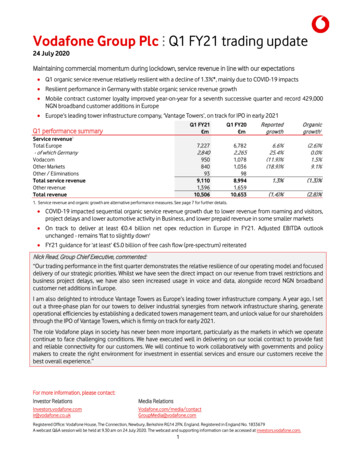

Transcription

RebuildingEuropeThe cultural and creativeeconomy before and afterthe COVID-19 crisisJanuary 2021

About the partners and supportersof the reportGESAC’s partners for the studyContentsAEPO-ARTISThe European Grouping of Societies of Authors and Composers(GESAC) commissioned EY teams to produce a report on thestate of the cultural and creative industries (CCIs) in Europe.Association of European Performers OrganisationsWhat was their economic situation before the COVID-19 crisis?What impact has the crisis had on activity and employment?And what are the main priorities for the sector to protect itselffrom the most serious consequences, to recover growth andenhance its value in the European economy? This study followsa report of the same type, entitled Creating Growth, publishedin December 2014.EUROCOPYAGESAC has brought together numerous partnersrepresenting the CCIs, in order to reflect the diversity andcollective strength of this economy.IMPALAThe EY team would like to thank GESAC’s team, GESAC'spartners and the experts interviewed across Europe. GESACand EY would also like to thank ADAGP, BUMA, GEMA, SACEM,SCAM, SIAE and SOZA for their contributions. Everyone'scontribution has been essential to the study.EUROCINEMAAssociation of European ProducersEuropean Federation of Joint Management Societiesof Producers for Private Audiovisual CopyingEVAEuropean Visual ArtistsFIAPFInternational Federation of Film Producers AssociationsIndependent Music Companies AssociationIVFInternational Video FederationSAASociety of Audiovisual AuthorsSROCSports Rights Owners CoalitionAbout GESACSupportive organizationsGESAC comprises 32 authors’ societies from all over Europe,which together represent over one million creators and rightsholders – from musicians to writers, visual artists to filmdirectors and many more, in the areas of musical, audiovisualand visual arts, and literary and dramatic works.AERweb: www.authorsocieties.euemail: secretariatgeneral@gesac.orgtwitter: @authorsocietiesEACAAbout the partners and supporters of the report02Executive summary04Editorials08123Before COVID-19The full power of culture and creation12Because of COVID-19The sharp fall28After COVID-19Rebuilding Europe42Detailed methodology and main sources50Association of European RadiosCEPICCoordination of European Picture AgenciesStock, Press and HeritageEuropean Association of Communications AgenciesECSAEuropean Composer and Songwriter AllianceEGDFEuropean Games Developer FederationAbout the study’s teamEPCEuropean Publishers CouncilThe study was carried out by EY Consulting, under thesupervision of Marc Lhermitte, with the participation of HugoAlvarez, Clémence Marcout, Quentin Nam and Enzo Sauze.FEPFederation of European PublishersFERAFederation of European Film DirectorsFSE/SCRIPTFederation of Screenwriters in national Federation of ReproductionRights OrganisationsIMPFIndependent Music Publishers International ForumClémenceMarcout2EnzoSauzeRebuilding Europe – The cultural and creative economy before and after the COVID-19 crisis3

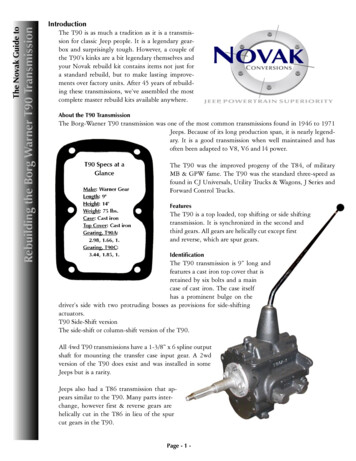

Executive summaryRebuilding Europe : the cultural and creative economybefore and after the COVID-19 crisisEmployment by sector in 2019(in million jobs; EU-28)Sources: Eurostat – Business Sector Profile; EY modeling and analysis 2020.EY 2021ChemicalsConstruction1.21. Before COVID-19 The full power of culture and creationAt the end of 2019, the cultural and creative economywas a European heavyweight With a turnover of 643 billion anda total added value of 253 billionin 2019, the core activities of thecultural and creative industries(CCIs) represented 4.4% of EU GDPin terms of total turnover. Therefore, the economic contributionof CCIs is greater than that oftelecommunications, high technology,pharmaceuticals or the automotiveindustry. Since 2013, total CCI revenues haveincreased by 93 billion and byalmost 17%. At the end of 2019, CCIs employedmore than 7.6 million people inthe EU-28, and they have addedapproximately 700,000 ( 10%) jobs,including authors, performers andother creative workers, since 2013. Between 2013 and 2019, the 10CCI sectors experienced varied butconstant growth rates: more