Transcription

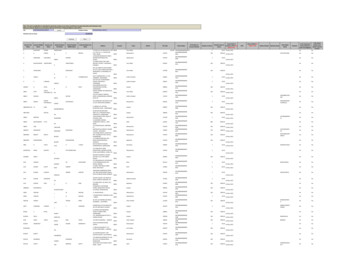

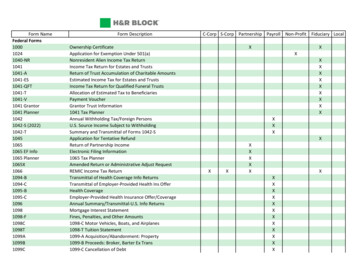

Form NameFederal T1041-V1041 Grantor1041 Planner10421042-S (2022)1042-T104510651065 EF Info1065 98-F1098C1098T1099A1099B1099CForm DescriptionOwnership CertificateApplication for Exemption Under 501(a)Nonresident Alien Income Tax ReturnIncome Tax Return for Estates and TrustsReturn of Trust Accumulation of Charitable AmountsEstimated Income Tax for Estates and TrustsIncome Tax Return for Qualified Funeral TrustsAllocation of Estimated Tax to BeneficiariesPayment VoucherGrantor Trust Information1041 Tax PlannerAnnual Withholding Tax/Foreign PersonsU.S. Source Income Subject to WithholdingSummary and Transmittal of Forms 1042-SApplication for Tentative RefundReturn of Partnership IncomeElectronic Filing Information1065 Tax PlannerAmended Return or Administrative Adjust RequestREMIC Income Tax ReturnTransmittal of Health Coverage Info ReturnsTransmittal of Employer-Provided Health Ins OfferHealth CoverageEmployer-Provided Health Insurance Offer/CoverageAnnual Summary/Transmittal-U.S. Info ReturnsMortgage Interest StatementFines, Penalties, and Other Amounts1098-C Motor Vehicles, Boats, and Airplanes1098-T Tuition Statement1099-A Acquisition/Abandonment: Property1099-B Proceeds: Broker, Barter Ex Trans1099-C Cancellation of DebtC-Corp S-Corp Partnership Payroll Non-ProfitXXXXXXXXXXXXXXXXXXXXXXXXFiduciary LocalXXXXXXXXXXXX

Form Name1099DIV1099DIV (Worksheet)1099G1099G (Worksheet)1099INT1099INT (Worksheet)1099MISC1099MISC (Worksheet)1099NEC1099NEC (Worksheet)1099OID1099PATR1099R1099R (Worksheet)1099S1099SA SF1120-W (Worksheet)1120 Planner1120SForm Description1099-DIV Dividends and Distributions1099-DIV Dividends and Distribution Worksheet1099-G Certain Government Payments1099-G Government Payments Worksheet1099-INT Interest Income1099-INT Interest Worksheet for Input1099-MISC Miscellaneous Information1099-MISC Miscellaneous Information Worksheet1099-NEC Nonemployee Compensation1099-NEC Nonemployee Compensation Worksheet1099-OID Original Issue Discount1099-PATR Taxable Distrib. Rec'd/Co-op1099-R Distributions: Retirement/Ins Contracts Etc1099-R Retirement Plans Worksheet1099-S Proceeds from Real Estate Trans.1099-SA HSA, MSA Distributions WorksheetForeign Tax Credit (Individual, Estate, or Trust)Income Tax Surety Bond for Foreign TaxesForeign Tax Credit - CorporationsCorporation Income Tax ReturnIncome Tax Return for Cooperative AssociationsIncome Tax Return of Foreign CorporationIncome Tax Return for Homeowners AssociationsInterest Charge Domestic Sales CorporationLife Insurance Company Income Tax ReturnProperty and Casualty Insurance Company Tax ReturnIncome Tax Return for Political OrganizationsIncome Return for Real Estate Investment TrustsIncome Tax Return Regulated Investment CompaniesIncome Tax Return for Settlement FundsEstimated Tax for Corporations1120 Tax PlannerS Corporation Income Tax ReturnC-Corp S-Corp Partnership Payroll Non-ProfitXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXFiduciary LocalXXXXXXXXXXX

