Transcription

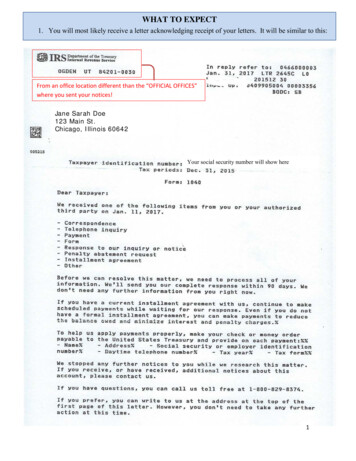

Fiserv & ACN 2019 Fiserv, Inc. or its affiliates. All rights reserved. Fiserv is a registered trademark of Fiserv, Inc. Otherproducts referenced in this material may be trademarks or registered trademarks of their respective companies.

Agenda About Fiserv Generating Leads Payment Devices Online Solutions FAQ’s

About Fiserv3

Global Leader in Payments and Fintech35yearsGlobalissuer processor#1Globalmerchant acquirerGlobal core accountprocessing providerNamed a FORTUNEWorld’s Most Admired Company 6 years in a rowof Fintechleadership –the originalFintech 3,000 average AuthorisationTransactions per Second 46,000 colleagues worldwide Supporting thousands of financialinstitutions and over 6 millionbusinesses in more than 100countries 2.4 trillionsales volume processedFORTUNE and the World’s Most Admired Companies are registered trademarks of Time Inc. and are used under license. From FORTUNE Magazine February 1, 2018, March 1, 2017, March 1, 2016, March 1, 2015, and March 17, 2014. 2018, 2017, 2016, 2015, and 2014. TIME Inc.used under license. FORTUNE and Time Inc. are not affiliated with, and do not endorse products or services of Fiserv, Inc. Pro forma 2018 GAAP revenue as presented in Exhibit 99.7 to Form 8-K filed on June 10, 2019.4

Fiserv SolutionsWe provide a full range of solutions across the value chain of commerce-enabling services and technologiesGlobal FinancialSolutionsGlobal BusinessSolutionsOverviewOverviewProvides financialinstitutions, whichinclude bank andnon-bank issuers* witha broad range ofsolutions that enablethem to offer financialproducts and solutionsto their customers5Key Solutions Processing Data accessservices** VisionPLUS platform Account supportservices Back officeoutsourcing Issuer processing Card personalisation Statements andlettersProvides businesses ofall sizes and industrieswith a wide range ofsolutions at the point ofsale across multiplechannels includingretail, mobile andonlineKey Solutions eCommerce Mobile commerce Merchantacquiring/paymentprocessing Clover integratedPOS operatingsystem Businessintelligence/analytics Marketing/LoyaltyNetwork & SecuritySolutionsOverviewProvides a range ofnetwork solutions andsecurity, risk and fraudmanagement solutions,as well as analyticssolutions, online andmobile bankingsolutions, healthcaresolutions andgovernment solutionsKey Solutions EFT networksolutions(STAR , debitprocessing) Stored valuenetwork solutions(Valuelink,MoneyNetwork,Gyft) Security/RiskManagement

Global Leader in Bank Acquiring Poland*Asia straliaDirect BusinessAcquiringPartnershipOver 80 alliances and 4,000 merchant facing sales and support personnel worldwide6

What is Merchant Acquiring?7

Generating Leads8

Do’s & Don’ts When Generating Leads9Do’sDon’t Make sure the business has a genuine need to accept cardpayments. It can be either face to face, over the phone or online. Tell the business that they are guaranteed to be accepted. This is afinancial product and subject to application. Make sure the business has sufficient projected card turnover towarrant the cost of accepting card payments – recommendedminimum annual card turnover of 10k. Talk pricing with the business. All pricing is tailored to the individualneeds and profile of the business. There is no one size fits allsolution. Make the business is aware that it will be Fiserv contacting them totake them through the process and that Fiserv will refer to the ACNrelationship when introducing themselves. Refer a business to Fiserv without prior discussion and consentfrom the business. Find out who their current supplier is – If they are an existing Fiservclient then do not refer the lead. Explain that Fiserv can communicate with them over the phone orbook a face to face to face. Ask the business to have current statements to hand if they alreadyaccept card payments through an alternative supplier.

Typical route of a ACN referral17The IBO identifies an inneed client and a lead issubmitted to Fiserv viaweb-lead formDetailed reporting duringthe entire cycle allows theassociation to track andmonitor each stage andraise any questions duringthe process, if required3A Fiserv BusinessConsultant (BC)meets with the clientand they agree on thesuitable product andservice2Fiserv Lead Management confirms receiptand contacts the client.(a) Telesales Hot-Transfer; or(b) A meeting is booked with a BusinessConsultant for a face-to-face meetingOnce approved, the Business Consultantwill contact the client and agree on a timeto meet and install the hardware andcomplete set up to process payments104Merchant Applicationform is completed andprocessed via ourauto-boarding systemFiserv’s support team toon-board and provide updateon new client and requestfurther information, if required65

Payment Devices11

Clover Product Suite162534Clover Station ProClover MiniClover FlexFiserv solutions featuring the Clover family of products gives you the convenience ofaccepting multiple payments on a range of sleek, user friendly devices – each as powerfulalone as they are working together.121.2.3.4.5.6.Powerful Business Management PlatformComprehensive ReportingState of the Art SecurityAccept the Latest Payment Methods (e.g. Apple Pay)Effortless updates to your DevicesCloud Access for Total Control

