Transcription

INSPIRING WHAT’S NEXT

EMIRATES NBDPRIVATE BANKING INSPIRING WHAT’S NEXTWhen everyone thinks you’ve done it all,Now is the time to look ahead and ask yourselfit is time to set your eyes on what’s next.“What’s next?”. To build bonds that last longerYou know that it’s not the time to rest onthan a lifetime. To inspire, and to be inspiredwhat you’ve done, but to do the things thatby the next generation. At Emirates NBD, wematter; for your passions, your ambitions orare your trusted partners on this journey, toperhaps, your legacy.help you INSPIRE WHAT’S NEXT.2

EMIRATES NBDGROUP AT A GLANCEEmirates NBD is one of the largest financial institutions in the GCC and the flagship bank ofMoscowDubai (56% government-owned). It is comprised of full-fledged and diversified offerings acrossRetail Banking, Wealth Management, Wholesale Banking & Trade Finance, Islamic as well asInvestment Banking.*LondonAustriaIt has an ever-increasing presence in the UAE, GCC and globally:Turkey 1,000 network branches International presence with operations in 13 countriesThe Bank has superior long-term credit ratings: Moody’sA2Stable FitchA Stable Capital IntelligenceA ngaporeIts financial robustness is reflected in key indicators (H1 – 2022):Jakarta AED 711 Bn Total Assets AED 5.3 Bn Net Profit AED 86.1 Bn Total Capital 15% Common Equity Tier - 1 Capital Ratio 6.1% NPL and 133.3% Coverage RatioEmirates NBD BranchesRepresentative OfficesDenizbank* Private Banking Centres3

ABOUT EMIRATES NBDPRIVATE BANKINGEmirates NBD Private Banking is the pivotallocal & regional expertise, combined with aunit of the Bank’s Wealth Managementglobal outlook across asset classes, sectorsDivision serving High-Net-Worth & Ultra-and geographies.High-Net-Worth individuals, families andselect institutions; and has grown to be oneWe have dedicated Private Banking officesof the most trusted and reputable names inin the United Arab Emirates (Headquartersthe Middle East. The company’s continuedin Dubai with a branch in Abu Dhabi), theprogress in delivering unrivalled clientKingdom of Saudi Arabia (Riyadh, Jeddahsolutions and excellent customer service hasand Khobar), the United Kingdom (London)*,been recognised by various industry awards.India (Mumbai) and Singapore.The investment team constantly identifiesOur teams however, have a global coverageopportunities for our esteemed clients tothroughout the Middle East, Africa, thegrow and preserve their wealth based onIndian Subcontinent, Europe as well asstrong convictions resulting from deepSouth East Asia.*Emirates NBD Bank PJSC is authorised by the Prudential Regulation Authority and regulated by the FinancialConduct Authority (FCA) and the Prudential Regulation Authority in the UK. Any services provided byEmirates NBD Bank PJSC outside the UK will not be regulated by the FCA and you will not receive all the protectionsafforded to retail customers under the FCA regime, such as the Financial Ombudsman Service and the FinancialServices Compensation Scheme.4

Investment Advisory ServicesDiversified portfolio strategies across geographies,sectors and asset classes.Trade Execution ServicesFacilitating client-instructed trade executions in marketssuch as equities, fixed income securities, futures,commodities and currencies.Discretionary Portfolio ManagementManaged portfolio service provided throughEmirates NBD Asset Management and by PrivateBanking in London.A LOOK AT OUR CORE OFFERINGLombard LendingCredit solutions against cash, investments, real estate,IPO financing and universal life insurance.Trust and Estate PlanningBespoke solutions and ownership structures based onyou and your family’s requirements.Real Estate AdvisoryAssistance for our clients across the spectrum of realestate needs both in the UAE and Prime Central London.Offshore Booking CentresBespoke solutions offered in the UAE as well as fromour centres in London, Singapore, KSA and India*.*For deposits only.5

INVESTMENTADVISORY SERVICESWe offer you advice on the various stages ofon a wide range of markets and strategies,investment decision-making. In doing so, weand are at hand at all times to decode thehelp you understand your true investmentmarket noise into sound l markets and construct investmentShould you choose a Managed Advisoryportfolios that meet your needs.Service, you will be continually If you are an active investor and followopportunities.events in the world markets with greatreviewed with you on a regular basis atbeinterest, you may appreciate our Advisoryyour convenience.Services allowing you to attain additionalknowledge from Emirates NBD’s investmentEmirates NBD Private Banking Advisoryadvisors. You can expect to receive solutionsServicestailored specifically to your needs and goals.decision-making, offering best in classplaceyouattheheartofinvestment strategies whilst utilising anOur highly skilled and qualified Investmentopen architecture product offering to bringAdvisors are equipped to offer you advicethem to life.6

