Transcription

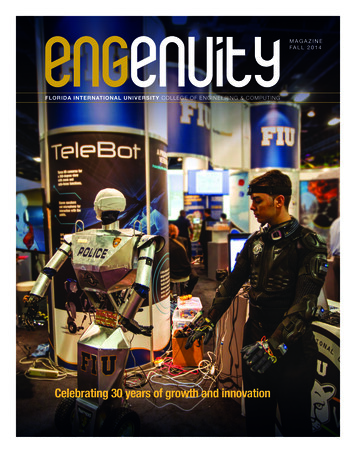

Definitive global law guides offeringcomparative analysis from top-ranked lawyersTMT2022Pakistan: Law & PracticeYousaf Khosa, Shafaq Rehman,Rafia Rauf and Saira Khalid KhanRIAA Barker Gillettepracticeguides.chambers.com

PAKISTANLaw and PracticeAfganistanContributed by:Yousaf Khosa, Shafaq Rehman, Rafia Rauf andSaira Khalid KhanRIAA Barker Gillette see p.19IranIslamabadPakistanIndiaCONTENTS1. Cloud Computingp.31.1 Laws and Regulationsp.32. Blockchainp.62.1 Legal Considerationsp.63. Legal Considerations for Big Data, MachineLearning and Artificial Intelligencep.83.1 Challenges and Solutionsp.84. Legal Considerations for Internet of ThingsProjectsp.84.1 Restrictions on a Project’s Scopep.85. Challenges with IT Service Agreementsp.95.1 Legal Framework Features6. Key Data Protection Principles6.1 Core Rules for Individual/Company Datap.9p.10p.107. Monitoring and Limiting of Employee Use ofComputer Resourcesp.137.1 Key Restrictionsp.138. Scope of Telecommunications Regime p.138.1 Scope of Telecommunications Rules andApproval Requirementsp.139. Audio-Visual Services and VideoChannelsp.159.1 Audio-Visual Service Requirements andApplicabilityp.1510. Encryption Requirementsp.1710.1 Legal Requirements and Exemptionsp.1711. COVID-19p.1711.1 Pandemic Responses Relevant to the TMTSectorp.172

PAKISTAN Law and PracticeContributed by: Yousaf Khosa, Shafaq Rehman, Rafia Rauf and Saira Khalid Khan, RIAA Barker Gillette1. CLOUD COMPUTING1.1 Laws and RegulationsGeneral Legal FrameworkPakistan currently does not have any generallaws imposing limitations on the entrusting ofprocesses or data to the cloud. The Ministry ofInformation Technology and Telecommunication (MOITT) is in the process of seeking comments from stakeholders on a consultation draft(v.25.08.2021) of a personal data protection bill(PDP Bill) before it is tabled in Parliament. Thisbill has undergone a few iterations, and themost recent draft appears to incorporate inputreceived from stakeholders on the earlier drafts.If enacted, the PDP Bill will require that personaldata is not transferred to any system locatedoutside Pakistan or not under the direct control of the federal or provincial governments ofPakistan, unless it is ensured that the countrywhere the data is transferred offers personaldata protection at least equivalent to that underthe PDP Bill. Such data is required to be processed in accordance with the PDP Bill and,where applicable, consent must be given by thedata subject.Other than the Enterprise Technology Governance and Risk Management Framework forImplementation by Financial Institutions (FIs)applicable to the financial sector (discussedbelow), Pakistan currently does not have codesof conduct imposing limitations on the entrusting of processes or data to the cloud in otherindustries.Industries with Greater RegulationBanking sectorThe regulator for the banking sector in Pakistanis the State Bank of Pakistan (SBP). Pursuant toBPRD Circular No 5 of 2017, the SBP has notified a framework titled the Enterprise TechnologyGovernance and Risk Management Framework3for Implementation by Financial Institutions (FIs)by 30 June 2018, which was amended by BPRDCircular No 6 of 2019 and BPRD Circular No 4of 2020.The framework is required to be integrated withthe FI’s overall enterprise risk management programme to identify, measure, monitor and control technology risks. However, the frameworkis not “one-size-fits-all” and its implementationneeds to be risk-based and commensurate withthe size, nature and types of products/servicesoffered and the complexity of the technologyoperations of individual FIs. FIs are required toexercise sound judgement in determining theapplicable provisions relevant to their technology risk profile while implementing this framework.The SBP framework set out process and requirements relating to (i) permissible cloud outsourcing arrangements, and (ii) internal controls incloud outsourcing arrangements.Permissible cloud outsourcing arrangementsThe framework provides that, subject to the policy approved by the board of the FI, FIs can takeadvantage of all types of cloud service models –including software as a service (SaaS), platformas a service (PaaS) and infrastructure as a service (IaaS) – from domestic and offshore cloudservice providers (CSPs), keeping in view that: FIs may use cloud services for non-coreoperations and business support processessuch as HR modules, procurement functions,non-production environments, sandboxing, inventory management, supply chainmanagement, office productivity, customerrelationship management tools, communication tools, security tools, computation andprocessing services, data analytics and riskmodelling, middleware and payment processing services/platforms; and

