Transcription

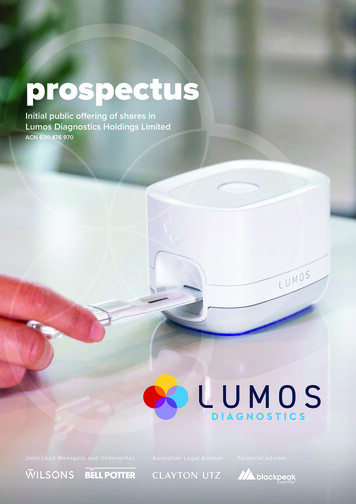

prospectusInitial public offering of shares inLumos Diagnostics Holdings LimitedACN 630 476 970J o i n t Le a d M a n a g e r s a n d U n d e r w r i t e rAu s t r a l i a n Le g a l A d v i s e rFinancial adviser

BImportant NoticesThe OfferThe Offer contained in this Prospectus is an invitation for you to applyfor fully paid ordinary shares (Shares) in Lumos Diagnostics HoldingsLimited ACN 630 476 970 (the Company or Lumos). This Prospectusis issued by the Company and Lumos Diagnostics SaleCo LimitedACN 650 279 511 (SaleCo). See Section 7.1 for further information onthe Offer, including as to details of the securities that will be issuedand transferred under this Prospectus.Lodgement and ListingThis Prospectus is dated Monday, 7 June 2021 and copy was lodgedwith the Australian Securities and Investments Commission (ASIC) onthat date (Prospectus Date).Lumos will apply to the ASX within seven days after the ProspectusDate for admission of the Company to the Official List and quotationof the Shares on the ASX (Listing).None of ASIC, the ASX or their respective officers take anyresponsibility for the content of this Prospectus or for the meritsof the investment to which this Prospectus relates.Lumos, SaleCo, each of their respective directors and officers,Computershare Investor Services Pty Limited (Share Registry) andBell Potter Securities Limited and Wilsons Corporate Finance Limited(the Joint Lead Managers) disclaim all liability, whether in negligenceor otherwise, to persons who trade Shares before receiving theirholding statement.Expiry DateThis Prospectus expires on the date that is 13 months after theProspectus Date (Expiry Date). No Shares will be issued or transferredon the basis of this Prospectus after the Expiry Date.Exposure PeriodThe Corporations Act prohibits Lumos from processing applicationsto subscribe for, or acquire, Shares offered under this Prospectus(Applications) in the seven day period after lodgement of thisProspectus with ASIC (Exposure Period). This Exposure Period maybe extended by ASIC by up to a further seven days.The purpose of the Exposure Period is to enable this Prospectusto be examined by market participants prior to the raising of funds.The examination may result in the identification of deficiencies in thisProspectus, in which case any Application may need to be dealt within accordance with section 724 of the Corporations Act.Applications received during the Exposure Period will not be processeduntil after the expiry of the Exposure Period. No preference will beconferred on any Applications received during the Exposure Period.Not investment adviceThe information contained in this Prospectus is not financial productadvice and does not take into account the investment objectives,financial situation or particular needs (including financial and taxissues) of any prospective investor.It is important that you read this Prospectus carefully and in itsentirety before deciding whether to invest in Lumos. In particular,in considering the prospects of Lumos, you should consider therisk factors that could affect the performance of Lumos. You shouldcarefully consider these risks in light of your investment objectives,financial situation and particular needs (including financial and taxissues) and seek professional guidance from your stockbroker,solicitor, accountant, financial adviser or other independentprofessional adviser before deciding whether to invest in the Shares.Some of the key risk factors that should be considered by prospectiveinvestors are set out in Section 5. There may be risk factors inaddition to these that should be considered in light of your personalcircumstances.You should also consider the assumptions underlying the ForecastFinancial Information set out in Section 4 and the risk factors set outin Section 5 that could affect Lumos’ business, financial condition andresults of operations.No person named in this Prospectus, nor any other person,guarantees the performance of Lumos, the repayment of capital byLumos or the payment of a return on the Shares.No person is authorised to give any information or make anyrepresentation in connection with the Offer which is not contained inthis Prospectus. Any information or representation not so containedmay not be relied on as having been authorised by Lumos or SaleCo,any of either of their Directors, officers, employees, advisers, agents,partners, consultants, representatives, the Joint Lead Managers, anyother Lead Manager Parties (defined below) or any other person inconnection with the Offer.Statements of past performanceThis Prospectus includes information regarding the past performanceof Lumos. Past performance information given in this Prospectusis given for illustrative purposes only. Investors should be awarethat past performance does not represent, and should not be reliedupon as being indicative of, future