Transcription

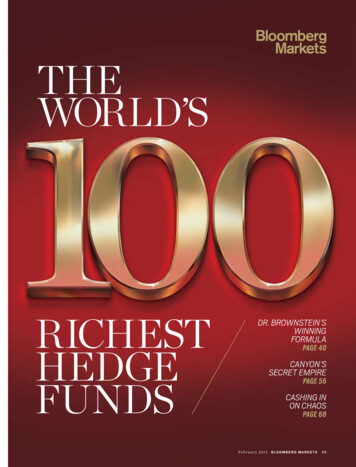

THEWORLD’SRICHESTHEDGEFUNDSDR. BROWNSTEIN’SWINNINGFORMULAPAGE 40CANYON’SSECRET EMPIREPAGE 56CASHING INON CHAOSPAGE 68Fe b r u a r y 2 0 1 1 B L O O M B E R G M A R K E T S39

100THE WORLD’SRICHESTHEDGE FUNDSCOVER STORIESFOR 20 YEARS, DON BROWNSTEIN TAUGHTphilosophy at the University of Kansas. He specialized in metaphysics, which examines the characterof reality itself. ¶ In a photo from his teaching days,he looks like a young Karl Marx, with a bushy blackbeard and unruly hair. That photo is now a relicstanding behind the curved bird’s-eye-mapledesk in Brownstein’s corner office inStamford, Connecticut. Brownsteinabandoned academia in 1989 to try tomake some money. ¶ The careerchange paid off. Brownstein is thefounder of Structured Portfolio Management LLC, a company managing 2 billion in five partnerships. Hisflagship fund, the abstrusely namedStructured Servicing Holdings LP,returned 50 percent in the first 10months of 2010, putting him at thetop of BLOOMBERG MARKETS’ listof the 100 best-performing hedgeC O N T I N U E D O N PAG E 4 3DR.BROWNSTEIN’SWINNINGFORMULABy ANTHONY EFFINGERand KATHERINE BURTONPHOTOGRAPH BY BEN BAKER/ REDUXTHE STRUCTURED PORTFOLIO MANAGEMENT FOUNDER MINESONCE-SHUNNED MORTGAGE BONDS FOR PROFITS. HIS FLAGSHIP FUND’S50 PERCENT GAIN PUTS HIM AT THE TOP OF OUR ROSTER OFTHE BEST-PERFORMING LARGE HEDGE FUNDS.40 BLOOMBERG MARKETSFe b r u a r y 2 0 1 1

1NO.BEST-PERFORMINGLARGE FUNDSDon Brownstein, left,and William MokStructured Portfolio ManagementFUND: Structured ServicingHoldings50%2010135%2009TOTAL RETURN

