Transcription

HSBC Bank USA, National AssociationJanuary 22, 2016Annualized Return CD with Minimum ReturnLinked to the S&P 500 Daily Risk Control 5% Excess Return IndexFinal Terms and ConditionsCD DescriptionIssuerHSBC Bank USA, National AssociationIssue7 Year Annualized Return CD with Minimum ReturnIssuer RatingAA- (S&P), Aa2 (Moody’s)DenominationU.S. dollars (USD)Trade DateJanuary 22, 2016Pricing DateJanuary 22, 2016SettlementDateJanuary 29, 2016Maturity DateJanuary 30, 2023Issue Price100% of the Principal AmountThe Annualized Return CD with Minimum Return provides anopportunity to receive an annual interest payment based uponpoint to point exposure to the Index, divided by the number ofyears since the Settlement Date, subject to the MinimumInterest Rate. The Index provides broad exposure to U.S.equities while seeking greater stability through a reduction in the overall volatility risk level relative to the S&P 500 TotalReturn Index. The CDs are intended for investors who arewilling to accept that the CDs will generate a positive return only to the extent that the S&P 500 Daily Risk Control 5%Excess Return Index has increased on any Interest ValuationDate compared to its Closing Level on the Pricing Date. TheIssuer will also pay the full Principal Amount if the CDs are heldto maturity, subject to our credit risk and FDIC insurance limits.ReferenceAssetThe S&P 500 Daily Risk Control 5% Excess ReturnIndex (ticker: SPXT5UE) (the “Index”)Payment atMaturityThe Principal Amount plus the final Interest PaymentAmount due on the Maturity DateInterestPaymentAmountThe Principal Amount multiplied by the applicableInterest Rate. As set forth in more detail below, theInterest Payment Amount for any interest period maybe as little as the Minimum Interest Rate.Interest RateThe Interest Rate for each Interest Payment Date willbe variable and will equal the greater of (A) theapplicable Interest Valuation Return divided by Ni,where Ni represents the number of years since theSettlement Date, and (B) the Minimum Interest Rate.MinimumInterest Rate0.25% per annum (corresponding to an APY of0.25%)Despite the phrase “risk control” in the title, the Index may appreciate less than the S&P 500 Total Return Index or it maydecline, such that the annual return on the CDs will be equal tothe Minimum Interest Rate. The Index is an excess return index that aims to reflect the returns of the S&P 500 Total ReturnIndex in excess of the London interbank offered rates forovernight deposits in U.S. dollars (the “overnight U.S. dollarLIBOR interest rate”).Highlights InterestThe Closing Level of the Index on the applicableValuation Level Interest Valuation DateInitial Level119.018, which was the Closing Level of the Indexon the Pricing DateInterestValuationReturnThe quotient of (A) the applicable Interest ValuationLevel minus the Initial Level, divided by (B) the InitialLevel, expressed as a percentage.InterestAnnually, as described hereinPayment DatesMinimumDenomination 1,000 and increments of 1,000 thereafterEstimatedInitial Value 918 per CDCUSIP40434AH69Placement Fee 3.50% of the Principal Amount (or 35 per CD) Annual Income Potential: Depositors will receive aninterest payment annually based upon the performance ofthe Index compared to the Initial Level, divided by thenumber of years since the Settlement Date, subject to theMinimum Interest Rate.FDIC Insurance: These deposits qualify for FDIC coverageof generally up to 250,000 in aggregate for all depositsper institution for individual depositors and up to 250,000in aggregate for all deposits per institution held in certainretirement plans and accounts, including IRAs.IRA-eligible