Form Name1120S Planner1120X1120/1120S EF 2045215922102210-F2220222222712290, 2290-V (07/21)243824392439 orm Description1120S Tax PlannerAmended U.S. Corporation Income Tax ReturnElectronic Filing InformationAuthorization and Consent of SubsidiaryCost of Goods SoldCompensation of OfficersApplication to Adopt, Change, or Retain a Tax YearExtension for Payment of Taxes for NOL CarrybackCorporation Application for Tentative RefundRequest for a Collection Due Process or HearingWithdrawal of Request for CollectionExport Exemption CertificatesContract Coverage Under Title II of the SSATransferee AgreementPayroll Deduction AgreementUnderpayment of Estimated TaxUnderpayment of Estimated Tax by FarmersUnderpayment of Estimated Tax by CorporationsSealed Bid for Purchase of Seized PropertyDepreciation AgreementHeavy Highway Vehicle Use Tax ReturnUndistributed Capital Gains Tax ReturnUndistributed Long-Term Capital GainsUndistributed Long-Term Capital Gains Input WkstElection by a Small Business CorporationEmployer/Payer Appointment of AgentPower of AttorneyApplication for Change Accounting MethodAcceptance of Proposed Disallowance for RefundInvestment CreditConsumer Cooperative Exemption ApplicationAnnual Report of Certain Foreign GiftsAnnual Return of Foreign Trust With a U.S. OwnerC-Corp S-Corp Partnership Payroll XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXFiduciary LocalXXXXXXXXXXXX

Form Name3520-A Page 33520-A Page 43800392140294070, 4070A41364255433-B433-B 472Form DescriptionForeign Grantor Trust Owner StatementForeign Trust Income US Owner/ Trust Benef StmtGeneral Business CreditExercise of Incentive Stock Option Section 422(b)Exemption from Social Security and Medicare TaxesEmployee's Report of Tips to EmployerCredit for Federal Tax Paid on FuelsRecapture of Investment CreditCollection Information Statement for BusinessCollection Information Statement for BusinessesInstallment AgreementRevise Existing TCC for FIRECorporation Refund of Overpayment of Estimated TaxRequest for Copy of ReturnRequest for Exempt Org. Pol OrgRequest for Transcript of Tax ReturnDepreciation and AmortizationLimitation on Business LossesCasualties and TheftsSales of Business PropertyRequest for Prompt AssessmentElection to be Treated as an Interest Charge DISCInvestment Interest Expense DeductionTax on Accumulation Distribution of TrustsTax on Lump-Sum DistributionsSchedule of Tax LiabilityElectronic Filing Transmittal for Wage Tax ReturnsElection to Postpone DeterminationSplit-Interest Trust Information ReturnAdditional Taxes on Qualified PlansCorporate Report of Nondividend DistributionsInfo Return with Respect to Foreign CorporationsReturn of 25% Foreign-Owned U.S. CorporationC-Corp S-Corp Partnership Payroll XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXFiduciary LocalXXXXXXXXXXXXXXXXXXXX

Form (D-1)706-GS(T)706-QDT7200 (04/21)802380278027-T80388038-CP8038-G8038-GCForm DescriptionIRA Contribution InformationPrivate School Exempt from Federal TaxNotice Concerning Fiduciary RelationshipFiduciary Relationship of Financial InstitutionResidential Energy CreditsInternational Boycott ReportAmerican Samoa Economic Development CreditStatement by Person(s) Receiving Gambling WinningsExpenditures to Influence LegislationWork Opportunity CreditEmployee Retention CreditWork Opportunity Cr Tax-Exempt Org Hiring VeteransEmployee Retention Credit Certain Tax-Exempt OrgAt-Risk LimitationsInstallment Sale IncomeBiofuel Producer CreditOffer in CompromiseExemption from Withhold on Foreign Earned IncomeWaiver of Restrictions on AssessmentCredit for Increasing Research ActivitiesGains and Losses From Section 1256Extension to File Business, Information, and OtherDistribution - Generation-Skipping TrustGeneration-Skipping Tax Return for TerminationsEstate Tax Return for Qualified Domestic TrustsAdvance Payment Employer Credits Due to COVID-19Corp Elections Making Qualified Stock PurchasesEmployer's Annual Return of Tip IncomeTransmittal of Employer's Return of Tip IncomeReturn for Tax-Exempt Private Activity Bond IssuesReturn for Credit Payments to Issuers of BondsReturn for Tax-Exempt Governmental BondsSmall Tax-Exempt Governmental Bond IssueC-Corp S-Corp Partnership Payroll XXXXXXXXXXXXXXXXXXXXXXXFiduciary LocalXXXXXXXXXXXXXXXXXXX