than 4%per year for video games, advertising,architecture and music; and between0.5% and 3% for audiovisual (AV),radio, visual arts, performing arts andbooks. Only the press suffered (-1.7%)due to the difficult transition betweenprint and online revenues. All the players point to a period ofintense innovation – not only thesearch for greater live or physicalexperiences by spectators, readers,players or visitors but also theexplosion in demand for onlinecontent: 81% of internet users in theEU used the internet for music, videosand games in 2018 – more than forshopping or social networking.Turnover and added value in 2013and 2019, and share of GDP(in billion and %, EU-28) 10.7Automotive10.3(4.2%)1.3Utilities213253%(1.6 )(1.7%)20132019Added valueTurnoverSources: Eurostat; GESAC; professionalorganizations; EY modeling and analysis 2020.8.4 more jobs than in thetelecommunications industry81%of internet users in the EU used theinternet for music, videos and gamesCCIs in Europe have become more international and entrepreneurial In 2019, the five largest EU-28 countries (France, Germany,Italy, Spain and the UK) accounted for 69% of CCI totalrevenue in the EU, but the strongest growth came fromCentral and Eastern Europe. Over 90% of CCI companies are small- and medium-sizedenterprises, and 33% of the workforce are self-employed –more than twice as many as in the European economy as awhole (14%). In 2017, the EU exported 28.1 billion worth of culturalgoods. The EU’s trade balance in cultural goods is in surplus( 8.6 billion), and the share of CCI exports in total EUexports was 1.5% – about the same as the surplus in tradein food, drinks and tobacco ( 9.1b in 2018). Revenues originating from the public sector accounted foronly 10.8% of revenues in 2018, compared with 11.5% in2013.47.6Cultural and creative industries 8.6bEU’s total trade balance in culturalgoods in 201990%of CCI businesses are smalland medium sizedSources: Digital Economy and Society Index (DESI); BusinessSector Profile, Eurostat; Cultural Statistics, EurostatTransportation and logisticsDigital experiences and online/offline distributioncombinations have fueled the growth, but the marketcontinues to evolve In the last six years, the turnovergenerated by online culturalcontent, services and worksgrew by 11.5% per year. Cultural enterprises havehistorically been one of the firstto experiment and adopt digitaltechnologies (digital photos,digital carriers such as DVD andBlu-ray, CDs, shooting digitally,streaming, virtual reality andonline platforms). Culturalcontent have fueled the growthand the development of theinternet from the very beginning,and still represent a high share ofbroadband consumption. Since 2013, CCI companiesand organizations haveRebuilding Europe – The cultural and creative economy before and after the COVID-19 crisisinvested heavily in innovationand digitization, both from abusiness perspective and in termsof production and customerexperience. Yet unbalanced relationshipswith global platforms andintermediaries on the internetmay compromise the financialviability, employment, innovationand investments in the sector. For the stakeholders of the CCIs,the challenges are numerous,including the remunerationof rights holders, the properfunctioning of the markets forcultural and creative content, andthe fight against illicit access toprotected works.5

Executive summaryRebuilding Europe : the cultural and creative economybefore and after the COVID-19 crisisEY 20213. After COVID-19 How to rebuild Europe2. Because of COVID-19 The sharp fallIn 2020, the cultural andcreative economy lostapproximately 31% of itsrevenuesTotal turnover generated by CCIs inthe EU-28 (in billion)and music (-76%) are the mostimpacted; visual arts, architecture,advertising, books, press andAV activities fell by 20% to 40%compared with 2019. The videogames industry seems to be the onlyone to hold up ( 9%). The total turnover of CCIs in the EU28 is reduced to 444 billion in 2020,a net drop of 199 billion from 2019.