Transcription

EMEA TMC clientconferenceCountry-by-countryreportingThe Crystal, London9-10 June 20151

AcronymsPBC – Provided by clientLTP – Local tax provisionCITR – Corporate income tax returnDTi – Deloitte Tax InsightDOL – Deloitte Online 2015 For information, contact Deloitte Touche Tohmatsu Limited2

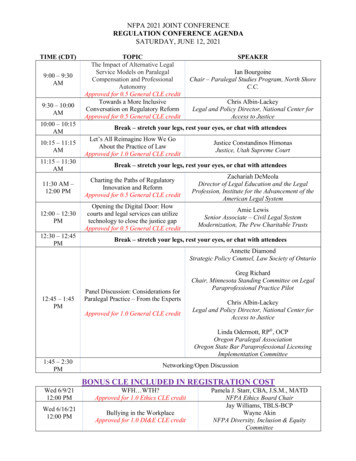

Agenda Introduction The tax function Base Erosion Profit Shifting (BEPS) The program Country-by-country reporting Country-by-country reporting tool - screenshots 2015 For information, contact Deloitte Touche Tohmatsu Limited3

Introduction 2015 For information, contact Deloitte Touche Tohmatsu Limited4

BackgroundThe perception of tax avoidance has becomea reputational riskNew stakeholders in the tax landscapeCustomers/ suppliersMedia /NGOs* lexity oflegislationTechnologychallengesShareholders /BoardroomCFO / TaxDirector /StaffTax & legalriskmanagementOECD /BEPSGlobalisedbusinessmodelsMore vigilanttaxauthoritiesEU / Antiabuse 2015 For information, contact Deloitte Touche Tohmatsu LimitedNationaltaxauthorities*NGOs - Non-governmentalorganisations5

Tax function 2015 For information, contact Deloitte Touche Tohmatsu Limited6

Components of the tax functionTP – Transfer pricing 2015 For information, contact Deloitte Touche Tohmatsu Limited7

BEPSProgram 2015 For information, contact Deloitte Touche Tohmatsu Limited8

BEPS actions related to transfer pricingAction Plandelivered to G20Finance MinistersG20 leaders meetNovember 2012February 2013July 2013“Addressing BaseErosion and ProfitShifting” publishedSeptember 2014 2015 For information, contactDiscussion drafts, publiccomments, public consultationson 2014 deliverablesSeptember 2015CFC rulesPermanent establishmentsInterest deductions – phase 1Harmful tax practices – phase 2Risk and capital, other high-risktransactions Disclosure of aggressive tax planning Dispute resolution Data collection and analysis measuringDeloitte Touche Tohmatsu Limited BEPSDigital economyHybrid mismatchesHarmful tax practices – phase 1Treaty abuseIntangiblesTransfer pricing documentationMultilateral instrument – phase 1 Late 2013Early 2014December 2015 Interest deductions – phase 2 Harmful tax practices – phase 3 Multilateral instrument – phase 28

Base Erosion and Profit ShiftingDeloitte 2015: BEPS global survey10 2015 For information, contact Deloitte Touche Tohmatsu Limited

Base Erosion and Profit ShiftingDeloitte 2015: BEPS global survey – unilateral measures11 2015 For information, contact Deloitte Touche Tohmatsu Limited

Base Erosion and Profit ShiftingExample of Unilateral MeasuresAnti-hybrid rules introduced and proposals are discussed in the digital areaFranceAnnounced reform of the corporate tax system to align on international tax lawSwitzerlandLegislation on the double Irish Tax structure applicable since 1 January 2015 with a 6year transitional arrangement.IrelandItalyLaw dealing with cross-border transactions including advertising industry & digitaleconomy enactedIntroduction of the tax on diverted profits. Applicable as from 1 April 2015United Kingdom12 2015 For information, contact Deloitte Touche Tohmatsu Limited

BEPSCountry-bycountry 2015 For information, contact Deloitte Touche Tohmatsu Limited13

Global TP documentation – three tiersI. Master File – Group-wide informationKey information about the group's global operations including a high-level overview of a company’sbusiness operations along with important information on a company’s global transfer pricingpolicies with respect to intangibles and financingII. Country-by-country (CbC) template – information consolidated at a country level (legalentities and permanent establishments)Key financial information on all group members on an aggregate country basis with an activity codefor each memberIII. Local File – transaction-level information for each taxpayerInformation and support of the intercompany transactions that the local taxpayer engages in withrelated parties 2015 For information, contact Deloitte Touche Tohmatsu Limited16

