Transcription

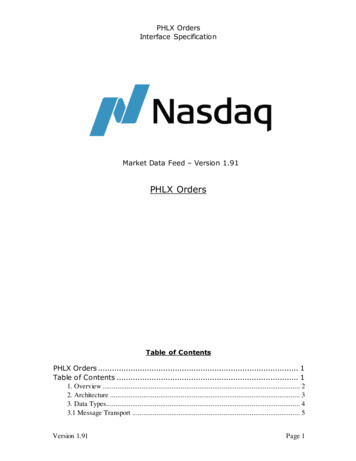

PHLX OrdersInterface SpecificationMarket Data Feed – Version 1.91PHLX OrdersTable of ContentsPHLX Orders . 1Table of Contents . 11. Overview . 22. Architecture . 33. Data Types. 43.1 Message Transport . 5Version 1.91Page 1

PHLX OrdersInterface Specification4. Message Formats. 54.1. System Event Message . 64.2. Options Directory Message . 74.3. Complex Order Strategy Message . 84.4. Security Trading Action Message.114.5. Complex Trading Action Message .124.6. Security Open/Closed Message .124.7. Strategy Open/Closed Message .134.8. Simple Order Message.144.9. Complex Order Message.164.10. Auction Notification Message .194.11. Complex Auction Notification Message .224.12. Support .23Appendix A – PHLX Order Addresses.24Appendix B – Revision Control Log .25Documentation Revision Control Log . 25August 10, 2015: PHLX Orders - Version 1.70.8 . 25March 2, 2015: PHLX Orders - Version 1.70.7 . 25April 21, 2014: PHLX Orders - Version 1.70.6. 25October 25, 2013: PHLX Orders - Version 1.70.5 . 25August 30, 2013: PHLX Orders - Version 1.70.4 . 25August 13, 2012: PHLX Orders - Version 1.70.3 . 25March 23, 2010: PHLX Orders - Version 1.70.1 . 25January 19, 2010: PHLX Orders - Version 1.70 . 26January 08, 2009: PHLX Orders - Version 1.60 . 26October 28, 2009: PHLX Orders - Version 1.50 . 26October 13, 2009: PHLX Orders - Version 1.40 . 26September 23, 2009: PHLX Orders - Version 1.30. 26September 22, 2009: PHLX Orders - Version 1.20. 26September 10, 2009: PHLX Orders - Version 1.10. 26August 3, 2010: PHLX Orders - Version 1.70.2. 26August 30, 2009: PHLX Orders - Version 1.00 . 261. Overview TOPO Plus Orders is a direct data feed product offered by Nasdaq PHLX that includesthe TOPO data feed as well as a PHLX Orders feed that provides the current state ofSimple and Complex Orders on the PHLX book, hence the TOPO Plus Orders moniker forthe overall data product.Version 1.91Page 2

PHLX OrdersInterface Specification* Please note that the following specification document outlines only the PHLX Ordersportion of the TOPO Plus Orders data product.The Top of PHLX Options(TOPO) specification document can be accessed at the phlx.pdfPHLX Orders features the following data elements: Current state of Simple and Complex Orders on a low latency, real time basis.This includes new orders and changes to orders resting on the PHLX book. Orderinformation that is disseminated reflects the size of an order which is available fortrading. This means that order volume can increase or decrease as orders arerouted away from the exchange or reintroduced to the book when refusedexecution at an away exchange. Order types not sent by the PHLX Order feedare:o Time in force IOC (Immediate or Cancel) Simple Orders are not sent. IOCComplex Orders are sent.o Fully Executed Orders upon Receipt. These are orders which are fullyexecuted by the matching engine upon entry to the PHLX trading systemAuction information for securities traded on the PHLX OptionsMarket.COLA Notification Messages, which is a message for reporting a Complex OrderLive Auction (COLA) taking place on the PHLX Options Market.Administrative and market event messages including:o Trading action messages to inform market participants when a specificoption or strategy is halted or released for trading on the PHLX OptionsMarket. o Security open/closed message to inform market participantswhen a specific option or strategy is eligible for automatic execution onthe PHLX Options Market.o Options Directory messages to relay basic option symbol and contractinformation for those options traded on the PHLX Options Market.o Complex Order Strategy Messages to relay information for those strategiestraded on the PHLX Options Market. The Strate gy Message lists the legswhich compose the Strategy and the leg ratios which uniquely define thisStrategy for an underlying. Alternatively, the reader can process theStrategy information in the Complex Order Message which contains thesame strategy information as in the Complex Order Strategy message.2. ArchitectureThe PHLX Orders feed will be made up of a series of sequenced frames. Each frame iscomposed of one message. The frames are typically delivered using a higher levelprotocol that takes care of sequencing and delivery guarantees.Version 1.91Page 3