-31% The crisis has hit Central andEastern Europe the hardest (from-36% in Lithuania to -44% in Bulgariaand Estonia). With a loss of 31% of its turnover, thecultural and creative economy isone of the most affected in Europe,slightly less than air transportbut more than the tourism andautomotive industries (-27% and -25%respectively).643444 All sectors are affected: even thosethat seemed to be protected byhome consumption faced a sharpdrop in income, given the central roleof physical experiences and salesin their business models, as wellas uncontrollable production anddistribution costs. The shockwaves of the COVID-19crisis are felt in all CCIs: performingarts (-90% between 2019 and rsand %-23%-20 9% 2VisualartsVideo gamesindustry-37-31%Average changein turnover-38%-53Change in turnover (in %)6Provide massive public fundingand promote private investment incultural and creative businesses,organizations, entrepreneurs andcreators – two indispensable leversto support and accelerate theirrecovery and transformation.Promote the EU's diversifiedcultural offering by ensuring asolid legal framework to allowfor the development of privateinvestment in production anddistribution, providing thenecessary conditions for anadequate return on investmentfor businesses and guaranteeingappropriate income for creators .Use the CCIs – and the multipliedpower of their millions of individualand collective talents – as a majoraccelerator of social, societaland environmental transitions inEurope. The financial viability of individuals – whether creative orbusiness – and CCI companies in the private and publicsectors is compromised by rising costs, successive delays,tight cash flow due to interruption of activities, and theuncertain return of acceptable economic and healthconditions. The seriousness of the crisis is illustrated, for example, bythe fall of around 35% in royalties collected by collectivemanagement organisations (CMOs) for authors andperformers, whose revenues will be sharply reduced in2021 and 2022. On the other hand, consumer spend on digital modelsdoes not compensate for the loss of revenues generatedin physical sales (of books, video games, newspapers, etc.)and events in most sectors. In the music sector, physical-76%Change in turnover (in billion)Sources: Eurostat; GESAC; professional organizations;Oxford Economics; EY modeling and analysis 2020.Challenge 3 – “Leverage”The COVID-19 crisis will have a massive and lasting impact on the entire CCI value chain-20%-32%Challenge 2 – “Empower”Sources: Eurostat; GESAC; professionalorganizations; Oxford Economics – Global Industry,Second Wave Scenario, as of 7 September2020; EY modeling and analysis 2020.-9-17Challenge 1 – “Finance”2020 (estimatewith the impact ofthe COVID-19 crisis)Estimated change in turnover 2019-20 by CCI sector (in % of total 2019 turnover and in billion; EU-28)AdvertisingAs a result of in-depth research and interviews conducted by EY teams, and based on theopinions of experts and organizations representing the CCIs, the following challenges havebeen identified as priorities for the recovery and growth of the creative economy:sales (CDs and vinyls) will be down 35%, while digitalrevenues for the recorded music industry are expected togrow by only 8%. The same trends apply for film with a dropof revenues generated by European cinemas estimated sofar at -75% in 2020. In the absence of a significant resumption of offlineproduction, distribution and promotion operations in 2021,the ability of CCIs to maintain and increase investmentin new projects, creation and innovation will be seriouslycompromised. In a recent EY Future Consumer Index, 46% of respondentssaid they would not feel comfortable going to a concertfor several months, and 21% said they would not feelcomfortable going for several years.-90%Rebuilding Europe – The cultural and creative economy before and after the COVID-19 crisis7