TRADE n-Emirates NBD Dubai provides access to the in-only services can help you strengthen yourhouse Derivative Trading System (DTS). We cover:whodon’tneedadvice,ourtrading capability by providing you efficientinvestment execution.OurExecutionDeskssituatedinDubaiand Singapore, provides access to listedcapital markets and over-the-counter (OTC)instruments globally. Our team of specialisttraders, spanning coverage from the openingof Asian markets until US market closure,5 days a week, 21 hours a day, are skilledin utilising global dark pool and algorithmictrading to ensure our clients receive the bestexecution possible. Foreign Exchange Global Fixed Income andEquity Securities Global Mutual Funds and ETFs Physical Bullion Trading Listed Derivative Solutions Cash Management, Swapsand ForwardsOur investment professionals remain by yourside with market information on flow andvolumes to assist you in your decision making.*UK and Singapore hours apply for services offered in the UK and Singapore.7

DISCRETIONARY PORTFOLIOMANAGEMENTManagementviews on assets and best-in-class productoffers Discretionary Portfolio Managementselections, where suitable. This hassle-freeservices,in-housesolution provides you with the comfortthrough the investment capabilities ofof knowing that your money is managedEmirates NBD London Branch (regulatedon a daily basis by a team of investmentby the FCA) and Emirates NBD Assetprofessionals, in strict accordance withManagement (DIFC, UAE).your objectives and tolerances.Discretionary portfolios are constructedWe have an established track recordand managed to meet the specific needs ofof managing mandates across differentthe individual investor, providing you houseasset classes.Emirates8NBDthatWealthareavailable

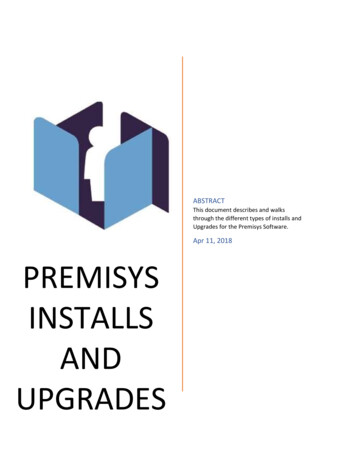

A detailedunderstanding of yourinvestment objectives,current & future cashflow needs as wellas your personal riskappetite, restrictionsand preferences.INVESTMENT SERVICES OUR APPROACHOur approach to advising you on your investments follows asystematic process that involves a thorough understanding of yourneeds, a portfolio constructed with carefully selected products,periodic reporting and regular rebalancing.ClientProfilingRegular reviews andrebalancing of yourportfolio to suit thechanging marketcircumstances, yourown risk profile, cashflow requirementsand our strategic andtactical asset r portfolio is thenconstructed with a mixof carefully selectedproducts includingmutual funds, singleline stocks and bondsas well as structuredsolutions.PortfolioReportingPeriodic 360-degreereporting, monitoringand analysis of yourentire relationshipwith us.9

INVESTMENT SERVICES ASSET ALLOCATIONAsset allocation is the art and science of combining different asset classes for the purposeof building multi-asset portfolios which can deliver sustainable returns with limited potentialdownside. These portfolios are called efficient portfolios.Our Chief Investment Office (CIO) offers global multi-asset portfolios, differentiated accordingto our clients’ risk profile – Cautious, Moderate or Aggressive. Bespoke investment solutionsare devised for clients with specific requirements.Our diversified investment solutions are the Clients with an Aggressive risk profilebuilding blocks of a client’s core portfolio. Thiswould typically invest the majority of theirstrategic asset allocation delivers the majorityportfolio in growth assets. These portfoliosof expected long-term returns of any portfolio.address capital-growth requirements and ClientswithaCautiousriskprofileare advised to invest in our cautiousinvestmentsolutions,biasedtowardssafer assets. These portfolios addresscapital-protection requirements and takeinto account the risk aversion of a cautiousrisk appetite client. OurModerateinvestmentsolutionsare biased towards a blend of incomegenerating and growth assets, appropriatefor a client with a moderate risk appetite.10take into account the aggressive, high-riskappetite of a client.While our Strategic Asset Allocation buildsthe backbone of our investment solutions,short-term investment advice is providedin the form of Tactical Asset Allocation calls.Our professionals, guided by the CIO team,leverage market inefficiencies and tilt theportfolio exposure towards asset classes,potentially offering higher returns in theshorter term.