Form 281828282838283-V82888288-A8288-B8300 3-FE8453-I8453-PE8453-S8453-TE85088518546Form DescriptionRequest for Recovery of OverpaymentsArbitrage Rebate, Yield Reduction and PenaltyInformation Return for Tax Credit BondsDirect Deposit of Corporate Tax RefundNotice of Inconsistent Treatment or (AAR)Exemption from W/H on Compensation of NR AlienChurches Exemption from SS and Medicare TaxesDisclosure StatementRegulation Disclosure StatementPublicly Offered Original Issue Discount ReturnDonee Information (Disposition Donated Property)Noncash Charitable ContributionsPayment Voucher for Filing FeeDispositions by Foreign Persons of U.S. PropertyWithholding on Dispositions by Foreign PersonsApplication for Withholding by Foreign PersonsReport of Cash Payments Over 10,000Electronic Deposit of Tax Refund 1Million or MoreReport of Sale/Exchange of Partnership InterestsRefund of Social Security Tax Erroneously WithheldInterest on DISC Deferred Tax LiabilityClaim for Refund and Request for AbatementCorporation Tax Declaration for e-File ReturnEmploy Tax Declaration for an IRS e-file ReturnExempt Organization Declaration for e-fileEstate or Trust Declaration for e-file ReturnForeign Corporation Declaration for e-file ReturnPartnership Declaration for e-File ReturnS Corporation Tax Declaration for e-File ReturnTax Exempt Entity Declaration/Sign EfileWaiver to File Information Returns ElectronicallyAffiliations ScheduleClaim for Reimbursement of Bank ChargesC-Corp S-Corp Partnership Payroll XXXXXXXXXXXXXXXXXXXXXXXXFiduciary LocalXXXXXXXXXXXXXXXX

Form 3Form DescriptionPassive Activity Loss LimitationsPassive Activity Credit LimitationsLow-Income Housing CreditAsset Acquisition StatementLow-Income Housing Credit AllocationAnnual Statement for Low-Income Housing CreditAnnual Low-Income Housing Credit Agencies ReportRecapture of Low-Income Housing CreditReturn of Excise Tax - Undistributed IncomeReturn of Excise Tax - Undistributed IncomeShareholder of a Passive Foreign Investment ReturnShareholder Election to End as a Passive ForeignAgreement to Rescind Notice of DeficiencyReporting Agent AuthorizationLow-Income Housing Credit Disposition BondInterest Computation Under the Look-Back MethodOffer to Waive Restrictions on AssessmentAnnual Certification Residential Rental ProjectElection to Have a Tax Year Other Than RequiredUser Fee for Exempt Organization DeterminationRequired Payment or Refund Under Section 7519Credit for Prior Year Minimum TaxApplication for US Residency CertificationAnnual Return for Partnership Withholding TaxPartner-Level Items to Reduce Sec 1446 WithholdingInstallment Payments of Section 1446 TaxForeign Partner's Section 1446 Withholding TaxReturn for Control or Change in Capital StructureExtension of Time to File Information ReturnsApp for Extension of Time to File FATCA Form 8966Corporate Passive Activity Loss/Credit LimitationsInformation Return for REMICsPartnership Withholding Tax Payment Voucher (1446)C-Corp S-Corp Partnership Payroll Non-ProfitXXXXXXXXXXXXXXXXXXFiduciary XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