EditorialEditorialCulture, the social cementof the post-COVID-19 worldCCIs are essential formaintaining our culturaldiversity, social cohesion andEurope’s attractivenessDavid SassoliPresidentEuropean ParliamentEurope’s diverse and rich cultural heritage and culture is thecement that fosters our common European sense of belonging.Not only does it contribute to our society’s social cohesion, to ourdemocracy and to our economy, but it also reflects our Europeandiversity, values, history and way of life. As such, it must becherished and supported.We are facing challenging times. TheEuropean Parliament recognized fromthe outset the dramatic effects of theCOVID-19 pandemic on the cultural andcreation sector, and on the many cultureprofessionals, authors, composers,musicians, writers and more, men andwomen whose present and future havebecome seriously uncertain.“We must think of culture as not only apivot for recovery but also the socialcement of a post-COVID-19 world thatneeds to be rebuilt, in which interpersonallinks will have to be reconnected.At a time when darkness seemed to havetaken over our private lives, culturalvenues, concerts, cinemas and theaters,Europeans took to their instruments andsang on their balconies.Art has a cathartic power that can accompany apost-pandemic society on the road to resilience.From the very start, we called on EUinstitutions and Member States torecognize the need for massive supportfor culture. For several months, theParliament fought tooth and nail toincrease the budget allocated to culturein the multi-annual financial framework.The Creative Europe program wassubstantially enhanced, and this victoryis the testament to our commitment torespond to the needs of citizens and tothe cultural and creative sector. We alsocalled strongly upon every Member Stateto ensure that the fundamental place thatculture deserves in the economic recoveryplan is preserved.8Art has a cathartic power that canaccompany a post-pandemic societyon the road to resilience. Art is not anaccessory; it is a viaticum. Art is not“political”; it is “poetic” – a creative forcethat animates us and allows us to livetogether, to survive, individually andcollectively.Mariya GabrielEuropean Commissionerfor Innovation, Research,Culture, Educationand YouthThe EU’s cultural and creative sectorsare an important pillar of our societyand economy. They are essential forour cultural diversity, strengtheningsocial cohesion and increasing Europe’sattractiveness internationally. Theyare also one of our most dynamicsectors, with positive spill-over effectson other sectors of the economy,such as the take-up of technology orcultural tourism. The contribution to oureconomy is enormous, with as muchas 4% of our GDP and more than sevenmillion jobs, more than the automotivesector in the EU!Yet the COVID-19 crisis has had adevastating impact on cultural andcreative sectors across all MemberStates. We have seen, on the one hand,the sector’s extraordinary capacity tomobilize and be creative at all levels, buton the other, the need for resources,targeted investment and greater supportin such critical moments.On our side, we reacted very quicklyusing the flexibility of our existinginstruments. But more importantly, weworked hard for the future. As a result, afew weeks ago, we managed to increasethe budget for the new Creative Europeprogramme 2021-2027 to 2.2bn, a50% increase compared with the currentprogramme. Moreover, other importantRebuilding Europe – The cultural and creative economy before and after the COVID-19 crisisinstruments, such as Erasmus , with anenvelope of 26bn, as well as HorizonEurope and, in particular, its Cluster2 on Culture, Creativity and InclusiveSociety (worth 2.3bn), will alsosupport the sector. Our work will focuson enhancing synergies among theseinitiatives, as well as with other fundingpossibilities available through DigitalEurope, REACT-EU or cohesion policyinstruments, to help the sector recoverand tackle future challenges.Over the past months since thebeginning of the crisis, I have receivedall the representatives of the sector tohear their concerns and gather dataabout losses due to restrictive measuresthroughout Europe. However, it is fair tosay that the full impact of the ongoingCOVID-19 crisis on the cultural sectorshas not yet been assessed, due to thesevere lack of data. Specific data isextremely important to respond rapidlyand identify the best possible tools tosupport the sector. The findings of thisstudy will be instrumental to definesuitable responses to this unprecedentedcrisis, and make sure that the measuresare targeted and efficient.I encourage you to read this veryinteresting study that shows, once more,the importance of this sector for oursocieties and economies.9