PHLX OrdersInterface SpecificationPHLX plans to offer the PHLX Orders data feed in the following protocol options:Protocol OptionNumber of Outbound ChannelsMoldUDP (multicast)Multicast Feed: 4 Outbound Channels segregated byUnderlying Symbol, per Group. The feed broadcasts inmulticast.MoldUDP (unicast)Mold Rerequestors: 4 Channels segregated byUnderlying Symbol, per Group. This set of channels isfor retransmission of missing or dropped Multicastdata, if required by the recipient.SoupBinTCP Version 3.00TCP Rerequestors: 4 Connections segregated byUnderlying Symbol, per Group usually used torerequest information missed for a period of timeThe PHLX Orders MoldUDP multicast feed is composed of 2 groups of Multicast Channels:the “O” Group, for Simple Order related information; and the “X” Group, for ComplexOrder related information. Each group has 4 channels segregated by underlying symbolfor a total of 8 channels.The PHLX Orders MoldUDP unicast rerequest feed is composed of 2 groups of unicast UDPConnections: the “O” Group, for Simple Order related information; and the “X” Group, forComplex Order related information. Each group has 4 channels segregated b y underlyingsymbol for a total of 8 channels. The MoldUDP channels are used for requesting lostmulticast data from the MoldUDP feeds if required by the recipient.The PHLX Orders SoupTCP rerequest is composed of 2 groups of TCP Connections: the“O” Group, for Simple Order related information; and the “X” Group, for Complex Orderrelated information. Each group has 4 connections segregated by underlying symbol for atotal of 8 channels. The SoupTCP connections should used for requesting large amountsof lost multicast data from the MoldUDP feeds if required by the recipient.Both the primary (“A feed”) and secondary (“B feed”) connections will be hosted byservers co-located with the trading system and will have identical performancecharacteristics.* Please note that Nasdaq has determined to provide local redundancy in the NY MetroArea (“A feed”) and (“B feed”), while using the Mid-Atlantic Region (“C feed”) for disasterrecovery in the event XL II order entry is switched from the NY Metro Area.A complete set of alternate connection parameters are available for each MulticastChannel and TCP Connection in the event of a failure in any of the primary connections.3. Data TypesAll integer fields are unsigned big-endian (network byte order) binary encoded numbers.Note that integers may be one, two or four bytes in length. The size is specified for eachmessage field.All alphanumeric fields are left justified and padded on the right with spacesVersion 1.91Page 4