886488658866886888698873887488758876Form NameForm DescriptionSpecial Loss Discount Account for Insurance CoOrphan Drug CreditTax Information AuthorizationChange of Address or Responsible Party - BusinessLow-Income Housing Credit AgenciesLike-Kind ExchangesRental Real Estate Income and ExpensesDisabled Access CreditCredit for Prior Year Minimum Tax - CorporationsEntity Classification ElectionTreaty-Based Return Position DisclosureQualified Electric Vehicle CreditRenewable Electricity and Coal Production CreditConsent to Extend the Time to Assess Tax Under 367Consent To Extend the Time To Assess TaxElection to Use Different Period for Estimated TaxEmpowerment Zone Employment CreditIndian Employment CreditCredit for Employer Taxes Paid on Employee TipsExtend the Time to Assess Branch ProfitsClaim Refund Excise Taxes - Sch 1,2,3,5,6,8Pre-Screening Notice and Certification RequestElection to Treat a Revocable Trust as an EstateU.S. Persons with Foreign Disregarded EntitiesBiodiesel and Renewable Diesel Fuels CreditU.S. Foreign Partnership Return (stand alone)Interest Computation Under the Look-Back MethodExtension of Time to File an Exempt OrganizationQualified Subchapter S Subsidiary ElectionExtraterritorial Income ExclusionNew Markets CreditTaxable REIT Subsidiary ElectionExcise Tax on Structured Settlement TransactionsC-Corp S-Corp Partnership Payroll XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXFiduciary XXXXXXXXX

Form Name8878-A8879-C8879-EMP 91289168916-A8918892289238924892589318932Form DescriptionE-File Electronic Funds Withdrawal AuthorizationE-File Signature Authorization for 1120IRS e-file Signature Auth 940/941/943/944/945E-File Signature Authorization for 990 or 1120-POLE-File Signature Authorization for 1041E-File Signature Authorization for 1120-FE-File Signature Authorization for 1065E-File Signature Authorization for 1120SCredit for Small Employer Pension PlanCredit for Employer-Provided ChildcareAsset Allocation StatementReportable Transaction Disclosure StatementElection of Partnership Level Tax TreatmentRequest to Revoke Partnership Level Tax TreatmentLow Sulfur Diesel Fuel Production CreditQualified Railroad Track Maintenance CreditAlternative Tax on Qualifying Shipping ActivitiesDomestic Production Activities DeductionCredit for Oil and Gas Production - Marginal WellsDistilled Spirits CreditEnergy Efficient Home CreditAlternative Motor Vehicle CreditAlternative Fuel Vehicle Refueling Property CreditCredit to Holders of Tax Credit BondsReconciliation of Sch M-3 Income for Mixed GroupsSupplemental Attachment to Schedule M-3Material Advisor Disclosure StatementThird-Party Sick Pay RecapMine Rescue Team Training CreditExcise Tax on Geothermal or Mineral InterestsReport of Employer-Owned Life Insurance ContractsAgricultural Chemicals Security CreditCredit for Employer Differential Wage PaymentsC-Corp S-Corp Partnership Payroll Non-ProfitXXXXXXXXXXXXXXXXXXFiduciary XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Form 66-C89748979899089918992899389948995, 0-V941-SS,941-V(SS)0621Form DescriptionCarbon Oxide Sequestration CreditQualified Plug-in Electric Drive Motor Vehicle CrStatement of Specified Foreign Financial AssetsCredit for Small Employer Health Insurance PremiumPreparer e-File Hardship Waiver RequestPTIN Application Due to Religious ObjectionPTIN Application for Foreign Persons w/o SSNPreparer Explanation for Not Filing ElectronicallySales and Other Dispositions of Capital AssetsNet Investment Income TaxFATCA ReportCover Sheet for 8966 Paper SubmissionsSmall Business Increasing Research ActivitiesPartnership Rep Revocation/Designation/ResignationLimitation on Business Interest Expense 163(j)Base Erosion Payments Substantial Gross ReceiptsU.S. Shareholder Calculation of GILTISection 250 Deduction for FDII and GILTIEmployer Credit for Paid Family/Medical LeaveQualified Business Income Deduction (Sec 199A)Qualified Opportunity FundInitial/Annual Statement QOF InvestmentsAgreement To Extend the Time To Bring SuitRequest for Taxpayer Advocate AssistanceConsent to Extend Time to Assess Income TaxConsent Fixing Period of Limitation on AssessmentConsent Fixing Period of Limitation on AssessmentConsent Fixing Period of Limitation on AssessmentU.S. Transferor of Property to Foreign CorporationEmployer's Annual Federal Unemployment Tax ReturnEmployer Account AbstractPayment Voucher Employer's Annual FUTAEmployer's Quarterly Federal Return (Samoa, Guam)C-Corp S-Corp Partnership Payroll XXXXXFiduciary XXXXXXXXXXXXXX

