Transcription

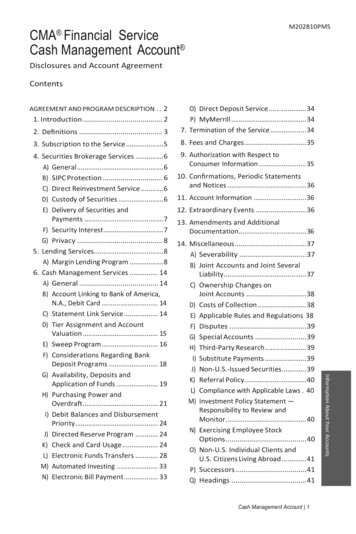

CMA Financial ServiceCash Management Account M202810PMSDisclosures and Account AgreementContents2. Definitions . 3O) Direct Deposit Service.34P) MyMerrill.347. Termination of the Service .343. Subscription to the Service.58. Fees and Charges.354. Securities Brokerage Services .6A) General.6B) SIPC Protection . 6C) Direct Reinvestment Service .6D) Custody of Securities .6E) Delivery of Securities andPayments .7F) Security Interest.7G) Privacy . 85. Lending Services.8A) Margin Lending Program .86. Cash Management Services . 14A) General . 14B) Account Linking to Bank of America,N.A., Debit Card . 14C) Statement Link Service. 14D) Tier Assignment and AccountValuation . 15E) Sweep Program. 16F) Considerations Regarding BankDeposit Programs . 18G) Availability, Deposits andApplication of Funds . 19H) Purchasing Power andOverdraft. 21I) Debit Balances and DisbursementPriority. 24J) Directed Reserve Program . 24K) Check and Card Usage. 24L) Electronic Funds Transfers . 28M) Automated Investing . 33N) Electronic Bill Payment. 339. Authorization with Respect toConsumer Information .35AGREEMENT AND PROGRAM DESCRIPTION . . 21. Introduction . 210. Confirmations, Periodic Statementsand Notices .3611. Account Information .3612. Extraordinary Events .3613. Amendments and AdditionalDocumentation.36Cash Management Account 1Information About Your Accounts14. Miscellaneous.37A) Severability .37B) Joint Accounts and Joint SeveralLiability.37C) Ownership Changes onJoint Accounts .38D) Costs of Collection.38E) Applicable Rules and Regulations 38F) Disputes .39G) Special Accounts .39H) Third-Party Research.39I) Substitute Payments .39J) Non-U.S.-Issued Securities.39K) Referral Policy.40L) Compliance with Applicable Laws . 40M) Investment Policy Statement —Responsibility to Review andMonitor.40N) Exercising Employee StockOptions.40O) Non-U.S. Individual Clients andU.S. Citizens Living Abroad .41P) Successors.41Q) Headings .41

R) Integration . . . . . . . . . . . . . . . . . . . 4115. Representations as to Ownership andCapacity to Enter into Agreement . . . 4116. Applicable Laws . . . . . . . . . . . . . . . . . . 4217. Customer Information andDue Diligence . . . . . . . . . . . . . . . . . . . 42About the CMA Annual AccountFee Waiver Program . . . . . . . . . . . . . . . . 43About the Merrill Lynch Bank DepositProgram . . . . . . . . . . . . . . . . . . . . . . . . . . 47Margin Truth-in-Lending DisclosureStatement . . . . . . . . . . . . . . . . . . . . . . . . 55Securities-Based Loan DisclosureStatement . . . . . . . . . . . . . . . . . . . . . . . . 58Appendix - CMA Account Fees . . . . . . . . 62The following pages contain the disclosures andagreement governing your CMA Account, includingdisclosures required by federal law.Agreement and ProgramDescription1. INTRODUCTIONTis Agreement and Program Description(“Agreement”), as amended from time to timeby Merrill Lynch, Pierce, Fenner & SmithIncorporated (“Merrill Lynch”), sets forth theterms and conditions governing the CashManagement Account (CMA ) financialservice (“Service”). Afer you open anaccount, you will receive a welcome kit,which includes confirmation about theaccount features and services you haveselected as well as other importantdisclosures. Te Service is an integratedfinancial service linking two components: (1)securities brokerage services; and (2) CashManagement Services including the Visa deferred debit card and check writingfeatures. Although these Cash ManagementServices are intended to provide you withaccess to assets in the account, CMAAccounts are not bank accounts. In addition,the Service includes the CMA Master2 Cash Management AccountFinancial Service consisting of: (1) a MasterCMA Account established with the servicesdescribed above; and (2) one or more CMASubAccounts . CMA SubAccounts have thesame investment capabilities as CMAAccounts, but do not ofer Visa cards, checkwriting and certain optional services. CMASubAccounts are also charged a diferentannual account fee and may be used tosegregate investments (for another familymember, for instance, or for a specificpurpose such as college funding). For moreinformation on fees, see the Appendix.Certain aspects of the Service, such asChecks, Cards, and/or the Margin LendingProgram, may not be available for Accountsthat are enrolled in an investment advisoryprogram or are in the process of enrolling inan investment advisory program. Additionally,your ability to direct trades and purchasesecurities in your Account may be limited ifyour Account is enrolled in an investmentadvisory program or in the process ofenrolling in an investment advisory program.Te services provided by, and the terms andconditions of, the investment advisoryprogram you select will be described inseparate documentation.Once you have established a CMA Accountand we have your signed and returned ClientRelationship Agreement, you may be eligibleto open additional CMA Accounts and/orenroll in optional services at a later datewithout completing a new Client RelationshipAgreement. Please see the ClientRelationship Agreement for more details.You agree to read this Agreement and retaina copy for your records. You acknowledgereceipt of the Merrill Lynch Bank DepositProgram Disclosure Statement, Appendix:CMA Account Fees, the Margin Truth-inLending Disclosure Statement and theSecurities-Based Loan Disclosure Statement,if applicable, all of which are referred to asthe “Documents” for purposes of thisAgreement. Te Documents, which containadditional terms governing the Service, are