PHLX OrdersInterface SpecificationPrices are integer fields. When converted to a decimal format, prices are in fixed pointformat with 6 whole number places followed by 4 decimal digits.Timestamp reflects the PHLX system time at which the outbound message wasgenerated. For every message, the timestamp is expressed in two fields: “Seconds”,which is the number of whole seconds after midnight of the day that the message is sent;and “Nanoseconds”, which is the sub-second portion of the time which represents theinteger number of nanoseconds. The “Seconds” field will have a range of 0 to 86399 (i.e.12:00:00am to 11:59:59pm) and “Nanoseconds” will have a range of 0 to 999999999. Alltimes in this protocol are U.S. Eastern Time zone.3.1 Message TransportMessages are transported by the underlying MoldUDP or SoupTCP Version 3.00 protocols.Each PHLX Orders message described in the following sections will have a sequencenumber defined by the underlying Protocols. For MoldUDP, the sequence numbers areexplicitly in the MOLD UDP header. For Soup TCP, the sequence numbers are implicit:they are calculated by the sender and recipient. Refer to the specifications for moreinformation.For data recovery purposes, the same PHLX Orders messages will be sent on Mold UDPand Soup TCP. This implies that for any particular PHLX Orders message sent, it will havethe same Mold UDP and Soup TCP sequence number. This makes data recovery simple, ifa sequence gap is detected in the multicast stream, then gap filling can take place usingMoldUDP. Soup TCP has the same sequencing information, but is better suited forrerequesting large amounts of data, for example missed Options Directory messages sentin the morning hours before market opening.4. Message FormatsAll messages described below have byte sizes and offsets.PHLX Orders will support four basic types of messages:o System Events o Administrative Data o PHLX orderrelated informationo PHLX auction informationWithin the system event and administrative types, PHLX may support multiple messageformats as outlined below.Version 1.91Page 5

PHLX OrdersInterface Specification4.1. System Event MessageThe system event message type is used to signal a market or data feed handler event.The format is as follows:System Event MessageNameOffsetLengthValueNotesMessage Type01“S”System Event MessageSeconds14IntegerSeconds portion of the timestampNanoseconds54IntegerNanoseconds portion of thetimestampEvent Code91AlphaRefer to System Event Codes belowVersion101IntegerVersion of PHLX Orders. Currently setto 1System Event CodesCodeExplanationWhen (typically)“O”Start of Messages. This is always the first messagesent in any trading day.After 2:00am“S”Start of System Hours. This message indicates thatPHLX is open and ready to start accepting orders.7:00am“Q”Start of Opening Process. This message is intended toindicate that PHLX has started its opening process.9:30:00am“N”End of Normal Hours Processing. This message isintended to indicate that PHLX will no longer acceptany new orders or changes to existing orders foroptions that trade during normal hours.4:00:00pm“L”End of Late Hours Processing. This message is intended 4:15:00pmto indicate that PHLX will no longer accept any neworders or changes to existing orders for options thattrade during extended hours.“E”End of System Hours. This message indicates that thePHLX options system is now closed. 5:15pm“C”End of Messages. This is always the last message sentin any trading day. 5:20pm“W”End of WCO Early closing. This message is intended toindicate that the exchange will no longer accept anynew orders or changes to existing Orders on lasttrading date of WCO options.12:00 NoonThis message is transmitted in both the “O” and “X” gro ups.Version 1.91Page 6

PHLX OrdersInterface Specification4.2. Options Directory MessageAt the start of each trading day, PHLX disseminates directory messages for all symbolstrading on the PHLX option system.Options DirectoryNameOffsetLengthValueMessage Type01Integer“D” Options Directory MessageSeconds14IntegerSeconds portion of the timestampNanoseconds54IntegerNanoseconds portion of the timestampOption ID94IntegerPHLX Option ID assigned daily, valid forthe trading daySecuritySymbol135ExpirationYear, Monthand Day182IntegerDenotes the explicit expiration date ofthe option.Bits 0-6 Year (0-99)Bits 7-10 Month (1-12)Bits 11-15 Day (1-31)Bit 15 is least significant bitExplicit StrikePrice204IntegerDenotes the explicit strike price of theoption. Refer to Data Types for fieldprocessing notes.Option Type241AlphaSource251IntegerIdentifies the source of the Option, validfor the trading dayUnderlyingSymbol2613AlphaDenotes the unique underlying stocksymbol for the option symbol. Normallymatches the stock symbol. Theexception is for corporate actionsassigned by PHLXOption ClosingType391IntegerDenotes the closing of the option.“N” Normal Hours“L” Late Hours“W” WCO Early Closing at 12:00 NoonPHLX Tradable401IntegerDenotes whether or not this option istradable at the PHLX exchange. Theallowable values are:“Y” Option is tradable at PHLXVersion 1.91NotesAlphanumeric Denotes the option symbol (securitysymbol) post-symbology rollout.Denotes the root portion of the OPRAsymbol pre-symbology rolloutOption Type:“C” Call“P” PutPage 7