Form Name941-V (06/21)941-X (07/21)941 (06/21)943-A943-X943, 3982990990-EZ990-PF990-T990-W990/1120POL EF InfoActivity WorkbookApportionmentAuthentication InfoBank Account InfoBlankBLS 3020Common WorkbookComparison (1041)Form DescriptionEmployer's Quarterly Federal Payment VoucherAdjusted Employer's Quarterly Federal Tax ReturnEmployer's Quarterly Federal Tax ReturnAgricultural Employer's Record of Federal TaxAdjusted Employer's Annual Federal Tax ReturnEmployer's Annual Return for Agricultural EmployeeEmployer's Annual Federal Tax ReturnEmployer's Annual Tax Return Payment VoucherAdjusted Employer's Federal Tax ReturnAnnual Return of Withheld Federal Income TaxAnnual Record of Federal Tax LiabilityPayment Voucher for Annual Return of Federal W/HAdjusted Annual Return of Withheld Income TaxConsent to Extend the Time to Assess Tax - 332(b)Corporate Dissolution or LiquidationApplication to use LIFO Inventory MethodConsent of Shareholder to Include Specific AmountCorporation Deduction for Consent DividendsReduction of Tax AttributesReturn of Organization Exempt from Income TaxReturn of Organization Exempt from Tax - ShortReturn of Private FoundationExempt Organization Business Income TaxEstimated Tax on Unrelated Business Taxable IncomeElectronic Filing InformationActivity WorkbookApportionment ScheduleTaxpayer/Authorized Signer Authentication InfoBank Account InformationBlank form TemplateMultiple Worksite ReportCommon Workbook1041 Prior Year ComparisonC-Corp S-Corp Partnership Payroll XXXXXXXXXXXXXXXXXXXXXXXXXFiduciary LocalXXXXXXX

Form NameComparison (1065)Comparison (1120S)Comparison (1120)Comparison (990)CT-1, CT-1(V)Elections/StatementsETA-9061Fixed AssetsFMS-234FMS-235FMS-236General ConsentI-9Info SheetK1 Input (1041)K1 Input (1065)K1 Input (1120S)Main InfoNOL WorksheetOther Rental/RoyaltyRolloverSch A (5713)Sch A (8038-CP)Sch A (8610)Sch A (8804)Sch A (940)Sch A (990-T)Sch A (990)Sch B-1 (1065)Sch B-1 (1120S)Sch B-2 (1065)Sch B (1120)Sch B (5713)Form Description1065 Prior Year Comparison1120S Prior Year Comparison1120 Prior Year Comparison990 Prior Year ComparisonEmployer's Annual Railroad Retirement ReturnElections and StatementsIndividual Characteristics Form (ICF) WOTCFixed AssetsPower of Attorney by a CorporationResolution by Corporation to Execute POAPower of Attorney by CorporationConsent for Use and Disclosure of Personal InfoEmployment Eligibility VerificationInformation SheetFederal K-1 (1041) Input WorksheetFederal K-1 (1065) Input WorksheetFederal K-1 (1120S) Input WorksheetMain Information WorksheetNet Operating Loss WorksheetOther Rent/Royalty WorksheetRolloverInternational Boycott FactorSpecified Tax Credit Bonds Interest Limit CompCarryover Allocation of Low-Income Housing CreditPenalty for Underpayment of Estimated Sec 1446 TaxMulti-State Employer and Credit Reduction InfoUnrelated Business Taxable IncomePublic Charity Status and Public SupportInfo - Partners Owning 50% of the PartnershipInfo on Certain Shareholders of an S CorporationElection Out Centralized Part Audit RegimeAdditional Information for Schedule M-3 FilersSpecifically Attributable Taxes and IncomeC-Corp S-Corp Partnership Payroll XXXXXXXXXXXXXXXXXXXXFiduciary LocalXXXXXXXXXXXXXXXXXXXXX