Features of 7 Year Annualized Return CD with Minimum Return Regardless of the Index performance, depositors will receive at least the Principal Amount at maturity, subject to our credit risk and FDICinsurance limits.The CDs provide the periodic interest payments over the term of the CDs.The annual return on the CDs will not be less than 0.25% if the CDs are held to maturity.Index Description The S&P 500 Daily Risk Control 5% Excess Return Index is designed to track the return of the S&P 500 Total Return Index (“SPXTR”) overand above the overnight U.S. dollar LIBOR interest rate. The exposure of the Index to the SPXTR will be between 0% and 150%, and will beadjusted daily in order to maintain a target annualized volatility of 5%. Additional information about the Index is available daily-risk-control-5-usd-excess-return-index. Information contained in this website is notincorporated by reference in, and should not be considered part of, this document.Potential PurchasersPotential purchasers may include: Those who seek the full repayment of their Principal Amount at maturity and a potential positive return based on the performance of theReference Asset. Those seeking the potential to earn an annual contingent and variable interest payment. Those willing to accept that the CDs may not pay interest at a rate greater than the Minimum Interest Rate in some or all periods, inexchange for the potential for above market interest payments. Those seeking FDIC-insured instruments.Potential purchasers should understand the following about the Index: The Index is an excess return index, which calculates the return on an investment in an index where the investment was made through theuse of borrowed funds. Thus, the level of the Index will equal the return of the SPXTR less the overnight U.S. dollar LIBOR interest rate.The overnight U.S. dollar LIBOR interest rate is estimated by leading banks in London, and represents the average interest rate that aleading bank would be charged if borrowing U.S. dollar funds overnight from other banks. The SPXTR is a total return index, such that thelevel of the SPXTR includes both the dividends and the price movements of the stocks included in the SPXTR. You should understand the nature of the Index before purchasing the CDs. There is no assurance that the SPXTR return will outperform the overnight U.S. dollar LIBOR interest rate, or that the CDs will outperformthe returns otherwise payable on ordinary certificates of deposit or other investment alternatives. The Index employs a mathematical algorithm intended to achieve a 5% volatility target, and dynamically adjusts the exposure to the SPXTRbased on its observed historical volatility. There is no assurance that this volatility strategy will be successful. The Index may not outperform the SPXTR or any alternative strategy that might be employed to reduce the level of risk of the SPXTR.Certain Risks and ConsiderationsPurchasing the CDs involves a number of risks. It is suggested that prospective depositors reach a purchase decision only after carefulconsideration with their financial, legal, accounting, tax and other advisors regarding the suitability of the CDs in light of their particularcircumstances. See “Risk Factors” beginning on page 14 of the Base Disclosure Statement and page 11 herein for a discussion of risks, whichinclude: The CDs are not ordinary certificates of deposit and the return on the CDs is uncertain and could be as low as the Minimum Interest RateThe amount payable on the CDs is not linked to the level of the Index at any time other than on the Interest Valuation DatesThe CDs are subject to our credit riskThe Estimated Initial Value of the CDs, which was determined by us on the Pricing Date, is less than the Issue Price and may differ from themarket value of the CDs in the secondary market, if any The price of your CDs in the secondary market, if any, immediately after the Pricing Date will be less than the Issue Price If we were to repurchase your CDs immediately after the Settlement Date, the price you receive may be higher than the Estimated InitialValue of the CDs Depositors will be subject to an Early Redemption Fee if they choose to redeem the CDs early, and therefore they may not receiveproceeds equal to the full Principal Amount of their CDs upon an early redemption There is no current secondary market for the CDs Potential conflicts of interest may exist because we and our affiliates play a variety of roles in connection with the issuance of the CDs Low volatility in the Index is not synonymous with low risk in the CDs, despite the fact that the title of the Index includes “risk control” The Index has limited actual historical information The Index may not be successful, may not outperform the SPXTR, and may not achieve its target volatility The Index dynamically adjusts exposure to the SPXTR based on observed volatility, which may lead to an under-exposure of your CDs tothe performance of the SPXTR The Index performance is subject to borrowing costs reflected by the overnight U.S. dollar LIBOR interest rate We or our affiliates are not affiliated with the Reference Index Sponsor, and changes that affect the Index will affect the market value of theCDs and the amount you will receive at maturity Variable rate debt instrument consequences of the CDs; U.S. federal income tax consequencesImportant information regarding the CDs is also contained in the Base Disclosure Statement for Certificates of Deposit dated September 2,2014 (the “Base Disclosure Statement”), which forms a part of, and is incorporated by reference into, these Terms and Conditions. Therefore,these Terms and Conditions should be read in conjunction with the Base Disclosure Statement and the Index Supplement dated October 26,2015 (the “Index Supplement”). A copy of the Base Disclosure Statement and a copy of the Index Supplement are available athttp://www.us.hsbc.com/basedisclosure, both of which can be obtained from the Agent offering the CDs.2

