Transcription

Opportunities in theIndian automotive aftermarketPrepared for Auto Serve 2010, a conference on improving theproductivity in the automotive aftermarket organised by theConfederation of Indian IndustryChennai, November 19th, 2010This report is furnished to the recipient for information purposes only. Each recipient should conduct their owninvestigation and analysis of any such information contained in this report. No recipient is entitled to rely onthe work of McKinsey & Company, Inc. contained in this report for any purpose. McKinsey & Company, Inc.makes no representations or warranties regarding the accuracy or completeness of such information andexpressly disclaims any and all liabilities based on such information or on omissions therefrom. The recipientmust not reproduce, disclose or distribute the information contained herein without the express prior writtenconsent of McKinsey & Company, Inc.

This report is furnished to the recipient for information purposes only. Each recipient should conduct their owninvestigation and analysis of any such information contained in this report. No recipient is entitled to rely onthe work of McKinsey & Company, Inc. contained in this report for any purpose. McKinsey & Company, Inc.makes no representations or warranties regarding the accuracy or completeness of such information andexpressly disclaims any and all liabilities based on such information or on omissions therefrom. The recipientmust not reproduce, disclose or distribute the information contained herein without the express prior writtenconsent of McKinsey & Company, Inc.

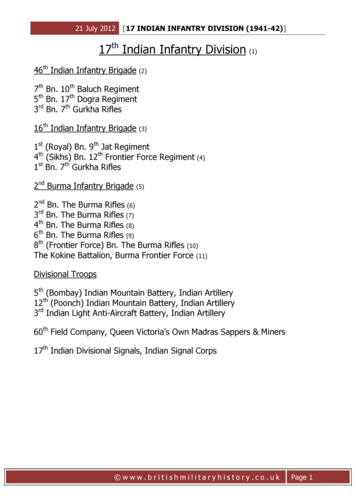

Executive SummaryThe automotive aftermarket for parts in India is a large and growing market thatspans manufacturers, distributors, retailers, service providers and garages.Currently worth INR 19,000 crore to INR 24,000 crore1, the market has beengrowing at 11 per cent, and is estimated to reach INR 39,000 crore to INR 44,000crore by 2015. This growth will primarily be fuelled by the increasing number ofvehicles on the road, as well as the aggressive expansion of independent andforeign players. While current margins for the industry remain attractive, playersacross the value chain may see margins reducing to the lower levels observed indeveloped economies. Therefore, to sustain profitability, it is imperative thatplayers evaluate additional ways of capturing value, including expanding servicenetworks, developing branded generic parts, forward integrating and buildingscale. Looking ahead, revenue pools remain large across the value chain, hence ifplayers are able to pursue appropriate strategies, significant profits can be made inthis sector.THE INDIAN MARKET IS LARGE AND HAS SCOPE FOR FURTHERGROWTHThe Indian automotive aftermarket has been growing at a steady pace and isexpected to expand rapidly over the next five years. The total size of this sector iscurrently estimated at USD 5 billion to USD 6 billion, while the global market isworth USD 490 billion to USD 540 billion.Growing market offers significant potentialThe Indian market is valued at INR 19,000 crore to INR 24,000 crore, of whichroughly 30 per cent comprises spurious parts. Commercial vehicles (CV), whichinclude multi-axle vehicles, light commercial vehicles (LCVs), buses and trailersaccount for roughly 22 per cent of this market (INR 4,500 crore to INR 5,500crore), with Maharashtra, Tamil Nadu, Gujarat and Kerala accounting for over 40per cent. The car market is estimated at INR 6,000 crore to INR 7,000 crore (341 Excludes services, which is estimated to be in the range of an additional Rs. 8,000 – Rs. 12,000 croreMcKinsey & Company 1

per cent of the market) with Maharashtra, Andhra Pradesh, Delhi and Tamil Naducumulatively accounting for about 40 per cent of the share (Exhibit 1).The two-wheeler market is the largest at INR 10,000 crore to INR 11,000 crore, or44 per cent of the market, and Tamil Nadu, Maharashtra, Gujarat and UttarPradesh constitute close to 45 per cent of the market. This market is also expectedto grow the fastest, given the strong growth in new sales (more than 15 per centper year) and the large volume of two-wheelers entering the vintage foraftermarket parts (2 to 12 years).EXHIBIT 1The Indian market, estimated at Rs. 19,000 - Rs. 24,000 crore, isdominated by the two-wheeler 2992578761,9873463465102,6451,854698Total market:INR 19,000-24,000 crCV marketINR 4,500-5,500 crCars marketINR 6,000-7,000 cr2-wheelermarketINR 10,000-11,000 cr1541,6601,2642,585Note: Above figures include spurious parts; PARC vehicle used from 1998 to 2008 to account for 3 to 13 year old vehicles;Spend per annum on CV – RS. 20,000; PC – Rs. 10,000; Two-wheeler – Rs. 2,500McKinsey & Company Globally, the automotive aftermarket is worth approximately USD 490 billion toUSD 540 billion (Exhibit 2). The largest markets are the US (USD 160 billion toUSD 170 billion) and Europe (USD 110 billion to USD 120 billion); China’smarket size is estimated at USD 65 billion to USD 70 billion, with other Asian andLatin American markets being around USD 60 billion, and Africa and the MiddleEast accounting for another USD 12 billion to USD 15 billion. Unlike the Indianmarket, CVs account for roughly 60 per cent of the overall market in developedMcKinsey & Company 2