Form NameSch B (941)Sch B (990)Sch C (1040)Sch C (1065)Sch C (5713)Sch C (990)Sch D (1041)Sch D (1065)Sch D (1120S)Sch D (1120)Sch D (941)Sch D (990)Sch E (1040) Page 1Sch E (1040) Page 2Sch E (5471)Sch E (990)Sch F (1040)Sch F (990)Sch G-1 (5471)Sch G (1120)Sch G (8865)Sch G (990)Sch H (1040)Sch H (1120-F)Sch H (1120)Sch H (5471)Sch H (8865)Sch H (990)Sch I-1 (5471)Sch I (1118)Sch I (1120-F)Sch I (990)Sch J (1041)Form DescriptionReport of Tax Liability for Semiweekly DepositorsSchedule of ContributorsProfit or Loss from Business (Sole Proprietorship)Additional Information for Schedule M-3 FilersTax Effect of the International Boycott ProvisionsPolitical Campaign and Lobbying ActivitiesSchedules D - Capital Gains and LossesCapital Gains and LossesCapital Gains and Losses and Built-In GainsCapital Gains and LossesReport of Discrepancies Caused by AcquisitionsSupplemental Financial StatementsSupplemental Income and Loss Page 1Supplemental Income and Loss Page 2Income/War and Excess Profits Paid or AccruedSchoolsProfit or Loss from FarmingStatement of Activities Outside the USCost Sharing ArrangementInformation on Persons Owning Voting StockApplication of Gain Deferral Method Section 721(c)Supplemental Fundraising or Gaming ActivitiesHousehold Employment TaxesDeductions Allocated To Connected IncomeSection 280H Limitations for a PSCCurrent Earnings and ProfitsEvents/Exceptions Reporting Gain Deferral 721(c)HospitalsInfo Global Intangible Low-Taxed IncomeReduction of Foreign Oil/Gas TaxesInterest Expense Allocation Under Section 1.882-5Grants and Other Assistance to OrganizationsAccumulation Distribution - Certain Complex TrustC-Corp S-Corp Partnership Payroll XXXXXXXFiduciary LocalXXXXXXXXXXXXXXXXXXX

Form NameSch J (1118)Sch J (5471)Sch J (990)Sch K (1118)Sch K (1120-IC-DISC)Sch K (990)Sch K1 (1041)Sch K1 (1065)Sch K1 (1120S)Sch K1 (8865)Sch L (1118)Sch L (990)Sch M-3 (1065)Sch M-3 (1120-F)Sch M-3 (1120-L)Sch M-3 (1120-PC)Sch M-3 (1120-S)Sch M-3 (1120)Sch M (5471)Sch M (8858)Sch M (990)Sch N (1120)Sch N (990)Sch O (5471)Sch O (8865)Sch O (990)Sch P (1120-FSC)Sch P (1120-F)Sch P (1120-IC-DISC)Sch P (5471)Sch P (8865)Sch PH (1120)Sch Q (1066)Form DescriptionAdjustments to Separate Limitation CategoriesAccumulated Earnings and ProfitsCompensation InformationForeign Tax Carryover Reconciliation ScheduleShareholder's Statement of IC-DISC DistributionsSupplemental Information on Tax-Exempt BondsK-1 (1041) Beneficiary's Share of IncomeK-1 (1065) Partner's Share of Income, DeductionsK-1 Shareholder's Share of Income, Deductions, Cr.K-1 Partner's Share of Income, Deductions, CreditsForeign Tax RedeterminationsSchedule L - Transactions with Interested PersonsNet Income (Loss) Reconciliation for PartnershipsNet Income (Loss) Recon for Foreign CorporationsNet Income (Loss) Recon for Life InsuranceNet Income (Loss) Recon - Property/Casualty InsNet Income (Loss) Reconciliation for S CorpsNet Income (Loss) Reconciliation for CorporationsTransactions Between Foreign CorporationTransactions Foreign Disregarded Entity and OwnerNoncash ContributionsForeign Operations of U.S. CorporationsLiquidation, Term, Dissolution of AssetsOrganization or Reorganization of Foreign CorpTransfer of Property to a Foreign PartnershipSupplemental Information to Form 990 or 990-EZTransfer Price or CommissionList of Foreign Partner Interests in PartnershipsIntercompany Transfer Price or CommissionTaxed Earning/Profits Certain Foreign CorpChanges of Interests in a Foreign PartnershipU.S. Personal Holding Company (PHC) TaxQuarterly Notice to Residual Interest HolderC-Corp S-Corp Partnership Payroll Non-ProfitXXXXXXXXXXXXXXXXXXXXXXXFiduciary XXX