INVESTMENT SERVICES CLIENT PROFILINGA detailed client profiling aims to understand your current and future cash flow needs aswell as your risk appetite, restrictions and personal preferences to be able to develop theideal portfolio to suit your investment atilityHigh11

INVESTMENT SERVICES PORTFOLIO CONSTRUCTIONA well-diversified portfolio is constructed using a core of carefully selected Mutual Fundscomplemented by Bonds/Sukuks, Single Stocks, Structured Products, Alternative Investmentsand FX & Commodities solutions for enhanced returns on your investments.Bonds/SukuksA. Mutual Funds Quantitative analysis based on past performance and risk parameters Qualitative analysis based on our experience, investment process and philosophy Approvals by a bank committee of senior professionals as well as market regulatorsB. Bonds/Sukuks A comprehensive global universe of fixed income securities to enhance portfolioconstruction and alpha through conviction themesC. Single Stocks* A selection of advisory stocks across geographies and global sectoral themes to rtfolio construction and enhance investment returnsD. Structured Products Through our structured products platform, we offer investors across all risk profilesand market expectations a value-added alternative to a direct investment into theirunderlying of choiceE. FX & Commodities Our team advises on a variety of FX & Commodities markets engaging clients on both,a short-term and long-term basisF. Alternative Investments Alternative instruments can add diversity and hedges to a core portfolio. We offer bothcapital-protected as well as capital-at-risk solutions*Currently offered through Dubai and Singapore.12FX &CommoditiesStructuredProducts

BEFOREINVESTMENT SERVICES REVIEW AND REBALANCING*Your dedicated Investment Advisor periodically reviews your portfolio and compares itsperformance against the benchmark and risk parameters. Taking into account the latestTactical Asset Allocation, your Investment Advisor will discuss suggestions for rebalancing,together with you, to achieve optimal portfolio performance.ReturnVolatilityPerformance of the Portfolio Give clients a periodic detailed report on cash flows, wealth projections and realised/unrealised gains for a deep understanding of where they currently stand and what toexpect from their portfolio in the futureRisk and Return analysis Identify portfolio gaps on a periodic basisAFTER Highlight portfolio risk deviations based on the risk budget of the portfolio Proactively monitor client portfolios for adherence to investment policiesRebalancing against the recommended Asset Allocation Present the CIO team’s fundamental views on each asset class, geography and sectoron a long-term basis Adjust portfolios to reflect the gap between the recommended and actual portfolio allocationInvestment Recommendation Conduct an exhaustive analysis of client portfolios at an individual holding level Recommend investments based on the prevailing Tactical Asset Allocation Suggest overweight and underweight recommendations at asset class and sub-assetclass levelsReturnVolatility*Available for managed portfolio services only.1313

14

LOMBARD LENDING SOLUTIONSWe offer a multitude of financing solutionsprovided by the Bank. Additionally we alsomadefamilies,accommodate IPO financing and can assist ininvestment companies, offshore trusts andhedging currency and interest rate exposuresholding companies. We tailor lending solutionsthrough SWAPS and FX forward transactions.availabletoindividuals,to your individual needs, paying close attentionto your situation and cash flow requirements.We also offer an array of real estate financingUnder our Lombard Lending program we offeroptions, such as acquisition, refinancingsecured lending against liquid assets such asand equity release. Real estate financinginvestment securities, deposits and preciousis available on residential and income-metals. Our Singapore office is able to offergenerating properties in the UAE as well aspremium financing of high-value universal liferesidential and commercial properties ininsurance policies (Jumbo Insurance).the UK. You can also enjoy direct access tovarious trade finance solutions provided byYou may choose to borrow against an existingour Wholesale Banking team.portfolio of assets or acquire new assets bycontributing equity in addition to leverage15

16

TRUST ANDESTATE PLANNINGEmirates NBD Private Banking’s TrusteesWe work with you and your advisors to meetWe will take the time to understand your globalThe plan can include liquidity planning tohave been in Jersey (Channel Islands) foryour succession planning, tax and legalassets and their current ownership. We workensure that sufficient funds are available,many years, demonstrating our commitmentrequirements and also assist with liquiditywith you to deliver a plan that will ensure thewhere inheritance taxes will need to be paid.to delivering high-quality advice andplanning and business succession issues.smooth succession of those assets, whethertrust services through an internationallyrenowned trust centre.Your structure will be able to hold yourinternational assets, including accounts withthat is for family succession, a charitablelegacy or business continuity reasons.However complex your situation, we assistfinancial institutions, properties, yachts andThe legacy plan can include specific provisionin constructing a wealth plan that can beaircrafts, to name a few.for who should inherit, in what percentagetailored to meet your own and your family’sspecific circumstances.Implementation of the structures is carriedout through our Jersey (Channel Islands)Trust Centre, which is regulated to theAdvanced planning can often lead to asmooth succession process and help tominimise family conflict.(following the Sharia or an alternative divisionof assets) and at what time (such as a minimumage before a person can inherit assets).highest international standards.17