Law and Practice PAKISTANContributed by: Yousaf Khosa, Shafaq Rehman, Rafia Rauf and Saira Khalid Khan, RIAA Barker Gillette all other banking applications and alliedinfrastructure – which are used to store andprocess customers’ information relating todeposits, loans and credits, and details ofbalances and transactions in ledger accountsof customers/borrowers – are not permittedto be placed under cloud-based outsourcingarrangements.Internal controls in cloud outsourcingarrangementsWhile entering into outsourcing arrangementwith CSPs, an FI is required to ensure that: all cloud-based outsourcing arrangementsare undertaken through legally binding servicelevel agreements (SLAs); their data is encrypted at database level, storage level and during network transmission,and will be logically segregated from otherdata held by the CSPs; the arrangement does not contain a lock-inclause – in the case of an exit from cloudservices, an FI will have contractual rights tocontinue with the arrangement until such timeas it is able to switch to a substitute arrangement; data transferability and portability from oneCSP to another is assured and its purging/deletion in case of exit; the CSP complies with the SBP’s requirementfor provision of data/information relating tothe FI’s operations; and disclosure of its data to any third-party byCSP is prohibited without approval of the FI.Subcontracting is allowed in outsourcingarrangements with CSPs provided the CSPscomply with all relevant laws and the SBP’sregulations.FIs are also required to ensure that their internal/external auditors and SBP have the right toconduct audit and on-site inspection of the CSPor its subcontractor. Furthermore, there shouldbe no restriction on visits by audit or SBP staff.Where audits cannot be conducted for any validreason, FIs may rely on internationally recognised third-party certifications and reports madeavailable by CSPs. However, such reliance isrequired to be supported by an adequate understanding and review of the scope, the methodology applied therein and the ability of third partiesand CSPs to clarify matters relating to the audit.These reports must be shared with the SBP asand when required.The Framework for Risk Management in Outsourcing Arrangements by Financial Institutions,notified by BPRD Circular No 6 of 2019, providesthat any outsourcing arrangement outside Pakistan, excluding group outsourcing, will requirethe SBP’s prior approval.Group outsourcing is defined as an arrangementwhere financial institutions, including foreignbanks’ branches, enter outsourcing arrangements including technological support servicesfrom their parent institutions/subsidiaries/headoffices or other branches of foreign banks/related group entities formulated for providing specialised services to group companies inside oroutside Pakistan.Processing of Personal Data in the Context ofthe CloudWhile there is currently no general legal framework to address the processing of personal datain the context of the cloud, the PDP Bill doescontain provisions which would become relevant, once the same is promulgated.Since the PDP Bill aims to regulate the processing of personal data, cloud service providerswill be required to comply with the provisionsthereunder; personal data stored on a cloud mayonly be processed with the consent of the datasubject unless the processing is necessary:4