countries. The global off-road equipment market, which includes constructionequipment such as cranes and rollers, as well as tractors, is roughly USD 11 billionto USD 15 billion.EXHIBIT 2The global aftermarket across CV, passenger cars and off-road is estimatedat USD 490-510 billionUSD billion, 2008Total CV PC OffroadUK: 23 - 28US: 160 - 170110 5015101EU: 110 - 120655454MEA: 12 - 15131China: 65 - 70India: 5 - 614LatAM: 60 - 7060.532352Rest of Asia:50 - 60502.51.5Total market:USD 490-540 billionNote: CV and passenger car breakup not available for Africa/ME, South East Asia and S. America; India and China PC includes 2 WheelersSOURCE: Datamonitor; AAIA Factbook; DAT; ZDK; IFA Nürtingen; AAI Factbook; US Dept. of Energy;McKinsey team; The Freedonia Group; McKinsey team analysisMcKinsey & Company Current market structure is fragmentedThe value chain in India remains highly fragmented and there is a significant levelof intermediation required for parts to reach end customers. The production ofparts is split between original equipment manufacturers (OEM), originalequipment suppliers (OES) and generic manufacturers. While OEM’s may rely ontheir own distribution networks, with parts being sold through directly-owned orfranchised dealers, the independent channel has grown in significance in recenttimes. Original equipment suppliers have the advantage of being able to bothdirectly supply OEMs, as well as go through independent distributors (Exhibit 3).McKinsey & Company 3

EXHIBIT 3The current value chain in India indicates that significant intermediation isrequired for parts to reach brandedRetailOEM salesunits andpart dealersASSPCustomersOwned andfranchiseddealersMainlyOEMor OESbrandedRetailers:largelyun-organizedOESs/Tier 1Independentpart dealersGenericmanufacturerGenericSOURCE: ACMA report; team analysisMainlyOESbrandedor /gasStationsPrivateMcKinsey & Company After making adjustments for the spurious parts market, the manufacturingrevenue pool of around INR 10,500 crore is roughly shared by OEMs (39 percent), OESs (34 per cent) and generic manufacturers (27 per cent). Distributors,who typically enjoy margins of around 15 per cent, have a profit pool of aroundINR 2,500 crore. Original equipment manufacturer’s sales units and distributorsenjoy a slightly higher share of the market at 55 per cent compared to independentdistributors at 45 per cent. Service providers, who interact directly with endcustomers, have a profit pool of around INR 3,000 crore. Despite notable recentgrowth, multi-brand dealers still constitute a small part (4 per cent) of a marketthat is dominated by OEM-franchised dealers (50 per cent) and small unorganisedgarages (46 per cent; Exhibit 4).McKinsey & Company 4

EXHIBIT 4The market is expected to grow at a rapid 11% per annumMarket growthINR croreRoleValue add(Incremental revenue)INR croreShare of playersPercent; INR croreMulti-brand120200620102015EServiceproviders 11,000 16,00011% p.a. se50 dealers1,500Garages S4,095 39OEM55 dealers1,3752734India's aftersales auto partmarket is growing strongly atmore than 11% (p.a.) reachingmore than INR 30,000 cr in 2015Generic2,835OEM3,5701 Excluding all spurious parts; only incremental revenues indicatedSOURCE: ACMA report, team analysisMcKinsey & Company PLAYERS MUST UNDERTAKE SPECIFIC INITIATIVES TO ENSUREMARGINS REMAIN AT CURRENT LEVELSThe growing automotive aftermarket presents a large opportunity for playersacross the value chain. However, with the market demand for parts and servicesset to double over the next 5 years, being able to satisfy this demand is asignificant challenge. Companies across the value chain will have to double theircapacity, as well as enhance their capabilities to produce parts for and service awider variety and complexity of vehicles. This will require significant additionalinvestments in capital.In the absence of a concerted effort by market leaders to build the required scaleand capability, the fragmentation in the industry is bound to increase, especiallyamong market intermediaries like distributors, retailers, and independent serviceproviders. Across the value chain, current margins in India are considerably higherthan those typically observed in the developed economies of the US and Europe(Exhibit 5). As the market matures in India, there is a threat that margins couldshow a downward trend. Players will therefore need to proactively pursue certaininitiatives to enable them to capture further value.McKinsey & Company 5