performance. Actual results coulddiffer materially from the past performance information contained inthis Prospectus.Forward-looking statementsNo person is authorised to give any information or make anyrepresentation in connection with the Offer which is not contained inthis Prospectus. Any information or representation not so containedmay not be relied on as having been authorised by Lumos, SaleCo,the Directors, the SaleCo Directors, the Joint Lead Managers or anyother person in connection with the Offer. You should rely only oninformation in this Prospectus when deciding whether to invest inShares. Except as required by law, and only to the extent so required,neither the Company nor any other person warrants or guarantees thefuture performance of Lumos, or any return on any investment madepursuant to this Prospectus.This Prospectus contains forward-looking statements which arestatements that may be identified by words such as “may”, “will”,“would”, “should”, “could”, “believes”, “estimates”, “expects”, “intends”,“plans”, “anticipates”, “predicts”, “outlook”, “forecasts”, “guidance”and other similar words that involve risks and uncertainties.The Forecast Financial Information is an example of forward-lookingstatements. These statements are based on an assessment ofpresent economic and operating conditions and on a number of bestestimate assumptions regarding future events and actions that, atthe Prospectus Date, are expected to take place (including the keyassumptions set out in Section 4).No person who has made any forward-looking statements in thisProspectus (including Lumos) has any intention to update or reviseforward-looking statements, or to publish prospective financialinformation in the future, regardless of whether new information,future events or any other factors affect the information contained inthis Prospectus, other than to the extent required by law.Such forward-looking statements are not guarantees of futureperformance and involve known and unknown risks, uncertainties,assumptions and other important factors, many of which are beyondthe control of Lumos, the directors and management of Lumos andSaleCo. Forward-looking statements should therefore be read inconjunction with, and are qualified by reference to, Sections 4 and 5,

Lumos Diagnostics Prospectusand other information in this Prospectus. Lumos and SaleCo cannotand do not give any assurance that the results, performanceor achievements expressed or implied by the forward-lookingstatements contained in this Prospectus will actually occur andinvestors are cautioned not to place undue reliance on these forwardlooking statements.RoundingA number of figures, amounts, percentages, estimates, calculationsof value and fractions in this Prospectus are subject to the effect ofrounding. Accordingly, the actual calculation of these figures maydiffer from the figures set out in this Prospectus.No offering where offering would be illegalThis Prospectus does not constitute an offer or invitation in any placein which, or to any person to whom, it would not be lawful to makesuch an offer or invitation. No action has been taken to register orqualify the Shares or the Offer, or to otherwise permit a public offeringof the Shares in any jurisdiction outside Australia. The distribution ofthis Prospectus (including in electronic form) outside Australia maybe restricted by law and persons who come into possession of thisProspectus outside Australia should seek advice on and observe anysuch restrictions. Any failure to comply with such restrictions mayconstitute a violation of applicable securities laws.The Offer is not being extended to any investor outside Australia,other than to certain Institutional Investors as part of the InstitutionalOffer. In particular, this Prospectus may not be distributed to, or reliedupon by, any person in the United States.The Shares have not been, and will not be, registered under theU.S. Securities Act of 1933, as amended (U.S. Securities Act), or thesecurities laws of any state or other jurisdiction of the United States, andmay not be offered or sold, directly or indirectly, in the United Statesunless the Shares have been registered under the U.S. Securities Act orare offered and sold, in a transaction exempt from or not subject to, theregistration requirements of the U.S. Securities Act or the securities lawsof any state or any other jurisdiction in the United States.See Appendix B for more detail on selling restrictions that apply to theOffer and sale of Shares in jurisdictions outside Australia.DisclaimerThe Joint Lead Managers have acted as joint lead managers andunderwriters to the Offer. The Joint Lead Managers, togetherwith their respective related bodies corporate, shareholders andaffiliates and their respective officers, directors, employees, partners,affiliates, agents and advisers (each a Lead Manager Party) have notauthorised, permitted or caused the issue or