PAKISTAN Law and PracticeContributed by: Yousaf Khosa, Shafaq Rehman, Rafia Rauf and Saira Khalid Khan, RIAA Barker Gillette for the performance of a contract to which thedata subject is a party; for compliance with any legal obligation towhich the data controller is subject, otherthan an obligation imposed by a contract; in order to protect the vital interests of thedata subject; for the administration of justice pursuant toan order of a court of competent jurisdiction; for legitimate interests pursued by the datacontroller; or for the exercise of any functions conferred onany person by or under any law.Furthermore, personal data is not permitted tobe processed unless: the personal data is processed for a lawfulpurpose directly related to an activity of thedata controller; the processing of the personal data is necessary for or directly related to that purpose;and the personal data is adequate but not excessive in relation to that purpose.The PDP Bill also provides that critical personaldata will only be processed in a server or datacentre located in Pakistan. Personal data, otherthan that categorised as critical personal data,may be transferred outside the territory of Pakistan under a framework (on conditions) to bedevised, and a mechanism for keeping a copyof personal data in Pakistan, which is also tobe devised by the National Commission for Personal Data Protection (which is required to beestablished within six months of the promulgation of the PDP Bill into law).Additional Compliance RequirementsA person providing cloud computing and/orhosting services may fall within the definitionof a “service provider”, “social media company” or a “significant social media company” in5terms of the Prevention of Electronic Crimes Act2016 (PECA) and the Removal and Blocking ofUnlawful Online (Procedure, Oversight and Safeguards), Rules 2021 (RBUO Rules).Pertinent definitions appearing in the PECA andRBUO Rules appear below: “online information system” means an information system connected with other information systems though internet and any cloudbased content distribution services; “service provider” includes a person who:(a) acts as a service provider in relation tosending, receiving, storing, processing ordistributing any electronic communicationor the provision of other services in relation to electronic communication throughan information system;(b) owns, possesses, operates, managesor controls a public switched network orprovides telecommunication services; or(c) processes or stores data on behalf ofsuch electronic communication servicesor the users of such services; “significant social media company” meansand includes a social media company withmore than half million users in Pakistan or ison the list specially notified by the PTA for thispurpose from time to time; “social media company” means any personthat owns, provides or manages online information system for provision of social mediaor social network service.The RBUO Rules have been notified under thePECA and provide that any service provider,social media company, or a significant socialmedia, are required to: make available community guidelines foraccess or usage of any online informationsystem, which community guidelines shouldeasily be accessible and will inform the user

Law and Practice PAKISTANContributed by: Yousaf Khosa, Shafaq Rehman, Rafia Rauf and Saira Khalid Khan, RIAA Barker Gilletteof the online information system not to host,display, upload, modify, publish, transmit,update or share any content in violation oflocal laws; provide to the Federal Investigation Agency(FIA) any information or date or content orsub-content contained in any online information system owned or managed or runby the respective service provider, socialmedia company or social media company,in decrypted, readable and comprehensibleformat or plain version in accordance with theprovisions of PECA; and deploy mechanisms to ensure immediateblocking of live streaming through an onlineinformation system in Pakistan of any onlinecontent particularly related to terrorism, hatespeech, pornography, incitement to violenceand that is detrimental to national security onreceiving intimation from the PTA.2. BLOCKCHAIN2.1 Legal ConsiderationsWhile blockchain companies have started toemerge in Pakistan, and the government hasacknowledged the potential of blockchain technology, currently there is no regulatory framework in place to govern the use of such technology and related services in Pakistan.In recent news, Pakistan’s Customs has partnered with logistics blockchain platform,TradeLens, to digitise supply chains moving inand out of the country and enhance control oftrade-based money laundering. Additionally, theMinister of Science and Technology recentlyaddressed a blockchain technology summit, atwhich he claimed that his ministry had launchedblockchain technology pilot projects in three universities, which intend to offer degrees on blockchain technology.Risks and LiabilityThe general risks associated with the use ofblockchain technology are compromised cybersecurity, breach of privacy (including the breachof personal data) and lack of standardised operating standards. However, given the lack of alegal framework for blockchain technology, theentities involved must carefully assess issuesof risk and liability, depending on the specificblockchain solutions or applications in questionand the structure of the blockchain, and makeprovision for the same under contract.Under BPRD Circular No 3 of 2018 (the “Circular”), the SBP has prohibited the banks andfinancial institutions it regulates from dealingwith cryptocurrencies, which are an applicationof blockchain technology. However, a constitutional petition has been filed in the High Court ofSindh (the “High Court”), seeking issuance of adirection of appropriate nature so as to nullify theCircular and the implementation of a regulatoryframework regarding crypto-assets and cryptomining in Pakistan. While the final judgment inthe foregoing case is yet to be passed, the HighCourt has passed an interim order recognisingthe importance of cryptocurrency given that it isswiftly becoming an accepted mode of consideration globally.Moreover, pursuant to the said interim order, theHigh Court ordered for a committee to be setup, chaired by the Deputy Governor, SBP, whichcommittee was directed to bring forward recommendations to the Ministry of Finance, as towhether cryptocurrency may be made permissible in Pakistan. The High Court further statedthat the foregoing decision is a policy matterand will be decided by the federal government.Hence, the Ministry of Finance and Ministry ofLaw have been directed to decide whether anyrecommendations put forward by the aforementioned committee are viable, keeping in viewArticle 18 of the Constitution of Pakistan (which6

