Transcription

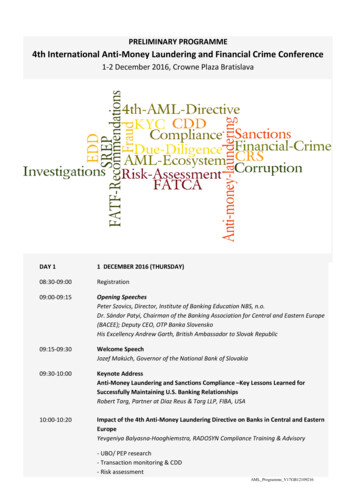

PRELIMINARY PROGRAMME4th International Anti-Money Laundering and Financial Crime Conference1-2 December 2016, Crowne Plaza BratislavaDAY 11 DECEMBER 2016 g SpeechesPeter Szovics, Director, Institute of Banking Education NBS, n.o.Dr. Sándor Patyi, Chairman of the Banking Association for Central and Eastern Europe(BACEE); Deputy CEO, OTP Banka SlovenskoHis Excellency Andrew Garth, British Ambassador to Slovak Republic09:15-09:30Welcome SpeechJozef Makúch, Governor of the National Bank of Slovakia09:30-10:00Keynote AddressAnti-Money Laundering and Sanctions Compliance –Key Lessons Learned forSuccessfully Maintaining U.S. Banking RelationshipsRobert Targ, Partner at Diaz Reus & Targ LLP, FIBA, USA10:00-10:20Impact of the 4th Anti-Money Laundering Directive on Banks in Central and EasternEuropeYevgeniya Balyasna-Hooghiemstra, RADOSYN Compliance Training & Advisory- UBO/ PEP research- Transaction monitoring & CDD- Risk assessmentAML Programme V17GB12109216

10:20-10:50Coffee Break10:50-11:20What are the challenges around information for AML research?by Bureau van Dijk Editions Electroniques SA, o.z.11:20-11:40The Monty Python Flying Circus of Money Laundering: Risk and the Question ofProportionalityJackie Harvey, Professor of Financial Management and Director of Business ResearchNewcastle Business School, Northumbria University-11:40-12:05Understand the reasons for the approach to AML unpicking the figures behindthe threat narrativeConsider the justification (or otherwise) for the risk based approachExamine the risk based approach in terms of proportionalityConclude with an overview of the reality of compliance for both individualinstitutions and countriesFATF- Recommendation 16 and implementationMichael Blicker, Senior Consultant, Fair Isaac Germany GmbH (FICO)Christian R. Drescher, Regional Director, Fair Isaac Germany GmbH (FICO)The bigger Picture: FATF 2016 challenges for Regulatory Compliance Solutions:- For a holistic customer view- In terms of CTF- As described in FATF recommendation 1612:05-13:00KYC and beneficiary ownership identification – roundtable discussionParticipants:Yevgeniya Balyasna-Hooghiemstra, RADOSYN Compliance Training & AdvisoryLuboslav Parihuzic, Compliance & AML, Tatra banka, a.s.Gregory Dellas, Manager Compliance Risk Management, International Banking andWealth Management, Bank of Cyprus (tbc)Martin Mužný, Prudential Inspection Division, Financial Market SupervisionDepartment, Czech National Bank13:00:14:00Lunch14:00-14:20Operational impact of AMLD IV in the context of FATF16 recommendationMichael Formann, Head of SWIFT Austria GmbH-14:20-14:50How to make sure your payment data is in line with recommendation 16 ofthe FATF: The Payment Data Quality Manager Tool of SWIFT.Update: KYC Registry for correspondent bankingCoverage, content, data elements and product evolutionDetecting Money Laundering: Recent themes observed by Kroll; the need for a coordinated approachby KrollAML Programme V17GB12109216