lodgement, submission,dispatch or provision of this Prospectus, and do not make or purportto make any statement in this Prospectus, and there is no statementin this Prospectus which is based on any statement made by a LeadManager Party. To the maximum extent permitted by law, each LeadManager Party expressly disclaims any and all liabilities (including,without limitation, any liability arising out of fault or negligence forany direct, indirect, consequential or contingent loss or damage)in respect of, and makes no representations or warranties (expressor implied) regarding, and takes no responsibility for, and has notindependently verified, any part of this Prospectus or the Offer(other than references to their name) and makes no representationor warranty as to the currency, accuracy, reliability, completenessor fairness of this Prospectus. The Lead Manager Parties make norecommendations as to whether you or your related parties shouldparticipate in the Offer nor do they make any representations orwarranties to you concerning the Offer, and you represent, warrantand agree that you have not relied on any statements made by aLead Manager Party in relation to the Offer and you further expresslydisclaim that you are in a fiduciary relationship with any of them.1The Lead Manager Parties are involved in, or in the provision of, awide range of financial services and businesses including (withoutlimitation) securities trading and brokerage activities and providingretail, private banking, commercial and investment banking,investment management, corporate finance, securities issuing, creditand derivative, trading and research products and services, including(without limitation) to, or in connection with, persons directly orindirectly involved with the Offer (such as Existing Securityholdersand members of the Board) or interests associated with suchpersons, out of which conflicting interests or duties may arise. In theordinary course of these activities, each of the Lead Manager Partiesmay at any time hold long or short positions, and may trade orotherwise effect transactions, for its own account or the accounts ofcustomers, including (without limitation) in debt or equity securities,loans, financing arrangements, or other financial accommodation,financial products or services, in connection with, or which rely on theperformance of obligations by, interests associated with the ExistingSecurityholders, members of the Board or other persons that may beinvolved in the Offer.Prospectus availabilityThis Prospectus is available in electronic form to Australian residentson the Lumos’ offer website, lumosdiagnostics.com/investors.The Offer constituted by this Prospectus in electronic form is availableonly to Australian residents accessing the website within Australiaand is not available to persons in any other jurisdictions, including theUnited States.A hard copy of the Prospectus is available free of charge during theOffer Period to any person in Australia by calling the Lumos OfferInformation Line on 1300 040 690 (toll free within Australia) between8:30am and 5.00pm (Sydney time), Monday to Friday.Applications and PrivacyApplications for Shares may only be made on the ApplicationForm attached to, or accompanying, this Prospectus in itshard copy form, or in its soft copy form available online atlumosdiagnostics.com/investors, together with an electronic copy ofthis Prospectus. By making an Application, you declare that you weregiven access to the Prospectus, together with an Application Form.The Corporations Act prohibits any person from passing theApplication Form on to another person unless it is attached to,or accompanied by, this Prospectus in its paper copy form or thecomplete and unaltered electronic version of this Prospectus.By completing an Application Form, you are providing personalinformation to Lumos and SaleCo through the Share Registry,which is contracted by Lumos to manage Applications. Lumos andSaleCo, and the Share Registry on their behalf, and their agents andservice providers may collect, hold, disclose and use that personalinformation to process your Application, service your needs as aShareholder, provide facilities and services that you request and carryout appropriate administration, and for other purposes related to yourinvestment listed below.If you do not provide the information requested in the ApplicationForm, Lumos, SaleCo and the Share Registry may not be able toprocess or accept your Application.Once you become a Shareholder, the Corporations Act and Australiantaxation legislation require information about you (including yourname, address and details of the Shares you hold) to be includedon the Share register. In accordance with the requirements of theCorporations Act, information on the Share register will be accessibleby members of the public. The information must continue to beincluded on the Share register if you cease to be a Shareholder.

