntuitiveYesNoYesCostLowHighLowPeer Analytics

Selected Risk and Skill Analyticsbased on predictive Statistical Equity Risk Models built to isolate active contribution from passivedifferences, that explain 97% of out‐of‐sample variance and ‐ uniquely ‐ statistically prove persistent skillSkill AnalyticsComponents of Incremental Return Isolate passive returns consistent passive exposuredifferences with benchmark), Timing returns (changes in passive exposures from long termaverage), and security‐selection returns.This fund (VDIGX) has top five percentile security selection skill, despite significantlyunderperforming the benchmark:Predictive Skill Metrics Properly measured, past performance is a predictive indicator offuture performance.Managers with top (bottom) decile security selection performance during the priorthree years are approximately twice as likely to deliver positive (negative) securityselection performance as not over subsequent three years.Position-sizing Performance The difference between actual security‐selection return andthe return which would have been achieved if all positions had been equal weighted.Significant position‐sizing losses are an indication of an over‐capitalized manager.Peer Analytics1

Risk AnalyticsCurrent Absolute Risk Risk (expected volatility of portfolio returns) due to systematic factorexposures and idiosyncratic security risk.Current Risk Relative to benchmark Relative risk (expected volatility of portfolio returnsrelative to the benchmark/tracking error) due to systematic passive exposures and idiosyncraticsecurity risk. Monitoring this risk accomplishes the following: Ensures that managers take sufficient security selection risk to justify active fees. Identifies one‐third of managers who are closet indexers, taking so little active riskthat they are unlikely to generate active returns to clients, even if highly skilled.Passive factors are market, sector, and style ETFs. Residuals are isolated security‐selection impacts.Manager Contribution to Portfolio Risk both absolute risk and variability of returnrelative to benchmark (tracking error)Peer Analytics2

Current Risk Exposures Passive exposures ranked by their expected contribution toportfolio risk (absolute) and relative risk/tracking error (relative)For this fund, two ETFs could offset over 75% of the tracking error not due to security selection.Historical Point-in-Time Market, Sector, and Style Risk ExposuresSignificant Historical Risk ExposuresPeer Analytics3

Current Individual Security Contributions to Risk Top‐ten securities shown ranked byexpected contribution to relative risk (tracking error)Current and Historical VaR Expected value at risk for various horizons/ probability of lossStress Tests Expected portfolio performance under various return scenarios. Any customstress tests are readily availablePeer Analytics4

As these models are designed to estimate risk as precisely as possible for even the most narrow portfolios, popular models today often use well over 100 risk factors, most of which are not directly investable. Bloomberg's Port function uses a fundamental risk model simi