PHLX OrdersInterface Specification“N” Option is not tradable at PHLXNOTE: The options directory messages are sent once per symbol, typically before the“Start of System Hours” System Event. Should it be necessary, intra -day updatesto this message will be sent as they occur.This message is transmitted in the “O” group only.4.3. Complex Order Strategy MessageWhenever a complex order is added in the system for an underlying, the order is normalizedand results in either the creation of a new complex strategy or is added to an existingstrategy. A Complex Order Strategy Message containing the strategy definition will be sent.For GTC strategies, these will be assigned each trading day and will not be persistent acrosstrading days. The Strategy ID assigned for a new complex strategy is unique for aparticular complex instrument for a trading session. However, Strategy IDs areindependent of session Options IDs and uniqueness of the IDs across both complex andsimple options is not guaranteed.Version 1.91Page 8

PHLX OrdersInterface SpecificationComplex Order Strategy MessageNameOffset LengthValueNotesMessage01Integer“R” Complex Order StrategyTypeMessageSeconds14IntegerSeconds portion of the timestampNanoseconds 5 4 Integer Nanoseconds portion of timestamp Strategy ID 9 4 IntegerPHLX Strategy ID assigned daily,valid while there are any opencomplex orders for the daySource131IntegerIdentifies the source of theStrategy, valid for the trading dayUnderlying1413Alphanumeric Underlying Symbol for theSymbolstrategy. All legs in this strategybelong to this UnderlyingAction271Alphanumeric Defines the state of the strategy:“A” Add“D” DeleteNumber of281IntegerNumber of legs in the strategyLegsNOTE: Leg field offsets below arean equation, where “n” is the ze robased leg number (0, 1, )Option ID21n 4IntegerPHLX Option ID for this leg, valid29for the trading day. The same IDas the corresponding Option inthe Options Directory Message.Zero (0) for Stock Leg.Security21n 5Alphanumeric Denotes the option symbol postSymbol33symbology rollout. Denotes theroot portion of the OPRAsymbol pre-symbology rolloutBlank for Stock Leg. UseUnderlying Symbol field.Expiration21n 2IntegerDenotes the explicit expirationYear, Month38date of the option.and DayBits 0-6 Year (0-99)Bits 7-10 Month (1-12)Bits 11-15 Day (1-31)Bit 15 is least significant bitVersion 1.91Page 9

PHLX OrdersInterface SpecificationZero (0) for Stock Leg.Denotes the explicit strike price ofthe option. Refer to Data Types forfield processing notes.Zero (0) for Stock Leg.ExplicitStrike Price21n 404IntegerOption Type21n 441AlphaOption Type:“C” Call“P” PutBlank (“ “) for Stock Leg.Side21n 451AlphaIndicates the side of the leg:“B” Leg is on Buy side“S” Leg is on Sell sideLeg Ratio21n 464IntegerStrategy Leg RatioThis message is transmitted in the “X” group only.Version 1.91Page 10