EXHIBIT 5Margins may fall to reflect levels seen in developed economiesPerformanceMargins indevelopedeconomies arelower becauseGross margins ibutorsAuto partsretailersServiceproviders(incl OEMdealers)6-88 - 1010 - 15AftermarketdistributorsAuto partsretailersServiceproviders(incl OEMdealers) Fragmenteddistributionand retailindustry Bargainingpower in thehands oflarge OESand thirdpartymanufacturers Players try tobypasselements inthe valuechainOESaftermarketbusiness8 -10OESaftermarketbusinessOEMaftermarketbusiness10 - 12OEMaftermarketbusinessMargins show a downward trend in mature markets – playerstherefore may need to evaluate additional ways of capturing valueSOURCE: Team analysisMcKinsey & Company 1. OEMs and OES’s must step up efforts to control parts distribution: Theaftermarket parts business is highly profitable for OEMs and it is imperative forthem to place adequate importance on expanding this business. Given that theaftermarket contributes a modest 24 per cent in revenues to OEMs, but asizeable 55 per cent to profits, this is a lucrative sector to play in. Withindependent players actively expanding, there is a need for OEMs to considervarious initiatives to attain a tighter control of parts distribution. Some OEMshave already made attempts to progress along some of these initiatives: Aggressively expand OEM service networks Structure exclusivity contracts on manufacturing and distribution withsuppliers and distributors Lock-in customers for a longer tenure through increasing warranty periods onvehicles Counter the threat of branded generic parts by launching second brands thatare cheaper and potentially useable across all makesMcKinsey & Company 6

Create awareness through promotions on the use of original spare parts, andtie up with insurance providers, to ensure higher off-take of original spares.2. Independent garages and multi-brand dealers must capitalise on India’sageing car-parc: Market interviews and analysis indicate that owners of oldervehicles often migrate to independent service networks for cheaper and fasterservice. The lower cost of servicing at independent garages is influenced byprimarily three factors – the ability to source generic parts at a lower cost thanOE spares, the ability to reach scale in smaller locations through servicingmultiple brand vehicles, and the lower overhead cost structure compared toOEMs. Given that the auto market in India has been growing rapidly for the lastfew years, both generic manufacturers and independent garages and serviceproviders must position themselves to capitalise on this trend. With OEMs morefocussed on vehicles in their warranty period, offering higher levels of servicefor older cars will be necessary for independent players to attract customers.This means they must build a reputation for reliability by focusing onstandardisation and quality, while adequately preparing for increasingcomplexity in vehicles (Exhibit 6).EXHIBIT 6ESTIMATESIndependent garages and multi-brand dealers mustcapitalize on the growing vintage of India’s car-parcRelative market sizes for aftermarket spares2012, INR croresServiceproviderOEM Owners of older carsmigrate to independentservice networks forcheaper and faster serviceCar vintageYears 2 2-44-6 638571588075706525100200 51015100200270202020Percentage oftotal in column1,100506603044020 As the car-vintagematures in India,independent garagesmust– Build trust: there islow confidence isquality and reliability– Bring instandardisation toprevent migration toOEM service providers– Prepare for increasingcomplexity in vehicleswith adequate trainingAssumptions Car owners are expected to move away from OEM service centers for lower price and faster service Car market expected to grow at 20% from 2010-12 Retail margins (15%) and spurious parts (20%) eliminated from market potential Local garages expected to hold on to their current share of marketSOURCE: Market interviews; team analysisMcKinsey & Company McKinsey & Company 7

