Transcription

Welcome to Travelers Personal Lines ProductMinnesota

AgendaWelcome to Travelers Personal Lines Product Overview Retention RequirementsProducts & Guidelines Auto Home Other Property LinesDoing Business with Travelers Billing Claims Miscellaneous

Travelers History1864 – first to insure against accidents1897 – first to issue anauto insurance policy1999 – first to offer identity theft insurance2006 – first to offer discountto hybrid car owners

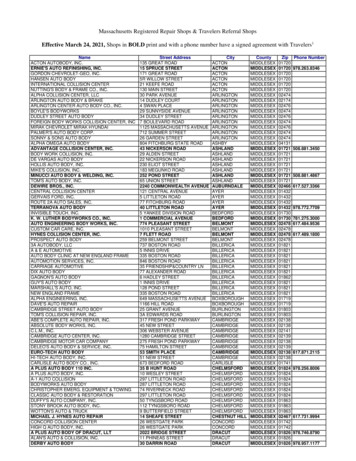

Travelers TodayTravelers is one of the largest providers of personal insurance products in theUnited StatesOver 6.1 million policies in force 6.0 billion in net written premium in 2005Represented by 12,000 independent agentsConsistently high financial strength ratings¾ A.M. BestA ¾ FitchAA-¾ Moody’sAa3¾ S&PAA-Superior Claim ServicesLeading the industry in the use of advanced digital and wireless technology, Travelers delivers on thepromise with fast, focused claim service – anytime, day or night, 365 days a year. Fender bender or weatheremergency, you can count on our claim professionals to deliver prompt claim resolution. Our network of over 5,000 autorepair shops can begin guaranteed repairs immediately. And, in emergency situations, our catastrophe team, includingfour (4) state-of-the-art Mobile Claim Headquarters are on call and on site. That’s why 90% of our claimants say theywould recommend Travelers to a friend.

Product Overview: What We OfferAutoHomeOther Property Lines, including PAF, Homesaver & PLUSWedding InsuranceBoat & YachtFloodCommercial LinesBenefits Plus

Travelers RequirementsSignatures, Who can sign?All Agents must be licensed and appointed with Travelers. Only licensedagents may sign applications.File Retention Your resident state and Travelers Home Office requires that your newbusiness be audited periodically. File retention reference cards are available on the Agent HQ under thePersonal tab, labeled Agency Audit & Retention Requirements. What do you send in and what do you keep in file?– Send money collected unless using Agency Sweep.– Keep all paper.Audits: Why we do themTop Audit Issues

Quantum Auto

Quantum Auto

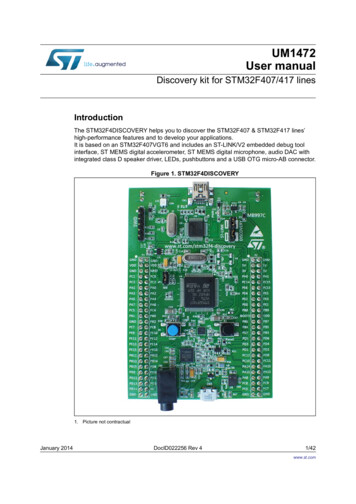

Quantum AutoWritten by The Travelers Home and Marine Insurance CompanyWhat is multi-variate pricing?Some Rating Variables Quote vs. effective date (advance shopper discount) Lienholders Addresses Companion policies Annual mileage MVR data Driver averagingPolicy Term: 6 month policies only.Eligibility (underwriting) guidelines

Quantum Auto: Coverages & LimitsOptional Coverages Loan/Lease Gap Coverage Repair or Replacement Collision Covered Property Electronic equipment Camper/trailers (pull-behinds)Maximum Limits: 500/500/500 or 500 CSLMinimum premium rule (state specific) – Remove for prototype

