Transcription

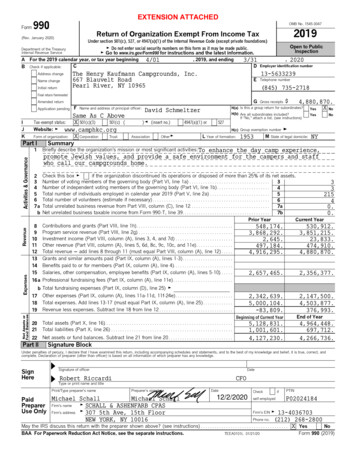

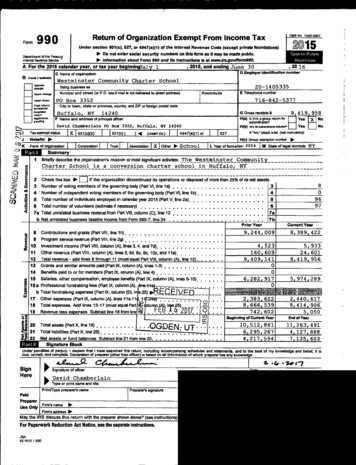

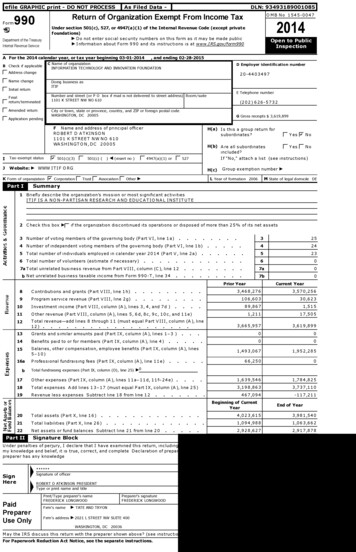

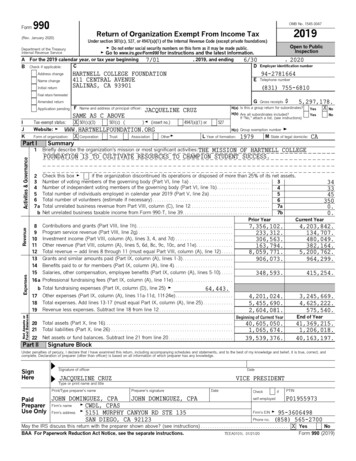

l efileFormGRAPHICprint - DO NOT PROCESSAs Filed Data -DLN: 93409241002078Short FormReturn of Organization Exempt From Income Tax990 -EZOMB NoUnder section 501 (c), 527, or 4947 (a)(1) of the Internal Revenue Code2007(except black lung benefit trust or private foundation)Sponsoring organizations , and controlling organizations as defined in section 512(b)(13)must file Form 990 All other organizations with gross receipts less than 100,000- The organization may have to use a copy of this return to satisfy state reporting requirements.TreasuryInternal RevenueServiceABFor the 2007 calendar year, or tax year beginning 07 - 01-2007Check if applicableIAddress chan g eIName changeI- Initial returnIFinal returnIAmended returnIApplication pendingPleaseuse IRSlabel orprint ortype.SeeSpecificInstruc tions.,2007 , and ending 06-30-2008C Name of organizationKnights of Columbus Council 2758,20D Employer identification number06-0952094Number and street (or P 0 box, if mail is not delivered to street address) Room/suitec/o Christian24 Branch Brook DriveE Telephone number(860) 651 9809City or town, state or country, and ZIP 4Simsbury, CT 06070F Group ExemptionNumber0- 0188G Accounting methodOther (specify) 0-* Section 501(c)( 3) organizations and 4947(a)(1) nonexempt charitable trustsmust attach a completed Schedule A (Form 990 or 990-EZ).HN/AI Websitet o Pu b licI nspec ti on-and total assets less than 250,000 at the end of the year may use this formDepartment of the1545-1150J Organization type (check only one)-F50 1(c) (8) 1 (insert no )I- 4947(a)(1) or527I- Cash(AccrualCheck - F if the organizationis not required to attachSchedule B (Form 990, 990-EZ, or 990-PF)K Check OT if the organization's gross receipts are normally not more than 25,000 The organization need not file a return with the IRS,but if the organization chooses to file a return, be sure to file a complete return Some states require a complete return.L Add lines 5b, 6b, and 7b, to line 9 to determine gross receipts, if 100,000 or more, file Form 990 instead of Form 990-EZN7VIWWContributions, gifts, grants, and similar amounts received12Program service revenue including government fees and contracts23Membership dues and assessments32,1764Investment income411,2975aGross amount from sale of assets other than inventory5a50,801bLess5b56,854cGain or (loss) from sale of assets other than inventory (line 5a less line 5b) (attach schedule)Sc-6,053c5,016cost or other basis and sales expenses61110aSpecial events and activities (attach schedule) If any amount is from gaming , check hereGross revenue (not including reported on line 1) SZof contributions.bLesscNet income or (loss) from special events and activities (line 6a less line 6b)7awdirect expenses other than fundraising expenses6a21,3206b6,304Gross sales of inventory, less returns and allowances7abLess7bcGross profit or (loss) from sales of inventory (line 7a less line 7b)7c8Other revenue (describe81699Total revenue (add lines 1, 2, 3, 4, 5c, 6c, 7c, and 8)922,605cost of goods sold10Grants and similar amounts paid (attach schedule)1013,56611Benefits paid to or for members117512Salaries, other compensation, and employee benefits1213Professional fees and other payments to independent contractors1390014Occupancy, rent, utilities, and maintenance149,77215Printing, publications, postage, and shipping1539116Other expenses (describe )1669917Total expenses (add lines 10 through 16) 1725,40318Excess or (deficit) for the year (line 9 less line 17)18-2,79819Net assets or fund balances at beginning of year (from line 27, column (A)) (must agree withend-of-year figure reported on prior year's return)19193,89320Other changes in net