incorporated into this Agreement and made apart hereof. Unless the context otherwiserequires, the term “Agreement” shall includethe Documents, as amended from time totime by Merrill Lynch. You certify that allinformation you provide in connection withthe establishment of your accounts, includingin reference to checks andVisa cards, is true and correct and thatMerrill Lynch, the Banks and UMB Bank, n.a.,may rely on and verify such information.Unless otherwise indicated, the Agreementapplies to CMA Accounts. Merrill Lynch ofersCMA Accounts, as well as various productsand services, through diferent servicemodels, including the client self-directed andfull-service channels. Based on the servicemodel, the same or similar account, productor service may vary in its price or feescharged to clients.2. DEFINITIONSIn this Agreement:“Account Value” means the value of cash,Bank Deposits, and long market value ofsecurities held as part of the Statement Link.“ACH” means Automated Clearing House. TeACH Network is a nationwide electronicpayment system used to transfer fundsbetween participating financial institutions.“Agreement” means the CMA FinancialService Cash Management AccountDisclosures and Account Agreement and theDocuments as amended from time to time.“BA-CA” means Bank of America California,N.A., its successors or assigns.“BANA” means Bank of America, N.A., itssuccessors or assigns.“Banks” means BANA, BA-CA, MLBTC andany other afliated depository institutionsparticipating from time to time.“Bank Deposits” means the MLBDP, ISA,International Bank Variable Rate DepositFacility and Preferred Deposit.“BTA” means Bank Transaction Account.“Business Day” means any day in whichboth the New York Stock Exchange and NewYork banks are open for business.“Card” or “Card(s)” means a Merrill LynchCMA Access Visa Debit card(s) issued byBANA for use with the CMA Account.“Cash Balance” means any uninvested cashbalance resulting from incoming receiptssuch as check deposits, cash deposits, ACHdeposits, Fedwire receipts or the proceedsfrom the sale of securities. Tis is also knownas your free credit balance.“Cash Management Services” meansservices such as bank deposit programsavailable through the Sweep Program, checkwriting, Visa debit card and ACH.“Checks” means checks provided byMerrill Lynch for use with the CMA Accountby Merrill Lynch’s third-party processinginstitution.“CMA Account” means a Cash ManagementAccount established for you, which is either acash account or, if you elect, a marginaccount.“CMA Master Financial Service” means theservice that consists of a Master CMACash Management Account 3Information About Your Accounts“Authorized cardholder(s)” means thecardholder(s) selected by you on theAdditional check and/or Visa cardAuthorization and Agreement Form to have aVisa card that is attached to your CMAAccount. Authority includes the power, onyour behalf, to use credit/charge cards andexecute sales drafs or cash advance drafson your CMA Accounts and borrow moneyfrom Merrill Lynch’s afliate should anoverdraf advance be made through yourCMA Account.“Availability Delay” means the amount oftime before a deposit to your CMA Accountwill become available for the Sweep Programor to pay Disbursements and other amountsdue.