HSBC Bank USA, National AssociationAnnualized Return CD with Minimum ReturnLinked to the S&P 500 Daily Risk Control 5% Excess Return IndexFinal Terms and ConditionsDeposit HighlightsGENERAL Certificates of deposit (the “CDs”) issued by HSBC Bank USA, National Association (the “Issuer” or the “Bank”) The Issuer will pay the full Principal Amount and the applicable annual Interest Payment Amounts if the CDs are held to maturity,subject to our credit risk and FDIC insurance limits The CDs are obligations of the Issuer and not its affiliates or agents, and amounts due under the CDs are subject to our credit riskand FDIC insurance limits The CDs are FDIC insured within the limits and to the extent described herein and in the Base Disclosure Statement datedSeptember 2, 2014 under the section entitled “FDIC Insurance” As described more fully herein, early withdrawals may be permitted at par in the event of the death or adjudication of incompetenceof the beneficial owner of the CDsSUMMARY OF TERMSSet forth in these Terms and Conditions is a summary of certain terms and conditions of the 7 Year Annualized Return CD withMinimum Return maturing January 30, 2023. The following summary of certain terms of the CDs is subject to the more detailed terms ofthe CDs included elsewhere in these Terms and Conditions, and also should be read in conjunction with the Base Disclosure Statementand the Index Supplement.Issuer:HSBC Bank USA, National AssociationIssuer Rating:Senior unsecured deposit obligations of the Issuer are currently rated Aa2 by Moody’s InvestorsService, Inc. and AA- by Standard & Poor’s Financial Services LLC, a part of McGraw-HillFinancial. The credit ratings pertain only to the creditworthiness of the Issuer and are not indicativeof the market risk associated with the CDs. The CDs are not individually rated.CDs:7 Year Annualized Return CD with Minimum Return maturing January 30, 2023.Book-Entry Form:The CDs will be represented by one or more master CDs held by and registered in the name ofCede & Co., as nominee of The Depository Trust Company (“DTC”). Beneficial interests in the CDswill be shown on, and transfers thereof will be effected only through, records maintained by DTCand its direct and indirect participants.Aggregate Principal Amount: 414,000Minimum Denominations: 1,000 in Principal Amount (except that each Agent may, in its discretion, impose a higherminimum deposit amount with respect to the CD sales to its customers) and multiples of 1,000 inPrincipal Amount thereafter.Principal Amount: 1,000 for each CDTrade Date:January 22, 2016Pricing Date:January 22, 2016Settlement Date:January 29, 2016Maturity Date:January 30, 2023, subject to adjustment as described in “Description of the Certificates ofDeposit—Adjustments to the Interest Valuation Dates.”Issue Price:Reference Asset:100% of the Principal AmountThe S&P 500 Daily Risk Control 5% Excess Return Index (ticker: SPXT5UE) (the “Index”). S&PDow Jones Indices LLC, the sponsor of the Index, will be referred to as the "Reference IndexSponsor." For summary descriptions of the Index and the Reference Index Sponsor, please refer tothe Index Supplement.3

Payment at Maturity:For each CD, the principal amount, plus the final Interest Payment Amount due on the MaturityDate. If the scheduled Maturity Date is not a Business Day, the required payment will be paid onthe next following Business Day, and no interest will accrue in connection with such postponement.Interest Payment Amount:The Principal Amount multiplied by the applicable Interest Rate.Interest Rate:The Interest Rate for each Interest Payment Date will be variable and will equal the greater of (A)the applicable Interest Valuation Return divided by Ni, where Ni represents the number of yearssince the Settlement Date, and (B) the Minimum Interest Rate.Minimum Interest Rate:0.25% per annum (corresponding to an APY of 0.25%)Interest Valuation Level:The Closing Level of the Index on the applicable Interest Valuation Date.Initial Level:119.018, which was the Closing Level of the Index on the Pricing Date.Interest Valuation Return:The quotient of (A) the applicable Interest Valuation Level minus the Initial Level, divided by (B) theInitial Level.Interest Valuation Dates,Interest Payment Dates and Ni:The Interest Valuation Dates and Interest Payment Dates are listed in the table below.iInterest Valuation DatesInterest Payment DatesNi, representingthe number ofYears since theSettlement DateAnnually on January 29, or if that day isnot a Business Day, the next followingBusiness Day. Those dates areexpected to be:1January 25, 2017January 30, 201712January 24, 2018January 29, 201823January 24, 2019January 29, 201934January 24, 2020January 29, 202045January 26, 2021January 29, 202156January 26, 2022January 31, 202267January 25, 2023January 30, 20237On each Interest Payment Date, the Issuer will pay an Interest Payment Amount equal to thePrincipal Amount multiplied by the applicable Interest Rate. The Interest Valuation Dates and theInterest Payment Dates will be subject to adjustment as described in “Description of the Certificatesof Deposit— Adjustments to the Interest Valuation Dates.”If any scheduled Interest Payment Date is not a Business Day, the relevant Interest PaymentAmount will be paid on the next following Business Day, and no interest will accrue in connectionwith such postponement.The Interest Payment Amount will be paid to the depositor as of the record date.Record Date:The "record date" for any Interest Payment Date is the date that is one Business Day immediatelyprior to that Interest Payment Date.Scheduled Trading Day:Any day on which all of the Relevant Exchanges and Related Exchanges are scheduled to be openfor trading for their respective regular trading sessions.Relevant Exchange:Any exchange or quotation system for the stocks or other securities included in the Index, wheretrading has a material effect (as determined by the Calculation Agent) on the Index.Related Exchange:Each exchange or quotation system or any successor to such exchange or quotation system or anysubstitute exchange or quotation system to which trading in the futures or options contracts relatingto the Index or the stocks or other securities included in the Index has temporarily relocated(provided that the Calculation Agent has determined that there is comparable liquidity relative to thefutures or options contracts relating to the Index or the stocks or other securities included in theIndex on such temporary substitute exchange or quotation system as on the original RelatedExchange) on which futures or options contracts relating to the Index or the stocks or othersecurities included in the Index are traded and where such trading has a material effect (asdetermined by the Calculation Agent) on the overall market for futures or options related to thestocks or other securities included in the Index.4