MINNESOTATRAVELERS QUANTUMNEW BUSINESS ELIGIBILITY RULESNo risk meeting any of the following criteria may be bound without prior company approval.The following operators are ineligible:1. Any operator who does not hold a valid full privilege driver’s license. This includes any driverwho holds only a learner’s permit or provisional license (not applicable if part of a family accountwhere another insured holds a valid full privilege license2. Any operator who has owned a car and was required by law to have insurance, but has beenuninsured more than 30 consecutive days immediately prior to application3. Any operator who has had 1 or more of the following moving traffic convictions in the past 60months:a. Criminal negligence, homicide, manslaughter, assault or any felony arising from the useof an auto.b. Failure to stop and report an accident; leaving the scene of an accident without stoppingto report it.c. Unlawful driving during suspension or revocation of license or registrationd. Theft or unlawful taking of an auto; operating without permission.e. Failure to stop for a school bus.f. Racing or participating in an unlawful race or timed /speed event.g. Attempting to elude a police officer.h. Illegal use of or loaning a license to an unlicensed person.i. Making a false statement in an application for a driver’s license or registration.4. Any operator who has less than 3 years experience and has had 1 or more of the following :a. Driving while under the influence of alcohol or drugs.b. Driving while drinkingc. Illegal possession of alcohol or drugs in a motor vehicled. Refusal to take a sobriety test.e. Reckless driving.

Quantum Auto Underwriting Continued:5. Any operator who has less than 3 years experience and has had more than 1 of the following:a. Minor conviction *b. Speeding convictionc. Careless driving convictiond. At-fault accident **e. Not-at-fault accident **.The following (household) risks are ineligible:1. Any risk with more than 1 of the following convictions in the last 60 months (Subject to item 4above):a. Driving while under the influence of alcohol or drugs.b. Driving while drinkingc. Illegal possession of alcohol or drugs in a motor vehicled. Refusal to take a sobriety test.e. Reckless driving2. Any risk with one conviction listed in item 1. a. thru 1.e above and one or more minor conviction,speeding conviction (all types), careless driving conviction or at-fault accident or not-at-faultaccident in the last 36 months */**.3. Any risk with two or more theft losses of the entire vehicle in the last 36 months and the vehicle was not recovered.4. Any risk with the following limits:

Quantum Auto Underwriting Continued:The following vehicles are ineligible:1. Any vehicle that has been altered for racing or equipped with racing items.2. Vehicles used commercially, including but not limited to livery (for hire) or delivery3. One of the following type of vehicles:a. Gray market vehicle (not manufactured for sale in the United States).b. Motorcycles with an engine size in excess of 1,000 cc.No risk exceeding any of the following criteria may be bound without prior company approval.The following chart outlines the maximum combination of driving record incidents that are eligible per operatorand per household in the past 36 months. Apply this chart for underwriting the entire policy.Single Car RisksMulti-Car Risks* Minor convictions mean for eligibility purposes only moving traffic convictions recorded by theDepartment of Public Safety on an operator’s motor vehicle record or conviction reported by similarauthority in another state. Solely for purposes of these Rules:

MINNESOTATRAVELERS QUANTUMNEW BUSINESS ELIGIBILITY RULESMinor convictions shall also include, but are not limited to, the following:1. Single conviction requiring an FR Filing2. stop light/stop sign conviction3. Illegal turning4. Illegal passingMinor convictions shall not include the following:1. Equipment convictions, including seat belt or child restraint systems convictions2. Driving an unregistered vehicle3. Driving with an expired driver’s license4. Driving without a valid driver’s license in possession as long as a valid driver’s license exists.5. Speeding convictions (all types)6. Careless driving conviction** At-fault and not-at-fault accidents do not include accidents where the payment was made solely underPIP and/or UM and/or UIM coverages or closed without payment (CWP).The following chart outlines the maximum combination of comprehensive losses that are eligible perpolicy in the past 36 months.Single Car RiskMulti-Car Risk*** Do not count towing losses equal to or less than 100 or comprehensive losses involvingwindstorm, hail, flood, lightning, earthquake, earth movement or landslide.PL-12479 7-06