14:50-15:10Compliance Beyond the Regulatory StereotypesMarios Skandalis, Director, Group Compliance Division at Bank of Cyprus-Establishment of an ethical compliance/AML frameworkKey differences and benefits for the implementationMethodology to reach a successful result15:10-15:40Coffee Break15:40-16:20Fighting financial crime – cooperation and coordination roundtableChaired by Mr. Massimo Nardo, Senior Manager, FIU ItalyParticipants:Oliver Gadney, Programme Officer, Global Programme against Money Laundering,Proceeds of Crime and the Financing of Terrorism, United Nations Office on Drugs andCrimeIvo Hrádek, Senior Police Officer, FIU Slovakia of National Criminal Agency of PoliceForce PresidiumOther participants to be confirmed16:20-16:40Money laundering and cyber threatRichard Parlour, Principal, Financial Markets Law International, UK16:40-17:00A light touch approach to immediately address 4th EU directive requirementsFilip Verbeke, Partner, Consortix-17:00-17:20Correspondent banking KYC and KYT enquiriesNicolas Marinier, Chief Compliance Officer, East-West United Bank S.A-18:00Flexibly map constantly evolving riskQuickly respond to regulators and internal control & auditConstant oversight and control with reduced effort and cost with a system inthe hand of legal & compliance peopleMain challenges due to US and EU sanctionsPressure on some USD clearing banksBanking secrecy issue and solutionsCommon pitfalls and lessons learned for smooth relationship and efficientpayments.Cocktail receptionAML Programme V17GB12109216

DAY 22 DECEMBER 2016 (FRIDAY)08:00-08:30Registration08:30-08:40Opening of Day 208:40-09:00On site supervision and national risk assessment from the perspective ofthe Czech National BankMartin Mužný, MSc., Prudential Inspection Division, FinancialMarket Supervision Department, Czech National Bank-09:00-09:20Fit & Proper – for board members and key personsDoris Wohlschlagl-Aschberger, Banking and Capital Market Expert, Vienna-9:20 - 9:40The role of the Czech National BankCollaboration with FIUNational risk assessmentAssessment & policyDiligent bank managementRegular trainingGeneral Data Protection Regulation (GDPR) adoptionJozefína Trnavská, Head of Legal Services, Compliance and AML, SberbankSlovensko, a.s.-key points for AMLcross border data sharing9:40-10:00Action plan for strengthening the fight against terrorist financing10:00-10:20Remote identification - opportunity or just an increased risk?Zuzana Jankovič, Compliance Manager, ZUNO BANK AG-What could remote identification be?Types of remote identificationAdvantage and risk connected to remote identificationWhere to go next - future of remote identification10:20-10:50Coffee break10:50-11:10Precedents on OFAC fines and funds blocking-11:10-11:30penalties for violationsrejected and blocked funds transfersBlockchain powered analytics and compliance systems for banks (tbc.)Said Fihri, Associate Partner, KPMG LuxembourgAML Programme V17GB12109216

11:30-12:10International Sanctions Landscape in the EU, Eastern Europe and the CIS – RoundtableDiscussionModerator:Jozefína Trnavská, Head of Legal Services, Compliance and AML, SberbankSlovensko, a.s.Participants:András Bácsfalvi, Head of Compliance, MKB Bank Plc.Michael Peer, Partner, Forensic, Advisory, KPMG in Central and Eastern EuropeOther participants to be confirmed-combining analytics with transaction monitoring and sanctions screening toachieve accurate resultsadequate internal organizationlatest developments of the changing environment: Cuba, Iran, Russia12:10-12:30Risk based compliance and AML management (tbc)Dennis Cox, CEO, Risk Reward Limited12:30-12:40Closing remarksAML Programme V17GB12109216

AML_Programme_V17GB12109216 PRELIMINARY PROGRAMME 4th International Anti-Money Laundering and Financial Crime Conference 1-2 December 2016, Crowne Plaza Bratislava DAY 1 1 DECEMBER 2016 (THURSDAY) 08:30-09:00 Registration 09:00-09:15 Opening Speeches Peter Szovics, Director, Institute of Banking Education NBS, n.o.