Form NameSch Q (1120-IC-DISC)Sch Q (5471)Sch R (5471)Sch R (940)Sch R (941) 06/21Sch R (943)Sch R (990)Sch S (1120-F)Sch UTP (1120)Sch V (1120-F)SS-4SS-5SS-8SSA-561-U2SSA-7050-F4T (Timber)Tax Summary 1041Tax Summary 1065Tax Summary 1120Tax Summary 1120SW-11W-12W-4VW2W2 (1040)W2CW2GW2G (1040)W2VIW3SSW3SSW3/W3CW4Form DescriptionBorrower's Certificate of ComplianceCFC Income by CFC Income GroupsDistributions From a Foreign CorporationAllocation Schedule for Aggregate 940 FilersAllocation Schedule for Aggregate 941 FilersAllocation Schedule for Aggregate Form 943 FilersRelated Organizations and Unrelated PartnershipsExclusion of Income - International Ships/AircraftUncertain Tax Position StatementList of Vessels or Aircraft, Operators, and OwnersApplication for Employer Identification NumberApplication for a Social Security CardDetermination of Worker StatusRequest for ReconsiderationRequest For Social Security Earning InformationForest Activities Schedule1041 Tax Summary / Carryover Worksheet1065 Tax Summary1120 Tax Summary / Carryover Worksheet1120S Tax SummaryHIRE Act Employee AffidavitW-12 IRS Paid Preparer Tax ID Number ApplicationW-4V Voluntary Withholding RequestW-2 Wage and Tax StatementW-2 Wage Worksheet for 1040W-2C Corrected Wage and Tax StatementW-2G Certain Gambling WinningsW-2G Gambling Winnings WorksheetW-2VI Virgin Islands Wage, Tax StatementW-3SS Transmittal of Wage and Tax StatementsW-3SS Transmittal of Wage and Tax StatementsW-3 Transmittal of Wage, W-3C CorrectedW-4 Employee's Withholding CertificateC-Corp S-Corp Partnership Payroll XXXXXXXFiduciary LocalXXXXXXXX

Form NameW4PW4RW4SW8BENW8BEN-EW8ECIW8IMYW9W9SYour Filing Instr.ZZSTCREDForm DescriptionW/H Certificate for Periodic Pension or AnnuityWTH Certificate Nonperiodic Payments/Rollover DistW-4S Request for Federal Income Tax from Sick PayW-8BEN Certificate of Foreign Status of OwnerCertificate of Beneficial Owner for US WithholdingW-8ECI Certificate of Foreign Person's ClaimW-8IMY Certificate of Foreign IntermediaryW-9 Request for Taxpayer ID Number/CertificationW-9S Request for Student or Borrower's Tax IDYour Filing InstructionsCredit for State Taxes PaidAlaskaAK 0405-062AK 0405-310AK 0405-315AK 0405-566AK 0405-574AK 0405-575AK 0405-6000AK 0405-6220AK 0405-6240 (Est)AK 0405-6240 (Ext)AK 0405-6300AK 0405-6310AK 0405-6325AK 0405-6385AK 0405-6390AK 0405-6395AK 0405-662AK 0405-668AK 0405-6750AK 0405-681Fisheries Business Tax BondAlternative Tax Credit for Oil and Gas ExplorationNotice of Transfer Oil/Gas Production Tax CreditSalmon Enhancement Tax ReturnFisheries Business Tax Annual Return and SchedulesSalmon or Herring Product Development CreditCorporation Net Income Tax Return and SchedulesUnderpayment of Estimated Tax by CorporationsEstimate Voucher Corporation Net Income TaxExtension Voucher Corporation Net Income TaxIncentive Credits SummaryIncome Tax Education CreditVeteran Employment Tax CreditTax Attribute CarryoversFederal-Based CreditsPassive Activity LimitationMining License Tax Return and SchedulesExtension of Time to File Mining License ReturnApplication for Voluntary DisclosureFishery Resource Landing Tax Credit ApplicationC-Corp S-Corp Partnership Payroll XXXXXXXXXXXXXXXXXXXXXXXXXXXXFiduciary LocalXX