PHLX OrdersInterface Specification4.4. Security Trading Action MessagePHLX uses this administrative message to indicate the current trading status of an indexor equity option within the PHLX Options Market.Trading firms should assume that all tradable securities are eligible for trading. PHLX willsend out a Trading Action message with “H” (HALTED) when an option is halted for trading.Thereafter throughout the trading day PHLX will use the Trading Action me ssage to relaychanges in trading status for an individual security. Messages will be sent when an optionis halted or is released for trading. Please note that securities may be halted in the PHLXsystem for regulatory or operational reasons.Trading Action ger“H” Trading Action MessageSeconds14IntegerSeconds portion of the timestampNanoseconds54IntegerNanoseconds portion of timestampOption ID94IntegerPHLX Option ID assigned daily, validfor the trading daySecuritySymbol135AlphanumericExpirationYear, Monthand Day182IntegerDenotes the explicit expiration date ofthe option.Bits 0-6 Year (0-99)Bits 7-10 Month (1-12)Bits 11-15 Day (1-31)Explicit StrikePrice204IntegerDenotes the explicit strike price of theoption. Refer to Data Types for fieldprocessing notes.Option Type241AlphaCurrentTrading State251IntegerDenotes the option symbolpostsymbology rollout. Denotes the rootportion of the OPRA symbolpresymbology rolloutOption Type:“C” Call“P” PutReflects the current trading state forthe option on the PHLX market. Theallowable values are:H Halt in effectT PHLX Trading ResumedPlease note that recipients should continue to process the Trading Action message inorder to determine if a contract is in a Halt state for the day. A security open messageshould NOT override the Trading action message indicating if an index or equity op tion ishalted. Recipients should use both messages in tandem to indicate if the issue is haltedand/or or open for auto execution.Version 1.91Page 11

PHLX OrdersInterface SpecificationThis message is transmitted in the “O” group only.4.5. Complex Trading Action MessagePHLX uses this administrative message to indicate the current trading status of a strategywithin the PHLX Options Market.Trading firms should assume that all strategies are eligible for trading. PHLX will send outa Trading Action message with “H” (HALTED) when a strategy is halted for trading.Thereafter throughout the trading day PHLX will use the Trading Action message to relaychanges in trading status for the strategy. Messages will be sent when the strategy is haltedor is released for trading.Trading Action ger“I” Strategy Trading Action MessageSeconds14IntegerSeconds portion of the timestampNanoseconds54IntegerNanoseconds portion of timestampStrategy ID94IntegerPHLX Strategy ID assigned daily, validwhile there are any open complexorders for the dayCurrentTrading State131IntegerReflects the current trading state forthe strategy on the PHLX market. Theallowable values are:H Halt in effectT PHLX Trading ResumedPlease note that recipients should continue to process the Trading Action message inorder to determine if a strategy is in a Halt state during the day. A strategy openmessage should NOT override the Strategy Trading Action message indicating if astrategy is halted. Recipients should use both messages in tandem to indicate if thestrategy is halted and/or or open for auto execution.This message is transmitted in the “X” group only.4.6. Security Open/Closed MessagePHLX uses this administrative message to indicate when an option has completed theopening process and is now available for auto execution or when the option has closed andis no longer available for auto execution.Security Open/Closed MessageVersion 1.91Page 12

PHLX OrdersInterface 01Integer“P” Security Open/Closed MessageSeconds14IntegerSeconds portion of the timestampNanoseconds54IntegerNanoseconds portion of timestampOption ID94IntegerPHLX Option ID assigned daily, validfor the trading daySecuritySymbol135AlphanumericExpirationYear, Monthand Day182IntegerDenotes the explicit expiration date ofthe option.Bits 0-6 Year (0-99)Bits 7-10 Month (1-12)Bits 11-15 Day (1-31)Explicit StrikePrice204IntegerDenotes the explicit strike price of theoption. Refer to Data Types for fieldprocessing notes.Option Type241AlphaOpen State251IntegerDenotes the option symbolpostsymbology rollout. Denotes the rootportion of the OPRA symbolpresymbology rolloutOption Type:“C” Call“P” PutReflects the current eligibility for autoexecution of the options security on thePHLX. The allowable values are:“Y” Open for auto execution“N” Closed for auto executionPlease note that recipients should continue to process the Trading Action message inorder to determine if a contract is in a Halt state for the day. A security open messageshould NOT override the Trading action message indicating if an index or equity op tion ishalted. Recipients should use both messages in tandem to indicate if the issue is haltedand/or or open for auto execution.This message is transmitted in the “O” group only.4.7. Strategy Open/Closed MessagePHLX uses this administrative message to indicate when a strategy has completed theopening process or when the strategy has closed and is no longer available for autoexecution.Security Open/Closed MessageNameVersion 1.91OffsetLengthValueNotesPage 13