Quantum Home

Quantum HomeWritten by Travelers Home & MarineMulti-variate pricingHome Buyer DiscountUses rating factors, such as: Mortgage Age of insured Roof type Secondary/Seasonal dwelling Miles to fire department Losses in year 4 - 7Underwriting Guidelines & Coastal Requirements (if applicable) All property must be insured to 100% of replacement cost as determined by areplacement cost estimator. Travelers uses MSB. Earthquake requirements (if applicable)Maximum Limits

Quantum Home: Packages & EndorsementsQuantum home offers coverage packages Silver Gold PlatinumOptional Endorsements Replacement cost on dwelling Replacement cost on contents Water backup coverage ID Fraud Expense: 25/yr, 25,000 coverage, NO deductible Valuable Items Plus PLUS Additional Windstorm Coverage

Quantum Home Coverage PackagesSILVERGOLDPLATINUMPLATINUMPLUS(Min. Cov A 500,000)HO-3HO-3 with:ARCP (25%) and Replacement CostContentsHO-3 with:the Enhanced Home Package, ARCP (25/50%)All Risk Contents and ID Fraud endorsementsCONDOHO-6HO-6 with:Replacement Cost ContentsHO-6 with:the Enhanced Home Package and ID FraudendorsementsTENANTHO-4HO-4 with: Replacement Cost ContentsHO-4 with:the Enhanced Home Package and ID FraudendorsementsHOMEHO-3 with:the Enhanced HomePackage, ARCP (100%) All Risk Contentsand ID Fraud endorsements(Min. Cov. C 100,000)HO-6 with:the Enhanced Home Package and IDFraud endorsementsN/A

SILVERGOLDPLATINUMCoverage A - AdditionalReplacement CostNot Included; 25% - 50%options available25% included50% includedDwelling PerilsAll RiskAll RiskAll RiskContents PerilsNamed PerilsNamed PerilsAll Risk (HO-15)Dwelling Loss SettlementReplacement CostReplacement CostReplacement CostContents Loss SettlementActual Cash ValueReplacement Cost70% of Coverage AReplacement Cost70% of Coverage AWater BackupNot includedNot included 5,000 Included; up to 75,000optionalID Fraud CoverageNot includedNot includedIncluded

Quantum Home Package: Platinum PlusMinimum Coverage A 500,000or Condo Minimum Coverage C 100,000Coverage A100% includedAdditional Replacement CostDwelling PerilsAll RiskContents PerilsAll Risk (HO-15)Dwelling Loss SettlementCash-Out Option included up to Cov. AlimitContents Loss SettlementReplacement Cost75% of Coverage AID Fraud CoverageIncludedWater BackupUnlimited up to Cov. A amount

QUANTUMHOMEMinnesota Homeowners New Business Eligibility GuidelinesThe following guidelines will assist you in identifying risks that are eligible for our QUANTUM HOMEprogram. These guidelines will not be applied in any manner that conflicts with the insurance laws orregulations of the state. Submit referrals prior to binding.All risks meeting the eligibility criteria outlined below are to be written in Eligibility Program A.I. A RISK IS NOT ELIGIBLE IF IT INVOLVES ANY OF THE FOLLOWING:A. Has more than 4 losses in the past 5 years, or more than 3 in the past 3 years, (includes non-serialnumbered catastrophe losses and serial numbered catastrophe losses, but excludes closed withoutpayment losses). Note: If any prior structural loss is at the risk address, the condition causing the lossmust have been repaired.B. An animal or pet that is vicious or has previously bitten or injured, or if any occupant has a dog of thebreed shown: Akita, Alaskan Malamute, American Staffordshire Terrier, Bullmastiff, Chow Chow,Doberman Pinscher, Great Dane, Pit Bull, Presa Canario, Rottweiler, Siberian Husky, Staffordshire BullTerrier, Any Wolf Hybrid or any mix of these breeds.C. Liability exposures involving any attractive nuisance type exposure including, but not limited to,unfenced in-ground swimming pools, skateboard ramps, bicycle jumps, etc.D. Is subject to landslide, mudslide or brushfire.E. Is a mobile or manufactured home.F. Is a dwelling with coverage A value of 1,000,000 or more with no monitored central station fire andburglary alarm system.G. Is over 15 road miles to the first responding fire department, unless risk is a house with Coverage A of 1,000,000 or more and then it must be within 7 road miles of the first responding fire department.