Early Redemption by Depositor: Although not obligated to do so, and subject to regulatory constraints, the Issuer or its affiliate isgenerally willing to repurchase or purchase the CDs from depositors at any time for so long as theCDs are outstanding. A depositor may request early redemption of the CDs in whole, but not inpart, by notifying the Agent from whom he or she bought the CDs (who must then notify the Issuer).All early redemption requests (whether written or oral) are irrevocable. In the event that a depositorwere able to redeem the CDs prior to the Maturity Date, the depositor would receive the EarlyRedemption Amount (as defined below) and will not be entitled to any further Interest PaymentAmount. Further, the Early Redemption Amount will be adjusted by an Early Redemption Fee. As aresult, the Early Redemption Amount may be substantially less than the Principal Amount of theCDs. Redemptions made pursuant to the Successor Option are calculated differently. See“Successor Option” herein.Early Redemption Amount:The Early Redemption Amount means the full Principal Amount, plus the Early Redemption Fee(which may be positive or negative). As described above, the Early Redemption Amount may besubstantially less than the Principal Amount of the CDs. A depositor, through the Agent from whomhe or she bought the CDs, may obtain from the Calculation Agent an estimate of the EarlyRedemption Amount which is provided for informational purposes only. Neither the Issuer nor theCalculation Agent will be bound by the estimate.Early Redemption Fee:The Current Market Value, minus the Principal Amount of the CDs.Current Market Value:The bid price of a CD, expressed in USD per CD, as determined by the Calculation Agent based onits financial models and objective market factors.Successor Option:In the event of the death or adjudication of incompetence of the Initial Depositor (as defined herein)of the CDs, subject to certain conditions and limitations, the CDs may be redeemed pursuant to theexercise of the Successor Option. See “Successor Option” herein. CDs so redeemed will not beentitled to any further Interest Payment Amount.Market Disruption Event:As described in “Description of the CDs—Market Disruption Events—The Index Reference Asset”in the Base Disclosure Statement.Discontinuance/Modificationof the Index:As described in “Description of the CDs—Discontinuance or Modification of an Index” in the BaseDisclosure Statement.Business Day:Any day, other than a Saturday or Sunday, that is neither a legal holiday nor a day on whichbanking institutions are authorized or required by law or regulation to close in the City of New York.Payment When Offices orSettlement Systems AreClosed:If any payment is due on the CDs on a day that would otherwise be a Business Day but is a dayon which the office of a paying agent or a settlement system is closed, we will make the paymenton the next Business Day when that paying agent or system is open. Any such payment will bedeemed to have been made on the original due date, and no additional payment will be made onaccount of the delay.Calculation Agent:HSBC Bank USA, National AssociationAll determinations and calculations made by the Calculation Agent will be at the sole discretion ofthe Calculation Agent and will, in the absence of manifest error, be conclusive for all purposes andbinding on the depositors of the CDs.Listing:The CDs will not be listed on any U.S. securities exchange or quotation system. See “Risk Factors”herein.FDIC Insurance:See “FDIC Insurance” herein and in the Base Disclosure Statement for details.ERISA Plans:See “Certain ERISA Considerations” in the Base Disclosure Statement for details.Estimated Initial Value:The Estimated Initial Value of the CDs is 918 per CD, which is less than the price you pay topurchase the CDs. The Estimated Initial Value does not represent a minimum price at which we orany of our affiliates would be willing to purchase your CDs in the secondary market (if any exists) atany time.Tax:See “Certain U.S. Federal Income Tax Considerations” herein for a description of the tax treatmentapplicable to this instrument.Placement Fee:3.50% of the Principal Amount (or 35 per CD)Governing Law:New YorkCUSIP:40434AH695