REAL ESTATE ADVISORYRESIDENTIAL REAL ESTATECOMMERCIAL REAL ESTATE Bespoke Search Service for Acquisitions Acquisitions Existing Properties and New Developments Property Management Sales Sales Secured Financing Secured FinancingOur experienced London-based residentialWe assist our clients at every stage of theWe support our Private Banking clients inowners, introducers and developers on bothsearch team offers a bespoke and discreetprocess including local market analysis,the acquisition, management, dispositionon and off-market basis.service tailored to individual client requirementsinspections, negotiations, offers, conveyancing,and financing of commercial property inand preferences. We source suitable propertiesloan arrangement and completion.key UK markets in partnership with leadingEmirates NBD offers select co-investmentinternational property advisory firms.opportunities for the acquisition, developmentthrough our extensive network of agents,or redevelopment of prime property in coreowners and developers on both an on and offmarket basis.18We source suitable properties through anlocations alongside leading international assetextensive international network of agents,managers and developers.

19

Suvo SarkarSenior Executive Vice President,Group Head of Retail Bankingand Wealth ManagementMEET THEMANAGEMENTSaod ObaidallaExecutive Vice President,Head of Private BankingMaurice GravierChief Investment Officer,Wealth Management20

A DEDICATED AND EXPERIENCEDINVESTMENT TEAMOur Chief Investment Officer (CIO) ‘s teamasset portfolios target certain risk returnconsisting of local, regional and globalcharacteristics offered either at a regional orspecialistsin-depthglobal level. The single-asset class portfoliosresearch and insights into local and globaloffer focused equity strategies for the GCC,markets through their daily, weekly, thematicEurope or with a global remit as well asand annual publications as well as theirHealthcare and Technology sectors. Weregular interactions with clients.have partnered with an Asian powerhouseprovidesyouwithto provide our clients insights into the AsianOur investment platform includes in-houseequity market. Our fixed income offeringmanaged multi-asset and single-asset classconsists of model portfolios for the GCC,portfolios run by our CIO team. The multi-emerging markets as well as Sukuk portfolios.21

GLOBAL RECOGNITIONPRIVATE BANKERINTERNATIONALE U RO M O N E YO U T S TA N D I N G P R I VAT E B A N KIN THE MIDDLE EASTH H H H H H H H H HB E S T L O C A L P R I VAT E B A N KIN THE UAEH H HP R I VAT E B A N K E RI N T E R N AT I O N A L MIDDLE EASTG LO B A L B A N K I N G &FINANCE REVIEWB E S T P R I VAT E B A N K I N T H EMIDDLE EASTHG LO B A L F I N A N C EB E S T P R I VAT E B A N KIN THE UAEH H HTHE ASIAN BANKERMIDDLE EAST & AFRICAC O U N T RY AWA R D SB E S T P R I VAT E W E A LT H B A N KIN THE UAEH22B E S T W E A LT H M A N A G E M E N TBANK UAEH HE U RO M O N E YB E S T P R I VAT E B A N K I N T H EU A E F O R P H I L A N T H RO P Y A N DS O C I A L I M PA C T I N V E S T I N GHA S I A N P R I VAT E B A N K E RB E S T P R I VAT E B A N K I N T H EMIDDLE EASTH HP R I VAT E B A N K E RI N T E R N AT I O N A LO U T S TA N D I N G N R I / G L O B A LINDIANS OFFERINGH H H H H HBANKER MIDDLE EASTPWM/THE BANKERB E S T P R I VAT E B A N KIN THE UAEH H HG LO B A L F I N A N C EB E S T W E A LT H M A N A G E M E N TS E RV I C E / P RO P O S I T I O NHB E S T P R I VAT E B A N K I N T H EMIDDLE EASTH H H HPWM/THE BANKERB E S T P R I VAT E B A N K F O RFA M I LY O F F I C E S E RV I C E SIN THE MIDDLE EASTHB E S T P R I VAT E B A N K I N T H EMIDDLE EASTHG LO B A L F I N A N C EE XC E L L E N C E I N C R I S I S :C L I E N T S E RV I C E S – M I D D L EE A S T A N D G L O B A L LYHG LO B A L F I N A N C EG LO B A L F I N A N C EB E S T P R I VAT E B A N K F O RS U S TA I N A B L E I N V E S T I N G MIDDLE EASTH

offers Discretionary Portfolio Management services, that are available in-house through the investment capabilities of Emirates NBD London Branch (regulated by the FCA) and Emirates NBD Asset Management (DIFC, UAE). Discretionary portfolios are constructed and managed to meet the specific needs of the individual investor, providing you house views on assets and best-in-class product selections .