Quantum Home Underwriting Continued:H. Is either:1. a dwelling with Coverage A of 1,000,000 or more or2. a dwelling 500,000 or more which is unoccupied more than 3 months of the yearwithout a central station monitored low temperature sensor or water flow sensorI. Is condominium with 500,000 or more of Personal Property (Coverage C) and Building (Coverage A)combined with no monitored central station fire and burglar alarm system.J. Is tenant policy with 500,000 or more of Personal Property (Coverage C) and Additions and Alterationscoverage with no monitored central station fire and burglar alarm system.K. Is vacant, unoccupied, or for sale.L. Is a log home Is a log home if the ISO protection class at the risk is 9 or 10, or the first responding firedepartment is over 5 miles from the risk.M. Is a secondary/seasonal dwelling and we do not write the primary dwelling.N. Contains a wood stove or pellet stove as an alternate heat source unless the stove has beenprofessionally installed or has been approved by the local fire department or building inspector.O. Is a dwelling subject to flood or wavewash (Flood Zones V and A) unless the risk is covered by a FloodPolicy up to the Coverage A and C limit, or the FEMA maximums of 250,000 Coverage A and 100,000 Coverage C, whichever is less.

Items II. – III. Apply to risks in any Eligibility Program:II. CONDITION OF DWELLING/CONDOMINIUM:A. The dwelling and all major systems (plumbing, heating, electrical, roof) must be in good condition and have no unrepairedconditions or any uncorrected fire or building code violations. If the dwelling is more than 25 years old, the Modernization Section ofthe ACORD Homeowners application must be completed. All dwellings are subject to inspection.Modernization Requirements:Roof must have been replaced within the past 20 years (except tile roofs or similar “lifetime”roof materials);Oil furnace/burner cannot be older than 25 years or gas furnace/burner cannot be older than 35 years;Electrical must have circuit breakers in whole or in part.B. Heating must be a central heating system or thermostatically controlled electric heating system. If the central heating systemincludes a wood or coal burning furnace as the primary heat source, the dwelling must have a backup oil or gas central heatingsystem or thermostatically controlled electric heating system. (Note: A converted coal furnace, kerosene heater, electric spaceheater or wood/coal/pellet stove cannot be the primary source of heat).C. Dwellings must be insured to 100% of Replacement Cost using costs associated with actual year built, i.e. homes built prior to1930 must use “Pre-1930” costs. Pre-1930 homes using “Standard” replacement costs to determine Coverage A replacement costare acceptable only when the Functional Replacement Cost Coverage is included on the policy.III. RISKS INVOLVING THE FOLLOWING MUST BE REFERRED TO AN UNDERWRITER:A. Risks with 2 or more fire losses, or 2 or more theft losses, or 2 or more water losses, or 2 or more liability losses within the past 5years.B. Is located out of state, unless a prior agreement exists between the company and the agency. If the agent has appropriate nonresident licenses, the risk may be submitted unbound for consideration.C. Business conducted out of home which involves client traffic on the premises.D. Contains a converted coal furnace, kerosene heater, electric space heater, or wood, pellet or coal stove as an alternate orsupplemental source of heat. (Note: All wood, pellet, coal stoves require completion of the Supplemental Heating Questionnaire.These stoves must be professionally installed, or approved by the local fire department or building inspector.)E. Farming/ranching operations.F. Home under construction.G. Dwelling with Coverage A of 1,000,000 or more which is an ISO protection class 9 or 10 and/or has nofire hydrant within 1000 feet of the dwelling.H. Dwellings that are listed on the State or National Historic Home Registry.I. Secondary or seasonal homes with Coverage A of 500,000 or more with no monitored central station fire and burglary alarm.J. Number of months rented is greater than 6 months.K. Risks involving the following values will be referred to underwriting:1. Dwelling – Coverage A is 1,000,000 or more2. Condominium – Coverage A and C combined is 500,000 or more3. Tenant – Coverage C and Additions & Alterations combined is 500,000 or more4. Risks with total exposure of 2,500,000 or more (Coverage A B C D Valuable Items Personal Articles Floater).