FUND, MANAGER(S)MANAGEMENT FIRM, LOCATIONSTRATEGYYTD TOTALRETURN2009RETURNIn BLOOMBERG MARKETS’ first-everranking of the top 100 largehedge funds, bets on mortgages,gold, emerging markets and globaleconomic trends stand out.ASSETS, INBILLIONSTHE 100 TOPPERFORMINGLARGE HEDGE FUNDS1Structured Servicing Holdings, Don Brownstein, William MokStructured Portfolio Management, U.S.Mortgage-backed arbitrage1.249.5%134.6%2Russian Prosperity, Alexander BranisProsperity Capital Management, RussiaEmerging markets1.139.3195.23Pure Alpha II, Ray DalioBridgewater Associates, U.S.Macro34.038.02.04Ikos FX, Elena AmbrosiadouIkos Asset Management, CyprusCurrency1.230.518.15Cevian Capital II, Christer Gardell, Lars ForbergCevian Capital, SwedenActivist2.629.835.76AQR Global Risk Premium, Team managedAQR Capital Management, U.S.Macro3.727.321.27Nisswa Fixed Income, Steve KuhnPine River Capital Management, U.S.Mortgage-backed arbitrage1.227.022.08Third Point Offshore, Daniel LoebThird Point, U.S.Event driven2.225.238.69Autonomy Global Macro, Robert GibbinsAutonomy Capital Research, U.K.Macro1.724.769.010Linden International, Joe WongLinden Asset Management, U.S.Multistrategy1.123.472.911All Weather 12% Strategy, Ray DalioBridgewater Associates, U.S.Macro2.223.211.312Ortus Currency Program, Joe ZhouOrtus Capital Management, Hong KongMacro1.723.119.113Pure Alpha 12%, Ray Dalio, Robert PrinceBridgewater Associates, U.S.Macro9.922.21.714Two Sigma Investments Compass U.S., Team managedTwo Sigma Investments, U.S.Systematic1.721.720.415Appaloosa Investment, David TepperAppaloosa Management, U.S.Global credit4.920.9132.016Cerberus Institutional Partners Series IV, Stephen FeinbergCerberus Capital Management, U.S.Distressed7.520.030.017Merchant Commodity, Michael Coleman, Doug KingAisling Analytics, SingaporeCommodity1.519.85.318Monarch Debt Recovery, Michael Weinstock, Andrew HerensteinMonarch Alternative Capital, U.S.Distressed1.619.035.019BlackRock U.K. Emerging Companies, Richard Plackett, Ralph CoxBlackRock Investment Management, U.K.Long/short2.018.66.1·Thoroughbred, David TepperAppaloosa Management, U.S.Fixed income5.718.6120.021Coatue Management, Philippe LaffontCoatue Capital Management, U.S.Long/short3.218.011.022Element Capital, Jeffrey TalpinsElement Capital Management, U.S.Fixed-income arbitrage1.617.378.823Discovery Global Opportunity, Rob CitroneDiscovery Capital Management, U.S.Emerging markets3.017.265.024Paulson Enhanced, John PaulsonPaulson & Co., U.S.Merger arbitrage*16.913.225Visium Balanced Offshore, Jacob GottliebVisium Asset Management, U.S.Long/short1.816.422.026Renaissance Institutional Futures, Jim SimonsRenaissance Technologies, U.S.Managed futures2.315.93.827Man AHL Diversified, Team managedMan Fund Management, U.K.Managed futures2.915.3–16.928Sola 1 Class A, Chris PucilloSolus Alternative Asset Management, U.S.Long/short2.515.17.929Tennenbaum Opportunities V, TCP Investment CommitteeTennenbaum Capital Partners, U.S.Credit1.015.058.5**30Ellerston Asia Pacific, Ashok JacobEllerston Capital, AustraliaLong/short1.414.9NASilver Point Capital Offshore, Edward Mule, Robert O’SheaSilver Point Capital, U.S.Credit4.514.9NA·

100FUND, MANAGER(S)MANAGEMENT FIRM, LOCATIONSTRATEGYASSETS, INBILLIONSYTD TOTALRETURN2009RETURNTHE WORLD’S RICHESTHEDGE FUNDS32Man AHL Diversified Futures, Team managedMan Fund Management, U.K.Managed futures1.314.6–16.433Brummer & Partners Nektar, Kerim Kaskal, Kent JanerBrummer & Partners Kapitalforvaltning, SwedenMacro2.214.2–6.1Glenview Opportunity Funds, Larry RobbinsGlenview Capital Management, U.S.Opportunistic1.014.2106.235Aspect Diversified, Gavin FerrisAspect Capital, U.K.Managed futures3.914.1–11.236Joho Partners, Robert KarrJoho Capital, U.S.Long/short2.313.921.037Paloma Partners, Donald SussmanPaloma Partners, U.S.Multistrategy1.713.023.0Perry Partners International, Richard PerryPerry Partners, U.S.Multistrategy5.113.025.239Wolverine Convertible Arbitrage Trading, Christopher GustWolverine Asset Management, U.S.Convertible arbitrage1.112.955.140Farallon Capital Offshore, Thomas SteyerFarallon Capital Management, U.S.Multistrategy3.812.826.641Winton Futures Class B, David HardingWinton Capital Management, U.K.Managed futures5.412.6–4.642Paulson Credit Opportunities, John PaulsonPaulson & Co., U.S.Credit8.812.435.043Spinnaker Global Opportunity, Claude Marion, Alexis HabibSpinnaker Capital, U.K.Emerging-market debt2.612.328.144GLG Emerging Markets, Bart Turtelboom, Karim Abdel-MotaalGLG Partners, U.K.Emerging-market equity1.312.135.2Renaissance Institutional Equities, Jim SimonsRenaissance Technologies, U.S.Long/short4.412.1–4.646BlueTrend, Leda BragaBlueCrest Capital Management, U.K.Managed futures11.912.04.447MKP Offshore Credit, Patrick McMahon, Anthony LembkeMKP Capital Management, U.S.Credit2.011.817.1Transtrend Diversified Trend Program–Enhanced Risk (USD),Team managedTranstrend, NetherlandsManaged futures5.711.8–11.349Strategic Value Restructuring, Victor KhoslaStrategic Value Partners, U.S.Distressed2.511.719.250R3, Rick RiederBlackRock Advisors, U.S.Distressed1.111.654.051Canyon Value Realization, Joshua Friedman, Mitchell JulisCanyon Partners, U.S.Multistrategy8.811.555.052Fir Tree Value, Jeff TannenbaumFir Tree Partners, U.S.Multistrategy6.311.122.153SAC Capital International, Steven CohenSAC Capital Advisors, U.S.Long/short12.011.029.054Fore Multi Strategy, Matthew LiFore Research & Management, U.S.Multistrategy1.110.848.5·Glenview Funds, Larry RobbinsGlenview Capital Management, U.S.Long/short3.410.882.7Pershing Square International, Bill AckmanPershing Square Capital Management, U.S.Event driven4.410.641.1Spinnaker Global Emerging Markets, Marcos LedermanSpinnaker Capital, U.K.Emerging-market debt1.710.628.3BlueCrest International, Michael PlattBlueCrest Capital Management, U.K.Macro8.210.545.4·OZ Global Special Investments Master, Daniel OchOch-Ziff Capital Management, U.S.Distressed1.210.58.4·PARS IV Offshore II Class A/1, William H. GrossPacific Investment Management, U.S.Global credit2.010.563.361Maverick Class A/1, Lee Ainslie IIIMaverick Capital, U.S.Long/short3.110.324.262Saba Capital Master, Boaz WeinsteinSaba Capital Management, U.S.Long/short1.810.18.063Tewksbury Investment, Matthew TewksburyStevens Capital Management, U.S.Multistrategy3.310.010.564Bay II Resource Partners, Thomas ClaugusGMT Capital Offshore Management, U.S.Long/short1.09.651.4·Clive, Christian LevettClive Capital, U.K.Commodity4.09.617.4·Millennium International, Israel EnglanderMillennium Capital Management, U.S.Multistrategy5.29.617.2AQR Absolute Return, Team managedAQR Capital Management, U.S.Multistrategy1.59.538.1····56·5867Fe b r u a r y 2 0 1 1 B L O O M B E R G M A R K E T S41