3. OEMs and distributors should develop branded generics to capture thecost advantage in this rapidly growing independent market: The Indianmarket for branded generics is already worth INR 3,000 crore to INR 4,000crore and is set to grow significantly in the next 5 years. Analysis shows thatgeneric brands tend to have much higher margins and are extremely popularamong consumers looking for fully functional, yet cheaper alternatives to OEspares, especially in the non-critical product ranges. Globally, distributors suchas Trost and Engine Tech have reaped the rewards of building a reliable brandof generics, while more recently, OEMs such as Toyota and Ford have alsointroduced lower-price second brands to capture some this market (Exhibit 7).EXHIBIT 7OEMs and distributors should develop branded generics to capture costadvantages in the rapidly growing independent marketIndependent brands have higher marginsGlobally players are already taking such actionsExample category "Brake pads"DistributorsSupplier A(OES brand)Workshopinvoice price140Supplier C(generic)14070EngineTech Reliable European brand, able tocommand high margins Pan-US distributor that globallysources and rebrands under ownnamePopular for focussed non-criticalproduct offerings et priceSupplier B(OES brand)3025OEM’s11010510040Relative marginPercent21%29%43%Absolute marginEUR/unit304030 Reduced price, lower qualitybranded spare parts launchedunder name Toyota Optifit Second brand ‘Ford Motorcraft’designed to fit all car makes Renault introduced cheaper brandnamed MotrioIndian market for branded generics likely to be Rs. 3,000-4,000 croreSOURCE: Market interviews; team analysisMcKinsey & Company 4. OES’s, independent players and distributors should consider partnershipsand options for forward integration: Since many key skills and capabilitiesrequired for success overlap along the value chain, forward integration offersplayers the potential to create additional value. Globally, OES’s such as HellaMcKinsey & Company 8

(direct distribution through Hella Logistics Center) and Bosch (Bosch CarService, 1a Autoservice) have successfully acted as parts distributors and evenservice providers. In India too, Bosch has successfully built an extensivedistribution network. Independent parts distributors must also actively look foropportunities to act as service providers and retailers. Such a move will allowdistributors to increase their bargaining power since they can provide supplierswith a ready market for their parts. Most American distributors already haveretail arms, while many European distributors such as Stahlgruber and Europartpartner with retail outlets such as Meisterhaft and AC Autocheck. In India, TVSdistribution has already made efforts to forward integrate through PartSmart andMyTVS. Forward integration may be crucial going forward as it enables marketleaders to tap into additional revenue sources, as well as build significant entrybarriers for new competition.5. Independent distributors should consider building scale, expandingglobally and sourcing from low-cost countries: While global trends and thecomplex nature of the Indian market indicate independent distributors are goingto remain valuable components of the value chain , it is imperative that theybuild scale in order to counter the threat of exclusivity from OEMs, OESs andthe risk of displacement by logistics providers. Furthermore, distributors willneed to build scale by building large own-brand portfolios, sourcing from otherlow-cost countries, and looking for opportunities to expand internationally.Globally, distributors have been trying to achieve relevant scale, with the top 10distributors both in the US and Europe having a minimum of around USD 200million in revenues. The recent spurt in merger and acquisitions (M&A)activities among distributors in these geographies are also markers to theirattempts to gain significance through scale.SIGNIFICANT PROFITS CAN BE MADE IF PLAYERS ALONG THE VALUECHAIN ADOPT THE APPROPRIATE STRATEGIESSeveral favourable trends will positively impact the Indian automotive aftermarketin the years ahead. However, all players remain susceptible to certain risks and sowill need to focus on implementing key imperatives in order to enjoy high marginsand growing profits.While increasing customer affluence and an already well-established network giveOEMs a sound starting position, they must continue to create barriers to entry forindependent players by expanding networks, demanding exclusivity and increasingwarranty periods. Similarly, despite the unique position of OESs that enables themto ride off the success of both OEMs and independent distributors, it is vital theyMcKinsey & Company 9

seize opportunities to forward integrate along the value chain. The growingnumber of parts suitable for manufacturing by generic players and the increasingvehicle parc (especially in rural India) puts generic manufacturers and independentgarages in a very attractive position. However, the focus must increasingly shifttowards quality and reliability as customer expectations grow. Independentdistributors, a vital element in the value chain, also face threats from OESs andmust therefore look to build scale through forward integration, creation of genericbrands and global sourcing. The Indian automotive aftermarket is at an inflection point – vehicle parc isincreasing, parts are getting more complex, customers are more price sensitive,and global suppliers are expanding their sourcing and distribution presence inIndia. Scaling up capacity to service the growing demand will be a challenge forIndian companies across the value chain, especially with margins likely to comeunder pressure. Overall, the industry revenue pools will significantly increase, andplayers who adapt their business models to the changing scenario, are likely toemerge as winners.Umang DuaConsultant, McKinsey & CompanyRamesh MangaleswaranDirector, McKinsey & CompanyAnanth NarayananPartner, McKinsey & CompanySrivatsan SridharEngagement Manager,McKinsey & CompanyMcKinsey & Company 10

Opportunities in the Indian automotive aftermarket Prepared for Auto Serve 2010, a conference on improving the . Franchise dealers 1,500 45 55 Independent distributors 1,125 OEM dealers 1,375 34 27 OES 4,095 39 OEM 3,570 Generic . Auto parts retailers 14-18 Aftermarket distributors 12-15 OEM aftermarket business 16-18 OES aftermarket business