assets or fund balances (attach explanation )2021Net assets or fund balances at end of year (combine lines 18 through 20)21Mli lm191,095Balance Sheets-If Total assets on line 25, column (B) are 250,000 or more, file Form 990 instead of Form 990-EZ(See page 41 of the instructions22Cash, savings, and investments23Land and buildings24Other assets (describe 25Total assets26 Total liabilities (describe 2785,7631C'1aCc1- Revenue - Exnenses and Channes in Net Assets or Fund Balances (See oaae 38 of the instructions(A) Beginning of year193,893(B) End of year22191,0952324)193,893)191,09526Net assetsorfund balances (line 27 of column (B) must agree with line 21)For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions .25193,893Cat No10642127191,095Form 990-EZ (2007)

Form 990-EZ (2007)Page 2TTRUMStatement of Pro g ram Service Accom p lishments (See page 42 of the instructions)Expenses(Required for 501(c)(3)What is the organization's primary exempt purpose? Fratenal benefit organizationand (4) organizations andDescribe what was achieved in carrying out the organization's exempt purposesIn a clear and concise manner,describe the services provided, the number of persons benefited, or other relevant information for each programtitle4947(a)(1) trusts, optionalfor others28 See Additional Data Table(Grants )If this amount includes foreign grants, check here.f28a)If this amount includes foreign grants, check here.f29a)If this amount includes foreign grants, check here0- fl30a29(Grants 30(Grants 310ther program services (attach schedule)(Grants )If this amount includes foreign grants, check here31aF.32 Total program service expenses (add lines 28a through 31a) 3275List of Officers , Directors , Trustees, and Key Employees (List each one even if not compensated See page 42 of the instructions )(A) Name and addressDennis Gacioch6 Field DriveSimsbury, CT 06070Lawrence Christian24 Branch Brook DriveSimsbury, CT 06070Tom Doran10 Wingagte LaneSimsbury, CT 06070(B) Title and average(C) Compensation(D) Contributions to(E) Expensehours per weekdevoted to position( If not paid ,enter -0-.)employee benefit plans &deferred compensationaccount andother allowancesTreasurer 2 000Financial Secty 2 000Grand Knight 2 000Other Information (Note the attachment requirement in General Instruction V, page 14 .)33YesDid the organization engage in any activity not previously reported to the IRS? If "Yes," attach a detaileddescription of each activity.34No33No34NoDid the organization have unrelated business gross income of 1,000 or more or6033(e) notice, reporting, andproxy tax requirements?.35aNoI f "Yes," has i t filed a tax return on Form 990 -T for this year?35bNo36No37bNo38aNoWere any changes made to the organizing or governing documents but not reported to the IRS? If "Yes,"attach a conformed copy of the changesIf the organization had income from business activities, such as those reported on lines 2, 6, and 7 (among others),but not reported on Form 990-T, attach a statement explaining your reason for not reporting the income on Form 990-T35ab36Was there a liquidation, dissolution, termination, or substantial contraction during the year? (If "Yes," attach astatement )37ab38a.Enter amount of political expenditures, direct or indirect, as described in the instructions 0-.37aDid the organization file Form 1120 -POL for this year?Did the organization borrow from, or make any loans to, any officer, director, trustee, or key employee or wereany such loans made in a prior year and still unpaid at the start of the period covered by this return? .b39If "Yes," attach the schedule specified in the line 38 instructions and enter theamount involved38b501(c)(7) organizations. EnteraInitiation fees and capital contributions included on line 9bGross receipts, included on line 9, for public use of club facilities.39a039b0Form 990-EZ (2007)