FUND, MANAGER(S)MANAGEMENT FIRM, LOCATIONSTRATEGYASSETS, INBILLIONSYTD TOTALRETURN2009RETURNTHE 100 TOP PERFORMING LARGE HEDGE FUNDS CONTINUED·AQR Delta, Team managedAQR Capital Management, U.S.Relative value1.09.519.3·Millburn Diversified Program, Team managedMillburn Ridgefield, U.S.Systematic1.19.5–7.4BlueCrest Emerging Markets, Nick RileyBlueCrest Capital Management, U.K.Emerging markets1.29.433.9BlueMountain Credit Alternatives, Andrew FeldsteinBlueMountain Capital Management, U.S.Global credit2.99.437.672Bay Resource Partners Offshore, Thomas ClaugusGMT Capital, U.S.Long/short2.09.356.673York Credit Opportunities, James DinanYork Capital Management, U.S.Distressed3.09.135.774OZ Asia Master, Daniel OchOch-Ziff Capital Management, U.S.Multistrategy1.49.034.0·Shepherd Investments International Class A, Brian Stark, Mike RohStark Investments, U.S.Multistrategy1.69.012.276Davidson Kempner International, Thomas Kempner, Marvin DavidsonDavidson Kempner Capital Management, U.S.Distressed5.78.9NA77Greenlight Capital, David EinhornGreenlight Capital Offshore, U.S.Long/short6.88.830.678Passport Capital Global Strategy, John BurbankPassport Capital, U.S.Macro1.78.719.3York European Opportunities, James DinanYork Capital Management, U.S.Event driven2.78.730.980Capula Global Relative Value A, Yan Huo, Masao AsaiCapula Investment Management, U.K.Fixed-income arbitrage5.58.612.2·Halcyon Partners Offshore, Kevah Konner, John BaderHalcyon Offshore Asset Management, U.S.Multistrategy1.08.621.5Carlson Double Black Diamond, Clint CarlsonCarlson Capital, U.S.Multistrategy3.78.528.2·Caxton Global Investment, Andrew LawCaxton Associates, U.S.Macro6.68.56.2·Davidson Kempner Distressed Opportunities InternationalClass A, Michael Leffell, Anthony YoseloffDavidson Kempner Capital Management, U.S.Distressed1.18.545.085York Select, James DinanYork Capital Management, U.S.Event driven1.28.282.686Advantage Advisers Xanthus, Takis SparaggisOppenheimer Asset Management, U.S.Long/short1.18.129.6Sark Limited , Emmanuel Gavaudan, Emmanuel BoussardBoussard & Gavaudan Holding, Hong KongMultistrategy1.78.125.188Scoggin Capital Management, Craig Effron, Curtis SchenkerScoggin Capital Management, U.S.Event driven1.88.037.089Boronia Diversified, Angus GrinhamBoronia Capital, AustraliaManaged futures1.77.9–6.190Paulson Recovery, John PaulsonPaulson & Co., U.S.Distressed2.27.825.591Octavian Global, Richard HurowitzOctavian Advisors, U.S.Global special situation1.07.630.6·Moore Macro, Louis BaconMoore Capital Management, U.S.Macro3.87.616.893Paulson Partners, John PaulsonPaulson & Co., U.S.Merger arbitrage*7.46.294Exane 1–Archimedes A, Cesar Zeitouni, Gilles LenoirExane Asset Management, FranceLong/short1.47.310.295Blenheim, Willem KooykerBlenheim Capital Management, U.S.Managed futures5.07.243.796Perella Weinberg Partners Xerion Offshore, Daniel ArbessPerella Weinberg Partners, U.S.Event driven2.37.135.397Citadel, Ken GriffinCitadel Investment Group, U.S.Multistrategy11.07.062.0CQS Convertible and Quantitative Strategies Feeder,Michael Hintze, Oliver DobbsCQS Cayman, U.K.Convertible arbitrage1.17.031.2Elliott International, Paul SingerElliott Management, U.S.Multistrategy16.86.730.1OZ Master, Daniel OchOch-Ziff Capital Management, s are for the 10 months ended on Oct. 29. Includes funds with more than 1 billion in assets. *Total for both funds is 5 billion. **As of Oct. 31, 2009.Sources: Bloomberg, hedge-fund databases, hedge-fund firms, investors42 BLOOMBERG MARKETSFe b r u a r y 2 0 1 1