Purchasing the CDs involves a number of risks. See “Risk Factors” beginning on page 11 of this document and page 14 of theBase Disclosure Statement.The CDs offered hereby are deposit obligations of HSBC Bank USA, National Association, a national banking association organizedunder the laws of the United States, the deposits of which are insured by the Federal Deposit Insurance Corporation (the “FDIC”) withinthe limits and to the extent described in the section entitled “FDIC Insurance” herein and in the Base Disclosure Statement.Our affiliate, HSBC Securities (USA) Inc. and other unaffiliated distributors of the CDs may use these Terms and Conditions and theaccompanying Index Supplement and Base Disclosure Statement in connection with offers and sales of the CDs after the date hereof.HSBC Securities (USA) Inc. may act as principal or agent in those transactions. As used herein, references to the “Issuer”, “we”, “us”and “our” are to HSBC Bank USA, National Association.HSBC BANK USA, NATIONAL ASSOCIATIONMember FDICThese Terms and Conditions were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal,state, or local tax penalties. These Terms and Conditions were written and provided by the Issuer in connection with the promotion ormarketing by the Issuer and/or distributors of the CDs. Each depositor should seek advice based on its particular circumstances froman independent tax advisor.Important information regarding the CDs is also contained in the Base Disclosure Statement for Certificates of Deposit andthe Index Supplement, which forms a part of, and is incorporated by reference into, these Terms and Conditions. Therefore,these Terms and Conditions should be read in conjunction with the Base Disclosure Statement and the Index Supplement. Inthe event of any inconsistency between the Base Disclosure Statement or the Index Supplement and these Terms andConditions, these Terms and Conditions will govern. A copy of the Base Disclosure Statement and a copy of the IndexSupplement are available at http://www.us.hsbc.com/basedisclosure, both of which can be obtained from the Agent offeringthe CDs.6

