Transcription

Chicago Board Options ExchangeMargin ManualApril 2000

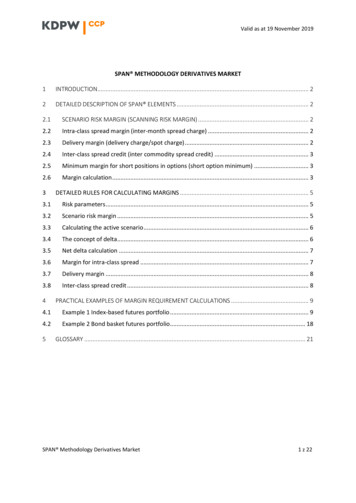

TABLE OF CONTENTSINTRODUCTION . 3INITIAL AND MAINTENANCE MARGIN REQUIREMENTSLong Put or Long Call (9 months or less until expiration) . 4Long Put or Long Call (more than 9 months until expiration) . 4Short Put or Short Call. 5-6Short Put and Short Call . 6Put Spread or Call Spread . 7Put Spread or Call Spread (cash account) . 8Long Butterfly Spread . 8Short Butterfly Spread . 9Long Box Spread . 10Short Box Spread . 10Short Put and Short Underlying . 11Short Call and Long Underlying . 11-12Short Call and Long Marginable Convertibles . 12Short Call and Long Marginable Stock Warrants . 12Long Put and Long Underlying . 13Long Call and Short Underlying . 13Conversion . 14Reverse Conversion . 14Collar . 14FLEX OPTIONSPut Spread or Call Spread . 15-16Short Put and Short Call . 16SAMPLE CALCULATIONS FOR OPTIONSEquity Options . 17-20Index Options . 21-23Reduced-value Index Options . 24-26CAPS Options . 27-28Interest Rate Options . 29-31Box Spreads and Butterfly Spreads . 32-36Maintenance Margin for Hedged Underlying Positions . 37-40www.cboe.com

INTRODUCTIONThis manual has been developed by CBOE to assist the margin personnel of member firms as well as to serve asa guide to all users of options. The requirements explained here are based on publication date rules andregulations, and therefore, subject to change. This manual should be used as a reference document and is notintended to be an all-encompassing restatement of Federal Reserve Board and Exchange margin rules. Personsusing this manual should be familiar with margin computational methods and procedures as well as the marginrequirements for all types of securities. Users contemplating margin account transactions are reminded that a 2,000 minimum margin account equity is required to effect new securities transactions and commitments[CBOE Rule 12.3(i)]. Further, broker-dealers require a minimum margin account equity well in excess of 2,000 for uncovered, short option transactions. It should be emphasized that substitutions involving loan valueand non-loan value securities be given consideration with regard to the relative changes in an account’s maximum loan value and debit balance rather than only to the proceeds of a sale.For further information, please contact CBOE’s Department of Financial and SalesPractice Compliance, (312) 786-7718.Percentage of PurchaseCost / Market Value75%Effective Date8/23/99Short Options (listed)Equity, Narrow Based IndexBroad Based IndexInterest Rate OptionsPercentageof Underlying20%15%10%Effective Date6/06/886/06/886/23/89SpreadsLong Butterfly SpreadShort Box SpreadRequirementPay Debit in FullStrike Price DifferentialLong Options (listed)Equity, Equity Indexwith Expiration 9 monthsMinimumPercentage10%10%5%Effective Date8/23/998/23/99Long options with 9 months or less until expiration remain non-marginable. Note that in respect of short putoptions, the minimum percentage is applied to the put’s exercise price instead of to the underlying value(effective 6/02/97). Butterfly and box spreads must be structured as defined in CBOE rules. Also, certain longbox spreads are eligible for margin of 50% of the exercise price differential (effective 8/23/99). Additionally,certain spread strategies having limited risk are permitted in the cash account (effective 8/23/99), as detailedlater in this Margin Manual. Certain strategies involving an American style option and a position in theunderlying (i.e., Long Put / Long Underlying, Long Call / Short Underlying, Conversion, Reverse Conversionand Collar) are eligible for reduced maintenance margin requirements (effective 8/23/99), as detailed later inthis Margin Manual.Option margin percentage requirements are subject to change. Contact the CBOE’s Department of Financialand Sales Practice Compliance for current percentages, (312) 786-7718.The prices of the various stock and option positions used as examples in the sample calculation section of thisMargin Manual are expressed in fractions. At the time of publication, the securities industry was preparing, buthad not yet begun, to quote and trade stock and options in decimal format. However, whether prices areexpressed in fractions or decimals, the methodology for calculating margin requiremements remains the same.

