Transcription

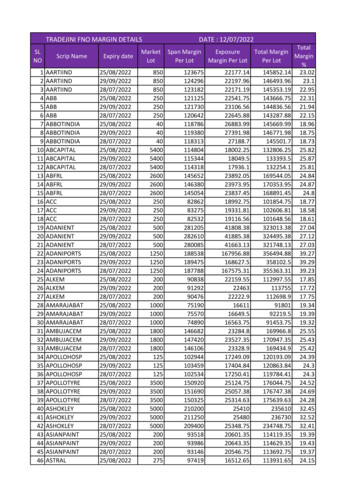

MARGIN OBLIGATIONS TO BE GIVEN BY WAY OF PLEDGE /RE-PLEDGE IN THE DEPOSITORY SYSTEM*1THE GENESISAn investor while trading with the broker needs to maintain margins for his trades. Margins canbe in the form of cash or stocks. Transferring cash is straight forward. As far as stocks areconcerned, when a client wants to pledge his stocks to obtain margins, he had to transfer securitiesfrom his account to the broker’s account. The broker then pledges these securities to the ClearingCorporation. This transfer of title (ownership) of the securities leaves a gaping hole in the system,allowing certain brokers to misuse these securities. Accordingly, SEBI has addressed this problemby introducing the new pledge system/margin rules in India.These norms came out during February, 2020 and were initially scheduled to come into effectfrom June 1. However, the date was then extended to August 1 and thereafter to September 1. Thenew margin rules have come into effect from September 01, 2020 after SEBI's refusal to furtherextend the deadline to implement the new rules on margin pledge.WHAT HAS TRIGGERED THE MOVE BY SEBI?Under the earlier system, as part of the account opening form, several brokers obtained a powerof attorney (POA) from their clients to access their account. This was required to provide highermargins for trading. A POA allowed a broker to move client securities from their dematerialised(demat) account to a collateral account which could be accessed by both the broker as well as aclient. Several brokers were seen misusing the POAs, prompting SEBI to rework their entiresystem of pledging.HOW DID BROKERS MISUSE THE POA?Several brokers used the shares of dormant or inactive clients to provide margins for other moreactive clients. Some brokers even raised money by pledging shares in the collateral account tofund other businesses. Also, they siphoned off dividends of inactive clients. SEBI has taken actionagainst several brokers for misusing their client securities.In a bid to curb the misuse of power of attorney (POA) given by the clients to the TM or CM, SEBIhad prescribed that margin obligations to be given in the form of securities by client willbe by way of pledge or re-pledge in the depository system. Besides, title transfer of securitiesto the client collateral demat account of the TM/ CM for margin purposes will not be permitted. Incases where a client has given a POA in favour of a TM / CM, such holding of POA will not beconsidered as equivalent to the collection of margin by the TM/ CM in respect of securities held inthe demat account of the client.*Mahesh Airan, Assistant Director, The ICSI.Views expressed in the Article are the sole expression of the Author and may not express the views of theInstitute.1.For the purpose of this article, the TM/CM/CC/DP shall stands for Trading Member/ Clearing Member/ClearingCorporation/Depository Participant respectively.STUDENT COMPANY SECRETARY SEPTEMBER 20201