PAKISTAN Law and PracticeContributed by: Yousaf Khosa, Shafaq Rehman, Rafia Rauf and Saira Khalid Khan, RIAA Barker Gilletterelates to the freedom of trade, business or profession). In the meantime, the Director of theFederal Investigation Agency (Cybercrimes), andrelevant officers, were also directed to act strictlyaccording to the law in respect of persons whomight seek to indulge in cryptocurrency and, ifnecessary, seek guidance from the SBP.Pursuant to a further interim order passed inthe aforementioned case, the High Court statedthat the committee has filed a detailed reportpursuant to which the committee has recommended a complete ban on all cryptocurrencyand unauthorised operation of crypto exchangesin Pakistan. The High Court has now directedthat the said report be shared with the Ministryof Finance and Ministry of Law, which ministriesare required to consider the report at joint meetings to reach a final decision on whether or notcryptocurrency is to be allowed in Pakistan inany form and, if so, what the regulatory framework of such business would be.More recently, the FIA decided to launch a grandcrackdown on cryptocurrency dealers and haswritten a letter to the PTA to shut down 1,600websites for this purpose, in view of the fact thatmillions have been purportedly embezzled fromPakistani citizens in digital currency fraud. Apartfrom shutting down these websites, the FIA hasalso sought the PTA’s assistance in taking actionagainst the people running the websites.Intellectual PropertyWhile blockchain as a software or databasecan be registered as an intellectual propertyunder the Copyright Ordinance 1962, intellectual property challenges relating to trade marks,copyrights and patents would be the same asfor other electronic and physical business activities, as no specific provisions relating to suchtechnology have been introduced within statuteor by way of delegated legislation.7Data PrivacyAs stated in 1.1 Laws and Regulations, there iscurrently no generally applicable data protectionlegislation in Pakistan. Given the nature of thetechnology used for such applications, a blockchain may be distributed over several nodes/servers across various geographic locations.Accordingly, when the PDP Bill is promulgated,the primary issue, with regard to blockchain anddistributed ledger technology, will be to determine which persons/entities fall within the ambitof the terms data controller and the data processor.In view of the fact that data, once entered into ablockchain, cannot be changed, in some cases,it may be difficult to determine the legal basis forthe processing of personal data, resulting in thepotential use of the data for a different purposethan the purpose originally intended.Additionally, it may be technically, organisationally and even legally difficult for data subjectsto exercise their rights (eg, the right to delete orrectify data), and this may also lead to potentialproblems in terms of cross-border transfers ofpersonal data.Service LevelsPakistan does not have any specific service levels applicable to blockchain technology. Theselevels will have to be based on how relevant parties negotiate the contractual framework for theimplementation and/or utilisation of the blockchain service.Jurisdictional IssuesPakistan does not have any laws to regulateblockchain technology. However, since this typeof technology is designed to operate over theinternet, and because a blockchain is distributed to multiple nodes that may be physicallylocated at various global geographic locations,and potentially spread out across several juris-