EditorialEditorialCCIs could become the N 1 allyof the European recoveryThe full power of cultureJean-Noël TroncPresident GESACCEO SACEMThe study presented in this documentwas commissioned by GESAC, whichrepresents over one million creatorsand rightsholders in Europe, and carriedout by EY Consulting. It serves twopurposes. First, it provides accuratedata on the massive economic impact ofthe COVID-19 crisis on the cultural andcreative industries in Europe. But it alsoasserts that this sector, an economicheavyweight at the heart of Europe’ssocial fabric, could become the numberone ally of the European economic“CCIs contribute toEurope’s identity,diversity andregeneration.recovery.Indeed, the current crisis is all themore serious as it affects a sector asdynamic as it is vulnerable; as essentialas it is diverse. CCIs are a world ofsmall businesses and freelancers (whorepresent one-third of workers in thecreative economy) as well as large firms,sometimes leaders at the internationallevel. They contribute to Europe’sidentity, diversity and regeneration, witha proportion of women in employmenthigher than in the European economy(48%) and a creative workforce youngerthan the average in 21 of the 27 MemberStates. And cultural activities – includingmusic, literature, visual arts, cinema,museums, theatres, architectureand video games – are vectors ofcommunication, inclusion and socialcohesion.10But culture is one of the most impactedeconomic sectors in Europe, with amassive drop of 31% of its revenuesin 2020 due to the COVID-19 crisisand full recovery not expected before2022. This situation might weaken theentire CCI value chain for a very longtime: artists, producers, publishers,technicians and, of course, authors, whoare the fundamental but also the mostthreatened link in the sector.After a first report published with GESAC in 2014, EY Consultingtook up the challenge of producing this second edition at the endof a dramatic year for the cultural and creative industries (CCIs),both in Europe and around the world.Marc LhermittePartner, EYFortunately, it’s not too late to takeaction. If specific measures and recoveryplans are put in place, CCIs could bemuch more than “one of the problems tobe solved” following the crisis, becominga significant part of Europe’s solution.Our report also shows the powerof culture, its dynamism and itscontribution to the EU’s global influence.Based on a massive turnover ofThat is why we, the European authors’right societies, suggest to the authoritiesthat they implement concrete solutionsto tackle three main challenges: Financing the cultural recovery bypromoting massive public and privatefunding for cultural and creativebusinesses, non-profit organizations,entrepreneurs and creators Empowering CCIs to reinforce theirpositive impact by ensuring a solid legalframework, allowing an adequate returnon investment and guaranteeing fairremuneration for creators Preparing for the future by using thecultural and creative industries – andthe multiplied power of their millionsof individual and collective, private andpublic talents – as a major acceleratorof social, societal and environmentaltransitions in Europe.The analysis shows that the Europeancultural and creative economy lostalmost a third of its activity in 2020.Culture was the first to suspend mostof its live and retail activity – and it willprobably be the last to resume withoutconstraint. Only air transport canchallenge culture for the unenviableposition of the most affected sector. Yetit is undeniable that other industrieshave been able to better explain theirvalue and potential, and channel publicsupport. 643 billion in 2019 (more than thetelecommunications, pharmaceuticalor automotive sectors), the value ofthe creative ecosystem, diversifiedand innovative by nature, lies above allin the 7.6 million people who create,produce and disseminate the artistic act– 700,000 more than six years ago. Andthe balance of trade in culture posted anet surplus of 8.6 billion in 2019.The EY team would like to extend itswarmest thanks to GESAC and itspartners for their incredible supportand collaboration, and to the dozens ofprofessionals, experts and creators whoprovided insights and convictions so thatEurope can use the full power of culture.ScopeThis study