Country-by-countryWhat’s new?Source: http://www.oecd.org/15 2015 For information, contact Deloitte Touche Tohmatsu Limited

Country-by-country reportsWhat’s new?(i) Model legislationwhich could be used by countries to require the ultimate parent entity of a multinationalenterprise (MNE) group to file the CbC report in its jurisdiction of residence.(ii) Three model of competent authority agreements that could be used to facilitateimplementation of the exchange of CbC reports.16 2015 For information, contact Deloitte Touche Tohmatsu Limited

Country-by-country reportsArticle 6 of the proposed model legislationCountry tax administrations should use the report to:- Assess high level transfer pricing risks where “effective risk assessment becomes an essentialprerequisite for a focused and resource-efficient tax audit”- Assess other Base Erosion and Profit Shifting risks in countryTransfer pricing adjustments imposed by country tax administration shall not be based on CbCreports: “Country-by-country report on its own does not constitute conclusive evidence thattransfer pricings are or are not appropriate”17 2015 For information, contact Deloitte Touche Tohmatsu Limited

Implementation frameworkTimelineThresholdFiling &informationexchange Country-by-country reporting to be filed for fiscal years beginning on orafter 1 January 2016. First report due in 2017. Legal and administrative means of adoption by individual countries stillto be implemented. Filing no later than 12 months after the last day of the reporting fiscalyear of the MNE group. Country-by-country reporting would be required for MNEs withrevenues above 750 million Euro. Jurisdictions should require country-by-country reporting from ultimateparent entities of MNE groups resident in their country. Automatic information exchange with the relevant qualifyingjurisdictions in which the MNE group operates. Emphasis on the need to protect confidentiality of the tax information.18 2015 For information, contact Deloitte Touche Tohmatsu Limited

Implementation frameworkReportingEntity Notificationobligation Ultimate parent of MNE groups orAnother constituent of the MNE when the ultimate parent is locatedin a country not having a qualified competent authority agreement oris in systemic failureMNE may chose another constituent entity to file the CbC reportAny constituent shall notify the tax authority of its tax residencecountry whether it is the ultimate parent entity or surrogate parententity who files the CbC reportIf the constituent is not the ultimate parent entity or the surrogateparent entity, it shall report the identification and address of theultimate parent entity or surrogate parent entity.19 2015 For information, contact Deloitte Touche Tohmatsu Limited

Country-by-country reportingWhat does it contain?1Overview of allocation of income, tax andbusiness activities by tax jurisdiction23List of constituent legal entitiesand business activities by taxjurisdictionAdditional information to facilitateunderstanding (*)(*) Source of data, FX rates applied, 20 2015 For information, contact Deloitte Touche Tohmatsu Limited

Allocation of income, tax & business activitiesThree types of dataBalancesStated capital1Overview of allocation of income,tax and business activities by taxjurisdictionB/S Cumulated earningsTangible assets(*)P&L Profit/Loss before tax External revenue Intercompany revenue HR Data# Number of employeesCurrent tax expenseTransactionItem Income tax paid(*) excludes cash & cash related 2015 For information, contact Deloitte Touche Tohmatsu Limited21

Extracting Financial DataIdentifying the right data sourcePoint of attentionsWhich system to use?Accounting System(ERP) SAP ECC Oracle EBS PeopleSoft JD Edwards Other Consolidation System(EPM) BPC HFM Cognos Controller Other Number of System Instances Granularity of Chart of Account “Legal Entity” DimensionDataWarehouse(BI) BW OBIEE Cognos TM1 Other 22 2015 For information, contact Deloitte Touche Tohmatsu Limited

Data collection strategy: local vs. centralCOLLECT FINANCIAL DATA LOCALLY IN LOCAL GAAP FORMAT no need to reconcile CbC reporting with local filings-time consuming data collection processCOLLECT FINANCIAL DATA CENTRALLY IN MANAGEMENT GAAP FORMAT less time consuming data collection process- need to reconcile CbC data with local filings23 2015 For information, contact Deloitte Touche Tohmatsu Limited