Law and Practice PAKISTANContributed by: Yousaf Khosa, Shafaq Rehman, Rafia Rauf and Saira Khalid Khan, RIAA Barker Gillettedictions, in the event of disputes, it is certain toraise potential choice of law and jurisdictionalissues. Contractual frameworks should addresschoice of law and jurisdiction along with the dispute resolution process.4. LEGALC O N S I D E R AT I O N S F O RINTERNET OF THINGSPROJECTS3. LEGALC O N S I D E R AT I O N S F O R B I GD ATA , M A C H I N E L E A R N I N GAND ARTIFICIALINTELLIGENCEWhile internet of things (IOT) projects and services are not subject to specific requirementsand do not require a special authorisation, thereare certain telecommunications standards whichmay become relevant depending on the type ofdevice(s) to be used and/or service(s) whoseprovision is contemplated.3.1 Challenges and SolutionsTechnologies such as artificial intelligence andmachine learning, which are at the cutting-edgeof computing, have had limited practical application until recently, but have come to pervadedaily life in a short span of time, and are galvanising a technological paradigm shift. Businessanalytics and big data are transforming the waybusinesses and governments operate. Competing on analytics is the new norm, wherebycompetitive advantage is defined by turning proprietary and other data sets into insights usingadvanced algorithms. The advances in big dataanalytics, machine learning and the use of artificial intelligence in relation thereto, may presenta great opportunity for Pakistan.There is, however, no specific regulatory framework currently applicable in Pakistan thataddresses the implementation and/or regulation of big data, machine learning and artificialintelligence, which may be the biggest challengerelating to the implementation of these technologies.A system or product utilising big data, machinelearning and/or artificial intelligence technologyis presently treated at par with any other systemor product of a similar nature.4.1 Restrictions on a Project’s ScopeThe regulator for the telecommunications sectorin Pakistan is the PTA, which was created pursuant to the Pakistan Telecommunication (Reorganisation) Act 1996 (PTA Act). Every licencegranted by the PTA to its licensee may contain: restrictions as to the types of telecommunication system or telecommunication serviceto be provided by the licensee, the area andperiod of operation and the types of telecommunication equipment that may be includedin its telecommunication system; the obligation to ensure that only terminalequipment which is approved for connectionto the telecommunication system in questionis so connected; and obligations to maintain confidentiality of customer data.Devices which utilise radioelectric spectrum totransmit and/or receive information require a“type approval” from the PTA, before they canbe connected to a public-switched network (further details of this are provided in 8.1 Scopeof Telecommunications Rules and ApprovalRequirements).8

PAKISTAN Law and PracticeContributed by: Yousaf Khosa, Shafaq Rehman, Rafia Rauf and Saira Khalid Khan, RIAA Barker GilletteMachine-to-Machine Communications andData ProtectionPakistan does not have a legal framework thatspecifically regulates machine-to-machine communications. While sector-specific regulatorsenforce data protection requirements as part ofthe law and the terms of the licences grantedthereunder, the PECA criminalises the misuse ofpersonal data without consent, and it is therefore important that machine-to-machine communications do not result in the commitmentof offences under the PECA. These offencesinclude: unauthorised access to information systemsor data; unauthorised copying or transmission of data; interference with information systems or data; unauthorised access to critical infrastructureinformation systems or data; unauthorised copying or transmission of critical infrastructure data; interference with critical infrastructure information systems or data; electronic forgery; electronic fraud; unauthorised use of identity information; unauthorised interception; malicious code; spamming; and spoofing.Communication SecrecyThe transmission of encrypted data on a public-switched network as traffic is not permittedunder the applicable laws. Non-standard protocols of communication, including encryption,cannot be undertaken without prior approval ofthe PTA. Prior approval of the PTA is requiredfor use of a non-standard mode of communication including virtual private networks (VPN) andnon-standard protocols which include encrypted messages. The use of any non-standard ofcommunication, including all mechanisms by9means of which communications become hidden or modified to the extent that they cannotbe monitored, is a violation of applicable laws.5. CHALLENGES WITH ITSERVICE AGREEMENTS5.1 Legal Framework FeaturesAgreements for provision of IT services are notspecifically regulated under Pakistan law, andare therefore subject to be governed accordingto the volition of the parties in terms of the Contract Act 1872, and are generally reflective ofbest practices in the sector. This provides partieswith the possibility to reflect their interest andwill in their legal relationship. A contract, however, may not be contrary to the law in force, andparties may be required to comply with certainobligations, which may result from sector-specific regulations.Please also refer to the ‘Banking sector’ and the‘Processing of Personal Data in the Context ofthe Cloud’ sections in 1.1 Laws and Regulations.Foreign Exchange ControlsOne of the greatest challenges that local organisations encounter in terms of entering into ITservice agreement(s) with non-residents, is inseeking an exemption from the SBP, in connection with the restriction imposed on outwardpayments to non-residents under the ForeignExchange Regulation Act 1947 (FERA). Pursuant to the FERA, save as may be provided inand in accordance with any general or specialexemption form the provisions of FERA whichmay be granted conditionally or unconditionallyby the SBP, no person in, or resident in, Pakistanis permitted to make any payment to or for thecredit of any person resident outside Pakistan.