INITIAL ANDMAINTENANCEREQUIREMENTSThis schedule contains a description of Exchange margin requirements for various positions in put options, calloptions, combination put-call positions and underlying positions offset by option positions. Unless noted otherwise, requirements are for listed options. Initial requirements must be satisfied within five (5) business days fromtrade date. Sale proceeds may be applied toward the initial requirement. Maintenance requirements must besatisfied within fifteen (15) calendar days. Positions may be margined separately to obtain lowest requirement.CASH ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTMAINTENANCEREQUIREMENTEquity; Broad andNarrow Based Indexes;Interest Rate Options;Long CAPSPay for each put or callin full.Pay for each put or callin full. Cash need notbe deposited in excessof put or call cost.None required (no loanvalue).Equity; Broad andNarrow Based EquityIndexes only.1Pay for each put or callin full.Listed75% of the total cost ofthe option.Listed75% of option marketvalue.OTC75% of the intrinsicvalue (in-the-moneyamount) of the optionplus 100% of theamount by which theoption’s purchase priceexceeds its intrinsicvalue. OTC optionmust be American styleexercise and beguaranteed by thecarrying broker-dealer.OTC75% of the intrinsicvalue of the option.OPTION TYPELong Put orLong Call9 months or less untilexpirationLong Put orLong Callmore than9 months untilexpiration1[For all other optiontypes, the requirementis the same as for a 9month or less option(above).]Note that in either case,the option has no valuefor margin purposeswhen time remainingto expiration reaches 9months.Other than equity options and broad and narrow based equity index options, only stock index warrants are eligible for purchase on margin.4

OPTION TYPEShort Put orShort CallBroad Based IndexCASH ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTMAINTENANCEREQUIREMENTPutDeposit cash or cashequivalents2 equal toaggregate exercise price,or an escrow agreement3 for a short indexput option.100% of optionproceeds plus 15% ofunderlying index valueless out-of-the-moneyamount, if any, to aminimum for calls ofoption proceeds plus10% of the underlyingindex value, and aminimum for puts ofoption proceeds plus10% of the put’sexercise price.For each short option,100% of option marketvalue plus 15% ofunderlying index valueless out-of-the-moneyamount, if any, to aminimum for calls ofoption market valueplus 10% of theunderlying index value,and a minimum forputs of option marketvalue plus 10% of theput’s exercise price.100% of optionproceeds plus 20% ofunderlying security /index value less out-ofthe-money amount, ifany, to a minimum forcalls of option proceedsplus 10% of theunderlying security /index value, and aminimum for puts ofoption proceeds plus10% of the put’sexercise price.For each short option,100% of option marketvalue plus 20% ofunderlying security /index value less out-ofthe-money amount, ifany, to a minimum forcalls of option marketvalue plus 10% of theunderlying security /index value, and aminimum for puts ofoption market valueplus 10% of the put’sexercise price.CallDeposit escrowagreement for a shortindex call option.*********Whether put or call,sale proceeds notreleased until deposit ismade.Equity, Narrow BasedIndexPutDeposit cash or cashequivalents equal toaggregate exercise priceor appropriate escrowagreement.CallDeposit appropriateescrow agreement.*********Whether put or call,sale proceeds notreleased until deposit ismade.2Acceptable as cash equivalents (pursuant to Regulation T of the Board of Governors of the Federal Reserve System) are securities issued orguaranteed by the United States or its agencies, negotiable bank certificates of deposit, banker’s acceptances issued by banking institutionsin the United States and payable in the United States, or money market mutual funds.3The term “escrow agreement” (pursuant to Exchange Rules), when used in connection with non cash-settled call or put options carriedshort, means any agreement issued in a form acceptable to the Exchange under which a bank holding the underlying security (in the case ofa call option) or required cash, cash equivalents or a combination thereof (in the case of a put option), is obligated to deliver to the creditor(in the case of a call option) or accept from the creditor (in the case of a put option) the underlying security against payment of the exerciseprice in the event the call or put is assigned an exercise notice.The term “escrow agreement,” when used in connection with cash-settled call or put options, stock index warrants, currency index warrantsor currency warrants carried short, means any agreement issued in a form acceptable to the Exchange under which a bank holding cash, cashequivalents, one or more qualified equity securities or a combination thereof in the case of a call option or warrant; or cash, cash equivalents ora combination thereof in the case of a put option or warrant, is obligated (in the case of an option) to pay the creditor the exercise settlementamount in the event an option is assigned an exercise notice or (in the case of a warrant) the funds sufficient to purchase a warrant sold shortin the event of a buy-in.5