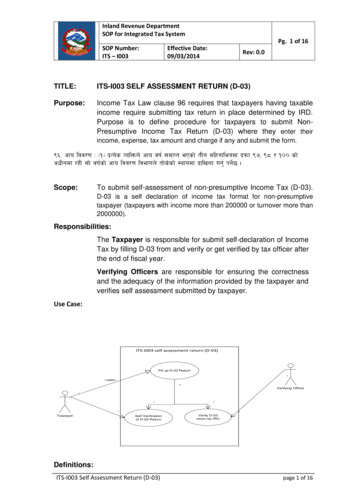

Information about the IndexThe Index tracks the return of the SPXTR over and above the overnight U.S. dollar LIBOR interest rate. The exposure of the Index tothe SPXTR will be between 0% and 150%, and will be adjusted daily in order to maintain a target annualized volatility of 5%.The Index is intended to provide a performance benchmark for the U.S. equity markets, while seeking greater stability and a reduction in the overall risk level relative to the SPXTR. The Index utilizes the existing S&P 500 Index methodology, plus an overlyingmathematical algorithm designed to control the level of risk of the SPXTR by establishing a specific volatility target and dynamicallyadjusting the exposure to the SPXTR based on its observed historical volatility. If the risk level reaches a higher threshold, the cashlevel is increased in order to maintain the target volatility. If the risk level is lower, then the Index will employ leverage to maintain thetarget volatility.The Index tracks the return of the SPXTR over and above the overnight U.S. dollar LIBOR interest rate. In other words, the Indexcalculates the return on an investment in the SPXTR where the investment was made through the use of borrowed funds. Thus, thereturn of the Index will be equal to that of the SPXTR less the associated borrowing costs. The Index represents a portfolio consisting ofthe SPXTR and a borrowing cost component accruing interest based on the U.S. overnight LIBOR rate. The exposure of the Index tothe SPXTR will be between 0% and 150%, and will be adjusted daily in order to maintain a target annualized volatility of 5%. There areno guarantees that the Index will achieve its stated targets.For more information about the Index, please see the accompanying Index Supplement.Hypothetical and Historical Performance of the IndexThe following graph sets forth the hypothetical back-tested performance of the Index from January 1, 2008 through September 9, 2009and the historical performance of the Index from September 10, 2009 to January 22, 2016. The Index has only been calculated sinceSeptember 10, 2009. The hypothetical back-tested performance of the Index set forth in the following graph was calculated using theselection criteria and methodology employed to calculate the Index since its inception on September 10, 2009. However, thehypothetical back-tested Index data only reflects the application of that methodology in hindsight, since the Index was not actuallycalculated and published prior to September 10, 2009. The hypothetical back-tested Index data cannot completely account for theimpact of financial risk in actual trading. There are numerous factors related to the equities markets in general that cannot be, and havenot been, accounted for in the hypothetical back-tested Index data, all of which can affect actual performance. Consequently, youshould not rely on that data as a reflection of what the actual Index performance would have been had the Index been in existence or inforecasting future Index performance. The graph below reflects the actual closing levels from September 10, 2009 to January 22, 2016that we obtained from the Bloomberg Professional service. We have not undertaken any independent review of, or made any duediligence inquiry with respect to, the information obtained from the Bloomberg Professional service. The hypothetical and actualperformance is not necessarily an indication of future results.* The information set forth in the above graph to the left of the dashed line is hypothetical back-tested performance data for the periodfrom January 1, 2008 through September 9, 2009, while the information to the right of the dashed line represents actual historicalperformance of the Index for the period from September 10, 2009 through January 22, 2016.7

Hypothetical or Historical levels of the Index should not be taken as an indication of future performance.8

QUESTIONS AND ANSWERSWhat are the CDs?The CDs are certificates of deposit issued by the Issuer. The CDs mature on the Maturity Date. Although not obligated to do so, andsubject to regulatory constraints, the Issuer or its affiliate is generally willing to repurchase or purchase the CDs from depositors uponrequest as described herein and for so long as the CDs are outstanding. Redemptions may also occur optionally upon the death oradjudication of incompetence of a depositor. See the section entitled “Successor Option” below.Each CD represents an initial deposit by a depositor to the Issuer of 1,000 in Principal Amount (except that each Agent may, in itsdiscretion, impose a higher minimum deposit amount with respect to the CD sales to its customers), and the CDs will be issued inintegral multiples of 1,000 in Principal Amount in excess thereof. Depositors will not have the right to receive physical certificatesevidencing their ownership of the CDs except under limited circumstances; instead the Issuer will issue the CDs in book-entry form.Persons acquiring beneficial ownership interests in the CDs will hold the CDs through DTC in the United States, if they are participantsof DTC, or indirectly through organizations which are participants in DTC.What amount will depositors receive at maturity in respect of the CDs?At maturity (and not upon an Early Redemption by Depositor), the amount depositors will receive for each CD held to maturity will beequal to the A) the Principal Amount of the CD plus B) the final Interest Payment Amount due on the Maturity Date, as described in the“Summary of Terms” above and the “Description of the CDs—Payment at Maturity” section in the Base Disclosure Statement. The APYon the CDs is only determinable at maturity.The payments on the CDs will not include dividends paid on the constituent securities of the Index. Apart from the Interest PaymentAmounts, no interest will be paid, either for periods prior to the Settlement Date, during the term of the CDs, or at or after maturity.For more information, see “Summary of Terms” above and “Description of the CDs—Payment at Maturity” in the Base DisclosureStatement.What Interest Payment Amount will be paid on the CDs?On each Interest Payment Date, the Interest Payment Amount will equal the Principal Amount multiplied by the applicable Interest Rate.The Interest Rate on each Interest Payment Date will be variable and will be equal to the greater of (A) the applicable Interest ValuationReturn divided by the number of years since the Settlement Date, and (B) the Minimum Interest Rate of 0.25% per annum. The InterestValuation Return as of any Interest Valuation Date will be the quotient of (A) the applicable Interest Valuation Level minus the InitialLevel, divided by (B) the Initial Level.What amount will depositors receive if they are able to sell their CDs prior to maturity through an earlyredemption?Although not obligated to do so, and subject

The S&P 500 Daily Risk Control 5% Excess Return Index is designed to track the return of the S&P 500 Total Return Index ("SPXTR") over and above the overnight U.S. dollar LIBOR interest rate. The exposure of the Index to the SPXTR will be between 0% and 150%, and will be adjusted daily in order to maintain a target annualized volatility .