covers the 10 corecultural and creative sectors thathave already served as the scope ofthe first report on CCIs in Europe,published in 2014 by EY andGESAC: pers and magazinesPerforming artsRadioVideo gamesVisual artsFor the sake of rigor andconsistency, we have decided tostay close to the UNESCO definitionof CCIs as activities “whoseprincipal purpose is productionor reproduction, promotion,distribution or commercializationof goods, services and activitiesof a cultural, artistic or heritagerelated nature.” Therefore, themain data shown in this report doesnot include certain other “creativeactivities,” such as fashion, jewelryor industrial design – nor sectorswhere creativity plays a centralrole, such as luxury goods orRebuilding Europe – The cultural and creative economy before and after the COVID-19 crisisgastronomy, which are sometimesincluded in CCI statistics, such asthose of Eurostat.The geographical scope of thestudy is the European Union (EU)and the United Kingdom (UK),known as the EU-28. Unlessotherwise stated, all referencesto the EU in this study refer to thescope of the EU-28.Unless otherwise stated, allreferences to creators refer toauthors, performers and otherartists.11

01Before COVID-19The full power ofculture and creationThe cultural and creative economyis now a European heavyweightAt the end of 2019, the coreactivities of the cultural and creativeindustries (even without includingother industries or adjacent activities,such as industrial design, fashion orgastronomy) represented a total addedvalue of 253 billion,1 or 1.7% of EUGDP, up 5% on 2013.In terms of turnover, creativebusinesses, organizations, freelancersand creators generated 643 billion– 93 billion more than in 2013.When total revenues are measuredin relation to EU GDP, the sectoraccounts for about 4.4% of theEuropean economy.Before the start of the COVID-19 crisis,the cultural and creative economy wasgrowing steadily in the EU. From 2013to 2019, it grew by 2.6% per year,while the EU average GDP growth was2.0%.The contribution of CCIs to theEuropean economy is greater than thatof other sectors, which are generallyconsidered to be landmarks of theEU economy: for example, the CCIGDP is 1.4 times greater than that oftelecommunications and 2.3 timesgreater than that of the automotiveindustry.And its growth between 2013 and2019 (2.6% per year) exceeded thatof the construction and automotivesectors (2.5% and 1.6% respectively).The sector also stimulates the growthof several other industries – suchas tourism, high technology, digitalindustries, transportation andtelecommunications – that are bothsuppliers and customers of CCIs. Theoverall spillover when these impactsare included confirms CCIs as akey driver of growth for the wholeEuropean economy.Turnover and added value in 2013and 2019, and share of GDP(in billion and %, EU-28) ed valueTurnoverSources: Eurostat; GESAC; professionalorganizations; EY modeling and analysis 2020.Added value by sector in 2019 (in billion; EU-28)3,082Business services737691668ConstructionFinancial servicesTransportation and logisticsAccommodation and cateringUtilitiesCultural and creative industriesAgriculture, forestry and fisheriesTelecommunicationsChemicalsHigh-tech goodsPharmaceuticalsAutomotiveTextiles, leather and clothingAerospaceOil and gas : Oxford Economics – Global Industry Scenarios; EY modeling and analysis 2020.112Without double counts.Rebuilding Europe – The cultural and creative economy before and after the COVID-19 crisis13

In 2019, CCIs employed more than 7.6 million people in the EUIn 2019, the core activities of the cultural and creativesectors employed 7.6 million people in the EU.Within the CCIs, four sectors provide employment for morethan one million people. Together, they accounted for 68%of the total (7.6 million): visual arts (1.9 million), music (1.2million), AV (1.1 million) and performing arts (1.0 million).Employment in the creative and cultural sectors grewsteadily between 2013 and 2019, from 6.9 million to7.6 million people,2 a slightly higher growth rate (1.9%)than the European average (1.3%). In six years, creativebusinesses and organizations, producers, developers,distributors, creative agencies, editors, broadcasters andmuseums created