Law and Practice PAKISTANContributed by: Yousaf Khosa, Shafaq Rehman, Rafia Rauf and Saira Khalid Khan, RIAA Barker GilletteThe SBP has, however, extended a generalexemption to the restriction contained in theFERA, whereby scheduled banks have beengiven a general permission to release foreignexchange up to a maximum of USD100,000 (orits equivalent in other currencies) per invoice forprivate sector companies incorporated in Pakistan, and those branches of foreign companieswhich are operating in Pakistan with the permission of the Board of Investment. The foregoing exemption applies when such companies/branches are undertaking permissible business/commercial activities, paying local taxesand periodically repatriating their profits abroad(subject to compliance with relevant provisionsof applicable law).After satisfying themselves of the genuinenessof the requests, and after deducting all applicable taxes, the SBP allows the above-mentionedpayments for charges on account of utilisationof IT services such as: satellite transponder charges; international bandwidth charges; international internet service charges; international private line charges; software licence, maintenance or supportfees for proprietary/specialised software; and subscriptions or payments for access to foreign electronic media and databases.The SBP has also extended a general permissionto scheduled banks to release foreign exchangeup to a maximum of USD400,000, or equivalentin other currencies, per year (starting from thedate of designation of the relevant scheduledbank), for each company/firm/sole proprietorship incorporated/established in Pakistan onaccount of commercial payments, pertaining todigital services, in favour of digital service provider companies.The above permissions are subject to the fulfilment of procedural requirements, set out in theForeign Exchange Manual (a compendium ofpermissions granted by the SBP as regard toFERA, from time to time).6 . K E Y D ATA P R O T E C T I O NPRINCIPLES6.1 Core Rules for Individual/CompanyDataData Protection LegislationCurrently there is no generally applicable dataprotection legislation in Pakistan. The PDP Bill, ifand when enacted, will provide for and regulatethe processing of personal data. The PECA criminalises the misuse of personal data (includingpersonal data processed by a third party in itscapacity as a service provider) without consent.Industry-specific regulators have data protectionrequirements, which have been imposed by legislation and in licences granted by them.Telecom sectorThe Pakistan Telecom Rules 2000 (PTA Rules)provide that a licence issued by the PTA will besubject to the PTA Act and the PTA Rules.Appendix B to the PTA Rules contains generalconditions that apply to all licences pursuant towhich licensed services are to be provided (theGeneral Conditions). Furthermore, the licenceand licensed services will be subject to the conditions as specified in the Schedule 2 annexedto the General Conditions. Pursuant thereto,all licensees of PTA are required to ensure thatemployees who obtain information about customers of the licensee or other customer’s business (customer information) in the course of theiremployment, observe the code of practice onthe confidentiality of customer information. Theconfidentiality code is required to be preparedby the licensees in consultation with the PTA and10

PAKISTAN Law and PracticeContributed by: Yousaf Khosa, Shafaq Rehman, Rafia Rauf and Saira Khalid Khan, RIAA Barker Gilletteis required to (i) specify the persons to whomcustomer information may be disclosed withoutthe prior consent of that customer, and (ii) regulate the customer information which may be disclosed without prior consent of that customer.Banking sectorThe SBP requires all banks and FIs to maintainconfidentiality of customer information. The Payment Systems and Electronic Fund Transfers Act2007 (PSEFT) regulates payment systems andelectronic fund transfers in Pakistan, and provides standards for protection of consumers andparticipants. Pursuant thereto, an FI is not permitted to, except as otherwise required by law,divulge any information relating to an electronicfund transfer, affairs or account of its customer,except in circumstances in which, according tothe practice and usage customary among bankers, it is necessary or appropriate for an FI todivulge such information, or the consumer hasgiven consent in respect thereof.Additionally, no person other than an officeror agent appointed by the FI that maintainsthe account of a consumer may have accessthrough an electronic terminal to informationrelating to electronic fund transfer, the affairs, orthe account of the consumer. The rules governing the operation of individual accounts will beapplicable to electronic fund transfers in relationto disclosure of information to third parties.The Regulations for Payment Card Security,issued under the PSEFT and as notified by theSBP (vide the PSD Circular No 5 of 2016), provide that: card service providers are required to ensurethe confidentiality of consumers’ data in storage, transmission and processing; and cu

practiceguides.chambers.com Definitive global law guides offering comparative analysis from top-ranked lawyers . is the State Bank of Pakistan (SBP). Pursuant to BPRD Circular No 5 of 2017, the SBP has noti- . sub-content contained in any online infor-mation system owned or managed or run by the respective service provider, social .