CASH ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTMAINTENANCEREQUIREMENTCAPSDeposit cash or cashequivalents equal to thecap interval times theindex multiplier.The lesser of:a) the cap interval timesthe index multiplier orb) 100% of the optionproceeds plus 15% ofthe underlying indexvalue less out-of-themoney amount, if any,to a minimum for callsof option proceeds plus10% of the underlyingindex value, and aminimum for puts ofoption proceeds plus10% of the put’s exerciseprice.The lesser of:a) the cap interval timesthe index multiplier orb) 100% of the optionmarket value plus 15%of the underlying indexvalue less out-of-themoney amount, if any,to a minimum for callsof option market valueplus 10% of theunderlying index value,and a minimum for putsof option market valueplus 10% of the put’sexercise price.Interest Rate OptionsPutDeposit cash or cashequivalents equal toaggregate exercise price.Sale proceeds notreleased until deposit ismade.100% of optionproceeds plus 10% ofthe underlying value lessout-of-the-moneyamount, if any, to aminimum for calls ofoption proceeds plus 5%of the underlying value,and a minimum for putsof option proceeds plus5% of the put’s exerciseprice.100% of option marketvalue plus 10% of theunderlying value lessout-of-the-moneyamount, if any, to aminimum for calls ofoption market value plus5% of the underlyingvalue, and a minimumfor puts of optionmarket value plus 5% ofthe put’s exercise price.For the same underlyingsecurity, short put orshort call requirement,whichever is greater, plusthe option proceeds ofthe other side.For the same underlyingsecurity, short put orshort call requirement,whichever is greater, plusthe option market valueof the other side.OPTION TYPEShort Put orShort CallCallNot permitted. 4Short Put andShort Call4EquityDeposit an escrowagreement for eachoption. See requirementfor short equity put orcall.Escrow agreements are not currently acceptable in lieu of a margin deposit for short interest rate option calls. In many instances, institutionalentities are not barred from trading these instruments on a margin basis, provided that the options serve to offset the risk exposure of otherinterest rate investments. Contact the Exchange’s Department of Financial and Sales Practice Compliance at (312) 786-7718 for moredetailed information.6

CASH ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTMAINTENANCEREQUIREMENTBroad and Narrow BasedIndexesDeposit an escrowagreement for eachoption. See requirementfor short index put orcall.For the same underlyingindex with the sameindex multiplier, shortput or short callrequirement, whicheveris greater, plus the optionproceeds of the otherside.For the same underlyingindex with the sameindex multiplier, shortput or short callrequirement, whicheveris greater, plus the optionmarket value of the otherside.Interest Rate OptionsNot permitted.5For the same underlyinginterest rate composite,short put or short callrequirement, whicheveris greater, plus the optionproceeds of the otherside.For the same underlyinginterest rate composite,short put or short callrequirement, whicheveris greater, plus the optionmarket value of the otherside.Equity; Broad andNarrow Based Indexes;Interest Rate Options;CAPSNot permitted, except asprovided below.For the same underlyinginstrument and, asapplicable, the sameindex multiplier; theamount by which thelong put (short call)aggregate exercise price isbelow the short put(long call) aggregateexercise price. Long sidemust be paid for in full.Proceeds from shortoption sale may beapplied.7Initial spread requirement must be maintained.OPTION TYPEShort Put andShort CallPut Spread orCall Spread6long side expires withor after short side5Treat as separate positions (See requirement for short interest rate put or call).6Reduced value options for the same underlying covering the same total aggregate underlying value may be combined with regular optionsfor spread and straddle positions. However, spread treatment is not available for a long CAPS offset by a short regular option.7It is important to remember that under certain circumstances, it is possible that the spread margin held by a carrying broker-dealer couldbecome insufficient to cover the assignment obligation on the short option if the long side is a European style option that can not beexercised, and that option is trading at a discount to its intrinsic value.7