Form 990-EZ (2007)Page 3Other Information ( Note the attachment requirement in General Instruction V, page 14.) (Continued)40a501(c)(3) organizations. Enter amount of tax imposed on the organization during the year undersection 49111111111b, section 4912 1111111, section 4955 1111111501(c)(3) and (4) organizations. Did the organization engage in any section 4958 excess benefit transaction duringthe year or did it become aware of an excess benefit transaction from a prior year? If "Yes, " attach anexplanation.cEnter amount of tax imposed on organization managers or disqualified personsduring the year under sections 4912, 4955, and 4958111111.dEnter amount of tax on line 40c reimbursed by the organizationFeAll organizations. At any time during the tax year, was the organization atransaction?41List the states with which a copy of this return is filed 111111142aThe books are in care of IPPr Lawrence Christian Fin Sect)YesNo40bNo42cNo24 Branch Brook DriveLocated at 11111 Simsbury, CTb At any time during the calendar year, did the organization have an in ereover a financial account in a foreign country (such as a bank account, seaccount)?If "Yes," enter the name of the foreign country 0See the instructions for exceptions and filing requirements for Form TD FcAt any time during the calendar year, did the organization maintain an office outside of the U S ''If "Yes," enter the name of the foreign country 0-43Section 4947(a)(1) nonexempt charitable trusts filing Form 990-EZ in lieu of Form 1041 -Check hereand enter the amount of tax-exempt interest received or accrued during the tax year.lllpl .I.43Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledgeand belief, it is true, correct, and complete Declaration of preparer (other than officer) is based on all information of which preparer has any knowledgePleaseSign2008-08-28DateSignature of officerHereLawrence Christian Financial SectyType or print name and titleDatePaidPreparer'ssignatureFrederick I Prior CPA CFPPreparersUseOnlyFirm 's name (or yoursif self-employed),address, and ZIP 4Check ifI selfempolyed OFPreparer's SSN or PTIN (See Gen Inst W)EIN MFrederick I Prior CPACourtyard on Mall Way Box 656Phone noF(860) 658-6556Simsbury, CT 060700656Form 990-EZ (2007)

l efile GRAPHIC p rint - DO NOT PROCESSAs Filed Data -DLN: 93409241002078TY 2007 Special Events ScheduleName : Knights of Columbus Council 2758EIN: 06-0952094Software ID: 07000211Software Version : 2007v2.4Event NameGross ReceiptsContributionsGross RevenueDirect Expense321Net Income (Loss)1,7211,7211,400Combined Breakfast1,2001,200Tootsie Roll Sale8,1348,1345177,617Golf Tournament10,26510,2655,4664,7991,200

Additional DataSoftware ID:07000211Software Version :2007v2.4EIN:Name :06 -0952094Knights of Columbus Council 2758Form 990EZ, Part III - Statement of Program Service AccomplishmentsExpenses(Required for 501(c )( 3) and(4) organizations and 4947Describe what was achieved in carrying out the organization ' s exempt purposes . Ina clear and concisemanner, describe the services provided , the number of persons benefited , or other relevant information foreach program title.(a)(1) trusts; optional forothers.)28 Retarded citizens-provide financial support to various organizations providing care and support toretarded people(Grants 10,916)If this amount includes foreign grants, check here.F28a29 Charitable-provide financial support for various charitable organizations in the community(Grants 150)If this amount includes foreign grants, check here .F29a30 scholarship-provide scholarship assistance to young people to help them further their highereducation-scholarship awards were granted to students pursuing college degrees(Grants 2,500)If this amount includes foreign grants, check here .F30aFraternal activities-provide for member participation in religeous, social and community support activitiesand provide aid and comfort for members who are sick or in distress(Grants )If this amount includes foreign grants, check here.F75

l efile GRAPHIC p rint - DO NOT PROCESSAs Filed Data -DLN: 93409241002078TY 2007 Gain/Loss from Sale of Public Securities ScheduleName : Knights of Columbus Council 2758EIN: 06-0952094Software ID: 07000211Software Version : 2007v2.4Gross Sales Price :50,801Basis :56,854Sales Expenses:Total (net):

l efile GRAPHIC p rint - DO NOT PROCESSAs Filed Data -DLN: 93409241002078TY 2007 Grants and Similar Amounts Paid ScheduleName : Knights of Columbus Council 2758EIN: 06-0952094Software ID: 07000211Software Version : 2007v2.4Item No.Class of ActivityDonee ' s NameDonee ' s Address1Disabled-CharitableARC of Farmington Valley16 Sunset Hill RdSimsbury, CT 06070Amount ( FMV)600Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