around 700,000 new jobs in Europe.At the end of 2019, CCIs had a much larger workforcethan other leading sectors of the European economy:for example, 2.9 times more than the automotiveindustry and 6.3 times more than chemical industries.could reach 8.7 million people,3 the difference beingin occupations outside the cultural sector (e.g.,industrial design). If fashion and high-end industries(e.g., luxury goods and services) are included, the total“creative” workforce reaches 12 million people.4Employment by sector in 2019(in million jobs; EU-28)Sources: Eurostat – Business Sector Profile; EY modeling and analysis 2020.12.110.710.3ConstructionTourismTransportation and logistics7.6Cultural and creative TelecommunicationsAccording to reports based on a much broader definitionof the creative industries, the total “creative” workforceAcross Europe and across all sectors, the mosaicof creative industries is showing its diversityOverview of creative sectorsIn terms of turnover, the three main areas of activity arethe visual arts ( 138 billion), advertising ( 129 billion)and AV ( 119 billion) sectors, which together account foralmost 60% of the CCIs’ total revenue. But growth rates showvariations between sectors.The video games sector experienced the strongest growth( 5.8% per year) between 2013 and 2019, more thandoubling its turnover in six years. The sector relied on thestrong growth of its online activity, particularly in the mainEuropean markets ( 155% in France, the UK, Germanyand Spain combined), thanks to intense innovation and thesearch for a greater experience for players (new types ofconsoles, better quality of visual effects, etc.) and the movetoward free game models, which rely on in-game sales ratherthan charging to join the game.The advertising sector grew faster than the Europeanaverage ( 5.5% per year between 2013 and 2019), thanks1,890Employment by CCI sector in 2019(in ‘000 persons employed, EU-28) 14%Sources: Eurostat; GESAC; professional organizations; EY modeling and analysis 2020.138 381221,192Music also experienced sustained growth ( 4%), half ofwhich was due to live performance ( 4.8%), while theperforming arts ( 2.9%) and visual arts ( 2.2%) experienceda strong development in some countries. Performing artsalso grew by 33% in the Czech Republic and 53% in Slovakia.The visual arts market grew by 50% in Denmark, reflectingthe “golden age” that the country entered 15 years ago,according to art critics.Sources: Eurostat; GESAC; professional organizations; EY modeling and analysis 2020. 11%Turnover in 20131,12294-10%9788903670619608 36%52 24%41393381Visual artsMusicTurnover in 20191191071,001After the difficult times that followed the economic crisisof 2008, architecture was able to grow by 5.3% between2013 and 2019, mainly due to strong real estate activityin general and in the area of sustainable renovation inparticular, as well as increased demand for integratedservice offerings, from design to construction.Turnover by CCI sector in 2013 and 2019 and 2013-19 growth rate(in billion, EU-28)%129to the strong growth of online advertising ( 12.3% overthe period) and the economic development of Central andEastern Europe ( 8.1% per year).Audiovisual Performing Advertising ArchitectureartsBooksNewspapers Video gamesand magazines industry 1%37 37 26%3156 152%2424Radio9234Without double counts.Cultural statistics – 2019 edition, Eurostat, 2019.Boosting the competitiveness of cultural and creative industries for growth and employment, European Commission, 2016.14Visual artsAdvertisingAudiovisual Newspapers Architecture Performingand magazinesartsRebuilding Europe – The cultural and creative economy before and after the COVID-19 crisisBooksMusicVideo gamesindustry 7%10 10Radio15

In the AV sector ( 1.8%), the increase in European featurefilm production ( 2% per year since 2014), the densenetwork of broadcasters, producers and distributionnetworks, and the emergence of video-on-demand (VOD)platforms ( 383%) contributed to the growth of the sector.The radio sector ( 2%) benefited from the emergence ofpodcasts, a small but growing ma

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Information about how EY collects and uses personal data and a description of the