OPTION TYPEPut Spread orCall SpreadSee above.See above.Cash AccountBroad and Narrow BasedIndexes only (see nextcell).Only long butterflyspreads composed ofEuropean style exercise,cash-settled indexoptions are permitted inthe cash account.For the same underlyinginstrument and, asapplicable, the sameindex multiplier; thelong sides must be paidfor in full. Proceedsfrom short option salemay be applied.Initial long butterflyspread requirement mustbe maintained.all component optionsare cash settledall component optionshave the sameexpirationintervals betweenexercise prices areequal8MARGIN ACCOUNTMAINTENANCEREQUIREMENTFor the same underlyinginstrument and, asapplicable, the sameindex multiplier; depositand maintain cash orcash equivalents equal tothe amount by which thelong put (short call)aggregate exercise price isbelow the short put(long call) aggregateexercise price. Long sidemust be paid for in full.Proceeds from shortoption sale may beapplied. An escrowagreement representingcash or cash equivalentsmay be deposited in lieuof requirement.all component optionsare European styleexercise index optionstwo short options ofthe same series offsetby one long option ofthe same type with ahigher strike price andone long option of thesame type with alower strike priceMARGIN ACCOUNTINITIALREQUIREMENTBroad and Narrow BasedIndexes, CAPSlong side expires withshort sideLong ButterflySpreadCASH ACCOUNTINITIALREQUIREMENTMargin AccountEquity; Broad andNarrow Based Indexes;Interest Rate Options;CAPSFor the same underlyinginstrument and, asapplicable, the sameindex multiplier; thelong sides must be paidfor in full. Proceeds fromshort option sale may beapplied.

OPTION TYPEShort ButterflySpreadtwo long options ofthe same seriesoffset by one shortoption of the sametype with a higherstrike price and oneshort option of thesame type with alower strike priceall componentoptions have thesame expirationintervals betweenexercise prices areequalCash AccountBroad and NarrowBased Indexes only (seenext cell).Margin AccountEquity; Broad andNarrow Based Indexes;Interest Rate Options;CAPSCASH ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTMAINTENANCEREQUIREMENTOnly short butterflyspreads composed ofEuropean styleexercise, cash-settledindex options arepermitted in the cashaccount.For the same underlying instrument and, asapplicable, the sameindex multiplier:Initial short butterflyspread requirementmust be maintained.For the same underlying instrument and, asapplicable, the sameindex multiplier,deposit and maintaincash or cash equivalentsequal to:PutsThe amount of theaggregate differencebetween the twohighest exercise pricesorPutsThe amount of theaggregate differencebetween the twohighest exercise prices.CallsThe aggregate difference between the twolowest exercise prices.Net proceeds from saleof short options may beapplied.CallsThe aggregate difference between the twolowest exercise prices.Net proceeds from saleof short options may beapplied.An escrow agreementrepresenting cash orcash equivalents may bedeposited in lieu ofrequirement.9

OPTION TYPELong Box Spreadlong call and shortput with the sameexercise price (“buyside”) coupled with along put and shortcall with the sameexercise price (“sellside”); buy sideexercise price islower than the sellside exercise priceCash AccountBroad and NarrowBased Indexes only (seenext cell).Margin AccountEquity; Broad andNarrow Based Indexes;Interest Rate Options;CAPSall componentoptions must expireat the same timeShort BoxSpreadlong call and shortput with the sameexercise price(“buy side”) coupledwith a long put andshort call with thesame exercise price(“sell side”); buy sideexercise price ishigher than the sellside exercise priceall componentoptions must expireat the same timeCASH ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTMAINTENANCEREQUIREMENTOnly long box spreadscomposed of Europeanstyle exercise, cashsettled index optionsare permitted in thecash account.For the same underlying instrument and, asapplicable, the sameindex multiplier; thelong sides must be paidfor in full. Proceedsfrom sale of shortoptions may be applied.Initial long box spreadrequirement must bemaintained.For the same underlying instrument and, asapplicable, the sameindex multiplier; thelong sides must be paidfor in full. Proceedsfrom sale of shortoptions may be applied.Long box spreadscomposed of Europeanstyle options.50% of the aggregatedifference in theexercise prices. Proceeds from short optionsales may be applied.Long box spread maybe valued at an amountnot to exceed 100% ofthe aggregate differencein the exercise prices.Cash AccountBroad and NarrowBased Indexes only (seenext cell).Margin AccountEquity; Broad andNarrow Based Indexes;Interest Rate Options;CAPSOnly short box spreadscomposed of Europeanstyle exercise, cashsettled index optionsare permitted in thecash account.For the same underlying instrument and, asapplicable, the sameindex multiplier;deposit and maintain atleast the amount of theaggregate difference inthe exercise prices. Netproceeds from sale ofshort options may beapplied.An escrow agreementrepresenting cash and /or cash equivalents maybe deposited in lieu ofrequirement.10 EXCEPTION For the same underlying instrument and, asapplicable, the sameindex multiplier;deposit and maintain atleast the amount of theaggregate difference inthe exercise prices. Netproceeds from sale ofshort options may beapplied.Initial short box spreadrequirement must bemaintained.