2Important NoticesLumos and the Share Registry may disclose your personal informationfor purposes related to your investment to their agents and serviceproviders including those listed below or as otherwise authorisedunder the Privacy Act 1988 (Cth):Investors should note that industry and sector data and statistics areinherently predictive and subject to uncertainty and not necessarilyreflective of actual industry or market conditions. the Share Registry for ongoing administration of the Share register;Third Party Reports the Joint Lead Managers to assess your Application; printers and other companies for the purposes of preparation anddistribution of documents and for handling mail; market research companies for analysing Lumos’ shareholder base;and legal and accounting firms, auditors, management consultants andother advisers for administering, and advising on, the Shares andfor associated actions.Lumos’ agents and service providers may be located outside Australiawhere your personal information may not receive the same level ofprotection as that afforded under Australian law.You may request access to your personal information held by oron behalf of Lumos and SaleCo. You may be required to pay areasonable charge to the Share Registry in order to access yourpersonal information.You can request access to your personal information or obtain furtherinformation about Lumos’ privacy practices by contacting the ShareRegistry as follows: Telephone: Telephone: 1300 850 505 Address: Yarra Falls, Computershare Investor Services Pty Ltd,452 Johnston Street, Abbotsford VIC 3067Lumos aims to ensure that the personal information it retains aboutyou is accurate, complete and up-to-date. To assist with this, pleasecontact Lumos or the Share Registry if any of the details you haveprovided change.No cooling-off rightsCooling-off rights do not apply to an investment in Shares pursuantto the Offer. This means that, in most circumstances, you cannotwithdraw your Application once it has been accepted.Defined terms and abbreviationsDefined terms and abbreviations used in this Prospectus, unlessspecified otherwise, have the meaning given in the glossary. Unlessotherwise stated or implied, references to times in this Prospectus areto (Sydney time).Unless otherwise stated or implied, references to dates or years arecalendar year references.Photographs and diagramsPhotographs and diagrams used in this Prospectus that do not havedescriptions are for illustration only and should not be interpreted tomean that any person shown in them endorses this Prospectus orits contents or that the assets shown in them are owned by Lumos.Diagrams used in this Prospectus are illustrative only and may notbe drawn to scale or accurately represent the technical aspects ofthe products.Market and industry dataThis Prospectus (and in particular Section 2) contains data relatingto the industries, segments, sectors and channels in whichLumos operates.Any statements, data or other contents referenced or attributed toreports by a third party (each a Third Party Report) in this Prospectusrepresent research opinions or viewpoints only of that third party, andare in no way to be construed as statements of fact. No third partyauthor makes any representation or guarantee as to the accuracyor completeness of any information upon which a view, opinion orforecast or information contained in any Third Party Report is based.Any views, opinions or predictions contained in a Third Party Reportis subject to inherent risks and uncertainties, and third parties do notaccept responsibility for actual results or future events. Any statementmade in a Third Party Report is made as at the date of or as specifiedin that Third Party Report and any forecasts or expressions of opinionare subject to future change without notice by any respective thirdparty author of such reports. As such, investors are cautioned not toplace undue reliance on such information. A third party is not obligedto, and will not, update or revise any content of a Third Party Reportirrespective of any changes, events, conditions, availability of newinformation or other factors which may occur subsequent to the dateof that Third Party Report. The Third Party Reports do not representinvestment advice nor do they provide an opinion regarding themerits of the Offer.Consent not sought for certain statementsUnless specifically noted in Section 10.7, statements made by,attributed to or based on statements by third parties have not beenconsented to for the purpose of section 729 of the CorporationsAct and are included in this Prospectus on the basis of ASICCorporations (Consents to Statements) Instrument 2016/72 relief fromthe Corporations Act for statements used from books, journals orcomparable publications.Investigating Accountant’s Report and FinancialServices GuideThe provider of the Investigating Accountant’s Report on theFinancial Information is required to provide Australian retail clientswith a Financial Services Guide in relation to that review underthe Corporations Act. The Investigating Accountant’s Report andaccompanying Financial Services Guide is provided in Section 8.Intellectual PropertyThis Prospectus may contain trademarks of third parties, which are theproperty of their respective owners. Third-party trademarks used inthis Prospectus belong to the relevant owners and use is not intendedto represent sponsorship, approval or association by or with us.WebsiteAny references to documents included on Lumos’ website(https://lumosdiagnostics.com) are provided for convenience only, andnone of the documents or other information on Lumos’ website, orany other website referred in this Prospectus, is incorporated in thisProspectus by reference.QuestionsIf you have any questions in relation to the Offer, contact theLumos Offer Information Line on 1300 040 690 between 8:30 amand 5:00 pm (Sydney time), Monday to Friday.This document is important and should be read in its entirety.