ArticleThe misappropriation or misuse would include use of one client’s securities to meet the exposure,margin or settlement obligations of another client or of the TM / CM. The matter was alsodiscussed in the Secondary Market Advisory Committee meeting. Hence, with effect fromSeptember 01, 2020, TM / CM shall, inter alia, accept collateral from clients in the form ofsecurities, only by way of ‘margin pledge’, created in the Depository system in accordance withSection 12 of the Depositories Act, 1996 read with Regulation 79 of the SEBI (Depositories andParticipants) Regulations, 2018 and the relevant Bye Laws of the Depositories.THE NEW REGIMEIn the new pledge system, the stocks don’t move from the investor’s demat account unless a pledgeis marked in favor of the broker. The broker is required to open a separate demat account labelled‘TMCM – Client Securities Margin Pledge Account’ for this purpose. The broker then re-pledgesthese securities in favour of the Clearing Corporation and obtains margins.SEBI's new margin rules aim at bringing transparency and preventing brokers from misusingclients' securities.PROCEDURE FOR CREATION OF MARGIN OBLIGATIONS BY WAY OF PLEDGE / RE-PLEDGEIN THE DEPOSITORY SYSTEMSection 12 of the Depositories Act, 1996 read with Regulation 79 of the SEBI (Depositories andParticipants) Regulations, 2018 and the relevant Bye Laws of the Depositories clearly enumeratethe manner of creating pledge of the dematerialised securities. Any procedure followed other thanas specified under the aforesaid provisions of law for creating pledge of the dematerialisedsecurities is prohibited. It is clarified that an off-market transfer of securities leads to change inownership and shall not be treated as pledge.Transfer of securities to the demat account of the TM / CM for margin purposes(i.e. title transfer collateral arrangements) shall be prohibited. In case, a client hasgiven a power of attorney in favour of a TM / CM, such holding of power of attorneyshall not be considered as equivalent to the collection of margin by the TM / CM inrespect of securities held in the demat account of the client.2SEPTEMBER 2020 STUDENT COMPANY SECRETARY

ArticleThe flowchart for creation of margin pledge is depicted as under:Depositories shall provide a separate pledge type viz. ‘marginpledge’, for pledging client’s securities as margin to the TM / CM.The TM / CM shall open a separate demat account for accepting suchmargin pledge, which shall be tagged as ‘Client Securities MarginPledge Account’.For the purpose of providing collateral in form of securities asmargin, a client shall pledge securities with TMTM shall re-pledge the same with CMCM in turn shall re-pledge the same toClearing Corporation (CC).The complete trail of such repledge shall be reflected in thede-mat account of the pledgorThe TM shall re-pledge securities to the CM’s ‘Client Securities Margin PledgeAccount’ only from the TM’s ‘Client Securities Margin Pledge Account’.The CM shall create a re-pledge of securities on the approvedlist to CC only out of ‘Client Securities Margin Pledge Account’STUDENT COMPANY SECRETARY SEPTEMBER 20203

ArticleIn this context, re-pledge would mean endorsement of pledge by TM / CM in favour of CM/CC,as per procedure laid down by the Depositories.DISPUTE RESOLUTION BETWEEN CLIENT AND TM/CMThe TM and CM shall ensure that the client’s securities re-pledged to the CC shall be availableto give exposure limit to that client only. Dispute, if any, between the client, TM / CM withrespect to pledge, re-pledge, invocation and release of pledge shall be settled inter-se amongstclient and TM / CM through arbitration as per the bye-laws of the Depository. CC andDepositories shall not be held liable for the same.CLIENT SECURITIES UNDER MARGIN FUNDING ACCOUNTThe funded stocks held by the TM / CM under the margin trading facility shall be held by theTM / CM only by way of pledge. For this purpose, the TM / CM shall be required to open aseparate demat account tagged ‘Client Securities under Margin Funding Account ’ in which onlyfunded stocks in respect of margin funding shall be kept/ transferred, and no other transactionsshall be permitted. The securities lying in ‘Client Securities under Margin Funding Account’shall not be available for pledge with any other Bank/ NBFC.CLOSING OF EXISTING DEMAT ACCOUNTSThe TM / CM was required to close all existing demat accounts tagged as ‘Client Margin/Collateral’ by August 31, 2020. The TM/CM shall be required to transfer all client’s securitieslying in such accounts to the respective clients’ demat accounts. Thereafter, TM / CM areprohibited from holding any client securities in any beneficial owner accounts of TM/CM, otherthan specifically tagged accounts as indicated above.OPERATIONAL MECHANISM FOR MARGIN PLEDGEInitiation of Margin PledgeFor the purpose of providing collateral in form of dematerialised securities as margin, aclient shall initiate the margin pledge only in favour of the TM / CM’s separate clientsecurities margin account tagged as ‘Client Securities Margin Pledge Account’ throughphysical instruction or electronic instruction mechanism provided by the Depositories.Such instructions shall have details of client UCC, TM, CM and Default Segment.In cases where a client has given a Power of Attorney (“POA”) to the TM / CM, the TM / CMmay be allowed to execute the margin pledge on behalf of such client to the demat accountof the TM / CM tagged as ‘Client Securities Margin Pledge Account’.The ‘pledge request form’ shall have a clause regarding express consent by the client forre-pledge of the securities by the TM to CM and further by the CM to CC.On receipt of the margin pledge instruction either from the client or by TM / CM as per thePOA, DP of a client shall initiate a margin pledge in the client’s account and the status ofinstruction will remain pending till confirmation is received from client / pledgor.Confirmation from the client / pledgor through OTP on mobile number / registered e-mailid or other verifiable mechanism, such confirmation shall be required only once from theclient / pledgor at the time of initial creation of pledge in favour of TM / CM and subsequentrepledging by TM / CM shall not require any further confirmation from the client / pledgor.The Depositories shall develop a verifiable mechanism for confirmation of the pledge bythe client.4SEPTEMBER 2020 STUDENT COMPANY SECRETARY