PL-11979 (3-07)

Other Property LinesHomesaver (dwelling fire)PAF (personal articles/valuable items policy)PLUS (personal liability umbrella supplement)BoatWedding InsuranceFlood

Homesaver(Dwelling Fire Product)

HomesaverPrimary Travelers Homeowners policy is desirableUnderwriting GuidelinesWe will insure up to 9 dwellings. More than 9 dwellings is consideredcommercial and will be declinedCurrent Homesaver insurance score must be run.Broad vs. Special CoveragesOptional Coverages Loss Assessment Coverage Water backup Earthquake

Minnesota Homesaver New Business Eligibility and Pricing GuidelinesThe following guidelines will assist you in identifying risks that are eligible for our HOMESAVER programs.These guidelines will not be applied in any manner that conflicts with the insurance laws or regulations ofthe state. Submit referrals prior to binding. If any of the following guidelines are not met, the risk maybe submitted to the Company unbound for consideration.I. AN ACCOUNT IS NOT ELIGIBLE IF IT INVOLVES ANY OF THE FOLLOWING:A. Liability exposures involving any attractive nuisance type exposure including, but not limited to,unfenced in-ground swimming pools, trampolines, skateboard ramps, bicycle jumps, etc.B. An animal or pet that is vicious or has previously bitten or injured, or if any occupant has a dog of thebreed shown: Akita, Alaskan Malamute, American Staffordshire Terrier, Bullmastiff, Chow Chow,Doberman Pinscher, Great Dane, Pit Bull, Presa Canario, Rottweiler, Siberian Husky, Staffordshire BullTerrier, Any Wolf Hybrid, any mix of these breeds.C. Is subject to landslide, mudslide or brushfireD. Is a mobile home/manufactured home.E. Dwelling risks having 1,000,000 or greater coverage A with no monitored central station fire alarmsystem. Owner occupied dwellings 1,000,000 or greater must also have a central station burglar alarm.F. Tenants risks having 500,000 or greater Personal Property Coverage C and Additions and AlterationsCoverage combined with no monitored central station fire and burglar alarm system.G. Condominium risks having 500,000 or greater Personal Property Coverage C and Building Coverage Acombined with no monitored central station fire and burglar alarm system.H. Is vacant, unoccupied, or for sale.I. Is a log home.J. Is subject to flood or wavewash (Flood Zones V and A) and the risk is not covered by a Flood Policy(including Excess Flood coverage) with coverage equal to the Homeowners dwelling coverage A limit

Homesaver Underwriting GuidelinesContinued:K. Contains a converted coal furnace, kerosene heater, electric space heater, or a wood, pellet, or coal stove as the primarysource of heatL. Is held for rent and contains a converted coal furnace, kerosene heater, electric space heater, wood, pellet, or coal stove asan alternate source of heat.M. No local management of rental property by owner or designated third party.N. Applicant is other than a private individual or a family-held corporation.O. Owns more than 9 rental dwellings or condominiums.

Homesaver Underwriting Guidelines:Continued:III. CONDITION OF DWELLING/CONDOMINIUM:The dwelling and all systems (plumbing, heating, electrical, roof) must be ingood condition and have no unrepaired conditions or any uncorrected fire orbuilding code violations. The dwelling must meet all the following minimum updatingand modernization requirements:A. Roof - The roof must have been replaced within the past 20 years (except tileroofs or similar “lifetime” roof materials)B. Heating - The property must have a central heating system or thermostaticallycontrolled electric heating system. If the central heating system includes a wood orcoal burning furnace as the primary heat source, the

Any operator who has owned a car and was required by law to have insurance, but has been. uninsured more than 30 consecutive days immediately prior to application. 3. Any operator who has had 1 or more of the following moving traffic convictions in the past 60. months: a.