Lumos Diagnostics ProspectusTable of ContentsImportant NoticesIFCKey Offer Details4Letter from the Chair61.Investment Highlights82.Industry Overview313.Company Overview574.Financial Information915.Key Risks1256.Key People, Interests and Benefit1377.Details of the Offer1598.Investigating Accountant’s Report1739.Intellectual Property Report18210. Additional Information21011. Summary of Significant Accounting Policies22412. Foreign Selling Restrictions231Glossary234Corporate Directory2453

4Key Offer DetailsKey Offer StatisticsOffer Price 1.25 per ShareTotal proceeds of the Offer 63.0mPrimary proceeds of the Offer to be paid to Lumos 38.0mProceeds of the Offer to be paid to the Selling Shareholders 25.0mTotal number of Shares to be issued under the Offer30.4mTotal number of Shares to be sold under the Offer20.0mNumber of Shares to be held by Existing Securityholders on Completion2,399.8mTotal number of Shares on issue at Completion3150.2mIndicative market capitalisation at the Offer Price4 187.7mPro forma net cash as at 31 December 2020 47.2mEnterprise value at the Offer Price5Enterprise value/pro forma FY21F revenue6 140.5m5.9xNotes:1. This table contains Forecast Financial Information and information derived from the Forecast Financial Information. The Forecast FinancialInformation is based on certain assumptions as discussed in Section 4 and should be read in conjunction with the discussion of the ProForma Financial Information in Section 4, the sensitivities set out in Section 4.7, the significant accounting policies summarised in AppendixA, and is subject to the key risks set out in Section 5. Certain financial information in this Prospectus is described as pro forma for thereasons described in Section 4.2. Forecasts have been included in this Prospectus for FY21F. There is no guarantee that the forecasts willbe achieved.2. Existing Securityholders may acquire additional Shares under the Offer.3. The exact number of Shares to be on issue (or held by particular Existing Securityholders) at Completion will depend on the dateCompletion occurs. This is because the number of Shares that Pre-IPO Convertible Notes convert into is determined by reference to theaggregate face value and interest accrued in respect of those notes at the date the number of those Shares is calculated. For this purpose,the Prospectus assumes that Completion occurs on the date indicated in the Important Dates table below. If Completion occurs on adifferent date, and the number of Shares to be on issue at Completion varies from that indicated in this Prospectus, Lumos will publish thatnumber of Shares to ASX at the time of Listing.4. Indicative market capitalisation at the Offer Price is defined as the Offer Price multiplied by the total number of Shares on issue at Completion.5. Enterprise value at the Offer Price is defined as the indicative market capitalisation at the Offer Price, less pro forma cash of 47.2m as at31 December 2020.6. Enterprise value/pro forma FY21F revenue is calculated as the enterprise value at the Offer Price divided by pro forma FY21F revenueof 23.8m.This Prospectus assumes all forward looking forecast financial tables are stated at the exchange rate of AUD0.78/USD1.00.

Lumos Diagnostics Prospectus5Important DatesProspectus DateOpening date of the Broker Firm Offer and Priority OfferClosing date of the Broker Firm Offer and Priority OfferMonday, 7 June 2021Tuesday, 15 June 2021Wednesday, 23 June 2021Settlement of the OfferMonday, 28 June 2021Completion of the OfferTuesday, 29 June 2021Expected dispatch of holding statementsExpected commencement of trading on the ASXWednesday, 30 June 2021Monday, 5 July 2021Note: This timetable is indicative only and may change without notice. Unless otherwise indicated, all references to time are to the time inSydney, NSW. The Company and SaleCo, in consultation with the Joint Lead Managers, reserves the right to vary any and all of the abovedates and times without notice (including, subject to ASX Listing Rules and the Corporations Act, to close the Offer early, to extend the ClosingDate, to accept late Applications or bids, either generally or in particular cases, or to cancel or withdraw the Offer, in each case withoutnotifying any recipient of this Prospectus or any applicants). If the Offer is cancelled or withdrawn, then all application monies will be refundedin full (without interest) as soon as possible in accordance with the requirements of the Corporations Act. Investors are encouraged to submittheir Applications as early as possible after the Offer opens.How to investApplications for Shares can only be made by completing and lodging the Application Form attached to or accompanyingthis Prospectus.Instructions on how to apply for Shares are set out in Section 7 of this Prospectus and on the back of the Application Form.