Form NameAK 0405-6900AK 0405-773AK 0405-775AK 08-400AK 08-4027AK 08-4181, 4438AK 08-4291AK Common WorkbookForm DescriptionPartnership Information Return, Sch A, B, and K-1Electronic Filing Waiver ApplicationRequest for Informal Conference, Power of AttorneyArticles of Incorporation Domestic Business CorpConstruction Contractor Registration ApplicationBusiness License Application, Credit Card PaymentName, Address Change or Duplicate Prof LicenseHidden State Common WorkbookAlabamaAL 20CAL 20SAL 2220ALAL 2848AAL 41, Sch K1AL 4506-AAL 4952AAL 65AL 8453-BAL 8453-CAL 8453-PTEAL 8821AAL ACCAL ADV-40AL ARAL BIT-VAL BIT-V (Est.)AL BIT-V (Ext.)AL BPT-INAL BPT-NW WkstsAL BPT-VAL BPT-V (Ext)AL Change of AgentCorporation Income Tax Return and SchedulesS Corporation Information/Tax ReturnUnderpayment of Estimated Tax for CorporationsPower of AttorneyFiduciary IT Return, A, B, C, K, K-1, G and ESBTRequest for Copy of Tax Form or Individual AccountInvestment Interest Expense DeductionPartnership/Limited Liability Company ReturnBusiness Privilege Tax Declaration for E-FilingCorporate Income Tax Declaration Electronic FilingS-Corporation/Partnership Declaration for e-FilingTax Information AuthorizationAllocations of Capital CreditTangible Personal Property ReturnAnnual Report of Project for Capital CreditBusiness Income Tax Payment VoucherBusiness Income Tax Payment Voucher (Estimate)Business Income Tax Payment Voucher (Extension)Business Privilege Tax Initial Privilege ReturnBalance Sheet Net Worth WorksheetsBusiness Privilege Tax Payment VoucherBusiness Privilege Tax Payment Voucher (Extension)Change of Registered Agent or Office by EntityC-Corp S-Corp Partnership Payroll XXXXXXXXXXXXXXXXXXXXXXXXXXXXXFiduciary LocalXXXXXXXXXXXXXXXXXX

Form NameAL Common WorkbookAL CPTAL EFT-001AL FDT-VAL FDT-V (Est.)AL FDT-V (Ext.)AL INT-4AL IT-489AL KRCCAL NMCAL NOL-F85AL NOL-F85AAL POAAL PPTAL PTE-C,Sch PTE-CK1AL PTE-VAL PTE-V (Est.)AL PTE-V (Ext.)AL Sch AB (20C)AL Sch AL-CARAL Sch B-1AL Sch BC (20C)AL Sch BPT-EAL Sch CP-BAL Sch D (41)AL Sch E (41)AL Sch EZAL Sch EZ-K1AL Sch FC (41)AL Sch FTIAL Sch K1 (20S)AL Sch K1 (65)AL Sch KRCC-BForm DescriptionHidden State Common WorkbookBusiness Privilege Tax Return and Annual ReportElectronic Funds Transfer Authorization AgreementFiduciary Income Tax Payment VoucherFiduciary Income Tax Payment Voucher (Estimated)Fiduciary Income Tax Payment Voucher (Extension)Notice of Change of Ownership, InterestTaxpayer Refund InformationProject/Distributing Entity Share of Capt CreditAffordable Housing Member Consent AgreementComputation of Net Operating Loss - Fiduciary (41)Net Operating Carryback or CarryforwardPower of AttorneyBusiness Privilege Tax Return and Annual ReportNonresident Composite Payment ReturnPass Through Entity Payment VoucherPass Through Entity Payment Voucher (Estimate)Pass Through Entity Payment Voucher (Extension)Schedule AB - Add-Back FormSec. of State Corporation Annual Report (CPT, PPT)Net Operating Loss Carryforward AcquisitionsSchedule BC - Business CreditsFamily Limited Liability

Form Name Form Description C-Corp S-Corp Partnership Payroll Non-Profit Fiduciary Local Federal Forms 1000 Ownership Certificate X X 1024 Application for Exemption Under 501(a) X . 2290, 2290-V (07/21) Heavy Highway Vehicle Use Tax Return X X X X 2438 Undistributed Capital Gains Tax Return X 2439 Undistributed Long-Term Capital Gains X X 2439 .