Account and one or more related CMASubAccounts.“LMA” means the Loan ManagementAccount credit facility provided by BANA.“CMA SubAccount” means the underlyingaccounts, tied to a CMA Master Account,established as part of the CMA MasterFinancial Service.“Master CMA Account” means the CMAAccount designated as the Master Account inthe CMA Master Financial Service.“Merrill Lynch” means Merrill Lynch, Pierce,“CMAT” means CMA for Trust. A CMA for Trust Fenner & Smith Incorporated, its successorsAccount is a CMA Account that holdsand/or assigns.personal trust assets.“Merrill Lynch Bank Deposit Program,”“Customer,” “Client,” “You,” “Your” or“MLBDP” or “MLBD Program” is available“Yours” means the individual(s) entering into through the Sweep Program. MLBDPthis Agreement.balances may receive a tiered interest ratebased on the total value of a Statement Link.“DDA” means Demand Deposit Account.MLBDP balances are held in specifieddeposit accounts established for you by“Deposit Account” means the BTA andMMDAs established through the Merrill Lynch Merrill Lynch as your agent with BANA and/orBA-CA for the CMA Account. Deposits in theBank Deposit Program.Merrill Lynch Bank Deposit Program are“Disbursement Priority” means the order in insured by the FDIC for up to 250,000 perwhich available cash, Money Accountdepositor, per ownership category, per bank.balances or credit facilities are used to pay“MLBTC” means Merrill Lynch Bank and Trustfor Disbursements.Company (Cayman) Limited, an afliated“Disbursements” means the items paid from bank incorporated in the Cayman Islands.the CMA Account and includes Visa“MMDA” means Money Market Deposittransactions, checks, cash advances,Account.Fedwire and ACH transactions and similaritems.“Money Accounts” means the Merrill Lynch“FDIC” means the Federal Deposit Insurance Bank Deposit Program and the ISA Program.For non-U.S. residents that are also non-U.S.Corporation.citizens, “Money Accounts” means the“FTS” means “Te Funds Transfer Service.”International Bank Variable Rate DepositFTS provides clients a way to move money by Facility.phone or through MyMerrill at no charge.“PIN” means personal identification number.Clients can move money between eligibleMerrill Lynch accounts or between eligible“Primary Money Account” means theMerrill Lynch accounts and non-Merrill Lynchautomatic sweep of Cash Balances into theaccounts such as checking, savings or moneyMLBDP or for non-U.S. resident clients whomarket deposit accounts at their bank,are also non-U. S. citizens, the Primary Moneysavings association or credit union.Account means the MLBDP or theInternational Bank Variable Rate Deposit“Investment Advisory Service” means oneFacility.of the managed money services madeavailable from time to time by or through“Purchasing Power” means the amountMerrill Lynch or an afliated company.available for cash management transactions,securities purchases or Disbursements.“ISA” or “ISA Program” means the InsuredSavings Account.4 Cash Management Account