RELEASE OF MARGIN PLEDGEIn case of a client creating pledge of the securities in favour of the TM / CM against margin,the TM / CM may release the ‘margin pledge’ after their internal exposure and riskmanagement checks.The request for release of pledge can be made by the client to its DP or to the TM / CM, whoshall release the pledge in the Depository system.For release of client securities given to TM/CM as margin pledge and which are re-pledgedin favour of the CC, the CM shall make a request to the CC. The client through TM, or the TMon his own, may request the CM to make an application to the CC for the release of marginpledge. CC shall do margin utilisation check at the CM level before releasing the re-pledgeof securities to the CM. The CC will release the re-pledged client securities to CM afterblocking other available free collateral of CM. The CM /TM in turn after doing their riskmanagement shall release the securities to TM / client, as the case may be.KEY TAKEAWAYS UNDER NEW FRAMEWORKThe stock will continue to remain in investor's demat account and can be directly pledgedto the clearing corporation. As the securities remain in investors’ own demat account, theywill enjoy all corporate benefits on their shares.Under the old system, cash margins were taken care of by the broker. Investors either hadto transfer their shares to the brokers’ account or give power of attorney (POA) to thebroker. Some brokers went on to misuse the POA assigned to them.It is mandatory for brokers to collect margins from investors upfront for any purchase ofsale of shares. Failing to do so will attract a penalty.No Power of Attorney to be assigned to brokers. The investors used to give authority tothe brokers by way of POA to execute transaction on their behalf. The POA cannot be usedfor pledging anymore.Investors who want to avail margin now have to create margin pledge separately.Earlier collecting upfront margin wasn’t mandatory, but under the new system, investorswill have to pay margin upfront to avail a margin loan.Shares bought today cannot be sold tomorrow. Currently, investor can use intradayrealised profits for taking new positions on the same trading day. According to the newnorms, investor will be able to use it only after T 2 days in case of equity/stocks oncereceived the delivery of shares in the account.STUDENT COMPANY SECRETARY SEPTEMBER 20205ArticleIn client account, margin pledge or re-pledge shall be reflected against each security, if it ispledged / re-pledged and in whose favour i.e. TM / CM / CC.The TM can re-pledge only in favour of CM’s demat account tagged as ‘Client SecuritiesMargin Pledge Account’. The CM shall create a re-pledge of securities on the approved listonly to the CC out of ‘Client Securities Margin Pledge Account’.While re-pledging the securities to the CC, CM/TM shall fully disclose the details of theclient wise pledge to the CC/CM. CM would need to have visibility of client level positionand client collateral so that CM shall allow exposure and / or margin credit in respect ofsuch securities to that client to whom such securities belong.