6Letter from the ChairDear investor,On behalf of the board, it is my pleasure to offer you the opportunity to become a shareholder in Lumos Diagnostics HoldingsLimited (Lumos).Lumos is a fully integrated developer and manufacturer of point-of-care (POC) diagnostic tests, with corporate headquarters inMelbourne Australia, and manufacturing facilities in California and Florida in the United States. The business was founded in 2015by Planet Innovation (located in Melbourne, Australia) and merged with Florida-based Rapid Pathogen Screening, Inc. in 2019.Lumos develops and manufactures proprietary and in-licensed POC diagnostic tests for commercial sale through distributorsunder its Products division, and develops and manufactures POC diagnostic tests for clients under fee-based commercialcontracts, under its Commercial Services division. Lumos’ Products and Commercial Services divisions are underpinned by itstechnology platform, which includes Lumos’ patents, know-how, expertise, skills and capabilities for developing lateral flow POCdiagnostic tests for different commercial applications and markets, in addition to a range of customisable digital reader formatsand digital applications (hardware and software tools) developed by Lumos.In FY20, Lumos launched FebriDx , a POC diagnostic test that is able to rapidly identify patients with a microbial infection and,if positive, determine if that infection is caused by a virus or bacteria. Lumos has already appointed distributors and commencedinitial commercial sales of FebriDx in target markets including the United Kingdom, Germany and Canada. An initial 510(k)submission for regulatory clearance for FebriDx in the United States is currently under review with the US Food and DrugAdministration (FDA) for the use of FebriDx to differentiate viral from bacterial infection in patients with acute respiratoryinfections. Subject to approval from the FDA for FebriDx , Lumos intends to launch the product into the United States market.Lumos is led by an experienced senior leadership team and has a track record of achieving revenue growth. For example,in 1H21 Lumos’ Commercial Services division generated revenue of 9.8m compared to revenue of 3.3m in 1H20, while itsProducts division generated 1H21 revenue of 1.7m compared to revenue of 0.1m for 1H20. Lumos made a pro-forma EBITDAloss of 17.7m in FY20, reflecting continued investment in sales and marketing, clinical trials, facilities expansion, manufacturingscale-up, research & development and building out the senior leadership team and is not expected to be profitable in theprospectus forecast period.The purpose of the offer is to provide funding and financial flexibility to support Lumos’ growth strategy and future growthopportunities; broaden Lumos’ shareholder base and provide a liquid market for shares; provide Lumos with the benefitsof an increased brand profile that may arise from being a publicly listed entity; and provide existing securityholders with anopportunity to realise a portion of their investment in Lumos.The offer will raise 63.0m at 1.25 per share, comprising the offer of 38.0m of new shares by Lumos, and 25.0m of existingshares allowing existing securityholders an opportunity to realise part of their investment in Lumos. Upon completion ofthe offer, new shareholders are expected to hold approximately 33.6% of Lumos shares. Existing securityholders will retainapproximately 66.4% of Lumos shares, of which approximately 75.6% of those shares will be escrowed voluntarily following thecompletion of the offer, with a staged release.This prospectus contains detailed information about the offer, the industry in which Lumos operates, Lumos’ growth strategies,and its financial and operating performance. Risk factors that could affect Lumos’ business, including its financial position,performance and prospects, include risks in relation to regulatory approvals and responsibilities; product acceptance; relianceon distributors and clients and suppliers; timing of orders and services; and risks in investing in shares generally. These andother risk factors are described in further detail in section 5 and should be considered in detail before making any investmentdecision. It is important that you read this prospectus in its entirety, and if you have any queries c

limitation) securities trading and brokerage activities and providing retail, private banking, commercial and investment banking, investment management, corporate finance, securities issuing, credit and derivative, trading and research products and services, including (without limitation) to, or in connection with, persons directly or