“Secondary Money Account” means aMoney Account that is available for depositby contacting your financial advisor. ASecondary Money Account providesautomatic withdrawal to cover Visa charges,checks and other cash managementtransactions, including security purchaseswhen your Primary Money Account isdepleted.“Securities and Other Property” includes,but is not limited to, money, securities,securities entitlements, financial assets,investment property, financial instrumentsand commodities of every kind and nature,and all contracts and options relatingthereto, whether for present or futuredelivery. Tis includes Securities and OtherProperty currently or in the future held,carried or maintained by us or by any of ourafliates, in our possession or control (or thepossession or control of our afliates) for anypurpose, for any of your accounts now or inthe future opened, including any accounts inwhich you may have an interest.“Service” means the CMA Financial Service.“SIPC” means the Securities InvestorProtection Corporation.“SMDIA” means the Standard MaximumDeposit Insurance Amount.“Stock Borrow Charge” or “SB Charge”refers to a premium charged for borrowingcertain securities in connection with shortsale transactions.“Sweep Program” means the automaticdeposit of available Cash Balances into thePrimary Money Account as well as anautomatic withdrawal to cover Visa charges,“TMA account” means Trust ManagementAccount.“UMB Bank n.a.” means United MissouriBank, n.a., its successors or assigns.3. SUBSCRIPTION TO THE SERVICETo open an account (includes CMA Account,CMA SubAccount or CMAT), you must providecertain information about yourself and otheraccount holders. Once you have providedthis information and completed a ClientRelationship Agreement, you may be eligibleto open or activate new accounts or certainservices without completing additionaldocumentation. If you need a copy of ourClient Relationship Agreement, call yourfinancial advisor or 800.MERRILL(800.637.7455), or visit your nearestMerrill Lynch branch ofce. You may open aCMA Account with a minimum of 20,000 inany combination of cash and securities( 2,000 for CMA SubAccounts). For certaingroup plans and special accounts, theminimums may be diferent.You may only open CMA SubAccounts foryourself or with members of your householdwho reside at your address and share aMerrill Lynch financial advisor. Unless youindicate otherwise, all CMA SubAccountstatements and notices will go to the mailingaddress we have on record for your MasterCMA Account. In addition, to the extentconfirmed to you when your CMA SubAccountwas established, you authorize Merrill Lynchto accept instructions from the CMA Accountholder for the transfer of any cash andsecurities between such accounts. If anerroneous transfer is made, you authorize usto initiate appropriate corrections. Teseauthorizations will remain in efect until weare notified otherwise in writing. Merrill Lynchwill establish accounts for you with BANA forcards and with Merrill Lynch’s third-partyprocessing institutions and Bank of Americafor check clearing, incoming Fedwires andCash Management Account 5Information About Your Accounts“Statement Link” means the accountsthat have been linked for valuation andmailing purposes. You are able to link eligibleMerrill Lynch accounts together for valuationand other purposes, such as the ability tohave all of your statements packaged in oneenvelope, ofering convenience and efectiveaccount management.checks and other cash managementtransactions, including security purchases.

receiving ACH transactions. Merrill Lynchreserves the right to alter or waive theconditions of subscription to the Serviceand also reserves the right to reject anyapplication to subscribe to the Service orany of its features for any reason.the CMA Account, including the rightsdescribed in Section 5(A).(B) SIPC PROTECTIONTe securities and cash that Merrill Lynchholds in your CMA Account are protected bythe SIPC. If a U.S. broker-dealer fails, SIPCCMA ACCOUNT FOR TRUSTfunds are available to make up for anyshortfall of clients’ assets that the brokerMerrill Lynch understands that trusteesdealer was required to maintain — up to ahave unique needs. Trough the U.S. Trustmaximum of 500,000 per client forCompany division of BANA, we ofer a fullrange of fiduciary services. We also ofer trust securities, inclusive of up to 250,000 perservices directly to our CMAT clients. You can client for cash. In addition, Merrill Lynch hasobtained “excess- SIPC” coverage from aenroll your CMAT in the Trust AdministrativeAdvantage service. Trough this service, U.S. Lloyd’s of London syndicate for large clientaccounts. Tis policy provides furtherTrust Company provides trust accounting,protection (including up to 1.9 million forfiduciary income tax preparation andcash) for customers who have received fullbill payment services, as well as otherSIPC limits, subject to an aggregate loss limittrust-related services. You can access theof 1 billion for all customer claims. SIPC andU.S. Trust Company’s elder care servicesthe excess coverage do not protect againstprovider at preferred prices. Trough thisinvestment losses from market action. Youservice you can gain access to a nationalmay obtain further information about theprovider of comprehensive long-term-careservices for beneficiaries. You can access our SIPC, including the SIPC brochure, via theSIPC’s website at sipc.org or by calling thehistorical pricing and valuation service(described within) to assist you in theSIPC at 202.371.8300.valuation of trust assets for gif, estate tax orEach account held by a separate customerother administrative purposes. Call your(as defined by applicable law) is treatedfinancial advisor for more information aboutseparately for purposes of SIPC protection.these services.4. SECURITIES BROKERAGESERVICES(A) GENERALTe CMA Account may be used to purchase,sell and hold securities and otherinvestments available from or throughMerrill Lynch. Trades are made through yourfinancial advisor upon your instructions. Ifthe CMA Account includes the MarginLending Program, it may also be used topurchase and sell securities on credit or toobtain loans based on the current marginloan value of securities in the CMA Account.Whether or not the Account is a marginaccount, Merrill Lynch shall have all of thelegal rights of secured credit with respect to6 Cash Management Account(C) DIRECT REINVESTMENT SERVICEBy enrolling in the Direct ReinvestmentService, you can have dividends from allNew York Stock Exchange, American StockExchange and Nasdaq Stock Market-listedstocks and most mutual funds automaticallyreinvested into more shares of the samestock or fund without commission charges.Call your financial advisor or 800.MERRILL(800.637.7455) for more information on thisservice.(D) CUSTODY OF SECURITIESMerrill Lynch will hold all securities for theCMA Account in a control location acceptableto the U.S. Securities and ExchangeCommission (SEC), which may include, but is