PHLX OrdersInterface SpecificationMessageType01Integer“Q” Strategy Open/Closed MessageSeconds14IntegerSeconds portion of the timestampNanoseconds54IntegerStrategy ID94IntegerNanoseconds portion of timestampPHLX Strategy ID assigned daily, validwhile there are any open complexorders for the dayOpen State131IntegerReflects the current eligibility for autoexecution of the options security on thePHLX. The allowable values are:“Y” Open for auto execution“N” Closed for auto executionPlease note that recipients should continue to process the Trading Action message inorder to determine if a strategy is in a Halt state for the day. A Strategy Open/ClosedMessage should NOT override the Strategy Trading Action Message indicating if astrategy is halted. Recipients should use both messages in tandem to indicate if thestrategy is halted and/or or open for auto execution.This message is transmitted in the “X” group only.4.8. Simple Order MessageWhen a Single Order is received or any change is made to an order, an Order messagecontaining the current order status will be sent.The Order ID field, a PHLX assigned identifier, is uniquely assigned for each order. Pleasenote that the Order ID is designed to be unique only across a single day. That is, it isguaranteed to be unique for a given order for a given day only. A GTC order that persistsacross days may have a different Order ID assigned to it on any given day.Simple Order MessageNameOffsetLengthValueMessage Type01AlphaSeconds14IntegerSeconds portion of the timestampNanoseconds54IntegerNanoseconds portion of timestampOption ID94IntegerPHLX Option ID assigned daily, validfor the trading daySecuritySymbol135AlphanumericDenotes the option symbolpostsymbology rollout. Denotes theroot portion of the OPRA symbolpresymbology rolloutVersion 1.91Notes“O” Simple Order MessagePage 14

PHLX OrdersInterface SpecificationExpirationYear, Monthand Day182IntegerDenotes the explicit expiration date ofthe option.Bits 0-6 Year (0-99)Bits 7-10 Month (1-12)Bits 11-15 Day (1-31)Where bit 15 is the least significant bitof the integerExplicit StrikePrice204IntegerDenotes the explicit strike price of theoption. Refer to Data Types for fieldprocessing notes.Option Type241AlphaOrder ID254IntegerSide291AlphaOriginal OrderVolume304IntegerOriginal Order Volume for this orderExecutableOrder Volume344IntegerVolume available for execution atPHLX. Note that this number canincrease or decrease as the sizeavailable for trading changes due toaway exchange routingOrder Status381AlphaIndicates the current status ofthe order: “O” Open“F” Filled“C” Cancelled (NOTE below)Order Type391AlphaIndicates the type of order:“M” Market“L” LimitMarketQualifier401AlphaLimit Price414IntegerAll or None451AlphaIndicates if order is All or None Order:“Y” Order is All or None Order“N” Order is not All or None OrderTime in Force461AlphaIndicates duration of the order:“D” Day Order“G” Good till cancelled (GTC)OrderVersion 1.91Option Type:“C” Call“P” PutPHLX assigned order idIndicates the side of the order:“B” Buy order“S” Sell order“O” Opening Order“I” Implied Order“ ” N/A (field is space char)Limit Price of Limit or Stop Order.Otherwise field is zero.Page 15