Short Put andShort Underlying(not permitted forCAPS or interest rateoptions)OPTION TYPECASH ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTMAINTENANCEREQUIREMENTEquityNot permittedNone required on shortput. Short saleproceeds plus 50%requirement on shortstock position.None required on shortput. Short stockrequirement is 100% ofstock market value plus: for stock with marketvalue of less than 5.00per share, the greater of 2.50 per share or100% of stock marketvalue for stock with marketvalue of 5.00 or moreper share, the greater of 5.00 per share or 30%of stock market value.Any amount (aggregate) by which theexercise price of the putexceeds the marketprice of the stock mustbe added to the stockmaintenance requirement, and to the stockinitial requirement forpurposes of determining if excess Reg. Tequity exists.Short Call andLong Underlying(not permitted forCAPS or interest rateoptions)Broad and NarrowBased IndexesNot permitted.None required on shortput. Short saleproceeds plus 50%requirement on shortunderlying stockbasket.None required on shortput. On underlying,same maintenancerequirement as forstock (above).EquityPay for underlyingposition in full.None required on shortcall. 50% requirementon long stock position.None required on shortcall. 25% requirementon long stock position.Long underlyingposition must be valuedat lower of currentmarket value or callexercise price formargin equity purposes.11

OPTION TYPEShort Call andLong Underlying(not permitted forCAPS or interest rateoptions)Broad and Narrow BasedIndexesShort Call andLong MarginableConvertibles(the convertiblesecurity must beimmediately convertible or exchangeableand may not expirebefore the short call;no money payableupon exchange orconversion; equityoptions only)EquityShort Call andLong MarginableStock Warrants(money payableupon exercise orconversion; equityoptions only)EquityCASH ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTMAINTENANCEREQUIREMENTNot permitted.None required on shortcall. 50% requirementon long underlying stockbasket; or unit investment trust or open endmutual fund specificallyapproved by theExchange.None required on shortcall. On underlying,same maintenancerequirement as for stock(above).None required on shortcall. 50% requirementon convertible security.None required on shortcall. 25% requirementon convertible security.Pay for the convertiblesecurity in full.Long underlyingposition must be valuedat lower of currentmarket value or callexercise price for marginequity purposes.The convertible securitymust be valued at lowerof current market valueor call exercise price formargin equity purposes.Not permitted.None required on shortcall. 100% requirementon warrants plus anyamount by whichexercise price of warrantsexceeds option exerciseprice.8 Warrants maynot expire before theshort call.Initial requirement mustbe maintained.The warrant may not begiven value for marginpurposes.8Regulation T allows loan value on a long, marginable stock warrant. However, pursuant to CBOE rules, when a long warrant is spreadwith a short call option, the warrant may contribute no equity to the account (no loan value). Therefore, the higher Exchange maintenance requirement becomes both the initial and maintenance requirement.12