not limited to: (i) a securities depository, suchas the federally regulated Depository TrustCompany for U.S. issuers and Euroclear forEuropean issuers; (ii) a Federal Reservemember bank; or (iii) a mutual fund’s transferagent. Securities are commingled in aMerrill Lynch book-entry account, generallyheld in nominee name at the control location,along with securities belonging to otherMerrill Lynch customers. Your securities willat all times be separately identified on thebooks and records of Merrill Lynch asbelonging to you, and Merrill Lynch willprovide you with statements that reflect yourholdings. Tis method of custody, which hassignificantly increased efciencies andreduced the risks associated with holdingcustomer securities, is used by all majorbanks, trust companies and brokerage firms,and has been recognized as providingunsurpassed safety for holders of securities.With regard to the custody of your securities,Merrill Lynch acts as your agent andtransmits your instructions through theappropriate control location. Wheresecurities are not held in nominee name, theissuer or control location, as appropriate,recognizes Merrill Lynch as your agent andhonors instructions provided by Merrill Lynchon your behalf.received promptly, Merrill Lynch will liquidatethe position unless an extension is obtained.Under exceptional circumstances andsubject to Merrill Lynch’s rights to liquidate,Merrill Lynch, on your behalf, may (in its solediscretion) apply for an extension from aregulatory organization. If Merrill Lynch doesso, you will be charged an extension fee. Ifthe position is liquidated, you will beresponsible for any resulting deficiency, feesand late charges. Fees will be automaticallydebited from the CMA Account and aresubject to change. If you elect to take deliveryof securities, the account statement willevidence delivery once they have beenmailed to you. If you do not receive them, youagree to notify Merrill Lynch promptly so thatreplacement proceedings can begin. If youfail to notify Merrill Lynch within six months ofthe delivery date shown on the accountstatement, you will be responsible forreplacing the securities through the transferagent and will have to pay all costs.Cash Management Account 7Information About Your AccountsSecurities purchased will be held in the CMAAccount unless you request delivery to you oryour designee, in which case Merrill Lynchwill forward your instructions to thecompany’s transfer agent afer payment isreceived. Delivery normally takes severalweeks afer the purchase has been settledand fully paid for. Delivery of securities may(E) DELIVERY OF SECURITIES ANDnot be available for issues that are held inPAYMENTSbook-entry form. Depending on the issuer,When buying or selling securities, there areyou may have the option of taking delivery oftwo key dates involved in the transaction. Tea security to be held in direct registrationfirst date is the trade date, which is the datewith the issuer’s transfer agent.that the order is executed. Te second is thesettlement date, at which time the transfer of (F) SECURITY INTERESTownership passes from the seller to theWhether or not the CMA Account is a marginbuyer. Typically, the settlement date is theaccount, all Securities and Other Property inday when payment is due for purchases orany account, now or hereafer held, carriedwhen securities are due for sales. Unless youor maintained by Merrill Lynch or by any of itsare enrolled in our Margin Lending Program,afliates in Merrill Lynch’s possession andtrades must be conducted on a “fully paidcontrol, or in the possession and control ofbasis,” meaning they must be paid in full onany such afliate, for any purpose, in or forthe settlement date. If you wish to trade onany account of yours, now or hereafermargin, your account must be enrolled in ouropened, including any account in which youMargin Lending Program. If payment is not