PHLX OrdersInterface es whether this is a:“C” Customer Order“F” Firm Order“M” On-floor Market Maker“B” Broker Dealer Order“P” Professional Order“ ” N/A (For Implied Order)Open CloseIndicator481AlphaIndicates whether this Order opens orcloses a position:“O” Opens position“C” Closes position“ ” N/A (For Implied Order)NOTES: An Order Status field value of “C” (Cancelled) indicates that the Executable OrderVolume number of contracts sent previously for this Simple Order was cancelled Stop Orders are indicated as a new regular or market order once the stop order iselected and eligible for posting and executionThis message is transmitted in the “O” group only.4.9. Complex Order MessageWhen a Complex Order is received or any change is made to a complex order for anunderlying, a Complex Order Message containing the order information will be sent.The Order ID field, a PHLX assigned identifier, is uniquely assigned for each order. Pleasenote that the Order ID is designed to be unique only across a single day. That is, it isguaranteed to be unique for a given order for a given day only. A GTC order that persistsacross days may have a different Order ID assigned to it on any given day.NOTE: Complex strategy information in the fields inclusively from “Underlying Symbol” tothe end of the Complex Order Message are identical to the information in the ComplexOrder Strategy Message for the Strategy ID of the Order. The Strategy ID encapsulatesthe strategy information. The strategy information at the end of this message is presentedas a convenience for users of this feed requiring complete strategy information for a givenComplex Order.Complex Order MessageNameOffsetLengthValueMessage Type01Integer“X” Complex Order MessageSeconds14IntegerSeconds portion of the timestampNanoseconds54IntegerNanoseconds portion of timestampStrategy ID94IntegerPHLX Strategy ID assigned daily,valid while there are any opencomplex orders for the dayOrder ID134IntegerPHLX assigned order idVersion 1.91NotesPage 16

PHLX OrdersInterface SpecificationSide171AlphaOriginal OrderVolume184IntegerOriginal Order Volume for thisorderExecutableOrder Volume224IntegerVolume available for execution atPHLXOrder Status261AlphaIndicates the current status ofthe order: “O” Open“F” Filled“C” Cancelled (NOTE below)“R” Re-notification (NOTE below)Order Type271AlphaIndicates the type of order:“M” Market“L” Limit“*” AnonymousThis field will be masked with “*”for new Complex Orders thatinitiated a COLAVersion 1.91Indicates the side of the order:“B” Buy order“S” Sell order“*” Side is hiddenThis field will be masked with “*”for new Complex Orders thatinitiated a COLAPage 17

PHLX OrdersInterface SpecificationLimit Price284IntegerLimit Price of Limit Order.Otherwise field is zero.Debit or Credit321AlphaPrice is:“D” Net Debit“C” Net Credit“ “ Even (or Market Order)“*” AnonymousThis field will be masked with “*”for new Complex Orders thatinitiated a COLAAll or None331AlphaIndicates if order is All or NoneOrder:“Y” Order is All or None“N” Order is not All or NoneTime in Force341AlphaIndicates duration of the order:“D” Day Order“G” Good till cancelled (GTC)“I” IOC (Immediate or Cancel)Customer/FirmIndicator351AlphaIndicates whether this is a:“C” Customer Order“F” Firm Order“M” On-floor Market Maker“B” Broker Dealer Order“P” Professional OrderUnderlyingSymbol3613AlphanumericUnderlying Symbol for thestrategy. All legs in this strategybelong to this UnderlyingNumber ofLegs491IntegerNumber of legs in the strategyNOTE: Open Close and Leg fieldoffsets below are an equation,where “n” is the zero based legnumber (0, 1, ) and “L” is thenumber of legsOpen CloseIndicatorn 501AlphaVersion 1.91Ind

traded on the PHLX Options Market. The Strategy Message lists the legs which compose the Strategy and the leg ratios which uniquely define this Strategy for an underlying. Alternatively, the reader can process the Strategy information in the Complex Order Message which contains the same strategy information as in the Complex Order Strategy .