OPTION TYPELong Put andLong UnderlyingEquity, Index9CASH ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTMAINTENANCEREQUIREMENTPay for each position infull.Pay for put in full. 50%requirement on longstock position.None required on put(no loan value).Provided long put isAmerican style exercise,long stock requirementis the lower of:1) 10% of the putexercise price plus100% of any outof-the-moneyamount, or2) 25% of stockmarket value.Long Call andShort UnderlyingEquity, Index9Not permitted.Pay for call in full.Short sale proceeds plus50% requirement onshort stock position.None required on call(no loan value).Provided long call isAmerican style exercise,short stock requirementis 100% of stockmarket value plus thelower of:1) 10% of the callexercise price plus100% of any outof-the-moneyamount, or2) for stock withmarket value of lessthan 5.00 pershare, the greater of 2.50 per share or100% of stockmarket value for stock withmarket value of 5.00 or more pershare, the greater of 5.00 per share or30% of stockmarket value.9Permitted only for options on individual stocks and stock index options. For stock index options, a qualified stock basket may serve as anunderlying component for the following strategies: Long Put and Long Underlying; Long Call and Short Underlying; Conversion; ReverseConversion; and Collar. A unit investment trust (“UIT”) replicating the S&P 500 index that has been approved by the Exchange mayserve as the underlying component in respect of the Conversion and Collar strategies. When an option is part of a hedge strategy, loanvalue on the option is not permitted.Also permitted with OTC options, however, the OTC option must be guaranteed by the carrying broker-dealer.13

OPTION TYPEConversionEquity, Index9long put and longunderlying with shortcallCASH ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTMAINTENANCEREQUIREMENTPay for put and longstock in full. Norequirement on shortcall.Pay for put in full. Norequirement on shortcall. 50% requirementon long stock position.None required on put(no loan value) or call.Provided options areAmerican style exercise,long stock requirementis 10% of the exerciseprice.put and call musthave same expirationand exercise priceReverseConversionLong stock positionmust be valued at lowerof current market valueor call exercise price formargin equity purposes.Equity, Index9Not permitted.long call and shortunderlying with shortputPay for call in full. Norequirement on shortput. Short saleproceeds plus 50%requirement on shortstock position.put and call musthave same expirationand exercise priceCollarlong put and longunderlying with shortcallput and call musthave same expirationput exercise pricelower than callexercise priceNone required on put(no loan value) or call.Provided options areAmerican style exercise,short stock requirementis 10% of the exerciseprice.Any amount (aggregate) by which theexercise price of the putexceeds the marketprice of the stock mustbe added to the stockmaintenance requirement, and to the stockinitial requirement forthe purpose of determining if excess Reg. Tequity exists.Equity, Index9Pay for put and longstock in full. Norequirement on shortcall.Pay for put in full. Norequirement on shortcall. 50% requirementon long stock position.None required on put(no loan value) or call.Provided options areAmerican style exercise,long stock requirementis the lower of:1) 10% of the putexercise price plusany put out-of-themoney amount, or2) 25% of the callexercise price.Long stock positionmust be valued at lowerof current market valueor call exercise price formargin equity purposes.9See p. 13.14

FLEX OPTIONSThe preceding margin requirements also apply to FLEX Options, with some exceptions which arereflected below (Put Spreads or Call Spreads; Short Put and Short Call).Note that FLEX Options can be offset against conventional options. Also, FLEX Options areallowed to be offset with FLEX Options or conventional options having a different exercise style(American vs. European). Additionally, Index FLEX Options are allowed to be offset with IndexFLEX Options or conventional index options with a different settlement value determination(open vs. close).Put Spread orCall SpreadOPTION TYPECASH ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTMAINTENANCEREQUIREMENTEquityNot permitted.Long side must expirewith or after the shortside.Initial spread requirement must be maintained.FLEX vs. FLEXFLEX vs.ConventionalSpreads betweendifferent exercise styles(American vs. European) permitted.For the same underlying instrument and, asapplicable, the sameindex multiplier; theamount by which thelong put (short call)aggregate exercise priceis below the short put(long call) aggregateexercise price. Longside must be paid for infull. Proceeds fromshort option sale maybe applied.1010It is important to remember that under certain circumstances, it is possible that the spread margin held by a carrying broker-dealer couldbecome insufficient to cover the assignment obligation on the short option if the long side is a European style option that can not beexercised, and that option is trading at a discount to its intrinsic value.15

CASH ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTINITIALREQUIREMENTMARGIN ACCOUNTMAINTENANCEREQUIREMENTSee above.See above.FLEX vs. FLEXBoth long and shortside must be Europeanstyle exercise, cashsettled index optionsFLEX vs.Conventio

using this manual should be familiar with margin computational methods and procedures as well as the margin requirements for all types of securities. Users contemplating margin account transactions are reminded that a 2,000 minimum margin account equity is required to effect new securities transactions and commitments [CBOE Rule 12.3(i)].