100JESSE NEIDERTHE WORLD’S RICHESTHEDGE FUNDSfunds managing 1 billion or more. The 1.2 billion fund skyrocketed 135 percent in 2009.In percentage terms, Brownstein, 67, beat outfunds run by bigger, better-known competitors,including Ray Dalio’s Bridgewater AssociatesLP. Dalio, though, has three funds in the top 15.Brownstein also topped Steven Cohen’s SACCapital International (No. 53).Brownstein did it by exploiting his expertisein something almost as esoteric as metaphysics:the market for exotic securities built from residential mortgages. It was the crackup in housingand mortgage markets that brought the U.S.economy to its knees in 2008 and earned billionsfor hedge-fund managers such as John Paulson,who saw it coming and bet that mortgage securities would crash.Brownstein and William Mok, StructuredPortfolio’s director of portfolio management,won’t say exactly how they made their 2010 killing. Their longtime strategy is to develop modelsthat predict when homeowners will refinancetheir mortgages—a move that reduces interestpayments on mortgage bonds. They then buysecurities they conclude are underpriced. Manyhomeowners have been unable to take advantage of tumbling rates to refinance their mortgages because their houses are worth less thanthey owe on their loans. Investors that betagainst a refinancing boom have profited.Two of Brownstein’s other funds are in a1NO.MOSTPROFITABLEFUNDSRay Dalio, aboveBridgewater AssociatesFUND: Pure Alpha II38%20102%2009TOTAL RETURNthree-way tie for ninth place inthe ranking of mid-size funds,which manage from 250 million to 1 billion. The SPM Coreand SPM Opportunity fundswere both up 31 percent.The hedge-fund ranking usesdata compiled by Bloomberg andinformation supplied by researchfirms, fund companies and investors. (See “How We Crunched theNumbers,” page 54.)Three of the top 10 funds mademoney on mortgage bonds, according to Bloomberg data. Themortgage market is often lucrative for hedge funds because it’svolatile, says Jeffrey Gundlach,chief executive at DoublelineCapital LP, a Los Angeles manager of mutual funds that trade mortgages. “Themortgage market ha

THE 100 TOP-PERFORMING LARGE HEDGE FUNDS FUND, MANAGER(S) MANAGEMENT FIRM, LOCATION STRATEGY ASSETS, IN BILLIONS YTD T OTAL RETU R N 2009 RETU R N 1 Structured Servicing Holdings, Don Brownstein, William Mok Structured Portfolio Management, U.S. Mortgage-backed arbitrage 1.2 49.5% 134.6%