may have an interest (other than retirementaccounts, such as IRAs), shall be subject to alien for the discharge of all the indebtednessand other obligations of you to Merrill Lynchand are held by Merrill Lynch as security forthe payment of any liability or indebtednessof you to Merrill Lynch in any of saidaccounts. Securities and Other Property heldin retirement accounts, such as IRAs, are notsubject to this lien and are not used assecurity for the payment of your obligationsor indebtedness for other accounts youmaintain with Merrill Lynch. Merrill Lynch,subject to applicable laws, without giving youprior notice, shall have the right to useand/or transfer Securities and Other Propertyso held by Merrill Lynch from or to any of theaccounts of yours whenever, in its judgment,Merrill Lynch considers such a transactionnecessary for its protection. In enforcing itslien, Merrill Lynch shall have the discretion todetermine which Securities and OtherProperty are to be sold and which contractsare to be closed. All Securities and OtherProperty will be treated as financial assetsunder Article 8 of the New York UniformCommercial Codes.(G) PRIVACYYou understand that Merrill Lynch sharesinformation with its afliates and the Banksin accordance with our privacy policies. Formore information on how and why we canshare information, please read our “U.S.Consumer Privacy Notice” by visitingml.com/privacy. You may also ask yourfinancial advisor or read the ClientRelationship Agreement for moreinformation.5. LENDING SERVICES(A) MARGIN LENDING PROGRAM(i)Margin requirements and creditcharges. Our Margin Lending Programallows you to borrow against the value ofeligible securities in your CMA Account.Merrill Lynch maintains the right, in oursole discretion at any time and without8 Cash Management Accountprior notice to you, to determine whichsecurities are eligible to borrow against.We may refer to the program as theMargin Lending Program. You can use amargin loan to buy securities or sellsecurities “short,” or as a source ofcredit for purchases using your CMAVisa card or checks. If enrolled in theMargin Lending Program, you agree tomaintain such Securities and OtherProperty in your account as required byMerrill Lynch.You agree that your monthly margin loanbalance shall be charged interest at arate permitted by the laws of the State ofNew York. If interest charges are notpaid at the close of a charge period, theywill be added to the opening balance forthe next charge period. Interest will thenbe charged upon the entire openingbalance of that next charge period.Currently, you can borrow up to 50% ofthe market value of most exchangelisted stocks in your CMA Account orCMA SubAccount. A greater or lesserpercentage of the value of bonds andother types of investments is available.With margin lending, you pay interestonly on the amount you borrow.Payments are not required as long asyour account meets minimum equityrequirements. Tere are no filing fees,application fees or points.You must keep a minimum of 2,000 inequity in your CMA Account to remaineligible for margin lending. In general,you may enroll only one account. Certainfiduciary accounts, such as custodialaccounts, are not eligible for thisprogram. Margin requirements aresubject to change and may varydepending upon factors such as securitytype, market price and concentration.Certain internet-related and othervolatile securities and holders ofcontrolled and restricted securitiesmay be subject to higher initial equityand maintenance requirements.

Merrill Lynch may change initial equityand maintenance requirements at anytime without notice. Borrowing againsttax-exempt bonds, tax-exempt municipalfunds and tax-exempt unit investmenttrusts may involve the loss of theinterest deduction from taxable income.You should check with your tax advisorbefore borrowing against tax-exemptinvestments or having them priced inyour account.If the account holders have enrolled inthe Margin Lending Program, all accountholders further agree that all Securitiesand Other Property that Merrill Lynchmay be holding for any of them, either inthis account or otherwise, shall besubject to a lien for the dischargeof obligations of this account toMerrill Lynch. Such lien is in addition toany rights and remedies Merrill Lynchmay otherwise have.(ii)Security interest in favor ofMerrill Lynch. Whether you enroll in theMargin Lending Program or not, thefollowing additional provisions will applyto your account. You agree that to the extentpermitted by New York law,Merrill Lynch shall collect from youreasonable costs and expenses ofcollection of any such debitbalance(s) and any unpaiddeficiency in your account,including but not limited toattorneys’ fees, that Merrill Lynchincurs or pays in connection withYou agree that all Securities andOther Property in any account —margin or cash — in which you havean interest, or which at any time arein your possession or under yourcontrol (other than retirementaccounts, such as IRAs), shall besubject to a lien for the discharge ofall your indebtedness and any otherobligations that you may owe toMerrill Lynch and are held by us orour afliates as security forpayment of any indebtedness orobligations to Merrill Lynch in anyof your accounts with us, includingaccounts in which you have aninterest. Securities and Other Property heldin retirement accounts, such asIRAs, are not subject to this lien andare not used as security for thepayment of your obligations orindebtedness for other accounts,cash or margin you maintain withMerrill Lynch. Merrill Lynch, subject to applicablelaws, retains the right to transferSecurities and Other Propertybetween accounts without givingprior notice whenever, in ourjudgment, we consider it necessaryfor ou

Merrill Lynch as your agent with BANA and/or BA-CA for the CMA Account. Deposits in the Merrill Lynch Bank Deposit Program are insured by the FDIC for up to 250,000 per depositor, per ownership category, per bank. "MLBTC" means Merrill Lynch Bank and Trust Company (Cayman) Limited, an afliated bank incorporated in the Cayman Islands.