ArticleTill now, clients needed to meet margin requirements in their account once at the end ofthe day. But, the new margin rules of SEBI will require them to fulfil their marginobligations at the beginning of the deal.BENEFITS OF THE NEW PLEDGE SYSTEMa.No misuse of securities : Since stocks don’t leave the investor’s account, there’s lesschance of misuse of securities. Also, it wouldn’t be possible to pledge one client’s stocksto offer margin to a different client.b.Corporate actions : In the existing pledge system, since the stocks are held in thebroker’s collateral account, the broker is the recipient of all cash and non-cash corporateactions like dividends, bonus, rights, etc. While the broker is required to voluntarilytransfer these benefits to the investor, a non-savvy investor may miss out on claimingsuch credits in the event that the broker doesn’t.c.Pledge allowed for all approved securities : Some brokers don’t accept pledge of allinstruments allowed by the Exchanges. For example, certain liquid funds pay dividendsin the form of more units of the same fund. The operational nightmare around reconcilingthe dividends received and transferring them to the investors has held brokers back fromaccepting these instruments as margins. Going forward, since the stocks are all held inthe client’s own account, any approved security will be accepted for pledge.d.Facility to sell pledged stocks : With the new pledge system it becomes much easier tosell pledged stocks.IMPACT OF NEW SYSTEM ON THE STOCK MARKETSMany are expecting the trading volumes to come down in the cash segment. This has less to dowith the new pledging system and more to do with the new margin norms. Under the newmargin norms, SEBI has virtually put an end to excessive leverage trades. The regulator hasdirected brokers to collect higher margins from their client. Failing to do so, SEBI will imposeheavy penalties. Also, clients will have to wait for the settlement cycle (T 2) to complete to usethe proceeds of their sales or to pledge newly bought shares. Earlier, brokers allowed clients touse profits from their trades or allowed newly bought shares to be pledged even before thesettlement cycle completed. Some expect cash market volumes to drop by 25%.CHANGES FOR STOCK MARKET INVESTORSClients who are not into intra-day and ultra-short term trading may not be impacted much.However, those who are active traders will have to provide higher margins which willtechnically increase their trading costs. Also, it could take time for traders to get a handle onthe new system. Further, there could be delays in getting shares pledged and unpledged in casedepository systems are not able to take the load and generate OTPs on time. New margin ruleswill affect the trading strategies that Investors may be using such as- Buy Today - SellTomorrow (BTST).6SEPTEMBER 2020 STUDENT COMPANY SECRETARY

Regulation 29 (4) of the SEBI(Substantial Acquisition ofShares and Takeover)Regulations, 2011 (“TakeoverRegulations”) provides that forthe purposes of disclosure underregulation 29(1) and (2), sharestaken by way of encumbranceshall be treated as an acquisition,shares given upon release ofencumbrance shall be treated as adisposal, and disclosures shall bemade by such person accordinglyin such form as may be specified.In this regard SEBI has dispensedwith the disclosures requirementspecified under Regulation 29(4)of Takeover Regulations, inrelation to shares encumberedwith TM /CM as collateral fromclients for margin obligation inthe ordinary course of stockbroking business.CONCLUSIONThe change in margin system and securities pledge-repledging could undoubtedly bringdisruptions in volumes of daily trading as there is insufficient preparation and validation by theparticipants in this system – viz. Exchanges, Depositories, Depository participants, TM/CM/CC,Brokers and clients. At the same time, it will bring transparency and preventing brokeragesfrom misusing clients' securities. This decision was taken by SEBI to reduce risk in financialmarkets, and curb the practice of excessive leverage. The changes will make it difficult to takea large position, if one does not have enough cash in the trading account.References .do?doListingAll orms-have-rattled-brokerages-120090100519 DENT COMPANY SECRETARY SEPTEMBER 20207ArticleDISCLOSURES ON MARGIN OBLIGATIONS GIVEN BY WAY OF PLEDGE/ RE-PLEDGE IN THEDEPOSITORY SYSTEM

The TM can re-pledge only in favour of M's demat account tagged as 'lient Securities Margin Pledge Account'. The M shall create a re-pledge of securities on the approved list only to the out of ' lient Securities Margin Pledge Account'. While re-pledging the securities to the CC, CM/TM shall fully disclose the details of the