Clover Station ProAn end-to-end business management system that helps you stay ontrack and allows you to focus on the things that make a difference anddifferentiate you from competition.13 Insight Detailed reports on sales,employees and customer behaviour Simplicity This solution is so much morethan just a cash register, manage allaspects of your business through onesystem Loyal Create customer loyalty bothphysically and digitally with rewardprogrammes to drum up new business Anytime, Anywhere Clover Station runs oncloud-based software so you can accessyour business information wherever youare

Clover MiniMore payments, more power less clutter Clover Mini is small and easyto move around, so you can free up valuable counter space when youneed it.14 Insight Detailed reports on sales,employees and customer behaviour Flexible Give your customers the flexibilityof paying by debit or credit cards,contactless or with their mobile phone. Customisable You can customise yoursystem with apps from the Clover Market,where there are tools to help every kind ofbusiness be more successful Anytime, Anywhere Clover Mini runs oncloud-based software so you can accessyour business information wherever youare – from a computer, tablet or phone

Clover FlexBuilt for businesses that are going places The flexible solution designedto meet your full range of payment and point-of-sale needs.15 Convenience Built in receipt printer andbarcode scanner Fast Wireless connectivity with anoptional 3G data plan Flexible Prints, emails, texts and storesreceipts Longevity Long lasting battery cansupport up to 8 hours of business on asingle charge Compatible Use the entire line of Cloverdevices Powered With business managementtools through the Clover Software plansand App market.

3rd Party Payment Devices16

Alternative Solutions17

Fiserv GatewayFiserv’s strategic Omni-Channel Payment Gateway provides afunctionality rich gateway offering designed to meet the needs of largeinternational clientsAuth iservGatewayPCI Level 1 compliant and has thescalability and robustness to meet thehigh transaction volume demands of ourvery largest international clients IPG exceeds industry standardtransaction response times Processed over 1.2 billion transactions in2019 Over 851,000 live stores 1.77 million transactions processed in asingle day (14th December 2019) One Integration gives a merchant or PSPaccess to IPG in 30 alTerminal FraudPreventionToolsOnlinePortal

FAQ’s19

Learnings from Month 1 – Barriers to progressing leadsUnable to contact 20% of leads we have been unable to progress with have been due to us being unable to contact. Check in with your customer, make them aware we do callfrom an unknown number. They are also able to call us on the number that we provide via email. We also send an email after 3 unsuccessful attempts.Does not wish to expect card payments or No opportunity to quoteIs this a genuine opportunity. Refer to the Do’s and Don’ts and FAQ’s before submitting, if you are unsure.Existing ClientPlease ensure you confirm that the client is not a Fiserv client before submitting, this includes our ISO’s (Independent Sales Organisation). The easiest way toconfirm this is by asking the client to review a statement. All our ISO’s will show Fiserv on their statements.Invalid contact detailsIf contact details are incorrect, we are simply unable to progress.20

Payment Processing & Merchant Terminals FAQsWhat if I am currently in contract?If you have less than 18 months left, then it would be worth reviewing. Fiserv will assist with up to 150 towards any cancellation fees you may incur.Cancellation fees typically equate to terminal rental amount, multiplied by the remaining months on the relevant lease / rental agreement. This may vary byprovider and other fees may apply.We currently use a full EPOS system; can you still help?Yes. We work & Integrate with many EPOS providers in the UK. Please submit the lead as normal and Fiserv will discuss in more detail.Can we address customers who have not previously received a credit or direct debit?Yes, if they anticipate processing more than 10,000 annually, they can be referred to Fiserv.What types of terminals do you offer and are varied lease times available?We can offer a variety of terminals to suit your business needs. In addition to the popular desktop terminals you often see in shops, we also offer a portable(Bluetooth & Wi-Fi), mobile terminals & Semi-Integrated terminals that talk to your current EPOS / software provider.Yes. terminal lease periods are available for terms ranging from 12 to 48 months.21

Payment Processing & Merchant Terminals FAQsHow long will it take for me to receive my funds?You can usually expect funding from the payments you process to be settled in your business banking account with 3-5 working days. Faster Funding isavailable upon request and subject to underwriting approval. Additional charges may apply for Faster Funding.What card payments can I accept?We can enable you to accept payments by Visa , MasterCard , American Express Diners Club International and Discover Global Network cards in person,over the phone or online. Payments can also be made via Apple Pay & Android Pay .Can I accept payments in more than one currency?Yes. Contact us to discuss the currency you wish to trade in and how you wish your account to be settled.Can I view my merchant account online?Yes. You have the option to use our easy online reporting tool Business Track which will enable you to access details of your card processing transactions &history securely via the internet.22

Payment Processing & Merchant Terminals FAQsHow much does card acceptance cost?We will offer you a competitive rate that reflects the profile of your business. This will be based on several factors including current or projected card turnover,whether you are new to cards and average transaction value.Where is your call centre based?Our call centre/helpdesk for Merchants is based in the UK.Do I have to use the card acceptance services provided by my bank?No, you don’t, card acceptance services can be provided independently of your banking services, so you are free to choose a provider that specialises in fast,secure and reliable card services.How long does the application process take?Your application will be processed within ten working days of submitting the completed documentation.23

2019 Fiserv, Inc. or its affiliates. CONFIDENTIAL – LIMITED

Fiserv & ACN. Agenda About Fiserv Generating Leads Payment Devices Online Solutions FAQ’s. 3 . merchant acquirer years . you don’t, card acceptance services can be provided independently of your banking services, so you are free to choose a provider that specialises in fast,