Item No.Class of ActivityDonee ' s NameDonee ' s Address2Disabled-CharitableCIB Oak Hill- East Hartland123 Mountain Rd EastEast Hartland, CT 06027Amount (FMV)600Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

Item No.Class of ActivityDonee ' s NameDonee ' s Address3Disabled-CharitableColumbian Charities of CTCT Council Knights of ColumbuNew Haven, CT 06510Amount (FMV)1,616Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

Item No.Class of ActivityDonee ' s NameDonee ' s Address4Scholarship-CitizenshipHigh School-Patriotism AwardsVarious-local communityVariouslocal community, CT 06070Amount (FMV)100Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

Item No.Class of ActivityDonee ' s NameDonee ' s Address5Disabled-CharitableConn Chasers Ltd15 Riverside RdSimsbury, CT 06070Amount (FMV)3,600Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

Item No.Class of ActivityDonee ' s NameDonee ' s Address6Disabled-CharitiableSpecial Olympics-Simsbury55 Winterset LaneSimsbury, CT 06070Amount ( FMV)900Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

Item No.Class of Activity7Disabled-CharitableDonee ' s NameSt Mary's Ch Soc Action CornDonee ' s Address880 Hopmeadow StSimsbury, CT 06070Amount ( FMV)600Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

Item No.Class of ActivityDonee's NameDonee ' s Address8Disabled-CharitableFAVARH225 Commerce DRCanton, CT 06019Amount ( FMV)600Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

Item No.Class of Activity9Disabled-CharitableDonee ' s NameOak Hill - Evans Dr Grp HomeDonee ' s Address24 Evans DriveSimsbury, CT 06070Amount ( FMV)600Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

Item No.10Class of ActivityDisabled-CharitableDonee ' s NameSalmon Brook Group HomeDonee's Address65 Salmon Brook StGranby, CT 06035Amount (FMV)600Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

Item No.Class of ActivityDonee ' s NameDonee ' s Address11Disabled-CharitableGreat Pond Group Home38 Great Pond RdSimsbury, CT 06070Amount (FMV)600Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

Item No.Class of ActivityDonee's NameDonee ' s Address12Disabled-CharitableOak Hill Group Home-Hartland47 Old Town RoadHartland, CT 06027Amount ( FMV)600Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

Item No.Class of ActivityDonee ' s NameDonee ' s Address13ScholarshipIndiv-3 college studentsVariousLocal community, CT 06070Amount (FMV)2,500Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

Item No.Class of ActivityDonee ' s NameDonee's Address14Charitable orgsOther grants supportVariousVarious, CT 06070Amount ( FMV)50Purpose of Payment to AffiliateRelationshipDescriptionBook ValueHow BV DeterminedHow FMV DeterminedDate of GiftNone

l efile GRAPHIC p rint - DO NOT PROCESSAs Filed Data -DLN: 93409241002078TY 2007 Other Expenses ScheduleName : Knights of Columbus Council 2758EIN: 06-0952094Software ID: 07000211Software Version : 2007v2.4DescriptionAmountSupplies108Miscellaneous expense134Conferences, Conventions, And Meetings240Carol sing refreshments83Bank and credit card expense76Advertising-KC pubs58

l efile GRAPHIC p rint - DO NOT PROCESSAs Filed Data -DLN: 93409241002078TY 2007 Other Revenues ScheduleName : Knights of Columbus Council 2758EIN: 06-0952094Software ID: 07000211Software Version : 2007v2.4DescriptionRoundingFifty-fifty drawingAmount1170

Instruc- Simsbury, CT 06070 Number 0- 0188 tions. * Section 501(c)(3) organizations and4947(a)(1) nonexemptcharitable trusts GAccounting method I- Cash (Accrual mustattach a completedScheduleA (Form 990or 990-EZ). Other (specify) 0-I Website N/A H Check - F if the organization is not required to attach