Leveraging on an end-to-end statutory compliance processProcessPlanningClient Calendar ofinternal and legaldue datesDataCollection Provide data Business information updateLocalTeamGlobalTaxCentreEurope(GTCE) Review and agreecalendar Governance andprocessDataValidation DataProcessingDeliverableDrafting Clarify/confirm ad hoc mattersIntegrate CbC additional datapoints in PBCs:- Tax Cash- Income by party(IC/external) Review of Financial Statementsand equity Review LTP, CITRUpload trial balancesUpdate mappingUpload integrated PBC dataCheck completion of PBCConduct integrity checks Identify, prepare and documentmanagement to local GAAP andtax adjustments Preparation of local GAAP trialbalance, financial statements andequity reconciliation Prepare LTP, CITRReview &Sign offSubmit &ArchiveMgmt.Reporting Review andapproveDeloitte Conversion Tool (DCT)Review CbC& TP ratios SubmitFinancialStatementsand CIT return Store onDOL/DTiConsolidateCbC report Data analyticsCbC reporting ToolSupportingTechnologyE-filing software 2015 For information, contact Deloitte Touche Tohmatsu Limited24

Key considerations to address in a CbC discussionRisk managementWhat /where are the group “material”legal entities? Legal entities driving Group effective tax rate (ETR) Complexity factor (systems, different data levels) Use by tax inspector: for TP risks & other BEPS risksData collection Legal entity/ country “pristine” dimensionCan consolidation system be used tocollect CbC financial data? Management chart of account granularity Tax paid (usually tracked via group tax provision module –e.g. Hyperion TaxProvision for Hyperion Financial Management) Nature of difference: permanent, temporary & timingCan the main statutory differences beexplained? Documentation of differences (source / valuation) Reconciliation of net equity under both management & local GAAPOpportunity “Core” and extended CbC Ratio: what a tax auditor can derive from CbC reportvs what can be derived based on a more granular approach and additionalquestions Rewarded risk: Deloitte global steps (DGS)Tax audit readinessWhat else can be done with “CbC-like”data?25 2015 For information, contact Deloitte Touche Tohmatsu Limited

CbCAppendix26 2015 For information, contact Deloitte Touche Tohmatsu Limited

GTCE - Deloitte Conversion ToolCountry drill-down: Country metricsThe Deloitte Conversion Tool (DCT) is an application developed by Deloitte to support GAAP to GAAPreconciliation and provide companies with multiple reporting functionalities, not only supporting statutoryaccounting reporting but also aiming at capturing relevant data for derived reporting obligations such as the newcountry-by-country reporting.27 2015 For information, contact Deloitte Touche Tohmatsu Limited

GTCE - Deloitte Conversion ToolCountry drill-down: Legal entity general ledger account balances28 2015 For information, contact Deloitte Touche Tohmatsu Limited

GTCE - Deloitte Conversion ToolGAAP/IFRS to Stat drivers29 2015 For information, contact Deloitte Touche Tohmatsu Limited

GTCE - Deloitte Conversion ToolAnalysis ratio30 2015 For information, contact Deloitte Touche Tohmatsu Limited

GTCE - Deloitte Conversion ToolCbC report – Overall dashboard31 2015 For information, contact Deloitte Touche Tohmatsu Limited

GTCE - Deloitte Conversion ToolCbC report – PDF file32 2015 For information, contact Deloitte Touche Tohmatsu Limited

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities.DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients. Please seewww.deloitte.com/about for a more detailed description of DTTL and its member firms.Deloitte provides audit, consulting, financial advisory, risk management, tax and related services to public and private clients spanning multiple industries. With a globallyconnected network of member firms in more than 150 countries and territories, Deloitte brings world-class capabilities and high-quality service to clients, delivering the insightsthey need to address their most complex business challenges. Deloitte’s more than 210,000 professionals are committed to becoming the standard of excellence.This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms, or their related entities (collectively, the “DeloitteNetwork”) is, by means of this communication, rendering professional advice or services. No entity in the Deloitte network shall be responsible for any loss whatsoever sustainedby any person who relies on this communication. 2015. For information, contact Deloitte Touche Tohmatsu Limited.33

Cognos Controller Other DataWarehouse (BI) BW OBIEE Cognos TM1 . Data collection strategy: local vs. central COLLECT FINANCIAL DATA LOCALLY IN LOCAL GAAP FORMAT no need to reconcile CbC reporting with local filings - time consuming data collection process 23